Looks like weather will be a most important player in the market. Only a slight influence from exports, and the cancellations. Not to mention the excess of storage, in spite of the low active rig count. Industrial return to usage is still minimal, but not to be ignored when it comes to the power grid.

Admittedly hard to call in this particular situation. Play the reverasals into fundes.

Thanks Mark!

October Natural Gas, the front month, expires on Monday.

Heating degree days, seasonally pass up cooling degrees right around October 4th, so the market is focused on the heating degrees in the forecast.

We have several days of some unseasonable cold coming up later this week but that seemed to all get dialed in on one day last week..........and then some with the super, mega one day spike higher last Wednesday with ng +$3,000/contract in the October contract.

The cold pattern will ease up and temps will be warming gradually to above average as week 2 progresses.

Prices tonight opened a bit lower, had a small spike even lower to the lows in the first minute, 2.765 for November, rallied to the plus side for a short while and now dropped to slightly lower.

So ng is not showing a strong directional tendency so far.

Last week was a big ole head fake.

Natural Gas Intelligence Tuesday Morning:

Heading into its first full session as the front month, November natural gas futures sold off in early trading Tuesday as analysts pointed to weakness in the physical market as a source of downward price pressure. The November Nymex contract was down 11.8 cents to $2.677/MMBtu at around 8:50 a.m. ET. The early selling Tuesday…

September 29, 2020

metmike: October weather forecasts warming up

The market was looking at this today

Another tropical storm brewing in the Caribbean this morning. Another chance to get short early next week after the inevitable pop in NG prices.

Thanks Jim!

Finishing up on this portion of the re mortaring of our patio job and will get back to posting more.

NGI Wed am:

With prices finding little support from mild weather shaping up after the current week, natural gas futures extended their recent slide in early trading Wednesday. After plunging 23.4 cents in Tuesday’s session, the November contract was down another 10.4 cents to $2.457/MMBtu at around 8:50 a.m. ET. Natural gas futures had a “tough day” Tuesday,…

September 30, 2020

Natural gas futures on Wednesday crept lower, following a steep drop the previous day, as traders mulled weather-driven demand concerns, stagnated liquefied natural gas (LNG) levels, and the potential for a higher storage injection with the federal government’s pending report Thursday morning. The November Nymex contract shed 3.4 cents day/day and settled at $2.527/MMBtu. The…

September 30, 2020

7 day temperatures for tomorrows EIA report.

Cool Southeast, warm NorthCentral.

Should be a robust injection!

Tempted to stay up overnight and trade the early shift. Everything so far says bearish.

Weekly Natural Gas Storage Report

for week ending September 25, 2020 | Released: October 1, 2020 at 10:30 a.m. | Next Release: October 8, 2020

+76 BCF nuetral(a tad bullish?) but weather is bearish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/25/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 09/25/20 | 09/18/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 872 | 851 | 21 | 21 | 817 | 6.7 | 827 | 5.4 | |||||||||||||||||

| Midwest | 1,033 | 1,009 | 24 | 24 | 962 | 7.4 | 946 | 9.2 | |||||||||||||||||

| Mountain | 231 | 225 | 6 | 6 | 198 | 16.7 | 205 | 12.7 | |||||||||||||||||

| Pacific | 316 | 312 | 4 | 4 | 290 | 9.0 | 306 | 3.3 | |||||||||||||||||

| South Central | 1,304 | 1,283 | 21 | 21 | 1,020 | 27.8 | 1,065 | 22.4 | |||||||||||||||||

| Salt | 358 | 349 | 9 | 9 | 216 | 65.7 | 259 | 38.2 | |||||||||||||||||

| Nonsalt | 945 | 934 | 11 | 11 | 804 | 17.5 | 806 | 17.2 | |||||||||||||||||

| Total | 3,756 | 3,680 | 76 | 76 | 3,285 | 14.3 | 3,351 | 12.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,756 Bcf as of Friday, September 25, 2020, according to EIA estimates. This represents a net increase of 76 Bcf from the previous week. Stocks were 471 Bcf higher than last year at this time and 405 Bcf above the five-year average of 3,351 Bcf. At 3,756 Bcf, total working gas is above the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

looks like the bulls want to break out so bad, but there just isn't enough support for it. Still waiting.

Thanks Mark!

The Energy Information Administration (EIA) reported a 76 Bcf injection into natural gas storage inventories for the week ending Sept. 25, a figure that offered no surprises to the market but initially knocked prices down a couple of notches. The November Nymex gas futures contract was trading about 5.5 cents lower in the minutes leading…

October 1, 2020

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 08, 2020 | 10:30 | ||||

| Oct 01, 2020 | 10:30 | 76B | 79B | 66B | |

| Sep 24, 2020 | 10:30 | 66B | 78B | 89B | |

| Sep 17, 2020 | 10:30 | 89B | 79B | 70B | |

| Sep 10, 2020 | 10:30 | 70B | 68B | 35B | |

| Sep 03, 2020 | 10:30 | 35B | 34B | 45B |

++++++++++++++++++++++++++

November Nymex natural gas futures swung in a 15-cent range Thursday before ultimately finishing the day exactly where they started. After government data showed an on-target storage report, the prompt month went on to settle Thursday flat at $2.527. December, however, fell 5.5 cents to $3.062. The stability at the front of the Nymex curve…

Figgity Diggity Friday to You! Here's your weather(bearish ng):

Certainly not a dull day today.

Thats for sure Mark!

We collapsed to huge losses on mild overnight models, then came all the way back to higher for the day briefly and have been under a bit of pressure ahead of the next models runs that should continue to advertise the week 2 warm up.

It's interesting that the week 2 temps will get warm enough to generate some fairly significant late season cooling demand.

That could have been a factor in the huge recovering in prices.

Cooling demand in October, unless it's record breaking and in the first half of the month, has limited bullish potential with regards to longevity.

From NG intelligence:

Markets

Yep. Dialing it in early. And if the week 2 temp forecast changes, it go up way higher.

Thanks......here's the latest on the tropics:

Markets

Record natural gas production declines and a potential rebound in winter demand could create the tightest market of the past decade, with Henry Hub prices soaring to $5.00/MMBtu if weather is colder than normal, according to Morgan Stanley. Researchers said that the precipitous drop in oil prices has stalled growth in the “free” associated gas…

October 6, 2020

metmike: Below comments from last nights close and this morning................but after this, we closed the Tuesday day session down $1,000/contract, despite a much stronger hurricane being forecast........so that got all dialed in and then some yesterday.

++++++++++++++++++++++++++++++++

Monday close:

After sinking near the 200-day moving average at the end of last week, natural gas futures bounced back with a vengeance Monday thanks to stronger liquefied natural gas (LNG) feed gas demand and strong cash prices. The November Nymex gas futures contract hit a $2.727/MMBtu intraday high before settling at $2.615, up 17.7 cents from…

October 5, 2020

+++++++++++++++++++++==

Tuesday early:

NGI All News Access

Amid continued strength in the outlook for liquefied natural gas (LNG) exports, albeit with looming uncertainty from another major hurricane aimed at the Gulf Coast, gas futures extended the previous session’s rally in early trading Tuesday. The November Nymex contract was up 2.8 cents to $2.643/MMBtu at around 8:50 a.m. ET. The National Hurricane Center…

October 6, 2020

Markets

As Hurricane Delta bore down on the Gulf of Mexico (GOM), prompting production shut-ins, natural gas futures advanced several cents in early trading Wednesday. The November Nymex contract was up 7.5 cents to $2.595/MMBtu at around 8:40 a.m. ET. Delta was about 35 miles from Cancun, Mexico, as of 8 a.m. ET, moving northwest at…

October 7, 2020

“Furthermore, yesterday Destin Pipeline noted that offshore gas flows into the system had been reduced significantly and were expected to fall below the minimum rate required to sustain operations at the Pascagoula Gas Plant. As a result, Destin will not be able to provide offshore gas transportation services until further notice.”

Meanwhile, the weather data trended cooler overnight, enough to add some demand to the outlook, according to Bespoke Weather Services.

However, projected gas-weighted degree day totals for the next 15 days remain “well below normal” overall and “well under what we saw last year on the same dates,” Bespoke said.

Bespoke said it does not expect “the core” of Delta to make a direct impact with liquefied natural gas (LNG) facilities in the potential path of the storm, “but Cameron LNG is a close call, per some model guidance…Yesterday, the market seemed to fear more substantial LNG impacts from the storm, so a miss to the east could allow prices to rise, barring cash weakness. Weak weather demand could cause some pressure again late month, however.”

Looking ahead to Thursday’s Energy Information Administration storage report, NGI is modeling a 75 Bcf injection for the week ending Oct. 2. That would compare with a 102 Bcf injection recorded in the year-ago period and a five-year average build of 86 Bcf.

7 day temperatures last week for tomorrows EIA report...very mild Midwest. Cold West and pretty warm south

Massive intraday swings continued midweek for natural gas futures, which closed higher once the dust settled. The November Nymex contract moved in a more than 20-cent range before finishing the day at $2.606, up 8.6 cents from Tuesday’s close. December picked up 5.3 cents to reach $3.149. After solid increases the past two sessions, spot…

October 7, 2020

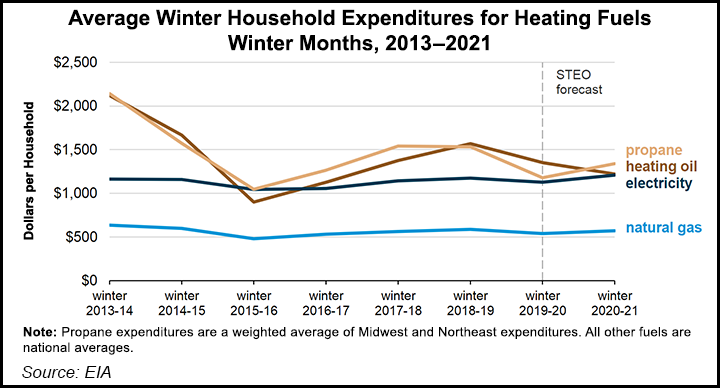

Americans can expect residential heating costs this winter to climb from a year earlier, including in the majority of states where natural gas is the most commonly used fuel to warm homes.

On average, accounting for all fuel sources, households across the United States will pay more this winter — October through March — than last winter, the U.S. Energy Information Administration (EIA) said Wednesday in its Winter Fuels Outlook. The prediction is based on higher expected energy consumption, as weather forecasts call for colder winter temperatures than a year earlier and as more Americans work from home amid the ongoing coronavirus pandemic.

“We’re in a period of demand rebound,” said Edward Morse, global head of commodity research at Citigroup Inc.

Morse joined representatives from EIA and the National Oceanic and Atmospheric Administration (NOAA) to provide commentary on the annual outlook during a webinar.

EIA generally expects more space heating demand this winter compared with last based on NOAA forecasts. The agency predicts U.S. average heating degree days to be 5% higher than last winter. It also expects that ongoing efforts to slow the spread of the virus – notably, more people working and attending school at home — will contribute to higher levels of home heating use than normal.

Natural gas consumption and expenditures are “expected to increase across all regions” of the Lower 48, said Tim Hess, manager of EIA’s Short-Term Energy Outlook (STEO).

Washington — Rising domestic demand for natural gas and improved LNG exports heading into the winter are likely to combine with declining production to push up Henry Hub spot prices to average $3.38/MMBtu in January 2021, the US Energy Information Administration said Oct. 6.

Receive daily email alerts, subscriber notes & personalize your experience.

In its October Short-term Energy Outlook, EIA also forecast that spot gas prices would stay above $3.00/MMBtu throughout 2021.

Total market production was estimated to decline from an average of 100.04 Bcf/d in 2019 to 93.88 Bcf/d in 2020 and 94.38 in 2021, although the levels were up from the prior forecast. EIA raised its fourth quarterproduction estimate by 2.15 Bcf/d to 96.48 Bcf/d and its its Q1-21 production forecast by 1.24 Bcf/d to 94.04 Bcf/d.

Lower gas prices in September reflected high inventory levels and relatively low demand for US LNG exports amid hurricane-related activity in the Gulf of Mexico, EIA Administrator Linda Capuano said in a statement accompanying the release of report, as well as EIA's winter fuels outlook Oct. 6.

The agency lowered the Q4 spot gas prices forecast by 23 cents to $2.68/MMBtu, and the Q1 forecast by 2 cents to $3.31/MMBtu, compared with the prior month's forecast.

But, "EIA expects that rising demand heading into winter, combined with reduced production, will increase Henry Hub natural gas spot prices to $3.38/MMBtu in January 2021." Capuano said.

Compared with last month's forecast, EIA raised its natural gas consumption estimates by 2.74 Bcf/d to 87.28 Bcf/d for Q4, but lowered its estimate for Q1 by 320 MMcf/d to 93.86 Bcf/d.

Gas consumption is expected to average 78.7 Bcf/d in 2021, down 5.9%, the report said reflecting higher natural gas prices that will cut into demand for gas in the power sector.

EIA officials, in an online forum Oct. 6, emphasized the October outlook remains subject to significant uncertainty because of the pandemic.

Thanks Mike.

Looking back over the charts, there has been a lot of volitility in the Oct/Nov contracts. Weather, hurricanes, supply, exports, various demand, covid fears, have all played a roll in the volitility we have seen. And it's been a roller coaster ride. At least it has kept me on my toes. This is why I am only daytrading NG at this time. And only when some fundamental news spurs a breakout. Because the market is reacting in $1000+ moves. Which lends me to believe there is a certain lack of confidence involved. Just kneejerk reactions.

I can agree, that we might well see $5 gas in Jan/Feb. But then again, it might not be sustainable due to the storage, extension of covid fears, and rigs coming back online due to rising prices. I'm not doubting the demand due to a La Nina winter. Just a bit skeptical. But the way things have gone this year, nothing in the way of "normal" is to be expected.

for week ending October 2, 2020 | Released: October 8, 2020 at 10:30 a.m. | Next Release: October 15, 2020

+75 BCF........an initial small spike higher says a bit bullish but it was close to the average guess, even a bit higher.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/02/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 10/02/20 | 09/25/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 893 | 872 | 21 | 21 | 846 | 5.6 | 852 | 4.8 | |||||||||||||||||

| Midwest | 1,062 | 1,033 | 29 | 29 | 999 | 6.3 | 979 | 8.5 | |||||||||||||||||

| Mountain | 236 | 231 | 5 | 5 | 202 | 16.8 | 209 | 12.9 | |||||||||||||||||

| Pacific | 318 | 316 | 2 | 2 | 295 | 7.8 | 310 | 2.6 | |||||||||||||||||

| South Central | 1,322 | 1,304 | 18 | 18 | 1,047 | 26.3 | 1,088 | 21.5 | |||||||||||||||||

| Salt | 366 | 358 | 8 | 8 | 226 | 61.9 | 268 | 36.6 | |||||||||||||||||

| Nonsalt | 955 | 945 | 10 | 10 | 820 | 16.5 | 819 | 16.6 | |||||||||||||||||

| Total | 3,831 | 3,756 | 75 | 75 | 3,387 | 13.1 | 3,437 | 11.5 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,831 Bcf as of Friday, October 2, 2020, according to EIA estimates. This represents a net increase of 75 Bcf from the previous week. Stocks were 444 Bcf higher than last year at this time and 394 Bcf above the five-year average of 3,437 Bcf. At 3,831 Bcf, total working gas is above the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

Thanks Mark!

At this time of year, in most years, speculation of what "might be" is at a maximum.

That's because the entire heating season is ahead of us, which is the biggest unknown with the greatest potential to make a massive difference in storage.

So there is often alot of risk premium in the price.

This year, with high storage, you can make a case of less need for risk premium.

With the very low rig counts and low supply coming in, some strong, early cold waves could produce impressive drawdowns, especially with more people working from home and at home at this point in time because of COVID.

Residential heating deman is going to be an even more dominant factor this Winter than usual with industrial demand on the weak side though.

The U.S. Energy Information Administration (EIA) reported a 75 Bcf injection into natural gas storage inventories for the week ending Oct. 2, a figure that was exactly on target with NGI’s projection. Though on the higher end of the wide ranging estimates, price reaction was rather muted immediately after the data was released. In the…

October 8, 2020

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 15, 2020 | 10:30 | 75B | |||

| Oct 08, 2020 | 10:30 | 75B | 73B | 76B | |

| Oct 01, 2020 | 10:30 | 76B | 79B | 66B | |

| Sep 24, 2020 | 10:30 | 66B | 78B | 89B | |

| Sep 17, 2020 | 10:30 | 89B | 79B | 70B | |

| Sep 10, 2020 | 10:30 | 70B | 68B | 35B |

The weather is actually starting to lean a bit more bullish with regards to early HDD demand later this month.

Story of the day

Colder forecasts/models are pushing natural gas higher.

I’ve been getting a kick out of how the news sources have been describing Gulf hurricanes’ effects on NG. Early in each threat, NG has tended to rise in anticipation of shutins. But later as the storm hits, it has tended to fall due to reduced LNG exports as well as reduced demand from outages and cooling. Why it has tended to be bullish early and bearish late is something I can’t answer. If anything, the net effect of most of these storms has been bearish from a combined supply/demand perspective. So, why wouldn’t NG drop immediately instead of first rising a lot followed by falling a lot.

By the way, my guess is that H Delta will end up pretty much a wash on the S/D picture for NG. My guess is that NG is up today due as Mike said to colder forecasts, not the storm.

Thanks Larry!

Interesting that we have record ng in storage for this time of year but cold weather this Winter, with more people at home and less supplies(very low rig count) will have the potential to generate some robust residential heating demand and chew into the surplus.

Here were the closing comments from Natural Gas Intelligence:

Further cooler trends in the latest weather data and steep production cuts because of Hurricane Delta combined to send natural gas futures prices screaming higher Friday. After surging to a $2.821 intraday high, the November Nymex gas futures contract capped off the week at $2.741, up 11.4 cents from Thursday’s close. December climbed a more…

Sometimes I get a kick out of the commentary by reporting sites. Not that they aren't right, after the fact. But the drama that they can interject into their articles. Especially when I have been watching the market all day. Especially when using adjectives such as "screaming". LOL! Well, it did make a $1000+ move up, and then died out. But I wouldn't have called it "screaming".

Thanks Mark!

I'm guessing that these reporters don't actually trade natural gas.........which is probably a good thing because having a position would likely make them biased.

They certainly have numerous contacts that DO trade ng though and use them as sources.

The vast majority of times, this probably gives them a much bigger market view based on participants than metmike or WxFollower have.

But every day, we have an equal number of people buying and selling, so alot of people are wrong every day. They probably know why they were wrong at the end of the day but that doesn't mean they were unbiased in their views.

Like a weather ensemble, which is a ton of model solutions compared to just 1 operational model, the ensemble is almost always more reliable and is always more consistent.

Consulting several ng traders every day to get their comments on why ng traded a certain way, in the long run would do better than just asking one person.

However, no matter how smart those traders are, they are a tiny fraction of the market and sometimes they are all wrong about the main reason that the entire market with thousands of traders traded the way it did.

Larry and I get it wrong too sometimes............unless he never loses money (-:

There are 2 natural gas seasonal graphs below.

The top one is very updated....1999-2019. The one below that is thru 10 years ago, 1991-2009.

They are almost identical thru early August............then really deviate tremendously!

What are some things we might learn from this? I would appreciate Larry and others chiming in with views.

1. Spring is an extraordinarily strong time frame for NG prices.......always has been. Something like 19 out of 20 years up for some embedded time frames.

2. Despite it being so dependable, in 2020 COVID caused the opposite to happen in unprecedented fashion.

3. Late June, thru July is the weakest period of the year historically. We started that period this year, with near record heat and CDD's being added to the weather forecast making it MORE bullish than the seasonal pressure.

4. That support gave way in early/mid July with the heat dialed in and the forecasts cooling off.

5. The August seasonal has apparently changed in the last 10 years. Used to be very weak and a continuation of the weak July(maybe it was hurricane premium coming out, when most of the production was coming from the Gulf). The more recent seasonal is nuetral for August.

6. Then, we have both graphs lining up together with Sept and Oct being very strong months historically.

7. Then, we have huge divergence which is very surprising to me based on what I "thought" which might be a bias.

I always remember November as being my most profitable month in the 1990's and it was always picking the October high and being short in November. I remember lots of Halloweens, trick or treating with the kids and having an especially fun time checking price quotes on the short positions. However, we had some very mild Novembers in the late 1990's too. ...so it makes sense.2 The 2009 seasonal shows that. However, the 2019 seasonal shows the complete opposite. The biggest difference of the year between these 2 graphs. November from the 2019 graph actually has the greatest % increase of any month. WOW!

Before commenting more, I will still need to look at HDD data for November to see if the Novembers from 2010-2019 were that much colder than the Novembers from 1991-1999 that they replaced on the 20 year chart. Memory tells me yes. Recent Halloweens for me......now trick or treating with the GRAND kids have featured everybody bundled up. Last Thanksgiving featured some major cold.

https://charts.equityclock.com/natural-gas-futures-ng-seasonal-chart

2000-2019 seasonal below

http://www.equityclock.com/charts/natural-gas-futures-ng-seasonal-chart/

The above chart represents the seasonality for Natural Gas Futures (NG) Continuous Contract for the past 19 years.

Any comments are appreciated.

Mike. Thanks for the charts.

On the subject of HDD's, is there a site or platform that calculates and graphs that information on a daily basis? Looking for regional averages if possible.

NGI Monday morning:

Markets

Further cooler momentum in the latest round of forecast data, against a backdrop of supply disruptions in the Gulf of Mexico (GOM) and in the Northeast, had natural gas futures rallying in early trading Monday. The November Nymex contract was up 16.6 cents to $2.907/MMBtu at around 8:40 a.m. ET. Weather data shifted cooler over…

October 12, 2020

metmike: Sharply colder weather coming this week gave us the huge, bullish gap higher last night. Moderation in week 2 is probably putting some pressure on since then but the gap still remains wide open.

Until it gets filled, it's an upside breakaway gap.

If it gets filled, its a gap and crap, failed break out formation.

With Gulf Coast liquefied natural gas (LNG) facilities unscathed by Hurricane Delta, export demand’s quick rebound combined with a chillier forecast to send natural gas futures sharply higher Monday. The November Nymex gas futures contract jumped 14.0 cents to settle at $2.881. December climbed 6.7 cents to $3.271. Spot gas prices also posted stout increases…

metmike: While the above could also be a big factor, temps moderating in week 2, especially on the European model caused us to completely fill the huge gap higher from Sunday evening's open.

Huge gaps higher are very bullish but when they get filled 24 hours later, they are the complete opposite............exhaustion gaps(gap and crap)

GAP AND CRAP TECHNICAL FORMATION DEFINED

Breakaway upside gap from the previous day that gets filled quickly.

This is a potentially very negative, buying exhaustion price formation. Initially, the market gaps above the previous days high on the next days open, leaving a gap in prices that were never traded between those previous days highs and the new days lows. This happens because of some powerful force affecting market/trader mentality while the market was closed that caused the bulls to get much more aggressive with buy orders and bears to pull back or be overwhelmed with BUY orders ABOVE the previous days high.

When that gap is open, it is often a breakaway gap, signaling even higher prices as the new force that caused it remains. If that gap is filled and prices return to the previous, lower range, it can be quite bearish...........usually only happens when the bullish force pushing the buying goes away. At that point, the exuberant buying has been exhausted and everybody buying on the most bullish news yet, has bought already and there's nobody left to keep buying and sellers actually have to push the market lower to attract buyers at lower prices.............BELOW the gap.

metmike: They're on it today with the reasoning. Bottom line is that technical formations at this time of year thru lat Winter, often don't mean anything except what the weather models showed that day.

They are actually pretty good weather forecasting tools for somebody that doesn't have access to the latest weather model data.

If natural gas is +2,000 on the day, you can almost assume the forecasts used by those closest to the latest data are getting much colder and vice versa.

A milder-trending temperature outlook saw natural gas futures reverse lower early Tuesday, paring gains from the previous day. The November Nymex contract was down 7.5 cents to $2.806/MMBtu at around 8:45 a.m. ET. Prices advanced double digits in Monday’s session as liquefied natural gas (LNG) export volumes appeared largely unscathed by last week’s Hurricane Delta…

metmike: NGI's explanation for the massive price plunge from yesterdays close, then Wednesday's open below.

NOTE: Scroll up a few pages to see the gap and crap technical formation that occurred and was described on Monday 10-12-20 (while prices were still much higher) that predicted this.

Natural gas futures headed lower Tuesday as morning weather models shifted warmer. Production moved considerably higher as well, sending the November Nymex gas futures contract down 2.6 cents to $2.855. December slipped 2.4 cents to $3.247. Spot gas prices were mixed amid cooler weather in the central and eastern United States and continued heat out…

October 13, 2020

++++++++=+++++++++++++++++++++++

A warming weather outlook and reports of a possible setback in the timeline for recovery in exports out of Louisiana had natural gas futures trading sharply lower early Wednesday. The November Nymex contract was down 19.0 cents to $2.665/MMBtu at around 8:50 a.m. ET. Analysts at EBW Analytics Group attributed the move lower to reports…

October 14, 2020

NGI after the close on Wednesday:

Natural gas futures tanked Wednesday as news of a sunken barge in the Calcasieu Ship Channel squashed hopes for a quick resumption in full exports from the Cameron liquefied natural gas (LNG) facility. Another warmer shift in the latest weather data and higher production also worked in favor of bears. The November Nymex contract settled…

October 14, 2020