Thanks for providing the link for that NG article Mike. Did you see Goldman’s suggestion for producers to buy woom options for protection?

That would make a great conversation. How could we maximize our capital assuming NG is going to $10. Options or contracts? Aggressive or conservative? Allow for how high a price swing without getting into a margin call.

Thanks for starting the new thread Jim.

I would NEVER advise speculators to buy calls or puts under most circumstances, including this one.

They only pay off on home run trades which almost never happen and you will burn up more money in the 10+ other attempts that resulted in those trades expiring worthless.

They can make sense for protection and in some cases for producers and in other unique strategies.

I haven't checked but the premium for ng calls right now must be pretty extreme. If you bought some Jan calls, for instance, you will need a pretty big move up just to break even.

I like my price moves up to pay off from the get go and $ for $ risk/reward on both sides.

The case for being long options is that it limits your risk to the cost of the option, which is especially attractive in an extremely volatile market because it allows you to not get taken out from a whipsaw spike drawdown against you that comes back in your favor.

I get that but so do the options sellers. They will make you pay a hefty price for the right to own an option. The more volatile the market is..........the more people are drawn towards options.........the higher the premium they pay for them is.

This reduces YOUR chances of turning a profit and increases their chances of making a small profit............which is what they do for a living.

But there are situations that still might justify buying options.

For me, as a short term weather trader, buying WOOM options based on a type of weather pattern evolving months from now(which is impossible to predict) is no better than going to the casino.........where the house sets the rules of the game(like options sellers) so that, in the long run they always make money.

Options sellers(calls in this case) will get obliterated if ng goes to $10 of course. But the specific circumstances that will cause that(extreme cold early Winter for instance) are just a crap shoot right now.

Thanks for starting the new NG thread Jim.

Previous thread here:

NG Thread 9/2/2021

35 responses |

Started by Jim_M - Sept. 2, 2021, 10:45 a.m.

https://www.marketforum.com/forum/topic/74505/

After the close Thursday:

Natural gas futures gathered even more momentum on Thursday, reaching a seven-year high as production remained weak in Hurricane Ida’s aftermath and the latest government inventory report confirmed a tight supply/demand balance. Ida “amplified already heightened supply fears,” said RBN Energy LLC analyst Sheetal Nasta. The October Nymex contract gained 11.7 cents day/day and settled…

Early Friday:

Natural gas futures held onto most of their recent gains in early trading Friday as analysts highlighted tight balances, warm September temperatures and global price trends as drivers of bullish sentiment. The October Nymex contract was down 2.2 cents to $5.009/MMBtu at around 8:55 a.m. ET. The U.S. Energy Information Administration (EIA) on Thursday reported…

September 10, 2021

metmike: $5 is extremely pricey. There is definately some late season heat in the forecast but the average CDD=HDD is less than a month, which means we are in sort of DD Limbo in the absence of EXTREME heat here or EXTREME cold in early October.

With storage so low vs average and Ida outages, CDD's can have more impact than usual. Just wait until we get into the HDD season.

FRIDAY CLOSING:

The situation is precarious to say the least. Getting to 3500 BFF is going to be challenging.

There is a tropical wave coming off of Africa that has already caught the NHC attention. Another shot in the Gulf and hard to say where that would take us.

Implied volatility for Dec natural gas options is 65 %. Not a good time to be a buyer !

Energy Crunch Deepens as U.S. Warns Europe Isn’t Doing Enough (yahoo.com)

I'm beginning to think that the world situation for winter heat this year is dire.

I just noticed the margin for NG is about double what it was 3 weeks ago.

metmike: It's getting pretty crazy! New highs for the move/contract this morning. Up another $2,000/contract.

New Tropical Storm Nicholas

Started by metmike - Sept. 13, 2021, 11:17 a.m.

https://www.marketforum.com/forum/topic/74836/

metmike: Strengthening a tad before making landfall later today, maybe to a bare min hurricane but no damage to ng.

7 day temps for this Thursdays EIA report released at 9:30am.

A bit below average in the eastern half, above average western half. Maybe neutral.

Last week's EIA:

for week ending September 3, 2021 | Released: September 9, 2021 at 10:30 a.m. | Next Release: September 16, 2021

Bigger than the estimate!

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/03/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 09/03/21 | 08/27/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 703 | 678 | 25 | 25 | 803 | -12.5 | 760 | -7.5 | |||||||||||||||||

| Midwest | 842 | 812 | 30 | 30 | 949 | -11.3 | 865 | -2.7 | |||||||||||||||||

| Mountain | 191 | 190 | 1 | 1 | 215 | -11.2 | 198 | -3.5 | |||||||||||||||||

| Pacific | 243 | 243 | 0 | 0 | 307 | -20.8 | 288 | -15.6 | |||||||||||||||||

| South Central | 943 | 948 | -5 | -5 | 1,240 | -24.0 | 1,046 | -9.8 | |||||||||||||||||

| Salt | 208 | 214 | -6 | -6 | 334 | -37.7 | 253 | -17.8 | |||||||||||||||||

| Nonsalt | 735 | 734 | 1 | 1 | 906 | -18.9 | 792 | -7.2 | |||||||||||||||||

| Total | 2,923 | 2,871 | 52 | 52 | 3,515 | -16.8 | 3,158 | -7.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,923 Bcf as of Friday, September 3, 2021, according to EIA estimates. This represents a net increase of 52 Bcf from the previous week. Stocks were 592 Bcf less than last year at this time and 235 Bcf below the five-year average of 3,158 Bcf. At 2,923 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Sep 09, 2021 Actual 52B Forecast 40B Previous 20B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 16, 2021 | 10:30 | 52B | |||

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B | |

| Sep 02, 2021 | 10:30 | 20B | 25B | 29B | |

| Aug 26, 2021 | 10:30 | 29B | 40B | 46B | |

| Aug 19, 2021 | 10:30 | 46B | 31B | 49B | |

| Aug 12, 2021 | 10:30 | 49B | 49B | 13B |

Rig count still on the low side.

The low was 68 last July. However, the rig count is only half of what it was in 2018/19. It was already plunging BEFORE COVID hit.

https://ycharts.com/indicators/us_gas_rotary_rigs

NG has NOT been following seasonals. Instead, the storage deficit is driving the price.

If its cold early this Winter.......don't be short natural gas, regardless of the price......until the weather models show milder temps.

These were the temperatures the last 90 days.

Blistering heat at times in the West/Northwest to N.Plains.

Slightly cooler than average in the South.

++++++++++++++++++++++++++++++++++++++++++++

Natural gas futures surged on Monday as a new tropical storm threatened to further shake the Gulf of Mexico’s (GOM) production foundation, a development that could hamper supply/demand balances at a time when gas in storage for winter is already light. The October Nymex contract cruised 29.3 cents higher day/day and settled at $5.231/MMBtu. November…

Tuesday morning

Tight domestic balances, strength in global prices and a tropical cyclone churning along the coast of Texas gave traders plenty to ponder early Tuesday as natural gas futures continued their ascent. After rallying 29.3 cents in the previous session, the October Nymex contract was up another 10.3 cents to $5.334/MMBtu at around 8:50 a.m. ET.…

metmike: It's a raging bull market. The slightest bit of extra bull news can cause it to leap higher and funds are heavily short, which is providing massive, potential short covering ammo when we spike higher.

Funds have a pretty big short position on right now...........and are taking it on the chin!!!

They've been adding to the position all year, after starting from a net long position but some may be forced to cover here.

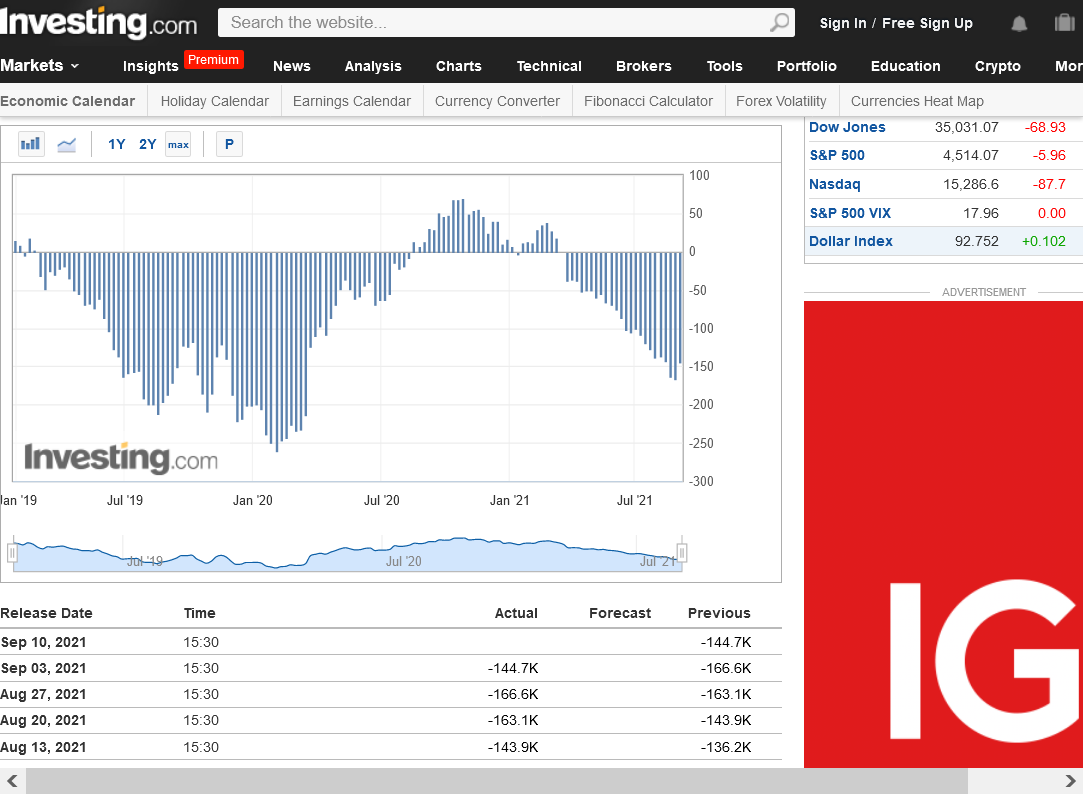

CFTC Natural Gas speculative net positions

https://www.investing.com/economic-calendar/cftc-natural-gas-speculative-positions-1820

Tuesday after the close:

Natural gas futures on Tuesday extended the ferocious rally launched a day earlier, hitting a high point for the year, as traders fixated on supply/demand imbalance concerns and cash prices continued to escalate. The October Nymex contract gained 2.9 cents day/day and settled at $5.260/MMBtu. A day earlier, the prompt month soared nearly 30 cents.…

Wednesday Morning:

Natural gas futures rocketed higher early Wednesday as supply concerns continued to grip the market. The October Nymex contract was up 17.4 cents to $5.434/MMBtu at around 8:45 a.m. ET. The continued gains in Henry Hub futures coincide with rallying prices overseas and storage adequacy concerns both at home and abroad, according to Bespoke Weather…

metmike: Both the GFS and European model got cooler/much cooler and less bullish overnight. But Sept is not a good weather market for natural gas and ng is trading very low storage and concerns that we won't have enough this Winter........not short term weather model changes. Wait until later in October and then we might see some great weather trading.

CDD's pass up HDD's seasonally in just over 3 weeks, so at this time of year, neither of them tend to be very robust(though the next 5 days of heat is pretty impressive for September, it's been in the forecast for over a week).

Forecast is +76B.

And that with only about half of the normal production from the gulf. Even if it is more, storage deficits will still probably drive the market up.

Thanks Mark!

These were the temps for last week's reporting period:

Natural gas futures on Wednesday rallied for a third consecutive session, again touching a new high for the year as traders fixated on potentially sparse supplies in the United States and Europe ahead of the peak winter demand season. At A Glance: Futures rally a third straight day Storage worries weigh on markets Cash prices…

Thursday Morning:

Natural gas futures pared their recent gains early Thursday as traders prepared to digest updated government inventory data that was expected to show a notably larger weekly injection compared to recent reports. The October Nymex contract was down 8.3 cents to $5.377/MMBtu at around 8:55 a.m. ET. That the October contract began to sell off…

metmike: GFS came out cooler and we started selling off just after midnight, then the European model came out MUCH cooler by a huge 13 CDD's and we bottomed to over $1,000 lower, then bounced a bit and dropped to $2,000 lower at 5.228, then had an incredible spike higher to 5.6 in (Almost $4,000 in 30 minutes, at 8:10 am). Then back down below 5.3 a bit over an hour later.

When the bearish EIA was released, the shocker was that the market hardly reacted!

I guess it just meant the bears are afraid to push the downside too hard(and we were already down sharply from, possibly the much more bearish lower CDD's overnight)

for week ending September 10, 2021 | Released: September 16, 2021 at 10:30 a.m. | Next Release: September 23, 2021

+83 BCF Bearish?

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/10/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 09/10/21 | 09/03/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 732 | 703 | 29 | 29 | 822 | -10.9 | 783 | -6.5 | |||||||||||||||||

| Midwest | 876 | 842 | 34 | 34 | 979 | -10.5 | 897 | -2.3 | |||||||||||||||||

| Mountain | 193 | 191 | 2 | 2 | 220 | -12.3 | 202 | -4.5 | |||||||||||||||||

| Pacific | 240 | 243 | -3 | -3 | 310 | -22.6 | 291 | -17.5 | |||||||||||||||||

| South Central | 965 | 943 | 22 | 22 | 1,271 | -24.1 | 1,064 | -9.3 | |||||||||||||||||

| Salt | 217 | 208 | 9 | 9 | 347 | -37.5 | 261 | -16.9 | |||||||||||||||||

| Nonsalt | 748 | 735 | 13 | 13 | 924 | -19.0 | 803 | -6.8 | |||||||||||||||||

| Total | 3,006 | 2,923 | 83 | 83 | 3,601 | -16.5 | 3,237 | -7.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,006 Bcf as of Friday, September 10, 2021, according to EIA estimates. This represents a net increase of 83 Bcf from the previous week. Stocks were 595 Bcf less than last year at this time and 231 Bcf below the five-year average of 3,237 Bcf. At 3,006 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

U.S. Natural Gas Storage Latest Release Sep 16, 2021 Actual 83B Forecast 76B Previous 52B

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 16, 2021 | 10:30 | 83B | 76B | 52B | |

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B | |

| Sep 02, 2021 | 10:30 | 20B | 25B | 29B | |

| Aug 26, 2021 | 10:30 | 29B | 40B | 46B | |

| Aug 19, 2021 | 10:30 | 46B | 31B | 49B | |

| Aug 12, 2021 | 10:30 | 49B | 49B | 13B |

Crazy that what is left of Nicholas is still churning over Louisiana. And we are heading into the weekend with another potential storm heading (my WAG) to the Gulf.

Just what we need. Another hurricane.

Looks like that rally before the report took the wind out of the sails.

I have been making stupid money playing those spikes. Smash and grab... :)

As far as prices today are concerned, it would appear all commodities are down today. So tonight we will hear that it was a risk off day.

Thanks Jim!

What's left of Nicholas is hardly doing anything, now will it.

I'll start a new tropical storm page for the next storm though, thanks to you pointing this one out in the Atlantic.

I read where exports were all but shut down last week because of Nicholas so a higher injection wasn't to be totally unexpected.

And on the other side of the pond.....

Great point on what's going on in Europe right now Jim1

A decade ago, that wouldn't matter when our exports were rinky dink and the US was isolated from the global market. It matters today.

Natural gas futures lost momentum on Thursday after a fierce rally that sent the prompt month more than 50 cents higher over the three previous sessions. Traders took profits after weather forecasts shifted cooler and a government inventory report showed a larger storage injection than expected. The October Nymex contract declined 12.5 cents day/day and…

metmike: The 6-10 day cooled off a tremendous amount the last 24 hours but check out the new look from the NWS for their extended forecasts!

@CelsiusEnergyFM monitors LNG feedstocks daily. I see anywhere from 8 Bcf/D to 11 Bcf/D from him. Would be interested in other perspectives / sources and how the numbers compare. Also projected growth and its time line? NG supply is not increasing in the US or worldwide.

What these news stories fail to even mention is that NG inexplicably spiked over 6% (34 cents) 7:41-8:05 AM CDT yesterday and then came back down 31 of those cents within 45-50 minutes later.

Imagine what it might be like during our first cold forecast in the next couple weeks/months.

What these news stories fail to even mention is that NG inexplicably spiked over 6% (34 cents) 7:41-8:05 AM CDT yesterday and then came back down 31 of those cents within 45-50 minutes later."

Thanks Larry! You and I both watched it in amazement!

https://www.marketforum.com/forum/topic/74722/#74959

By metmike - Sept. 16, 2021, 12:46 a.m.

GFS came out cooler and we started selling off just after midnight, then the European model came out MUCH cooler by a huge 13 CDD's and we bottomed to over $1,000 lower, then bounced a bit and dropped to $2,000 lower at 5.228, then had an incredible spike higher to 5.6 in (Almost $4,000 in 30 minutes, at 8:10 am). Then back down below 5.3 a bit over an hour later!!!!

When the bearish EIA was released, the shocker was that the market hardly reacted!

12z GFS ensemble came out much cooler.........more bearish.

Thanks Jim,

Agree. The market could be dialing alot of that risk premium in right now(looking ahead) and if its not cold..........we crash lower.

Something else is going on too. Commodities are red across almost the entire board.

Joe,

Great link and good topics to discuss. I'll try to pick up on some of that later today or this weekend and others certainly have great contributing value.

The NG market is the hottest one right now by far!

The crash in ng 30+ minutes ago coincided EXACTLY with the MUCH cooler GFS Ensemble. That was it for sure.

-8 CDD's in just that run vs the previous one!

European model was also a bit cooler.

Most bearish 8-14 day in over a month.

Crash? It was already down quite a bit. Aren’t you the one that said weather has very little impact on NG prices this time of year?

Thanks Jim,

I said/say that September is usually not a great weather trading month unless their is an extreme anomaly but with storage so low, changes can amplify the affect.

There were at least 2 times this week that I watched ng drop hard after much cooler guidance came out.

This one on Thursday from the very early morning guidance:

https://www.marketforum.com/forum/topic/74722/#74959

metmike: GFS came out cooler and we started selling off just after midnight, then the European model came out MUCH cooler by a huge 13 CDD's and we bottomed to over $1,000 lower, then bounced a bit and dropped to $2,000 lower at 5.228, then had an incredible spike higher to 5.6 in (Almost $4,000 in 30 minutes, at 8:10 am). Then back down below 5.3 a bit over an hour later.

And this was the 2nd one on Friday after the midday models:

https://www.marketforum.com/forum/topic/74722/#75042

The crash in ng 30+ minutes ago coincided EXACTLY with the MUCH cooler GFS Ensemble. That was it for sure.

-8 CDD's in just that run vs the previous one!

In addition, this was also a weather comment from Thursday:

https://www.marketforum.com/forum/topic/74722/#75001

The 6-10 day cooled off a tremendous amount the last 24 hours

In retrospect, after watching the trading and analyzing the markets reaction this month, with storage so low, the unseasonable heat we just had, was likely a factor in this massive spike higher. There was also a major hurricane with big long lived shut ins, low storage and other factors but the markets reaction lined up well with the weather.

September is usually a crummy month to trade weather but I'm just noting and reporting what happened this year.

Pretty big gap lower on the open this evening!(changed that to small gap below)

Looks ominous on the charts.

We opened modestly lower at 5.016, spiked down to 4.96 within seconds, then spiked just above the open to 5.024 a minute later.....then down to 4.95 up a bit then the low so far of 4.934.

That's a massive fall from Thursday's incredible spike high to 5.6!!

https://www.marketforum.com/forum/topic/74722/#75027

https://www.marketforum.com/forum/topic/74722/#75037

5:41pm-The low on Friday was 5.044 so the gap lower this evening is fairly small for natural gas.......between 5.044 and 5.024.......$200/contract.

We hit a low of $4.920 several minutes ago, so the gap is not getting filled this evening.

If it stays open, it's a downside break away gap.

Filling it is a potential gap and crap but those are best technical exhaustion patterns at the top or bottom of a longer move in one direction, not very reliable here and if the gap gets filled in a few days, it won't mean as much.

(we would have needed a gap above 5.6, last weeks high for instance that got filled to have big significance)

I find it hard to believe that a simple weather change at this time of year is going to be the impetus for a collapse in NG prices. So all of a sudden we are going to start seeing 120 bcf injections every week for the next 6 weeks to get us back up to the 5 year average. That scenario seems extremely unlikely.

NG being nearly 70 cents lower than that spike to $5.60 just 2 trading days ago is unreal. That spike up and then right back down as a % was unlike anything I've ever seen.

It obviously hasn't been trading much on wx for most of this month as wx's impact has been relatively small on a day to day basis as one would expect. It is just a wild and wacky market.

I would think that it has been trading a combination of things. 2 hurricanes, shut-ins, power disruption, port disruption, European shortage, our own shortage, exports gaining.

"So all of a sudden we are going to start seeing 120 bcf injections every week for the next 6 weeks to get us back up to the 5 year average. That scenario seems extremely unlikely."

Thanks Jim!

Where is the quote of anybody saying anything like that please or am I misinterpreting you.

These were the 7 day temperatures, ending last Friday for this Thursday's EIA report. Bullish heat for much of the country(+CDD's) but NOT extreme heat. Normally in mid September temperatures are not the main driver for prices in natural gas.