Sell the rumor-buy the news Wednesday???

How about both?

I flattened all my positions Thursday in anticipation of transferring out to Ninja. Worked out pretty well so far. Couldn’t resist dipping the toesies back in just now with additional buy stops, gtc above the market for the possible bounce.

It really feels like the algos et. al. are staging for the next leg up, with the exception of wheat. Historically that rally begins in earnest in a couple of weeks. Still in all, I’ve planted (pun intended) my resting buy orders above that marker, too.

Trade on.

p.s. Actually I stepped out Thursday evening in the early part of the night trading. I’ve noticed that in the thinner market, exuberance prevails at the opening and after about 30 to 45 minutes calmer minds take over and sanity prevails through the night. Then three or two flurries, Europe, then the 07:45 close. Decent dependability for day scalping or re-positioning. Ymmv.

Whoa—I feel like Duke and Duke, yelling at the markets “to stay open and keep trading.”

Got filled, ZCN @ 7.11, ZCZ @ 6.10, and ZLN @ 63.80.

I dunno stomper.

The old crop corn doesn't have to follow the weather for new crop and with the USDA report coming up, bullish expectations might be more powerful.

We are still running out of corn and beans and need to ration.

On the weather. The weather pattern that made everything so bullish for new crop last week..cold temps and very dry weather has completely reversed to MUCH warmer and tons of widespread rain in week 2 with pretty high confidence.

Might even be excessive rains in the southwest corn belt.

So the weather is pretty dang bearish. However, it could flip suddenly to traders being concerned about too much rain......there's that much on the way.

One thing that could turn bullish with the new weather pattern is excessive rains, as mentioned in the S.Plains to S.Cornbelt, blocking the best moisture getting farther north.

That is a huge COULD and stretching it to try to see how the new bearish, wetter pattern could be construed as bullish.

There's now enough corn and beans planted............ahead of the planting pace, that it will be tough to get the market concerned about planting delays from too much rain.

Rains are bearish when you have this much drought.

Now if we get 5+ inches of rain in less than a week in a couple of states...............that would be bullish, regardless of the drought.

Some of my muddled thoughts: we know old crop stats. Price rationing is inevitable. Ethanol, livestock feed, corn oil profiting on the edilble/oil for fuel, China. For future reference, I’m going to clump all managed, hedge funds and algos into one term. Call ‘em fund money. (Or funny money).

Their focus is to rip the market a new one. Take no prisoners. The rain pic is a bit clouded (pun, again) by the strangely cold temps. We may not see the exponential movements for a time, not again til the drought re-manifests. And the heat. Old time iconic Chicago weatherman Harry Volkman had a belief that the weather moved in frequent cyclic waves. Warmer winter led to cooler spring led to warmer summer, sort of thing. This was before El niño/La niña was popular. We’ve had a warm winter and this spring is surely cooler than the norm. Count me in on the side of a hot, dry summer.

I’m not going to over load the new crop just yet. But I plan to do so to the old crops. Wheat’s another story.

As I mentioned earlier, mice can survive, and thrive living around elephants. Just gotta be REAL nimble and don’t be over-exposed.

Thanks stomper,

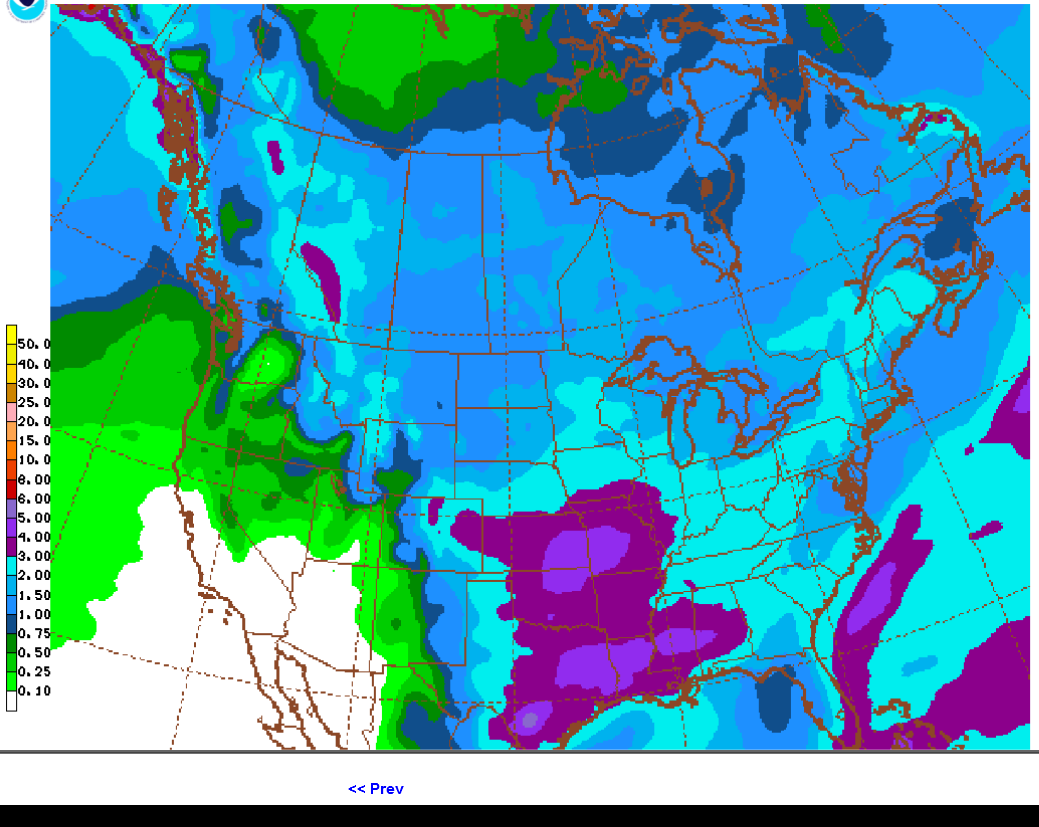

Based on the weather, the market is bearish. This is the total rain the next 2 weeks from the just updated 18z GFS ensemble.

As mentioned earlier, the new pattern poses more of a potential threat for excessive rain problems in the s.Midwest to s.Plains than for drought.

However, a market spiking higher from a potential drought scare the previous week, isn't likely to worry about flooding until the threat gets pretty high.

Great call stomper on the markets turning around today! I didn't think that we would be this strong.

Several things going on today with some hefty cross currents.

1. The old crop supply running out is not going to be solved until the new crop hits the market and so the front months are still a rationing market(requiring high prices to ration out excessive demand for limited supplies).

2. There's a USDA report out tomorrow thats expected to be bullish.

3. The weather is still bearish overall and you can see that in the spreads. The new crop last week was leading from bullish weather but its a huge drag this week, especially today.

4. The specific weather model solutions are not entirely bearish now either. The pattern coming up is a bit tricky because of a zone of extreme rains that may develop in the south. Excessive rains are not good, especially falling in areas that don't need rain that much, some have been too wet this Spring. What that often does, especially with the pattern being caused by a building ridge in a location that causes the storms to weaken, headed into the building ridge is that those storms could set up a zone of excessive rains that actually blocks the moisture and rains from getting farther north. So then, too much rain falls where they don't need it and the areas farther north get short changed. I'm not saying at all that's why we are higher today but its an underlying consideration for resolving future weather interpretations by the market in deciding if this pattern is bullish or bearish for new crop prices.

This was the early morning solution of the European Ensemble model for total rains the next 2 weeks.

Note the 5+ inches in the South/Central US............too much rain.........same place that was shown yesterday but slightly farther south. Rain amounts peter out quickly headed northeast and in fact, by the time we get to the Eastern cornbelt, amounts have really tapered off.

Farther north, in ND, where the worst drought is, they are almost completely cut off from the dynamics generating the storms(based on what some models, like this one think).

Other models, using teleconnections and analogs, suggests the Northern Plains will actually be very wet..............but they can't dial in the sort of affects that I mentioned on the previous page and here.

Another item that you picked up on before you started with this thread...........is that yesterdays plunge was an over reaction.

BIG Traders all with the same idea at the same time trying to get thru the door at once and traders that want to take the opposite position but don't want to get in the way................by buying........step aside, yesterday because they will get run over........until the OVER selling surge lets up.

This is probably why you got buy stopped into your position at that price yesterday as the market was able to generate that bounce higher, suggested the extreme selling party momentum had let up.

I'm guessing that it happened a bit early yesterday near the close because the big funds stopped trading with their huge sell orders and it allowed the buying to regain some footing/power vs getting swamped/crushed all day by big funds.

What do you think stomper?

When new weather model updates hit the market like they are now, late morning/early pm...........it reminds the market, especially new crop that the upcoming weather pattern is now bearish overall.

When the weather is bullish and new models come out, we ALWAYS make new highs as the fresh data confirming that comes out and afterwards.