Happy July 20th!

There will be a dome, moving around the next 2 weeks. It still could expand north or east later this month/early August ............instead of receding.........and the models just don't realize it yet. However, many of the latest models have some northwest type flow into the Midwest and ridge riders coming around the periphery of the dome late this month.

So there are still decent rains to some key areas but some areas will get short changed.

+++++++++++++++++++++++++++++++++++++++++++++

Heat fill coming up for corn

Started by metmike - June 25, 2020, 7:52 p.m.

https://www.marketforum.com/forum/topic/54571/

July 3rd update: Early La Nina right now! My Summer Forecast/La Nina this Summer! Started by metmike - May 23, 2020, 11:33 p.m.

https://www.marketforum.com/forum/topic/52701/

Latest COVID-19 numbers. ...........going way up.....deaths(lagging indicator) are also starting to climb higher.

https://www.marketforum.com/forum/topic/55092/

Scroll down and enjoy the latest comprehensive weather to the max...... occurring because of the natural physical laws in our atmosphere as life on this greening planet continues to enjoy the best weather/climate in at least 1,000 years(the last time that it was this warm) with the added bonus of extra beneficial CO2.

Reasons to keep being thankful here in 2020!

https://www.marketforum.com/forum/topic/45623/

Go to the link below, then hit the location/county on the map for details.

https://www.spc.noaa.gov/ Go to "hazards"

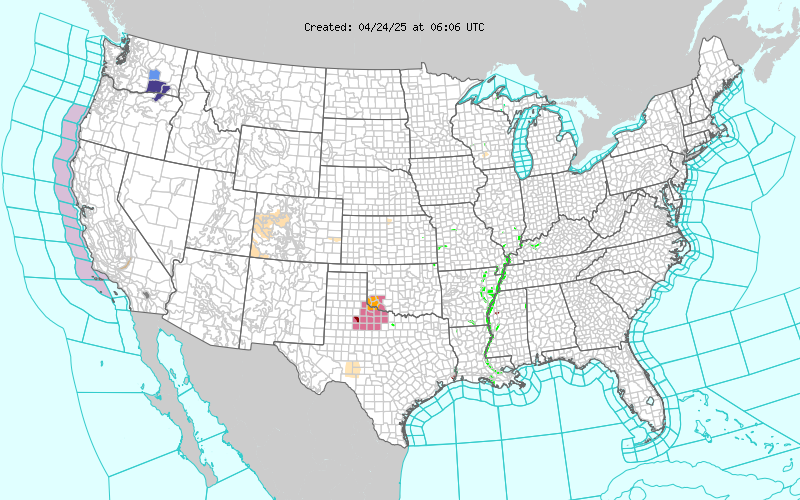

Here are the latest hazards across the country.

|

Purple/Pink/blue on land is cold/Winter weather. Brown is wind, Green is flooding. Gray is fog. Reddish is a red flag advisory.

Go to the link below, then hit the location/county on the map for details.

https://www.spc.noaa.gov/ Go to "hazards"

https://www.mesonet.org/index.php/weather/map/us_air_temperature/air_temperature

https://www.mesonet.org/index.php/weather/map/wind_chill_heat_index1/air_temperature

Current Weather Map

| NCEP Days 0-7 Forecast Loop | NCEP Short-Range Model Discussion | NCEP Day 3-7 Discussion |

Current Jet Stream

| Low Temperatures Tomorrow Morning |

Highs today and tomorrow.

Highs for days 3-7:

Heat spreads east/northeast THIS week(90's)!!!

Temperatures compared to Average for days 3-7

Considering that we passing the hottest time of year climatologically, having red departures above average means pretty impressive heat. The widespread nature of the heat, means hefty CDD's with air conditioners humming across the country! Much of the electricity to generate AC comes from burning natural gas.

https://www.wpc.ncep.noaa.gov/medr/medr_mean.shtml

Surface Weather features day 3-7:

Heat spreads east. Nearly stationary front in the Midwest will be the focus for good rains.

This pushes north (to the Upper Midwest) late in the week/next weekend with heat following it.

Liquid equivalent precip forecasts for the next 7 days are below.

Stalled front with rains in many places for the first half of the week(some spots miss good rains).

Pushes north on Friday and takes the rain with it to the Upper Midwest/Great Lakes.

Day 1 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_94qwbg.gif?1526306199054

Day 2 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_98qwbg.gif?1528293750112

Day 3 below

http://www.wpc.ncep.noaa.gov/qpf/fill_99qwbg.gif?1528293842764

Days 4-5 below:

http://www.wpc.ncep.noaa.gov/qpf/95ep48iwbg_fill.gif?1526306162

Days 6-7 below:

http://www.wpc.ncep.noaa.gov/qpf/97ep48iwbg_fill.gif?1526306162

7 Day Total precipitation below:

https://www.wpc.ncep.noaa.gov/qpf/p168i.gif?1566925971

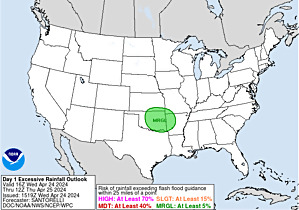

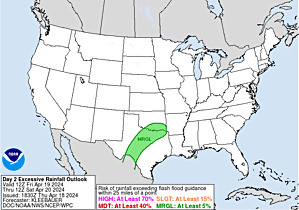

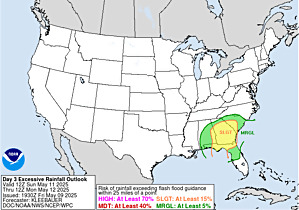

Excessive rain potential.

Mesoscale Precipitation Discussions

Current Day 1 Forecast Valid 16Z 08/30/19 - 12Z 08/31/19 |

Day 1 Threat Area in Text Format

| Day 2 and Day 3 Forecasts |

Current Day 2 Forecast Valid 12Z 08/31/19 - 12Z 09/01/19 |

Day 2 Threat Area in Text Format

Current Day 3 Forecast |

Last 24 hour precip top map

Last 7 day precip below that

https://www.wunderground.com/maps/prec

Learn About Daily Precipitation

Learn About Weekly Precipitation

Current Dew Points

Moisture returning north to meet the stalled front.

Latest radar loop

http://www.nws.noaa.gov/radar_tab.php

| (3400x1700 pixels - 2.2mb) Go to: Most Recent Image |

Go to: Most Recent Image

You can go to this link to see precipitation totals from recent time periods:

https://water.weather.gov/precip/

Go to precipitation, then scroll down to pick a time frame. Hit states to get the borders to see locations better. Under products, you can hit "observed" or "Percent of Normal"

Soilmoisture anomaly:

These maps sometimes take a day to catch up to incorporate the latest data(the bottom map is only updated once a week).

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

Drought Monitor maps:

Latest: The first map below is the latest. The 2nd one is from last week.

April 23: LOOKY_LOOKY! For the first time this year, its gotten dry enough for a few (small)areas in the Upper Midwest/Western Cornbelt to report slight drought.

April 30: Drought increased a bit......Plains and U.Midwest.

May: 7: Drought increased a bit from KS westward.

May 14: Drought increased a bit again, now, parts of Iowa have slight drought(this dry weather is why planting is ahead of schedule). Rains are coming to the dry spots in the forecast though.......bearish.

May 21: A bit more drought in ND.

May 28: Not much change

June 4: Drought increases a tad in the N.Plains and Upper Midwest.

June 10: Drought worsening in the S.Plains could be part of the La Nina signal!!

June 17: Drought got worse again in the S.Plains and yellows/slight drought emerged in new locations............all of Indiana.

June 24: Drought help in some places(KS) but increased a bit in others(ND).

July 1: Drought shrunk in Ohio Valley(I got 5.5 inches of rain in sw INdiana!) but not much change elsewhere. Surprised it didn't shrink more in IN/IL where some places(Bowyer) got great rains recently.

July 8: The main change was an increase over w.IA and e.NE. At the end of July with the hot/dry weather coming up, the S.Plains drought should expand into the S.Midwest to the Eastern Cornbelt.

July 15: Drought increased again over IA/MO/IN/OH. In july, evaporation usually exceeds rainfall, so some of this is seasonal. Hot temps coming up will accelerate evaporation.

The maps below are updated on Thursdays.

https://droughtmonitor.unl.edu/

The top map is the Canadian ensemble average, the maps below are the individual members that make up the average at the end of week 2.

+++++++++++++++++++++++++++++++++++++++++

Each member is like the parent, Canadian model operational model.......with a slight tweek/variation in parameters. Since we know the equations to represent the physics of the atmosphere in the models are not perfect, its useful to vary some of the equations that are uncertain(can make a difference) to see if it effects the outcome and how.

The average of all these variations(ensembles) often yields a better tool for forecasting. It's always more consistent. The individual operational model, like each individual ensemble member can vary greatly from run to run.........and represent an extreme end of the spectrum at times. The ensemble average of all the members, because it averages the extremes.............from opposite ends of the spectrum.........changes much less from run to run.

End of week 2....................0z Canadian ensembles:

Sunday: The jet stream has been shifting progressively farther south the last few days, late week 2 on this model. Pushing the dome farther south. Potential for active, northwest type flow into the Midwest. However, patterns like this can sometimes become less productive rain producers later in the Summer as soil moisture dries up.

Monday: Dome weakening and shifting southwest. Active northwest flow into the Midwest to Northeast.

360h GZ 500 forecast valid on Aug 04, 2020 12 UTC

Forecasts for the control (GEM 0) and the 20 ensemble members (global model not available)

Individual GFS ensemble solutions for the latest 0z run:

Sunday: Individual solutions are very different in the Midwest. Some have active northwest flow..........some have the heat ridge building in. Regardless, the dome is not dead and will most likely be centered around the S.Plains again.

Monday: Individual solutions vary on placement of the weakening dome/heat ridge.

GFS Ensemble mean(average of all the individual solutions above). The first map is a mid/upper level map. The 2nd one is a temperatures map at around 1 mile above the surface. These are anomalies(difference compared to average).

NCEP Ensemble t = 360 hour forecast

Sunday: Positive anomalies almost everywhere. The greatest anomaly in the US is over the NorthCentral part. Interesting weak negative anomaly far Northeast at the end of week 1............associated with the -NAO and potentially bringing in some cooler air to that area temporarily.

Monday: Mainly positive anomalies across the country.

2 weeks out below

++++++++++++++++++++++++

Latest, updated graph/forecast for AO and NAO and PNA here, including an explanation of how to interpret them...............mainly where they stand at the end of 2 weeks

https://www.marketforum.com/forum/t

Previous analysis, with the latest day at the bottom for late week 2 period.

Discussions, starting with the oldest below.

Sunday, July 19, 2020: -NAO continues. Potential for more cooling than model solutions show in the Upper Midwest to East. PNA has a huge spread and uncertainty late week 2. Higher potential for some big changes to the model solutions late in week 2 because of this(and less reliability in individual solutions). Regardless, none of this strongly suggests the pattern will not continue to feature a large area of hot weather, especially in the S.half of the US.

Monday: Still negative NAO has me leaning a bit cooler than models in the northern half of the country. AO and PNA near 0.

National Weather Service 6-10 day, 8-14 day outlooks.

Updated daily just after 2pm Central.

Temperature Probability

| the 8-14 day outlooks ArchivesAnalogsLines-Only FormatGIS Data | |

Temperature Probability | |

| |

Previous posts:

By Jim_M - July 6, 2020, 12:18 p.m.

Corn and Beans HAVE to be under some significant stress right now.

++++++++++++++++++++++++++++++++++++++++++++++

By metmike - July 6, 2020, 1:28 p.m.

Actually Jim, not in most of the cornbelt. Probably where you are but most of the belt has pretty good soil moisture and temps have not been that hot until now.

++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Weather Monday

By Jim_M - July 6, 2020, 1:40 p.m.

I've been away from home for the last week, but before I left leaves were rolling in the fields around me in NE Ohio. But even at that, corn looked good. But corn in my area is only about waist high, which is typical. Lots of growing to do.

Jim,

The crop condition report maps show the deterioration in the ECB from lack of rains.

With the OH corn dropping -10% and beans -7%!

+++++++++++++++++++++++++++++++++++++

By mikempt - July 7, 2020, 10:04 a.m.

We got flooded here in Valley Forge,Pa.. The bullseye once again! Six inches of rain in less than an hour! I thought i was in texas!!

+++++++++++++++++++++++++++++++++++++++++++++

By metmike - July 7, 2020, 12:21 p.m.

https://weather.com/news/news/2020-07-06-pennsylvania-philadelphia-flash-floods-water-rescues

https://www.inquirer.com/weather/philadelphia-flood-warning-severe-weather-20200706.html

By metmike - July 8, 2020, 1:43 p.m.

12th warmest June on record for the Corn Belt (production weighted); comparable to what was recorded in 2018 and 2016

By metmike - July 8, 2020, 1:49 p.m.

0.43" below normal on rainfall in June for the Corn Belt (production weighted); comparable to what was recorded in 2017 and 2016

|

+++++++++++++++++++++++++

Wretched performance by the ECMWF ensemble last week Left map not "dry"...would be ridge-running rains...but just in the northern Corn Belt. Heat with that pattern would be impressive. Right map? No dome, no big heat, battle zone of air masses, excellent Corn Belt rain chances

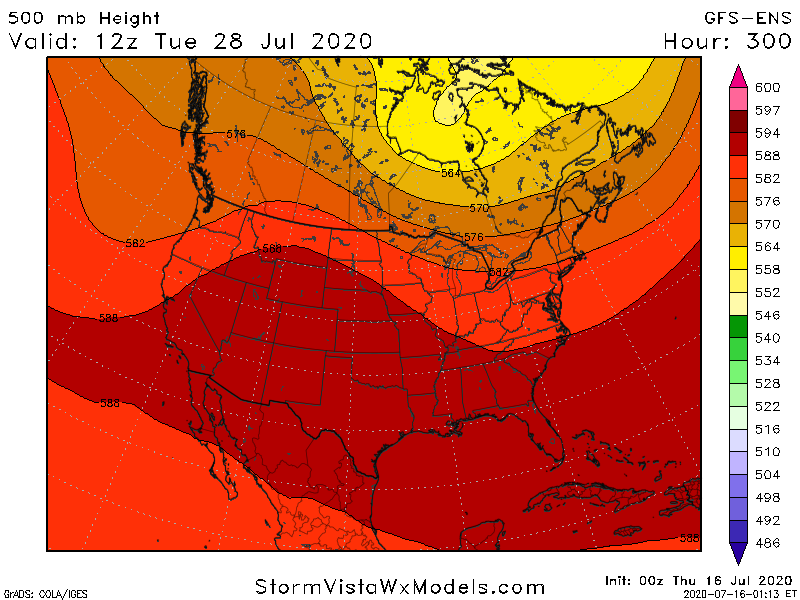

By wxdavid - July 16, 2020, 1:33 a.m.

MIKE

At this point I have to wonder if the trade is going to bite on this shift by the operational GFS and other models to build back the heat at the end of July going into early August. The model data back on July 4th weekend was pretty bullish about the Heat and the Dome coming up for this week instead of looking at no heat for the Midwest with a lot of rain

.

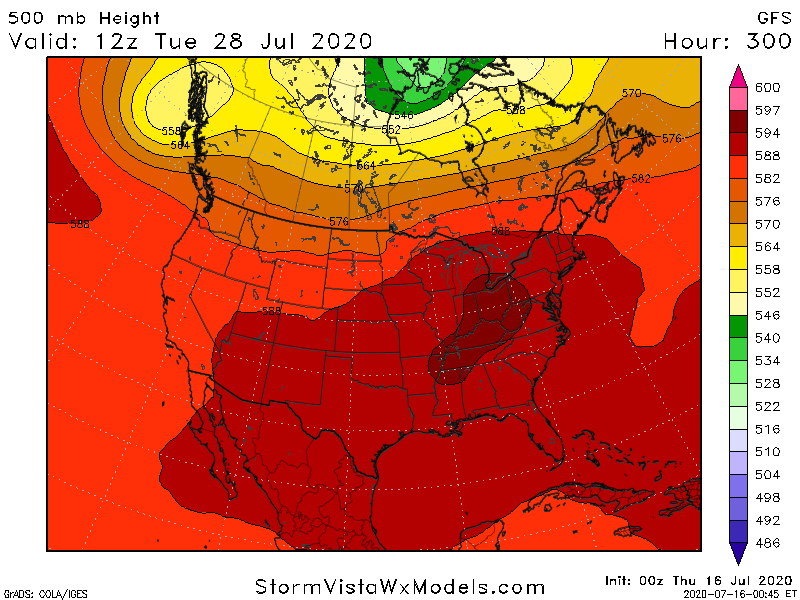

these two images show the 0z GFS MODEL at 500 mb valid 300 hrs out 7/28. The image on the TOP is the operational GFS and the dark red blob over the Midwest is the models depiction of heat Dome. That's where the temperatures are always the hottest and most likely DC above or close to 100 degrees F Max temperatures.

the image on the BOTTOM is the GFS Ensemble and as you can see it has a significant trough over the Eastern third of the country no heat Dome and in a much cooler pattern

+++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Weather Thursday

By mcfarm - July 16, 2020, 8:39 a.m.

huge rain came across Ill. By the time it got to the Ind state line it had dwindled down to a few tenths. Then as it approached Indy it split....again as it has all summer. North and south got some we got zero and this one we were counting on.

+++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Weather Thursday

By metmike - July 16, 2020, 10:53 a.m.

Dave,

The market is biting this morning. GFS looks pretty bullish.........others models, not as much.

Great points in your post.

+++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Weather Thursday

By metmike - July 16, 2020, 10:58 a.m.

mcfarm,

Sorry to read that you missed. I witnessed that happening on the radar last night.

Those are the worst.........getting Harleyed as we used to call it after our SD friend that this happened to over a dozen times one year.

Got 1.02 in our rain gauge here in the SW corner of IN.

Us and far N.IN got real lucky.

How much did others get?

+++++++++++++++++++++++++++++++++++++++++++

By metmike - July 16, 2020, 11:13 a.m.

Actually, the ensemble AVERAGE is not as bullish but half the members support the dome building in.

The Canadian model ensembles like the idea of it building farther east and would be bullish NG.

Still enough rain coming up the next week to keep things from getting too bullish at the moment.

However, the pattern is very close to being one that features "ridge riders" over the top of the top, diving into the Midwest to the Dome shifting just a bit farther north or northeast and it turning drier, especially in the western half of the Midwest.

Ridge riders then, might be more productive for the eastern Midwest, which would have better northwest flow.

I remember several Summers where northwest flow situations featured more and more rain events that ended up like the one mcfarm experienced in C.Indiana last night.

Huge rain in IL, completely dries up headed across the Wabash River on the IN border.

+++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Weather Thursday

By metmike - July 16, 2020, 1:15 p.m.

12z GFS was very bearish!

+++++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Weather Thursday

By bowyer - July 16, 2020, 1:28 p.m.

We had a nice all day rain yesterday. One inch on our farm. We also are used to watching rains come across Iowa, then die out when they hit the Mississippi river. We weren't Harleyed this time !

+++++++++++++++++++++++++

Re: Re: Re: Re: Re: Weather Thursday

By WxFollower - July 16, 2020, 2:38 p.m.

Mike said: 12z GFS was very bearish!

------------------------------

12Z Euro says the 12Z GFS is full of poop. Which is closer to reality? Stay tuned to the next exciting episode of "As The Models Turn".

Edit: Whereas the 12Z GFS has a cool Canadian high next week moving into the MW/NE, the 12Z Euro says "What Canadian high?" and instead has a blazing hot dome in the E US! Some locations in the MW/NE have a 25+ F degree difference between the models late next week!

++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Re: Weather Thursday

By metmike - July 16, 2020, 3:13 p.m.

thanks much Larry!

Huge difference for the last few days, 8-9-10 between those 2 models.

The ng market doesn't seem to buy into that hotter days at the moment.

We need the EE to keep it going thru then end of week 2..........stay tuned, like you said.

Its always fun when the models change like this..............sort of stinks because you cant have any confidence in the forecast or trading position but when was the last time you watched models that said the same thing for a week and confirmed each other with a run of the mill pattern that you couldn't wait to see the next model update?

Extreme weather is FUN to forecast(we don't want people to be hurt though-its not about that, its about the meteorology)!

Big changes are FUN and challenging!

++++++++++++++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Re: Re: Weather Thursday

By WxFollower - July 16, 2020, 3:28 p.m.

Mike said, "The ng market doesn't seem to buy into that hotter days at the moment."

--------------------------------------------------

Actually, NG rose over 2 cents while the Euro operational was coming out. It isn't so much "buying into it" but rather adding the hotter Euro into the mix of possibilities (as i see it). NG came down on the cooler 12Z GFS/GEFS. If the 12Z Euros warmer, wouldn't it make sense for it to bounce back whatever amount on that? Otherwise, it would be ignoring the Euro, a better model, which would make no sense unless there are OTHER (nonwx factors) which are simultaneously coming into play like the Dow/COVID, an invasion from Mars, etc.

Edit: And now the EE has come out and remains as hot as the 0Z EE and hotter than the 12Z GEFS. It has solidly AN temps for the E US through the entire run vs the 12Z GEFS, which had only slightly AN temps there throughout almost the entire run.

++++++++++++++++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Re: Re: Re: Weather Thursday

By metmike - July 16, 2020, 3:39 p.m.

I agree that we had a blip higher are the E OP model came out but it went nowhere

and we still held most of the losses.

To me, the E heat is mainly early in week 2 vs the GFS and for something like 3 days.

Which doesn't matter unless it continues because of a pattern change vs timing and placement of features based on uncertainties........in the same general pattern.......which seems to be the case right now. To me at least.

+++++++++++++++++++++++++++++++++++++++++++++

By metmike - July 16, 2020, 3:41 p.m.

The EE, like the E model is hotter, mainly days 8-9-10 than its previous run, then cools it back to the previous run after that(which is still hot but with dropping CD's).

Do you agree with that Larry!

+++++++++++++++++++++++++++++++++++++++++++

By WxFollower - July 16, 2020, 3:44 p.m.

Mike, I disagree with your take. See my edited post for my thoughts.

Edit: And don't forget that the NG market doesn't always move logically with wx changes as there are other factors, including COVID, DOW, technical, possible Martians, etc, Also, you need to consider the timing as often there is a delayed reaction that waits til forecasts pick up on these model changes (in some cases, not nearly all cases). Many traders wait for wx forecast to come out as they don't read model data, itself.

Edit: Regarding the 12Z EE being still hot to the end but with lower CDDS: keep in mind that there is more of a tendency of a reversion to the mean the further you go out in time on a run.

Edit #3: Regarding the 12Z EE being as hot as the 0Z EE. NG fell quite a bit on cooler 12Z GFS/GEFS in anticipation of cooler forecast adjustments. But the 12Z EE came in about as hot as the 0Z EE, which already was hot. So, now that means that there may not be those cooler forecast changes coming soon after all. Translation: just lookin at 12Z model changes and considering that NG fell sharply on cooler forecast changes due to the GFS/GEFS, a betting man would lean toward more bouncing back because well the forecast may stay the same instead of cooling off since the 12Z EE wasn't cooler than its prior run.

+++++++++++++++++++++++++++++++++++++++

By metmike - July 16, 2020, 3:58 p.m.

The CMC En was also cooler in week 2, similar to the GFS EN.

The Canadian model too.

All of them agree on modest troughing along or just west of the East Coast.

The center of the dome/heat ridge at the end of week 2 is back in the S.Plains to S.Rockies with an extension of the ridge, arching north into the N.Plains.

The tilt and location of the ridge northward is going to modulate any ridge riding perturbations that come around the periphery of the dome and possibly dive southeast into the Midwest.

I've seen this type of pattern get drier and drier as the Summer progresses.........weather systems generating less and less rains and missing more and more areas, with the dryness creeping up, especially in the WCornbelt.

But the models might look different in the few days.

To maximize the bullishness of heat, we need the center of the dome around 1,000 miles farther east at the end of week 2(instead of a weak trough that will make it LESS hot)

+++++++++++++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Weather Thursday

By WxFollower - July 16, 2020, 4:04 p.m.

1) The CDN ens is the worst/least reliable of the 3 ensembles. Maxar rarely takes it into account as a result. Also, that model has the largest cold bias.

2) The EE is by a good margin the best.

3) The EE is hot til the end. Slight drop in CDD's is expected on an ensemble run due to reversion to the mean as you go out further in time. A slight E US trough is reflective of this and yet it is still well AN and as hot as the 0Z.

4) I've said this before and will say it again: I think you emphasize the end of week 2, which has the lowest chance of verifying closely, too much in relation to the rest of the run. I notice that when you post about the Canadian ens, you only post the last map of the run. Regardless, the end of week 2 is still hot on the EE.

5) I wouldn't want to be short NG at these levels. In contrast, I think it is a buy down here. How often do I even mention my thoughts about price like this? NG is still, even after this small bounce, a whopping nearly 20 cents lower than its recent high in the low 1.90s (~1.924 on 7/7/20) and with the hottest of the summer coming as well as at least 2 and likely 3+ small weekly EIA builds coming. That will lead to a significant reduction of both the one year and 5 year storage surplus.

+++++++++++++++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Weather Thursday

By metmike - July 16, 2020, 5:23 p.m.

Great thoughts Larry!

I think you remember me telling you some of the reason that I use the 360 hour solutions in my weather updates.

If I was getting paid, I would use many more maps for each time period leading up to 360 hours but I pick 360 hours because thats the last time frame of the last map for all the ensembles.

It obviously is never going to be as good at 168 hours or 240 hours for accuracy but there is a certain amount of dialing in the solution(CDD's) for each time period(and price movement/changes) that changes after each model run based on whether the new solution matches the old one or not.

There is no exact formula but the farther out the time frame, generally speaking, with the less known about it, the more potential it has to change. As you say, thats why its not as reliable, however if we have total/cumulative CDD's for the entire period that are important(you use them like everybody else), the period at the end will always have more potential to contribute to changes in total CDD's.

So this late week 2 period is the most likely to have the biggest impact in CDD and HDD changes.

Also, its most likely to give us a clue about where the pattern is headed beyond 2 weeks which carries less weight then prior periods but it does matter.

For instance, if we had big changes for days 4-5-6, compared to the previous runs, we would have much more confidence in the solution than days 12-13-14 of the same thing but the market, after seeing days 4-5-6, also sees days 7-8-9-10......14.

A 3 day period in the middle of the forecast is not going to be that big of a big deal(it is for grains and rain however) if its not leading us into a pattern change that continues beyond that. And we know that because we can see it NOT happening on maps after day 6.

However, for days 12-13-14, we not only have the much higher potential for needing to dial in more or less heat vs the previous days 12-13-14, when those days turn sharply warmer or cooler.........we have an additional factor of extrapolating that out beyond the last maps with speculation of the early week 3 pattern.............which will soon be inside of the 2 week window.......and be getting much more attention from actual daily maps that depict the pattern.

I don't think that too many people are using the late week 1 or early week 2 pattern on weather maps to predict whats coming up after week 2. They will mainly be using the late week 2 pattern on weather models , along with other tools.

We may agree with how important late week 2 CDD days are on a stand alone basis compared to the same change in CDD's for late week 1, but I see additional power for those days to form opinions on what comes next.........which is what speculative markets are thirsting for.

Another way to put it, if days 4-5-6 added 10 CDD's then went back to the same CDD's as the previous run for days 7+, we would add just 10 CDD's to the forecast.

If days 12-13-14 added 10 CDD's to the forecast, we would add 10 CDD's and also, add more cooling to the speculative week 3 forecast which is just being formed and has the most potential to carry big changes/higher impacts because of the unknowns.

This can be underappreciated but think of it like this. A week later the end of week 2, will be the end of week 1 and we will have spent a week of trading week 3 days that become week 2 days and the market is always looking ahead.

This is especially important on a weekend. When, instead of just a change from one model run to the next, you have 8 models runs between the close on Friday and open on Sunday Evening.

What period would have the highest potential to see huge changes? The later ones.

Plus, you move a couple of early week 3 days up to late week 2 days in the forecast from progression and they now become part of the cumulative CDD computation.

I agree with you on the upcoming heat being super impressive and not wanting to be short here. There is no way for this particular pattern to look cool enough to imagine being short at these prices.

July is very often a very weak month for NG prices/seasonals. And like last Friday, it's going to be pretty tough to add enough heat to an already hot forecast to make people that have not bought on heat thats been there for the last 3 weeks to suddenly be impressed enough to buy on more heat.

Everybody must know how incredibly bullish the next 2 or 3 EIA numbers will be.

COVID, indutrial demand destruction and lost exports are hanging heavy but they should not make that much difference in RESIDENTIAL demand.

People if anything, might be spending a bit MORE time at home with the AC on.

We really need more heat in the East/South to maximize the CDD's and bullishness(I think).

It's not a positive thing for the price today to be the lowest its been since July 2nd.

This was just before the holiday weekend and before prices went up 2,000+ quickly the following week from the forecast going from hot, to record CDD totals.

Since that quick spike higher, ng has struggled but the amount of heat has not increased either, in fact on a few days, we have been LESS hot.

++++++++++++++++++++++++++++++++++++

By WxFollower - July 16, 2020, 5:53 p.m.

Mike, I still don't agree with you as you've made these same points before and your points didn't change my mind. I think you're misguided here. I look at the entire ensemble's cumulative CDDs first and foremost rather than giving more weight to the very end. Yes the very last day tends to vary more from run to run but that's because it is more of a wild guess/low reliabliity/less meaningful. Why should I care about a wild guess? The market is smart enough to know this and not put more emphasis on the very end of the run imo.

I'll give an extreme example to further make my point. Using your thinking, if the GEFS or EE runs went out 30 days, what would stop you from giving day 30 more weight than any other day? I mean you do it for day 16..why wouldn't you do it for day 30? I'd think that would be silly but based on your logic you'd do it.

And actually, we can look at an even more extreme example: Euro weeklies, which go out 45 days. For the most part, the mkt doesn't give a hoot about the Euro weeklies. Days like 20-45 are near useless. Sorry, that's how I see it. You and I will just have to agree to disagree.

Edit: Further supporting my point, look how much warmer is late week ONE on the 18Z GFS vs the 12Z. So, even late week one can be quite changeable much less late week two.

+++++++++++++++++++++++++

By metmike - July 16, 2020, 8:05 p.m.

Thanks Larry,

I was not trying to change your mind, just telling you my thinking for why I use the end of week 2 maps in my extended range discussions after your criticism of this earlier:

"4) I've said this before and will say it again: I think you emphasize the end of week 2, which has the lowest chance of verifying closely, too much in relation to the rest of the run. I notice that when you post about the Canadian ens, you only post the last map of the run. Regardless, the end of week 2 is still hot on the EE."

++++++++++++++++++++

"Using your thinking, if the GEFS or EE runs went out 30 days, what would stop you from giving day 30 more weight than any other day? I mean you do it for day 16..why wouldn't you do it for day 30? I'd think that would be silly but based on your logic you'd do it."

Nope, I wouldn't do it using my logic for the exact reason that we both agree on. Forecast skill drops as the forecast period becomes more distant. At what time frame do models lose so much skill that they are no longer useful? Let's assume that the GFS products going out 15 days, mean that NOAA/modelers believe there is value still, even on day 15(384 hours). I will guess that we could add a couple days to that and probably have some skill but not alot of skill............but 30 days? No chance. 20 days? Nope. I only go to 360 hours now(not even to the max of 384 hrs that I could show for the GFS and Canadian models because I actually think that might be taking it a bit too far). I evaluate the pattern at 360 as my end point, then extrapolate what that might mean for pattern changes that could be taking place then, for the start of week 3.

"we can look at an even more extreme example: Euro weeklies, which go out 45 days. For the most part, the mkt doesn't give a hoot about the Euro weeklies. Days like 20-45 are near useless. Sorry, that's how I see it. You and I will just have to agree to disagree"

LARRY,

We are not disagreeing on this. You have never seen me use a 45 day outlook or the weeklies. I agree completely that days 20-45 are near useless. My position is that I see some but dropping skill to 360 hours, which is 14 days that can be extrapolated to a few more days using speculation and..............this is the most important --strong model agreement at the distant time frames. If the ensembles are all over the place at 360 hours, they are almost useless. Sometimes they will break up into 2 camps with the opposite solution and the average is in the middle. This can be useful to tell us that 1 camp may be right and the other one completely wrong. Or the GFS and EE are completely different on day 360........it gives us a range and that we can follow to see what model converges to the other one or if both converge. In general, as you know the average(ensemble) is better and always more consistent.

When all the ensembles from different models have something very similar at 360 hours they are very useful. There are other things that bolster or weaken confidence like the the AO or NAO at that time frame(which usually is a reflection of the model solutions, so its not really a 2nd opinion as much as applying a strong tendency of certain patterns to have a tendency to result in models under appreciating the scope of telleconnections that certain indices capture.

Just like you, I look at the cumulative CDD's and give that the most weight. But what I notice, is that all things being equal, if the trend in CDD's over the last several days in the period is up, the market, at least initially reacts more bullish, even if the cumulative CDD's are the same as the previous run.

As you know, the market reacts immediately as the CDD's are coming out, each day or 2 at a time sometimes. The last few days in the forecast, are the ones with the last reaction. If it was cooler early but then turned hotter late enough to at least offset, I think the price will often reflect the end result and be higher then when the run started. Other factors come into play immediately after that if the cumulative CDD's are not that much different...........like the market anticipating the next models runs and other fundamentals.

Above all else, do know that I am always skeptical of model solutions at distant time frames. Models, using mathematics representing the physics of the atmosphere solving millions of equations to give us our weather. It's a dang miracle and shows how brilliant human beings are......in being able to predict the future.......of the weather.

Larry,

Do you ever think about how lucky guys like us are when looking at weather models all day? It's like having a crystal ball telling us the future. Seriously man, in what other venue can you actually see the future unfolding day by day(sometimes hour by hour) going out 2 weeks?

And its not just the future of something trivial. The weather, as this discussion shows plays a massive role in everybody's life. Can determine prices for commodities. Crop production and so on.

And even if that wasn't the case, the incredible physical realities in our atmosphere and the hundreds of laws that go into it. The role that H2O plays. The freezing point of water. Evaporative cooling/condensation heating. Solar energy driving the entire process. Rotation of the earth causing the coriolis force interacting with pressure gradients. Thunderstorms with lightning, Tornadoes, hurricanes, snowstorms.....OMG, I need to stop now before my head explodes from the joy of contemplating it all (-:

But seriously, you and me can watch it all day long on our computers..........and it keeps changing to make things interesting.

I've been doing this for 36 years now and there has not been 1 minute of 1 hour that I haven't really enjoyed looking at weather models and can't wait for the next run.

It may get very tedious posting weather stuff because its extra work but the analysis part is like being in heaven every time.

When I did speaking engagements to kids in their science class at school, I would usually tell them about how fun the job was(being on tv back in the old days was fun too as people treated you as a celebrity-even though you were no better than anybody else). I would tell the kids that I have a little secret for them but they can't tell too many people because if my boss finds out, I'll have to get another job to earn a living.

I would then tell them, that if I had lots of money, I would do this job for free because its so much fun.

And Larry, how many people can look at all these models like we do and understand what they mean?

When I started trading in 1994, I bought a satellite dish for the roof and a 15K system from WSI (from the profits on my 2K account opened in 1992) that gave me the latest weather information the second the NWS got it..........printed out very slowly on a printer.

There was no internet of course. Almost no other traders had this, so when the 48 hour NGM would come out, I would be 30 minutes ahead of the market reaction in the 1990's. Like taking candy from a baby!

Today, we can get thousands of times that information on the internet which loads in less than a second. Private weather services have in house models that beat the release times of the NWS.

When trading, instead of taking candy from a baby, I often feel like the baby with the wild gyrations that define todays price changes.

Losing money from a weather trade is never any fun but analyzing the weather will always be epic fun.

How did you get started?

++++++++++++++++++++++++++++++++

By WxFollower - July 17, 2020, 2:05 a.m.

The internet is both good and bad. The bad is the constant spread of fake news/misleading info/hatred but the good are things like wx models. I remember when I hardly knew what a wx model was until Tom Skilling taught me about the European back in the 1980s on WGN-TV cable station.

What got me started? Back when I was doing stats/math for a living, some guy in a cowboy hat (Ken Roberts is his name...see link below) sent a mass mailing booklet about trading commodities to try to get us to buy his advice. Within that booklet was only 1 page or so about trading on wx. I already had been following wx since a little boy and thus my nickname here. Also, I was following wx as a fun hobby on Prodigy and then the new thing called the WWW in the early to mid 1990s. Then I read you could actually make money on the combo of investing and following wx?? I thought wow, I want to look into this. Although I never bought anything from the cowboy trader, I started off as a loser letting some fund trade for me. But I also did a search and found Freese-Notis and Craig Solberg's Wxtrades. I analyzed Craig's history and never turned back.

Cowboy hat commodities trading guru Ken Roberts:

"In 1997, WORTH magazine declared that '... Ken Roberts has introduced more people to [commodities] than anyone in the universe.'"

Well, Ken did the same for me even though I never bought any of his stuff!

++++++++++++++++++++++++++++++++

By metmike - July 17, 2020, 7:15 a.m.

I remember Ken Roberts well Larry.

There were so many hucksters around then that I figured he was one too....especially when I was using the weather to make a killing and every huckster I was contacted by had a plan that I knew was doomed to fail......like buying HO calls before the winter.

I’ll look back at his stuff though because I think I remember changing my initial opinion on him after seeing more of his approach and thinking that, year that could actually work and maybe he’s not just ripping people off to get heir money to buy his system.

++++++++++++++++++++++++++++++++++++++++++

By metmike - July 17, 2020, 7:20 a.m.

GFS has troughing in the east and southeast where we need heat rigging later in week 2 to maximize the heat in the high population areas.....instead this pattern maximizing heat closer to where crops grow and minimizes it where a lot of people live.

+++++++++++++++++++++++++++++++++++++++++

By metmike - July 17, 2020, 7:30 a.m.

Besides that pattern on the last 6z gfs, the 0z Eae was cooler for every day after day 4.

++++++++++++++++++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Weather Thursday

By WxFollower - July 17, 2020, 11:07 a.m.

Mike said:

“GFS has troughing in the east and southeast where we need heat rigging later in week 2 to maximize the heat in the high population areas.....instead this pattern maximizing heat closer to where crops grow and minimizes it where a lot of people live.”

———————————————-

Mike,

Despite this troughing on the 6Z GFS late in week 2, NG is now up another 2 cents from where I said I wouldn’t be short and ~3 cents above where it was when you made this post. It is near 1.743. Maybe I should start my own wx trading recommendations service? ;)

++++++++++++++++++++++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Weather Thursday

By metmike - July 17, 2020, 12:10 p.m.

Thanks Larry!

Yes, the upcoming heat is just too much to completely ignore with these historically low prices. Residential demand will be at a record the rest of the month.

Even though the forecast has been cooled, especially the EE that lost 5 CDD's on the last run(which caused the price spike down early this morning below the previous July lows) its NOT cool.............just LESS hot.

+++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Re: Re: Weather Thursday

By metmike - July 17, 2020, 12:32 p.m.

I don't even have to look at the GFS to know what the market thinks it will show/what it shows by looking at the price of NG.

+++++++++++++++++++++++++++++++

By WxFollower - July 17, 2020, 12:52 p.m.

Mike,

It must be the Martians this time. ;) It isn’t the Dow as it is up and it wasn’t the GFS because it was warmer when NG was falling. Remember that wx model changes (or wx period) are far from the only factor in prices.

+++++++++++++++++++++++++++++++++

By metmike - July 17, 2020, 1:47 p.m.

Funny,

Yes, sometimes ng does not always behave exactly as expected...more like its on another planet(-:

I still think the market was ANTICIPATING the cooler days after day 8 on this last GFS.

The GFS has had its share of less heat solutions for the week 2 period the last couple of days and if I thought this would be more likely than not.........and am right, I get paid a few minutes later when the maps show it.

Making money in ng is often being tied to being in these short lived spikes up and down just before they start or very early..........and sometimes they come back.

When prices come back, if you waited to see all the GFS maps before buying or selling, you probably get the WORST price and have nothing but drawdown from the price returning to pre model run levels.

+++++++++++++++++++++++++++++++++++++++++

By WxFollower - July 17, 2020, 2 p.m.

My very close following of NG is that it usually doesn't care much, if any, about the operational GFS past about day 10. It used to, but

1) I think it has since gotten smarter and realized that the 11-15 day GFS has very low credibility since it often jumps so much from run to run.

2) By the time day 10 is coming out, the GEFS is about to start and NG typically starts to focus on the GEFS because it has more weight due to higher credibility than the GFS. It will then focus on it through most of its run, including well into week 2 unlike what I've observed it does for the GFS.

The GEFS used to start after the GFS was completed. So, that allowed NG to focus more on the 11-15 GFS than it does now.

++++++++++++++++++++++++++++++++

By metmike - July 17, 2020, 4:08 p.m.

I agree about the operational GFS. The NG does not consider it important and when the ensemble is coming out, it ignores is much of the time.

The grains, however seem to react MUCH more to it though.

The GFS ensemble had a downtrending CDD line for the last 5 days and I know that you don't think that period matters as much, I think on a Friday, with the market closed for 2 days it matters even more.

When we come in Sunday Night, those days will have much greater value and if you think of the mindset of traders that are holding their position over the weekend(or thinking of putting one on-or covering) here in the last hour of trading on Friday, not too many are worried about the price change between now and the close.

Most know that ng rarely opens on Sunday at 5pm right where is closed Friday at 4pm.

Changes in the models will be the biggest determinant, especially cumulative CDD changes.

What period has the biggest potential to contribute to those changes?

The last several days +the 2 additional ones.

This last EE came out less hot for every day in the forecast period, along with a downtrending CDD line on the graph for the last 5 days........like the GFSE had.

The better EE model that was hotter yesterday than the GFS has shifted less hot, more in line with the GFS this time.

Note my avoidance of cooler because its still pretty hot.

+++++++++++++++++++++++++++++++++

Re: Re: Re: Re: Weather Thursday

By metmike - July 17, 2020, 4:36 p.m.

I realize too that climatology will dial down extremes towards the end of the forecast period in the models and that could part of the cooling.

Also, the NAO dives lower in the last several days of the forecast on half of the solutions today. If this happens, more troughing and cooling is likely in the high population areas of the East.

It's more useful in Winter as a tool but even with slight weighting in my view, it goes in the cooler direction.

I want to be long ng but need to see a legit meteorological reason for the heat ridge to shift much farther east, where the most people live.

Email: meteormike@msn.com | IP Address: None | Cookie ID: None

0 likes

By metmike - July 19, 2020, 2:44 p.m.

48-hour rainfall totals in China (major corn growing areas shaded) Not what the swollen Yangtze River needed...

Email: meteormike@msn.com | IP Address: None | Cookie ID: None

0 likes

By metmike - July 19, 2020, 2:45 p.m.

Even in wet summers, there always seems to be some part of the Corn Belt that just can't buy a rain. This summer that area is to the northwest of Des Moines where radar estimates a small area has had under four inches of rain over the past 60 days

Email: meteormike@msn.com | IP Address: None | Cookie ID: None

0 likes

By metmike - July 19, 2020, 2:49 p.m.

Average highs over the past week A BRUTAL period of weather for the Texas panhandle Note Borger with an AVERAGE high in that period of 110 Heat unlike any ever recorded in July at Amarillo (topping out at 110) and Borger (116)

metmike: One would think that the TX cotton rating would plunge tomorrow, with a big increase in p/vp.

The intense heat like this, is over for now.