It finally came out. Here is why NG dived on Friday. Not the the weather forecast might have had an impact, but a change in our LNG export program would have been huge.

Thanks for that additional key news item from Friday Jim and for getting a new ng thread started.

This is the link to the previous thread:

NG Thread 9/10/2021

47 responses |

Started by Jim_M - Sept. 10, 2021, 8:10 a.m.

Picking up where we left off from last week:

Friday's closing comments:

By Kevin Dobbs

September 17, 2021

+++++++++++++++++++++++++++++++++++++

Monday Morning:

September 20, 2021

Natural gas saw a small gap lower yesterday evening, below the lows of Friday.

That was filled around 5:30 am this morning, with ng even trading higher for the day for awhile.

Storage is low for this time of year and Winter is coming. Temperatures are not deviating a great deal from average the next couple of weeks at a time of year that has less significance because HDD will be passing up CDD in a few weeks, so both are typically low in late Sept.

However, the market is ultra sensitive to news because of the storage situation.

These were the 7 day temperatures, ending last Friday for this Thursday's EIA report. Bullish heat for much of the country(+CDD's) but NOT extreme heat. Normally in mid September temperatures are not the main driver for prices in natural gas.

These were the temps for last weeks EIA and the results of the report.

A bit below average in the eastern half, above average western half. Maybe neutral weather.

++++++++++++++++++++++++++

for week ending September 10, 2021 | Released: September 16, 2021 at 10:30 a.m. | Next Release: September 23, 2021

+83 BCF Bearish?

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/10/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 09/10/21 | 09/03/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 732 | 703 | 29 | 29 | 822 | -10.9 | 783 | -6.5 | |||||||||||||||||

| Midwest | 876 | 842 | 34 | 34 | 979 | -10.5 | 897 | -2.3 | |||||||||||||||||

| Mountain | 193 | 191 | 2 | 2 | 220 | -12.3 | 202 | -4.5 | |||||||||||||||||

| Pacific | 240 | 243 | -3 | -3 | 310 | -22.6 | 291 | -17.5 | |||||||||||||||||

| South Central | 965 | 943 | 22 | 22 | 1,271 | -24.1 | 1,064 | -9.3 | |||||||||||||||||

| Salt | 217 | 208 | 9 | 9 | 347 | -37.5 | 261 | -16.9 | |||||||||||||||||

| Nonsalt | 748 | 735 | 13 | 13 | 924 | -19.0 | 803 | -6.8 | |||||||||||||||||

| Total | 3,006 | 2,923 | 83 | 83 | 3,601 | -16.5 | 3,237 | -7.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,006 Bcf as of Friday, September 10, 2021, according to EIA estimates. This represents a net increase of 83 Bcf from the previous week. Stocks were 595 Bcf less than last year at this time and 231 Bcf below the five-year average of 3,237 Bcf. At 3,006 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

++++++++++++++++++++++++++++++

U.S. Natural Gas Storage Latest Release Sep 16, 2021 Actual 83B Forecast 76B Previous 52B

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 16, 2021 | 10:30 | 83B | 76B | 52B | |

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B | |

| Sep 02, 2021 | 10:30 | 20B | 25B | 29B | |

| Aug 26, 2021 | 10:30 | 29B | 40B | 46B | |

| Aug 19, 2021 | 10:30 | 46B | 31B | 49B | |

| Aug 12, 2021 | 10:30 | 49B | 49B | 13B |

metmike: Seasonal HDD's are increasing fast and seasonal CDD's are falling fast. HDD's pass up CDD's seasonally in just over 2 weeks.

Usually, neither of them are can be very high by themselves at this time of year. If one is extremely high, the other one will usually be extremely low. A rare exception might occur if we had near record cold along the northern 1/3rd of the country and record heat in the southern 1/3rd.

Even then, it would still not be close to a major cold wave in Winter or major heat wave in the Summer by themselves in the high population areas. We do have low storage currently though, so temperatures are causing a more robust price response than they typically would in mid September.

| Directors Cut | 9/17/2021 | ||||||||

| NDIC | |||||||||

| Oil | M over M | M over M | Gas | M over M | M over M | ||||

| Mth | Mthly cum | Bbls/ D | Mthly cum | Mcf/ D | |||||

| 2021 | July | 33,411,470 | -1% | 1,077,789 | -4% | 89,122,575 | 0% | 2,874,922 | -4% |

| June | 33,845,554 | -3% | 1,128,185 | 0% | 89,477,475 | -3% | 2,982,583 | 0% | |

| May | 34,953,034 | 4% | 1,127,517 | 1% | 92,411,537 | 4% | 2,981,017 | 1% | |

| April | 33,646,529 | -2% | 1,121,551 | 1% | 88,898,778 | 0% | 2,963,293 | 3% | |

| March | 34,361,668 | 13% | 1,108,441 | 2% | 89,236,535 | 18% | 2,878,598 | 6% | |

| Feb | 30,324,555 | -15% | 1,083,020 | -6% | 75,710,555 | -14% | 2,703,943 | -5% | |

| Jan | 35,568,679 | -4% | 1,147,377 | -4% | 88,327,784 | -2% | 2,849,283 | -2% | |

| 2020 | Dec | 36,956,504 | 1% | 1,192,145 | -3% | 89,680,150 | 4% | 2,892,908 | 0% |

| Nov | 36,736,201 | -3% | 1,224,240 | 0% | 86,323,059 | -3% | 2,887,402 | 0% | |

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | 2,873,654 | 2% | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | 2,815,112 | 7% | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | 2,635,250 | 14% | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | 2,302,356 | 17% | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | 1,973,289 | 2% | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | 1,928,122 | -29% | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | 2,712,168 | -13% | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | 3,125,895 | |||||

| All time highs | |||||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | ||||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | ||||||

| Rig count | 218 | 5/29/2012 | |||||||

Bakken continues to significantly trail all time production highs `~ -400K Bbls/D oil and ~ -300 Bcf/D nat gas. No chance at attaining max levels with current rig count. Its my understanding with the exception of Permian all other shale basins are lagging also.

This China problem isn't helping any of the markets.

Evergrande crisis: 5 things to know about the Chinese business empire on the brink - CNN

NG being what it is could see a violent snap back and be right back at upper $5 range in a couple days. Like Thursday if it's a poor injection number.

Thanks for the great info Joe!

Jim,

I’m not sure where the next move is. That could have been the top if temperatures are mild in October into early winter.

Tuesday after the close:

Wednesday morning/earlier:

metmike: Nothing profound that I can add here.

+75 predicted.

Predicted, but seems inadequate.

Thanks much Mark and Jim. Sorry for the delay. Been tied up with several other issues.

https://ir.eia.gov/ngs/ngs.html

for week ending September 17, 2021 | Released: September 23, 2021 at 10:30 a.m. | Next Release: September 30, 2021

+76 BCF..............almost right on the money!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (09/17/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 09/17/21 | 09/10/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 751 | 732 | 19 | 19 | 847 | -11.3 | 807 | -6.9 | |||||||||||||||||

| Midwest | 904 | 876 | 28 | 28 | 1,005 | -10.0 | 928 | -2.6 | |||||||||||||||||

| Mountain | 196 | 193 | 3 | 3 | 224 | -12.5 | 206 | -4.9 | |||||||||||||||||

| Pacific | 240 | 240 | 0 | 0 | 312 | -23.1 | 294 | -18.4 | |||||||||||||||||

| South Central | 990 | 965 | 25 | 25 | 1,282 | -22.8 | 1,075 | -7.9 | |||||||||||||||||

| Salt | 228 | 217 | 11 | 11 | 349 | -34.7 | 263 | -13.3 | |||||||||||||||||

| Nonsalt | 762 | 748 | 14 | 14 | 933 | -18.3 | 812 | -6.2 | |||||||||||||||||

| Total | 3,082 | 3,006 | 76 | 76 | 3,671 | -16.0 | 3,311 | -6.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,082 Bcf as of Friday, September 17, 2021, according to EIA estimates. This represents a net increase of 76 Bcf from the previous week. Stocks were 589 Bcf less than last year at this time and 229 Bcf below the five-year average of 3,311 Bcf. At 3,082 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly period

++++++++++++++++++++++++++++++++++++++++++++++++++++++++

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Sep 23, 2021 Actual76B Forecast75B Previous83B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 23, 2021 | 10:30 | 76B | 75B | 83B | |

| Sep 16, 2021 | 10:30 | 83B | 76B | 52B | |

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B | |

| Sep 02, 2021 | 10:30 | 20B | 25B | 29B | |

| Aug 26, 2021 | 10:30 | 29B | 40B | 46B | |

| Aug 19, 2021 | 10:30 | 46B | 31B | 49B |

These were the temperatures for that report:

metmike: Some real late season heat building but this is the very tale end of the CDD season and in 3 weeks, the same temperature forecast will be BEARISH because it cuts down on the rapidly growing seasonal HDD's. Sam will become a major hurricane but does not look like a threat.

metmike: Actually the NGV moved decidedly above $5 after that 1:30pm close and stayed up there.

https://finance.yahoo.com/news/citi-isn-t-ruling-natural-072832568.html

"Liquefied natural gas prices are skyrocketing as seasonally low European inventories, booming Chinese demand and supply constraints from Russia to Nigeria lead to a bidding war for the power generation feedstock before the northern hemisphere winter. Japan-Korea marker prices have jumped almost 50% so far this month to near $30 per mmBtu, while in Europe LNG is up around 40% to close to $25. Price gains in the U.S. have been more subdued.

Average prices next quarter will be moderately higher than current levels in Citi’s base case, the bank said in the note. However, there are likely to be price spikes and if unusually cold weather boosts demand and hurricanes in the U.S. Gulf of Mexico disrupt supplies, cargoes could trade in the $100 per mmBtu range, or $580 a barrel in oil-equivalent terms, it said.

See also: China Begins Winter Gas Buying Spree at the Worst Possible Time

“Global natural gas prices could continue to go parabolic in the coming weeks and months,” Citi analysts said in the note. “Strong demand and a lack of supply response have sharply tightened the market. Any surprise demand surge or supply disruptions could propel price further upward.”

The ripple effects from the surge in gas prices into other fuels also look wider than initially thought, Citi said. Switching to liquefied petroleum gas for heating will influence naphtha and gasoline, greater use of kerosene will affect jet fuel and diesel prices, while fuel oil will play a bigger role in electricity generation, it said. However the LNG rally will fade -- prices could drop 70% by the third quarter of next year from this winter’s levels, the bank said."

Soon to be Hurricane Sam is no threat:

I wonder how many people are putting flowers in their windmill with not even a clue just how perilous it could be this winter for far to many people, because they are going too hard on the green agenda.

Yes Jim.

You mentioned a couple of days ago that you thought we would snap back strongly.

Reposted with permission from the BOE REPORT

"Let’s drive this energy conundrum home a little better for all these people who are, as Principal Skinner put it on the Simpsons, “furrowing their brows in a vain attempt to comprehend the situation.”

The world has been sold a faulty bill of goods, based on a pathetically simplistic vision of how renewable energy works. A US government website highlights the problem with this example: “The mean turbine capacity in the U.S. Wind Turbine Database is 1.67 megawatts (MW), At a 33% capacity factor, that average turbine would generate over 402,000 kWh per month – enough for over 460 average U.S. homes.”

Thus armed, bureaucrats and morons head straight to the promised land by multiplying the number of wind turbines by 460 and shocking-and-awing themselves with the results. Holy crap, we don’t need natural gas anymore (as they tell me in exactly those words).

So they all start dismantling the natural gas system – not directly by ripping up pipelines, but indirectly by blocking new ones, by championing ‘fossil-fuel divestment campaigns’, by taking energy policy advice from Swedish teenagers – and then stand there shivering in dim-witted stupor when the wind stops blowing, and the world’s energy producers are not in any position to bring forth more natural gas."

How we generate electricity

Started by madmechanic - Aug. 7, 2021, 2:17 p.m.

https://www.marketforum.com/forum/topic/73293/

Green energy

Started by wglassfo - June 9, 2021, 12:48 p.m.

https://www.marketforum.com/forum/topic/70725/

Wind/ solar/batteries

16 responses |

Started by metmike - May 6, 2021, 9:58 p.m.

https://www.marketforum.com/forum/topic/69028/

Here's a story for you. Now exactly where does Encinitas think their electric is coming from? Hydro? In a state that is running extremely low on water and hydro power in California is down, what, 20% or so? Solar panels? The tragedy in all of this is when people do die from freezing to death or too much heat, these politicians face no ramifications for their actions. They aren't engineers. They have no concept of what they are doing other than they think "fossil fuels bad". Encinitas isn't the only California city doing this, they are joining the band wagon.

Encinitas could ban natural gas hookups from new homes (msn.com)

Thanks Jim!

Great stories.

Pretty impressive price charts below. Above the MEGA $6 resistance from the polar vortex high in Feb. 2014 and there is tremendous upside potential!

https://tradingeconomics.com/commodity/natural-gas

3 year chart below. Double where the price was earlier this year. More than triple the price of early 2020......which was the lowest in 30 years!

10 year chart below. Note the Feb 2014 Polar Vortex spike high just above $6.

30 years below. Note the Sept 2005 hurricane(s) high, then double top in June 2008. Then we had fracking production take over and prices crashed. The Feb 2014 polar vortex high just above $6 is shown a bit too low on this graph.

metmike: CDD's were +3 on the European model but HDD's were -2. This is not a big factor but I'm chiming in with the information now because HDD's will catch up to CDD's in less than 2 weeks!

With that being the case and the market looking out ahead, one can guess that cold(or not) forecasts in week 2 and beyond will now be the MOST important weather.

The 12z European model was a whopping -7 CDD's....... and +3 HDD's.

This would be -4 DD's and bearish but the market went higher anyways............and the total numbers right now are dinky compared to most times of year, so the market is obviously NOT trading that information.

metmike: Seasonals are actually positive here too.

NG has NOT been following seasonals. Instead, the storage deficit is driving the price.

If its cold early this Winter.......don't be short natural gas, regardless of the price......until the weather models show milder temps.

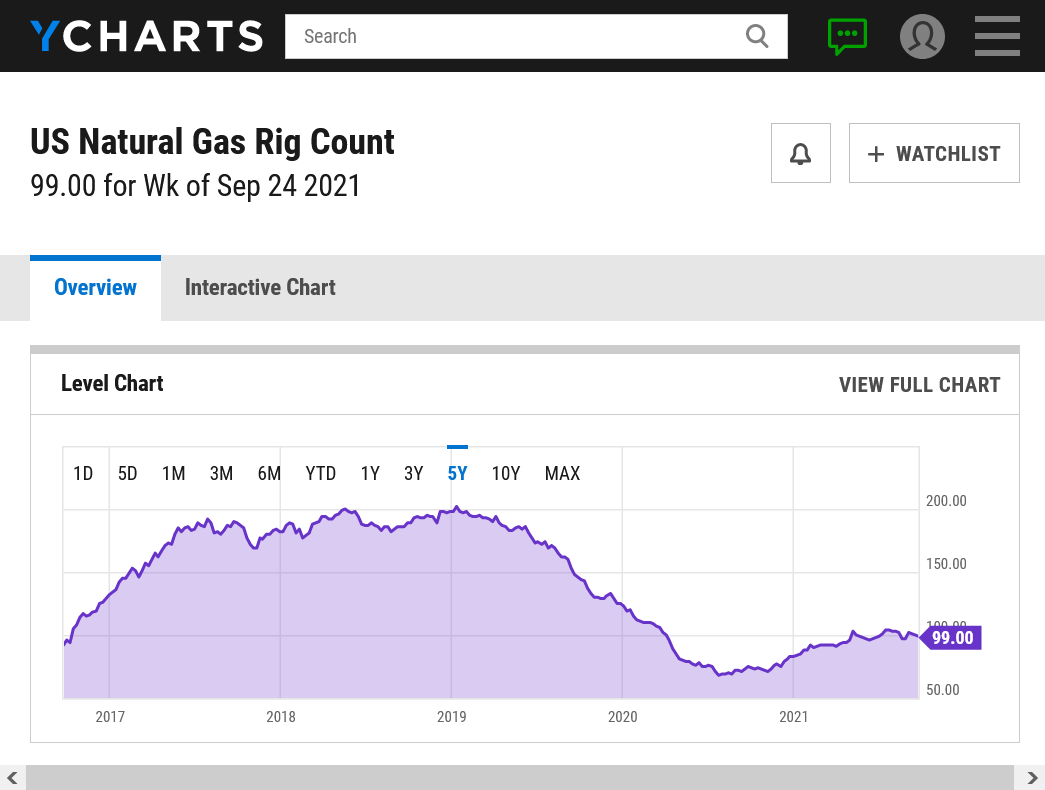

Rig count still on the low side.

The low was 68 last July. However, the rig count is only half of what it was in 2018/19. It was already plunging BEFORE COVID hit.

https://ycharts.com/indicators/us_gas_rotary_rigs

Funds have a pretty big short position still right now...........and are taking it on the chin!!!

They'd been adding to the position all year, after starting from a net long position but some have been forced to cover here, possibly ahead of the October expiration?

CFTC Natural Gas speculative net positions

https://www.investing.com/economic-calendar/cftc-natural-gas-speculative-positions-1820

$6 mmBtu 4th quarter 2021 with LNG spot swings to (gulp) $100. Perhaps a worse case senario...very cold weather...lower wind generation.

https://peakoil.com/consumption/citi-not-ruling-out-100-natgas

Thanks Joe!

We mentioned that earlier in the week too but its an eye opener!

Looming front-month expiration helped spark a massive surge in natural gas futures prices in early trading Monday. The expiring October Nymex contract was up 32.4 cents to $5.464/MMBtu at around 8:50 a.m. ET; November was up 32.8 cents to $5.528. Higher prices at European benchmarks and the impending expiration of the October contract appeared to…

metmike: Lots of big funds are short. Expiration of the front month, Oct. is tomorrow. In the past, under similar situations, there were several occasions, when we had a short squeeze, spike high tied to expiration that marked THE highs when storage was low just before or early in the heating season.

I'm not trying to pick the top. Just observing.

They're blowing out alot of shorts crying uncle today!

If this is how volatile it is when it’s the end of a contract month, what’s it going to be life during the first cold snap?!

metmike: WOW!

This is where NG is dangerous. We could be back at $5.50 by the end of Wednesday.

It's well on it's way!

Yep, Just an expiration, short squeeze spike that went parabolic from panic buying.

The big fund short was probably the main fuel.

From earlier this morning:

Volume today for just the November NG has been over 300 K contracts!

Natural gas prices across the world climbed higher on Tuesday, fueled by the prospect that there will be energy shortages from Europe to Asia this winter. British and Dutch benchmarks closed higher Tuesday, beating an all-time record set Monday after finishing close to $30/MMBtu. In the United States, prices also continued climbing toward $6 as…

metmike: That's exactly what happens when you shut down coal plants and focus all your attention on FAKE green energy.......wind and solar. CO2 from fossil fuels is massively greening up the planet. How would this NOT happen above?

Fake beer crisis/Death by GREENING!

Started by metmike - May 11, 2021, 2:31 p.m.

https://www.marketforum.com/forum/topic/69258/

How we generate electricity

Started by madmechanic - Aug. 7, 2021, 2:17 p.m.

https://www.marketforum.com/forum/topic/73293/

Wind/ solar/batteries

16 responses |

Started by metmike - May 6, 2021, 9:58 p.m.

https://www.marketforum.com/forum/topic/69028/

Green energy

Started by wglassfo - June 9, 2021, 12:48 p.m.

So much intrigue with energy/green/politics. Its so hard not to get wrapped up in ”might happen”, “could happen”. I have my popcorn and ready to watch it unfold.

While you’re eating the popcorn it’s always nice to note a few good trading opportunities that justify putting down the popcorn and taking part in the show!

My keyboard is covered in popcorn oil and salt with all the trading I'm doing in NG. :)

Funny! Good for you!

I actually eat 2 big bowls of microwave toasted hot air popcorn late every evening and my wife sometimes complains about popcorn all over the floor in the kitchen and living room.

And its also on the floor in my office from eating it while on the computer but it doesn't bother Mike (-:

You need a dog to clean up after you. :)

From earlier this morning:

7 day temps for tomorrows EIA report. Should be a big number.