Obviously from the massive rains coming up.

However, there are signs that the heat ridge could strength in week 2 and become bullish in early July!!

SX has been very strong this evening, but SN even stronger(after dropping $1 with an expanded limit on Thu)

At 12:03 CDT, SX dropped 10c in a few seconds. Wow!

Obviously somebody hit the market with a huge selling order. Possibly triggered some stops on the way down.

I believe this is probably related to the increasing rains in some bone dry areas right now. The GFS ensemble is also coming out and shows a stronger cold front early in week 2.

https://www.marketforum.com/forum/topic/70329/#70331

In June, rain makes grain for the mostly planted crop. Failed rain makes price gain(-:

Latest radar images:

https://www.wunderground.com/maps/radar/current

This link below provides some great data. Hit the center of the box below for the area that you want, then go to observation on the far left, then surface observations to get constantly updated surface observations. Let us know how much rain you got/get!

|

The threat for hot/dry weather to return has grains off to the races.

The nice rain event in some dry areas fell apart earlier this morning and added greatly to the fuel.

In June:

Rain makes grain.

However,

Failed rain makes for price gain.

November beans back in the teens(+$13)

On Sunday Night, we have a good chance of the market opening with double digit gains or double digit losses.

The models are going back and forth for early July on the pattern. Some have a dome of death heat ridge in the Midwest, others keep the heat ridge farther south and have tons of rain.

Latest weather maps(most are updated constantly) here:

Corn was limit down -40c on Thursday, so we have expanded limits today.

CZ has been above +40c!, the usual limit.

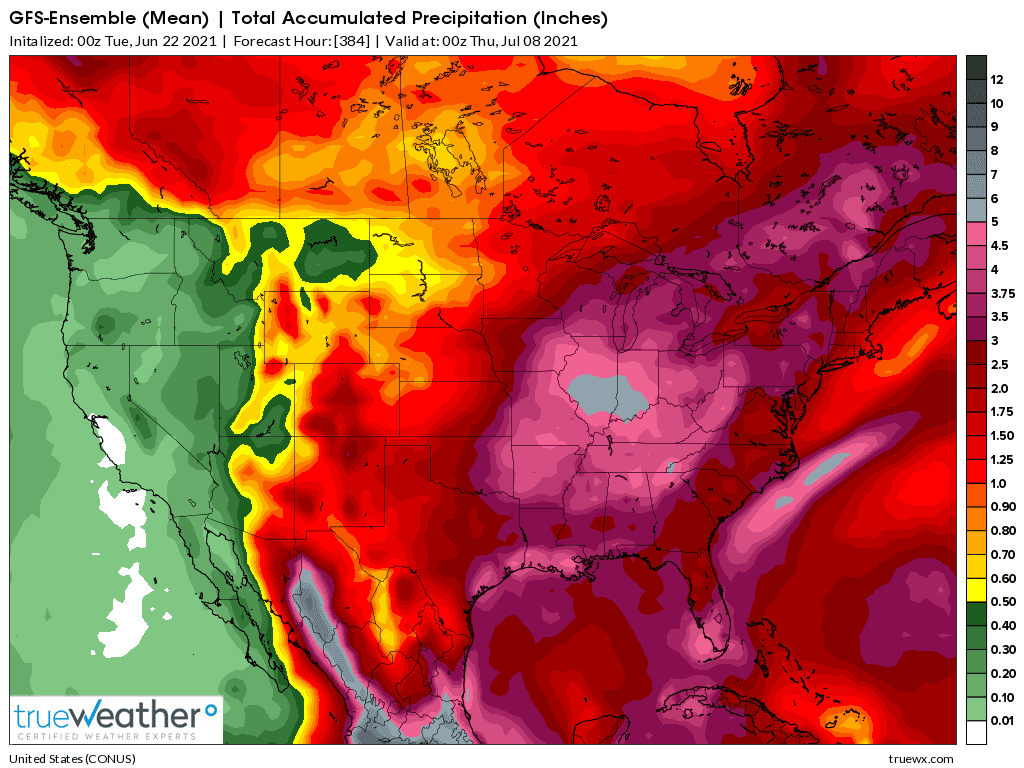

The GFS ensemble average keeps the heat ridge in the south and the 2.5 inch rain line in W.IOWA to the MN/WI border.

Everywhere east gets more than that. 4" or more for most of IL/IN/OH.

Everywhere west get less to much less.

There is tremendous disparity in individual solutions. Some DO have the heat ridge in the Midwest but most don't. See the maps below. This is the GFS ensemble at 312 hours.

The Canadian model has almost no Midwest heat ridge solutions.

That's the 2nd set of maps below

+++++++++++++++++++++++++++++++++++++++

Canadian ensembles at 360 hours for the just out 12z run:

360h GZ 500 forecast valid on Jul 03, 2021 12 UTC

Forecasts for the control (GEM 0) and the 20 ensemble members (global model not available)

++++++++++++++++++++++++++++++++++++++

After a historic drop near $1.20 per bushel Thursday, front-month CBOT #soybeans jumped 5% (66.25 cents) on Friday, breaking the $14 mark before settling just below. November beans rose 4.8% and moved back into the teens, finishing at $13.13 per bushel.

The markets should open sharply lower on the nice rains in some very dry places but the forecast for the WCB and Plains is bullish.

Bearish for the ECB.

Rains dried up earlier this morning and will completely miss most of the ECB this time but more chances later this week.

Crop ratings this afternoon will PLUNGE!

Cleaned out the last bean bin, I was going to take it to town but Mike’s comment convinced me to wait til tomorrow.

We’ll see if he makes me money.

Very funny mcfarmer (-:

That's one reason I never give advice or trade for somebody else.

Not because they would be upset with me when the inevitable loss takes place..........but I am far more upset about it myself.

I traded a 50K account for my wifes business 2 decades ago, the only time I took somebody else's money.......so I know. It messes up objectivety and causes emotional thoughts to be too strong(and I'm unable to turn off all my emotions in trades....in fact, in recent years, that fact by itself has sabotaged me badly).

So I just tell you the weather, as comprehensive as I know how and how the market is CURRENTLY reacting to it and includ the best weather forecast that I know how to provide...........and you can decide based on all that information what the market price will be tomorrow.

If I wanted to make those decisions for you, then I might as well take your money and get paid for doing it.

This way, I can give you a ton of very useful information............when its convenient for me to give it to you and don't have to charge a penny for it and don't feel bad when a forecast is wrong ......that I ripped you off(which is more important to me than actually making money).

I am certain that the information has resulted in people having the opportunity to make informed decisions that made them MUCH more money than any losses...........or I wouldn't be doing it.

There's no pressure on me..........so I can have fun sharing my love of meteorology and trading.

So if the price is lower tomorrow...........its on you.

My suggestions to producers much earlier this year was to do some selling then, before we hit the top and it would have been to get rid of any old crop back in the Spring.........outside of weather connected price moves like this one.

Past experience tells me that being too greedy means you always miss the top, then often wait for the price to come back after the top is hit and the price just keeps falling.......and you end up selling closer to the low of the year.

Producers are blessed with extremely lows stock this year, so that even if you sell near the lows for the rest of the year, it will be a better price than the highs for many recent years.

But that doesn't mean you shouldn't try to sell most of your crop in the upper 50% of the price range. If you think we are at that level, especially with old crop........then at least consider selling some.

But if you had that mentality, you would have already sold the rest of your old crop before this and possibly hedged some of your new crop.

When you decide on a new strategy as we go along........its understandable because you never know how much new crop that you will have. Could be a bin buster or a crop failure.

Guys in the ECB will wonderful looking crops right now are going to be more aggressive sellers than those with severely stressed crops in the Upper Midwest, WCB.

June 21 evening market thoughts. Just for you mcfarmer (-:

Why is MWE, even with the huge gap higher and what must be the worst crop rating in history and an extremely bullish weather forecast........... still 50c below the contract highs from earlier this month.....June 6th at $8.43?

It might be underpriced and we still make new highs this week.......but I like to judge how the market reacts to bullish news.

Sure, the gap higher tonight was a knee jerk bullish reaction but the MWE has been acting horrible lately with extremely bullish weather. This tells me that we ran out of speculators willing to aggressively buy this market without looking back because its so bullish.

Those guys are the ones that jump in early on the bullish move, when the bullish news is brand new news.

They have been absent at some times recently, when they should be pushing prices higher... and the price charts are scaring them away as well as technical traders after the spike high reversal lower on June 6/7 with the most bullish news yet resulting in a powerful buying exhaustion, gap and crap sell off to a lower close formation.

Same with the corn and beans. The reversal lower earlier this month at this time of year with too much rain right now in the forecast is just not the recipe for guys to buy without worrying about price because they are confident that its going higher. Thats the type of buyer that we MUST HAVE in a weather market at this time of year if prices are to go higher.

Otherwise, the crop slowly marches towards being made with less and less time to hurt it more and less and less reason for speculators to be long.

At this time of year, fundamentals don't matter as much. Right now, we are trading next weeks crop rating and the week after that, what the rating will be.

With this much rain in the forecast for later in the week, the market knows that those places will stay the same or get better to offset the deterioration in the Upper Midwest/N.Plains.

A crop NOT deteriorating or even slipping 1% is bearish at this time of year because it got a week closer to being made.

What if IL/IN/OH get 4 inches of rain?

Dang, that locks in yields close to average(for many places in those states) unless we have extreme heat and massive heat fill for the corn.

We can still have a huge dome of death move in on the week 2 maps later this week/month and park over the Midwest in July/August. This is possible. But thats what it will take to challenge the old highs.

All the weather maps below are the individual GFS ensembles for 2 weeks from now.

Below that are all the Canadian ensembles.

Several are pretty bullish and if they ended up correct, then after the market dials in this upcoming rains or when much of it has fallen......we have more upside.

But they are the minority.

And it will be July. It takes a more and more bullish forecast to move the price higher by the same amount as the growing season progresses.

We might hear "its pollination, which is the most critical time" which will be true but you still can't hurt the crop as much as if the hot/dry had started earlier in the season.

Father time, along with the strong seasonal tendencies always wins in July and August in the absence of extreme hot/dry.

I am chomping at the bit to be long again on some extreme hot/dry with a dome of death but am just providing an honest, reality check based on the facts on the evening of June 21st.

Long ways to go but physical realities based on science/weather and an objective view of dynamics in the markets shape my thinking as opposed to hoping the market and weather do what I would prefer.

It's weather of course and 2 days from now, I may be telling you how bullish things suddenly look. But if you are wondering why the markets have not been acting better, the above explains it.

GFS ensembles from 12z run today.

Canadian ensembles below from the most recent 12z run.

384h GZ 500 forecast valid on Jul 07, 2021 12 UTC

Forecasts for the control (GEM 0) and the 20 ensemble members (global model not available) above

Ensemble average for European model same run/time frame......slightly more bullish than the other 2 above.

Ensemble Average for CMC model for that same period. This model is the most bullish of the 4. We need something like this but even more amplified to take us much higher than the current prices(with some confidence)

Thank you for the evening market thoughts ! we had another 1/2" rain last night. Very cool tonight. Crops are looking much better. More rain chances late week.

YW and thank YOU Bowyer.

up to 4 inch rains to the north of us early in the weekend. Then that much to the south of us today.

I measured .01 in the rain gauge today. Been 2 weeks since our last good rain.

I see that MWE finally was able to get above $8 again just now. With the horrible HRS wheat crop and an additional drop of 10% in the ratings, one would think we should be limit up. The HRS is rated at an incredible 37% P/VP, with only 27% G/Ex!

https://www.marketforum.com/forum/topic/71355/

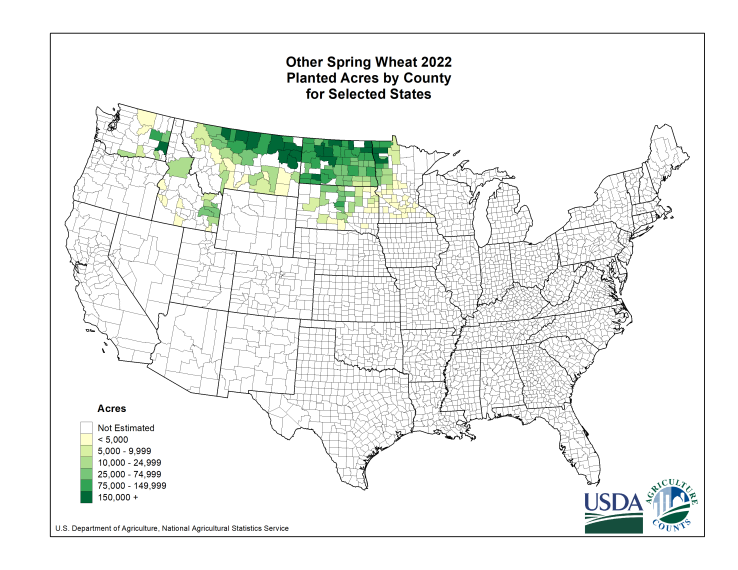

Tons of rain for many corn/bean locations in the next week but not much for the HRS wheat crop.

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

This is the latest 2 week rain forecast for the just out GFS Ensemble for 0Z.

The dark red contour is 2.5+ inches of rain........it's HUGE.

Inside that are greater and greater amounts. The gray shade in 5+ inches of rain for s.IL/IN! This is why the beans have reversed to 11c lower tonight after opening higher off of the -2% drop in crop ratings.

Corn was +8c on the -3% crop ratings and got back to unch.

The N/C.Plains and most of MN are pretty dry. The MWE is still holding most of its massive gains after the -10% drop in crop ratings.