mm,

Just throwing this article out there

Richard Snow, Analyst

The Doji candlestick, or Doji star, is a unique candle that reveals indecision in the forex market. Neither the bulls, nor bears, are in control. However, the Doji candlestick has five variations and not all of them indicate indecision. That is why it is crucial to understand how these candles come about and what this could mean for future price movements in the forex market.

This article explains what the Doji candlestick is and introduces the five different types of Doji used in forex trading. It will also cover top strategies to trade using the Doji candlestick.

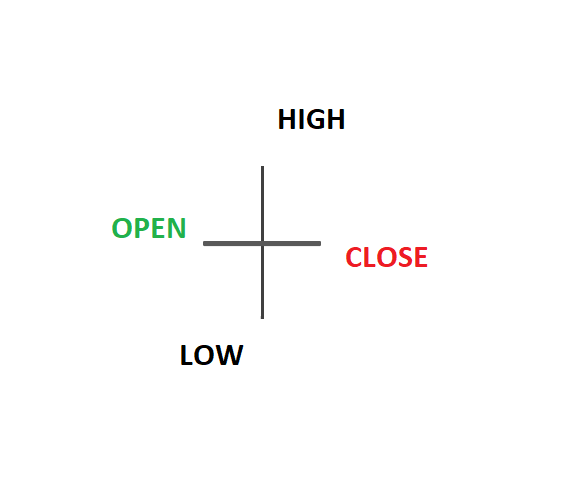

The Doji candlestick, or Doji star, is characterised by its ‘cross’ shape. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. Generally, the Doji represents indecision in the market but can also be an indication of slowing momentum of an existing trend.

The Doji star can prove invaluable as it provides forex traders with a “pause and reflect” moment. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. Traders may view this as a sign to exit an existing long trade.

However, it is important to consider this candle formation in conjunction with a technical indicator or your particular exit strategy. Traders should only exit such trades if they are confident that the indicator or exit strategy confirms what the Doji is suggesting.

Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. Therefore, it is crucial to conduct thorough analysis before exiting a position.

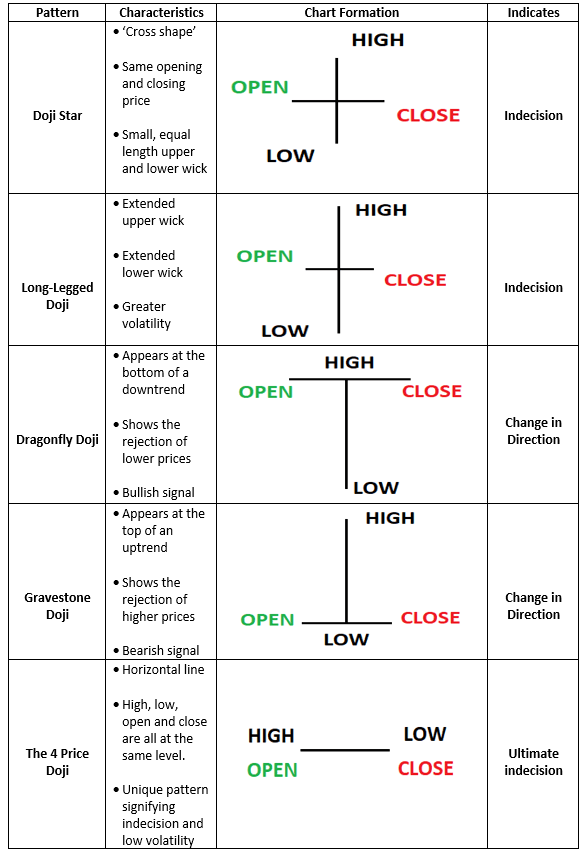

Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. While the traditional Doji star represents indecisiveness, the other variations can tell a different story, and therefore will impact the strategy and decisions traders make.

Furthermore, it is very unlikely to see the perfect Doji in the forex market. In reality, traders look for candles that resemble the below patterns as closely as possible and more often than not, the candles will have a tiny body. Below is a summary of the Doji candlestick variations. For an in-depth explanation read our guide to the different Types of Doji Candlesticks.

There are many ways to trade the various Doji candlestick patterns. However, traders should always look for signals that complement what the Doji candlestick is suggesting in order to execute higher probability trades. Additionally, it is essential to implement sound risk management when trading the Doji in order to minimise losses if the trade does not work out.

Below we explore various Doji Candlestick strategies that can be applied to trading.

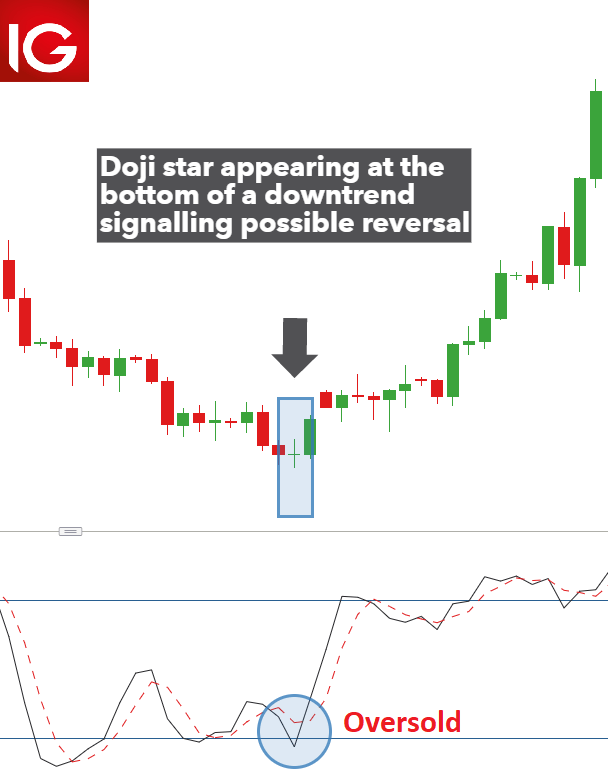

1) Trading with the Doji star pattern

The GBP/USD chart below shows the Doji star appearing at the bottom of an existing downtrend. The Doji pattern suggests that neither buyers or sellers are in control and that the trend could possibly reverse. At this point it is crucial to note that traders should look for supporting signals that the trend may reverse before executing a trade. The chart below makes use of the stochastic indicator, which shows that the market is currently in overbought territory – adding to the bullish bias.

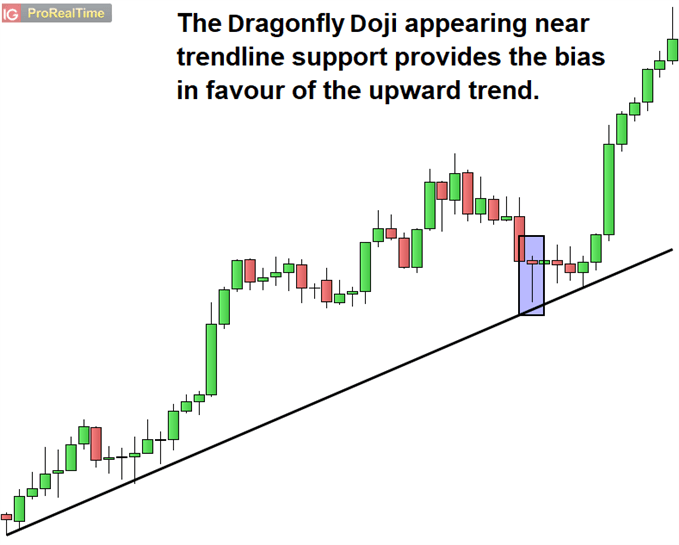

2) Using the Dragonfly Doji in Trend Trading

A popular Doji candlestick trading strategy involves looking for Dojis to appear near levels of support or resistance. The below chart highlights the Dragonfly Doji appearing near trendline support. In this scenario, the Doji doesn’t appear at the top of the uptrend as alluded to previously but traders can still trade based on what the candlestick reveals about the market.

The Dragonfly Doji shows the rejection of lower prices and thereafter, the market moved upwards and closed near the opening price. This potential bullish bias is further supported by the fact that the candle appears near trendline support and prices had previously bounced off this significant trendline.

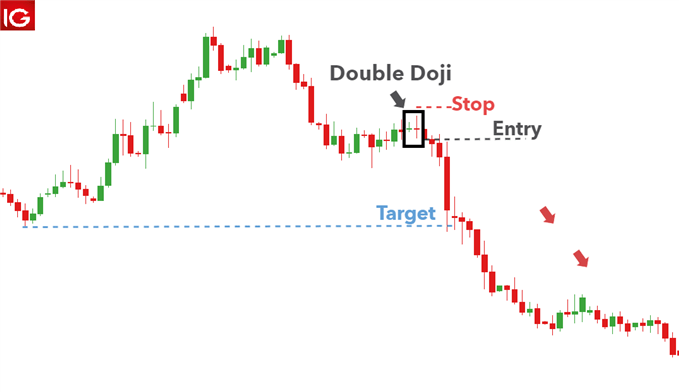

3) Double Doji Strategy

A single Doji is usually a good indication of indecision however, two Dojis (one after the other), presents an even greater indication that often results in a strong breakout. The Double Doji strategy looks to take advantage of the strong directional move that unfolds after the period of indecision.

Traders can wait until the market moves higher or lower, immediately after the Double Doji. In the GBP/ZAR chart below, the entry point can be below the low of the two Dojis with a stop placed above the highs of the two Dojis.

Targets can be placed at a recent level of support however, breakouts with increased momentum have the potential to run for an extended period of time hence, a trailing stop should be considered.

Thanks VERY much John!

I totally forgot the awesome discussion that we were having on this topic.

Candlestick chart patterns

Started by metmike - May 6, 2022, 10:23 p.m.

https://www.marketforum.com/forum/topic/84136/

This discussion shows some high probability candlestick chart patterns. I like reversal patterns alot!

https://www.investopedia.com/articles/active-trading/092315/5-most-powerful-candlestick-patterns.asp

This was the one with the highest probability below:

:max_bytes(150000):strip_icc():format(webp)/The5MostPowerfulCandlestickPatterns1-30019e515b6a4ed485b04ab2cfe26157.png)

The bullish three line strike reversal pattern carves out three black candles within a downtrend. Each bar posts a lower low and closes near the intrabar low. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. The opening print also marks the low of the fourth bar. According to Bulkowski, this reversal predicts higher prices with an 83% accuracy rate.