Looks like the GFS is getting milder. In short mode.

Thanks Mark!

Previous discussion here:

NG Thread 10/10/21

62 responses |

Started by MarkB - Oct. 10, 2021, 11:23 a.m.

for week ending October 8, 2021 | Released: October 14, 2021 at 10:30 a.m. | Next Release: October 21, 2021

Shockingly BULLISH! (vs expectations) +81 BCF

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/08/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 10/08/21 | 10/01/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 834 | 810 | 24 | 24 | 906 | -7.9 | 876 | -4.8 | |||||||||||||||||

| Midwest | 997 | 971 | 26 | 26 | 1,078 | -7.5 | 1,020 | -2.3 | |||||||||||||||||

| Mountain | 210 | 206 | 4 | 4 | 240 | -12.5 | 217 | -3.2 | |||||||||||||||||

| Pacific | 251 | 248 | 3 | 3 | 320 | -21.6 | 303 | -17.2 | |||||||||||||||||

| South Central | 1,079 | 1,054 | 25 | 25 | 1,325 | -18.6 | 1,126 | -4.2 | |||||||||||||||||

| Salt | 269 | 259 | 10 | 10 | 366 | -26.5 | 283 | -4.9 | |||||||||||||||||

| Nonsalt | 810 | 795 | 15 | 15 | 959 | -15.5 | 843 | -3.9 | |||||||||||||||||

| Total | 3,369 | 3,288 | 81 | 81 | 3,870 | -12.9 | 3,543 | -4.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,369 Bcf as of Friday, October 8, 2021, according to EIA estimates. This represents a net increase of 81 Bcf from the previous week. Stocks were 501 Bcf less than last year at this time and 174 Bcf below the five-year average of 3,543 Bcf. At 3,369 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 14, 2021 | 10:30 | 81B | 94B | 118B | |

| Oct 07, 2021 | 10:30 | 118B | 105B | 88B | |

| Sep 30, 2021 | 10:30 | 88B | 87B | 76B | |

| Sep 23, 2021 | 10:30 | 76B | 75B | 83B | |

| Sep 16, 2021 | 10:30 | 83B | 76B | 52B | |

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B |

These were the temperatures, ending the previous Friday for last Thursday's report. Extremely mild over most of the country especially the northern half(where most of the HDD's are this time of year). It was quite a bit milder in the Northeast vs the previous week.

Chilly in the Northwest.

These were the temperatures for this Thursdays report.........7 days thru last Friday. Extremely mild for the Eastern 1/2 of the country, especially Great Lakes area(near record mild).

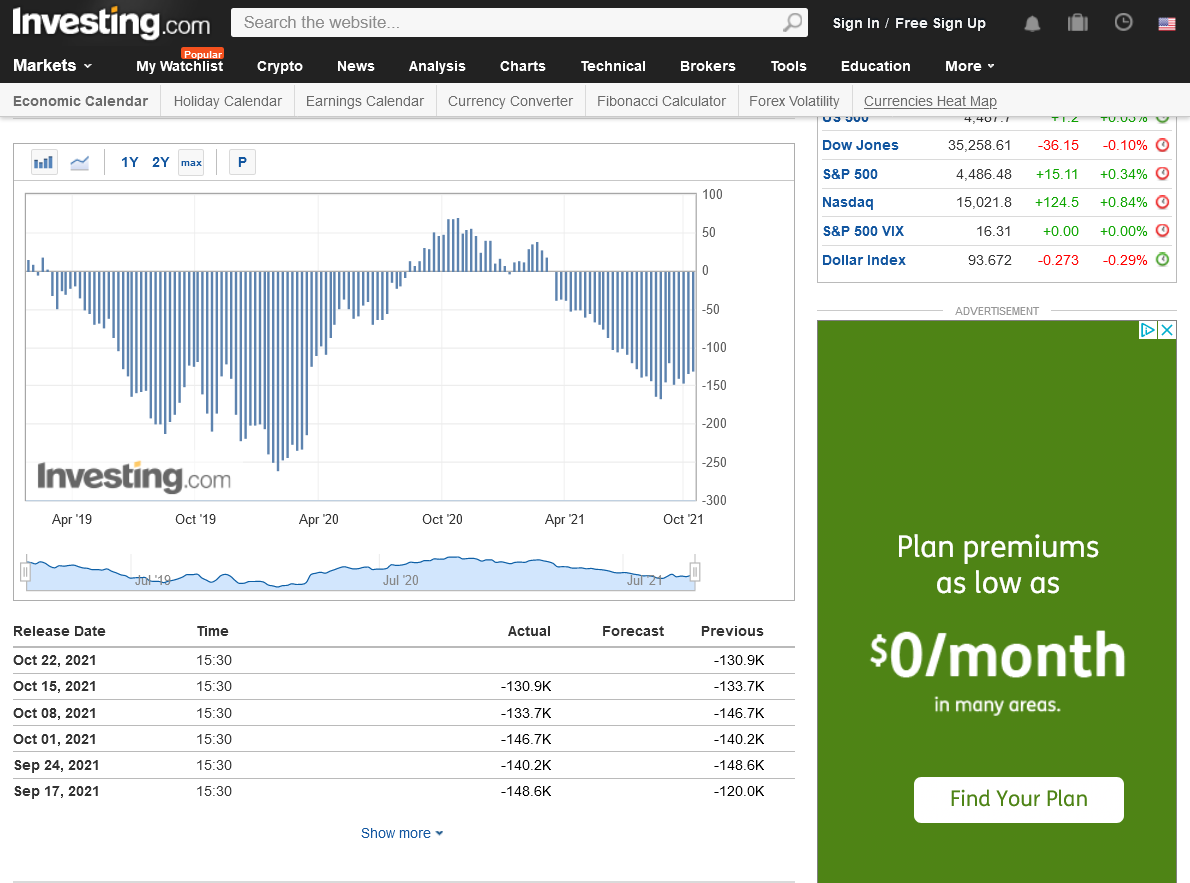

CFTC Natural Gas speculative positions Large Funds. Still pretty short.

https://www.investing.com/economic-calendar/cftc-natural-gas-speculative-positions-1820

NG has NOT been following seasonals that closely. Instead, the storage deficit is driving the price, mainly the deficit in Europe during the past month.

October is actually the typical time frame to expect a seasonal high for Natural Gas. More often than not, prices drop between now and the end of Winter and then go up with very high probabilities from there thru early Spring.

Many people think that Winter makes ng prices go higher. No, natural gas traders/the market dials in Winter BEFORE it comes. Extreme, unexpected cold in Winter that EXCEEDS expectations make NG prices go higher in Winter.........especially when it first shows up in the forecast(when traders dial it in by bidding up prices).

It's pretty obvious that ng made its seasonal top earlier this month.

Signs of potential pattern change to colder!

GFS Ens was even milder but the pattern change will take time to evolve, if it does.

Until it starts adding HDDs, the market can keep collapsing lower from these lofty levels.

metmike: We managed to come all the way back to $5+ for a short while........which would be a reversal higher from sharply lower if it held...........but it may not under this environment. Anything is possible with prices the rest of the day.

We ARE trading weather!

One only has to watch the market react very strongly to the updated HDD information as it comes out to know that....every single run of the GFS ENS and European and European ENS. Even the crummy GFS operational model gets reactions(that are crushed quickly by the ENS that follows).

The market could be trading the potential pattern change to colder that I mentioned very early this morning and elaborated on here:

https://www.marketforum.com/forum/topic/75004/#76425

"For the first time this month, the week 2 pattern is evolving more strongly in a way that suggests a potential pattern change that is capable of unloading more serious cold in sustained fashion.

The AO is really plunging to solidly negative at the end of the period. The NAO stays negative!"

https://www.cpc.ncep.noaa.gov/products/precip/CWlink/daily_ao_index/ao.shtml

https://www.cpc.ncep.noaa.gov/products/precip/CWlink/pna/nao.shtml

++++++++++++++++++++++++++++++++++++++++++++

https://www.psl.noaa.gov/map/images/ens/t850anom_nh_alltimes.html

This is the 500mb anomaly below at the end of the period from the GFS ensemble mean. The center of the positive height anomaly in Northern Canada is the foundation for the potential new pattern turning colder. If it grows and heights drop in the US..........viola.......we will have an efficient north to south air mass delivery mechanism!

This will not show up in Tuesdays 8-14 day outlook! Too early for that.

While the prospect of a cold winter is threatening to send an energy market already in crisis spiraling further, efforts in China to secure the supplies it needs to get through the season could make matters worse. China is the world’s largest energy consumer, and it has rapidly transformed into a natural gas-buying behemoth in…

U.S. onshore oil and natural gas production is set to rise from October to November, propelled by supply growth in the Permian Basin and Haynesville Shale, according to updated projections Monday from the U.S. Energy Information Administration (EIA). Natural gas production from seven key U.S. producing regions — the Anadarko, Appalachia and Permian basins, along

LNG

Moving the energy economy to net zero emissions is timely and costly, and the world now faces another dilemma: a natural gas market under “tremendous pressure” ahead of winter, the International Energy Agency (IEA) said Wednesday. In launching its annual World Energy Outlook (WEO-2021), the global energy watchdog acknowledged that winter 2021/2022 is opening with…

I see today's rise from an earlier drop to be largely from crude's sharp rise today in combo with NG doing a dead cat bounce after such tremendous recent drops. However, the 12Z GFS was also a little cooler, which probably helped it then. And perhaps what Mike said about the potential for the longer term cooling is in play.

I often get a kick out of the way news is worded to try to explain things, From WSJ today, note the silly comment that I bolded in this morning's story and compare it to the more accurate statements I bolded in the story below this from yesterday:

Natural gas prices completely erase earlier declines and climb 1.6% to $5.069/mmBtu in what traders say is a technical move after two straight days of declines -- including a nearly 8% plunge yesterday -- that left the commodity oversold. The market fell sharply the past two weeks after hitting a 13-year-high of $6.312/mmBtu on Oct. 5, and the narrative for the retreat has largely been mild weather that's reduced demand. But weather is almost always mild in October, and storage is still at a bullish, 5% deficit to the five-year average with only a couple weeks left before the so-called winter withdrawal season begins. (dan.molinski@wsj.com)

1450 ET - Natural gas prices plunge 7.8% to finish at $4.989/mmBtu as mild-to-warm weather throughout much of the country keeps demand on the weak side and reduces fears of winter shortages. It's the first time the market has closed below $5 since September 23. "NOAA's 6 to 10-day temperature outlook predicts warmer-than-normal conditions for the entire US except parts of the Northeast and West Coast, with those warmer conditions spreading even to the Northeast by the end of the month," says Schneider Electric's Christin Redmond. "This should decrease early heating demand, and leave market balances looser, allowing for the storage deficit to decline further ahead of the start of withdrawal season." (dan.molinski@wsj.com)

Agree totally.....great example. Thanks Larry!

Coming off a steep decline over the past two trading sessions, natural gas futures attempted to regain some footing on Tuesday. A sharp drop in production aided the rebound, lifting the November Nymex gas futures contract by 9.9 cents to $5.088/MMBtu. December settled at $5.350, up 11.4 cents on the day. At A Glance: Production…

metmike: Interesting spike down here early this evening AFTER the 18z GFS Ensemble came out +5 HDD's colder which is fairly bullish. This is the complete opposite of what I would have expected. I sold some NGX a couple of times the last couple of days on less HDD's and more bearish solutions of models and thought that trading the HDD's was going to be a big money maker but would have got obliterated doing that in the last hour, with NGX plunging around $800/contract from 7:09 to 7:40pm a bit after the colder solution was completely out.

I guess this means to be careful (-:

On top of this, we made a sharply lower low early this morning then reversed to close solidly higher which could be seen as a strong bullish signature on the charts/technically and give people trading ng more confidence to buy on the much colder 18z GFS. Glad one of those people was not me (-:

Looks like November which expires 2 weeks from tomorrow still has double the volume of December.

November expires a week from tomorrow. The current numbers showing up on my trade platform on OI, are 70,628 for Nov., and 151,464 for Dec. Volume, however, is the opposite. Nov is still trading more than Dec. That will probably change after thursday's report. I will shift to Dec after thursday.

As we have passed what would be seasonal highs, and we have attained a high not seen since 2014, I will be looking to short this from now til Feb. I don't hold long term trades. I probably should, but I like being out of the market by week's end. That way, I don't get caught up in a gap in the wrong direction.

Thanks for the correction on nov expiring in 1 week, not 2.

GFS was milder, then the European model was less mild/colder.

No clear change in one direction from 0z models. Same weather outlook from me, with potential pattern change to colder late in the period that is not universally agreed on by models. If it was, the market would not be stalled out.

If they all go very mild or much colder, that should help push us in one direction. We've dropped a ton the last 2 weeks with Winter still ahead and I have no idea what's going on in Europe/Asia's markets which is the huge wild card in a market that is no longer isolated to just the US but instead becoming more and more global.

Wind is another element complicating things. I haven't gotten a handle on the wind forecast. Wind energy bumps out ng demand/replaces it. Lack of wind causes ng demand to increase.

metmike: Can't add anything. The market spent some time below $5 earlier but bounced back up above $5.1. Potential pattern to real cold as week 2 progresses on SOME individual ensembles. Others keep it very mild.

Am noticing the Dec is gaining on the Nov..........bear spreading even though we have been higher at times today for both. Maybe cash prices and bearish weather is keeping Nov down and speculating is helping Dec.

https://ir.eia.gov/ngs/ngs.html

for week ending October 15, 2021 | Released: October 21, 2021 at 10:30 a.m. | Next Release: October 28, 2021

+92 BCF bearish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/15/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 10/15/21 | 10/08/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 862 | 834 | 28 | 28 | 921 | -6.4 | 892 | -3.4 | |||||||||||||||||

| Midwest | 1,027 | 997 | 30 | 30 | 1,102 | -6.8 | 1,047 | -1.9 | |||||||||||||||||

| Mountain | 211 | 210 | 1 | 1 | 244 | -13.5 | 219 | -3.7 | |||||||||||||||||

| Pacific | 253 | 251 | 2 | 2 | 323 | -21.7 | 305 | -17.0 | |||||||||||||||||

| South Central | 1,108 | 1,079 | 29 | 29 | 1,329 | -16.6 | 1,148 | -3.5 | |||||||||||||||||

| Salt | 283 | 269 | 14 | 14 | 361 | -21.6 | 293 | -3.4 | |||||||||||||||||

| Nonsalt | 825 | 810 | 15 | 15 | 968 | -14.8 | 855 | -3.5 | |||||||||||||||||

| Total | 3,461 | 3,369 | 92 | 92 | 3,919 | -11.7 | 3,612 | -4.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,461 Bcf as of Friday, October 15, 2021, according to EIA estimates. This represents a net increase of 92 Bcf from the previous week. Stocks were 458 Bcf less than last year at this time and 151 Bcf below the five-year average of 3,612 Bcf. At 3,461 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Oct 21, 2021 Actual 92B Forecast 90B Previous 81B

Oct 21, 2021 10:3092B90B81B

Oct 14, 2021 10:3081B94B118B

Oct 07, 2021 10:30118B105B88B

Sep 30, 2021 10:3088B87B76B

Sep 23, 2021 10:3076B75B83B

Sep 16, 2021 10:3083B76B52B

The Energy Information Administration (EIA) reported a 92 Bcf injection into natural gas storage for the week ending Oct. 15, coming in slightly above consensus but within the range of expectations. The latest EIA figure, another sign of improving U.S. supply ahead of the winter, sent gas prices — already lower day/day early in Thursday’s…

metmike: Bearish reaction by the market. HDD's were lower/milder overnight too. Still a potential pattern change to colder in early November as noted a couple of days ago.

November is leading the charge higher with the 12z models coming up much colder.

December is almost back to unch.

More bullish weather is fighting a bearish current.

1. Bearish EIA.

2. Solid top formation in Oct.

3. Seasonals often turn down at this time of year......in the absence of major cold.

If the pattern keeps morphing colder, the weather should win.

metmike: Wow! They totally missed the much colder guidance causing the reversal higher.

With updated weather models seen teasing the possibility of colder temperatures developing next month, natural gas futures rallied sharply early Friday. The November Nymex contract was up 14.8 cents to $5.263/MMBtu as of around 8:50 a.m. ET. The latest model runs as of early Friday showed a setup that could increase the chances for more…

metmike: It's the potential pattern change that I've been posting about this week! HDD's went up overnight on all the models, especially the 6z GFS ENS that really caused the spike higher.

If the colder pattern does not emerge or the models turn milder again, we can break $5 pretty easily. I would not want to have a position over this weekend though with the wide disparity of solutions and the market clearly hanging on every model run now.

A big shift in one direction and we could open $2,000 contract higher or lower on Sunday Night.

If the pattern morphed to some extreme cold, we could be back near $6 pretty quickly next week, which is over $8,000/contract higher than the Nov contract. +6,000 for the Dec contract.

What's interesting is that a couple of the indicators, AO and NAO don't look quite as cold beyond 2 weeks as they did to me earlier this week but the actual HDD's are responding to the actual pattern during the next 2 weeks(which is colder) and increasing and this is one of the biggest very short term drivers for the market right now....HDD's

metmike: This is the first time in my life to see production NOT increase with prices soaring higher. It has to be fear in the industry of investment in something that is under massive attack right now from this administration and the world........that has won the war on fossil fuels by using the fake climate crisis.

ALL the new money is going to alternative(fake green) energy and carbon capture technology. Carbon capture will be huge in this environment because it will allows absolutely essential fossil fuels to continue to survive.

I totally forgot about the bearish breakaway, downside gap that started the week on the Sunday Night open.

Since Dec is now trading with more volume than the Nov, which expires next Wed, lets focus on the Dec contract. This is what Mark predicted earlier this week.

Nov was much weaker earlier this week and even though its been stronger the last 2 days, it was unable to fill that gap with todays high of 5.379. Got close though as last Fridays low was 5.400.

Dec on the other hand, earlier this morning filled the gap barely by touching the bottom of it and not going a tick higher. 5.590 was today's high and it was also Fridays low.

Usually, a filled downside or upside gap is a gap and crap formation indicating an exhaustion in the direction of the original gap but the trader needs to apply discernment.

1. The sooner the filled gap, the more powerful the exhaustion and reversal signature. 5 days later is not too late but its not as powerful as, let's say earlier tin the week, with the delayed filling.

2. The November did NOT fill the gap. So that keeps it open on the front month and the original signal potentially still valid.

3. How the price reacts after filling the gap is the most critical element to judge its significance. When we are trading above it, the filled gap is seen as bullish. If we barely muster enough strength in a spike higher to touch the bottom of it, fill it then go back down it suggests the TOP of the gap is strong selling RESISTANCE.

4. 5.590 is now the critical level of significance for Dec ng. It was last Fridays low. It was also today's high and the high for this week.

5. If models turn colder over the weekend, we will likely gap higher above that level on Sunday Night. On the Nov contract, this would put in a an island bottom trading formation on the daily and WEEKLY charts. ..if it happened.

This would be where all of this weeks prices were LOWER than the previous Friday and all of next week's prices are HIGHER than every trade this week.

That would be extremely bullish in many circumstances. But it totally depends on the weather. We should know on Sunday BEFORE the open if the models change alot in what direction the gap will be.....if there is going to be a gap.

They might not change much though and it won't be clear then with the open NOT a gap higher or lower.

6. Technical signatures don't mean as much in a weather market........other than they are telling you what the weather models showed first. The weather outlook changed FIRST and early birds trading the change caused the initial price reaction. The price did not react first...........people might think it did but what usually happened is that those perceiving the market reacting first were not one of the early birds that recognized the first signs of the weather changes and when THEY saw the changed weather, the market had already had its initial reaction from the early birds jumping in before THEY realized what was going on.

12z GFS +4 HDD's, Euro +7 HDD's. So ng had nowhere to go but up.

Just updated, NWS weeks 3-4......bearish but this is a low skill product.

Natural gas futures forged higher on Friday as forecasts suggested mild fall weather and its dampening effect on demand could shift colder next month. The November Nymex contract settled at $5.280/MMBtu, up 16.5 cents day/day. December gained 11.5 cents to $5.461. At A Glance: Forecasts point to stronger demand Storage supplies mount through autumn Cash…

metmike: We added alot of HDD's from the colder forecast on Friday, compared to Thursday and especially to earlier in the week. Much of the guidance does not want to amplify the cold at the end of the period,(like it did on previous days this week) which will be needed to keep us going up. The models want to shift back to very mild again as we start week 3. Models have very low skill for this kind of pattern, especially with the strongest positive anomaly on the planet just northwest of Hudson Bay at that time. Any amplification and slight shift of that feature and all of a sudden, the models wake up and shift from zonal, west to east flow dominating to a meridional, north to south flow for the air masses, especially in the East.

Right now, the Southeast will have the coolest air vs average because the origin of the air masses is coming from relatively mild(compared to average for that area) central Canada and the farther south it gets, the colder it is compared to that average.

We still haven't had enough time to brew serious cold in central Canada, with the night hours just recently surpassing the day light hours and the air masses hitting central Canada being more mild Pacific origin.

Look and see here that the major cold, in blue is still over 2,000 miles north of the US border right now from around N.Greenland across the high Arctic to N.Alaska and back to Siberia.

If the air masses started surging from a location from that far north into the US, then the bottom drops out. The pattern MUST amplify to accomplish that.

Here is what we look like in 2 weeks. Wow, look how the cold has shifted south and is now in a position to being within striking distance of the US.....solid blue shades less than 1,000 miles north of the US border.

A bit of this is because its closer to Winter, the rest is from the pattern change. Not much change in model solutions would cause some of that cold to be entering via Canada in November.

Higher open.

Forecast is colder with more HDD's than Friday.

Got the higher open.........a gap higher at 5.629, the low so far.

So it's a bullish breakaway gap until we fill it down to 5.590, the high on Friday, which would make it a buying exhaustion gap and crap..

On the front month, November that expires on Wednesday, the gap higher left a weekly island of trading from last week behind/lower.

This would be potentially VERY bullish but the weather models need to keep getting colder to confirm that.

metmike: WOW! Back to $6 on the Dec even faster than I speculated last week would happen with the pattern change if models continued colder. 0z GFS after midnight was actually milder and thew me for a loop but most of the other guidance has been colder...........just need to see the enormous, $5,500/contract gains to know that.

I don't have the NGI recap yet but the extended guidance reflects the much colder outlooks compared to a week ago(when the actual signals in the atmosphere were starting to first show up).

https://www.marketforum.com/forum/topic/75004/#75013

https://www.marketforum.com/forum/topic/76401/#76411

Trading this has been challenging. Last week, being too early meant using tight stops or potentially suffering huge drawdowns because the market was not convinced of the cold yet.

On Sunday/Monday, maximizing a long position meant using NO stops and riding out down spikes, which would just take you out with a tight stop.

Unfortunately, I didn't adjust my trading mentality quickly from last week to today and let tight stops take me out of potentially huge profits.

Sunday nights mentality should have been buy and hold........no matter what because the weather change was so powerful and needed to be dialed in.

After a rally like this, we've pretty much dialed in all the cold that's out there for the next 2 weeks.

It will need to get colder to go higher and we can go lower with milder forecasts.

The November front month expires on Wednesday and in this environment, the potential for price fireworks just before expiration is very high. That could have been part of the reason for the extreme move today.

Natural gas futures aimed for the sky on Monday as a much colder turn in the weekend weather models catapulted prices. Aided by a sharp increase in liquefied natural gas (LNG) demand, as well as upcoming contract expirations, the November Nymex gas futures contract jumped 61.8 cents to $5.898. December shot up 59.5 cents to…

metmike: Interestingly, you would think that record smashing, sustained cold is on the way based on how the market reacted today. However, the brand of cold coming up is not extreme at all. Certainly below average temps but maybe more like 10 degrees F below average for a week(colder than that with high temp anomalies) before possibly moderating later in week 2. This is not going to be pure Arctic air(although the air mass coming in at the very start of week 2 could have a bit of southern Arctic properties/origins. .........then possibly really warming up after that?

The AO is actually close to 0, while the NAO is solidly negative but neither is extreme or suggesting a blocking pattern.

European model was not as chilly....causeda big spike to lower on the day for awhile.

As the market factored in warmer forecasts that hinted at milder temperatures returning in mid-November, natural gas futures retreated in early trading Tuesday. After probing as high as $6.091/MMBtu in after hours trading, the November Nymex contract was back down at $5.742 at around 8:50 a.m. ET, off 15.6 cents from the prior day’s settle.…

metmike: After the European model came out a whopping 8 HDD's milder, that was all she wrote.....the top was in for now..... but the ride lower was extremely volatile and spikey. November, front month expires tomorrow, so more spikes are likely. Memory tells me the day before the expiration featured under this situation had quite a few spikes but this market has some unprecedented dynamics.

1. Storage is NOT precariously low headed into Winter, just below the 5 year average but the market will trade like it is.

2. Record smashing high prices in Europe and this being more of a global market after our exports opened up has caused us to no longer be isolated and that factor to affect our market.

3. The attack on fossil fuels is greatly discouraging new production. For the first time in history, prices more than doubled but the rig count is still just half of what it was before the pandemic. All the money is shifting to fake green energy, where all the incentive for profits is. Investing more in ng is extremely risky here, even at these prices.

4. The EIA last week was bearish.

5. The cold coming up looks to NOT be extreme and only last around a week, then possibly moderating. The AO is only neutral. For extreme cold, solidly negative is favored. The NAO stays negative which does favor a continuation of seasonable cold in the East.

6. Cold early in the heating season almost always has more power to move the market when supplies are not extremely low. In the 2nd half of Winter, the market knows that Winter is almost over and as long as the math adds up for enough in storage to meet demand from extreme cold..........there's no way we will run out. In late October into November, there is plenty of time for sustained, extreme cold to draw down storage to precariously low levels. We are NOT safe yet from that happening, so that chance means added risk premium in the price. Cold like we have coming up this early just erodes the cushion for handling extreme cold, sustained cold if it ends up defining the upcoming Winter........which is still not known. Unknown weather allows for speculation to have more power.

7. We had an extremely bullish gap higher on Sunday Night that remains WIDE open. That has NOT been negated. The November left a weekly island gap behind and the Dec almost did(just filling last weeks gap by 1 tick). This still remains the most powerful technical signal on the charts.

8. If we close lower today, which seems likely but it would not be shocking to come back if the 12z models were colder.......then we will have a powerful reversal lower pattern. Since it happened AFTER the gap higher on Sunday Night, we can assume the market has changed its tune about the weather...........seen as extremely bullish on Sunday/Monday......resulting in an over reaction up. Then seen as much less bullish on Tuesday, resulting in taking out some of the risk premium.

9. If we close the gap that started the week, it will because the weather models kept taking out cold/continued milder like the last European model was. This would be extremely bearish and indicate we had a buying exhaustion with the gap higher. However, trading it as such is very dangerous. If we fill the gap because the models turned milder and the market dialed in the latest weather forecast, being short will only make you money if the models keep getting milder. Don't be short when all the models are colder. The charts and anything else doesn't matter if all the models get colder or if they get warmer. Don't be long either when the forecasts are getting milder AND THE MARKET HAS ALREADY reacted, like it just did and is waiting for the next model run to decide how to react on the fresh, latest news.

EDIT- that last statement should have been don’t be short AFTER the market has reacted to warmer forecasts and maybe over reacted to the downside, like earlier today.....if the new models shift colder again.

Some thing with being long. Great position on Monday for excellent reasoning but the market over reacted and the if new model dat is milder.....still cold but milder, much of your profits will go bye bye.

Safe Position trading mainly works in this environment when the weather forecasts stay consistent in the same direction....that actually happens much of the time.

Buyinglast Thursday after the EIA and holding, while the forecast got colder every day thru Monday had a 10,000 move in it.too bad I didn’t take much out of it because I didn t apply that strategy....partly because I was afraid to stay long over the weekend.

20 years ago when I had an account balance of several hundred K, that’s exactly what I would have done.

Metmikes trading can improve by practicing some of what he says here with more discipline and confidence

It’s incredibly important to be humble and be prepared in case you are wrong and in fact spend more time looking for reasons that you might be wrong.

Balance that with a proven reliable system that provides enough confidence to use effectively ....and this is key.....the disciple to use that system consistently in a way that trumps the emotion fear.

Fear of being wrong and losing money that paralyzes a traders critical thinking and messes up their decisions.

We all think a certain way when observing a market without a position and no skin in the game.

When wehave a position on or even about to enter, the amount of additional stress that affects our decisions is almost totally counter productive and in some cases destroys our ability to trade with maximum, objective discernment.

With an off the charts volatile ng market right now, this is a tough challenge for all of us, me included.

Pretending otherwise is the opposite of being humble, as kris mentioned last week and acknowledging it, is the best way to confront it.

metmike: A bit confusing trade during the afternoon session. The European model came out -a whopping +7 HDDs, pretty bullish. We did spike up almost $1,000 just after 2pm on that and hung out just below $6 for close to 30 minutes, then we sold back down close to the pre European model release.

It would appear that we need MORE cold to stay above $6.

7 day temps below for this Thursday's EIA period.

Mild temps again, so the # will be big vs the average build for late October.

However, not as mild as the previous several weeks

Any guesses?

++++++++++++++++

Previous week EIA was a very bearish at +92 BCF. The temps for that week are below.

https://www.marketforum.com/forum/topic/76401/#76496

....the week before extremely bullish

https://www.marketforum.com/forum/topic/75979/#76085

Models came out much colder overnight but the price reaction has been totally nutso.

After a bit of stength much of the night, we actually sold off hard to just below 5.9, just before 7am(maybe because the operational GFS was warmer) but the GFS was even colder after that....then we took off higher up to test the highs of Monday at almost 6.2 an hour later at 8am. +$3,000/contract in 1 hour.

Then we sold off back close to 5.9 around 11 am, down -$3,000/contract in 1 hour.

Now we are at mid range around 6.050 up a bit on the day.

November expires today(adding greatly to the volatility), that was the Dec price. It's one thing to have a 3,000 range like this, on Monday it was over $4,000 but its almost unheard of to be bouncing back and forth from the low, then high, then low, then, as of now in the middle of the extreme range.

The price spiking to 6.2, then selling off would represent a double top with Mondays high, for this move if it were to hold. If weather models turn colder, it means very little.

That roar heard throughout the U.S. gas market on Thursday was that of natural gas futures, which went out like a lion Wednesday as yet another shift in the latest weather data led to continued volatility. The prompt month rolled off the board at $6.202, up 32.0 cents on the day. The December contract, which…

metmike: 18z GFS ensemble was -8 HDD's less and very bearish.........so we spiked down earlier.

More Pacific flow on that run.

What will the EIA report show tomorrow do you think??

WOW!

NG has come all the way back from down almost 2,000 just 2 hours ago.

The 0z models came in colder with +7 HDD's for both major models.

for week ending October 22, 2021 | Released: October 28, 2021 at 10:30 a.m. | Next Release: November 4, 2021

+87 BCF bearish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (10/22/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 10/22/21 | 10/15/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 885 | 862 | 23 | 23 | 938 | -5.7 | 906 | -2.3 | |||||||||||||||||

| Midwest | 1,052 | 1,027 | 25 | 25 | 1,116 | -5.7 | 1,070 | -1.7 | |||||||||||||||||

| Mountain | 212 | 211 | 1 | 1 | 245 | -13.5 | 221 | -4.1 | |||||||||||||||||

| Pacific | 255 | 253 | 2 | 2 | 323 | -21.1 | 305 | -16.4 | |||||||||||||||||

| South Central | 1,144 | 1,108 | 36 | 36 | 1,329 | -13.9 | 1,173 | -2.5 | |||||||||||||||||

| Salt | 304 | 283 | 21 | 21 | 360 | -15.6 | 308 | -1.3 | |||||||||||||||||

| Nonsalt | 840 | 825 | 15 | 15 | 968 | -13.2 | 865 | -2.9 | |||||||||||||||||

| Total | 3,548 | 3,461 | 87 | 87 | 3,951 | -10.2 | 3,674 | -3.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,548 Bcf as of Friday, October 22, 2021, according to EIA estimates. This represents a net increase of 87 Bcf from the previous week. Stocks were 403 Bcf less than last year at this time and 126 Bcf below the five-year average of 3,674 Bcf. At 3,548 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ag

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Oct 28, 2021 Actual 87B Forecast 86B Previous 92B| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 28, 2021 | 10:30 | 87B | 86B | 92B | |

| Oct 21, 2021 | 10:30 | 92B | 90B | 81B | |

| Oct 14, 2021 | 10:30 | 81B | 94B | 118B | |

| Oct 07, 2021 | 10:30 | 118B | 105B | 88B | |

| Sep 30, 2021 | 10:30 | 88B | 87B | 76B | |

| Sep 23, 2021 | 10:30 | 76B | 75B | 83B |

The Energy Information Administration (EIA) delivered no surprises on Thursday, reporting an on-target 87 Bcf injection into storage inventories for the week ending Oct. 22. Natural gas futures were already sharply lower ahead of the EIA report on returning production and stronger wind generation. The November Nymex contract was down 30.0 cents to around $5.900/MMBtu…

metmike: The November expired yesterday and we were down much more than that for the front month December today. The market is looking ahead of this big cold snap which IS NOT a permanent pattern change to meridional, north to south flow.

The surges of cold air from Canada (but not frigid) will last for less than 2 weeks, after which, mild, zonal flow will kick in and spread dried out Pacific origin air masses from west to east. Most of the models agree on that today vs only just over half of them yesterday. This is clearly milder than Monday, when we finished dialing in ALL the cold that this pattern has to offer in the forecast.......which started getting dialed in late last week.

The milder pattern by mid November is still not certain.

We still have not filled the bullish breakaway gap higher from Sunday Nights open. If the models keep this trend, that will get filled, if not tomorrow, then for sure next week but only if the models stay mild.

You DON'T want to be long in the month of November if the forecasts are turning much milder.

As is typical with ng trading these days, the market OVER reacts on many days to the changes in the weather outlook......or other items.

For instance, the colder forecasts on Monday, did not increase the amount of demand for heating that justified a 6,000/contract increase in value of ng. But traders all seeing the same information at the same time wanted to do the same thing..........buy natural gas.

When there is excessive, aggressive buying like that, the only way to satiate it with offsetting sell orders is to go to higher and higher prices that provide new layers of selling to match the furious buying at the market.

It's often just a knee jerk reaction to fresh news with technical buy signals going off in trader programs, short covering, along with some emotions all wrapped into one.

Huge down days like today from milder weather forecasts, also didn't decrease the amount of heating demand by and amount of over 4,000/contract but it was the same thing in reverse but a bit different in a couple of elements.

Part of it might be that the rally on Monday was over done and the market gravitating in the direction of the fundamentally justified price...........not the wild speculated driven price.

There were likely less longs bailing from margins calls today than there were shorts bailing on Monday from severe draw downs.

So what is the true, fundamental value of ng?

Certainly not this high but astute traders know not to get wrapped up in the true value of any commodity when speculating.

We often hear that the market is always right. (whatever the price is now, is the right price)

I also think the market is almost always WRONG. It's a futures market that predicts the future price. The only time the market is right, is when the same value it assigned to todays price occurs again..............which is very rare. The market earlier this week was REALLY wrong...........much too high based on where we are today.

Successful traders apply skills that allow them to be LESS wrong than the market is today at the current wrong price about the future but at least know THE DIRECTION that the market is wrong about.

Having the direction that the market needs to correct in right, the profits amount to how great the correction is while they have the right position on.

metmike: No, it was mainly from extended models looking milder.