Between ‘Price Rationing’ and ‘gouging’? I’ve long held the opinion that gouging was justifiable. Now we’re seeing ‘price rationing’ in our realm of commodities. Splain this to me, Lucy.

Price rationing is based on the laws of supply and demand.

When supplies are insufficient to meet demand(people/entities want to buy more than exists in storage/stocks) than to re-balance the under-supplied market, the price MUST go higher to stifle enough demand so that total buyers/demand is equal to the number of sellers/supply.

For instance, here's a hypothetical.

If old crop bean stocks(in storage/on farms) totaled 60 million bushels and our export sales for the rest of the year were 50 million bushels, there would be a razor thin difference. Of course the market could never get down to 10 million but this is hypothetical and lets say we could.

THEN, if demand increased by 25 million bushels and was 75 million and we only had 60 million bushels to sell, what happens? We can't get down to -15 million bushels........that's impossible.

What happens is that the buyers must fight between themselves, using price to see who gets those remaining bushels. As the price gets higher and higher, entities will withdraw from the bidding war because beans become too expensive for them to afford. They may shut down operations or cut back or delay purchases until the new crop is harvested but when beans go from, let's say, $15 to $18, they will get TOO EXPENSIVE for enough buyers to that demand drops off by, let's say 25 million bushels so that demand and supply come back into balance.

We call that price rationing. This happens based entirely from the legit laws of supply/demand applied thru the market forces/trading to accomplish a needed outcome that can be accomplished no other way.

Price gouging is when an individual entity, sees a short term dynamic that creates a very temporary imbalance in local supply that is not part of the big picture fundamental described above and they want to capitalize on it by imposing a much higher price on consumers that must have that commodity TODAY and can't wait until next week or go to the next town/state to get it.

Gasoline stations are know for this.

Having a car is absolutely needed by everybody. When the gas tank is getting low, you MUST fill it up right away to keep it running.

Let's say there is bullish political news.......Iran bombed all of Saudi Arabia's oil facilities but we found out later, that production was barely affected. Initially, despite no supply disruption, the oil market will spike higher to dial in risk premium. This would include futures gasoline prices and the regional gas distibutors, LOVE to take advantage of this price gouging opportunity as they will often jack up prices 5-20c immediately, even though the gas they bought and are selling didn't cost any more. All the local gas stations hiked their prices by that amount because the cost of their gas from the distributor just got hiked.

If people start panicking, like on the East Coast a couple of weeks ago when the gas pipeline was shut down and stations were running out of gas.......local stations will use this opportunity of vulnerable consumers that MUST have gas or their cars will run out and jack up the price at their station by $1 or even much more. This is very illegal and they can be prosecuted.

What the regional distributor did and does all the time.............using political news or upcoming holidays to sock it to travelers(because of higher demand, even though supplies are plenty and did not cost a cent more) is legal and they get away with it because the government watch dogs let them.

I'll bet there has been close to 100 times in the last decade, when our regional gas distributor was over charging to all of our local gas stations with no legit justification.

With regards to price gouging in the commodities markets, with most of them there is just way too much volume from too many buyers and sellers to do that.

If, instead of many thousands of farmers, we just had a couple of massive farmers who decided they weren't going to sell because they knew there were desperate buyers they could take advantage of..........then it would be different.

In thinly traded markets like oj, or oats I would think that this could be very possible. Even wheat, especially MN/HRW wheat the volume is not that great and you might see what we would call price gouging.

If funds are super loaded up to one side in wheat(their open interest can be greater than the entire crop production) and the fundamentals turn against them, the volume of their covering can't be matched with opposing orders and the price can have an extreme spike.

Lots of verbiage and hyperbole, but replace the words ‘price rationing’ with gouging and the end results are one and the same.

To use a smaller example, prior to the arrival of a hurricane, an enterprising chap from, let’s say Peoria, rents a large U-Haul truck, drives to Green Bay where there’s a surplus available of smaller gas powered generators. Buys 85 of them. Drives down to the area of the expected hurricane landfall.

It arrives and amidst the damage and destruction, generators are in high demand and very short supply. Aha! Our trusty entrepreneur has a readymade, needy market. Now factor into the asking price the truck rental, fuel, meals in transit, lodging, cost of the goods, driver’s wages, etc., and oh yes, risk acceptance PROFIT. And, of course, the limited stock. And then the return to Peoria costs. The asking price is triple the non-emergency price, or more.

Now our trusty entrepreneur is accused of gouging, arrested and charged with a crime, for heaven’s sake.

Re-write this scenario with the local gas station instead. His local distributor is at the mercy of larger international companies and their supply line. There are numerous distributors clamoring for gas and a limited availability of supply. And add in the uncertainty of future supplies being available. A big factor in business planning, to be sure. So what happens? Prices are bid up so as to acquire some product. Ultimately, another foul claim of price gouging.

What’s happening in the corn market now? Prices have risen from $3 to over $7. Gouging? Indeed. Hogs? $.50 to $1.20. Gouging? You betcha! Who’s squawking? China? Nah, they’re happy to pay up ‘cause they need the goods in a bad way. What’s the price of soybeans in yuan on the Dalian (sp?) market?

We traders here look for price volatility to assume risk and thereby profit from it. The more extreme the price movement, the larger the profit.

And we’re not necessarily all from Peoria, either.

kind of sounds like pornography doesn't it? Cannot define but when you see it you know it

OK, let me explain it to you a different way then stomper.

Price gouging is not going to make much difference in the amount of demand..............because its not causing a change in demand(cutting demand). It's basically taking advantage of short term circumstances to charge more to people who are going to buy it no matter how high you jack up the price.

Price rationing exactly DOES CHANGE the amount of demand...............that's what it's designed to do. When prices go higher, it DOES CUT DEMAND because prices get too expensive for some buyers and they withdraw from the buying pool. This is needed in markets that have demand which exceeds supplies.

You could actually say that every day of trading is LIKE price rationing(on paper for that day). The higher the price gets, usually the buying dries up, until sellers equal the number of buyers and we reach a balance/equilibrium.

But thats not the type of using the price mechanism for rationing that we are talking about. We are talking about total supplies being too low to meet demand/buying looking at the bigger picture, even though each day trading is part of the big picture.

And we don't necessarily have to be running out of something. The less you have of it(more scarce) the more that it will be worth. Basic economics.

This link give some good explanations:

ttps://www.economicsonline.co.uk/Competitive_markets/Rationing_and_incentives.html

The difference between rationing and gouging is when the price being charged is considered UNFAIR based on the big picture demand/supply picture.

A hurricane, for instance only causes a local spike in demand and lack of supply for certain items that don't represent the big picture. If generators stopped getting manufactured this year and you couldn't find any, anywhere in the country in 2022, then that would represent a change in the big picture and would be a fair reason to charge more for generators.....everywhere.

If we only took into account the local supply, like at a grocery store(and not the big picture) then a grocery store selling bread would charge less in the morning after they get stocked with fresh bread, as the day went on and their bread was being sold down, they could count how many loaves were left and charge more and more as they ran out. If they were down to their last loaf at 10pm, they could sell it to the highest bidder and certainly more than when they had 50 loaves in the morning...........but that would be UNFAIR.

Changing the price for a loaf of bread.......or gallon of gas or any other needed item based on a short term increase in demand is often price gouging.

They do what I call legal price gouging all the time in the gasoline market.

I really have observed something like 100 times in the last 2 decades, when the regional gas distributor jacked up prices for absolutely no justifiable reason based on fairness.

I follow the energy prices every day and usually know the fundamentals and news.

However, the legal watch dogs, obviously allow them a tremendous amount of latitude/flexibility and its clear they must be pushing it to the limit all the time.

Personally, I think the legal watch dogs are doing a horrible job based on observations.

They apparently are most concerned with individual gas stations jacking up prices well above fair levels but NOT the way that its imposed on us in the real world.

Most of the local gas stations get gas from the same regional distributor. If you think you are getting better gas at one station vs another, then you don't understand this. It's almost all coming from the same place. The regional distributor will sell gas for the same prices to places in several states that they supply. State @ local taxes and other costs also get applied after the sale but are pretty much the same for every gas station.

Around here, Sams and Walmart use a different regional distributor and their gas is often 20c/gallon cheaper than most of the other stations.

You will notice, that when the gas suddenly goes up by 10c at one station, almost every other station in town jacks up the price by exactly 10c within a couple of hours. And amazingly, they all have almost the same price.

Some have suspected they are all colluding with each other but actually, the regional distributor sets the same price they all paid for the same gas at the same time and they all respond almost simultaneously.st

It's the regional distributor that abuses whatever fairness rules are being applied to their sale price for their gasoline(in my opinion/observation) .

Like I said, for no good supply/demand reason but often a silly news excuse, I've seen them hike the price by as much as 10c in an in instant...............then, it takes 2 weeks for the price to slowly work back down by a couple of pennies at a time to where it should be fairly priced.

When we are talking 10's of millions of gallons of gas, 10c/gallon is alot of money.

https://www.eia.gov/energyexplained/gasoline/regional-price-differences.php

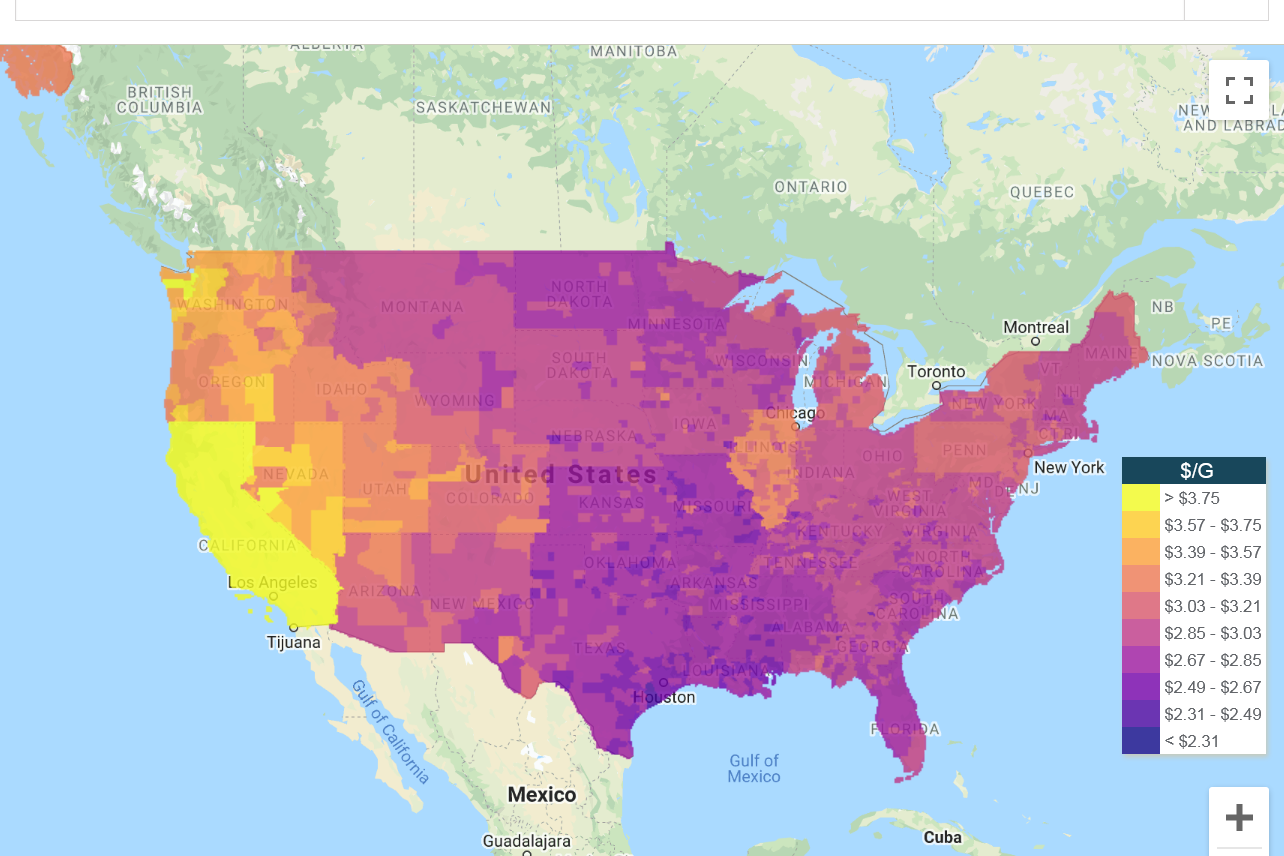

Why are west coast gasoline prices higher?

Current gas prices:

https://www.gasbuddy.com/gaspricemap?lat=38.822395&lng=-96.591588&z=4