Partly due to 13 years of Zero interest rate (ZIRP) Fed policy, partly due to wage pressures I think inflation is finally, after 35 years of "the sky is falling", here to stay. Even if supply chain problems work themselves out employers are not going to tell workers "we are reducing your pay".

The metaphor that scares me is that the ZIRP by the Fed these past years is like putting out lots of dry straw. It isn't a problem until it gets lit. Then you can't put it out so easily. And putting it out with higher interest rates has its own collateral damage.

I own gold and have for decades, but I am not certain that will be the protection I hope it to be. Short video below by a guy who thinks the Fed will start tightening next year because inflation will become more important than unemployment. Hold the profit makers (Google, MSFT, AAPL, Facebook) and dump the high flyers with "great potential in 10 years" like EVs etc...

https://www.youtube.com/watch?v=q155I4LqJhk

...please move to the TR section.

Thanks joj,

When the Fed raises interest rates, the interest of the astronomically high debt also goes up.

This was the projection a few years ago that did not anticipate this much of an increase in the interest rates.

"Net interest spending will grow faster than any other part of the budget. CBO estimates that interest costs will increase by 186 percent from 2018 to 2029 (220 percent under the Alternative Fiscal Scenario), while GDP will increase by 53 percent and consumer prices by 25 percent over that same period. Meanwhile, Social Security and federal health care programs – the two largest categories of spending in the federal budget – will grow by 89 percent and 96 percent, respectively, through 2029; discretionary spending will grow by 21 percent and revenue by 70 percent (38 percent and 59 percent under the Alternative Fiscal Scenario, respectively)."

"As the national debt continues to grow and interest rates on Treasury bills rise closer to their historical norms over the coming decade, the federal government’s interest payments are set to increase dramatically, taking up a larger and larger chunk of overall federal spending. Returning our debt trajectory to a sustainable course through a combination of spending reductions and revenue increases sooner rather than later would significantly alleviate this burden."

metmike: We are doing the exact opposite.

https://www.crfb.org/papers/how-high-are-federal-interest-payments

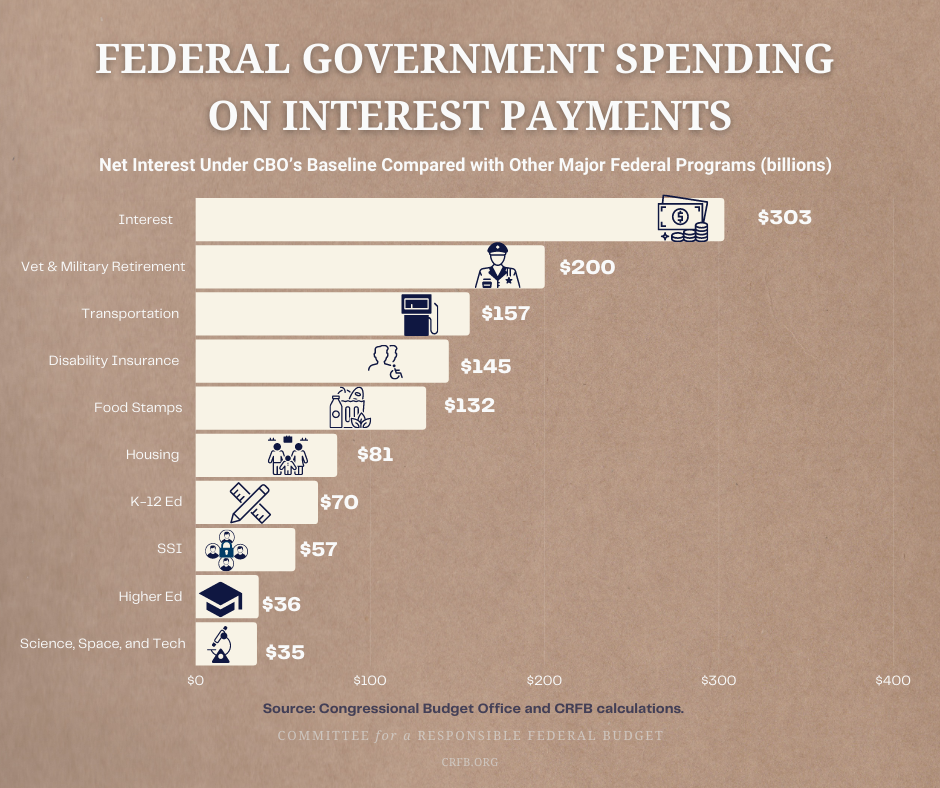

Even with exceptionally low interest rates, the federal government is projected to spend just over $300 billion on net interest payments in fiscal year 2021. This amount is more than it will spend on food stamps and Social Security Disability Insurance combined. It is nearly twice what the federal government will spend on transportation infrastructure, over four times as much as it will spend on K-12 education, almost four times what it will spend on housing, and over eight times what it will spend on science, space, and technology.

As interest rates rise, the cost of debt service payments will grow. Today’s low interest rates are partially the result of the COVID-19 pandemic, economic fallout, and response (though also partially reflect a long-term trend), and are thus unlikely to last. For example, although the rate on the 10-year Treasury note fell from just below two percent at the beginning of 2020 to nearly 0.5 percent by August, it has since rebounded to around 1.5 percent. CBO projects it will continue growing to 3.3 percent by the end of the decade, though that projection comes with a high degree of uncertainty.

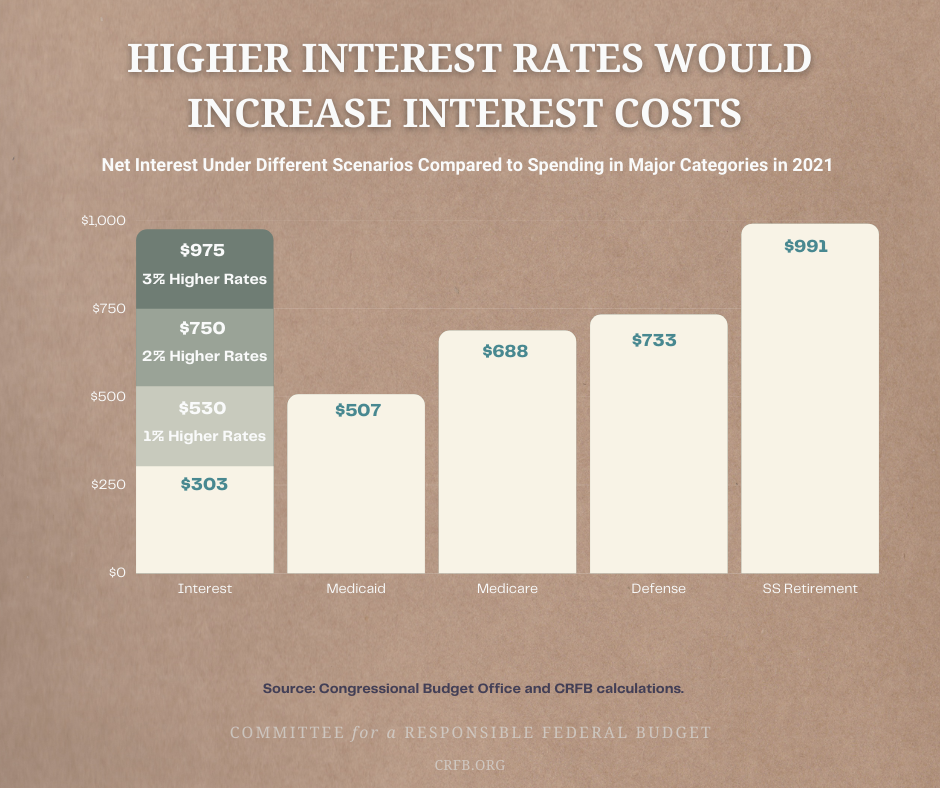

Higher interest rates will mean higher interest payments and deficits. For example, if interest rates were one percentage point higher than projected for all of 2021, interest costs would total $530 billion — more than the cost of Medicaid. If rates were two percentage points higher, interest costs would total $750 billion, which is more than the federal governments spends on defense or Medicare. And at three percentage points higher, interest costs would total $975 billion — almost as much as is spent on Social Security benefits. On a per-household basis, a one percentage point increase in the interest rate would increase costs by $1,805, to $4,210.

While interest rates on the national debt are low historically speaking, the sheer amount of debt means that the federal government still spends billions of dollars on interest payments every year. These payments are larger than many federal government programs. Plus, because the debt we hold today will carry over into future years, there is considerable risk that higher potential future rates will result in interest payments that crowd out spending on even the largest government programs and priorities.

Given this risk, it would be prudent to address our long-term structural debt issues sooner rather than later. Once the U.S. recovers from the COVID-19 pandemic, policymakers should work to adopt a combination of entitlement reforms, smart spending reductions, and revenue increases that will ultimately put debt and deficits on a more sustainable path.

Good stuff MM.

My only remark is about the conclusion:

"Once the U.S. recovers from the COVID-19 pandemic, policymakers should work to adopt a combination of entitlement reforms, smart spending reductions, and revenue increases that will ultimately put debt and deficits on a more sustainable path."

Revenue increases, a euphemism for tax increases, are stone walled by Republicans.

Spending reductions are stone walled by Democrats (and even Republicans these days).

Politicians who attempt to act responsibly on the above are summarily shown the door.

Which to me means don't blame the politicians. Look in the mirror. We have the government we voted for.

Very true joj.

With the Fed unquestionably making big increases to interest rates at the next couple of meetings, the interest on the National debt will skyrocket even higher than previous monstrous projections.