88 bcf injection. Bearish. But you have to have cajones of steel to short NG. Or have a very tight stop.

But not THAT bearish apparently... :)

Off the wire:

Natural gas prices are adding to earlier gains, up 3.2% at $5.650/mmBtu despite a weekly EIA report that came in bearish compared to expectations and averages. The US government agency says gas-in-storage climbed by 88 billion cubic feet, compared to forecasts in a WSJ survey for an 84-bcf rise, and compared to the average rise of 72. Investors may be reading the report as bullish since it was only slightly above forecasts, and it puts total storage at 3.170 trillion cubic feet, which is still a bullish 6% below the five-year average with only about a month before the so-called winter-withdrawal season begins.

NG thread 9/20/2021

51 responses |

Started by Jim_M - Sept. 20, 2021, 7:58 a.m.

https://www.marketforum.com/forum/topic/75144/

+++++++++++++++++++++++++++++++++++++++

Latest Release Sep 30, 2021 Actual 88B Forecast 87B Previous 76B

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 30, 2021 | 10:30 | 88B | 87B | 76B | |

| Sep 23, 2021 | 10:30 | 76B | 75B | 83B | |

| Sep 16, 2021 | 10:30 | 83B | 76B | 52B | |

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B | |

| Sep 02, 2021 | 10:30 | 20B | 25B | 29B | |

| Aug 26, 2021 | 10:30 | 29B | 40B | 46B |

Thanks, Not sure what to think right now Jim.

They were loading for bull, 20 minutes before the report came out. And with the rest of the world prices still skyrocketting, there wasn't any doubt about what was going to happen.

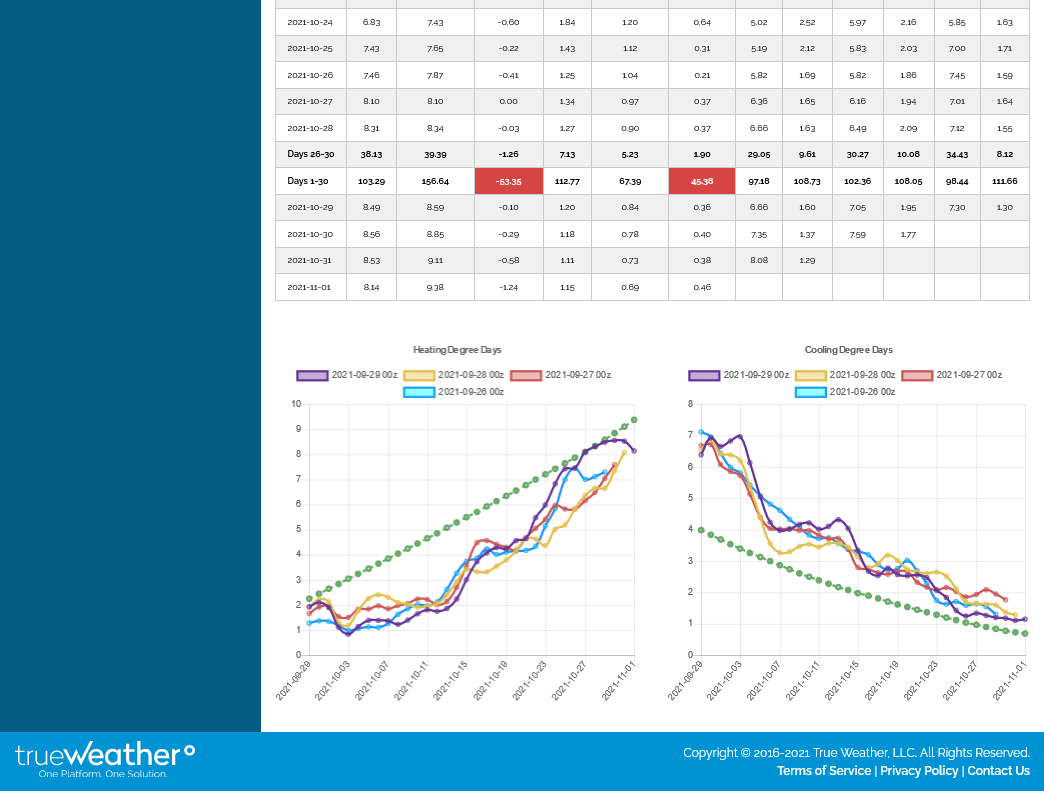

7 day temps for tomorrows (now today's) EIA report. Should be a big number.

https://www.marketforum.com/forum/topic/75144/#75545

Oil turns bullish again after a report from Bloomberg News, citing unnamed sources, says China's government has ordered state-owned energy companies to secure supplies for winter at all costs. WTI crude was trading as much as 2.3% lower earlier in the session at $73.14 a barrel and looked like it might register its first losing week in six weeks. But the US benchmark is now 1% higher at $75.55 a barrel, which would put it in position to close at a fresh, three-year-high and set it on course for a sixth straight weekly increase.

Thanks Jim.

Next week, for NG, seasonally the HDD's pass up/overtake CDD's so most of the forecast period now(that includes week 2) is based on HDD's being more important.

The market has NOT been trading weather but the weather is a bit bearish from warmth in week 2 reducing the HDD's.

However, there are signs that later next month it could get colder.......take that with a grain of salt. The market should be ultra sensitive to weather as we get into the HDD season but some of the risk premium is already dialed into these much higher prices. A very mild November could crush Natural Gas prices.

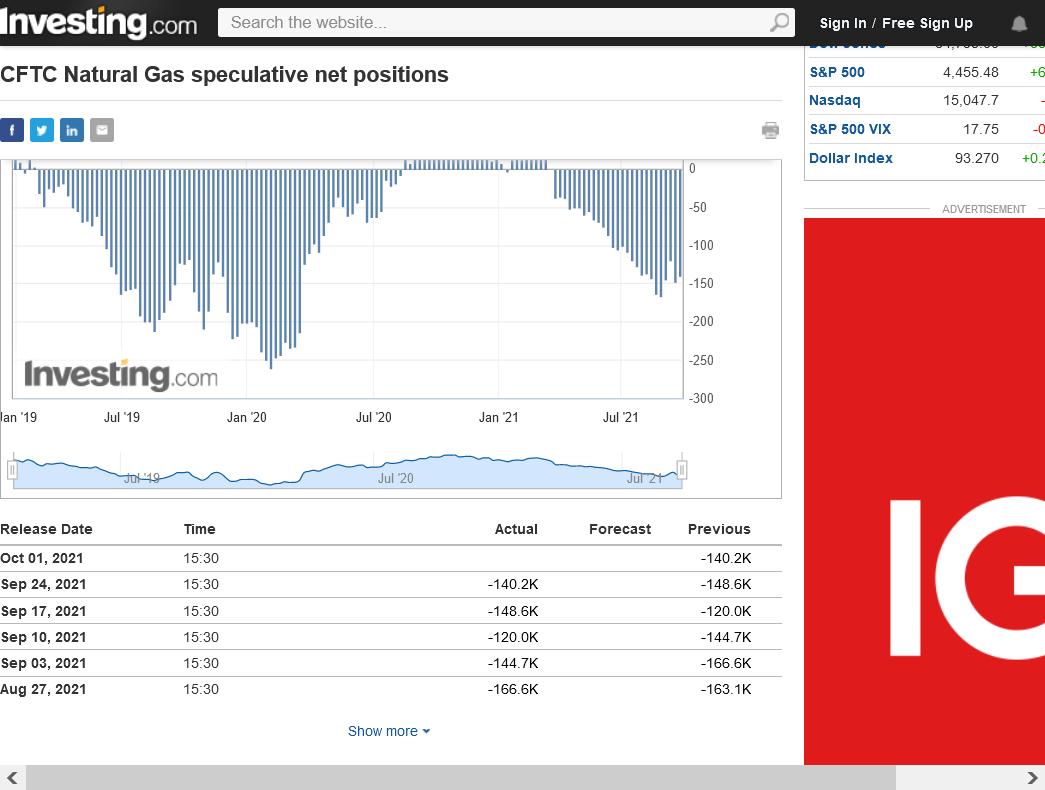

Funds have a pretty big short position still right now...........and have been taking it on the chin!!!

They'd been adding to the position all year, after starting from a net long position but some have been forced to cover here, possibly ahead of the October expiration?

CFTC Natural Gas speculative net positions

https://www.investing.com/economic-calendar/cftc-natural-gas-speculative-positions-1820

While I am here....a note to Katie. I believe that is Alex's wife, correct?

The ads have hit ridiculous status. Just my humble opinion.

Sorry to hear that about the ads Jim.

Steady calls for U.S. exports and global supply worries outshined a robust government inventory print and forecasts for light domestic demand, sending natural gas futures higher on Thursday. The November Nymex contract, a day after shedding 40.3 cents in its debut as the front month, recovered ground and advanced 39.0 cents day/day to settle at…

metmike: It's NOT about weather.

https://www.marketforum.com/forum/topic/75004/

You're suffering with it too Mike. It's almost become comical. No...it is comical.

In my entire trading career, 29 years, I've never done a natural gas trade at this time of year because temperatures have never been a major factor.

I've been chomping at the bit to jump in at times and you know the feeling.........when the market that you're following takes off in the direction that you thought it would go, it gives you this deflated feeling...........as if you actually lost money...........because you didn't make money.

But that's what emotions do to traders.

Emotions are a traders worst enemy!!!

Earlier this morning:

metmike: When NG goes down, it's the bearish weather. When NG goes up, it's something different than the weather. To trade weather, it has to go UP and DOWN from weather changes, unless the weather changes are HUGE and its almost impossible to generate HUGE HDD or CDD changes at this time of year. They will need to all be HDD changes now. Heat is officially bearish in October.

metmike: Definitely NOT from weather.

I agree Mike. As long as we are hearing about extreme shortages in Europe and China, volatility is going to be high. While the last couple weeks injections have been pretty strong, if we have a week injection week, it's going to get nuts. Well...more nuts than it is now.

That expiration spike last week was pretty dang nuts Jim!

We went up $11,000/contract in just over a day, topping on Tuesday, just above $6.3.

Then we dropped $9,000 the next day, Wednesday down to $5.4

Then up $6,000 late Thursday(actually early in the Fri session) with a high of $6.

Then almost back down to $5.5 near the close on Friday.

We came out strong to start the week, spiking well above $6 on Monday morning before closing just above mid point.

Now were back up $1,100 from the Monday close.

More volatile than this?

And its not like we're going in just one direction.

Traders are struggling with whether we are going to have enough gas or we have plenty. If things get hairy, we could see whole dollar or two moves. I know I have seen it before and you probably have too. Or we could have a warm winter and be at $3 in no time at all.

With the price up so high, I'm surprised we aren't seeing rigs come back online. Last report was 99. We had 200 in '19. If exports don't ramp up, then we may make it for our own storage.

Still, I also think that there may be a lot of delinquincies this winter for energy. Consumer wise.

That the rig count stays at less than half where it was 2 years ago at these prices is baffling.

pertinent to rig count.

Qualified labor (drillers, wireline operators, electricians, truckers) and parts in very short supply... and

smaller Independents have acquired the leasehold positions of the larger companies that survived the shale co meltdown of 2018/2019. While the oil property changed ownership no new development financing model has emerged. The companies remain shut out of the capital markets and now operate one or two rigs max. The exception CLR.

Thanks much Joe!!

I'll bet that investors are also being scared away by the climate crisis scare that's on a mission to obliterate fossil fuels, including natural gas.

There is literally trillions on the table for entities in solar, wind and carbon capture right now. I'm actually involved in what should be a very successful carbon capture project that will continue the burning of fossil fuels while cheaply eliminating the CO2, SO2, NOx and so on.

Though I KNOW that CO2 is a beneficial gas that's greening up the planet(the REAL green energy) ..........if eliminating it from burning fossil fuels is what we need to keep fossil fuels...........we have a winning technology that makes almost everybody happy(not the plants).

metmike: Almost up to the highs from early last week!!

It will be interesting to see if the bulls have the temerity to hold onto their long position into another potentially bearish injection number on Thursday.

For myself, I see a selling/profit taking day tomorrow.

Your guess is maybe better than mine Jim(-:

We both agree that weather has nothing to do with this....although the 12z European model was +2 HDD's.

Seasonally/climatalogically, HDD's just passed on CDD's and will be going up rapidly thru mid January, when HDD's peak.

However, this year, because of the current warmth, the HDD's won't pass up the CDD's for another 11 days or so.

The CDD's right now are pretty high for October but even that is not great and we all know that record high CDD's late this month will mean record LOW HDD's. ....which will count the most.

Well, I'll let you in on an observation I have made over the last couple months and something I should probably write down and keep track of. But to me, it seems that Wednesdays are typically down days in NG.

Last Wednesday was down $9,000 from the spike expiration high the previous day.

We've actually traded around that high since early this afternoon.

You're probably right on the injection being a big one ......this week, on Thursday.

Here's the temps for that period.

Good call Jim.

Thank you! It's just an observation that I have made before. Maybe it's just profit taking the day before the EIA report and it's done often enough that at least to me it seems like a pattern.

Yes, good call Jim.

We made new highs for the move and I think new highs for the last decade a bit after 5am this morning at 6.458, so anybody shorting too early was feeling extreme pain.

We've dropped $6,000/contract since then to 5.850 and are down far enough that it looks like a major reversal lower is inevitable on the daily charts.

Ordinarily, that would be a potentially very powerful bearish technical signature on the price charts.

In the current, off the charts, back and forth extreme price volatility for ng it might or might not be a big deal....just depends on global ng prices and the injection tomorrow.

NGI after the close on Tuesday:

Natural gas futures broke through $6.000/MMBtu for the second time this week as U.S. production took a notable step down on Tuesday at the same time global supply concerns roiled the domestic market. The November Nymex gas futures contract surged 54.6 cents to settle at $6.312. December gas finished at $6.432, up 52.6 cents on…

NGI earlier this morning:

In another show of volatility, natural gas futures pared their recent gains in early trading Wednesday, slashing double digits off of the previous session’s rally as analysts continued to note an exceptionally mild October forecast. After soaring 54.6 cents higher in Tuesday’s session, the November Nymex contract was down 17.7 cents to $6.135/MMBtu at around…

metmike: Weather is still bearish with seasonally low HDD's in week 2 and beyond. One thing that is a major risk to using the weather here. When the first cold outbreak starts showing up in the US extended forecast, we assume that it will be bullish and the market will be ultra sensitive and react strongly. However, the market has NOT been trading US storage recently. It's been trading Europe's record high prices because they have not been able recharge storage after a very cold Winter(and have been focusing on the fake green energy). If Europe has peaked and is on the way down at the same time that the US extended outlook turns cold.......it could spell disaster for buyers/bulls aggressively anticipating strong upside to US prices........that care the most about Europe's prices FOR THE FIRST TIME IN HISTORY.

In the past, the US market was totally independent and had a mind of its own but increasing exports ramping up in the US has connected/linked the US market more to global prices.

I put this thread in the NTR forum because its eventually going to get loaded with non trading posts.......actually, this brings it to both forums..........and its extremely important for many people living in the Northern Hemisphere right now.........actually EVERYONE on the planet because the price spikes are GLOBAL.

This Winters potential energy crisis

Started by metmike - Oct. 6, 2021, 1:32 p.m.

From yesterday.......causing the spike higher:

https://finance.yahoo.com/news/europe-gas-power-surge-records-093323557.html

And this from today that probably had a lot to do with the collapse.

Russia Offers to Ease Europe’s Gas Crisis, With Strings Attached (yahoo.com)

Thanks Jim,

Great info. I wish I knew the conversion to US units of natural gas pricing on the chart that they provide. Regardless, that's an impressive move and spike higher.

Under current policies, oil and natural gas production will continue growing through 2050 amid rising global energy consumption driven by developing Asian economies, according to the latest long-term projections from the U.S. Energy Information Administration (EIA). In its International Energy Outlook 2021(IEO2021) report published Wednesday, the agency predicted a nearly 50% increase in global energy…

October 6, 2021

metmike: This is the perfect example of proving the total political bs involved with this issue. 3 years ago, they were telling us 2030 was when we had to eliminate fossil fuels to save the planet. Actually, they started it in 1989, telling us we had until 2000 to cut back to save the planet. Now, most of them use the year 2050.........but then look at the ones who understand the reality, the EIA. They just came out projecting an INCREASE in oil and gas production and demand through 2050. This proves the sham of this totally political, fake climate crisis.

Renewables could displace fossil fuels to power the world by 2050, report claims

metmike: Hogwash! 0% chance of that! Stop stealing peoples intelligence with anti science, anti energy propaganda to trick them into thinking differently. Renewables (fake green energy) are great in places where they make sense but most of the world will still be mostly powered by reliable fossil fuels for decades to come.

metmike: NG really has been like a scary trading roller coaster the last couple of weeks. I think that unless we have a cold start to the main heating season, October will put in the highs, maybe even earlier today. The market has been trading worst case scenario and traders are speculators of the future. The news stories the last few weeks about the ng market this Winter have been OMG.... it's going to be an apocolypse if this Winter is cold! People will freeze and die! When we have a legit weather market, the market doesn't wait for the week 2 Arctic blast or week 2 heat dome to hit....it spikes higher way before the actual weather arrives..............dials it in.

More often than not, the highs come many days BEFORE the actual extreme weather hits.

We've been trading the potential heating shortage apocolypse now.

Another pretty solid rule in speculative weather trading. The earlier in the season the extreme comes, the more speculators jump in and the greater the power to move the market.

Hot/Dry in June for 2 weeks for instance, will often move the corn market more than hot/dry in July, even though July is key pollination time for corn.

Extreme cold in November/December is usually more powerful than the same cold in January/February. Might be the same HDD's but speculators can make for a much worse case scenario in November/December, than in February........at which time the window for damage or big drawdowns is closing up.

In October, the window is still WIDE OPEN for the most extreme possible, catastrophic situation in ng. You can't rule out anything and the market is dialing that possibility in.

Good stuff Mike. I agree that NG has been a roller coaster ride. It is truly one of those markets that if you're in the money, you set your stops close. :)

Putin definitely put a wet blanket on the hit prices. Which is a good thing. If we see a big injection number today, we might be heading to $5 or even less. All those trading companies that were heavily short are breathing a "little" easier today.

Gonna get interesting in a couple of minutes. Dutch gas market down 30% in the last 2 days. High injection expected here.

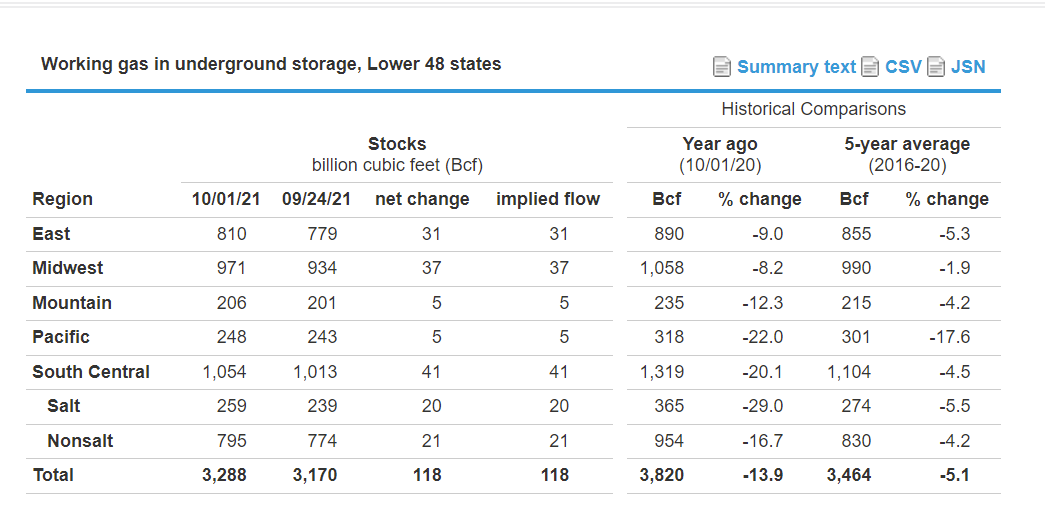

BIG number!

Very bearish!

U.S. Natural Gas Storage

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Oct 07, 2021 Actual 118B Forecast 105B Previous 88B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 07, 2021 | 10:30 | 118B | 105B | 88B | |

| Sep 30, 2021 | 10:30 | 88B | 87B | 76B | |

| Sep 23, 2021 | 10:30 | 76B | 75B | 83B | |

| Sep 16, 2021 | 10:30 | 83B | 76B | 52B | |

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B | |

| Sep 02, 2021 | 10:30 | 20B | 25B | 29B |

metmike: Prices actually managed to get just above unchanged a couple of times after the release, so the super bearish number is not exactly causing the market to collapse..........at least not so far late this morning.

Weather is still bearish except the 6z GFS operational model had an impressive blast of cold late in the period but its clearly an outlier right now.

With European natural gas prices continuing to sell off and U.S. fundamentals remaining firmly in bear territory following the government’s latest storage report, futures prices slid early. The November Nymex contract touched a $5.393/MMBtu intraday low but popped quite a bit given little change in the global backdrop, settling Thursday at $5.677, up two-tenths of…

metmike: NG closed higher after the mega bearish EIA number. Which could mean several things.

1. The market expected it.

2. The market cares more about other things, like Europes record high prices

3. The market is dialing in risk premium, in case we have a cold Winter. Seasonals with years of below average storage are pretty strong in October.

4. Something else that I can't think of at the moment and maybe you guys can think of.

It's not weather...........yet.

The markets are all crazy tonight. This is a significant sign that attitudes are changing. I don't trade when the markets are like this. Changes coming.

Sure is crazy Mark.

Looks like the margin is at least $6,400/contract. Is that right?

With the market still on edge as it awaits details on early heating season temperatures, natural gas futures advanced in early trading Friday. The November Nymex contract was up 4.7 cents to $5.724/MMBtu at around 8:45 a.m. ET. Natural gas prices continued to show volatility in after-hours trading ahead of Friday’s session, with the prompt…

metmike: Still mild weather models.

Weather continues bearish for ng.

https://www.marketforum.com/forum/topic/75004/

https://www.marketforum.com/forum/topic/75004/#75931

However, the 12z European model was a whopping +6 HDD's vs the previous run.

This comes entirely from a MUCH stronger early week 2 cold front/intrusion(that allows the cold in the West and in S.Canada to dump into the entire Midwest/East, instead of resisting its penetration).

This is NOT from a pattern change and by the end of week 2......it's back to very mild again.

Margin this am was $7040. Maintenance is $6400.

I think the market is weighing in the possibility that the European energy crunch might be in resolution soon. Going to have to see what their storage is like over the weekend.

Thanks Mark!

metmike: Interesting is that when we spike higher, we hear that it's from items that have ZERO to do with the weather. When we spike down..........it sometimes was from the weather.

But the weather hasn't changed a bit(in fact, it was a bit colder and more bullish on Friday PM than it was recently).

If the weather changes are bullish and we go up..........then the weather forecast shifts to bearish and we go down.........THEN we can say the market did what it did from the weather.

I'm not necessarily disagreeing with their explanations, just stating the obvious........we aren't trading weather as the main item yet.