Please continue NG talk here.

MetMike just posted this excellent info:

"Insane day for ng.

Down almost $1,500/contract, then after a bullish EIA report came roaring back to finish higher.

Normally, this time of year, if the outlook for November is mild, natural gas is under big selling pressure. Especially with near record ng in storage right now we would expect that.

With large specs being long 500,000 contracts right now, the selling ammo could be huge. Very early this morning, the European model came out milder and we got a sample of that, I believe.

Had the guidance and forecasts after that continued to warm things up in November, we could have continued lower and even after the bullish EIA report, would have struggled.

However, much of the guidance has been suggesting a pattern change later in week 2 that will feature a -AO, -NAO and building upper level ridge off the Pacific Coast to around Alaska.

This suggests that it could turn much colder, starting in the West to Upper Midwest, then possibly shifting farther east.

The bullish part of this is that its meridional flow(north to south). It means cold air in the high latitudes is transported to the mid latitudes.

Where that flow is aimed is very important. The farther east it hits, the more bullish it is.

If an upper level ridge builds in the East and keeps it mild there, then its not so bullish.

This is in contract to zonal, west to east flow, which is almost always bearish because it keeps all the cold locked up to the north with no change to hit anywhere."

-------------------------------------------------------------------------------

My comment about upper E US ridge/SE US ridge:

In recent years, the SE ridge has been relentless, supported by the very warm Indonesian waters of the W Pacific as well as the +AMO of the Atlantic. And now we have a strong La Nina to go along with that. So, I expect the SE US ridge/W Atlantic ridge/E US ridge to be very stubborn again this winter. It will probably take strong -NAO to overcome this. At some point it will return. We'll see!!

Thanks very much Larry for starting the new thread and excellent starting comments.

Previous NG threads:

NG 10/14-29/2020

43 responses |

Started by WxFollower - Oct. 14, 2020, 6:26 p.m.

https://www.marketforum.com/forum/topic/60064/

+++++++++++++++++++++++++++++

NG 9/27

48 responses |

Started by MarkB - Sept. 28, 2020, 12:21 a.m. https://www.marketforum.com/forum/topic/59561/

++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Next week could be huge for natural gas. If we turn colder, with the tight balances mentioned below, we could erode ng in storage with some big early drawdowns.

Staying warm with the Southeast ridge being strong, as Larry noted would likely put the top in with near record storage and November looking mild without alot of residential heating demand in the East.

This was from earlier this morning:

Markets

As traders weighed a warmer temperature outlook against the tight supply/demand balance evidenced by the latest government inventory data, natural gas futures hovered close to even early Friday. The December Nymex contract was off 1.0 cent to $3.291/MMBtu at around 8:40 a.m. ET. Recent shifts in the weather modeling had Bespoke Weather Services making warmer…

October 30, 2020

metmike: Extremely impressive afternoon for natural gas. Without much assistance from models(that you would have guessed, based on price action at this time of year were much colder-they weren't) the natural gas closed the late session sharply higher for the day.

This confirms yesterday's amazing, sharp reversal higher from down $1,500 before the EIA report to closing higher.

Though the models did not exactly TURN colder, the pattern of meridional, north to south air transport from high to mid latitudes, hitting the west to Midwest in week 2 is threatening enough to be bullish for speculators.

This early in the heating season, speculation on the upcoming Winter and how much ng storage will be drawn down is at maximum power!

Interesting that this is happening with near record ng in storage..........but the supplies appear to be very tight and with a continued historically tiny rig count and increasing exports, we could not just whittle down the surplus but in the case of a very cold Winter, we could actually end the season with very low ng in storage.

Maybe the economy picking up better than expected is suggesting adding back more industrial demand then what was previously thought.

This could be part of the reason for the bullishly small injections recently.

Regardless. We are entering the time of year, the heating season when residential heating demand is much more important than anything else by a wide margin when its anomalous............either with much above or much below average HDD's.

Natural gas futures on Friday traded in a narrow range of gains and losses as markets mulled weather-driven demand concerns against encouraging signs of tighter balances, notably including stronger liquefied natural gas (LNG) volumes that helped minimize storage injections. The December Nymex contract ultimately gained 5.3 cents day/day and settled at $3.354/MMBtu. January rose 5.2…

October 30, 2020

https://www.marketforum.com/forum/topic/60593/

Re: INO Evening Market Comments

By metmike - Nov. 1, 2020, 10:46 p.m.

Thanks tallpine!

Natural gas weather is bearish with warmth in the east after this cold snap recedes in a couple of days.

for week ending October 23, 2020 | Released: October 29, 2020 at 10:30 a.m. | Next Release: November 5, 2020

+29 BCF.............BULLISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/23/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 10/23/20 | 10/16/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 941 | 923 | 18 | 18 | 909 | 3.5 | 900 | 4.6 | |||||||||||||||||

| Midwest | 1,118 | 1,105 | 13 | 13 | 1,088 | 2.8 | 1,064 | 5.1 | |||||||||||||||||

| Mountain | 245 | 245 | 0 | 0 | 210 | 16.7 | 215 | 14.0 | |||||||||||||||||

| Pacific | 323 | 323 | 0 | 0 | 298 | 8.4 | 315 | 2.5 | |||||||||||||||||

| South Central | 1,329 | 1,329 | 0 | 0 | 1,165 | 14.1 | 1,172 | 13.4 | |||||||||||||||||

| Salt | 360 | 360 | 0 | 0 | 286 | 25.9 | 311 | 15.8 | |||||||||||||||||

| Nonsalt | 968 | 969 | -1 | -1 | 880 | 10.0 | 861 | 12.4 | |||||||||||||||||

| Total | 3,955 | 3,926 | 29 | 29 | 3,670 | 7.8 | 3,666 | 7.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,955 Bcf as of Friday, October 23, 2020, according to EIA estimates. This represents a net increase of 29 Bcf from the previous week. Stocks were 285 Bcf higher than last year at this time and 289 Bcf above the five-year average of 3,666 Bcf. At 3,955 Bcf, total working gas is above the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Oct 29, 2020 Actual29B Forecast37B Previous 49B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Nov 05, 2020 | 10:30 | 37B | 29B | ||

| Oct 29, 2020 | 09:30 | 29B | 37B | 49B | |

| Oct 22, 2020 | 09:30 | 49B | 52B | 46B | |

| Oct 15, 2020 | 09:30 | 46B | 55B | 75B | |

| Oct 08, 2020 | 09:30 | 75B | 73B | 76B | |

| Oct 01, 2020 | 09:30 | 76B | 79B | 66B |

7 day temperatures for this Thursday's EIA report.

Cold in the Plains, warm in the Southeast.

Rig count actually dropped 1 and remains just above the record lowest ever of 69, set in August of this year. The latest is at just 72............this is bullish with regards to supplies.

This says we will see a warming trend ahead.

Right you are Mark!

And the European model was even warmer overnight!

Monday Morning early:

Natural gas futures fell in early trading Monday as overnight guidance pointed to an increased chance for a warmer-than-normal start to the winter heating season. The December Nymex contract was off 9.4 cents to $3.260/MMBtu at around 8:40 a.m. ET. The American and European weather models trended “decidedly bearish” overnight, with both models shedding 10-12…

November 2, 2020

Natural gas futures on Monday dropped as mid-range weather worries overshadowed continued strong liquefied natural gas (LNG) levels. The December Nymex contract shed 11.0 cents day/day and settled at $3.244/MMBtu. January lost 9.4 cents to $3.375. Spot gas prices, meanwhile, dipped lower despite a chilly start to the week. NGI’s Spot Gas National Avg. fell…

By Kevin Dobbs

November 2, 2020

metmike: Milder temps in November make it almost impossible for natural gas to keep going higher.

"metmike: Milder temps in November make it almost impossible for natural gas to keep going higher. "

----------------------------

Mike,

I agree that is often true, but that didn't matter on Friday, when it didn't stop rising much of the day despite warmer forecast/models.

That was not intended to apply to every model or every day of course but I was surprised too at how strong the market was on Friday, considering just the HDD's, which were not very impressive.

We also had a meridional(north to south) flow with a potential falling to negative AO and NAO, even though the models aimed most of the cold pretty far West on Friday, when cold air is getting dumped from high to mid latitudes, its potentially much more bullish than zonal flow that locks it up farther north...........and no chance of it making it to the high population centers.

With a zonal flow, the jet stream has to completely buckle and drastically change to tug down blobs of cold into the US.

With meridional flow already in place and an upper level ridge around Alaska, just a shift eastward in the same pattern that was aiming the cold towards the Western US and it gets you real cold, much easier.

I wouldn't have wanted to be short over the weekend with that pattern if it had shifted eastward by Sunday.

It didn't so here were are.

https://www.naturalgasintel.com/

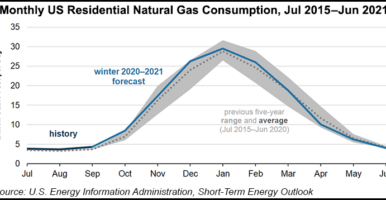

Changes in behavior due to the Covid-19 pandemic, along with colder temperatures, will result in greater residential natural gas consumption during the 2020/21 winter, according to a forecast from the Energy Information Administration (EIA). The EIA’s most recent projections show residential natural gas consumption averaging 21.1 Bcf/d from October 2020 through March 2021, a 5%…

With that prediction, and exports starting to rise, I can't see anything else that is bullish right now.

Weather is still decidedly bearish.

Weather rules in November when it is one sided.

The next 2 EIA reports could be bullish enough to offset some of that though.

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Nov 05, 2020 | 10:30 | 37B | 29B | ||

| Oct 29, 2020 | 09:30 | 29B | 37B | 49B | |

| Oct 22, 2020 | 09:30 | 49B | 52B | 46B | |

| Oct 15, 2020 | 09:30 | 46B | 55B | 75B | |

| Oct 08, 2020 | 09:30 | 75B | 73B | 76B | |

| Oct 01, 2020 | 09:30 | 76B | 79B | 66B |

Good point Mark!

$3 held today.

The EIA report on Thursday is going to have to be awfully bullish to keep us up here, if even then if the forecast is warmer.

Wednesday earlier:

In the face of another round of milder trends from the latest weather data, natural gas futures continued to grind lower in early trading Wednesday. The December Nymex contract was down 3.1 cents to $3.028/MMBtu at around 8:40 a.m. ET. With prices already down sharply this week amid expectations for mild temperatures later this month,…

November 4, 2020

Looks like the weather is still going to be on the warm side. Not sure if there was enough shutin production, but maybe. Might be a rough day tomorrow.

Agree Mark!

If the EIA isn't too extremely bullish and the forecasts stay warm, $3 should give way.

Natural gas futures fell for a third consecutive day Wednesday as mild fall weather and its dampening effect on demand eclipsed robust liquefied natural gas (LNG) levels and overall tightened balances. The December Nymex contract settled at $3.046/MMBtu, down 1.3 cents day/day. January fell 1.8 cents to $3.177. Diminished near-term weather demand also dragged spot…

November 4, 2020

++++++++++++++++++++++++++++++++++++++++++++

As traders looked ahead to potentially the first reported withdrawal of the heating season from the latest round of government inventory data, natural gas futures advanced modestly early Thursday. The December Nymex contract was up 1.8 cents to $3.064/MMBtu at around 8:35 a.m. ET. The Energy Information Administration (EIA) is on track to report the…

November 5, 2020

7 day temps for this EIA. Cold in the Plains/center. Warm Southeast.

for week ending October 30, 2020 | Released: November 5, 2020 at 10:30 a.m. | Next Release: November 13, 2020

-36 BCF Bullish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/30/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 10/30/20 | 10/23/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 947 | 941 | 6 | 6 | 927 | 2.2 | 908 | 4.3 | |||||||||||||||||

| Midwest | 1,119 | 1,118 | 1 | 1 | 1,105 | 1.3 | 1,083 | 3.3 | |||||||||||||||||

| Mountain | 240 | 245 | -5 | -5 | 208 | 15.4 | 216 | 11.1 | |||||||||||||||||

| Pacific | 320 | 323 | -3 | -3 | 294 | 8.8 | 316 | 1.3 | |||||||||||||||||

| South Central | 1,293 | 1,329 | -36 | -36 | 1,186 | 9.0 | 1,195 | 8.2 | |||||||||||||||||

| Salt | 348 | 360 | -12 | -12 | 300 | 16.0 | 324 | 7.4 | |||||||||||||||||

| Nonsalt | 945 | 968 | -23 | -23 | 886 | 6.7 | 871 | 8.5 | |||||||||||||||||

| Total | 3,919 | 3,955 | -36 | -36 | 3,719 | 5.4 | 3,718 | 5.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,919 Bcf as of Friday, October 30, 2020, according to EIA estimates. This represents a net decrease of 36 Bcf from the previous week. Stocks were 200 Bcf higher than last year at this time and 201 Bcf above the five-year average of 3,718 Bcf. At 3,919 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Nov 05, 2020 Actual-36B Forecast-26B Previous29B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Nov 13, 2020 | 10:30 | -36B | |||

| Nov 05, 2020 | 10:30 | -36B | -26B | 29B | |

| Oct 29, 2020 | 09:30 | 29B | 37B | 49B | |

| Oct 22, 2020 | 09:30 | 49B | 52B | 46B | |

| Oct 15, 2020 | 09:30 | 46B | 55B | 75B | |

| Oct 08, 2020 | 09:30 | 75B | 73B | 76B |

Bullish and the market yawns. smh

Weather forecast is too warm!

I was thinking bullish too. But the market doesn't seem to agree with us. Waiting for it to bottom.

Got short at 063, moved stop to 034.

Bollinger band turned up. Not breaking below the 016 low of the consolidation. Out at 021. I'm done.

The U.S. Energy Information Administration (EIA) on Thursday reported a natural gas withdrawal of 36 Bcf from storage for the week ending Oct 30, exceeding the market’s expectations. It marked the first pull of the season and arrived two weeks early when compared to historical norms. The decrease reflected chilly weather during the covered week…

"And the heat goes on, yeah the heat goes on."

Looks like it would have been nice to hang in for the rest of the day. Danged appointments.

November 5, 2020

November 6, 2020

metmike: Big drop on the open Sunday Evening that basically dialed in the continuation in very mild temperatures as far as the maps go out. Just not AS warm as this, which is record warmth.

Considering the bullish fundamentals, possibly very bullish and us dropping $5,000/contract in just a week with most of Winter still ahead, we are struggling to go lower and the 2.820 opening minute low has held.

It seems tough to imagine us going much higher with such a mild 2 week forecast though but when forecasts do turn colder, the bulls will spike the price much higher in a hurry...............if its decidedly colder.

Natural gas futures held steady in early trading Monday, avoiding further losses despite continued signs of warmth from the latest weather data. The December Nymex contract was up 0.4 cents to $2.892/MMBtu at around 8:45 a.m. ET. The “very warm” temperature outlook that dominated guidance last week held in model runs through the weekend, and…

November 9, 2020

From Natural Gas Intelligence..........their headlines:

Expectations for near-record warmth in November overshadowed the dose of certainty injected with a presidential election result over the weekend and news of a key milestone in the search for a coronavirus vaccine, sending natural gas futures lower on Monday. The decline marked a sixth straight day of losses. The December Nymex contract fell 2.9…

November 9, 2020

NG up some tonight. Combination of temps possibly getting much cooler in the northern places, and the uncertain path of Eta? Or maybe short term cooling with the cold front sweeping across later this week.

Helped by a modest uptick in heating demand expectations in the latest round of weather data, natural gas futures recovered some of their recent losses in early trading Tuesday. The December Nymex contract was up 3.4 cents to $2.893/MMBtu at around 8:40 a.m. ET. Models added some heating degree days (HDD) over the previous 24…

November 10, 2020

metmike: The market told us yesterday that it couldn't go any lower with an incredibly mild forecast for November. Is the threat of minorshut ins from Eta a factor?

The AO drops a bit and NAO really drops late in week 2, so this "might" be a harbinger of colder weather later this month and the HDD's did increase overnight but we are far from a chilly/cold forecast.................more like LESS mild.

NGI:

7 day temperatures for this Thursdays EIA report:

Very warm, West to Midwest vs average. Cool Southeast..............vs average.

Must have been the temp map update that caused the after lunch jump.

Exactly right Mark!

European model came out MUCH colder!!

Would you have a link for that?

Slightly improved weather-driven demand and rising spot prices fueled a second-straight day of gains for natural gas futures. The December Nymex contract gained 8.2 cents day/day and settled at $3.031/MMBtu on Wednesday. January advanced 7.8 cents to $3.151. NGI’s Spot Gas National Avg. climbed 13.5 cents to $2.585, a third consecutive day of gains. Wednesday’s…

Thursday after the close.

Natural gas futures traded in a narrow range of gains and losses throughout most of Thursday’s session, as traders awaited more clarity on weather and storage levels. The December Nymex contract ultimately dipped lower late in the session and shed 5.5 cents day/day to settle at $2.976/MMBtu on Thursday. January fell 5.7 cents to $3.094.…

for week ending November 6, 2020 | Released: November 13, 2020 at 10:30 a.m. | Next Release: November 19, 2020

+8 BCF............Bearish vs expectations

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (11/06/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 11/06/20 | 10/30/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 942 | 947 | -5 | -5 | 932 | 1.1 | 912 | 3.3 | |||||||||||||||||

| Midwest | 1,127 | 1,119 | 8 | 8 | 1,107 | 1.8 | 1,094 | 3.0 | |||||||||||||||||

| Mountain | 243 | 240 | 3 | 3 | 207 | 17.4 | 216 | 12.5 | |||||||||||||||||

| Pacific | 322 | 320 | 2 | 2 | 291 | 10.7 | 316 | 1.9 | |||||||||||||||||

| South Central | 1,293 | 1,293 | 0 | 0 | 1,195 | 8.2 | 1,212 | 6.7 | |||||||||||||||||

| Salt | 345 | 348 | -3 | -3 | 310 | 11.3 | 335 | 3.0 | |||||||||||||||||

| Nonsalt | 948 | 945 | 3 | 3 | 885 | 7.1 | 877 | 8.1 | |||||||||||||||||

| Total | 3,927 | 3,919 | 8 | 8 | 3,731 | 5.3 | 3,751 | 4.7 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,927 Bcf as of Friday, November 6, 2020, according to EIA estimates. This represents a net increase of 8 Bcf from the previous week. Stocks were 196 Bcf higher than last year at this time and 176 Bcf above the five-year average of 3,751 Bcf. At 3,927 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Nov 13, 2020 Actual8B Forecast-3B Previous-36B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Nov 19, 2020 | 10:30 | 8B | |||

| Nov 13, 2020 | 10:30 | 8B | -3B | -36B | |

| Nov 05, 2020 | 10:30 | -36B | -26B | 29B | |

| Oct 29, 2020 | 09:30 | 29B | 37B | 49B | |

| Oct 22, 2020 | 09:30 | 49B | 52B | 46B | |

| Oct 15, 2020 | 09:30 | 46B | 55B | 75B |

The U.S. Energy Information Administration (EIA) on Friday reported an injection of 8 Bcf into storage for the week ending Nov. 6. The result was shy of expectations, but it did not subdue markets that had anticipated the second natural gas withdrawal of the season.

Next weeks EIA report is also going to be bearish vs history because of record warmth the first half of the period.

The first 5 days for those 7 days is below(it cooled off close to average on days 6 and 7 which are not done yet).