Argentina Grain Exchange has pegged argentina soybean production at 45 million bu

USDA reported argentina production at 47 million on March report

I hope I remembered these numbers correctly

Argentina Grain Exchange is a more recent estimate than USDA

Both Argentina and Brazil are reporting early harvest of full season corn yields as disappointing

Brazil has a problem with mature beans caught in rain and delayed harvest as being of very poor quality, with discounts for most late harvested beans ranging from small shrivelled sprouted, rotten to high moisture. However, a good portion, maybe 40 % of beans were harvested before heavy rains started. It's hard for me to keep Argentina and Brazil separated and also Brazil is so big, weather is so different in all parts of SA. Dry in places for growing conditions and wet for harvesting seem to get the headlines

This yr seems to be more extreme when you look at fair good and excellent numbers and also harvested acres compared to the average

Elevators are discounting heavily as the damaged beans are more than the elevator can handle

Domestic corn increased in price last week and is now 6.20- 6.40 USD. End users are waiting for lower prices and very little corn forward contracted as all attention is on finishing the bean harvest and planting second crop Safrina where second crop Safrrina is done in a regular zone/area for second crops. Farmers will continue to plant Safrina corn until end of March due to strong domestic prices although the window for Safrina corn closed at end of March. If rain continues a month past normal rainy season then Safrina corn has a chance of normal yield, but if rain ends at normal time then March plantings of Safrina corn will be in trouble from dry conditions. Normal second crop of Safrina is approx 114 bu/acre on a good yr.

Just some info on SA corn and soybeans as best as I can do.

Great way to open up the week with one of the most important discussions we could have here..............on corn and beans.

Thanks Wayne!

Other thoughts please?

I have a few.

1. Brazil’s crop is going to be around 7% LARGER than last year with the crop being around 134-137mmt, depending on who you believe. So Brazil’s crop is going to be something like 8-9 mmt bigger than last year. That 2mmt difference out of Argentina is a rounding error. The bigger the SA crop gets the smaller these 2-3 mmt variations impact is.

2. There are poor quality beans and corn every year. Somehow they always get sold. What is the impact on price.? You aren’t going to get rich on the price difference. The market knows about the quality and here we are. There are probably a 1000 uses for low quality beans and corn.

3. I do appreciate the information provided, but the bottom line is SA is going to have another record bean crop. Corn? Ehhhh....maybe not, but the odds are on the market returning towards the mean. These are lofty prices and with record crops being harvested and potentially being planted, long positions are on shaky ground.

Something else occurred to me last night. If the EIA is right and we may never see pre-pandemic crude demand again, that is a lot of ethanol that doesn't need made. That will eventually crush corn and over the next couple years, we would definitely see corn in the $2 range again.

HI;

Re: Ethanol, Green Deal, alternate energy etc.

1st of all I have sold some corn at current prices. not a lot but some

I also read about the future of what some think about the Green Deal. Seems to me you can find what ever your bias may be, to fit with the Green Deal.

Some think Biden's green deal will actually increase demand for soy oil as a bio fuel. The article opined that nobody wants to get into a discussion about food vs fuel use age as the world is on this Green Deal. It seems that soy oil fits with the Green Deal as a bio fuel. Cooking oil has gone up a lot and some EM countries are already priced out of the cooking oil products such as palm oil, soy etc. The article said that 4 refineries [who knows where they are or even what country] have stopped producing regular gas, diesel etc and have switched to producing bio fuels from soy beans and other high oil raw products..

Will ethanol have a larger role in the future Green Deal applications. Nobody knows but it has been proven in tests done on a Cummins diesel engine to replace the diesel fuel with all ethanol, plus some technology and run the engine on all [100 %] ethanol. Cost is the limiting factor at present as the engine must be expensive. Will this fit with the Green Deal, I don't know, but one off setting factor is the elimination of all emission controls that cost so much to repair and operate, especially in today's heavy engines.

I think the Green Deal folks realize we won't be all electric in 5-10 yrs. You will hear credits and carbon penalties but it looks to me as if a lot of the Green Deal is just wish full thinking and actually doing a complete do over will prove to be impossible in the time line given for the Green Deal. We hear them talk about alternate low carbon energy. Between you and me I don't think they have a clue what this alternate energy will be or where it will come from. They talk a good story but the proof will be when it actually happens.

Now you and I both know that what we read isn't always true, so take my comments with a grain of salt

I think the Green New Deal is a pipe dream. Electric vehicles are all about the battery and right now, I don't feel like the battery tech is there. There is a market for electric cars, but I just don't see it as a main stream vehicle unless all these car companies know something about future batteries that we don't know. Now, if they cut the size in half and double the range, you can kiss internal combustion goodbye. But I don't see that happening in my lifetime.

Regardless, there is no doubt that the pandemic has put a serious dent in crude demand. Here we are a year later and still not close to pre-pandemic levels and ev's already have a foothold. Interesting times for sure.

The Green New Deal could never work anywhere close to its current form.

I'm a practicing environmentalist!

I strongly advocate for a cleaner planet, and cutting back on overcomsumption of natural resources..............and helping those less fortunate on that planet, no matter where they live.

I am strongly for developing alternate, clean and VIABLE energy sources.

However, the climate crisis is made up for a political agenda and the Green New Deal is based on fairy tale science, technology, economic and energy principles.

Renewable vs fossil fuels: Diffuse solar vs dense fossil fuels. Benefits of CO2. September 2019

https://www.marketforum.com/forum/topic/39321/

Renewable energy: When can it replace fossil fuels? August 2019

https://www.marketforum.com/forum/topic/35846/

Another secret about fossil fuels: Haber Bosch process-fertilizers feeding the planet using natural gas-doubling food production/crop yields. September 2019

https://www.marketforum.com/forum/topic/39215/

Get the entire truth based on authentic science:

Can we just be honest with ourselves, there is no amount of renewable and recylcable activity gonna reverse the demise of our planet. Yes, we can slow the enviormental degradation but if you think some sort of pollution eqilibrium or restoration is possible please go look in a mirror and ask yourself what you see

With almost 8 billion people, this is the reality becker.

And the world's population is only increasing!

Agreed, the common denominator is ALL types of pollution is people. Until countries take population control seriously and don't freak out if population in countries declines instead of increases, we are headed for more and more of all kinds of trouble.

I suppose it depends on where you get your info

Agrural expects 133, an increase of production

As of March 16 Brazil ConAgra is expecting Brazil soybean production to be DOWN from last yr and argentina isn't looking at the best of yrs. for harvest production

Demand for cooking oil in Africa is almost non existent

They can't afford to buy cooking oil of any kind, thus no demand at current prices

Don't take my word for any thing because I don't know what to believe and possibly neither does anybody else

Even if it's 130, it's still bigger than last years crop. I think Mike is right. China's crop (regardless of how big or small) suffered some major damage last year which is why, despite the fact of normal to above normal crops for SA and US, the bins are empty. But China being China, no one outside the country would ever know that because it diminishes their control.

This is what I think happened, also mentioned earlier at this thread for corn.

https://www.marketforum.com/forum/topic/64916/#64948

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

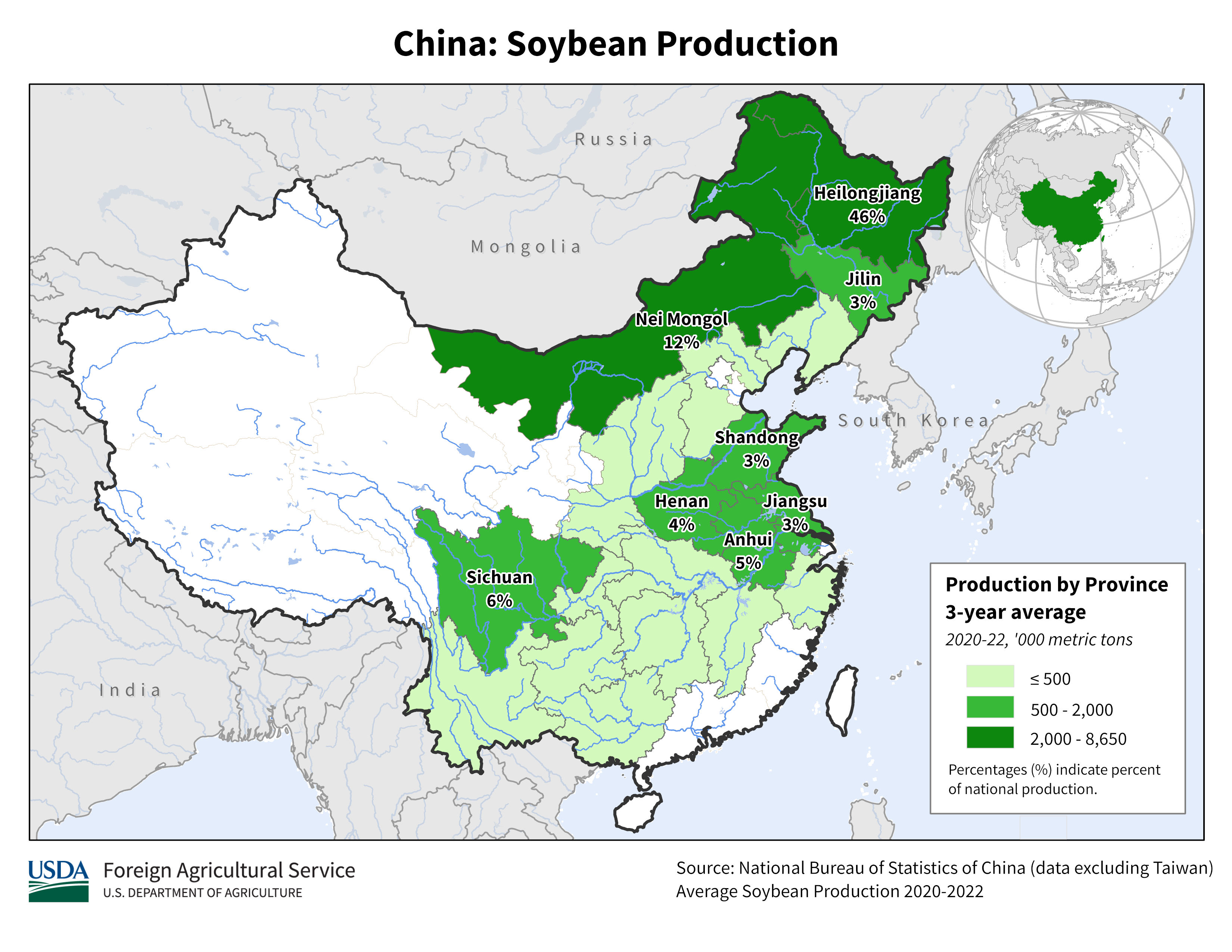

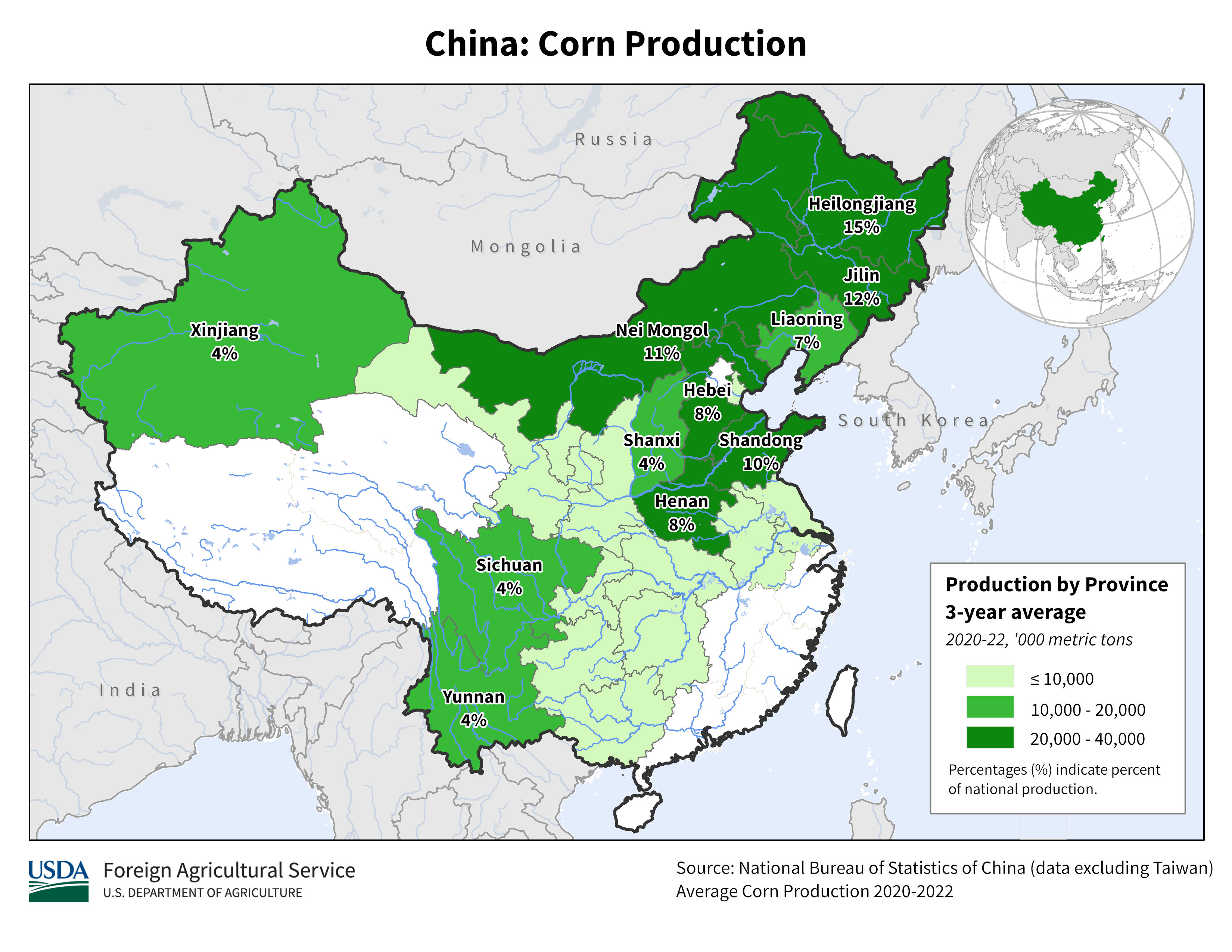

These are the 3 Typhoons that hit the high production green areas above in China in a very short period late last growing season and did tremendous damage to their corn and soybean crop. Soils were already saturated from the first 2, so the winds from the 3rd one left corn plants more vulnerable to being uprooted and likely damaged beans too.

https://en.wikipedia.org/wiki/2020_Pacific_typhoon_season

Main article: Typhoon Bavi (2020)

| Typhoon (JMA) | |

| Category 3 typhoon (SSHWS) | |

| |

| Duration | August 20 – August 27 |

|---|---|

| Peak intensity | 155 km/h (100 mph) (10-min) 950 hPa (mbar) |

| Typhoon (JMA) | |

| Category 4 typhoon (SSHWS) | |

| |

| Duration | August 27 – September 3 |

|---|---|

| Peak intensity | 175 km/h (110 mph) (10-min) 935 hPa (mbar) |

Main article: Typhoon Maysak (2020)

| Typhoon (JMA) | |

| Category 4 super typhoon (SSHWS) | |

| |

| Duration | August 30 – September 7 |

|---|---|

| Peak intensity | 195 km/h (120 mph) (10-min) 910 hPa (mbar) |

Main article: Typhoon Haishen (2020)

China had a pretty good idea how much damage was done and how small the 2020 crop was last Fall but didn't tell the rest of the world how bad it was............so they could do record buying before prices got this high. If the market had known what China knew, when China knew it, speculators and end users would have been buying much earlier as the market dialed in the expected demand from China .....needing to replace the massive supplies lost from the 3 typhoons.

The market found out gradually, based on massive unexpected buying, week after week from China.

We still don't know how low the 2020 production in China was for sure but have been able to come up with better guesses based on how much they bought.............most of which was purchased at prices much lower than this(when the rest of the world was still assuming the bigger China crop).

I don't know this with certainty but am using an educational guess (which I am making myself, not based on reading it elsewhere but using the facts).

I think you are dead on Mike

Thanks Jim. That got us to where we are now, where we go next will be based on US growing season weather and with super tight stocks, the price volatility could be very high.

However, if weather adversity does not show up(like everyone is expecting) there is no reason to maintain prices this high.