Yesterday's report showed a 16 million barrel draw.

Today, oil is taking off.

Of course, one week's EIA number usually means nothing. The more surprising number from yesterday was daily product supplied - 23,191, up from 19837 the week before & 19,335 same week last year. It was pretty heavy in all categories, and the highest one week I can remember.

Anyhow, this goes with my favorite new Twitter genre - people posting about how they use 60 gallons of gas a week and this inflation is killing them. No, none of them are truck drivers, travelling salesmen, or cabbies. All claim to believe in free markets.

Thanks much patrick. Great to read you.

Wow, I had no idea the crude has a monstrous drawdown yesterday!

Actually, in checking your number........it appears to be wrong. The drawdown was -4.584M.

Where did you get -16 Million from?

Oil rose for a second day after the U.S. reported the biggest crude stockpile drop since September while the dollar slipped.

Futures in New York gained 2.1% on Thursday in a thinly traded session as a weaker dollar helped bolster the appeal of commodities. The U.S. Energy Department on Wednesday reported a 4.58 million-barrel slump in crude inventories, a bullish signal to investors which may quell previous demand outlook concerns.

“We still have a bid in the market from yesterday’s EIA report, which deserves a lot of love,” said Bob Yawger, director of the futures division at Mizuho Securities USA. The report alone gives markets a reason from trading sharply downwards in the upcoming days, he added.

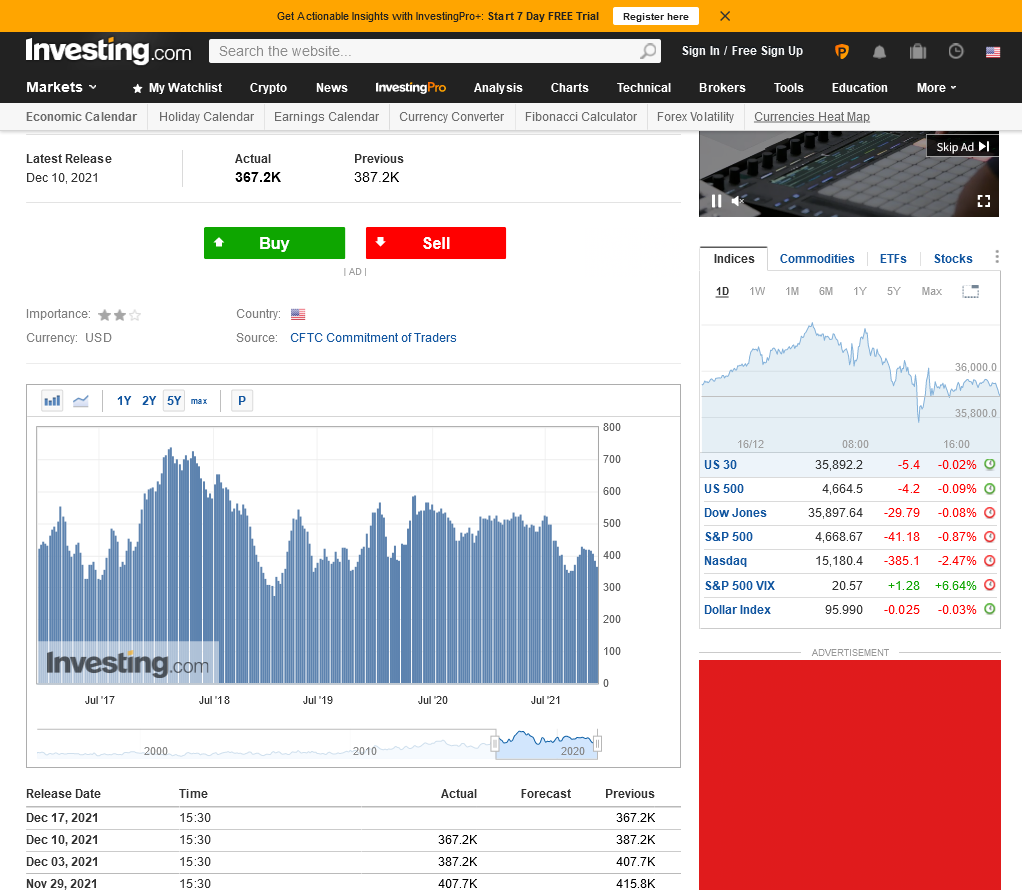

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 15, 2021 | 10:30 | -4.584M | -2.082M | -0.240M | |

| Dec 08, 2021 | 10:30 | -0.240M | -1.705M | -0.910M | |

| Dec 01, 2021 | 10:30 | -0.910M | -1.237M | 1.017M | |

| Nov 24, 2021 | 10:30 | 1.017M | -0.481M | -2.101M | |

| Nov 17, 2021 | 10:30 | -2.101M | 1.398M | 1.001M | |

| Nov 10, 2021 | 10:30 | 1.001M | 2.125M | 3.291M |

Weekly US ending stocks of crude oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

Weekly ending stocks for unleaded gasoline.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

Actual price below.............sort of following the seasonal above.

Funds are always mega long crude apparently in recent years.

https://www.investing.com/economic-calendar/cftc-crude-oil-speculative-positions-1653

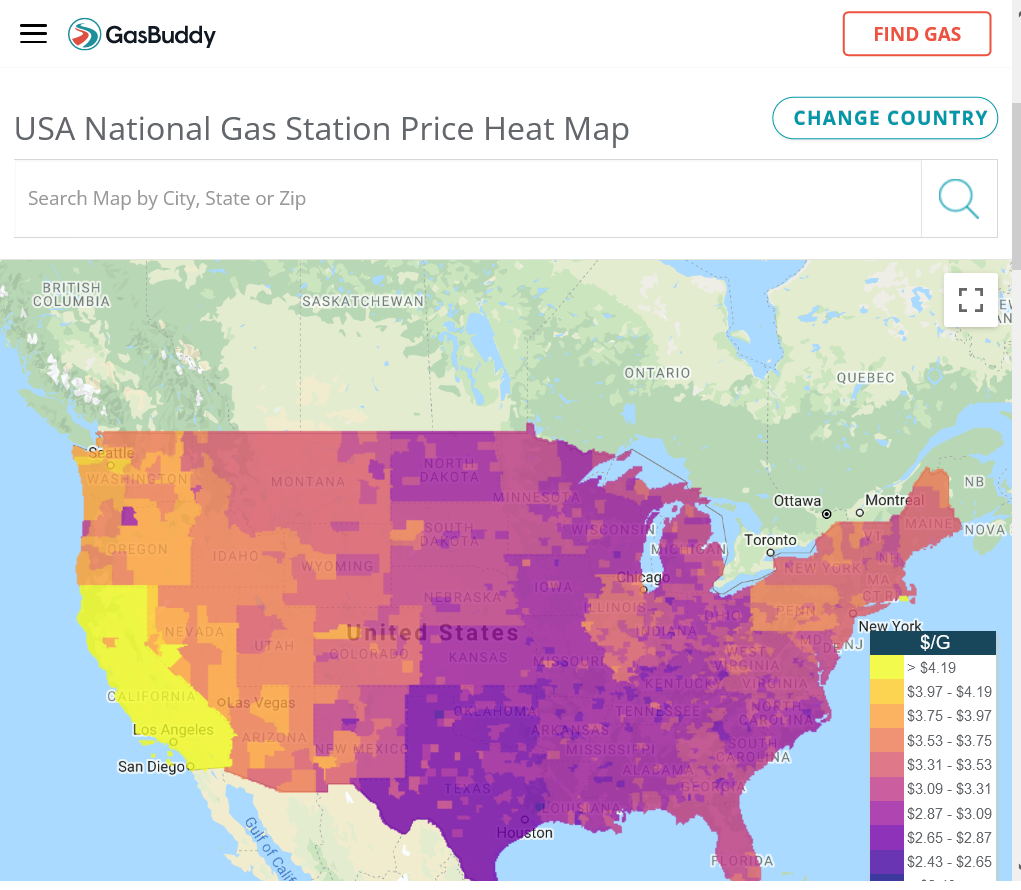

Here are the latest gas prices across the country:

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.10118167223963

https://www.quora.com/Why-are-west-coast-gasoline-prices-higher

The two main reasons are transportation and taxes. Part of the cost of gasoline is what it costs to take refined product and transport it to the end user. Below is a map of the main refineries and pipeline in North America.

You can see that the west coast has a much smaller amount of infrastructure than other parts of the map. As a result, more of your gasoline is refined in places that require it to be shipped by transportation.

The second reason is that the states on the West Coast have used fuel taxes more than the average.

If you add to that state requirements about how the gasoline is blended based on the various state environmental air quality and emissions standards, you can tweak the price again. The addition of MTBE or ethanol seasonally, further adds cost to a gallon.

Both coasts tax their gasoline beyond the norm. Add to that in California they require 2 to 3 times as many fuel mixes as any other state which increases the cost again.

I meant total stocks. Crude jumps around on refinery usage, Also, there's been some drawdown of the SPR lately -- 40 million since last year - so 17.8, not 16.

Thanks Patrick, I wondered if you meant that.

That's pretty substantial. In the absence of any COVID related slowdowns any continuation in that direction would be very concerning if not alarming.

I strongly believe the war on fossil fuels is having a significant/powerful affect on investment capital going into developing additional supplies for all the fossil fuels.

Much of the funding, grants, favorable taxing and best financial opportunities are in alternate energy plays. The plan is to impose carbon taxes and penalties soon but that could get waived because people are squawking about inflation with energy prices leading the way.

With that being the case, I think that we won't be seeing the robust storage situations that defined fossil fuels at time in the past...or cheap prices. Those days are gone forever.

Crude stocks are the lowest in 7 years and close to the lowest in 10 years right now.......and being depleted even while tapping into SPR oil.

The only thing that can change that, other than a temporary COVID shutdown, is MORE supplies.

The war on fossil fuels is trying to do the complete opposite and is winning. However, increasing prices, though not having their previous more immediate effect on supply based on the historical response, one would think will eventually cause new supplies when storage drops low enough and prices high enough.

But the curve has shifted, especially the risk for investment money curve.

When fossil fuels were king, oil and natural gas companies could drill with impunity and expect their investments to pay for themselves, even if it took awhile.

Now the mentality is that fossil fuels are killing the planet and big oil is evil, corrupt and greedy and we need to eliminate them ASAP. This won't be happening for numerous decades but if you look at the blue print that some people in the market place look at.........fossil fuels are going away and sinking money in them is risky.

Weekly US ending stocks of crude oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

You might disagree with me on the climate part but the point here is to look at what they did to the coal industry. ....intentionally.

Investors in the coal industry got their butts beat. We are in the early stages of an attempt to do this with oil and ng. It won't work because alternate energy promises can't come close to meeting the real world demand.......however, they are next on the hit list.

Crude is getting clobbered this evening.

Opened down slightly, at Just over $70 but has slid down close to $68, down $2.57.

Probably taking the grains lower too.

The weather is pretty bullish in SA and we opened modestly higher in the beans and were trading +6c and staying up there for several hours but reversed to over 2c lower., now back to unch.

Crude, the new covid barometer. I agree with you on its effects of grains. If crude wasn't such an anchor today, we would be up significantly higher in corn and beans.

Agree Jim,

Crude down over $4 now.

Beans had no choice but to go higher because the weather in SA is just too bullish.

If crude was up, I'm betting beans would be 20c higher.

However, this is impossible to trade. I tried to buy some s on the open but the price was too low and backed off.

We dropped 13c overnight from the highs but how does one know when the drop will end?

Then we shot up almost 20c from those lows and have backed off again but are 5c higher.

I will guess that we've dialed in the $4 drop in crude but if it crashes another few bucks quickly, who knows.

Funds are always mega long in crude, which is potental selling fuel.

Or..........we could bottom here and everything goes back up.

We have to remember that this is a market trading speculation.

I trade the weather FORECAST which is a form of speculation. No damage has happened but if the next few weeks, do in fact stay hot and dry in Argentina, there will be some real damage.

But its still just speculation.

vs the speculation of COVID and dropping oil.

No losses there either yet but its keeping weather speculators from buying today as well as causing the usual downward pressure from plunging crude.....speculation of its own.

The thing about crude is, if covid is detrimental to crude prices, OPEC will cut much more quickly this time.

Jim,

I would agree with that if all other variables were the same except for the COVID factor.

However, in the last year, the war on fossil fuels has ramped up and changed a great deal for this industry with regards to the mindset of big money investing in future production.

Previous to this war, there was much less risk and much more reward with a more favorable tax structure, funding opportunities and no carbon taxes.......in the US that is. Drilling rigs searching for new oil have dropped off and not recovered/responded as strongly as in the past when prices went up this much.

Things probably won't change as much for OPEC countries that will certainly not have all these regulations and penalties but they understand the consequences in countries focusing all the new money towards developing unreliable, fake green energy as an opportunity for them to make even more money on their products, mainly crude oil for OPEC.

So I still think that you make a good point but there are complicated new dynamics to consider.

It seems unlikely that we would completely shut down like before too but never say never in this environment.

People's tolerance for COVID is much higher than before.

What would get them totally bent out of shape before..........is just the new normal now.

I think a key metric to gauge things by is the number of hospitals filled to capacity and no longer able to care for sick people.

If that soared into the many hundreds of hospitals across a dozen+ states and millions of people needed to be hospitalized that had no place to go...............we could have no choice but to have more near complete shut downs of some industries for a brief period to get us thru that brief period to minimize that disaster.

Its that risk/reward thing.

We are willing to take much more risk today, than in 2020..........and have the vaccines to lessen the death toll(13 times more likely to live or avoid the ICU if vaccinated vs unvaccinated) but in my opinion, there is a tiny chance that if the 5 times more contagious Omicron(compared to Delta) infected most of the population suddenly, we might have to shut down alot of things to let it infect most of us...........at a slower rate and get it over with while FLATTENING THE CURVE.

If you can spread the infections out over 8-12 weeks, for instance instead of 4-6 weeks, there will be twice as much room in hospitals for the really sick people.

The most important item is to have a place for the really sick people to be treated. ......or should I say, avoid at any cost, having millions of really sick people with no place to go.

True enough. I know here in NE Ohio, hospitals are full. It's crazy how we went from a 100 people in South African have a new strain of Covid, to it's now the leading infectious virus in the country now. Makes me believe either the US was asleep at the wheel or to your point, we are numb to it...or both.

Crude is having a huge up day today Jim!

Making new highs for the week.

By patrick - Dec. 22, 2021, 11:36 a.m

https://markets.businessinsider.com/commodities/oil-price?type=wti?utm_source=markets

The rebound in crude from its $66 is impressive. But I fear it has more to do with Russia’s Arctic’s and Putin’s statements than anything to do with crude. The builds in products has been as equally as impressive and the declines in crude supplies which leads me to think that questions about demand might surface soon.

Thanks Jim! You might be right.

Bumping this to show the steady drawdown of a million barrels a day in total stocks for 9 weeks now. Production is steady, up about 600k/day over what it was a year ago, but demand isn't responding to price yet, and Brent is still above WTI.

Thanks much patrick!

U.S. Crude Oil Inventories

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

Latest Release Feb 09, 2022 Actual -4.756M Forecast 0.369M Previous -1.046M

Release DateTimeActualForecastPrevious

Feb 09, 2022 10:30-4.756M0.369M-1.046M

Feb 02, 2022 10:30-1.046M1.525M2.377M

Jan 26, 2022 10:302.377M-0.728M0.515M

Jan 20, 2022 11:000.515M-0.938M-4.553M

Jan 12, 2022 10:30-4.553M-1.904M-2.144M

Jan 05, 2022 10:30-2.144M-3.283M-3.576M

Crude NOT following the seasonal this Winter! This is actually a time frame where crude often hits a bottom, with strength in the Spring.

The relentless million barrel a day shortfall continued, this time with high consumption in Other

Crude stocks seem to have stabilized, with winter products dragging down the total. this is not what's driving the market today (Duh!) but might as well post it anyhow.

Thanks much patrick. It's still great to look at the other elements, especially fundamentals because when everything settles down and emotions wear off.........the market will have to reconcile to those realities again.

Of course with the energy markets, we could have a NEW reality since Russia is a huge player in the energy markets!

Going to keep this thread until the streak ends. Down 10.6 last week. With gasoline prices rising, consumption went from 8743 to 8962. Maybe that was just people filling up before it gets even worse ($4.45 today at a usually cheap place), but I'm still seeing a lot of shiny new intimidator hood pickups (that really don't belong on narrow city streets full of lots of short pedestrians) driving around with no passengers or cargo .

Thanks VERY much Patrick. Great post.

We're drainng oil and oil products across the board.

Obviously there's SPR oil also being fed to the market too.

Latest Release Mar 09, 2022 Actual-1.863M Forecast-0.657M Previous-2.597M

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Mar 09, 2022 | 10:30 | -1.863M | -0.657M | -2.597M | |

| Mar 02, 2022 | 10:30 | -2.597M | 2.748M | 4.515M | |

| Feb 24, 2022 | 11:00 | 4.515M | 0.442M | 1.121M | |

| Feb 16, 2022 | 10:30 | 1.121M | -1.572M | -4.756M | |

| Feb 09, 2022 | 10:30 | -4.756M | 0.369M | -1.046M | |

| Feb 02, 2022 | 10:30 | -1.046M | 1.525M | 2.377M |

Weekly US ending stocks of crude oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W

Weekly ending stocks for unleaded gasoline.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

Per today’s weekly EIA report, here is the US crude oil production in millions of barrels/day:

Current:11.6 (up 0.7 vs one year ago)

One year ago: 10.9 (way down from one year prior due to pandemic)

Two years ago: 13.0 (near the max just before the pandemic took hold)

Thanks Larry!

That drop in production had to come from somewhere.

The forecast, takes us almost 2 more years to get back to those highs!

However, this was BEFORE crude prices spiked about $100!

https://www.eia.gov/todayinenergy/detail.php?id=51318