Crop calendar for Argentina:

http://www.soybeansandcorn.com/Argentina-Crop-Cycles

Crop Calendar for Brazil:

http://www.soybeansandcorn.com/Brazil-Crop-Cycles

The maps below are for the past 30 days, 90 days and 180 days % of average precipitation.

Soybean country of Brazil has been dry!!!

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

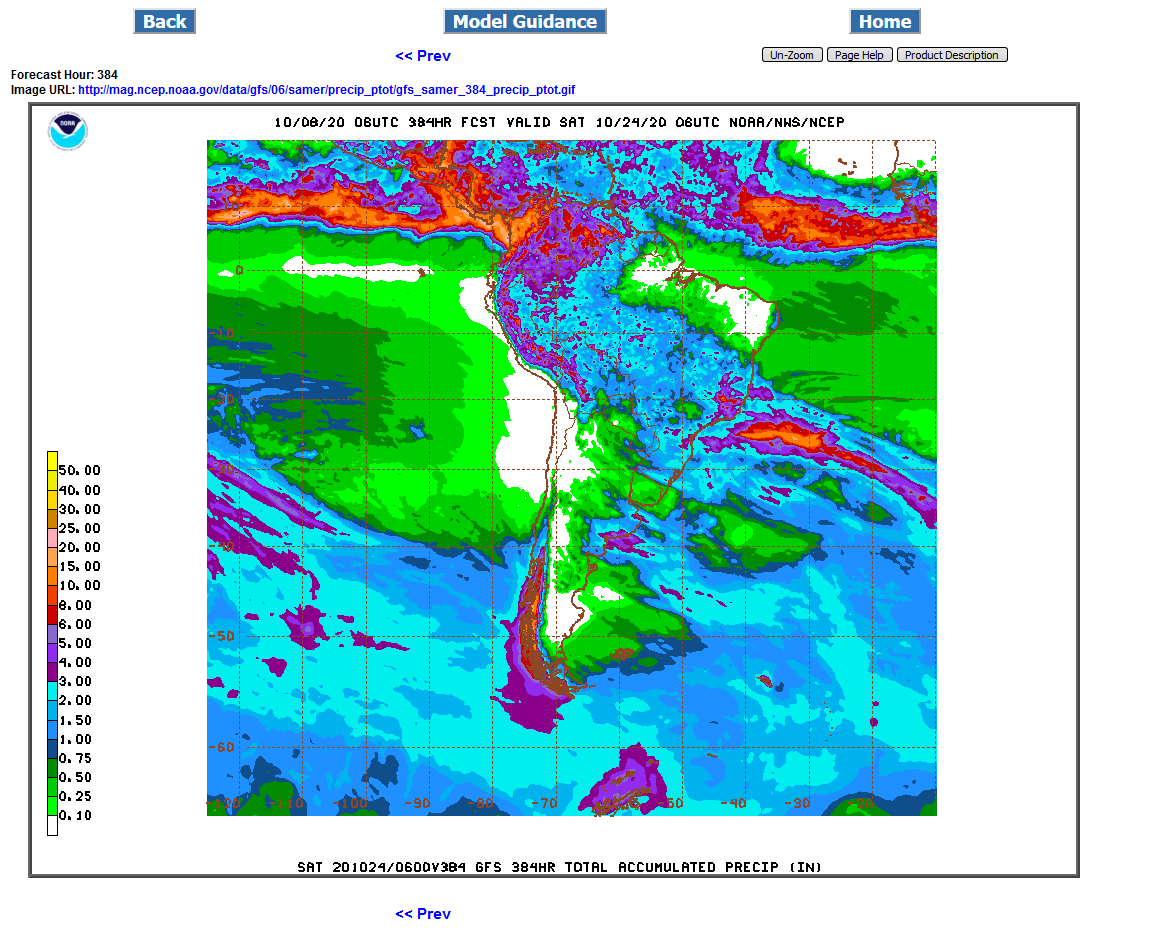

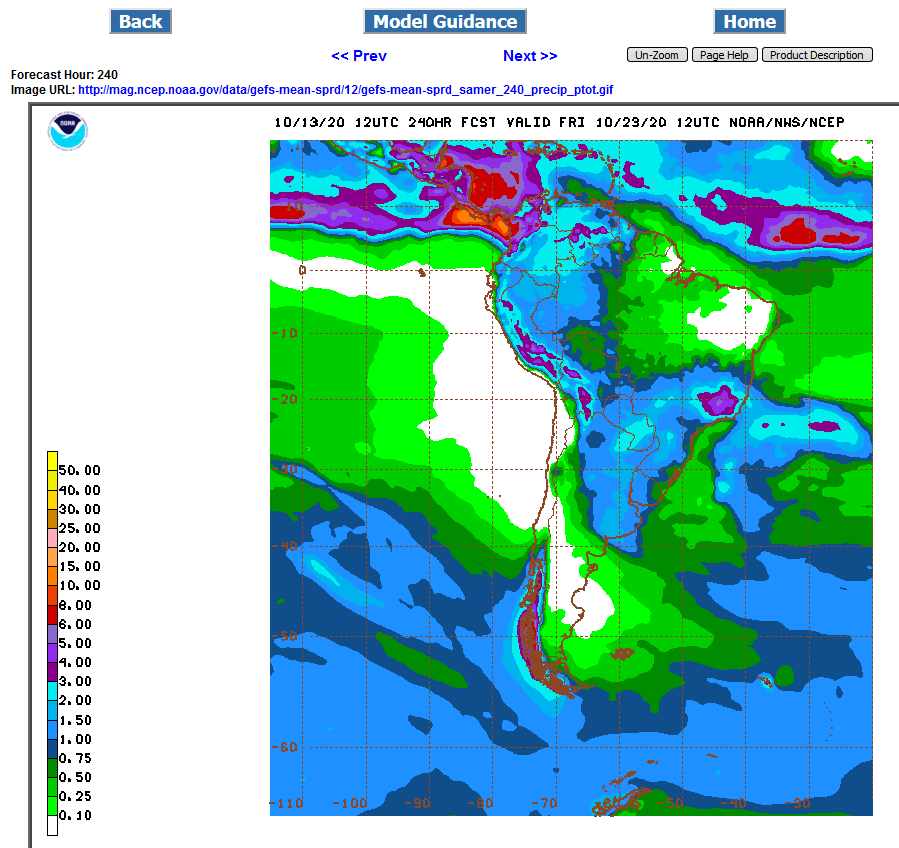

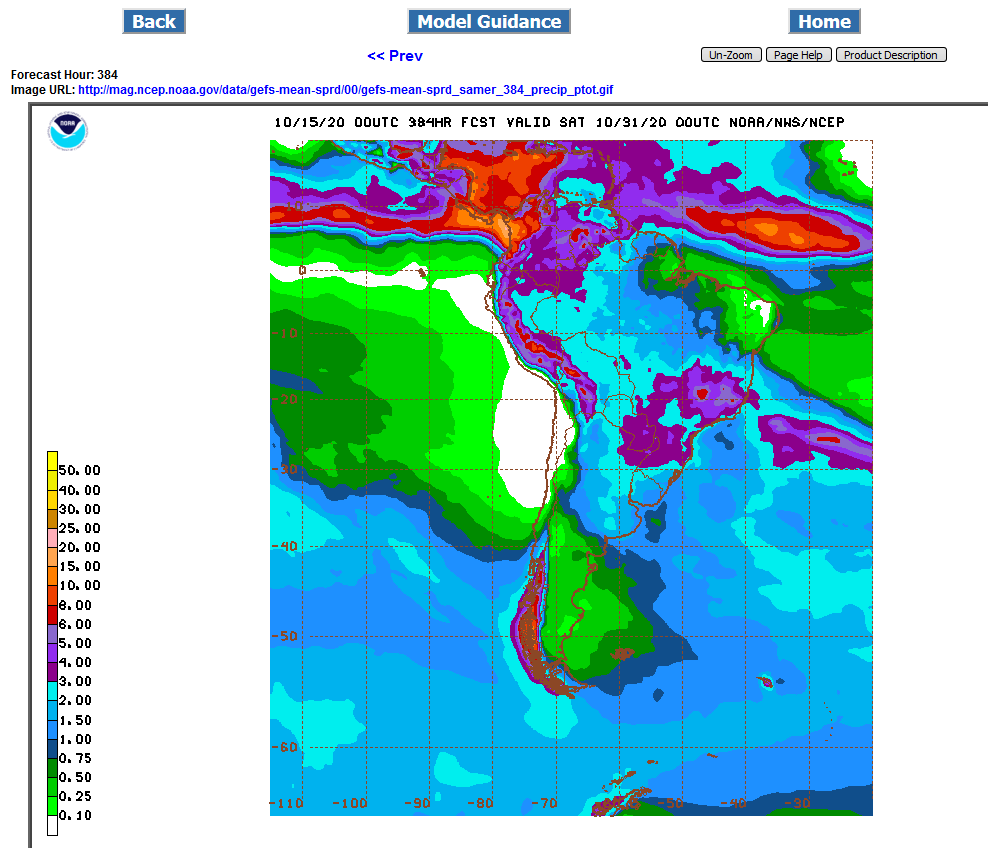

The forecasts below come from the GFS/US model.

The big weather story is that the hot/dry pattern will break in week 2 and allow some big rains for coffee land(far east/central) and potentially decent rains farther west into soybean land.

http://wxmaps.org/outlooks.php

Monitoring rain/satellite pictures:

https://en.allmetsat.com/images/goes_py_suda_zoom_ir.php

https://www.eldoradoweather.com/satellite/misc/s.america-ir-sat.html

https://www.accuweather.com/en/br/national/satellite

Rain amounts 24 hours:

http://www.inmet.gov.br/portal/index.php?r=tempo2/mapasPrecipitacao

Rain amounts for longer periods globally:

https://www.cpc.ncep.noaa.gov/products/Global_Monsoons/gl_obs.shtml

If not for the huge increase in CO2 the past 100 years, crop conditions in areas of natural droughts would have deteriorated much more. Increased CO2, besides acting as atmospheric fertilizer also causes plants to be more water efficient. They don't need to open their stomata as wide or as often to let CO2 in. As a result, they lose less water/moisture from evapotranspiration.

Soybeans are a C3 plant. C3 plants benefit the most from the increase in CO2.

The preceding discussion has presented the average effects of elevated CO2, but obscures important patterns of difference in response among plant species. One of the most important determinants of species differences in response to elevated CO2 is photosynthetic type. Most plant species (~90%) utilize a photosynthetic process known as C3 photosynthesis. Other species use either of two physiologically distinct processes known as C4 and CAM photosynthesis (Figure 2). C4 plants include most tropical and sub-tropical grasses and several important crops, including maize (corn), sugar cane, sorghum, and the millets. There has therefore been considerably more research on the responses to elevated CO2 in C4 than in CAM plants.

Figure 2: Each plant species utilizes one of several distinct physiological variants of photosynthesis mechanisms, including the variants known as C3 and C4 photosynthesis.

"Current evidence suggests that the concentrations of atmospheric CO2 predicted for the year 2100 will have major implications for plant physiology and growth. Under elevated CO2 most plant species show higher rates of photosynthesis, increased growth, decreased water use and lowered tissue concentrations of nitrogen and protein. Rising CO2 over the next century is likely to affect both agricultural production and food quality. The effects of elevated CO2 are not uniform; some species, particularly those that utilize the C4 variant of photosynthesis, show less of a response to elevated CO2 than do other types of plants. Rising CO2 is therefore likely to have complex effects on the growth and composition of natural plant communities."

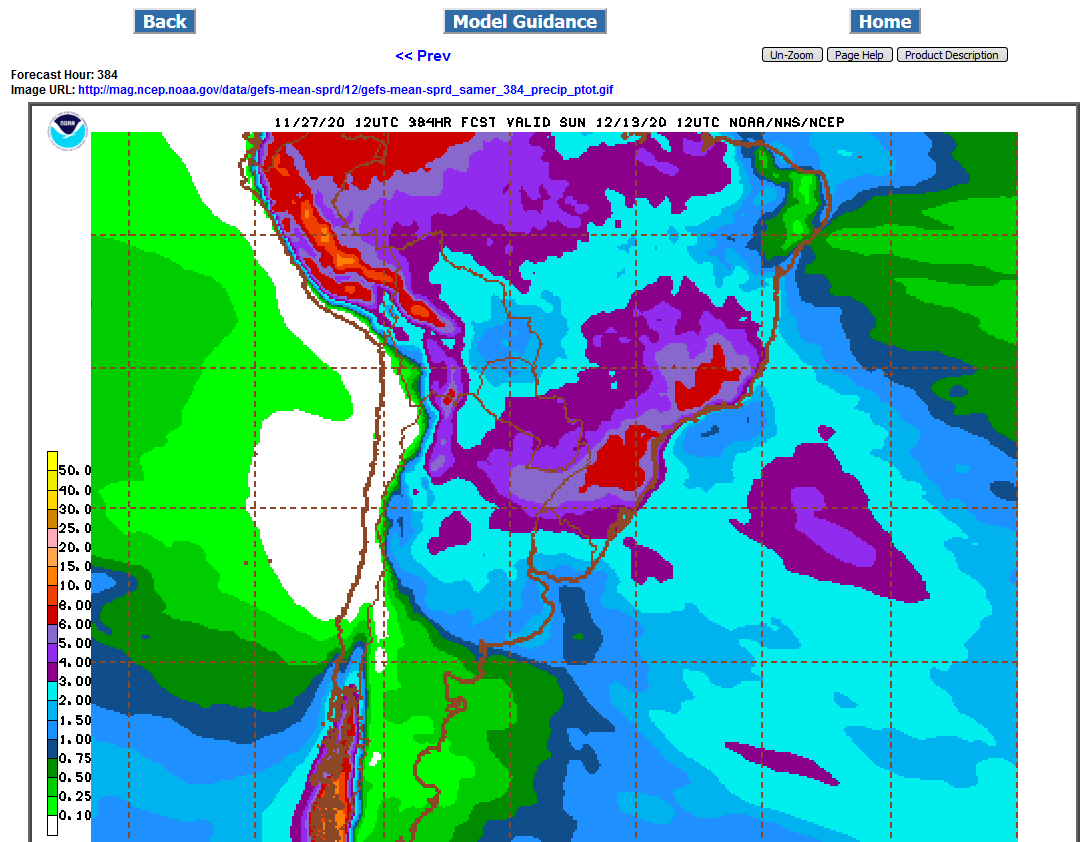

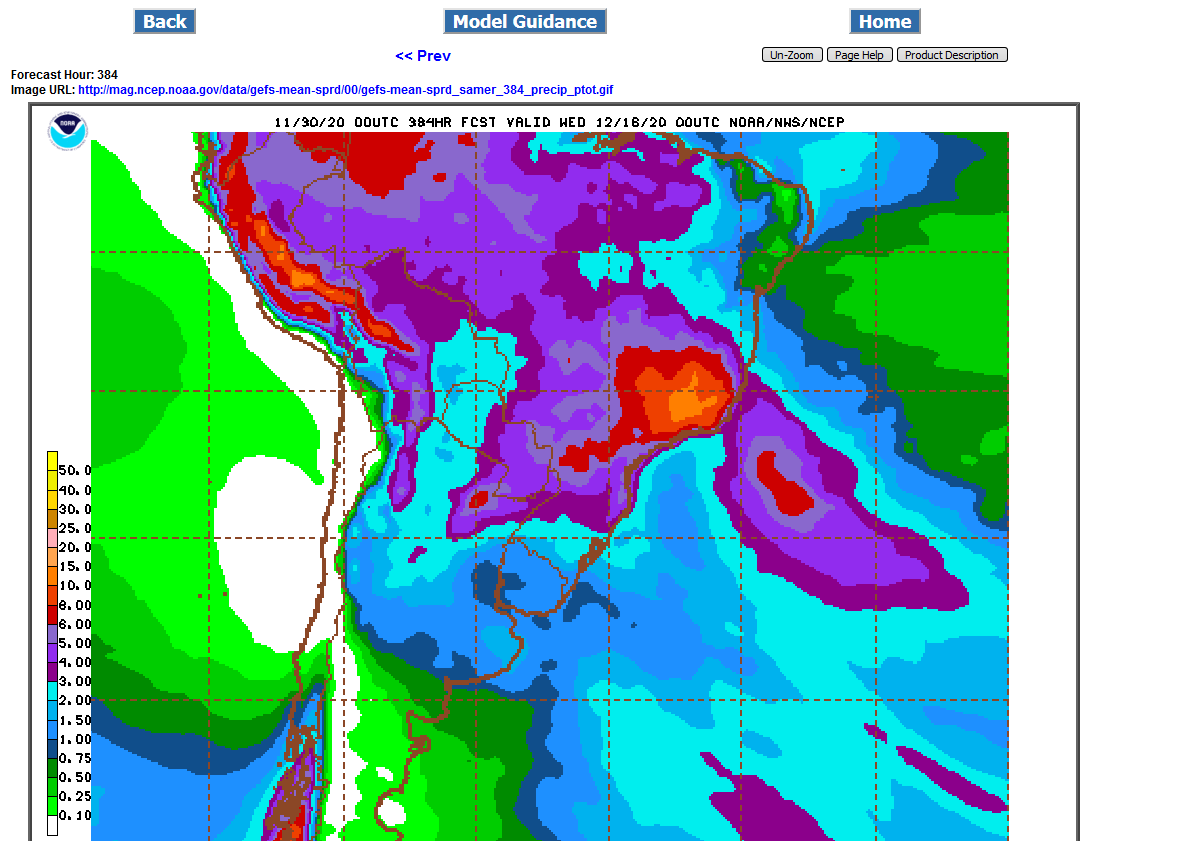

Latest 2 weeks rains for South America:

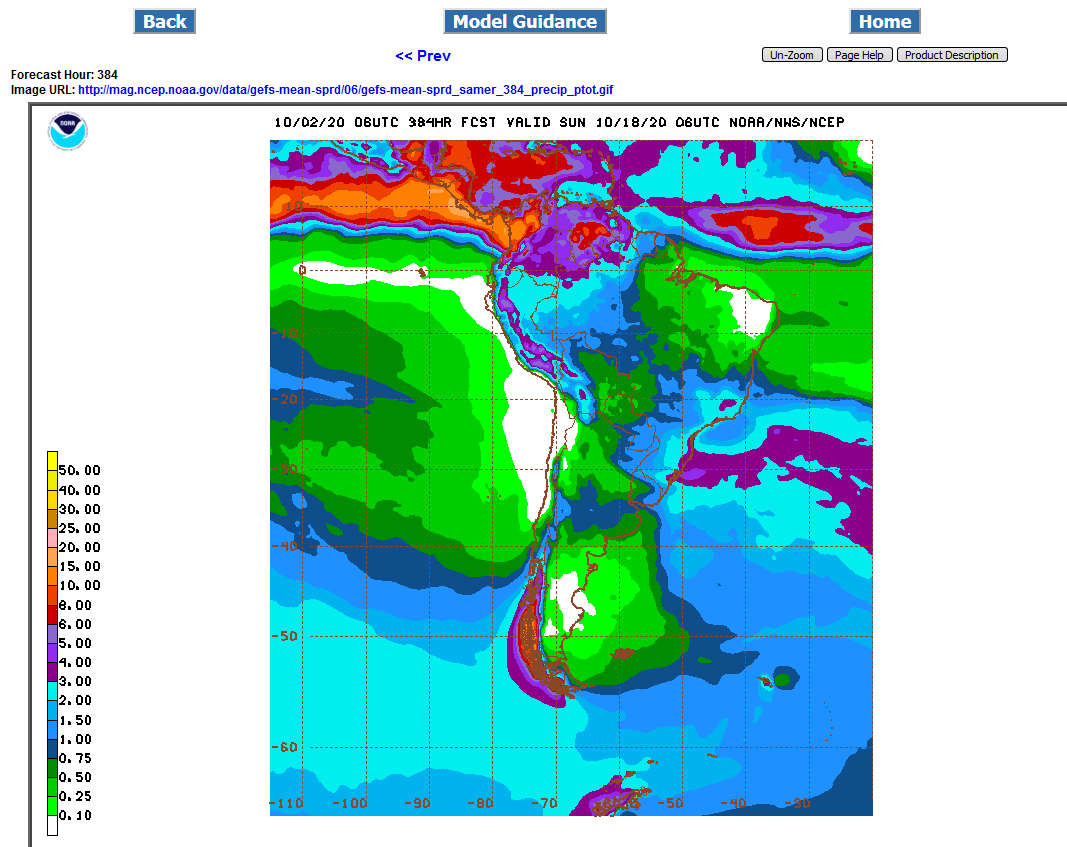

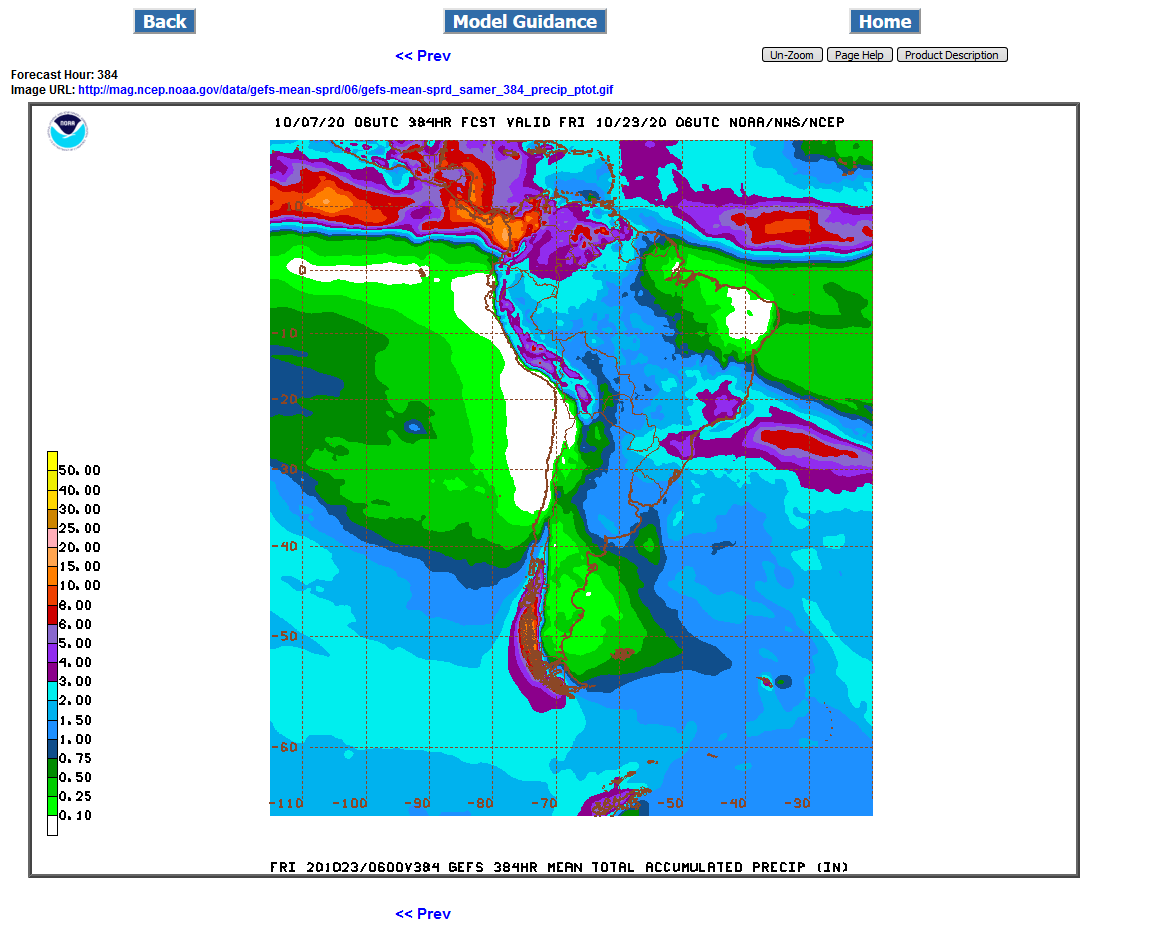

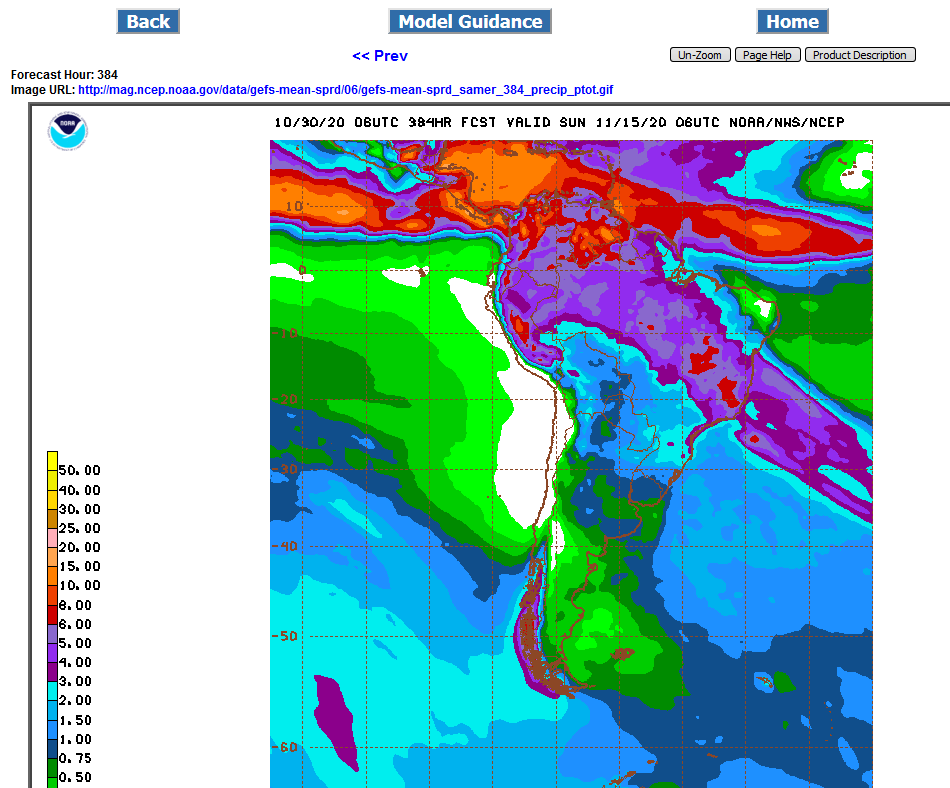

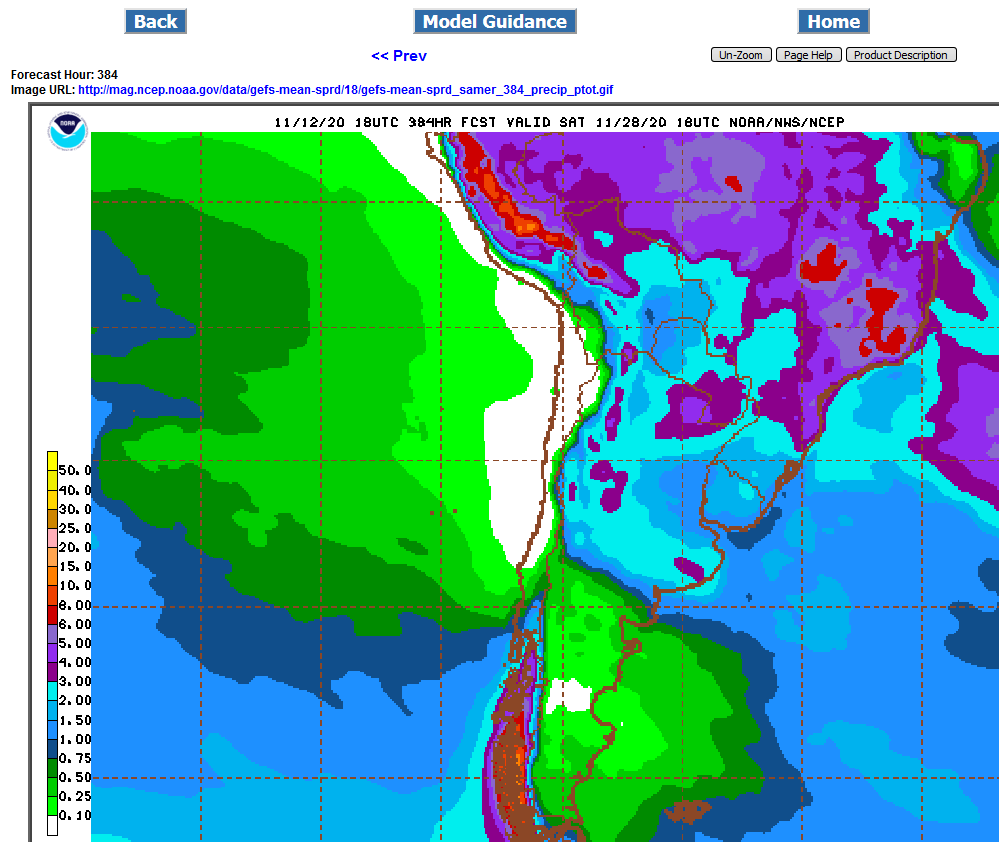

GFS: Massive, drought denting rains(all in week 2)

.png)

GFS Ensemble: Heavier rains, farther east and south but not as much for central Brazil soybeans.

.png)

Last 6z GFS ensemble. Huge rains in the east and south(especially for coffee) but not enough west/central beans(Mato Grosso).

Previous discussion on Coffee thread:

Looks like great rains for much of the Brazil crop areas which have been having drought coming up on the GFS.

However, the GFS ensemble still short changes Mato Grosso in the west/central district and a huge state that produces almost 1/3 of the soybeans.,,but great rains everywhere else, especially coffee country in the far east.

1st map is the GFS

2nd map is the GFS ensemble

.png)

Slow planting of #soybeans in Mato Grosso (or anywhere else in #Brazil that is big on second-crop #corn) is considered to be more harmful for 2nd corn than soy. If soy harvest is late, the corn growing season could be pushed back into the dry season, often reducing yields.

+++++++++++++++++++++++++++++++++++++++++=

This chart from IMEA shows planting progress for #soybeans in Mato Grosso, #Brazil. Planting is well off normal pace early on. Planting was a little sluggish last year, but decent October rains allowed the efforts to pick up speed mid-month.

September soil moisture in Mato Grosso's crop-heavy North district is usually the lightest of the year coming out of the dry season. But this year, soils are the driest in more than 20 years. Sowing of #soybeans in #Brazil's top-producing state is already behind normal.

++++++++++++++++++++++++++++++++++++++

Soils were also similarly dry in Sept. 2015 (led into a poor 15/16 soy harvest, was even worse for #corn) and in Sept. 2019. Though last year, October rainfall was a bit above average. Forecast for next 2 weeks is light on rainfall.

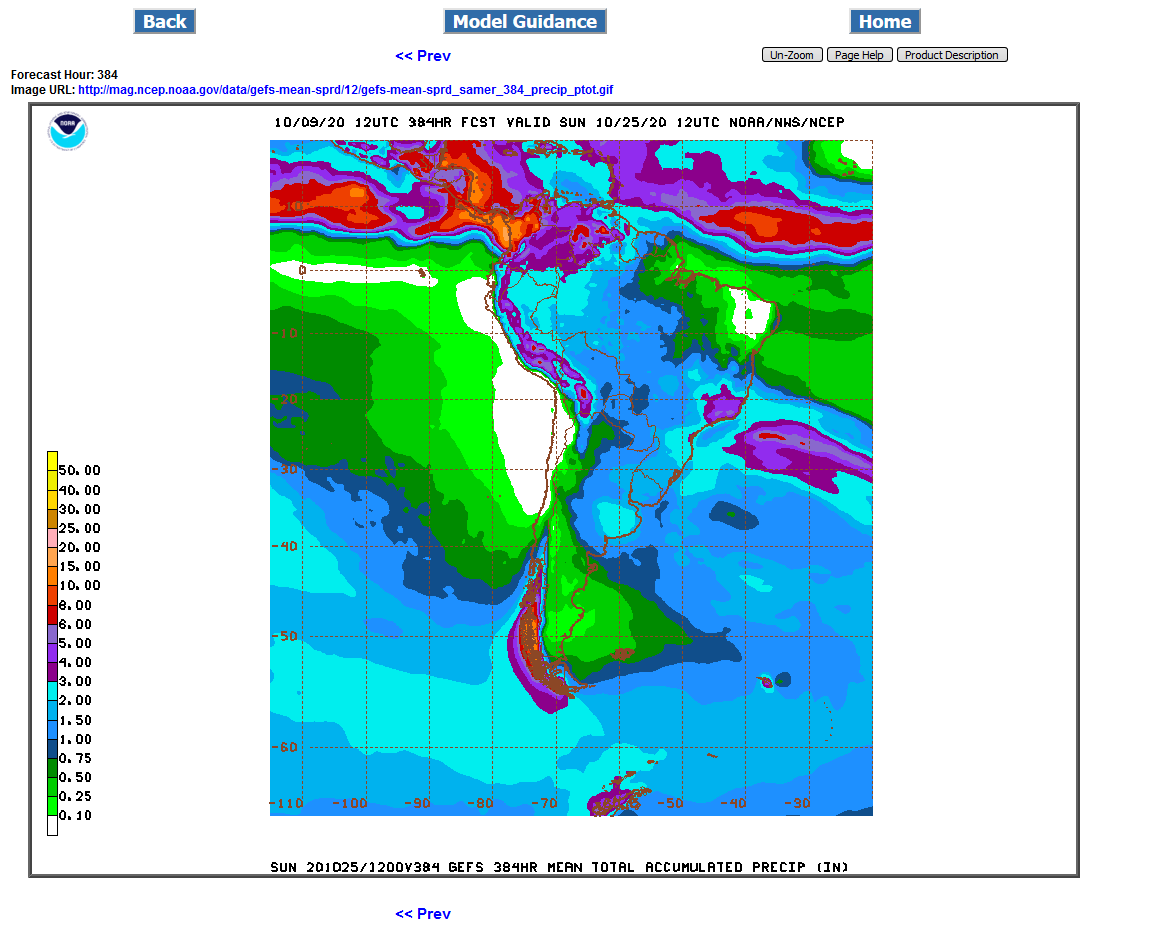

There continues to be a big disparity in the amount of rain for the key soybean state of Mato Grosso between the operational model of the GFS-wetter-first map and the ensemble-drier-2nd map.

The ensemble is almost always more consistent and used by the market with more confidence.

.png)

If the drought in Brazil is the main driver for prices right now, then the short term highs may be close.

2 week rains on the GFS ensemble have really increased the past day for the driest areas.....Mato Grosso.

It looks like some good rains in less than a week for a few days but then possibly going back to hot/dry.

The latest 12z GFS ensemble backed off on the rain amounts.

Rain amounts have backed off on the last 2 runs.

Total rain amounts were back to higher for Mato Grosso in the last 6z GFS emsemble mean.

Rain amounts for Mato Grosso on this last 12z GFS Ensemble look about the same maybe and inch+ but they need 2+ inches at least.

Actually, they could use 5 inches but anything less than 2 inches to be followed up with more rains quickly.

This is the 2 week total, much of it coming up in the event next week.

Big increase in rains forecast for Mato Grosso, especially the southwestern areas is pressuring beans today.

2 week totals from GFS ensemble below.

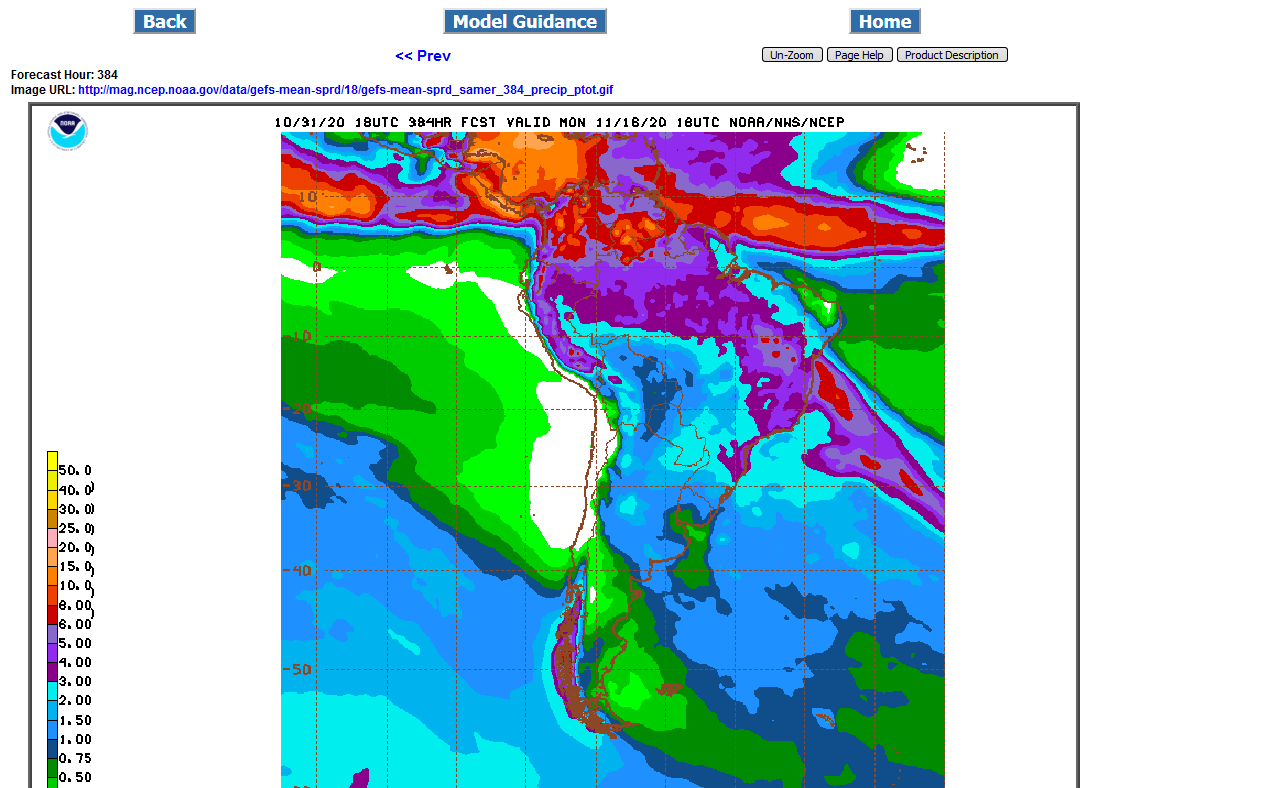

Last 2 runs are a bit less impressive with the rains for Mato Grosso. This is the 18Z GFS ensemble 15 day total rains. Just over an inch of rain for most of MG. Thats more than the last numerous months but not nearly enough to make a dent in the severe drought.........we'll see what November brings but it will be late to plant for some places in Central Brazil by then.

.png)

A lot of good stuff there Mike! Thanks for all the posts. After reading them all, I walk away thinking, it's dry and while there is some rain, on average, it's less than needed.

Thanks jim, we appreciate all your wonderful comments!

We added rains for Matto Grosso Sunday/Sunday Night then took some away Monday/Monday Night.

What has happened the last 24 hours is that we took out almost all the rain for MG thru day 10 and now added a pretty decent amount after that(2 inches in W.MG).

If the models are right, then we are kicking off the start of the rainy season after day 10, with those rains going very far northeast and hitting Bahia and vicinity which has been in severe drought.

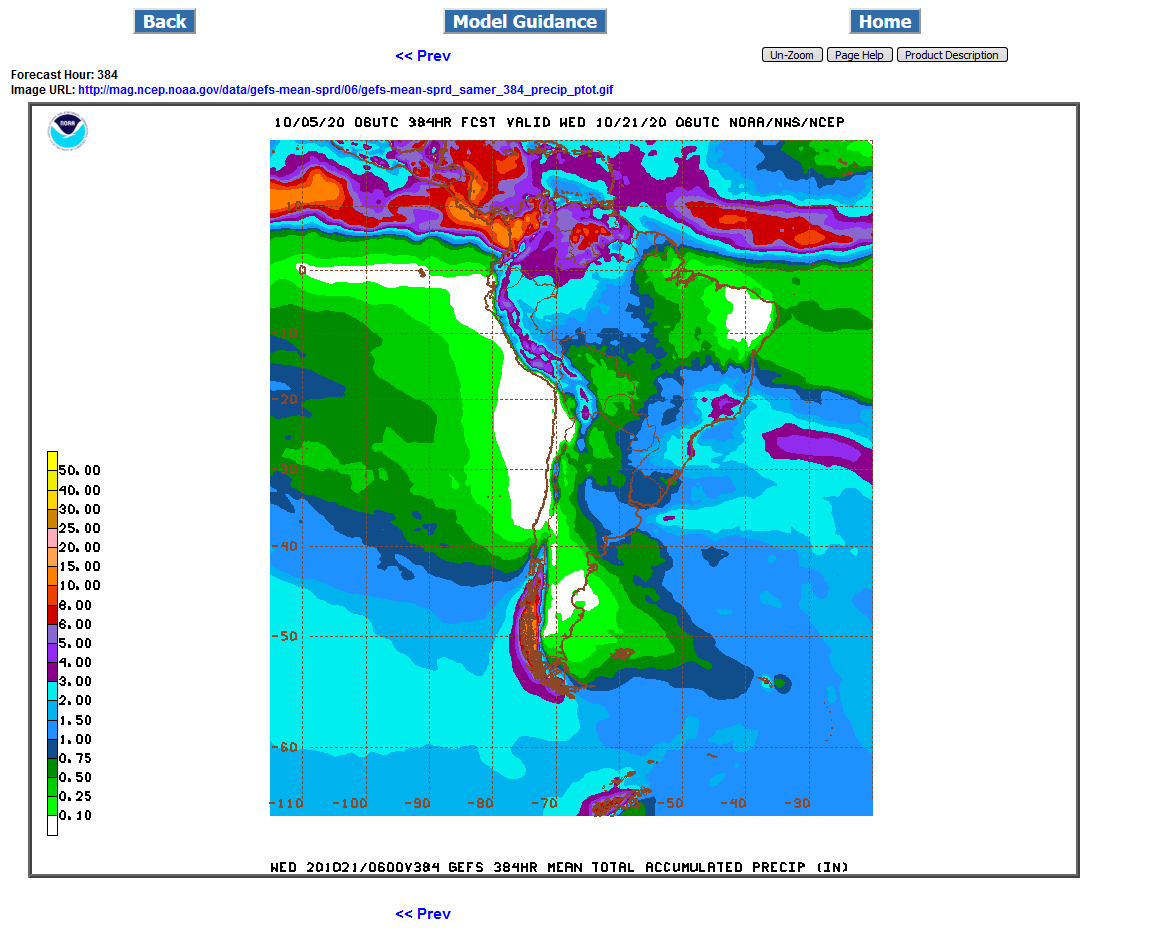

GFS Ensemble from 12z run below:

Thru day 10 on the first map.

Thru day 15 on the 2nd map

.png)

It still looks wet in most of the prime arabica coffee areas of Brazil for the forseeable future. Regardless, a decent amount of damage likely occurred during the intense hot/dry period of ~9/23-10/9.

Latest 18z run of the GFS ensemble is a bit less with rains for MG and points northeast but it does look like a pattern change in week 2 that could lead into the start of the rainy season that would feature additional rains in November.

The southern parts of Brazil will be getting widespread 2-3 inches of rain. N. Argentina 1.5-2 inches.

Central Brazil, including MG which produces 30% of the crop only gets around 1 inch on the map below.

.png)

Last 2 runs of the GFS ensemble have quite a bit of week 2 rains for Matto Grosso. 2 inches.

A bit less rain for coffee which is probably going to see a bit too much rain in some places.

The late night guidance beefed up on the rains in the driest area and caused us to sell off.

This is still week 2 and there will be changes because its so far out.

The early morning ensemble pulled back on the rains by around 1/2 inch but still has close to 2 inches in the sw parts of MG...barely enough to get by.

The last 2 runs are below.

First one was 10 hours ago, 2nd one 4 hours ago.

.png)

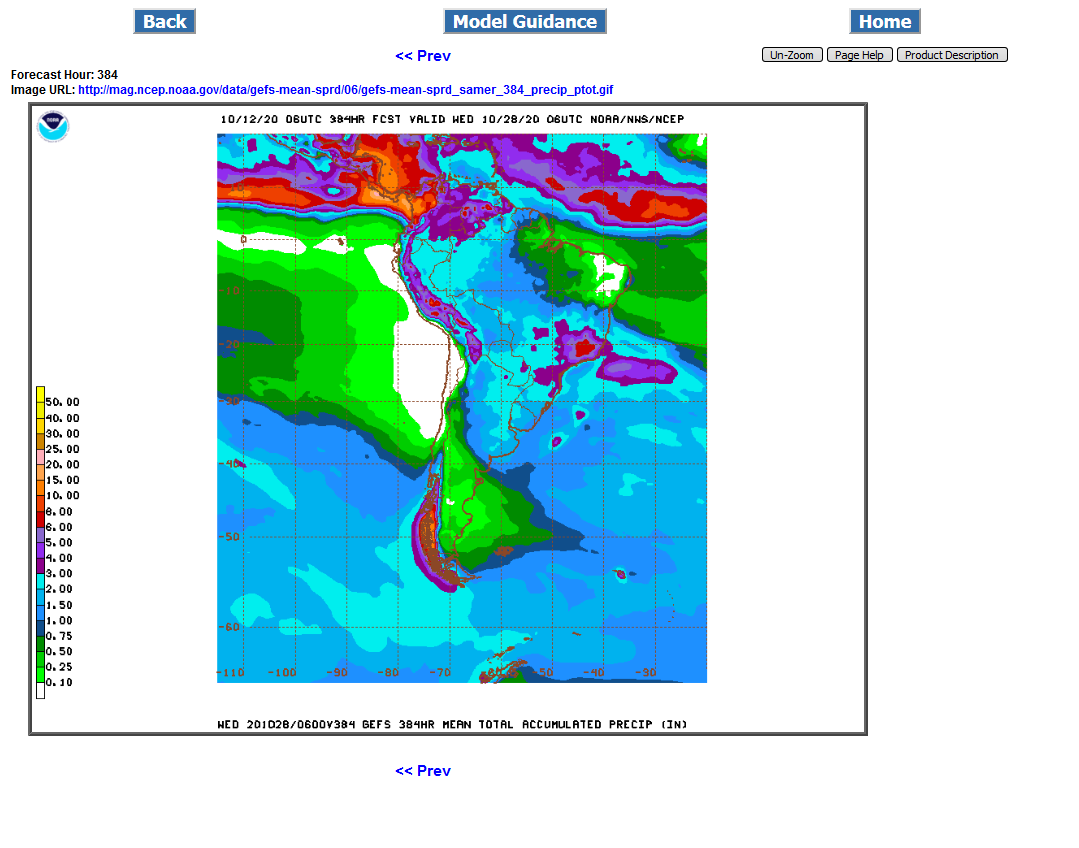

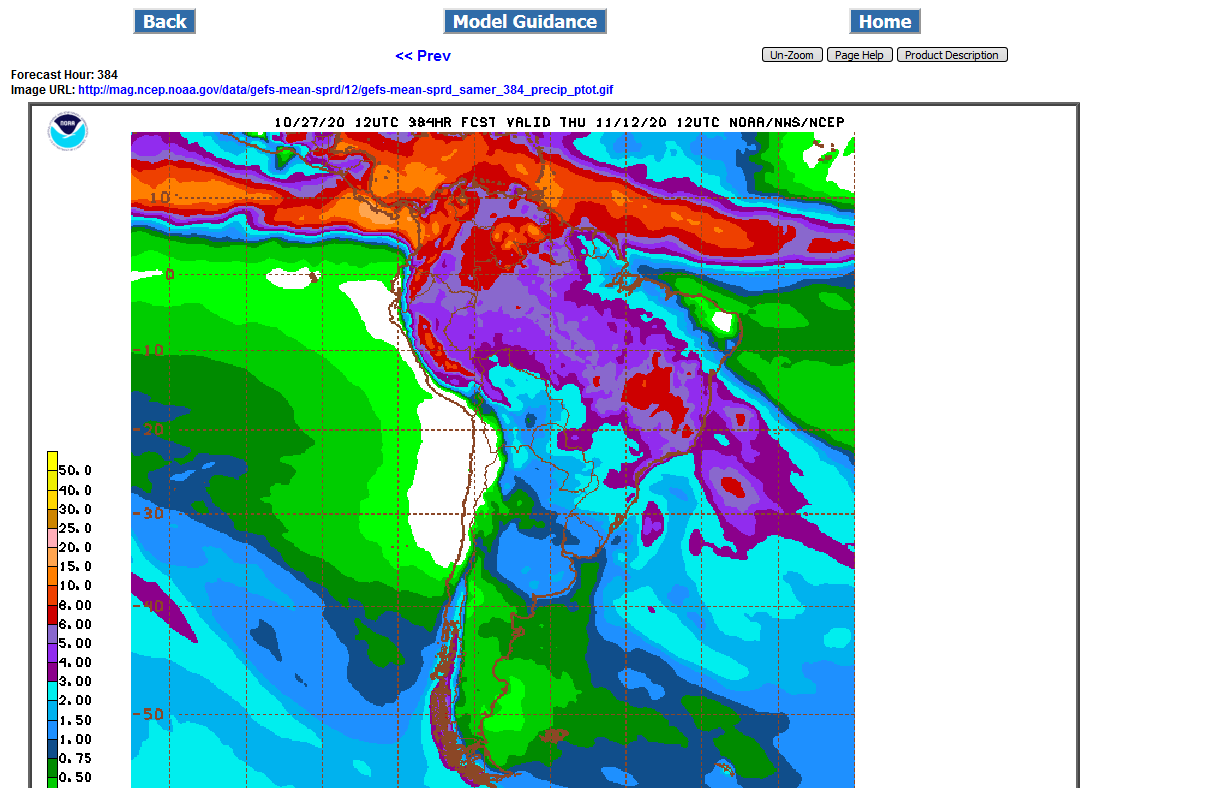

Big rains for Mato Grosso, 3-4+ inches of rain the next 2 weeks.

Maybe much of this was dialed in with Fridays spike down.

1050 support held tonight on the open with this bearish weather forecast.

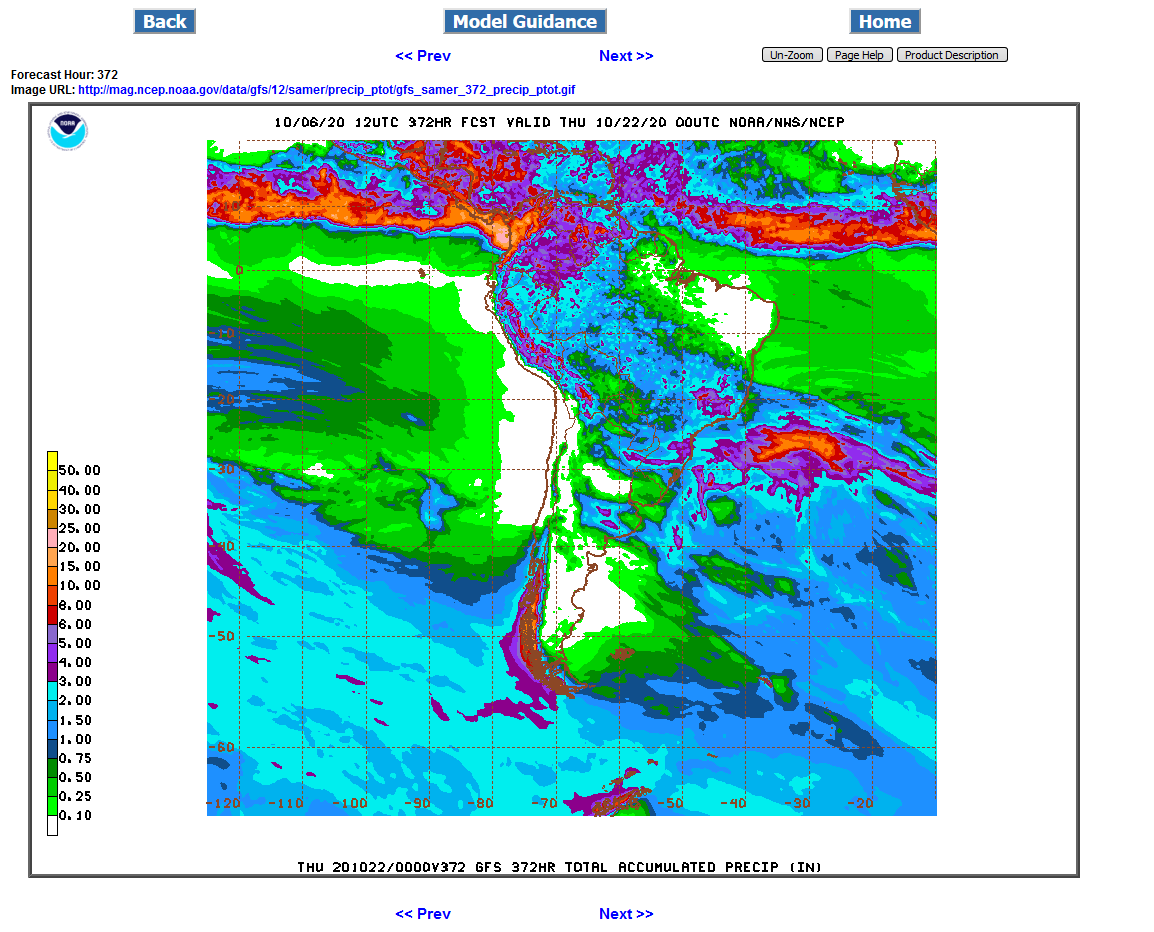

18z, just updated GFS Ensemble below. Some places in coffee land getting 8 inches of rain. Much more than this and it may pose some problems and actually turn bullish for coffee.

.png)

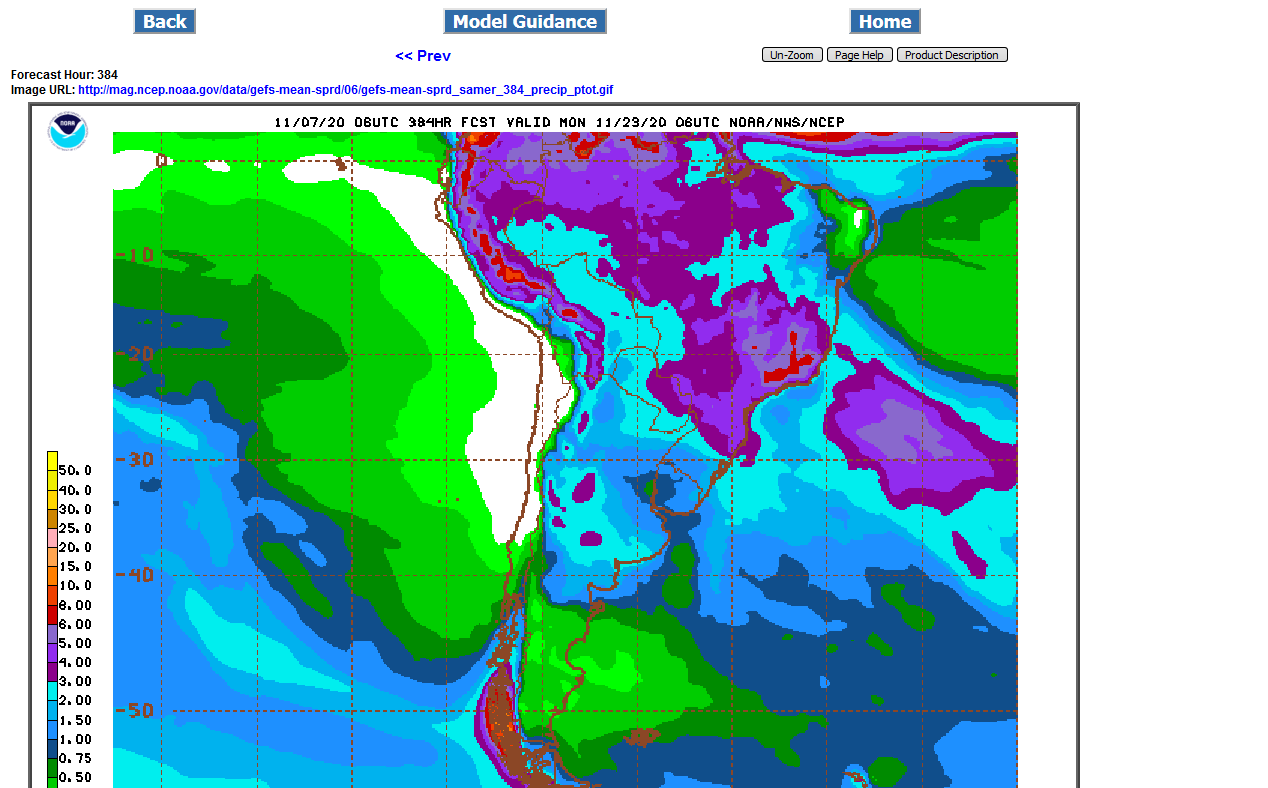

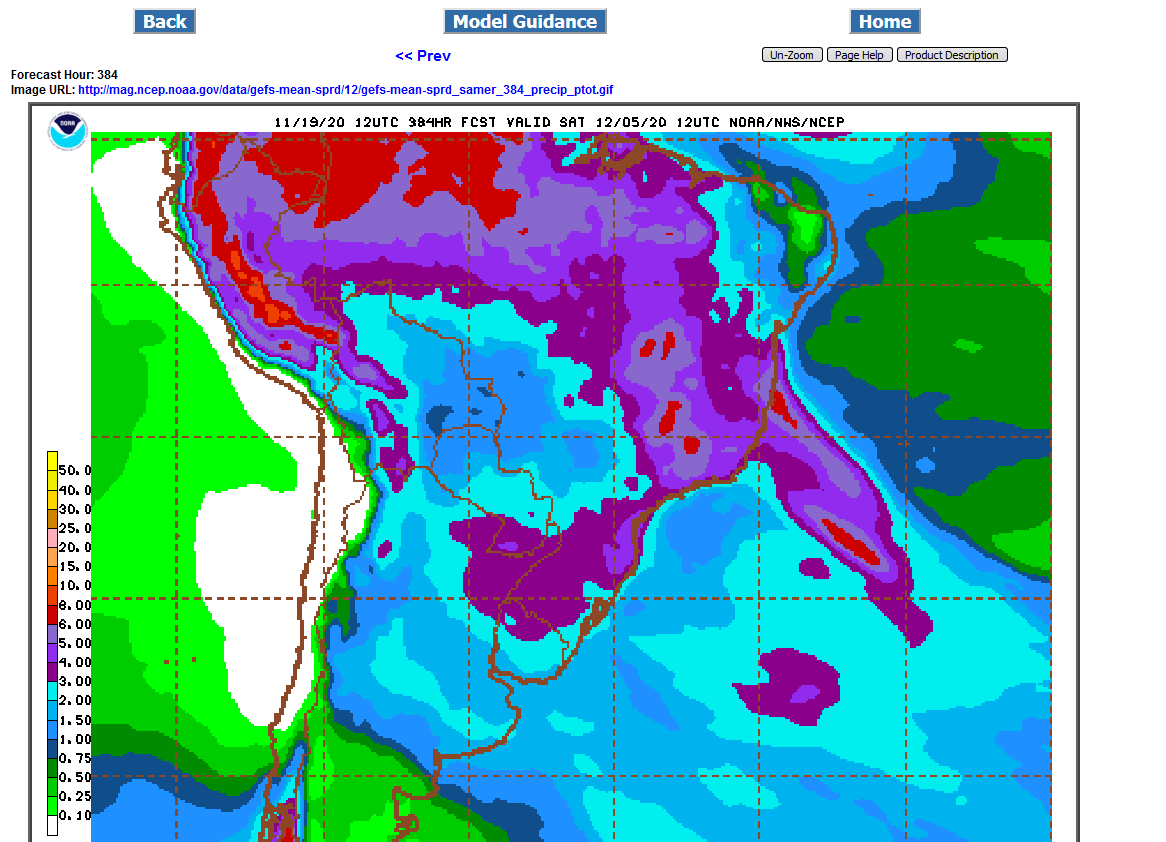

Weather continues bearish for all of South America.

Over 2 inches of rain the next 2 weeks everywhere in Brazil and Argentina.

Demand from China and elsewhere is more bullish than the weather is bearish though.

These are rain totals from the last, 6z GFS Ensemble.

Rain amounts have increased in coffee land and may be getting excessive.

Not quite as much rain for several areas of Brazil and Argentina:

Coffeeland still looks wet for awhile.

Agree on wet coffee land Larry! 6+ inches in many spots

Good rains to the driest areas of Brail...........3+ inches the next 2 weeks in much of Mato Grosso.

2 inches elsewhere.

Under 2 inches in Argentina, that might start getting a bit dry in the Northern growing area but should be ok.

Last 12z GFS Ensemble rain totals below.

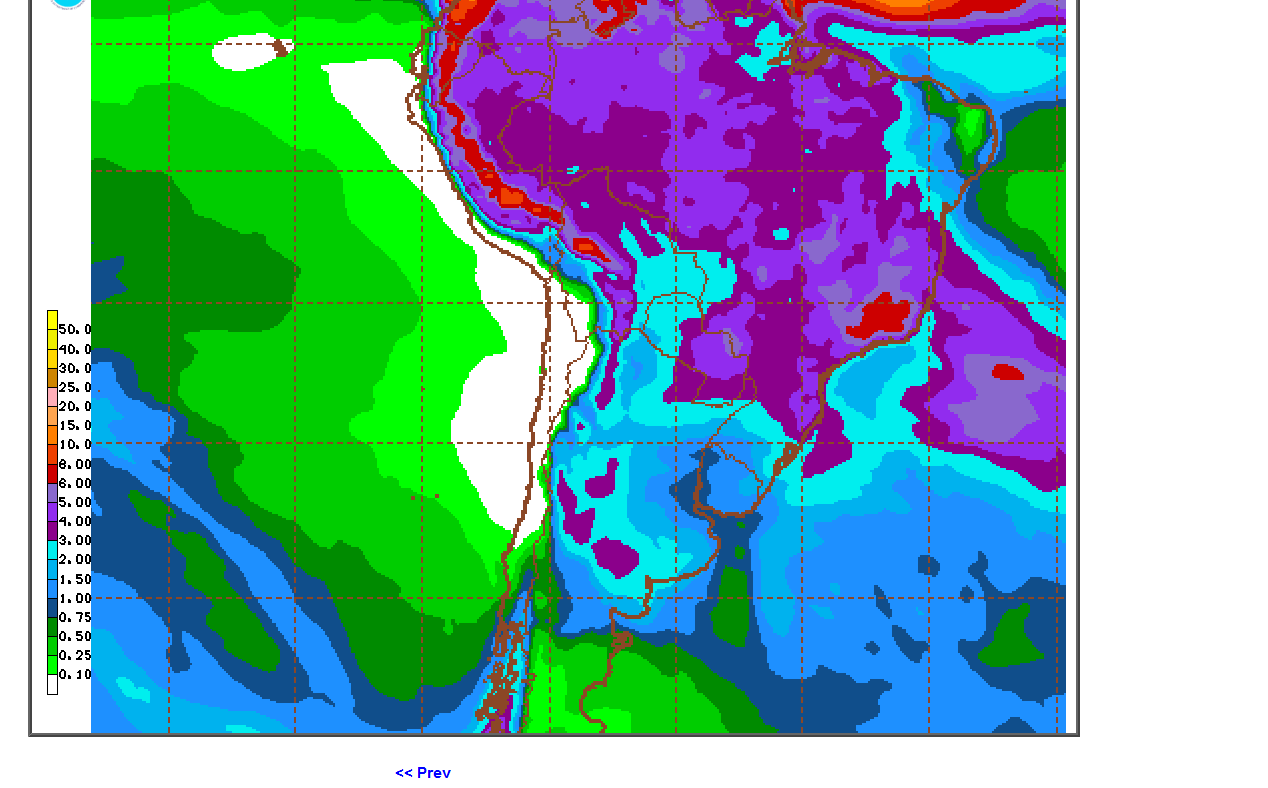

Here are the 2 week total rains for SA.

Huge rains in the driest places and pretty good rains for most of Brazil.

Getting a bit dry in Argentina.

Last 18z GFS Ensemble for 2 weeks:

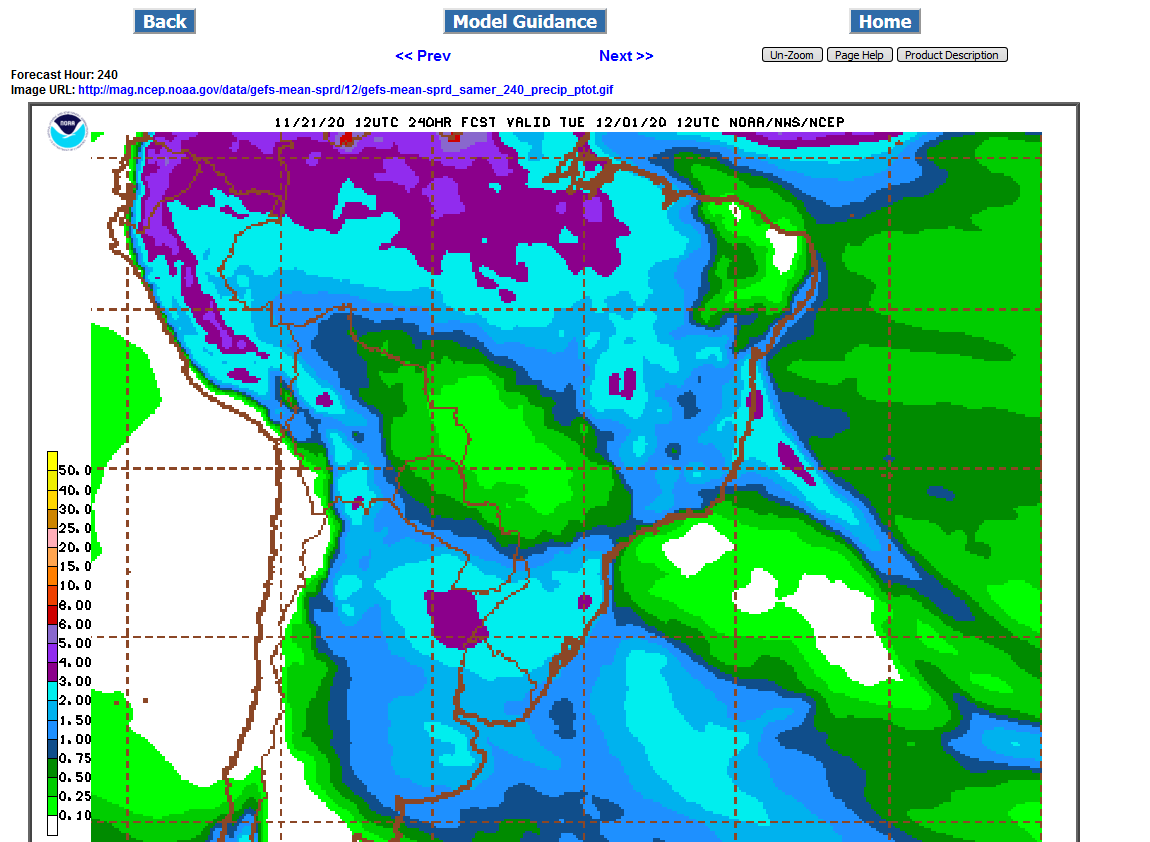

Decent rain most places in South America.

From the 18z GFS ensemble for South America.

These locations should be getting 1+ inches a week. Soils there don't hold moisture as well as our soils, so they need a bit more rain than we do.

The first map below is rain totals for the next week. Rain amounts look pretty skimpy in all the N. Argentina crop growing locations and barely enough to get by in some far south and far northern parts of central Brazil locations.

.png)

The 2nd map is for rain totals for 2 weeks. Still skimpy for N.Argentina and barely enough in some Brazil locations but no rain suppressing dome and rain prospects do look better in week 2 for many areas.

.png)

oybeans Soaring November 2020

6 responses |

Started by metmike - Nov. 5, 2020, 12:08 p.m.

https://www.marketforum.com/forum/topic/60859/

Big rains coming up in much of Brazil the next 2 weeks!

The area's to watch now, that will turn drier are N. Argentina and very far south Brazil.

Plenty of rain most places in SA, especially Brazil.

Least amount northeast Argentina, where some places might see just an inch or a bit less. Far southern Rio Grande Do Sul(far south) in Brazil may only get an inch too.

Pretty good rains most places.......bearish weather in SA.

Lots of rain on models the last 2 weeks but in many places, only half of it has actually fallen.

2 week rains below. Light blue is close to average/barely enough to keep up. Less than that will dry out, more(purples/reds) and it replenishes very low soil moisture.

If we could get some drier runs/forecasts, that would really add some fuel..png)

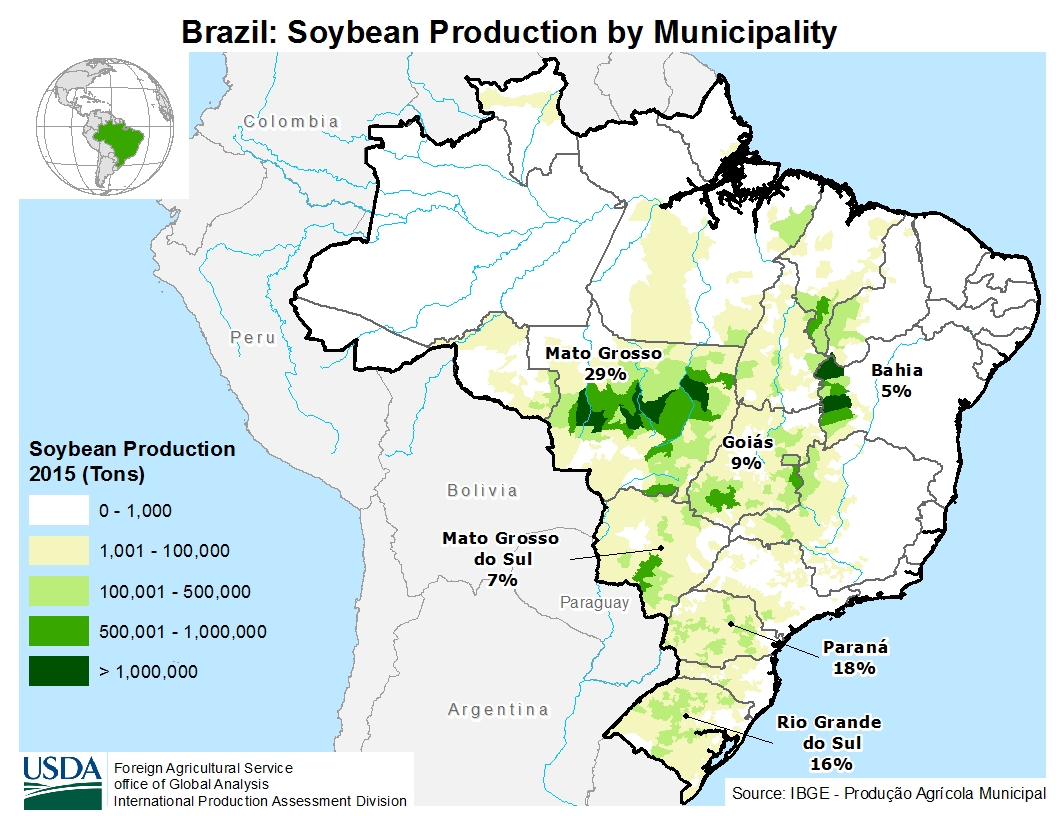

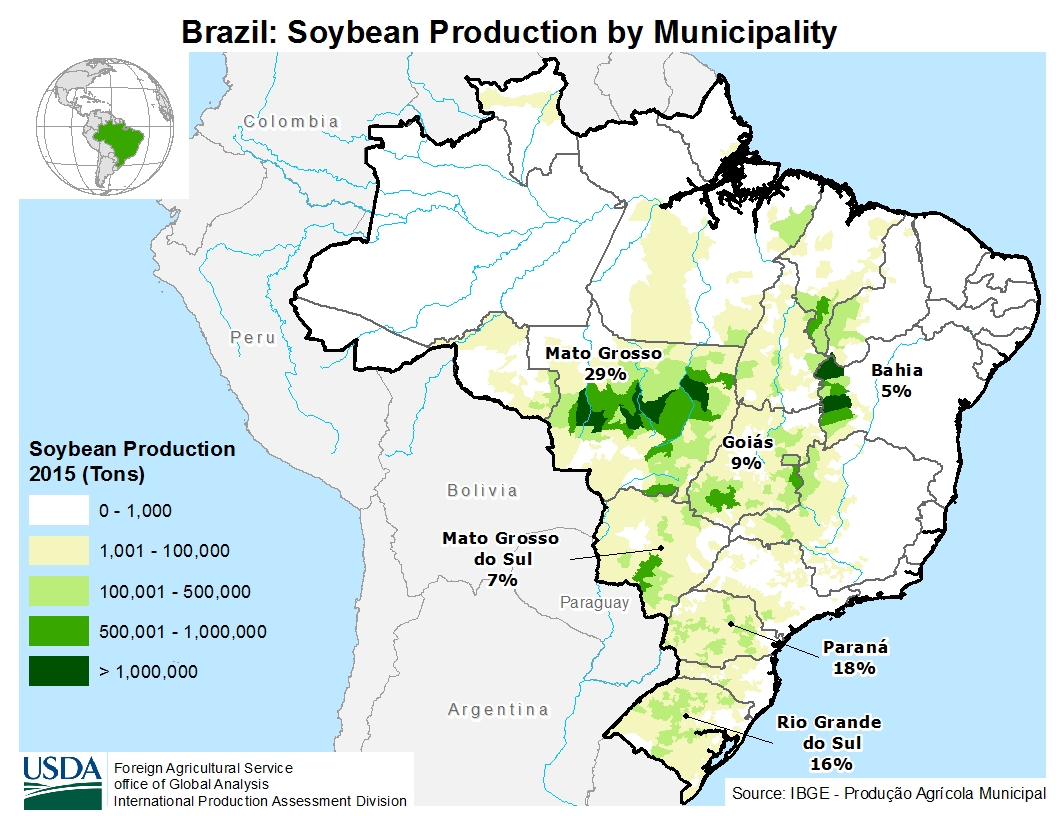

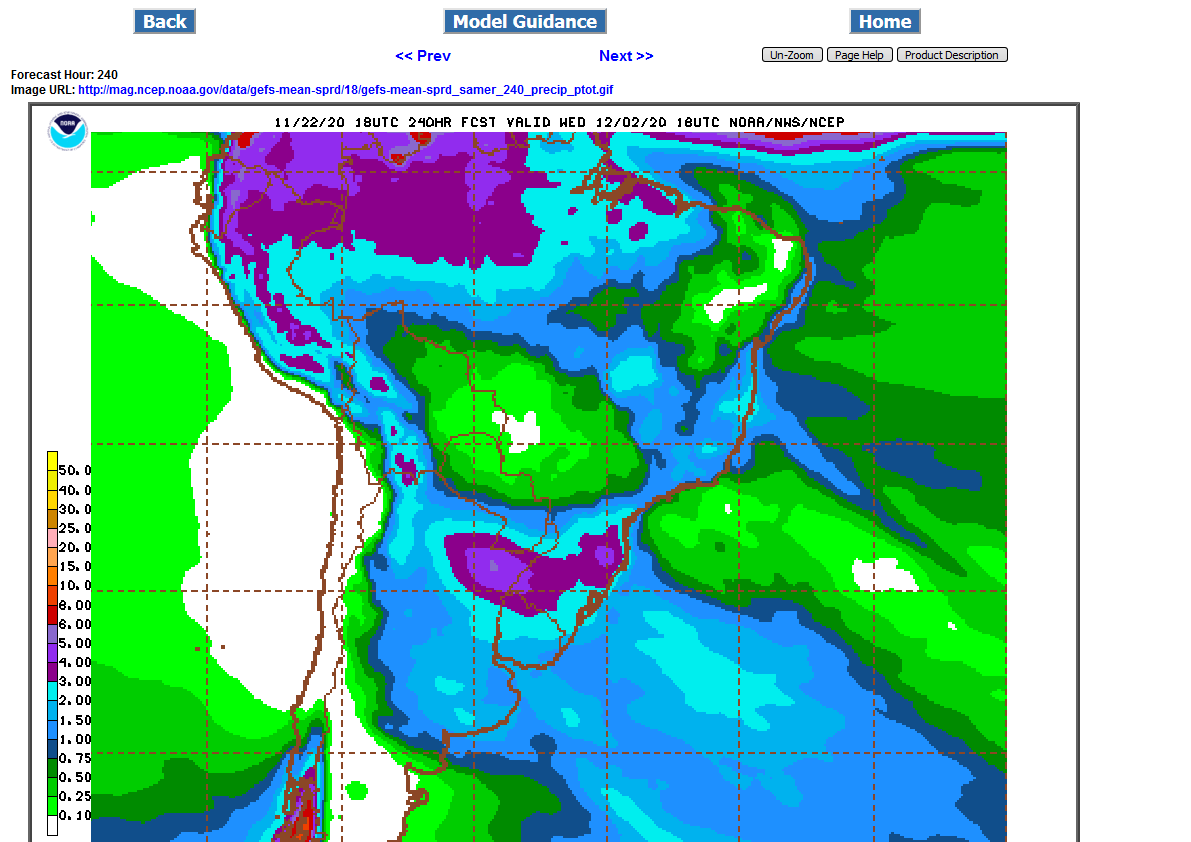

#1 state producer Mato Grosso is short changed in the dark blue!

Everywhere else gets good rains.

.png)

Much of Mato Grosso-29% of production for Brazil, does not get a great deal of rain, especially southwestern half.

Also short changed is Mato Grosso Du Sul-7% of production for Brazil.

The rest of Brazil gets good rains.

The southern part of the N.Argentina key areas might also be light on rain amounts.

2 week rains below from the GFS ENS Mean, 12z run.

Forgot to mention the Gois-9% production will be one of the driest states the next 2 weeks.

So the dry weather coming up will be affecting over 1/3rd of soybean production in Brazil, possibly more than 40% if the dry zone shifts a bit northeast.

The rest of Brazil and most of Argentina look good, except the southern parts of the N.Argentina key growing area may be on the light side.

The area in green, will receive very little rain the next 10 days and represents, maybe 40% of the Brazil soybean production. Scroll up to see that.

This was the 18z GFS Ensemble. There will be heat with the dry weather.

Models do pick the rains up after that though.

Mike,

In addition to days 1-10, does the C or S market consider days 11-15 of the forecast as much as NG does? TIA

Maybe a bit less because rain in much harder to forecast than temps but it varies based on the situation.

Just like any weather market, whether its different than previous forecasts matters alot.

Pattern changes to colder or hotter can be pretty definitive because of the way large scale features of the atmospher change with pattern changes.

If air masses will be coming from the north in the new pattern, vs the south in the old pattern, temperature anomalies will flip to the opposite of what they were with very high confidence(based on analysis of the pattern-assuming it verifies)...........because the origin of the air masses will be from completely different/opposite locations.

With rains, it can be a bit trickier as you know.

You can be dry with air masses coming from the south and also with air masses coming from the north.

And you can be wet with air masses coming from the south and also coming from the north.

The only reason I showed 10 days above is because that's when the hot/dry pattern may break and rains return. Normally, I just show 2 week totals but in this case, showing 2 weeks is misleading because all the rain comes towards the end of the period.

Beans are sharply higher because of the hot/dry weather mentioned the last few updates. The next 10 days below feature very little rain in the green areas of Central Brazil. This will affect, maybe 40% of production and this area already has a drought and planted late because of it.

Southern Brazil gets great rains to N. Argentina.

After 10 days, rain chances start picking up in Central Brazil but models have been delaying the return of rains by a day the last 3 days, so they stay just beyond 10 days.

We bumped up against $12 on the open and are getting very pricey, volatile and very over bought but there is still great potential upside if we see some panic buying up here.

Potential for a parabolic move higher. I don't know if that will happen though. Large producers might look at locking in some good prices if that happens.

The risk is that this current La Nina, lasting thru the Winter, could cause the US growing season to start with increasing drought from the Plains, moving east.

Us weather guys don't have great skill predicting that far out, so don't use that as a forecast, just consider that odds of a drought next year are elevated by something like 25%, depending on the La Nina. The longer it lasts, the higher the chances for drought into the 2021 growing season.

Pray for more global warming because that's what increases El Nino's(warmer tropical Pacific), increases precip in the US and suppresses droughts.

Global warming is why we've had the record LEAST amount of droughts in the Cornbelt the past 3 decades............just one in 2012, the previous one 1988(historically, with the old climate we should have had at least 3 droughts during that time frame). That one happened because of the lingering affects of the previous natural La Nina 2011/start of 2012(cold water in the tropical Pacific). The drought in 1988 was caused by a La Nina.

The last 4 decades has featured the best weather/climate for growing crops because of global warming/climate change/more rains/less droughts with more El Ninos vs La Nina's. But we have a moderate, natural La Nina right now that also increases chances for and probably caused the current drought in Central Brazil.

More on that here:

The drought out West and wildfires were not caused by man made climate change:

NEW: California governor blames wildfires on climate 'emergency': Using another natural disaster for political agenda. The real reason for the wildfires. It's been much drier than this before....wildfires worse. A look at the current, drought causing La Niña....the opposite of global warming. September 2020

https://www.marketforum.com/forum/topic/59093/

Latest model run is increasing rains and moving the rains up earlier by over a day in the week 2 period, which is a negative weather factor right now compared to Sunday.

2 week rains below:

1. First one is from Sunday Evening

2. 2nd one from the just out 12z GFS Ensemble mean........light rain gap in the middle with green last evening has filled in with a bit heavier amounts

.png)

Before those rain chances hit, there will be over a week of hot/dry in at least 40% of key soybean country.........in a region that has a drought still.

2 week rains below. Only the far west/central areas of Brazil that grow soybeans will have rains below average and most of that is a dry week 1.

So the weather in South America looks bearish after a hot/dry week 1 for Central Brazil.

The 2nd map below, shows the week 1 rains(or should I say "lack of rains" in Central Brazil)

Week 1 rains below

.png)

Rains increasing for Brazil!

Alot of rain coming up for Brazil. In dry/drought striken Central Brazil, most of this is week 2 rains as the pattern turns very wet there after week 1:

Map 1 is rain totals after 1 week.

Map 2 is rain totals after 2 weeks.

.png)

Still tons of rain coming to Brazil, most of it in week 2. Coffee land could get over 10 inches of rain the next 2 weeks............which would be TOO MUCH rain for that region:

This was the 2 week rain forecast from the 12z GFS Ensemble:

.png)

12z GFSE took away a small portion of the good rains in day 5-10for ARG.