hayman,

I hate to disappoint you but those temperatures would be 10 degrees too mild for a damaging freeze ......if that were the forecast but that doesn't make any difference.

You just posted something from a week ago that happened a long time ago:

This is the actually forecast right now.......a near 0 chance for a freeze.

mike

Orange Juice Prices Soar With Frost Threatening Florida Crop

"Most of the state’s growing areas are under a frost watch, and temperatures could descend this weekend below 30 degrees Fahrenheit by Sunday morning, according to Drew Lerner, the president of World Weather Inc. Cold winds could hurt developing fruit and further reduce yields, tightening supplies at a time of surging costs."

Orange Juice Heads for Longest Rally Since 1991 on Frost Risk

Orange juice futures are heading for the longest winning streak in more than 30 years with frost threatening groves in Florida, the top supplier. “The entire citrus country will be at risk of frost” this weekend

You see, dear Met, my charts predict your weather. Not the other way around. You are going uphill all the time and I'm already perched on top of the mountain with a panoramic view and notice the first inkling. While you wait for your runs, models and maps. And then agonize whether it'll be "dialed in" or not. And if not, well... Must be the "dumb" commodity. Where's the MetMike that inspired me with the tale of swinging a hundred or more cars of OJ at a time? That's what I call being "at bat" and "going for the fence". Can't say that I didn't alert you to this eventuality over a week ago and on other earlier postings as well. The administration of this Forum, particularly your devotion to the NTR side, must subtract from your energy reserves. I know that it would certainly debilitate me to expend the effort you do. And that's not even counting the attention you focus on family, chess kids, etc. Sure, probably not a single piece of fruit will be damaged by whats to come. But the imagined threat of a dreaded outcome is what feeds fear. After all, market behavior is all just fear and greed. Take care, Sir.

Thanks hayman, appreciate the comments. I didn't mean to offend you with my honesty in the previous post. I obviously did and apologize.

"Can't say that I didn't alert you to this eventuality over a week ago and on other earlier postings as well."

Just a bit of a reality check again for you hayman to help you out. Your alert above was an article from over a week earlier about cold that was happening that morning.......18 days ago.

https://www.marketforum.com/forum/topic/80421/

Published:

You see, dear Met, my charts predict your weather. Not the other way around. You are going uphill all the time and I'm already perched on top of the mountain with a panoramic view and notice the first inkling. While you wait for your runs, models and maps. And then agonize whether it'll be "dialed in" or not. And if not, well... Must be the "dumb" commodity. Where's the MetMike that inspired me with the tale of swinging a hundred or more cars of OJ at a time? That's what I call being "at bat" and "going for the fence". Can't say that I didn't alert you to this eventuality over a week ago and on other earlier postings as well. The administration of this Forum, particularly your devotion to the NTR side, must subtract from your energy reserves

If it makes you feel better to attack me because of the honest post earlier in this thread........go right ahead.

However, you should, instead focus on these PERSONAL comments that I made about my real feelings towards you:

https://www.marketforum.com/forum/topic/78502/#80069

By metmike - Jan. 7, 2022, 4:02 p.m.

"hayman, I find you to be an extraordinarily creative person with keen/gifted observational skills.

Extremely esoteric in communicating thoughts which probably go over many peoples heads. I was once described, by the smartest person that I knew in high school as the most esoteric person he knew...so I totally get you."

++++++++++++++++++++++++++++

"After all, market behavior is all just fear and greed. Take care, Sir."

hayman,

You left out the most important emotion of all. I thought that you had mentioned it before here. HUMILITY. I'll let you decide if your last post was an example of that or not.

Again, I'm sincerely sorry for the way that I worded that post so that it generated a personal attack and very much appreciate you tipping us off about the cold temps in Florida this weekend because, you are right that I wasn't watching them as closely as you.

Please remember that I get paid 0 for doing this and put into it as much time that I can as a labor of love.

I can't follow every market all day every day, especially for free.

It's very much appreciated when people here make contributions to help me out, and I do my best to respond the best I can to every comment by every person out of appreciation and respect for them.

The objective is to help make the world a better place, including helping traders to see the latest market and especially weather information.

Your assistance/contributions are extremely appreciated.

As usual, I'll try to follow up with the latest OJ information, especially weather regarding the freeze threat to Florida that you alerted us to.

I 'm not perfect though and won't tell traders what positions to have either.

metmike

Here's where they grow the orange crop in Florida:

https://citrusindustry.net/2020/11/18/cold-acclimation-and-freeze-protection-for-florida-citrus/

Damage will begin to occur in round oranges after four hours at 28° F.

Another piece of the cold-protection puzzle is duration. Simply put, trees can survive with little or no damage at or below a given freezing temperature provided that the amount of time at that temperature is of short duration. An example is the susceptibility of new citrus flush 2 to 4 inches in length at one temperature with three different durations. At a minimum temperature of 28° F for 30 minutes, less than 5 percent of the new flush is killed. At 28° F for two hours, 50 percent of this flush is killed. If the duration is three hours at 28° F, 90 percent dies.

When looking at a similar scenario with round oranges, a one-hour duration at 26° F results in no fruit damage, while a four-hour duration at 26° F results in 30 percent fruit damage. These are factors to consider when making a citrus cold-protection plan.

https://fawn.ifas.ufl.edu/tools/coldp/crit_temp_select_guide_citrus.php

https://edis.ifas.ufl.edu/publication/cg095

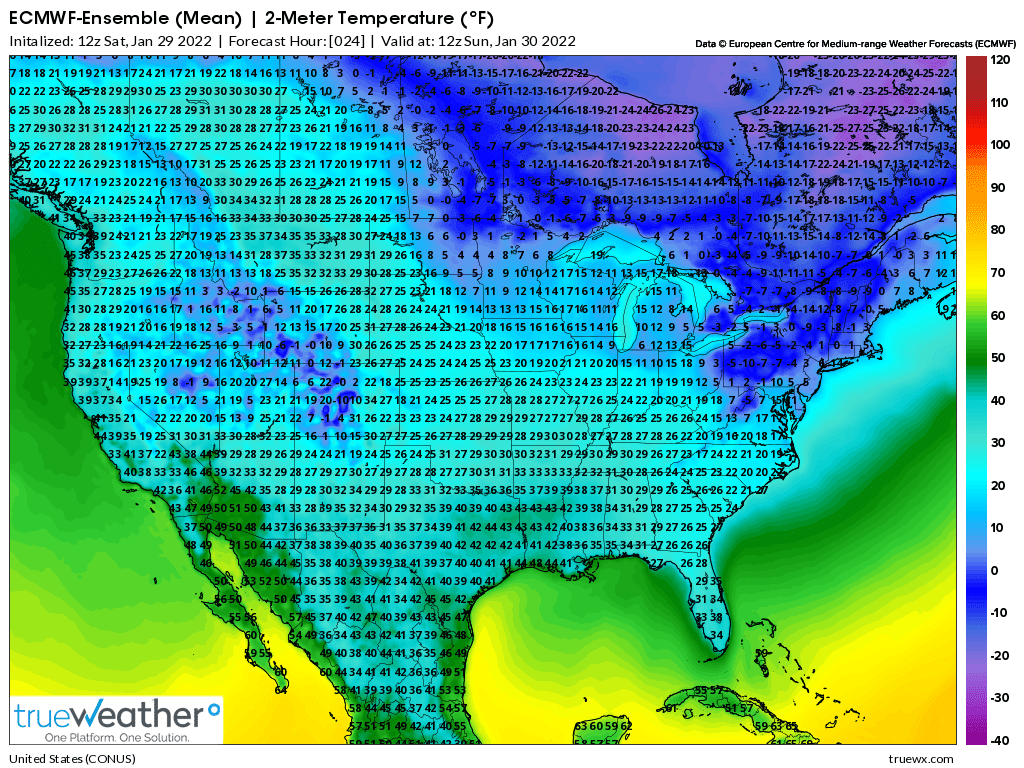

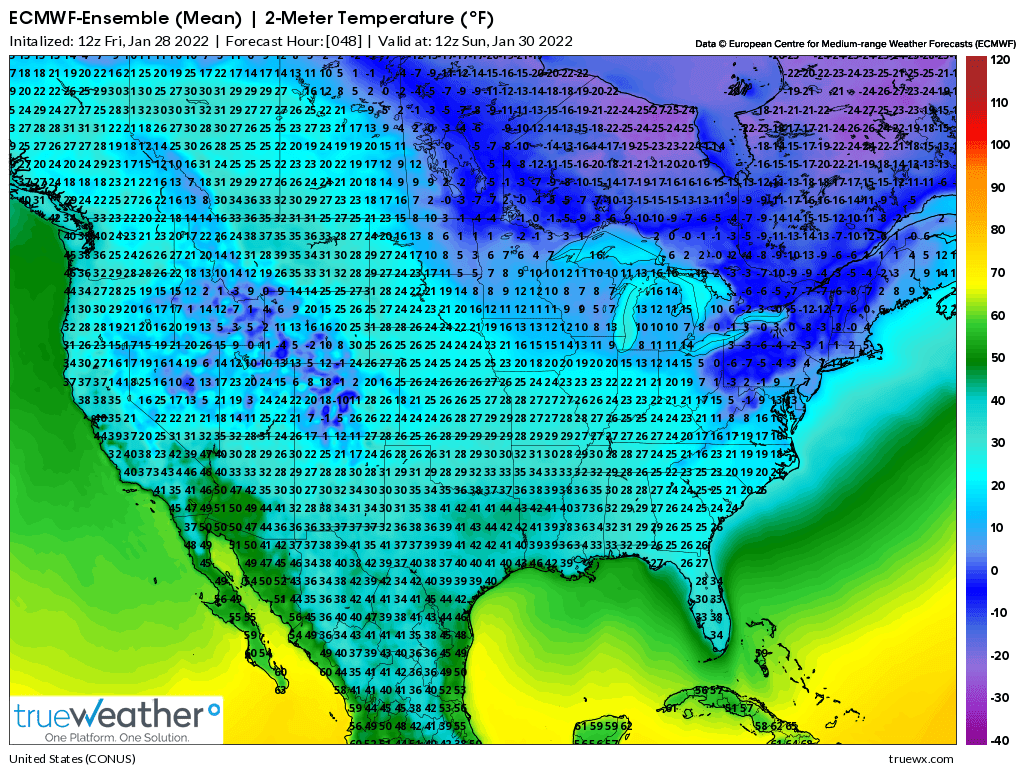

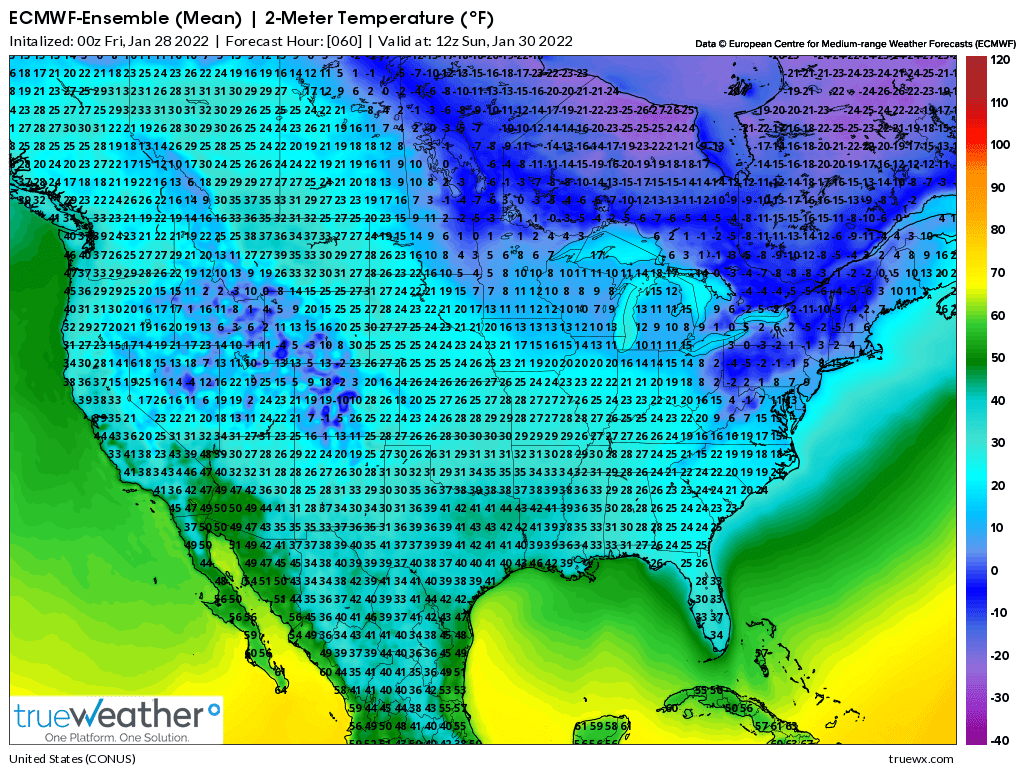

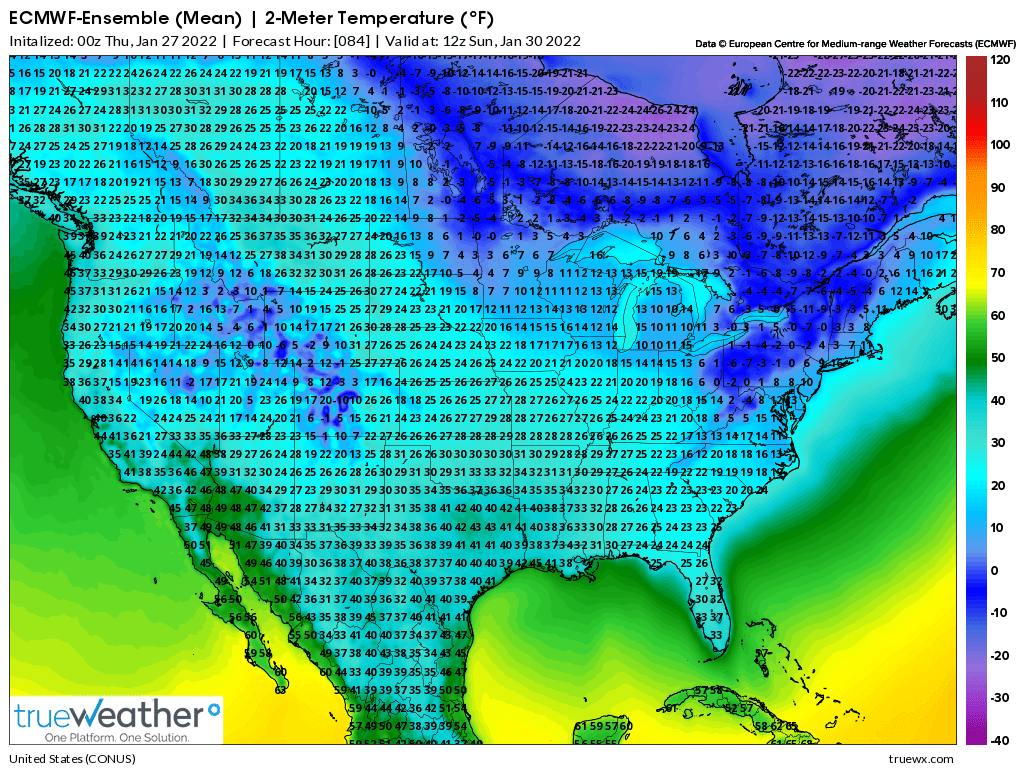

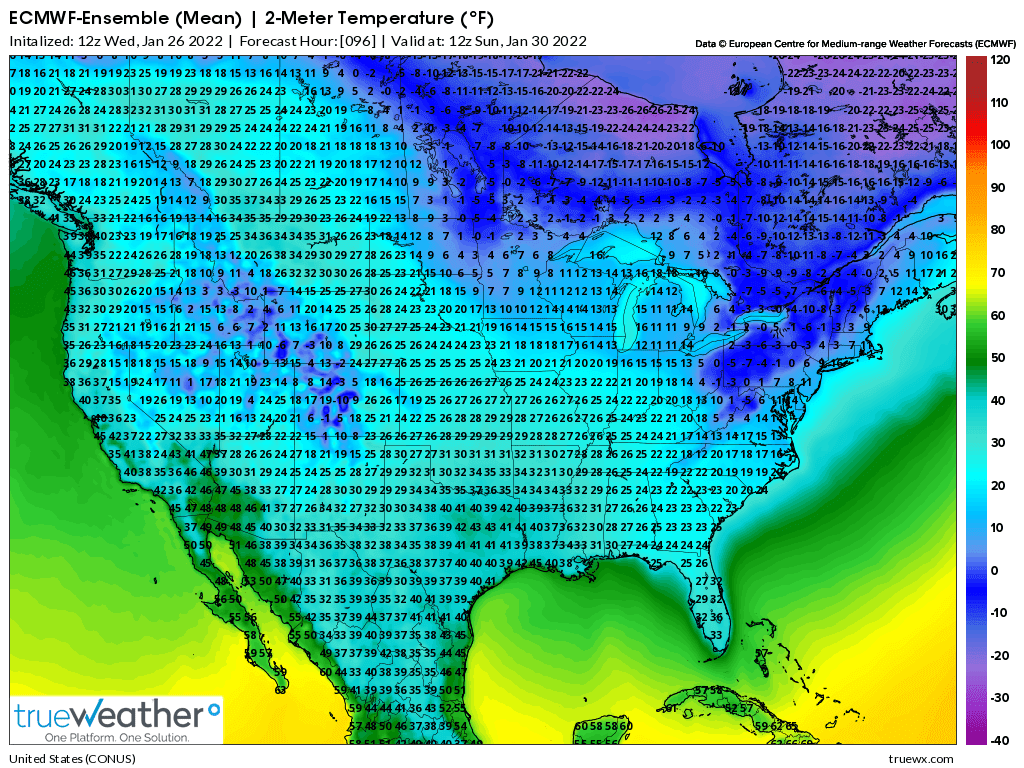

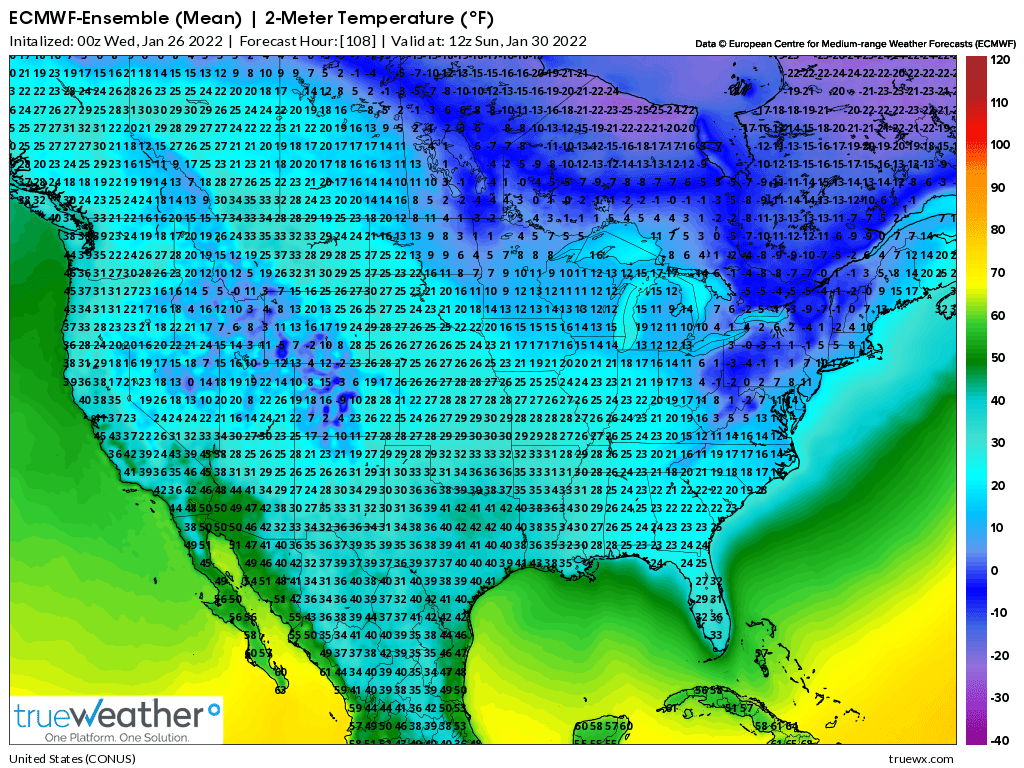

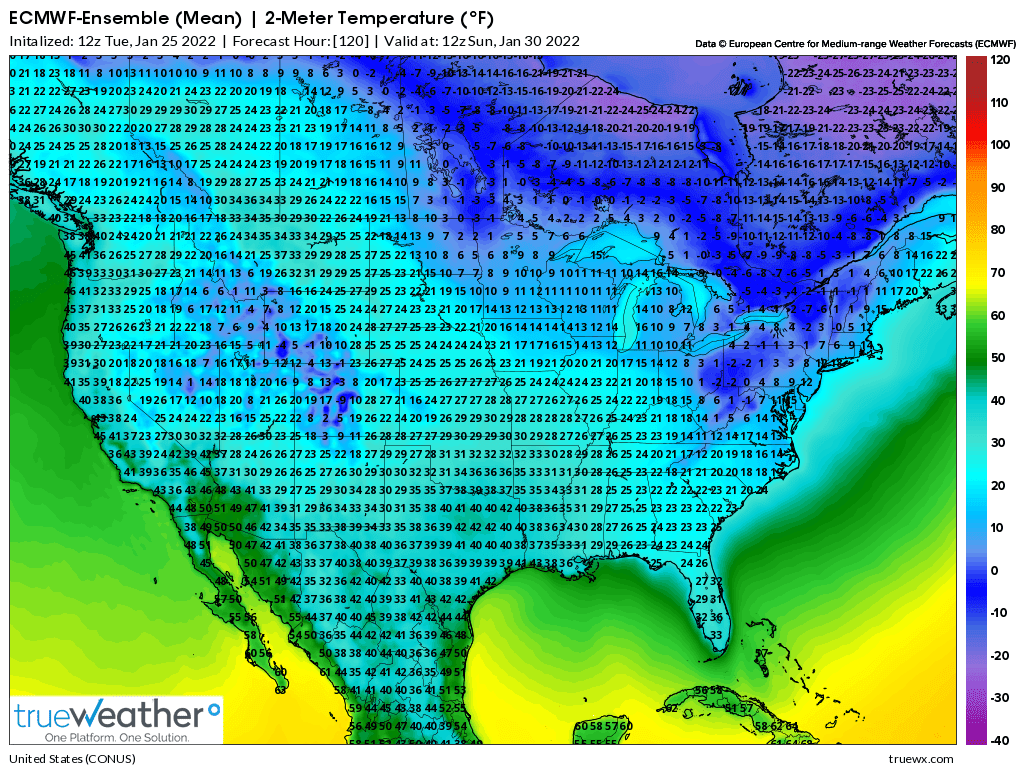

Latest forecast from the 12z European model at the top, with the previous ones(12 hours previous) below that for early Sunday Morning, which is the only threat day.

These are 2 meter temperatures. Temperatures near the ground will be a few degrees colder. If these were soybeans, those temperatures near the ground would do more damage. These are NOT low temperatures but instead the temperatures around sunrise. The low temperatures will likely be a couple degrees colder than this.

Saturday afternoon below, slightly less cold again but models don't matter that much when we get this close........watching the weather real time is most important, something called NOWcasting.

https://www.marketforum.com/forum/topic/80421/#80918

Friday after Noon below...just a smidgen less cold(still no hard freeze):

Friday after midnight below:

From Thursday after noon.

Thursday after midnight below

Wednesday after noon below

Wednesday after midnight below

Tuesday after noon below

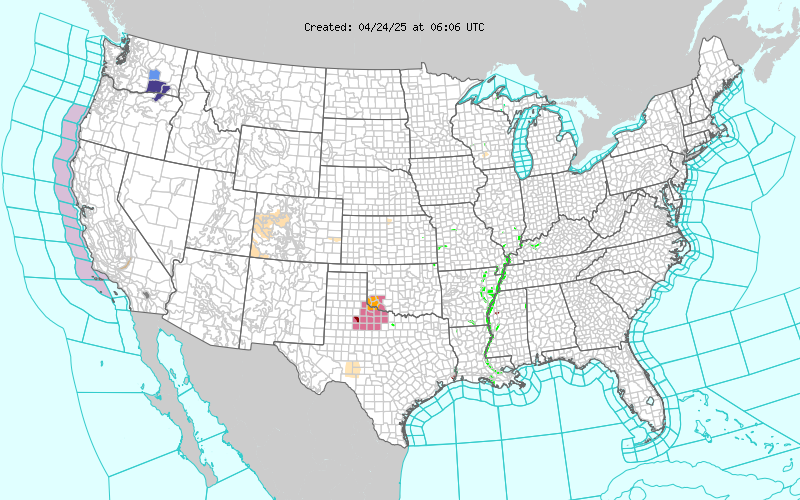

Hazards map for NWS watches, warnings and advisories from the Severe Storm Prediction Center.

Nothing going on here on Thursday Morning in FL citrus country but tomorrow/Friday, we will see Freeze watches/warnings and Winter chill watches/warnings covering much of the state except the very far south.

These are the 2 main NWS forecast offices that predict weather and make statements for most of the counties that grow oranges:

This is farther north:

These are current conditions in Florda. We are 48 hours away from the time frame to really monitor these maps closely(overnight Saturday)

https://www.spc.noaa.gov/exper/mesoanalysis/new/viewsector.php?sector=18

https://www.spc.noaa.gov/exper/mesoanalysis/new/viewsector.php?sector=18#

https://www.spc.noaa.gov/exper/mesoanalysis/new/viewsector.php?sector=18#

Updated the temp forecast earlier this morning.

https://www.marketforum.com/forum/topic/80421/#80915

OJ price plunging today agrees with the models that its not quite cold enough for this freeze to do damage.........however the air is extremely dry and if winds go calm overnight on Saturday over dry soils, noted below temps have the potential to drop lower than expected.

Upper 20's are being forecast right now by the NWS:

https://www.marketforum.com/forum/topic/80421/#80917

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

Oj has been locked limit down for the past 40 minutes. As mentioned earlier, the OJ market does not see freeze damage.

Upper 20's will not do anything but minor, isolated damage. As shown last night, Temperatures have to stay at 28 degrees or colder for 4+ hours, 26 degrees or colder for 2+ hours.

That can still happen with the extremely dry air and dry soils if winds go calm very early on Saturday night but the market speaks.

What an outstanding lesson on the need to be humble in order to succeed. You are bullseye dead on in recognizing my unhealthy bias and cared enough to spell it out for me so generously. I became the technical indicator that I recognize vividly in others when they get emotionally carried away into irrational exuberance. Suggesting that a market turn is imminent as the "fish is firmly hooked". Likewise, to see the frost hyped in unanimity across all major media was a classic "sell the news" after such an astounding run-up in price.

Early morning buy of the Cocoa futures was successful, totally. Yet my aggressive pyramiding the OJ and no stoploss policy bought a front row seat to a rare "lock limit" event, though not in the direction fantasized! Though locked throughout the 2nd half of the day, noticed they were still letting people out, but only at rock bottom limit down price. The overflow waiting to get out waned into the final hour. May locked, but July locked briefly only to trade severely lower, mostly a penny up from lock.

And now, super interesting. Any sane long is either out or spread out with a distant contract. A lot of new shorts perhaps entered. From almost $1.65 to $1.50 is 15 cents off the top in a very thin market. That's some good profit taking. Should the market's sudden idea that this freeze is a nothingburger get a slap in the face over the weekend, a back to back limit back up could be envisioned. After all, the gloves are now off and price volatility maxed by limit. Of course, the entire price climb might unzip further, by successive lock limit downs.

My positions are OJ and Rice pyramids, 5 contracts each. Plus today's 3 new Cocoa. Rice made an extreme hammer, pinbar, positive into next week. Cocoa created a bullish engulfing candle, mostly consuming yesterday's hard down. Suffice it to say, all positions remain on and I personally spoke with margins at TD and let them know of both my awareness and readiness to take whatever action needed come Monday. Definitely, this situation has the horns to impale me and blowup vaporize the account. Again, a better lesson to get my attention could not be envisioned. He has provided what I so much needed as per MetMike's wise advice!

Thanks hayman,

We always do best working together. You are a genuine, active trader with seasoned skills/understanding along with unique insights and lots of energy.

There have been numerous times that I was not watching a particular market and somebody pointed something out about it.

It's true that in the old days, I had waaay more time to look only at markets and weather all day.

I was actually a skilled, natural trader from the get go in 1992 because I used weather and discipline and an analytical mind(the kind that is drawn to chess) and back in those days(before the internet) had advanced weather technology(satellite dish on my roof for weather data) that provided an incredible advantage.

Today, every trader with a connection to the internet can get the same stuff. It still needs interpretation but there are plenty of interpreters trading it 24 hours a day now.

However, in 2018, being moderator dumped something into my lap that I realized could be used to enrich the lives of others(that want to learn) outside the trading arena and beyond local charities and youth education programs/chess, while learning more myself about how to see thru the politically muddied waters in order to clearly view objective truths and more about what it means to be a human being the last 4 years than I learned the previous 40 years in some realms.

https://www.marketforum.com/forum/topic/77019/

https://www.marketforum.com/forum/topic/77011/

Few of us are born with the blue print to have the brains and hearts to be one with compassion and humanity. ........and authentic/objective learning from an mind open to ALWAYS see all sides of issues.

Not only is it necessary to strip away the political baggage but we have to always consider being wrong BEFORE thinking that we are right.

Only then can authentic discernment take place.

And it is so, so, so difficult at first because cognitive bias drives our thinking........unless we learn how to try to manage it.

Even as I state this, please don't get the impression that fighting personal cognitive bias has been mastered for me. That will never happen.

It takes almost daily reminders, like those at the links above to create a mindset that isn't natural for most of us. For me, that's been the best part. I'm not just reading a link/quote that somebody posted somewhere, then forgetting about it 5 minutes later.

I have to actually search the internet and read many, many quotes until I hit ones that often will hit me with impact, like "wow, this is one is so good that I want to share it with everyone!!!"

Then I cut and paste it and sometimes add a bit more. In the course of tending that thread, I'll end up reading most of those quotes dozens of times during a 3 month period.

This causes repetition of wonderful messages about compassion, humanity........ powerful things to make the world better in my mind.......as a result of tending just those 2 threads.

And sharing those positive messages with others(that are interested). That gives another boost to the reward for my presence here.

Having some of it rejected, continuously, sometimes with strong opposition is no reason to despair. These messages have caused a positive change in my life and it wasn't because I was seeking to change my life at all. I was doing it exclusively for readers here and then realized............wow, it did what I had hoped for.........TO ME!

I would never have created those threads or ones like them for metmike to read and reread on his personal computer. Doing things for other people often generates the most benefits to the giver......even more than the receiver.

https://health.clevelandclinic.org/why-giving-is-good-for-your-health/

Sorry for going off the topic of trading but, its a message that all traders and non traders should know and apply to their lives. If you never go to the NTR forum.........you would never get this!

Intraday 1-minute candle chart with corresponding volume bars for March OJ. Just the one day fills the page, opening on the far left with a red down candle and finishing on the right. The first is 1-minute, the complete day. The second is 5-minute, also the whole day. Finally, back to 1-minute again, this time a closeup of the immediate prelude to crashing lock limit, the power crash bar and most interestingly the subsequent trading at lock limit down price. We have here a leaky lock limit, (purposely?) allowing trades at the worst price possible. Notice, throughout the day, down moves accompanied by distinctive bursts of volume, with the final crash bar toward (but not hitting) lock limit has the most volume of the day (104 trades). The second most volume was the very first minute of the day, the red candle at far left (72 trades). Curious action just subsequent to lockdown, volume spike of 47 flanked on both sides by 15's in the first few minutes. Then continued trickle of trades until closing. More later!

Great stuff hayman!

For sure the Monday early trade will be extremely wild regardless of how cold it gets early on Sunday.

I'm seeing forecast for some 6 mph North wind perhaps coinciding with the lowest temperatures forecast. Seems wind accelerates freezing, obviously on the windward side of the fruit. I vaguely recall a lively Market Forum debate on wind chill and freezing of plant leaves that JoeK weighed in on loudly. Argument was made that wind dispels frost formation. The Dew Point may be the most important factor in potentiating damage. "Dew point, the temperature at which saturation has been reached, when water vapor condenses into water. The lower the dew point, the more danger of cold damage to your plants."

THE FORECASTING OF DEW METEOROLOGIST JEFF HABY

"In calm freezes, the citrus fruit will begin to freeze from the stem end down to the blossom end. In windy freezes, the fruit will begin to freeze on the wind exposed side of the fruit."

How Do Citrus Growers Determine Freeze Damage?

A city by the name of FROSTPROOF in Southern Florida may get the chance to prove it or not

Frostproof, FL Detailed Forecast

How Much Cold Can Your Citrus Trees Handle?

Frostproof hourly forecast with dewpoints and wind

https://www.marketforum.com/forum/topic/80421/#80915

We just watch the observations at this point, models dont matter as much this close to the event.

It's called NOW casting.

https://www.marketforum.com/forum/topic/80421/#80918

Technically, NOW casting is only for 6 hours out but you can see things farther out than that using NOW casting(in my experience).

https://en.wikipedia.org/wiki/Nowcasting_(meteorology)

This type of forecast therefore includes details that cannot be solved by numerical weather prediction (NWP) models running over longer forecast periods.

With regards to your source, Jeff Haby..........he's the best for learning about meteorology, bar none!

https://www.marketforum.com/forum/topic/79941/#80013

| THE COOLING EFFECTS OF SURFACE SNOW COVER |

METEOROLOGIST JEFF HABY

https://www.theweatherprediction.com/habyhints/207/

If you really want to learn a ton of great stuff about meteorology, this guy is one of the best!

THE ULTIMATE WEATHER EDUCATION WEBSITE

WEATHER PREDICTION EDUCATION AND RESOURCES

http://www.theweatherprediction.com/

HABY'S WEATHER FORECASTING HINTS

http://www.theweatherprediction.com/habyhints/

Not sure if this map will update automatically here like most of the other maps ones above.

I guess we'll find out in the next hour!

We need temps to drop to 28 for 4 hours or 26 for 2 hours to start some damage in the orange groves.

There's still potentially 9 hours or so left that could see the temps drop.

https://www.usairnet.com/weather/maps/current/florida/temperature/

You might think that there is a bunch of missing data in the SouthCentral parts of Florida. Actually, it's from the Everglades:

https://study.com/academy/lesson/everglades-national-park-facts-location.html

Thanks hayman! I agree.

What's interesting, doing some NOW casting is that dew points have fallen off of a cliff.....into the teens and even single digits below.

The models moderate the air mass overnight by almost 10 degrees vs 24 hours earlier.

It's possible that if we keep the winds from bringing in any marine air the next 24 hours and keep pockets of the extremely dry air in place in southcentral FL overnight that calm winds and ideal radiation cooling could cause a severe inversion near the surface and some spots that drop well down into the 20's.

I'm just saying its possible because of the very dry soils that are less likely to evaporate moisture today into the surface layer to moisten up this air mass.

However, I suspect that dewpoints may jump back closer to freezing overnight in many places and limit how low the temps can get.

If the timing of the air mass had been around 12 hours sooner or later, I think temps could have been at least 5 degrees colder with this event.

Everything has to be timed so perfectly with freeze events in Florida.

Dewpoint of 9 degrees last hour at Kissimmee FL below.

https://w1.weather.gov/data/obhistory/KISM.html

| weather.gov |

| Kissimmee Gateway Airport |

| Enter Your "City, ST" or zip code |

| metric |

| Max. | Min. | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Air | Dwpt | 6 hour | altimeter (in) | sea level (mb) | 1 hr | 3 hr | 6 hr | ||||||||||

| D a t e | Time (est) | Wind (mph) | Vis. (mi.) | Weather | Sky Cond. | Temperature (ºF) | Relative Humidity | Wind Chill (°F) | Heat Index (°F) | Pressure | Precipitation (in.) | ||||||

| 30 | 10:56 | NE 8 | 10.00 | Fair | CLR | 48 | 9 | 20% | 44 | NA | 30.36 | 1028.1 | |||||

| 30 | 09:56 | N 14 | 10.00 | Fair | CLR | 45 | 8 | 22% | 39 | NA | 30.36 | 1028.2 | |||||

| 30 | 08:56 | N 5 | 10.00 | Fair | CLR | 41 | 23 | 49% | 38 | NA | 30.35 | 1027.8 | |||||

| 30 | 07:56 | Calm | 10.00 | Fair | CLR | 31 | 27 | 85% | NA | NA | 30.33 | 1027.3 | |||||

| 30 | 06:56 | Calm | 10.00 | Fair | CLR | 30 | 25 | 36 | 29 | 82% | NA | NA | 30.31 | 1026.5 | |||

| 30 | 05:56 | Calm | 10.00 | Fair | CLR | 30 | 26 | 85% | NA | NA | 30.28 | 1025.4 | |||||

| 30 | 04:56 | Calm | 10.00 | Fair | CLR | 31 | 26 | 82% | NA | NA | 30.26 | 1024.9 | |||||

| 30 | 03:56 | NW 5 | 10.00 | Fair | CLR | 34 | 25 | 70% | 29 | NA | 30.26 | 1024.8 | |||||

| 30 | 02:56 | Calm | 10.00 | Fair | CLR | 34 | 25 | 70% | NA | NA | 30.26 | 1024.8 | |||||

| 30 | 01:56 | Calm | 10.00 | Fair | CLR | 34 | 25 | 70% | NA | NA | 30.26 | 1024.9 | |||||

| 30 | 00:56 | NW 3 | 10.00 | Fair | CLR | 36 | 25 | 44 | 34 | 64% | NA | NA | 30.26 | 1024.9 | |||

| 29 | 23:56 | W 5 | 10.00 | Fair | CLR | 36 | 25 | 64% | 32 | NA | 30.27 | 1025.0 | |||||

| 29 | 22:56 | W 5 | 10.00 | Fair | CLR | 35 | 25 | 67% | 31 | NA | 30.25 | 1024.6 | |||||

| 29 | 21:56 | NW 5 | 10.00 | Fair | CLR | 38 | 23 | 55% | 34 | NA | 30.25 | 1024.5 | |||||

| 29 | 20:56 | W 3 | 10.00 | Fair | CLR | 40 | 20 | 45% | NA | NA | 30.23 | 1023.6 | |||||

| 29 | 19:56 | NW 6 | 10.00 | Fair | CLR | 41 | 20 | 43% | 37 | NA | 30.20 | 1022.9 | |||||

| 29 | 18:56 | N 8 | 10.00 | Fair | CLR | 44 | 15 | 52 | 44 | 31% | 39 | NA | 30.18 | 1022.0 | |||

| 29 | 17:56 | N 12 G 21 | 10.00 | Fair | CLR | 47 | 12 | 24% | 42 | NA | 30.16 | 1021.2 | |||||

| 29 | 16:56 | NW 16 | 10.00 | Fair | CLR | 49 | 18 | 29% | 43 | NA | 30.13 | 1020. | |||||

Yes, single digit dews is crazy wild setup that may enhance tonight"s frosty temperature effects. Personally, I am relieved that the citrus growers did not get frozen hurt. The last thing they need is additional misery, what with reduced crop, incurable greening disease and less than top prices for their efforts. OJ price is technically in a very sustainable bull development, what with the backwardation affording the forward roll and enhanced demand picture due to virus awareness concerns. I think that tonight's possible additional scare, that price tomorrow might not see continued down. Am of the idea that it was concerted manipulation of a thin market to fleece latecomers and flush stops. It was in an instant that price swooped to within a few ticks of down limit. Any stops would have been triggered, but executed at that near limit down price, instead of the intended higher value. Perfect shearing of sheep, verifiable proper correction, skimming the froth off the top. Sure, I'm loaded long, but I could see OJ opening higher and continuing its bull drive. Fib extension and old overhead gap fulfillment points to $1.70's target. Finally, important to note that Monday, despite being the beginning of the week, actually is the final day of the month. thereby we could expect some volatile realignment squaring to complete the respective monthly Japanese candle for all commodities. I have indications that Cocoa could have a run of over 100 points higher Monday and that Rice may finally join the power bull trend of the rest of the grains with a very pronounced display. Thank you for so comprehensively blanketing this frost/freeze event with your warm meteorological wisdom!

It's always the most fun sharing with somebody that understands what's being shared.......and responds back in kind!

I'll have to look back to see when this freeze event occurred but we were at the old house so it was prior to 1999 and I called it my birthday present from the market.

My birthday is Feb. 5.

The week before, the models were actually just the one and only model( the MRF-medium range forecast model) was showing a major freeze event for most of FL on Feb. 5.

I loaded up on the Oj with large double digit contracts(I'll have to check my records, all in pen/pencil from those days).

The first day the freeze was impressive on the extended maps on the open.

The was THE low of the week before the freeze, which came on the following Monday morning, I think. So not even a penny drawdown and those are the kind of trades which made trading fun when I had weather that only insiders had in those days.

Every day thru Friday, the market traded higher, dialing in more risk premium as the event got closer and more likely and not moderating, if anything looking even colder.

I had decided to NOT hold it to see if there was a freeze because by Friday, all the speculators EXPECTED a freeze. The cat was out of the bag by then end of the week and I traded Oj EVERY Winter back in the good old days and knew that only an event that far exceeded expectations would cause even more upward movement.

Also, most of the crop had/has been harvested by Feb, if I remember correctly and I knew that a Feb freeze is not nearly as powerful as one a month or more earlier to damage many more oranges still on the trees.

So I got out on Friday near the close and on the highs of the week. Watching some extreme cold temps the morning of the freeze and watching all the news reports on the financial news networks, with pictures of icicles on oranges and stuff like that before the open, made me wish that I'd stayed long but was still thinking "this is what all the traders knew was going to happen and now the talking heads are all reporting it"

I don't remember where we opened, maybe it was close to unch. I think this was 9:30am for OJ back then. Within a few minutes we went to lock limit down and I was the happiest guy on earth for his birthday present the week before for the freeze event on Feb. 5th.

The rest of the day, I remember the talking heads all saying that the OJ market is totally screwed up. All these potential major damage reports with widespread temps in the lower 20's all the way south and OJ lock limit.......DOWN the entire day.

Because the market KNEW before they did and traded it the week earlier.

So the reason to bring this up is that the current market might have KNOWN there would be no damaging freeze with this event ON FRIDAY.

It's possible, that the confirmation of what it knew already could result in the market going higher on Monday.

You are better in touch with the funamentals of the current market than me but I'm just stating what MIGHT happen this time.

So as to not sound like I'm bragging with that huge profit.

In the Winter of 2002/3 I think it was over the New Years weekend, I think because we didn't open until Tuesday(long weekend) I was long 200 contracts and the extra day after no freeze created an extra months worth of intense stress on me trying to decide what to do on the open.

Fortunately, I picked some good prices and the market had really bullish fundamentals and there was almost no risk premium in the market for the freeze, which is why I sort of gambled that it might get colder and be a bullish surprise.

I was in almost daily contact with greenman that Winter(which is why I think it was 02/03) and he was totally fascinated wanting to know what my plan would be to get the heck out of 200 contracts of March OJ.

I honestly was not sure. For non OJ traders, that's $15,000/c.

My account size was half a million in those days and I had a couple of massive grain losses by holding over the weekend 2 times during the previous decade so I wasn't sheeting my pants, just realizing how dumb it was to gamble over a long weekend, hoping it would get colder and having no escape because the event would happen before the market opened back up.

So I didn't want to just put in a market order of that size on the open. It might cause the market to open 10c lower. I really didn't know. That would be a 150,000 loss.

I put in several orders to sell at different prices lower, maybe the lowest was 5c lower and most of them got filled at the highest price with a loss of just over 60K.

I was cool with that and immediately accepted it, especially since the OJ closed much lower than where I got out and as you know hayman............sometimes the most important part of a trade is WHAT YOU DID LAST!

I kept the loss from being 100+ K by taking the punishment like a humble man on the open for being wrong.

Most selling prices were all near the high of the day.

The dew point has popped way back up to around freezing as suspected which eliminates any outside chance of surprise 20s tonight.

I wouldn’t be shocked if you end upright tomorrow on the price.

The lock limit down on Friday And no freeze may cause early pressure but if you’re right things could reverse with some good buying.

A few temperatures down near freezing to 3 stations at 30 degrees here at 3am EST.

Not likely to be 28 for 4 hours or 26 for 2 hours but it going to be fairly close again.

This is a frozen shot, not updated of 3am temps.

https://www.usairnet.com/weather/maps/current/florida/temperature/

Perfect, nobody gets hurt, neither oranges nor their farmers. But a very exciting weekend where Mama Nature flexed her winter muscles yet was merciful. Got to worrying that a damaging freeze would instantly make available tons of oranges that would need immediate processing into juice, thereby knocking price down first before recovering. Still think that Friday was a deliberate skinning of latecomers by "allowing" them exit throughout most of the day, but only by paying up the equivalent of a full limit per contract. Only thing that makes sense. Supply issues are unprecedented, weakest crop since World War II. Quality hurt by greening disease, an unstoppable plague for over a decade with no hope in sight. Commercial pressure to "sell the farm" never been more fierce and monetarily attractive. I saw them offer the limit down bid, not interested. My average on the 5 tracts is about $1.38, yes, I accumulated early and proper. Problem being, I paid myself almost daily with the profits, leaving scarcely over margin, betting on smooth bull rise. And on OJ's flare top intraday Thursday where it thrust to $1.64, I jumped and used those open profits to quickly buy the 3 May Cocoa! So I came into Friday with a small margin call. Right now my initial margin requirement is just over 20 Grand and my total account equity is less than half that, some $9800 and change. Margin desk fears me, that's why I keep such close touch so they don't erase me.

Why does the margin desk fear you?

Hopefully, things will turn around.

If I go over margin at the end of the day they suspend my day trading buying power.

It’s X4 on day trades so I can load up ....but I never do like the old days.

Turned into a chicken.. too much fear.