Here's the previous thread that smashed all records for number of posts because it's not been updated. Sorry you had to scroll so far for so long!

NG March contract 1/30/22

124 responses |

Started by tjc - Jan. 30, 2022, 6:32 p.m.

Wednesday's close:

Natural gas futures continued to retreat sharply midweek in yet another display of the market being largely disengaged from fundamentals. After bouncing back to a $7.410 intraday high, the May Nymex gas futures contract settled Wednesday at $6.937/MMBtu, down 23.9 cents from Tuesday’s close. June futures slid 21.2 cents to $7.065. At A Glance: Talk…

metmike: Hard to believe that the short squeeze on Monday spiked prices above $8.2, highest since 2008, before the fracking was really gushing supplies in.

https://www.macrotrends.net/2478/natural-gas-prices-historical-chart

Temps last week for this morning's EIA report. Cold West to Upper Midwest(especially N.Rockies)-where not many people live.

Mild TX and Northeast, where alot of people live. Look for a bearish number.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 21, 2022 Actual 53B Forecast 37B Previous 15B

VERY BEARISH!

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 21, 2022 | 10:30 | 53B | 37B | 15B | |

| Apr 14, 2022 | 10:30 | 15B | 15B | -33B | |

| Apr 07, 2022 | 10:30 | -33B | -26B | 26B | |

| Mar 31, 2022 | 10:30 | 26B | 21B | -51B | |

| Mar 24, 2022 | 10:30 | -51B | -56B | -79B | |

| Mar 17, 2022 | 10:30 | -79B | -73B | -124B | |

| Mar 10, 2022 | 11:30 | -124B | -117B | -139B | |

| Mar 03, 2022 | 11:30 | -139B | -138B | -129B | |

| Feb 24, 2022 | 11:30 | -129B | -134B | -190B | |

| Feb 17, 2022 | 11:30 | -190B | -193B | -222B | |

| Feb 10, 2022 | 11:30 | -222B | -222B | -268B | |

| Feb 03, 2022 | 11:30 | -268B | -216B | -219B |

https://ir.eia.gov/ngs/ngs.html

for week ending April 15, 2022 | Released: April 21, 2022 at 10:30 a.m. | Next Release: April 28, 2022

+53 BCF VERY BEARISH!

Note the blue line below, showing how that storage is very low, even for this time of year!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/15/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 04/15/22 | 04/08/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 238 | 229 | 9 | 9 | 323 | -26.3 | 290 | -17.9 | |||||||||||||||||

| Midwest | 304 | 293 | 11 | 11 | 420 | -27.6 | 376 | -19.1 | |||||||||||||||||

| Mountain | 89 | 90 | -1 | -1 | 118 | -24.6 | 102 | -12.7 | |||||||||||||||||

| Pacific | 169 | 169 | 0 | 0 | 209 | -19.1 | 190 | -11.1 | |||||||||||||||||

| South Central | 650 | 617 | 33 | 33 | 808 | -19.6 | 785 | -17.2 | |||||||||||||||||

| Salt | 201 | 186 | 15 | 15 | 255 | -21.2 | 249 | -19.3 | |||||||||||||||||

| Nonsalt | 449 | 431 | 18 | 18 | 553 | -18.8 | 536 | -16.2 | |||||||||||||||||

| Total | 1,450 | 1,397 | 53 | 53 | 1,878 | -22.8 | 1,742 | -16.8 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,450 Bcf as of Friday, April 15, 2022, according to EIA estimates. This represents a net increase of 53 Bcf from the previous week. Stocks were 428 Bcf less than last year at this time and 292 Bcf below the five-year average of 1,742 Bcf. At 1,450 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

1. Very low storage

2. Prices and ng crunch in Europe....increased demand for US exports

3. Strong positive seasonals in April

4. Highest US price since late 2008.

5. Changing policies of Biden administration. Going from trying to kill ng off a year ago to being more favorable because of the energy crisis(that was inevitable with fake green energy "attempting to" replace efficient, reliable and abundant fossil fuels)

Higher prices at the tail end of Winter and in the early Spring are extremely likely in most years. They were inevitable this year.

After the spike above 8.2 on Monday and drop to 6.7 this morning, natural gas has become almost impossible to trade right now.

In fact, we went from 7+ to 6.703 after the EIA report, a drop of over $3,000/contract in less than 5 minutes.

There are times when I have traded NG on weather. And may come again when a hurricane forms in the gulf.

But right now, the weather, nor storage balance, except for Europe (rolling eyes!), doesn't mean anything in the market. US exports to Europe are meaningful to Europe right now. Weather be damned.

Front month, May NG expires on Wednesday, the 27th. Crazy things came happen the few days before expiration but it will be almost impossible to out-crazy last week mega spike to the highest price in over 10 years on Monday to almost 8.2 vs the May NGK contract, then closing on Friday, before 6.5.......17,000+/contract lower than that high!

Natural gas futures volatility continued ahead of contract expirations this week, with the May Nymex contract up early as freeze-offs in the Rockies over the weekend dented production. The prompt month traded in a nearly 50.0-cent range before settling Monday at $6.669/MMBtu, up 13.5 cents from Friday’s close. June futures rose 14.2 cents to $6.805.…

++++++++++++++++++++++++++++

Early Tuesday:

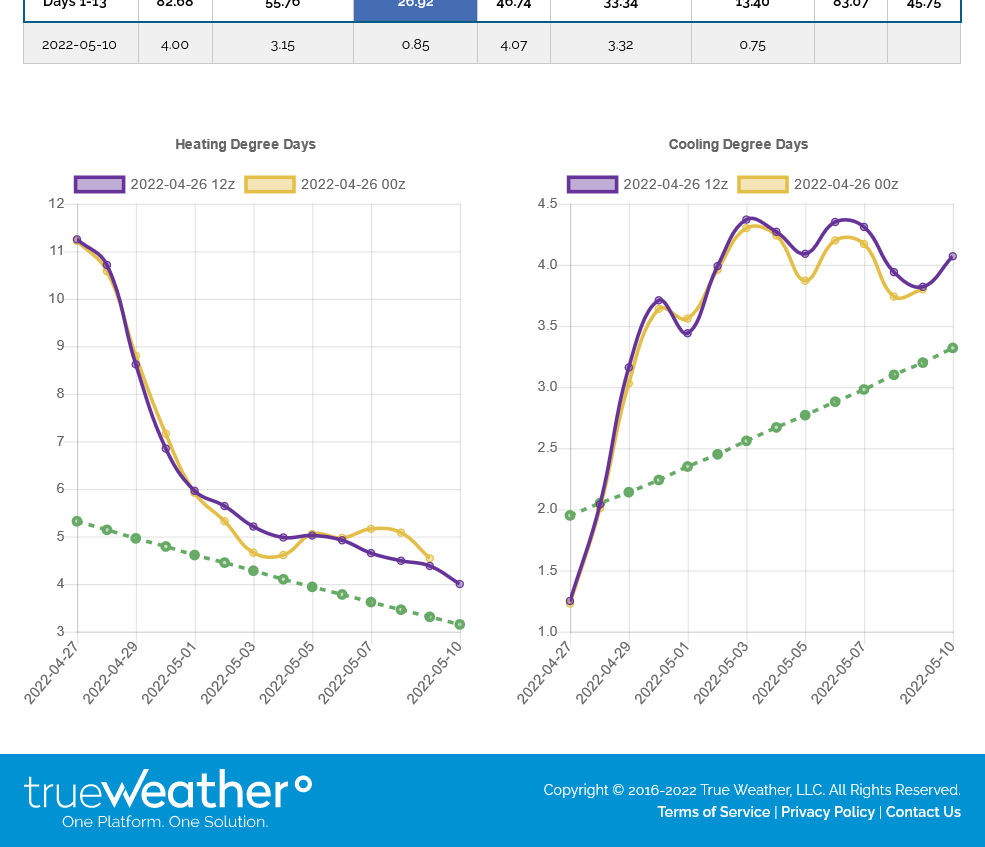

metmike: CDD's will pass up HDD's after May 9th, which is now 13 days away, so weather is usually not a huge factor here.

However, the cold over the next 2 weeks will be focused on the north(where HDD's are greatest) and heat will be focused on the south(where CDD's are greatest) giving us an unusually high amount of total DD's for this time of year. That's probably a minor factor but worth noting.

Seasonals are still strong and the front month expires tomorrow are other more important factors..........and of course pretty low storage for this time of year.

Related to the HDD/CDD comment on the previous page:

https://www.marketforum.com/forum/topic/78385/#78393

Highs for days 3-7:

Natural gas futures traders hit the pedal Tuesday, accelerating price gains after the latest production data showed another sharp decline in output. Contract expirations also played into intraday volatility along the Nymex curve, ultimately pushing the May contract up 18.1 cents to $6.850/MMBtu. June futures climbed 17.3 cents to $6.978. Spot gas prices also strengthened…

metmike: Regarding the point that I made on the previous page of elevated HDD's and elevated CDD's simultaneously occurring, that rarely happens.........but usually only at this time of year or in the Fall, when HDD's are getting ready to overtake CDD's.

The market is expecting a HOT Summer along with ALL the seasonal forecasts pointing towards that(with the weakening but still present La Nina). This would gobble up a great deal of ng to use to burn/generate electricity for cooling.

metmike: Front month May expires in a few hours!

metmike: Between 6am and Noon, NG shot up $5,000/contract. On what? Nothing I can identify but maybe there was news from a source I don't know about.

Natural gas gapped higher this evening on the open and has added 1,000/contract to those gains, up almost 2,500/contract.

I'm not sure why.

CDD's, seasonally pass up HDD's on May 9th but in THIS forecast, we have more CDD's than HDD's.

In fact, we have +11 HDD's vs average and at the same time +21 CDD's above average. That's a bit unusual and because the heat is focused in the South(with the above avera CDD's) and the chill is focused in the North(with the above HDD's).

Regardless, starting in week 2, the amount of CDD's will be trivial and we can assume at this point that any cold in the forecast will become increasingly bearish and heat, increasing bullish until this fall, when it flips back again.

It's possible that the above temps in todays forecast are part of the bullish ammo feeding natural gas right now.

Get all the comprehensive weather on the recently updated weather page here....and continue to enjoy living in the time of human history that has blessed us with the technology to be able to have all these products at our fingertips!

https://www.marketforum.com/forum/topic/83844/

If your wife is like mine, your own CDD's, begin a week or two before the average. Just because she requires meat hanging temps in the house. LOL! Of course, we live in AL. So it always begins early anyways for me.

As for the market, we still have Ukraine to consider. And Russia is still making headway, albeit slowly. Ukranian resistance is high, and climbing.

It would also seem that there is an internal war going on in Russia as well. Various generals getting fired and replaced. A question of if Putin is actually receiving accurate information. Soldiers of various ranks, who are not up for the fight, for one reason or another.

I know you prefer to trade based on weather. But right now, weather isnt the only concern. And I will be the first to admit, that figuring out which way the market will go, even in intraday trading, has become very difficult due to the variety of factors, weather being only one of them, being considered.

Thanks Mark!

Yes, my wife loves is cool in the Summer and warm in the Winter and I actually turn the heat/AC off when she's gone during the day.

She's accepted 64 in the cold season and 76 in the hot season though, so it's not too ba when she's here.

Here's the latest comprehensive weather.

My wife likes 64 these days, due to the "woman's disease". But that's when I build a raging fire in the fireplace. Because I like 75+. Perhaps its because I have worked outdoors most of my life. And have acclimated to 95 degree summers. So the house at 68 degrees, is freezing cold to me.

Nonetheless. NG trading has moved beyond our shores. And beyond weather. The arctic occilations don't mean danged a thing, when the pipeline to Europe is blocked by war.

May 2, 2022

metmike: So apparently it was from the increasing CDD's in the forecast and speculation of it being a sign of things to come. A couple of weeks ago, after he had the short squeeze, panic buying spike higher buying exhaustion that took the price to 8.2, then plunged well below $7, I never thought we would climb back this fast.

metmike: Pretty amazing bull move the last few days. Was today a double top with last months high? I wouldn't count on it with this amount of strength. We're up another $5,500/contract at the moment and down to just over $8 from the highs.

It appears that it's impossible to know how high we might go in this environment.

$10? $12? Who knows, not me.

PS-I noted the last European model was +7 CDD's.

Temperatures for this Thursday's EIA:

Revised/corrected: Cold N.Plains/Upper Midwest to Northeast and farther west. Mild southern half, especially S.Plains.

Natural gas futures continued to rocket higher in early trading Wednesday as forecasts advertised potential record early-season heat regionally, exacerbating supply concerns. Coming off a 47.9-cent rally in the previous session, the June Nymex contract was up another 46.8 cents to $8.422/MMBtu at around 8:50 a.m. ET. Prices as of early Wednesday had advanced beyond…

metmike: Yep. First big heat ridge of the season coming in week 2! European model was up another +4 CDD's overnight! https://www.marketforum.com/forum/topic/83844/

Natural gas futures rallied a fourth consecutive day – and for a seventh time in eight sessions – as both domestic and global supply concerns intensified while signs of robust summer demand accumulated. The June Nymex gas futures contract spiked 46.1 cents day/day and settled at $8.415/MMBtu. July rose 44.7 cents to $8.472. At A…

metmike: https://www.youtube.com/watch?v=J2hI3-KvYZY

https://en.wikipedia.org/wiki/The_5th_Dimension

We needed some music for this natural gas bull party (-:

Actually, this might be more appropriate for consumers right now (-:

https://www.youtube.com/watch?v=MAMgEmsddpU

Here is a wonderful version of these Hans Zimmer greats at the film music concert in Vienna/2012:

https://www.youtube.com/watch?v=cIk-Kxw_7Kc

https://www.youtube.com/watch?v=7F9UKWk7Y4Q

I love “Up, Up, and Away”! Was a very young kid when it was released.

Thanks Larry!

the guidance had less heat overnight and after new highs in the evening had some spikes lower and volatility.

if the guidance continues with less heat and the EIA is bearish, we could have a short term high in.

Thanks Larry!

the guidance had less heat overnight and after new highs in the evening had some spikes lower and volatility.

if the guidance continues with less heat and the EIA is bearish, we could have a short term high in.

https://ir.eia.gov/ngs/ngs.html

for week ending April 29, 2022 | Released: May 5, 2022 at 10:30 a.m. | Next Release: May 12, 2022

+77 BCF...bearish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/29/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 04/29/22 | 04/22/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 253 | 238 | 15 | 15 | 330 | -23.3 | 319 | -20.7 | |||||||||||||||||

| Midwest | 324 | 309 | 15 | 15 | 440 | -26.4 | 401 | -19.2 | |||||||||||||||||

| Mountain | 92 | 90 | 2 | 2 | 123 | -25.2 | 110 | -16.4 | |||||||||||||||||

| Pacific | 176 | 171 | 5 | 5 | 223 | -21.1 | 205 | -14.1 | |||||||||||||||||

| South Central | 721 | 681 | 40 | 40 | 833 | -13.4 | 838 | -14.0 | |||||||||||||||||

| Salt | 233 | 215 | 18 | 18 | 263 | -11.4 | 268 | -13.1 | |||||||||||||||||

| Nonsalt | 489 | 467 | 22 | 22 | 570 | -14.2 | 570 | -14.2 | |||||||||||||||||

| Total | 1,567 | 1,490 | 77 | 77 | 1,949 | -19.6 | 1,873 | -16.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,567 Bcf as of Friday, April 29, 2022, according to EIA estimates. This represents a net increase of 77 Bcf from the previous week. Stocks were 382 Bcf less than last year at this time and 306 Bcf below the five-year average of 1,873 Bcf. At 1,567 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release May 05, 2022 Actual77B Forecast68B Previous40B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| May 05, 2022 | 10:30 | 77B | 68B | 40B | |

| Apr 28, 2022 | 10:30 | 40B | 38B | 53B | |

| Apr 21, 2022 | 10:30 | 53B | 37B | 15B | |

| Apr 14, 2022 | 10:30 | 15B | 15B | -33B | |

| Apr 07, 2022 | 10:30 | -33B | -26B | 26B | |

| Mar 31, 2022 | 10:30 | 26B | 21B | -51B | |

| Mar 24, 2022 | 10:30 | -51B | -56B | -79B | |

| Mar 17, 2022 | 10:30 | -79B | -73B | -124B | |

| Mar 10, 2022 | 11:30 | -124B | -117B | -139B | |

| Mar 03, 2022 | 11:30 | -139B | -138B | -129B | |

| Feb 24, 2022 | 11:30 | -129B | -134B | -190B | |

| Feb 17, 2022 | 11:30 | -190B | -193B | -222B |

metmike: The market is focused on the upcoming heat and concerns about low storage.

The last 12z European model was another -3 CDD's but it also was +1 HDD's.

I'm thinking that the market at this moment, is not counting a few CDD's here and there but instead is LOOKING AT THE HOT OVERALL PATTERN.

In other words..........so what if this or that model adds or subtracts X number of CDD's. If the NEW pattern is staying hot overall..........those model variations don't mean diddly squat when it comes to how much natural gas will be used/burned in the month of May to generate electricity for AC/cooling demand.

From yesterdays close:

Natural gas futures flirted early with a loss for the first time this week on the heels of a bearish storage report but quickly turned a corner and rallied again on Thursday as traders fixated on supply/demand imbalances. The June Nymex gas futures contract settled at $8.783/MMBtu, up 36.8 cents day/day. July rose 36.9 cents…

metmike: It's Friday after Noon. Instead of $10, we went back to $8. Is it because the weather models turned cooler in the PATTERN? Beats me. But we went up 20,000/contract in 2 weeks thru yesterday(a greater range than for many entire years in the past) and are down 7,000/contract just today(a greater range than many entire months in the past)

metmike: Insane week considering the often, fairly quiet time of year and total amount of degree days.

Latest run of the GFS going out just over 2 weeks, shows:

HDD's are going to be around +7 compared to average.

CDD's are +35 vs average.

This is a total of +42 Degree Days, which is around +10 DD's, all in CDD's compared to early in the week.

In January, +42 HDD's vs average is moderately bullish and a gain of +10 HDD's over several days is slightly bullish but the monumental gains thru Thursday were way overdone based on the actual amount of extra ng demand based on numbers this small.

The market is obviously mega sensitive and way OVER reacting to weather and other news.

Seasonally, this is exactly where CDD's pass up HDD's in a typical year.........which this one is not.

The market has been mostly focused on the CDD's all month from the upcoming early heat wave and relatively high confidence(for a seasonal weather outlook) forecast for a hot Summer.

The question is whether this weeks heat ridge is the beginning of the new, La Nina induced pattern that gradually takes over and builds/strengthens this Summer?

I'm really not sure what the pattern will be late this month.

metmike: NG has crashed lower since then. Down 9,000/contract in just the last 3 hours.

It's almost impossible to trade right now.

Natural gas futures floundered for a second consecutive session on Monday, as speculative buyers moved to the sidelines following a colossal bull run to start May. A catalyst for that rally – weak production – showed signs of recovery, easing concerns about inadequate supplies to meet extreme heat-driven demand in the South. The June Nymex…

metmike: After rallying well over 20,000/contract in around 2 weeks, we dropped 20,000 in just a couple of days. That range..........going way up and back down is much greater than the range for entire years in many of the trading years of the past.

When we spiked to 8.2 last month from what looked like a short squeeze, then dropped around 14,000/contract, I thought the highs were in.......Then we shot up more than 20,000 to almost 9.0 pretty quickly and are back down.

Are the highs in now?

If we don't have extreme, sustained(lasting weeks) heat in the high population areas, I'll guess YES!

Big spike down after 7 am to lowest in a month, almost 6.4 then, since just before 8am, in 2 hours we're up 9,000/contract to 7.3.

The last 6z GFS added 11 CDD's, which means the POTENTIAL that this 6.430 was the low of the month but only if the heat increases on all the other models runs for the rest of the week.

Since these INSANE price gyrations have resulted in Larry/WxFollower leaving trading (very understandibly) its seems unlikely that we'll be treated to his very insightful observations any more or even him reading these posts )-:

Temps for the EIA report that was just released:

Cold Midwest = +HDD's

Hot south/southeast = +CDD's

So it was bullish

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

https://ir.eia.gov/ngs/ngs.html

for week ending May 6, 2022 | Released: May 12, 2022 at 10:30 a.m. | Next Release: May 19, 2022

+ 76 BCF bullish........this is the time of year of the biggest injections

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/06/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 05/06/22 | 04/29/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 274 | 253 | 21 | 21 | 345 | -20.6 | 341 | -19.6 | |||||||||||||||||

| Midwest | 342 | 324 | 18 | 18 | 456 | -25.0 | 419 | -18.4 | |||||||||||||||||

| Mountain | 96 | 92 | 4 | 4 | 130 | -26.2 | 115 | -16.5 | |||||||||||||||||

| Pacific | 183 | 176 | 7 | 7 | 233 | -21.5 | 215 | -14.9 | |||||||||||||||||

| South Central | 749 | 721 | 28 | 28 | 854 | -12.3 | 865 | -13.4 | |||||||||||||||||

| Salt | 241 | 233 | 8 | 8 | 268 | -10.1 | 276 | -12.7 | |||||||||||||||||

| Nonsalt | 507 | 489 | 18 | 18 | 586 | -13.5 | 589 | -13.9 | |||||||||||||||||

| Total | 1,643 | 1,567 | 76 | 76 | 2,019 | -18.6 | 1,955 | -16.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,643 Bcf as of Friday, May 6, 2022, according to EIA estimates. This represents a net increase of 76 Bcf from the previous week. Stocks were 376 Bcf less than last year at this time and 312 Bcf below the five-year average of 1,955 Bcf. At 1,643 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| May 12, 2022 | 10:30 | 76B | 79B | 77B | |

| May 05, 2022 | 10:30 | 77B | 68B | 40B | |

| Apr 28, 2022 | 10:30 | 40B | 38B | 53B | |

| Apr 21, 2022 | 10:30 | 53B | 37B | 15B | |

| Apr 14, 2022 | 10:30 | 15B | 15B | -33B | |

| Apr 07, 2022 | 10:30 | -33B | -26B | 26B |

metmike: The 0Z GFS was -6 CDD's vs the previous one and we spiked down overnight. Mainly with was from the heat ridge not as strong from TX to the south. This may have caused HRW priced to drop also.

18z GFS was a massive +10 CDD's vs the previous 12z run. We had a small spike up when that was first coming out but have settled back towards the lows/open which were not long after the open.

That could mean that if the forecast turns cooler, we might find some good selling pressure if additional heat is unable to push us higher here.

Or, it could mean that traders are waiting for the overnight models because those are the ones that will matter the most.

I've been saddened this week to know that WxFollower has given up on trading natural gas because of the spikes that dishonest traders use to manipulate the market so often using computer algorithm's that cause crazy gyrations meant to take out other honest traders who use stops or other orders to lessen their risk.

I hate to hear that also. I sometimes faded you for his outlook. ;-)

However. I understand the frustration. The machine traders have been able to throw a few glitches in the market. And even with the simple, passive technical trading systems, it has even caused problems as well. And there are some traders, maybe machine operators, that do the opposite of what we are expecting, in order to shake the market up, knock out opposition, etc. I'm not big enough to even dream of being able to do such. But I understand the concept.

But it hasn't been all bad for me. I'm mostly a technical trader, that checks the fundamentals as a backup. And sometimes makes use of fundamentals to predict actions ahead. But when there is an unexpected spike on the minute chart, I know that this is usually triggered by someone big enough to make it happen. So I adapt. I catch what I can of the trade, until it reaches exhaustion levels. When the run has reached exhaustion levels, I know that whoever made the run happen, is about to reverse position, and try to average out with a profit, on the way back. It's a strategy that is used in stock trading, and it seems to be heavily used iin commodity trading.

With the advent of machine trading, things have changed in the commodities trading arena. And is also why most of my trades last less than an hour. Yes, I'm a daytrader. I hardly ever hold a position overnight anymore. I go in and snipe trades when I see the setup patterns, and catch the outbreaks. I win more than I lose, because I use stops to lock-in a certain amount of profit. Or loss. Granted, that I don't have big long term profits. But dimes add up to dollars. Whether I make $100/day, or $1000/day. And sometimes I lose $100/day. But in the end, it pays the bills. That's why I''m in this racket.

This reminds me of what a survivalist trainer once said. "Either you adapt, or you die. There is no in between."

This reminds me of what a survivalist trainer once said. "Either you adapt, or you die. There is no in between."

Thanks Mark!

Actually, there are other choices.

1. You can partially adapt and make less money/lose more often than before

2. You can refine your trading to filter out the trades that are causing the most trouble and focus on the ones that are most likely to follow your system.

3. You can choose not to adapt and just not play anymore, like Larry did.

The best thing about trading is that unlike being in the wilderness and trying to survive, YOU pick the trades.

You can do nothing 99% of the time if your want and load up on the 1% of trades which are the highest confidence/least likely to mess you over.

Trading is often like trying to hit a fast, constantly moving target and shooting not at the current position but instead, shooting at where the target will have moved to when your arrow arrives.

Adapting is very important as you mentioned but the markets, when all is said and done .......in the end, still trade the fundamentals.

The greater the supply and less demand, the lower the price will go.

The lower the supply and greater the demand, the higher the price will go.

Knowing how we get there is always the challenge but if you can predict the fundamental changes before the market dials them into the price.........you have the type of edge which gives you potential to consistently make money.

It isn't just manipulation/algos that has been a factor. There are other factors including that it obviously isn't as primarily a US wx market as it used to be. That may actually be a bigger factor. The good news is that when looking at my alltime record it is a solid positive. Don't want to give that back.

Totally agree Larry.

I trade ng with a frequency of less than 5% of what I used to because of the factors that we've discussed.

I keep thinking that I do it to make money/for a living but then think about the time spent following and analyzing vs the reward and remind myself that its more of a fun and challenging hobby that I enjoy sharing with others here.

Grains this Summer have unlimited potential on weather. My last trade was KE/HRW wheat.

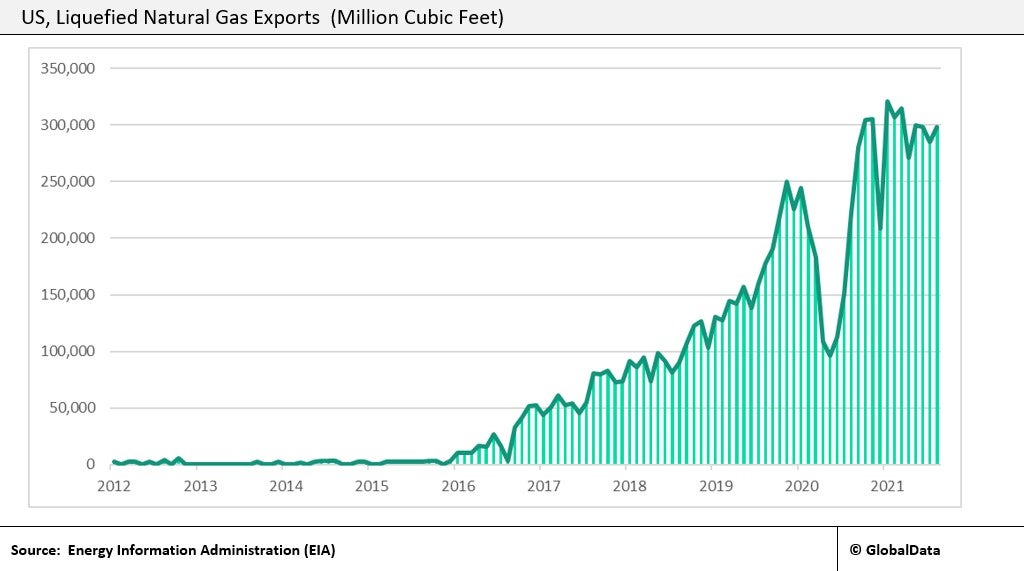

That last point of yours was pretty profound too, Larry. News about NG in Europe from........whatever, with their extremely low supplies and the fact that ng is now GLOBAL instead of the US trading just the US, like it did before we established a huge export market is huge and WILL trump weather at any point when THAT news is big.

https://www.offshore-technology.com/comment/lng-export-capacity-us-2022/

May 16, 2022

metmike: Bipolar ng trading continues! After opening sharply higher last evening, then testing the lows around 6:30am, we suddenly spiked higher by almost +5,000/contract in just 2 hours.

This was followed by a sustained drop of MORE THAN $5,000/contract to NEW LOWS less than 3 hours later to unchanged for the day!

I can totally see why Larry decided to stop trading the natural gas market. It's not tradable and being manipulated by algorithms and speculative money, amongst other things that often dominate the fundamentals/weather.

Indeed, Mike, insane! In addition to algos/manipulation, how much of this wild movement is due to uncertainty about how much LNG will be exported to Europe?

How do the DD comparisons look vs Friday PM and vs Sunday PM? I no longer can follow them and thus have no idea.

The actual CDD's were not much different. However, the CMC, Euro and Canadian models have a very impressive heat ridge, along to east of the Miss River building later in week 2.

The GFS was MUCH cooler with zonal flow, very cool in the north, thru the 0Z model. Then, at 6z, the GFS jumped on board with the heat ridge idea of the other models late in week 2 even though the CDD's were only +2.

I'd say that was what caused the 5,000 spike up with moderate/high confidence........but we quickly sold off to new lows below that by 3 hours later without any new models coming out.

metmike: No. The market sees a huge heat ridge building in week 2. Watch the NWS 8-14 day outlook later today and especially later this week to see them pick up on it.

metmike: The NWS 8-14 day was too cool. Watch it heat up for the rest of the week and quickly spread to the 6-10 day outlook as the heat gets closer.

Big heat coming!

metmike: The market has known about this heat for the last 3 days. It's also expected to arrive in June, from the La Nina Summer forecast. At these prices........how much is dialed in?

If June features intense heat, we can still go much higher. If it surprises and turns cooler, we'll be back below $7. EIA out tomorrow.

Temps from last week for the EIA report tomorrow. Very unusual temp configuration. Chilly West and Southeast. Near record warmth in the middle.

Here comes the heat in week 2. Thursday and Friday should expand it even more in, especially the Central and also the Eastern US.

metmike: Actually, what happened is that overnight CDD's were up(hotter models) and prices shot higher, then the 12z models were not quite as hot and we came back down.

NG spiked lower after midnight when the European model came out less hot in week 2, then came roaring back when the GFS came out the warmest yet several hours later.

Latest Release May 19, 2022 Actual89B Forecast87B Previous76B

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| May 19, 2022 | 10:30 | 89B | 87B | 76B | |

| May 12, 2022 | 10:30 | 76B | 79B | 77B | |

| May 05, 2022 | 10:30 | 77B | 68B | 40B | |

| Apr 28, 2022 | 10:30 | 40B | 38B | 53B | |

| Apr 21, 2022 | 10:30 | 53B | 37B | 15B | |

| Apr 14, 2022 | 10:30 | 15B | 15B | -33B |

https://ir.eia.gov/ngs/ngs.html

for week ending May 13, 2022 | Released: May 19, 2022 at 10:30 a.m. | Next Release: May 26, 2022

+89 BCF neutral to a tad bearish but the market is looking at the big heat in June!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/13/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 05/13/22 | 05/06/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 296 | 274 | 22 | 22 | 356 | -16.9 | 363 | -18.5 | |||||||||||||||||

| Midwest | 364 | 342 | 22 | 22 | 470 | -22.6 | 441 | -17.5 | |||||||||||||||||

| Mountain | 103 | 96 | 7 | 7 | 134 | -23.1 | 121 | -14.9 | |||||||||||||||||

| Pacific | 187 | 183 | 4 | 4 | 245 | -23.7 | 225 | -16.9 | |||||||||||||||||

| South Central | 781 | 749 | 32 | 32 | 884 | -11.7 | 893 | -12.5 | |||||||||||||||||

| Salt | 251 | 241 | 10 | 10 | 278 | -9.7 | 284 | -11.6 | |||||||||||||||||

| Nonsalt | 531 | 507 | 24 | 24 | 605 | -12.2 | 608 | -12.7 | |||||||||||||||||

| Total | 1,732 | 1,643 | 89 | 89 | 2,090 | -17.1 | 2,042 | -15.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,732 Bcf as of Friday, May 13, 2022, according to EIA estimates. This represents a net increase of 89 Bcf from the previous week. Stocks were 358 Bcf less than last year at this time and 310 Bcf below the five-year average of 2,042 Bcf. At 1,732 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

12z guidance so far has been cooler, GFS was -5 CDDs and taken 2,000+ off the price of ng!

There it is!

https://www.marketforum.com/forum/topic/83540/#84572

But the 12z guidance all came up less hot. Euro was a whopping -9 CDDs

metmike: Market is up almost $4,000/contract just 2 hours after that article was sent out. June expires this week and there's still heat for at least part of the forecast with low amounts in storage.

Natural gas futures raced ahead Monday, snapping the two-day slump that closed out the prior week, as U.S. exports gathered more momentum and modest production offset cooler near-term weather forecasts. The June Nymex gas futures contract settled at $8.744/MMBtu, up 66.1 cents day/day. July gained 64.9 cents to $8.827. NGI’s Spot Gas National Avg. rose…

metmike: July natural gas is up to double the volume of June, as June heads towards the last trading day on Thursday. That expiration could have played a big role in today's spike up.

7 day temps for this Thursday's EIA report.

Very warm in much of the country, chilly Northwest to N.Plains. Very close too the La Nina analog.

https://www.marketforum.com/forum/topic/83844/#84287

Natural gas futures were rallying in early trading Wednesday as analysts pointed to tight fundamentals, while the looming Nymex prompt month contract expiration raised the possibility of volatile price action ahead. The expiring June contract was up 36.2 cents to $9.158/MMBtu at around 8:45 a.m. ET. July was trading 35.4 cents higher to $9.190. EBW…

metmike: Again, it's all about June NG expiring tomorrow! It's possible that this coulc be the highs for some time if intense heat doesn't arrive.

GFS Ensemble had -5 CDDs and was part of the $2,500/contract drop in ng price, then the Euro Ens had +5 HDDs and we bounced back $1,000.

On a day like today, ahead of the front month expiration or even a week like this.......using weather to gauge price reactions is like trying to use a magnifier glass to see the forest of trees (-:

Yeah, you might run across some interesting bumps on a tree but the rest of the trees that define the forest might be totally different.

EIA number bullish!

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| May 26, 2022 | 10:30 | 80B | 89B | 89B | |

| May 19, 2022 | 10:30 | 89B | 87B | 76B | |

| May 12, 2022 | 10:30 | 76B | 79B | 77B | |

| May 05, 2022 | 10:30 | 77B | 68B | 40B | |

| Apr 28, 2022 | 10:30 | 40B | 38B | 53B | |

| Apr 21, 2022 | 10:30 | 53B | 37B | 15B |

https://ir.eia.gov/ngs/ngs.html

for week ending May 20, 2022 | Released: May 26, 2022 at 10:30 a.m. | Next Release: June 2, 2022

+80 BCF, 8 less than expected

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/20/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 05/20/22 | 05/13/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 325 | 296 | 29 | 29 | 381 | -14.7 | 388 | -16.2 | |||||||||||||||||

| Midwest | 391 | 364 | 27 | 27 | 495 | -21.0 | 467 | -16.3 | |||||||||||||||||

| Mountain | 109 | 103 | 6 | 6 | 143 | -23.8 | 128 | -14.8 | |||||||||||||||||

| Pacific | 190 | 187 | 3 | 3 | 255 | -25.5 | 235 | -19.1 | |||||||||||||||||

| South Central | 797 | 781 | 16 | 16 | 925 | -13.8 | 921 | -13.5 | |||||||||||||||||

| Salt | 251 | 251 | 0 | 0 | 294 | -14.6 | 292 | -14.0 | |||||||||||||||||

| Nonsalt | 546 | 531 | 15 | 15 | 631 | -13.5 | 630 | -13.3 | |||||||||||||||||

| Total | 1,812 | 1,732 | 80 | 80 | 2,199 | -17.6 | 2,139 | -15.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,812 Bcf as of Friday, May 20, 2022, according to EIA estimates. This represents a net increase of 80 Bcf from the previous week. Stocks were 387 Bcf less than last year at this time and 327 Bcf below the five-year average of 2,139 Bcf. At 1,812 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 80 Bcf natural gas into underground storage for the week ended May 20. The result fell short of market expectations and historic averages, driving Nymex natural gas futures higher. Ahead of the print, the June contract was up 13.1 cents at $9.124/MMBtu. The…

metmike: The market spiked higher after the bullish EIA number but expiration of the June contract and a SHORT SQUEEZE on trapped shorts was what we traded this week.

As soon as June expired, we dropped another 2,500/contract in 30 minutes, even with +2 CDDs on the GFS, down $8,000 from the spike highs immediately after the report.

The amount of heat in the 2 week forecast, never came close to justifying the 15,000 or so rally this week(from lows to highs).

Today will look like a double top with the 9.437 high from yesterday. As mentioned then, I think it will take much more heat in the forecast to surpass that.

It can happen, especially with the low injection number and Biden (signalling that he will ship) some of our natural gas to Europe and trying to discourage new ng investment money in the US with his legislation.

Mike said:

"It can happen, especially with the low injection number and Biden shipping our natural gas to Europe and trying to discourage new ng investment money in the US with his legislation."

-------------------------------

Mike,

I'd like to address the bolded. I realize that he's encouraging it and maybe I'm getting technical, but does Biden actually have the power to do what I bolded? I had wondered about that in another thread (I think a week or two ago). Consider David Blackmon's opinion in this Forbes article:

"In order to dramatically increase its capacity to export more LNG to Europe, the U.S. industry would need to invest billions in additional pipeline and export infrastructure to move and handle the added volumes of natural gas."

"In 2021, EIA data cited by Inside Climate News shows that roughly 75% of U.S. LNG exports flowed under contracts to Asia and other non-European nations. While that mix no doubt shifted somewhat during the 4th quarter as the energy crisis in Europe accelerated, the reality is that, in our system of free enterprise, it is the contractual relationships, not the federal government, that will decide where the LNG flows."

Thanks Larry, you are right and I was just reading an article like that one to post here from another source to try to figure out how that would work.

It appears that the government would have limited power to FORCE this on a private industry but its not clear.

Your article is pay walled. Here's another one. I adjusted the statement above accordingly.

https://www.mei.edu/publications/biden-administration-promises-us-lng-europe-how-does-work

A large decline in production fueled a rebound in natural gas futures midweek, with lower wind generation providing additional market support. The July Nymex contract settled Wednesday at $8.696/MMBtu, up an astounding 55.1 cents on the day. August futures climbed 54.8 cents to $8.686. Spot gas prices also rallied on robust power burns, with NGI’s…

metmike: Once again, more evidence of what happens when you rely on wind turbines (or solar panels) to generate electricity. When the wind doesn't blow and sun doesn't shine.........you can't generate power/electricity. Reliable fossil fuels are there 24 hours/day, 365 days/year.

Energy insecurity, supply shortages..........high prices(especially when we have a low amount of ng in storage, like we do currently). Fake green energy is also anti-environmental!

EIA Bearish

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jun 02, 2022 Actual 90B Forecast 86B Previous 80B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jun 02, 2022 | 10:30 | 90B | 86B | 80B | |

| May 26, 2022 | 10:30 | 80B | 89B | 89B | |

| May 19, 2022 | 10:30 | 89B | 87B | 76B | |

| May 12, 2022 | 10:30 | 76B | 79B | 77B | |

| May 05, 2022 | 10:30 | 77B | 68B | 40B | |

| Apr 28, 2022 | 10:30 | 40B | 38B | 53B |

https://ir.eia.gov/ngs/ngs.html

for week ending May 27, 2022 | Released: June 2, 2022 at 10:30 a.m. | Next Release: June 9, 2022

+90 BCF Bearish

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/27/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 05/27/22 | 05/20/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 357 | 325 | 32 | 32 | 409 | -12.7 | 418 | -14.6 | |||||||||||||||||

| Midwest | 420 | 391 | 29 | 29 | 519 | -19.1 | 494 | -15.0 | |||||||||||||||||

| Mountain | 113 | 109 | 4 | 4 | 150 | -24.7 | 133 | -15.0 | |||||||||||||||||

| Pacific | 195 | 190 | 5 | 5 | 266 | -26.7 | 245 | -20.4 | |||||||||||||||||

| South Central | 817 | 797 | 20 | 20 | 955 | -14.5 | 948 | -13.8 | |||||||||||||||||

| Salt | 248 | 251 | -3 | -3 | 299 | -17.1 | 297 | -16.5 | |||||||||||||||||

| Nonsalt | 569 | 546 | 23 | 23 | 656 | -13.3 | 651 | -12.6 | |||||||||||||||||

| Total | 1,902 | 1,812 | 90 | 90 | 2,299 | -17.3 | 2,239 | -15.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,902 Bcf as of Friday, May 27, 2022, according to EIA estimates. This represents a net increase of 90 Bcf from the previous week. Stocks were 397 Bcf less than last year at this time and 337 Bcf below the five-year average of 2,239 Bcf. At 1,902 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

7 day temps last week for EIA.

Very warm East Coast/Southwest, chilly in the center.

On June 1st, an article from NGI had this:

"Energy Aspects pointed out that with heat building, particularly in the southern United States, the market may have already seen its peak injection for the season at 89 Bcf."

--------

It only took the next EIA report (at +90) to exceed the prior season high injection of 89. Also, we'll have to see how the infamous Memorial Day EIA week goes. On average that week has had the largest injection by a good margin. This year had above average heat (CDDs). So, the EIA may not be as big as the +90 of the prior week. We'll see.

Larry couldn't take not trading ng and is back (-:

Totally kidding. It's wonderful to read your always insightful thoughts.

Actually, I just looked at the weather models for the first time since late Wednesday Night-sick wife since then- and holy cow..........the building heat ridge in week 2 is EXTREMELY impressive!

New NG thread: