Scroll down for the latest weather. Most of the maps below are constantly updated.

Here on June 1st, the models show a building heat ridge in the center of the country as we go out the next 2 weeks. This is bullish for both the grains and natural gas.

Previous weather thread:

Weather 5-19-21

37 responses |

Started by metmike - May 19, 2021, 12:26 p.m.

https://www.marketforum.com/forum/topic/69635/

For the grains, this has been the situation the past month:

5-28-21: The weather flipped to being bullish on 5-26

5-19-21: As mentioned several times, the weather pattern turned bearish for the grains on 5-9-21 and has remained that way with drought stricken ND on tap to get the most rain in at least a year. Maybe 2 inches in many places.

In June, for the planted crop.

1. Rains make grain

2. Failed rains make for price gain.

Latest radar images:

https://www.wunderground.com/maps/radar/current

This link below provides some great data. Hit the center of the box below for the area that you want, then go to observation on the far left, then surface observations to get constantly updated surface observations.

|

Current Conditions below updated every few minutes.

https://www.spc.noaa.gov/exper/mesoanalysis/new/viewsector.php?sector=13#

Surface moisture in the air:

The latest rain forecasts are below.

Day 1 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_94qwbg.gif?1526306199054

Day 2 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_98qwbg.gif?1528293750112

Day 3 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_99qwbg.gif?1528293842764

Days 4-5 below:

http://www.wpc.ncep.noaa.gov/qpf/95ep48iwbg_fill.gif?1526306162

Days 6-7 below:

http://www.wpc.ncep.noaa.gov/qpf/97ep48iwbg_fill.gif?1526306162

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Severe Storm Risk.

https://www.spc.noaa.gov/products/outlook/

Current Day 1 Outlook | |

Current Day 2 Outlook | |

Current Day 3 Outlook | |

Current Day 4-8 Outlook |

Weather maps for days 3-7 below:

Extended weather.

https://www.cpc.ncep.noaa.gov/products/predictions/610day/ | |||||||||

| 6 to 10 day outlooks | |||||||||

| Click below for information about how to read 6-10 day outlook maps Temperature Precipitation | |||||||||

| Click below for archives of past outlooks (data & graphics), historical analogs to todays forecast, and other formats of the 6-10 day outlooks ArchivesAnalogsLines-Only FormatGIS Data | |||||||||

Temperature Probability | |||||||||

Precipitation Probability | |||||||||

| |||||||||

These are the areas with the risk of excessive heat, days 3-15:

https://www.wpc.ncep.noaa.gov/threats/threats.php

https://www.cpc.ncep.noaa.gov/products/predictions/threats/temp_probhazards_d8_14_contours.png

Soilmoisture anomaly:

These maps sometimes take a day to catch up to incorporate the latest data(the bottom map is only updated once a week).

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

Drought Monitor....long term drought.

Top map was updated June 17th. 2nd map was the previous week/map.

Drought got worse in the Midwest!

https://droughtmonitor.unl.edu/Maps/CompareTwoWeeks.aspx

++++++++++++++++++++++++++++++

Soil Temperature:

http://news.ncgapremium.com/index.cfm?show=1&mapID=20

You can go to this link to see precipitation totals from recent time periods:

https://water.weather.gov/precip/

Go to precipitation, then scroll down to pick a time frame. Hit states to get the borders to see locations better. Under products, you can hit "observed" or "Percent of normal"

Good site with tons of data:

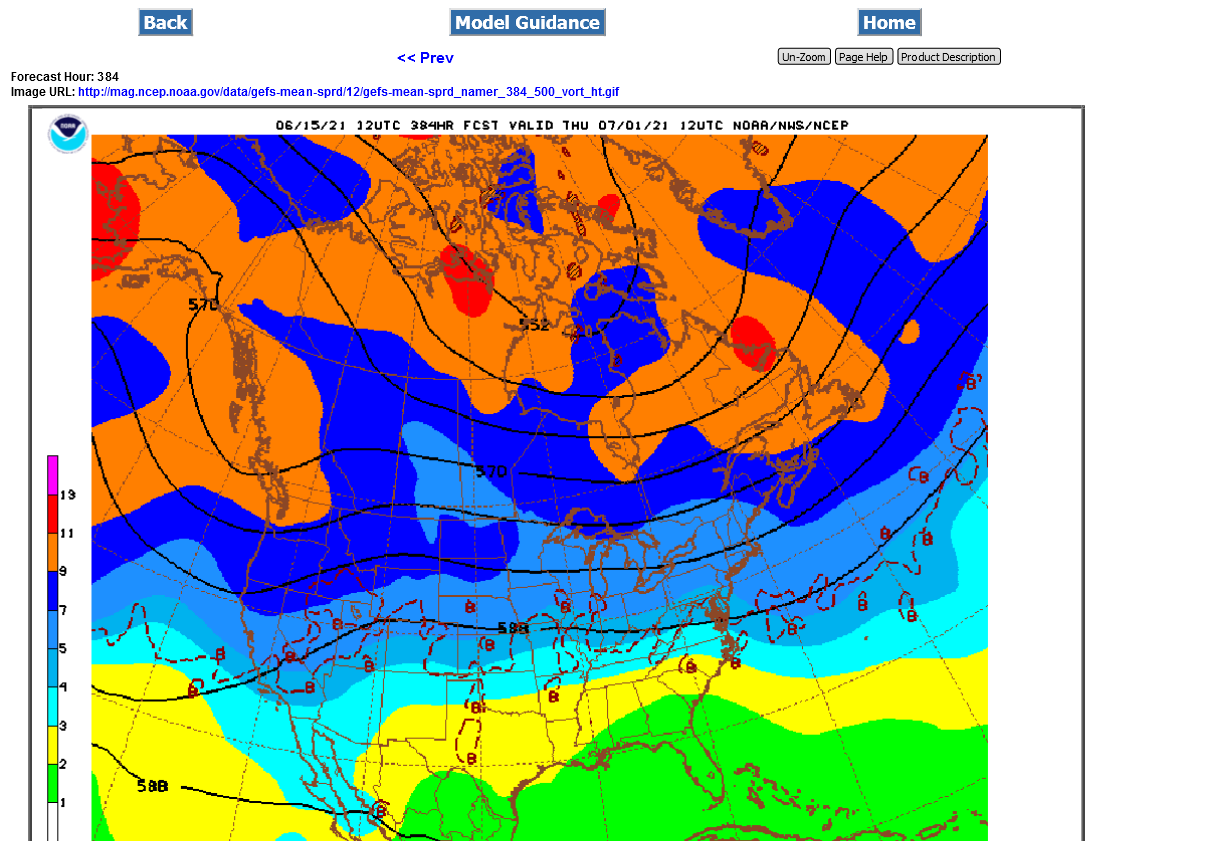

GFS ensembles below from the oz run at the end of 2 weeks. Updated daily.

Drought/weather of 2012 vs 2021

10 responses |

Started by metmike - May 20, 2021, 11:12 p.m.

I don't see any reason to sell corn or beans yet, based on the information you have provided. Thank you for taking the time to post!

Thanks Jim!

This was my comment earlier..........under tallpines morning report. Should have posted it here:

https://www.marketforum.com/forum/topic/70356/#70360

Weather.........turned bullish a week ago for the grains and natural gas......week 2 GFS shows the upper level ridge may be backing up.

The forecast is not actually BEARISH right now in week 2, just LESS bullish compared to the last few days and the bullishness from those days was already dialed in with the much higher prices.

So fair value had been determined based on everything that we thought we know about the weather yesterday.

Today, compared to/relative to what the market thought yesterday, the forecast has the dome of death trying to retrograde southwestward which MIGHT mean less heat and the potential for weather systems to top the ridge in the N.Plains and drop southeast into the Midwest.

Iowa still does not have much rain on the actual solutions but the market is looking att THE BIG PICTURE PATTERN as well as changes from yesterday.

Yesterdays buyers, were expecting the trend of the previous 5 days to continue.......the forecast had gotten a bit more bullish each day. Then today, they are disappointed because it got a bit less bullish in some respects.

Sometimes, even the same pattern can stop being bullish if, after 5 days it stays the same and doesn't get more bullish on day 6...........as long as traders were expecting the pattern to get more bullish and it didn't do that.

On weekdays, we would never go overnight from very bullish(like we were the last few days) to suddenly bearish. Changes that great almost never happen that quickly.

On weekends, yes because there is over 2 days worth of changes that can accumulate in 1 direction.

Overnight, when we become LESS bullish like this, if the changes continue in that direction for the next day or 2, the forecast/weather will eventually turn net bearish but by then, traders have had time to ratchet/erode the price/market down after each model run and when it is finally BEARISH........the top took place a couple of days before then and everybody knows, with those that jumped on the first signs of it having taken the action of selling when the forecast initially told us that it was LESS BULLISH.....like this morning.

If the models don't continue LESS bullish and go back to being MORE bullish, then we go back up and the buyers on todays dip are rewarded.

++++++++++++++++++++++++++++++++++

Thursday Morning comment:

Actually, I still don't have a great deal of rain in the forecast..........YET!

To me, the sell of this morning was much to do over the 6Z GFS ensemble backing the ridge up even more than yesterday. That solution came out around 6am and was consistent with previous run of trying to do that after the late pm Wed. guidance came out more bullish.

I would only call this LESS bullish and not bearish....YET.

It's not like we also haven't gone up alot the last week and the crop is actually in great shape right now and a large part of the belt has tons of moisture. The exception is the HRS crop which is being obliterated but even there, we have some decent opportunities for rain over the top of the ridge when it backs up.

If this was over a week ago, and CZ was at $5, we might be sharply higher with the same exact forecast........because the forecast had not turned bullish yet and the market was trading pure bearishness.

Numerous days of bullish weather maps were dialed in since then.

This is much more bullish than 9 days ago but LESS bullish than yesterday evening and LESS bullish than the peak of bullishness earlier this week.

Also, the maps were getting more and more bullish for several days......but the trend has been less and less bullish with the heat ridge backing out and possibly ridge riders and even northwest flow if it continues.

For sure LESS heat. Heat is the biggest killer in a drought. Dry and hot kills crop. Dry and cool can still give us average yields.

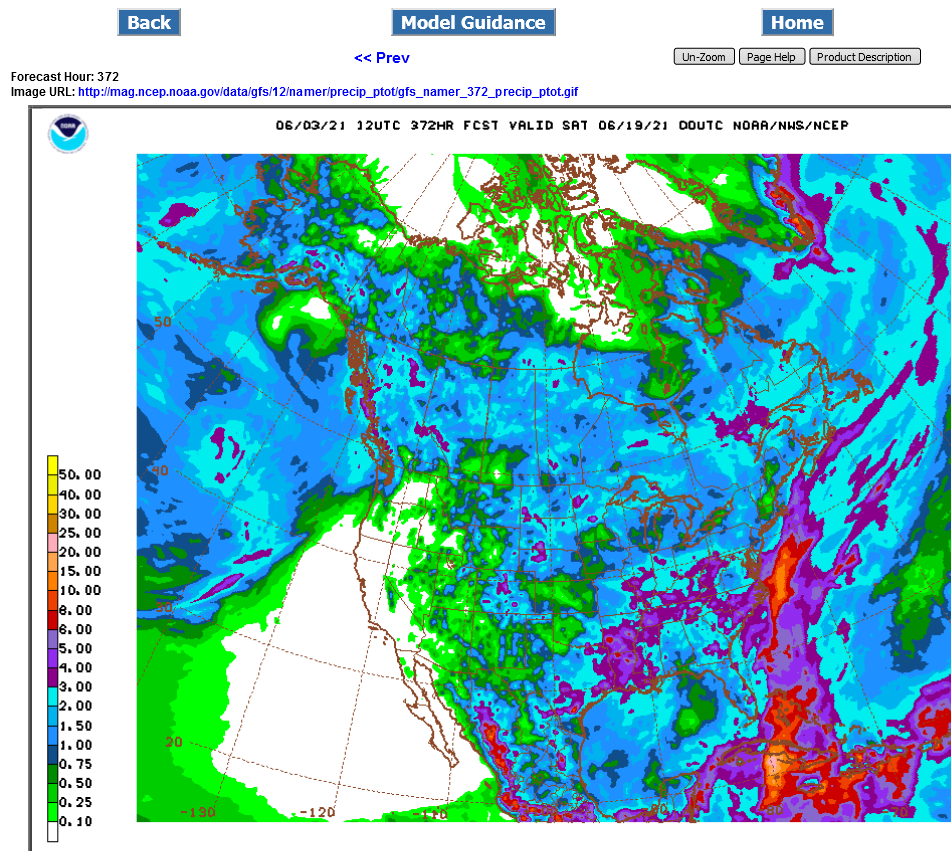

Last run of the 12z GFS operational model that put additional pressure on the grains. Map at 2 weeks with northwest flow along with 2 week rainfall totals.

The operational model is well known as an outlier at times.

.png)

Thanks Mike

Grains futures on the CBOT are sinking in response to an uptick seen in the US dollar today. The WSJ Dollar Index is up 0.7%, which is pressuring grains. "Wheat is probably the most susceptible to a strong dollar on the global market, as it is grown in most areas of the world," "As such, a strong dollar makes it difficult for US wheat to compete." Wheat futures are leading grains lower, with the most active contract down 1.8%, corn 1.7% lower and soybeans off 0.5%.

Off the wire.....

Thanks Jim,

This is what the response is from a person paid to tell everybody why the markets are moving the way that they are and MUST give an explanation because its their job.

They don't have inside information and they don't look at weather models in a weather market, so unless somebody tells them later..........gives them the real reason.......this is what they come up with.

I'm not saying the strong dollar is not a factor but does anybody really think that in June, during the growing season, the grains are focused on the DX and not a big shift in the weather pattern that backs a major heat ridge out of the cornbelt when the current stocks are at historical lows and we MUST have a big new crop that is currently in the ground right now?

We're very grateful to get this report/news Jim. I had no idea what the DX was doing and it is an important element in determining the cost of our exports to other countries. The higher the DX, the more expensive.

3pm: Addition: The European model after the close completely disagrees with the less Bullish scenario.

Rains the past week.

Wet in the southern half(east got some rains this week), dry in much of the north.

https://water.weather.gov/precip/

The European model after the close completely disagrees with the less Bullish scenario from the earlier guidance.

The NWS extended guidance was also maintaining its bullish hot and dry outlook.

This should help support prices tonight early.

Hello, Market Forum

Metmike---Do you have a quick weather update going onto grain close?

Are you long?

Hi tjc,

Looks very warm to hot and mostly dry thru 2 weeks in the Central Plains to Western/Central Cornbelt.

Here's the latest "speculative" week 3-4 guess-look (-:

If the heat ridge backs up farther west, then northwest flow will bring better rain chances to the Midwest which is why this outlook has above average rains.....but there isn't much cool air behind any of those potential systems.

https://www.cpc.ncep.noaa.gov/products/predictions/WK34/

| Week 3-4 Outlooks | ||

| Valid: 19 Jun 2021 to 02 Jul 2021 Updated: 04 Jun 2021 | ||

| Please provide comments using the online survey. | ||

Temperature Probability | Precipitation Probability (Experimental)  | |

Iowa does not sit in a pretty place in any of these maps and we arent into the dry part of the year yet. This coming Monday might be the peak of crop ratings, if we havent already seen them.

With the need for a high yield corn crop, things are looking iffy.

Agreed if you just look at all the NWS products going out 2 weeks.

However, this is what I'm seeing with the pattern.

The potential for the upper level heat ridge to back up a bit farther southwest with time, especially late in week 2.

This will introduce new chances for rain getting into IA because we will see ridge riders........perterbations in the jet stream/flow coming around the periphery of the core of the heat ridge..........in the N.Plains, that drop southeast on the backside of the ridge, towards the higher moisture, in something that could even morph into northwest but absent much cooler air.

The systems will tug down air that is less hot and we could alternate between very warm/hot and temps back down to average for a day or 2.

Areal coverage in a regime/pattern like this is not complete.

At the end of the period, out of 100 different GFS and European model ensemble solutions, we have close to 40% of them liking this pattern described above.

Any amplification of it can quickly boost rain amounts to above average if there is definative northwest flow aloft over very warm humid conditions at the surface.

But this is 2 weeks out.

The other item is that the southern Cornbelt is too WET right now. We need drier weather with heat in that region.

The upper Midwest to Central Midwest will start to get hurt with hot/dry weather the next 2 weeks but not south of that. If rains return to the Upper/Central Midwest in 2 weeks, the market will collapse lower again like it did when the weather turned bearish in early May but not wait for the rains. As soon as it shows up with any sort of confidence.....BEFORE the NWS extended guidance shows it, probably by at least a day.

https://www.marketforum.com/forum/topic/68905/#69164

https://www.marketforum.com/forum/topic/69352/

Funds were more loaded to the gills with records longs in early May, so there will likely not be nearly as much selling to cover as there was during those 2+ weeks.

Been making weather comments under this thread:

This is the rainfall the last 7 days:

Rainfall expected the next 7 days here:

https://www.marketforum.com/forum/topic/70329/#70334

Scroll up for the rest of the weather.

A new shot of cooler air on tap for late week 1 and early week 2 on the overnight models..........and this backs up the heat ridge. However, it acts like it wants to return after that and the Central Cornbelt is never in a great place to get much rain.

ND will get some decent rain this week, as mentioned on the Sunday open page and on the maps above.

12z GFS ensemble continues the trend of the last several models and backs the heat ridge up a bit more than the previous runs.

Will it start returning at the end of 2 weeks?

The trend is for it to back up more in each run, so at least not as quickly.

If December corn isn't $6.50 by next Monday, I'll be surprised.

So will be all the traders long right now (-:

So true! hahaha

592 to 597. Friday to Monday’s open. Low today was 605. Gap fill move was thwarted twice today. Actually three times. Just around the 7:45 close, at the open, a spike lower failing at 605, then the third at 11:45, 605.75. My guess is that the immediate response to the WASDE report will spike down for an instant, filling the pesky gap. I will have orders sitting in the sep and dec contracts for just a few. I’ve already got good positions on the July and December, except for the pissy one yesterday. GTC order from a week or so ago at 6.18. Sucker got filled at the high of the day, one tic from the 618.25 print. Oh well. Plan the trade, trade the plan.

One thing that bothers me is the proximity to the upper Bollinger Band. My inclination will be to get filled and get out almost immediately upon the bounce reaction. I’ll probly have a resting sell order up top somewhere. ( Not reacting promptly to the B Band incursion cost me big $$$ both yesterday and today in the hog market. A valuable lesson learned. I guess I just fell in love with the gi-normous profits in the position and didn’t want to exit. Shame on me. Won’t happen again—-until the next time. LOL.)

thanks for heads up on the WASDE report coming out on Thursday. I was totally oblivious and could have been clobbered from ignorance.

I would have been watching the screen and thinking "what the heck just happened!!

then, realizing in seconds(possibly a richer or poorer man than I was a minute earlier) that its 11 am, that a report I didn't know about was just released.

I've avoided a position during a report for the last 12 years.

Nice rains still this week for drought stricken ND.

After the heat ridge backs up this weekend into early next week, it looks to return in week 2.

Models are really showing major heat spreading east and becoming widespread later this month.

A line of strong storms sweeping thru the n.plains to Nebraska right now Is putting a bit of pressure on the corn and beans.

They may fall apart before hitting IA late this morning. A big rain in IA would drop prices by double digits.

Those storms have held together nicely and as a result have caused those double digit losses expected as they’ve tracked into MN and now approaching IA.

Once they die down, we should bounce up.

This has been more rain in extremely dry areas than the market expected.

I had my long position in corn and looked at the radar before I went to bed. Got out of my position knowing I wouldn't sleep well knowing it was raining in that area and having it in the back of my mind, what is that doing to my long position.

Good for you Jim!

At this time of year, it can be like the saying "1 bird in hand is worth more than 2 in the bush"...........except it's "an inch of rain in the rain gauge is worth more than 2 weeks of dry weather on the weather maps"

Well said! Live to trade another day!

What is the latest? Farm talk was lamenting not much rain.

Is it time to be long over the weekend?

Hi tjc,

I can't advise you on what position to have over the weekend because the weather models could change drastically and we could gap higher or lower on the open Sunday Night.

I just give you the latest weather information and you can decide how much risk you want to take for yourself.

I know that you love buying calls because you thinks it limits risk and as usual, would strongly advise that you not doing that in most situations.

I have no idea what the price of calls are right now but will guess its extremely over inflated and it will take a huge move higher to make money and even a small move higher to lose money.

Odds are increasing that next weeks weather could turn less bullish than it is right now and following this weeks price movement, you will note that every time we tried to or made new highs(beans) they were solidly rejected.

If the forecast is nothing but hot and dry next week and all the rain are behind us.........then we WILL make new highs.

But that's what it will take. I'm not telling you not to do that, just that buying calls or having calls here on Friday have a much greater chance of losing money than making money next week.

If we take off higher next week, they can make big money but we need a dome of death with very little rain and temps well into the 90's for 2 weeks for that to happen.

Ask yourself.........if the market thought that was going to happen, would SX be down 24c right now?

Of course this could just mean its a buying opportunity but I think its more than todays rains or this weeks rains............the 8-14 day part of the forecast is starting to look wetter.

If that continues for 2 more days, you don't want to be long on Sunday Night.

We should also note a tremendous amount of disparity on individual ensemble solutions.

The European ensembles are drier but maybe 30% of them make a case for it to wetter later in week 2 and many of the wetter ones, get really wet.

The GFS ensembles have been the wetter model all month.

The dynamics that could lead to that is a repositioning of the heat ridge.

Where perturbations in the flow travel around the periphery of the heat ridge will mean everything.

At this time of year, even if with a HOT forecast, if the surface flow is southerly and transporting up gobs of heat and humidity, unless you are underneath the heat ridge with enough warm air aloft to cap the rising motion of air below, then any sort of wave that tracks into your area can be a very productive rain maker.

If the heat ridge is farther west, or even north not enough moisture can make it up because air masses are of dry, western heat origin or dry moderated Canadian air origin after fronts pass and the air aloft tends to be very warm and capping when fronts come thru. This is what the last few 6-10, 8-14 day outlooks showed.

If the heat ridge repositions father south or east, that all changes. It looks like the new position later this month might be to the south.

Moisture comes father north, weather systems can act on NON capped, less hot air aloft traveling around the periphery of the heat ridge.

No cool air to speak of though but rain making become more prolific.

Here's a look at the just out 12z Canadian Ensemble model that shows this sort of pattern.

The area under the capping, center of the heat ridge is actually where its been much too wet recently.

2 weeks of dry weather down here would be beneficial!

The periphery of the heat ridge, where rains would be most likely is where current conditions are the driest.

https://weather.gc.ca/ensemble/charts_e.html?Hour=384&Day=0&RunTime=12&Type=gz

384h GZ 500 forecast valid on Jun 27, 2021 12 UTC

Forecasts for the control (GEM 0) and the 20 ensemble members (global model not available)

I'm still looking for the pattern to become WETTER as week 2 goes along.

I think that the market faltering this last week when we were near the highs, was on to this.

Look for the extended NWS guidance(which is automated on the weekends) to add more rain each day from now into early next week.............if the pattern change depicted on recent runs continues.

However, there is tremendous uncertainty. If the heat ridge expands much farther north, instead of it being in a favorable position for big rains in the Midwest, it could shut down the rains.

For sure we will have a heat ridge but the exact location matters the most.

As expected, we're getting the increase in rain forecast in the extended guidance with Saturdays just updated automated forecasts.

Same forecast philosophy here on Sunday. Scroll up for most of the maps that were updated automatically today.

This is the area burning up right now.

There was not much surplus/subsoil moisture coming in and this is the rain total for the past 2 months.

The brown is less than 50% of average rain. The bright red is less than 25% of average rain.

Note on the 2nd map below, the much above temperatures in the exact same area because of the heat ridge that was in that location. Cool and dry doesn't kill crops...............HOT and dry can put a big hurt on VERY quickly.

Soils dry out much faster(double the evaporation rates, with hot vs cool..especially this time of year with the high angled sun and the corn not big enough to provide a shade canopy for the soils). Transpiration rates and moisture requirements also are higher for the growing crops.

The report I got from my advisor was rain fall over parts of NA corn belt

My maps show extended rain fall starting this week end

We got 1/2" this morning

Will be enough to join up with lower sub soil moisture as you could kick the soil and find moisture before today's rain [2" of dry top soil]

Just wondering how the majority of corn belt is doing

Obviously some thing happened or some think some thing will happen

A week of dry when corn decides future yield is when??? for majority of crop

Some are talking waist high corn

That doesn't seem like distressed crop

How much is seriously distressed

Market must think most is not or will not be distressed

Am I correct??? thinking most of the crop is doing okay???

Or?? Is the market price wrong???

Our crop looks decent and living on hand to mouth rain fall

Have done some irrigation on sweet corn

Wayne,

We get to find out how the crop is doing today at 4pm your time, when the crop condition is released.

I'll have that here for you shortly after that.

Look for conditions to deteriorate slightly to modestly in the driest places on the maps above.....northern half of the Western cornbelt.

In the far south, conditions have been too wet and could deteriorate a bit in low production spots.

So a drop of a few% is likely but the market is looking ahead at a much wetter weather pattern on the way and the overall crop ratings should hold up.

It's probably not a drop into the yield losing P/VP category but a drop for the G/E to F that needs rain to get back to G/E.

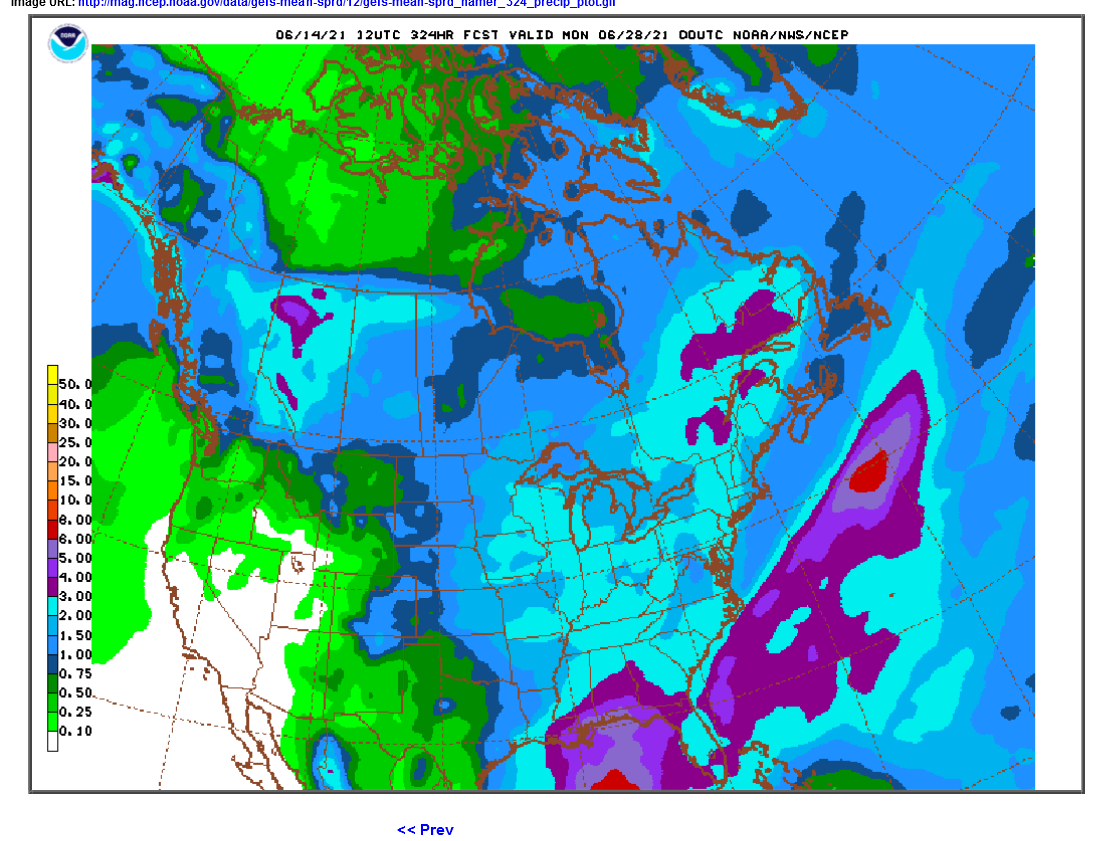

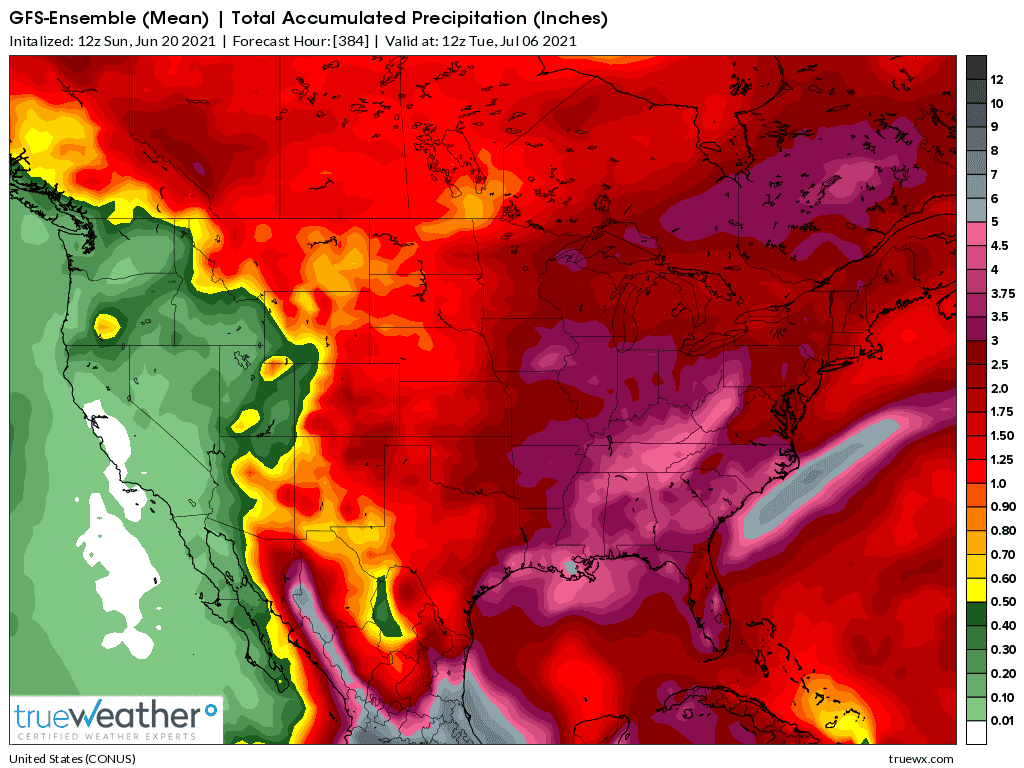

This is the just now updated 12z GFS ensemble rain forecast thru 14 days, with a couple days left at the end of the run. Whats interesting is that the European model, that won't be updated for awhile, was actually wetter than the GFS overnight. It's been the other way around this month until now......the GFS has been wetter every time.

Whats interesting is that the European model, that won't be updated for awhile, was actually wetter than the GFS overnight. It's been the other way around this month until now......the GFS has been wetter every time.

The always jumpy 12 z GFS operational model was a bit drier but nobody gives it much weight.

The 12z GFS ensemble actually had a bit MORE rain than the previous run.

Here's my complete summary from the new guidance:

This is the pattern at the start of week 3:

Corn is up today

What does the market know that I don't

Though we would get general good rain in IA

That is a major corn producer

It's not weather. The forecast is still wet/bearish with no heat ridge.

SX would not be down 26c if the market was worried about the weather.

Weather continues bearish obviously.

The models have really been cranking up rains from around Central IA eastward in the extended. 3-5 inches for the week 2 period. The European model is a bit drier and the Western Cornbelt looks drier, as well as the Plains.

GFS ensemble has potential dome of death type heat ridge developing late in week 2 but TONS of rain before that happens in the Central and Eastern Cornbelt.

European model not as impressive with the dome but also not as wet.

The Western Cornbelt(and Plains) are going to get the least amount of rain and have the highest heat, when it returns at the end of the month.

This is why the MWE is up strongest tonight.

Keep an eye on the radars tonight.

https://www.marketforum.com/forum/topic/70329/#70330

Nice rain event over some xtremely dry areas today.

We received six tenths, enough to make us think it can still rain. The new seedlings will benefit but the crops are just getting into the high water use stages so Mike will have to step up his game and bring us more.

I have a 150 gallon rain barrel for the garden, it went dry last week and now is a little over half full. Amazing how much water falls on an area the size of our roof with these little showers.

Thanks mcfarmer,

Your area is really hurting bad )-:

The good rains for the next week look to be barely east of you but I'll do my best to convince the weather Gods to coax them a bit farther west (-:

2 week totals below........most of it in week 1. The dark red shade is 2.5 inches

These were the areas helped by rains, mostly the last 3 days and mostly after they will show up in the crop ratings.

Latest weather

No changes in the forecast. This is the latest 0z GFS Ensemble just out.

These are the latest rain amounts after 2 weeks in the left bottom corner. The gray shade is 5 inches of rain for most of IL. Everywhere inside(and including) the dark red shade is 2.5 inches+, which includes all of IA.

The left top corner shows a huge upper level ridge building in 2 weeks.

No changes. Huge rains coming to the central and eastern cornbelt this weekend/early next week.

The biggest threat will be excessive rains.