A crude oil inventory draw of 1.6 million barrels sent oil prices higher today, with the Energy Information Administration also reporting a fall in gasoline inventories and a modest build in distillate fuel inventories.

This compared with a draw of 4.5 million barrels for the previous week, the third weekly draw—and hefty—in a row.

A day earlier, the American Petroleum Institute cooled oil bulls’ optimism by estimating a gasoline inventory build of close to 5 million barrels for the week to August 14.

The EIA, for its part, estimated gasoline stockpiles had shed 3.3 million barrels last week, versus a modest decline of 700,000 barrels. Gasoline production last week fell, to 9.4 million bpd from 9.6 million bpd a week earlier.

Distillate fuel inventories rose by 200,000 barrels in the week to August 14, after a 2.3-million-barrel draw estimated for the previous week. Distillate fuel production averaged 4.7 million bpd, versus 4.8 million bpd for the previous week.

Refinery runs fell to 14.5 million bpd last week from 14.7 million bpd the week before.

Brent crude traded at $44.89 a barrel at the time of writing, with West Texas Intermediate at $42.44 a barrel in what is shaping up to be a mixed-results week. Oil started the week with a rise on the back of reports China was planning to ramp up oil imports from the United States but the budding rally ended soon amid doubts that the U.S. economy was recovering as quickly and consistently as it should be.

On top of that, OPEC+ is meeting today to discuss the progress of its production cut deal and future plans, adding a new angle of uncertainty. Even though no surprise news is expected to come out of this meeting it could tell traders how the deal is going and whether internal agreement remains robust.

OPEC+ boasted record compliance in July, at a combined 94-97 percent, according to different surveys.

"Oil futures trimmed losses Wednesday after the Energy Information Administration said crude and gasoline inventories fell last week. West Texas Intermediate crude for September delivery CL.1, -0.33% was off 15 cents, or 0.3%, at $42.74 a barrel after trading as low as $42.26. The Energy Information Administration said crude inventories last week fell by 1.6 million barrels, while gasoline inventories were down 3.3 million barrels. Oil had been under pressure after the American Petroleum Institute late Tuesday reported a rise in gasoline inventories, which would be a bearish sign in the final stretch of summer driving season. The EIA said distillate inventories rose by 200,000 barrels. Analysts surveyed by S&P Global Platts had expected the EIA data to show U.S. crude supplies fell 3.8 million barrels last week, while gasoline stocks were expected to show a decline of 2 million barrels. Distillate supplies were forecast to fall 900,000 barrels."

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 19, 2020 | 10:30 | -1.632M | -2.670M | -4.512M | |

| Aug 12, 2020 | 10:30 | -4.512M | -2.875M | -7.373M | |

| Aug 05, 2020 | 10:30 | -7.373M | -3.001M | -10.612M | |

| Jul 29, 2020 | 10:30 | -10.612M | 0.357M | 4.892M | |

| Jul 22, 2020 | 10:30 | 4.892M | -2.088M | -7.493M | |

| Jul 15, 2020 | 10:30 | -7.493M | -2.098M | 5.654M |

| Jul 08, 2020 | 10:30 | 5.654M | -3.114M | -7.195M | |

| Jul 01, 2020 | 10:30 | -7.195M | -0.710M | 1.442M | |

| Jun 24, 2020 | 10:30 | 1.442M | 0.299M | 1.215M | |

| Jun 17, 2020 | 10:30 | 1.215M | -0.152M | 5.720M | |

| Jun 10, 2020 | 10:30 | 5.720M | -1.738M | -2.077M | |

| Jun 03, 2020 | 10:30 | -2.077M | 3.038M | 7.928M |

Weekly US ending stocks of crude oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

Weekly ending stocks for unleaded gasoline.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

Crude 3 month chart

| |

Crude 1 year chart below

| |

Crude 5 year chart below

| |

Crude 10 year chart below

| |

Unleaded Gasoline Price Charts:

| |

| |

5 year........are we headed back to the highs?

| |

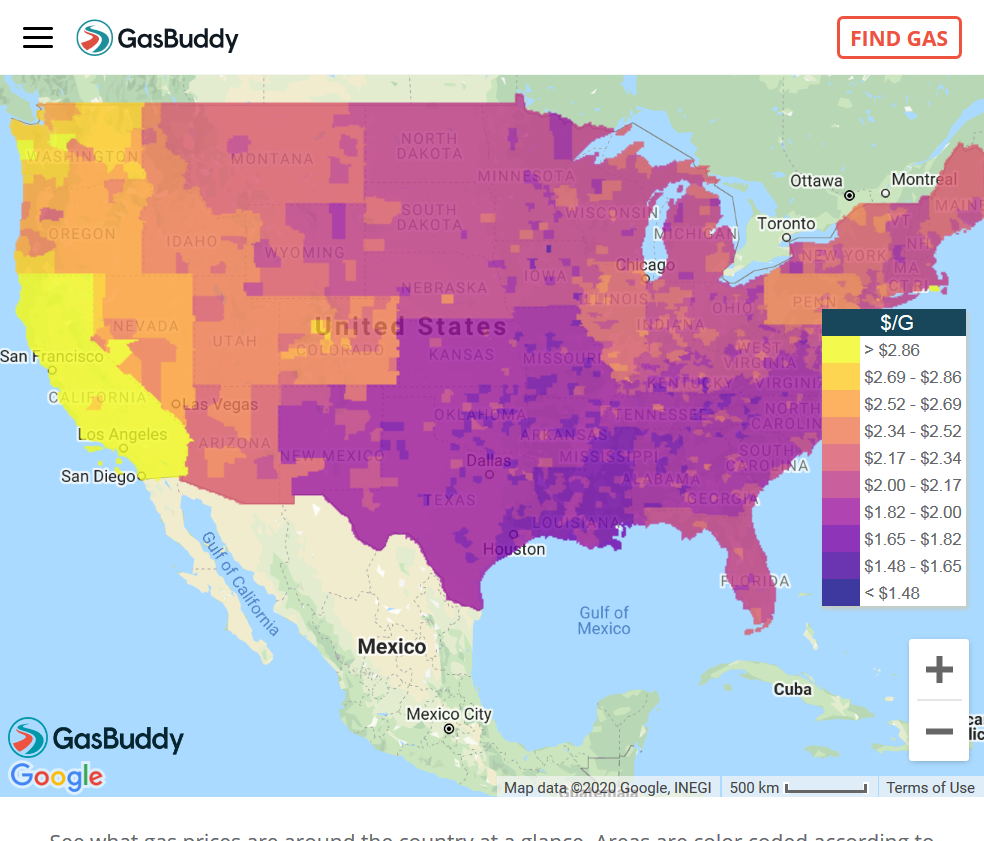

Current gas prices:

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.822395

https://www.quora.com/Why-are-west-coast-gasoline-prices-higher

https://www.oilandgas360.com/opec-meets-to-review-compliance-with-oil-cuts/

OPEC+ is unlikely to change its output policy, which currently calls for reducing output by 7.7 million barrels per day (bpd) versus a record high 9.7 million bpd up until this month, OPEC+ sources said.

“The meeting will be mostly a focus on conformity and compensation,” said an OPEC source, rather than any major tweaks to the OPEC+ supply cut deal.

Other sources said the virtual meeting, scheduled to start at 1400 GMT, would look in particular at compliance by countries such as Iraq, Nigeria and Kazakhstan. They have made a smaller share of their reduction than members such as Saudi Arabia.

Another OPEC source was upbeat, saying the producers could deal with challenges like rising U.S. or Libyan production.

“Everything will go well within OPEC+ because everyone needs stability and visibility in the market,” the source said.

Overall compliance reached 95% to 97% in July, according to OPEC+ sources and a draft report seen by Reuters.

That is high by OPEC standards. In July, Saudi Arabia was pumping below its target and Iraq and Nigeria, while lagging the Gulf OPEC members on compliance, were pumping less than in previous months, according to a Reuters survey and other assessments.

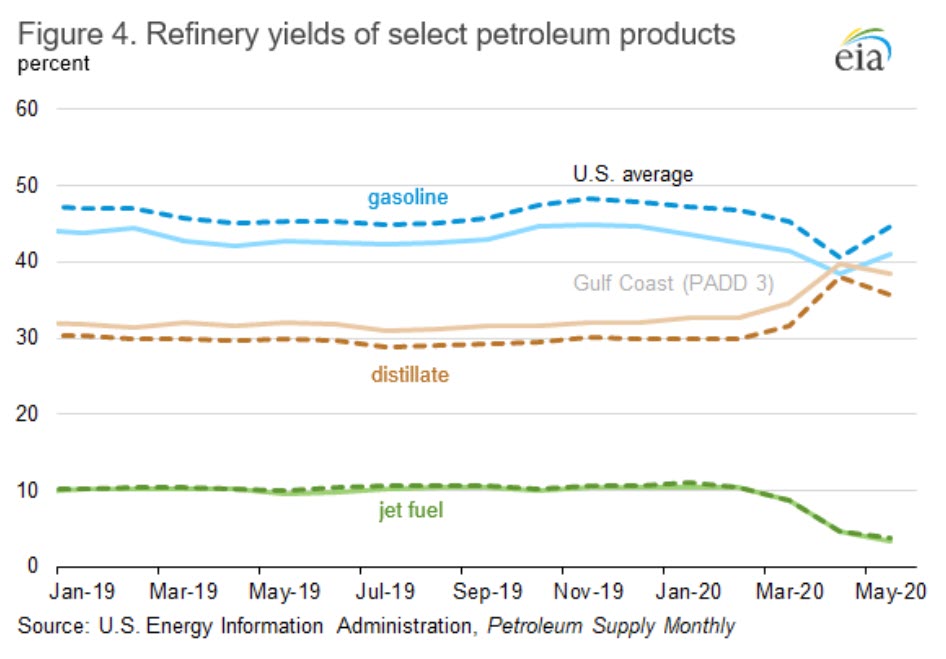

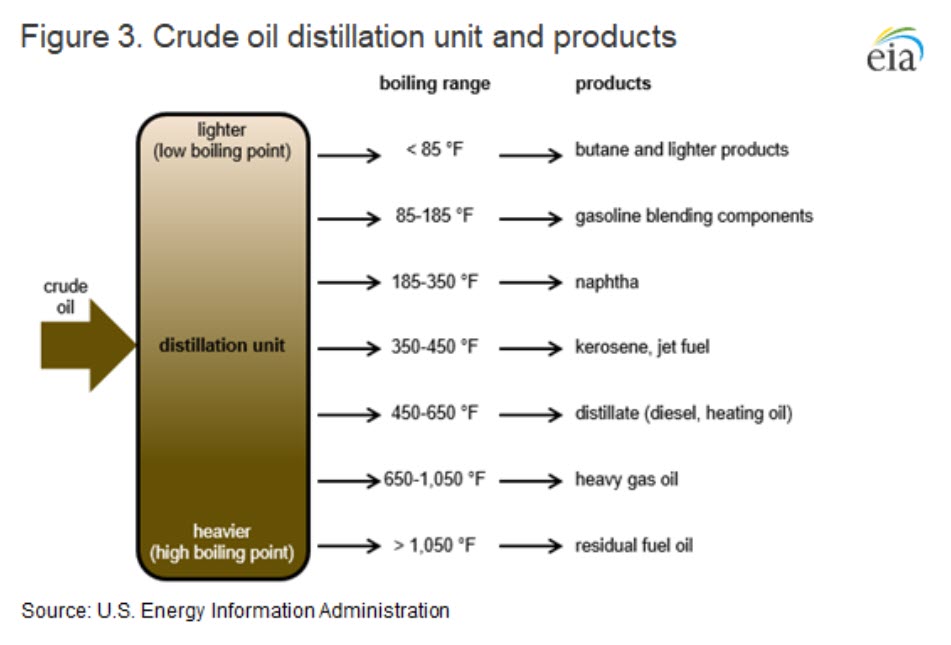

One way that refiners can accomplish a change in yield slate is by adjusting the operation of their distillation towers. For example, jet fuel has a boiling point between that of naphtha and distillate (Figure 3). By changing the process conditions in its distillation columns, a refinery can shift volumes of jet fuel into either naphtha or distillate, thereby reducing the volume of jet fuel produced and increasing the volumes of naphtha or distillate, or both, depending on demand and price signals such as crack spreads.

To compensate for the record decline in jet fuel and gasoline prices, U.S. refineries shifted their yield slate away from gasoline and jet fuel and produced more distillate fuel (Figure 4). In 2019, U.S. refinery finished motor gasoline yield was 46.2%, and distillate fuel yield was 29.7%. In April 2020, U.S. gasoline yield fell to 40.7%, a record low, while distillate yield rose to a record high of 38.1%. In the U.S. Gulf Coast (Petroleum Administration for Defense District, or PADD, 3), distillate yields were higher than gasoline yields in April for the first time on record. Compared with 2019 levels, jet fuel yields at the U.S. level and in PADD 3 decreased by more than 50% to 4.7% and 4.6%, respectively, in April. Jet fuel yields on the East Coast (PADD 1) decreased substantially compared with last year. East Coast refiners reported less than 0.1% jet fuel production in April and May, compared with a five-year average of approximately 7.6%. As demand for transportation fuels began to increase in May, refinery throughput and yields have begun to return to historical levels, although U.S. jet fuel production is still significantly lower than any other time since 1993.