Forecast is -57.

Thanks for starting a new thread Mark!

This is the link to the previous one.......always our most active thread!

NG 11/17/2021+

71 responses |

Started by MarkB - Nov. 17, 2021, 9:40 p.m.

These were the temps for tomorrows EIA report. Chilly in the East where lots of people live and heat their homes.

Mild in the Plains to the N.Rockies that have a low population density(except for TX).

I was gonna wait until it would read "12/3/21", but I got tired of scrolling. ;-)

Natural gas futures extended their losses for a third straight day as weather models continue to portray a pattern that is more reflective of springtime conditions than winter. After shedding more than 90 cents over the previous two sessions, the January Nymex gas futures contract plunged another 30.9 cents to settle at $4.258/MMBtu. Spot gas…

metmike: No changes in the weather forecast philosophy or market expectations.

Here's the latest weather:

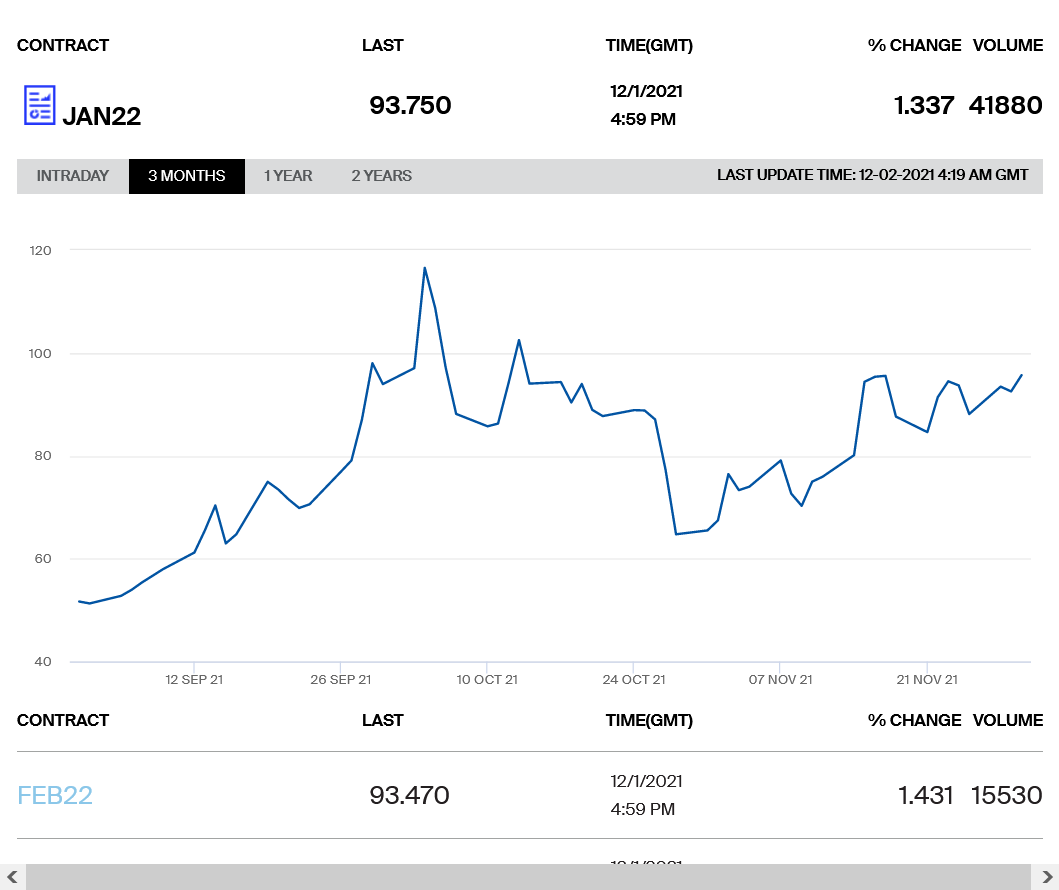

Dutch TTF is still holding it's higher than normal prices. Mainly due to Europe's late start on injections ahead of the winter season. And they are still at the lowest storage level in 6 years. And already withdrawing heavily. Good for our export market.

https://www.theice.com/products/27996665/Dutch-TTF-Gas-Futures/data?marketId=5325990&span=1

Thanks Mark,

Wow! Prices are back near the November 17 high of 95.548 and not that far from the record October 4 high of 116.529!

But its been pretty chilly there recently and they have another week of cold on the way before temperatures moderate...gradually getting to above average as week 2 passes by.

https://www.psl.noaa.gov/map/images/ens/t850anom_eu_alltimes.html

Continued meager weather-driven demand expectations kept the pressure on natural gas futures in early trading Thursday as the market awaited the latest round of weekly government inventory data. The January Nymex contract was off 9.8 cents to $4.160/MMBtu at around 8:50 a.m. ET. Estimates ahead of the latest Energy Information Administration (EIA) storage report, scheduled…

metmike: No changes in the weather forecast philosophy or market expectations.

Here's the latest weather:

https://www.marketforum.com/forum/topic/78385/

Addition: We should note that bitter cold air will be pooling in Canada from cross polar flow(out of Siberia), even as an upper ridge builds in the Southeast US and keeps it from moving bodily into that region(which will feature near record warmth). In situations like this, the dense cold air in Canada is hard to keep out, especially farther northwest of the upper level ridge. Any shift that allows air from Canada to penetrate farther south will have some frigid air to tap from the country to our north.

So there is a risk for some very cold temps late this month.

https://ir.eia.gov/ngs/ngs.html

for week ending November 26, 2021 | Released: December 2, 2021 at 10:30 a.m. | Next Release: December 9, 2021

-59 BCF Neutral

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (11/26/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 11/26/21 | 11/19/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 867 | 889 | -22 | -22 | 934 | -7.2 | 875 | -0.9 | |||||||||||||||||

| Midwest | 1,043 | 1,066 | -23 | -23 | 1,124 | -7.2 | 1,058 | -1.4 | |||||||||||||||||

| Mountain | 206 | 210 | -4 | -4 | 240 | -14.2 | 218 | -5.5 | |||||||||||||||||

| Pacific | 263 | 262 | 1 | 1 | 318 | -17.3 | 300 | -12.3 | |||||||||||||||||

| South Central | 1,185 | 1,197 | -12 | -12 | 1,324 | -10.5 | 1,198 | -1.1 | |||||||||||||||||

| Salt | 335 | 338 | -3 | -3 | 366 | -8.5 | 338 | -0.9 | |||||||||||||||||

| Nonsalt | 851 | 859 | -8 | -8 | 958 | -11.2 | 860 | -1.0 | |||||||||||||||||

| Total | 3,564 | 3,623 | -59 | -59 | 3,939 | -9.5 | 3,650 | -2.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,564 Bcf as of Friday, November 26, 2021, according to EIA estimates. This represents a net decrease of 59 Bcf from the previous week. Stocks were 375 Bcf less than last year at this time and 86 Bcf below the five-year average of 3,650 Bcf. At 3,564 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Dec 02, 2021 Actual-59B Forecast-57B Previous-21B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 09, 2021 | 10:30 | -21B | |||

| Dec 02, 2021 | 10:30 | -59B | -57B | -21B | |

| Nov 24, 2021 | 12:00 | -21B | -22B | 26B | |

| Nov 18, 2021 | 10:30 | 26B | 25B | 7B | |

| Nov 10, 2021 | 12:00 | 7B | 10B | 63B | |

| Nov 04, 2021 | 09:30 | 63B | 63B | 87B |

Neutral for the week, but kind of bullish. The percentage under the 5 year average has increased. We have probably reached the point that we are not going to get any closer to it. And I emphasize "Probably". At least if you believe the Farmer's Almanac and the intensely bitter winter we are supposed to have. As I look out the window at the sunshine and an almost 60 degree day. :)

No signs of a Sudden Stratospheric Warming event ahead......just the opposite. The stratospheric polar vortex at 10hPa looks locked in at 16 days...........in the high Arctic, at the pole to the other side of the North Pole.

https://www.cpc.ncep.noaa.gov/products/stratosphere/strat_a_f/

https://www.cpc.ncep.noaa.gov/products/stratosphere/strat_a_f/gif_files/gfs_t10_nh_f384.png

Still looks like the MJO could make it to phase 7 later in December based on the update this week which would increases chances for a pattern change to cold(if the NAO shifts negative). That would be later in December.

Phases 7, 8 and 1 help to facilitate teleconnections that favor cold dumping in to the US, especially the Midwest. Phase 8 has the coldest analogs(from below) as the MJO matures, moving counterclockwise on the forecast plot below. The numbers are the dates.

Considering the amount of cold in Canada later this month, IF, IF the pattern shifted, the brand of cold entering along the northern border would be pretty extreme.

https://www.daculaweather.com/4_mjo_phase_forecast.php

metmike: We added HDD's overnight but didn't change the very mild pattern.

Natural gas futures tumbled lower in early trading Monday, crashing through the $4/MMBtu barrier as weekend forecast trends further reduced already-mild weather-driven demand expectations. The January Nymex contract was down 38.4 cents to $3.748/MMBtu at around 8:50 a.m. ET. Both the American and European modeling agreed on forecast trends over the weekend that would cut…

metmike: Weather comments yesterday here: https://www.marketforum.com/forum/topic/78385/#78704

One thing that could be adding to the enormous bearish pressure is that Europe, that has been pretty cold recently is going to warm up to well above average..so their record high prices may be under some downward pressure.

We had a huge gap lower on the open, on the daily AND weekly charts, well below the psychological $4 barrier.

The low last week was 4.042 and the high early this morning, on a bounce that got just above the open from Sunday Night was 3.886. There was no trading at any prices between 4.042 and 3.886.......which is why we call it a "gap".

Technically, gaps have powerful meaning on price charts. Unfilled gaps are usually breakaway gaps in the direction of the gap.

Filled gaps suggest they were exhaustion gaps and suggest a move in the opposite direction of the initial gap, especially if it occurs within a short period.

This one is a powerful break away gap, until or if it gets filled. A trade back above $4 to fill the gap is only going to happen when the extended weather models predict the frigid air in Canada dumping into the US bodily.

The Canadian model looks almost on the verge of doing this(just coincidence that this is where the cold air will come from) at times recently. IF/when it happens, the snap back in prices could be pretty severe/quick, considering the coldest air on the planet will be pooling in Canada this month.

Note the positive anomaly also in Europe at 2 weeks:

It won’t be death by a thousand cuts for natural gas. It’ll be far less than that after an increasingly bearish December weather outlook slashed another hefty chunk off natural gas prices to start the week, leaving prompt-month prices down about $1.20 since last Monday (Nov. 29). With production recovering from recent lows and sitting…

metmike: If the ridge in the Midwest/East weakens and allows the dam to break on the cold air in Canada, we will spike way above $4 in a flash...........but the models like the idea of the ridging holding right now.

MetMike

With a forecast change, 'prompt' rebound. Without, how low? In other words, 3.49--buy and hold?

Nice to read you tjc,

I have no idea how low prices can go if it stays mild.

Buy and hold without assistance from the weather is the complete opposite of any trade that I've made the past 29 years and would never do that.

However, this is a great buying set up.....but only if the forecast turns decidedly colder.

Temperatures for this Thursday weekly storage report.

Near record warmth in the N.Rockies to Plains into the Midwest.

A tad chilly in the Northeast and FL. Clearly, the number will be small for this time of year but not record lowest.

Still settling from the European flummox. If weather isn't extremely bullish, the default is lower.

Actually, it may need to STAY extremely bearish to continue down here. With Europe's weather bearish too.

This is NO LONGER the natural gas market that we want it to be from years ago.

It's no longer just domestic but is instead global.

Natural gas futures managed a rebound from the prior day’s massive sell-off, even as the persistently warm December outlook trimmed gains from early in the session. After touching a $3.829/MMBtu intraday high, the January Nymex gas futures contract settled Tuesday at $3.708, up 5.1 cents on the day. February climbed 4.9 cents to $3.674. Spot…

++++++++++++++++++++++++++

Wed morning:

With updated weather models seen hinting at a possible shift away from the exceptionally mild temperatures that have dominated recent forecasts, natural gas futures rallied in early trading Wednesday. The January Nymex contract was up 15.8 cents to $3.866/MMBtu at around 8:50 a.m. ET. While not adding to demand expectations day/day, the latest forecast outlook…

metmike: The forecast is a bit colder and we were due for a bounce. We partially filled the gap lower from Sunday Night, when we spiked to 3.923 a short while ago but got some initial selling pressure that has us back to 3.850.

https://wattsupwiththat.com/2021/12/06/us-lng-exports-hit-new-record-highs/

The skyrocketing growth of US LNG exports has been dazzling.

for week ending December 3, 2021 | Released: December 9, 2021 at 10:30 a.m. | Next Release: December 16, 2021

-59 BCF

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (12/03/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 12/03/21 | 11/26/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 843 | 867 | -24 | -24 | 918 | -8.2 | 859 | -1.9 | |||||||||||||||||

| Midwest | 1,019 | 1,043 | -24 | -24 | 1,099 | -7.3 | 1,036 | -1.6 | |||||||||||||||||

| Mountain | 206 | 206 | 0 | 0 | 233 | -11.6 | 213 | -3.3 | |||||||||||||||||

| Pacific | 266 | 263 | 3 | 3 | 313 | -15.0 | 294 | -9.5 | |||||||||||||||||

| South Central | 1,171 | 1,185 | -14 | -14 | 1,299 | -9.9 | 1,192 | -1.8 | |||||||||||||||||

| Salt | 328 | 335 | -7 | -7 | 362 | -9.4 | 342 | -4.1 | |||||||||||||||||

| Nonsalt | 842 | 851 | -9 | -9 | 937 | -10.1 | 850 | -0.9 | |||||||||||||||||

| Total | 3,505 | 3,564 | -59 | -59 | 3,861 | -9.2 | 3,595 | -2.5 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,505 Bcf as of Friday, December 3, 2021, according to EIA estimates. This represents a net decrease of 59 Bcf from the previous week. Stocks were 356 Bcf less than last year at this time and 90 Bcf below the five-year average of 3,595 Bcf. At 3,505 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Dec 09, 2021 Actual-59B Forecast-54B Previous-59B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 09, 2021 | 10:30 | -59B | -54B | -59B | |

| Dec 02, 2021 | 10:30 | -59B | -57B | -21B | |

| Nov 24, 2021 | 12:00 | -21B | -22B | 26B | |

| Nov 18, 2021 | 10:30 | 26B | 25B | 7B | |

| Nov 10, 2021 | 12:00 | 7B | 10B | 63B | |

| Nov 04, 2021 | 09:30 | 63B | 63B | 87B |

Natural gas futures struggled to put up more gains on Thursday after traders digested the latest government inventory data. Even with the potential for cold later this month still in play, the January Nymex contract settled at $3.814/MMBtu, off one-tenth of a cent from Wednesday’s close. February, however, climbed 1.0 cent to $3.784. Spot gas…

metmike: Model updates were a bit milder with even less HDD's than the previous runs.

Natural gas futures hovered close to even early Friday as analysts mulled evidence of tight balances and as forecasts continued to tease the potential for somewhat colder temperatures to develop later this month. The January Nymex contract was up 1.7 cents to $3.831/MMBtu at around 8:50 a.m. ET. Updated forecasts early Friday trended slightly colder…

metmike: Models were all colder overnight. the European model, for instance was +8 HDD's but, after an initial surge higher, ng is struggling to hold gains because its really just LESS mild and not yet below average temps.

With Europe's natural gas, low storage panic and record high prices the last 2 months pulling up US prices(because global prices matter now with our exports ramping up),

the US has been tracking ng prices and weather in Europe.

It's going to really warm up there and stay mild the next 2 weeks(maybe near record warmth in far Northern Europe-which has the peak positive anomoly below at 10 days)..........this is a bearish influence for ng prices.

The big positive anomaly along the US East Coast shows signs of eroding and shifting south........which will allow more and more of the cold from Canada in later this month.

1st map below is 10 days.

2nd map is 15 days.

https://www.psl.noaa.gov/map/images/ens/z500anom_nh_alltimes.html

+++++++++++++++++++++++++++++++++++

The NAO and AO will also be crashing from extremely positive(warm) to below 0, which greatly increases the chances for cold to move from higher to middle latitudes.

https://www.cpc.ncep.noaa.gov/products/precip/CWlink/daily_ao_index/ao.shtml

https://www.cpc.ncep.noaa.gov/products/precip/CWlink/pna/nao.shtml

Natural gas is finally reacting to the colder weather models........making new highs for the week and pushing into the bottom of the extremely bearish breakaway gap lower from Sunday Night.

Part of the gap was filled so far but selling might pick up if models don't continue colder.

If they do continue colder...........the lows are in and we should fill the gap and it will be a selling exhaustion technical formation.

There's the chance that we don't fill the gap today.........THEN we gap higher on Sunday Night.....leaving a powerful island bottom formation on the weekly charts and an upside breakout for next week.

An island, because this weeks trading range was entirely BELOW the lows of the previous week and the lows of next week(if we gap higher).

4.042 is where we need to go to fill the gap lower from Sunday Night(last weeks low).

Going to need more cold to do that!

I’m wondering if a several week long NG play via an ETF would be good to consider now. Many indications are suggesting high population areas of the E and C US (especially up north) will likely turn much colder than they have been in week 2. Also, many CFS runs (yes, very speculative that far out and they jump around so much) as well as MJO based climo suggest this cold could dominate for several weeks. I’m wondering if a short term investment in a NG price based ETF would be a good risk now because they plunged in late November and early December largely due to the current unusual warmth. Combined with this is a secondary factor, colder also modeled to return to Europe at about the same time and continuing at least into early January. European temps, though not nearly as important as US temps, are somewhat of a factor due to a big increase in exports to there.

I think futures are too risky for a position trade. And options may bleed out too much premium over time. But perhaps a NG ETF would be long exposure worth considering.

Further to the above, the 12Z Sun GEFS is deceptively much colder with 14 HDD colder than the 12Z Fri GEFS along with cross polar flow feeding very cold air into W Canada to the N Plains late. I say deceptive because the bulk of the cooling is back during 12/19-22 rather than near the end.

Note the bitter cold is in two locations of the N Hemisphere with the other over Europe as the cold returns there ~12/20-1. There’s impressive blocking over the N Atlantic and near Alaska squeezing the cold down.

The 12Z Sun EE is not out yet but the 0Z EE was also much colder than the Fri 12Z run.

Note that the 12Z Fri runs being compared to were themselves about 10 HDD colder than their respective 0Z Fri runs.

Translation: I think NG will open higher and possibly significantly as the bearish days are already well known and some of them have cooled a lot as noted (12/19-22), bitter cold is poised to quite possibly come down into the MW to NE late this month into January with the MJO then in phase 8 heading to cold phases 1 and 2, and Europe is likely headed for a longlasting cold period starting in 8-9 days.

Not sure on your earlier post but its certainly something to consider for others.

I trade exclusively on trying to be in a position before the market reacts to a, mainly short term change in the weather forecast.........so that's just me.

+++++++++++++++++++

On your 2nd post. I agree completely with it.

The AO and NAO are dropping hard with many members negative that favors transport of air from high to middle latitudes(and there's some frigid air in Canada to tap into).

https://www.marketforum.com/forum/topic/78385/#78399

The positive 500 mb anomaly at the end of 2 weeks looks like a Greenland block type set up....often very cold for the Eastern 1/2 of the US.

https://www.marketforum.com/forum/topic/77552/#77808

And the MJO is shifting to a cold influence.......which you told us about late in November. Congrats on that!

https://www.marketforum.com/forum/topic/78566/#78600

+++++++++++++++++++++++++++++++++++++++++++++

Re: Re: Re: Re: NG 11/17/2021+

By WxFollower - Nov. 22, 2021, 10 p.m.

Mike et al,

Watch the MJO. It is forecasted by the Euro and other models to be in a position that could bring a resurgence of cold into the E half of the US in mid to late December, especially if the NAO, AO, and PNA were to shift by 12/10.

https://www.marketforum.com/forum/topic/77992/#78221

My main, offsetting concern is with the -PNA.

If that results in a much deeper trough in the West, it's going to build heights to the east which will try impede the movement of cold in Canada into the US.

However, the dense cold air near the surface dropping from north to south.... is likely to still be able to undercut any westerly and even southwesterly upper level flow above it........and penetrate pretty far south, even though it will moderate if traveling over bare ground(no snow cover).

However, if the trough out west is deep enough, the southerly component of winds to the east(Midwest/East) could be strong enough and all the way down to the surface to deflect a great deal of the cold back to the north.

Thanks, Mike! I hear you about the -PNA. However, -PNAs are actually common in La Niña and can easily still allow for strong cold in the Midwest to NE US with -NAO and with the help of the MJO. Getting that cold deep into the SE on a sustained basis would be a challenge though. There it would probably only come and go.

12Z Sun EPS slightly warmer than 0Z Sun but still 6 colder than Fri 12Z and 16 colder than 0Z Fri. So, I’m still guessing it opens up but you never know with NG. If not up or only slightly up, I might consider conservatively going long in some way.

If we gap higher on the open(very possible), we'll have the island trading formation from last week that I mentioned on Friday.........very bullish.

https://www.marketforum.com/forum/topic/78566/#78878

Of course we have to hold the gap.........which we did get on the open as no surprise.

A very small gap.

3.968 was the low just after the open. 3.965 was the high on Friday.

Failing to do that is a gap and crap, buying failure exhaustion formation for todays bar.

But I think the extreme gradient between cold in Canada and warmth in, especially the southern US makes any chart formation worthless because a shift north or south in the temperature pattern on updated models will get all the weighting.

If models turn sharply warmer or colder overnight.....the price should follow.

-8 HDD's for the GFS and operational EURO was -8 HDD's so we filled the gap higher and are on the lows, 3.961 but still up from the close of Fri..........so far.

EE will determine where we go the next 40 minutes.