It's clear fundamentals are not driving the train right now because this would likely not ensue after the most bullish possible U.S. soybean acreage on Thursday. Market is in liquidation mode, backed by ongoing worries about the economy.

Full circle. CBOT November #soybeans plunge over 4% on Friday to settle at $13.95-1/4 per bushel - basically IDENTICAL to the same date a year ago ($13.95-1/2).

It might just be my perception, but as I understand it, the weather was supposed to be bearish this weekend, but I’m not impressed. I haven’t seen any real rains over the corn belt in the last couple days. We got a little spit here on Friday night, in NE Ohio. Enough to settle the dust.

https://water.weather.gov/precip/

how is the weekend weather shaping up? as predicted ? bullish or bearish? what are the next levels of support in dec wheat and corn? thoughts?

wow you must have read my mind jim m lol

Rains so far were less than expected.

Here's all the weather:

https://www.marketforum.com/forum/topic/83844/

Rains:

https://www.iweathernet.com/total-rainfall-map-24-hours-to-72-hours

+++++++++++++++++++++++++++++++++++

https://www.marketforum.com/forum/topic/83844/#86689

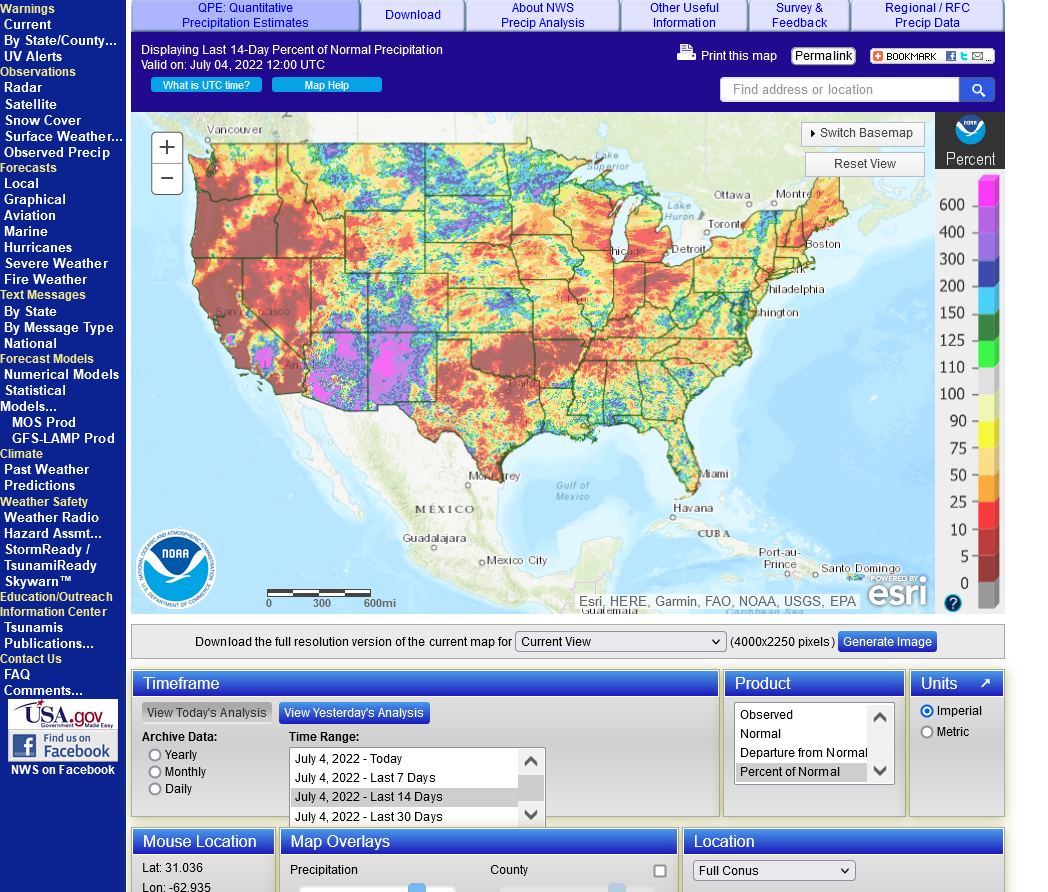

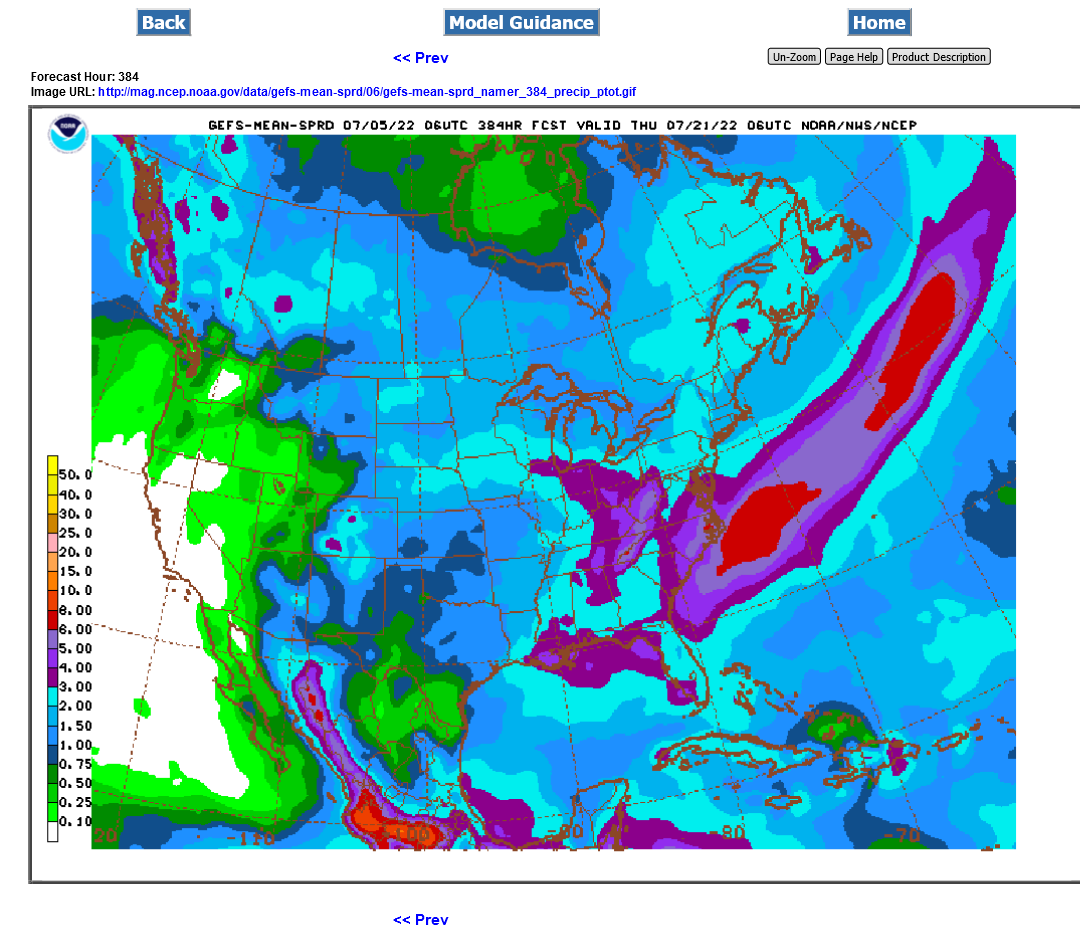

Huge rains for much of the Cornbelt coming up.

However, the southwestern Cornbelt is in some trouble. Depends on where exactly the heat ridge completely shuts down the rains butthe cut off will be but KS/MO and points south, possibly into s.IL/sw.IN.

Looks great for Jim in ne.OH!

Crop ratings will fall on Tuesday. In some states without much rain, possibly BIG drops.

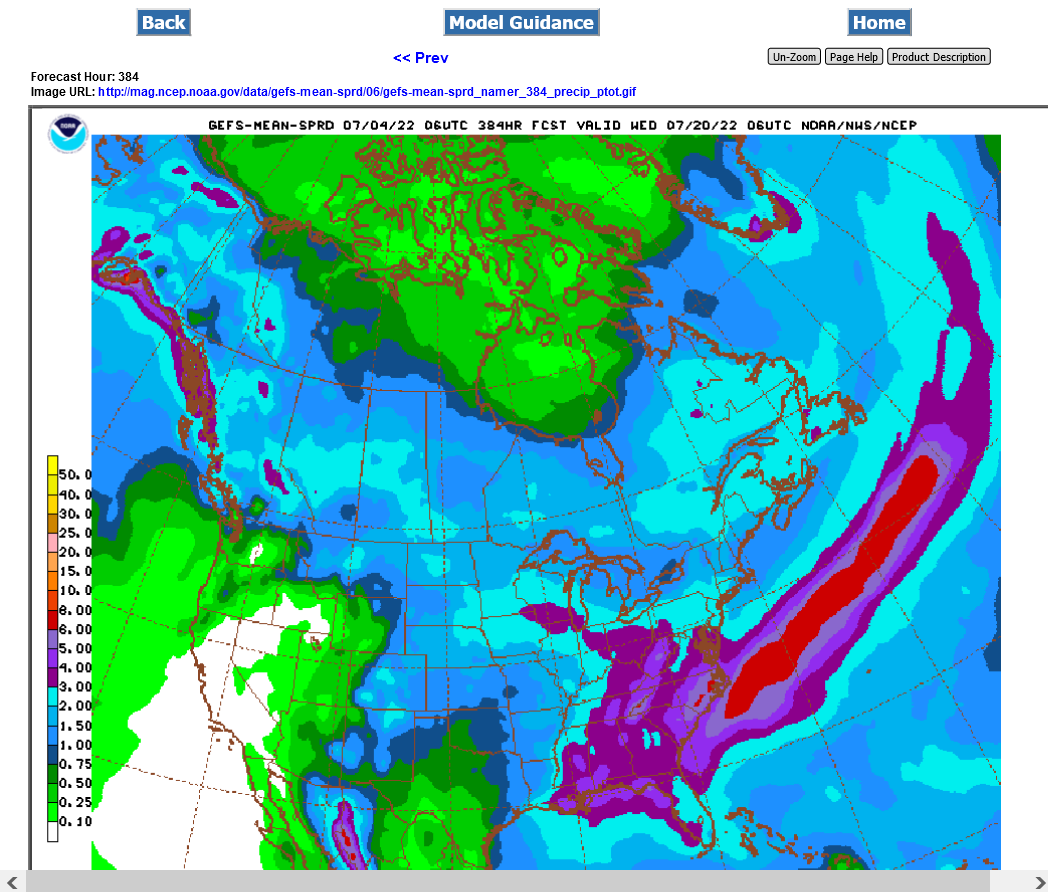

Rains the last 7 days

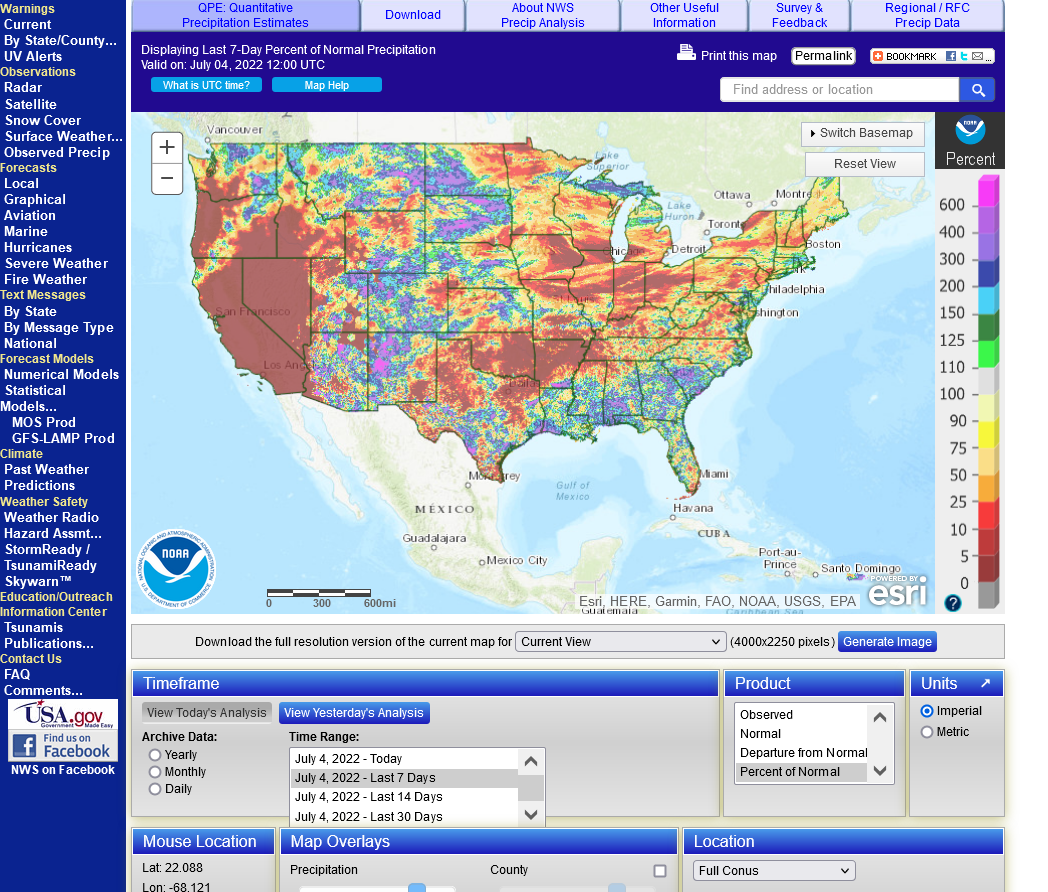

Rains the last 14 days

Rains the last 30 days

Temps were on the cool/mild side last week, which will keep the drops from being too excessive:

In our part of the corn belt which is less than 1/4 of IA Corn has been showing heat stress even on what is considered cooler temps

Hasn't rained more than a couple of times for 1/10" for all of June

Even part of our corn at the outer limits of where we farm got 2/10" and corn did not respond except when it was actually raining

Corn is starting to get yellow tinge, plus blue tinge showing roots can't use nitrogen and moisture stress

Golly corn is not doing very well here

Beans that got planted early are still growing

Later planted have stopped growing, possibly due to roots not able to find moisture

We have a chance of rain tomorrow which if enough or a change in rain trend, could still give an average crop

Thanks Wayne!

Best rain amounts look to be south of you but hopefully, you'll get a big rain from one of these numerous events.

The week 2 part of the forecast may dry out more but with temperatures starting out on the cool side.

I will guess that grains start HIGHER.

Less rain than expected and crop ratings will be dropping for sure tomorrow.

Seasonally, they often drop 1% or even 2% this time of year but I'm guessing they will drop double that number..

I see now that grains don't open until 8:30 am Tuesday/tomorrow.

3+ inch rains coming to the very dry eastern Cornbelt on the last 6z GFS ensemble!

2 inches IA/NE.

Last NWS 7 day rain forecast added a ton of rain too. Bright red is 3"+.

Southwest cornbelt could be in big trouble though.

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Other models are not this wet, especially for the southwest cornbelt.

Get all the weather here:

Crude down $8 which is helping to put pressure, as well as the cat is out of the bag on the recession(which was inevitable)

Decent rain event right now in some extremely dry spots.

Crude off its highs and back below $100.

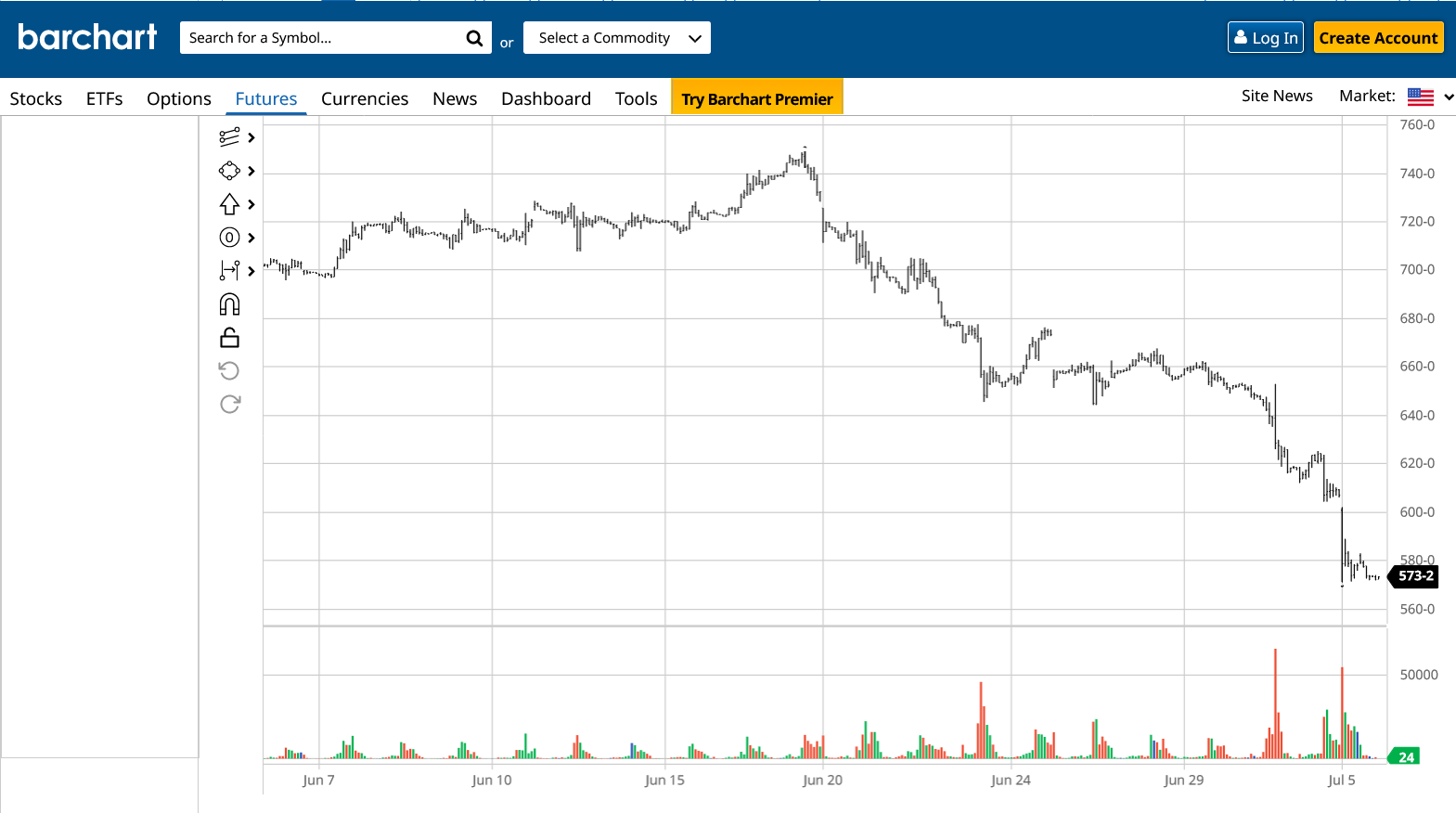

I don't see "crashing grain prices". Unless you see the new highs as the norm. Which they may become. While wheat and soybeans have seen a drop, corn has not.There might be a shift in the protein crops.

I don't see "crashing grain prices". Unless you see the new highs as the norm. Which they may become. While wheat and soybeans have seen a drop, corn has not.

What planet are you on Mark?

https://www.barchart.com/futures/quotes/ZCZ22/interactive-chart

December Corn chart for the last month below.

As long as crude doesn’t keep dropping the lows are probably in.

The gap lower on tuesday morning, instead of a bearish downside beak away gap could end up being a selling exhaustion gap.

still a lot of potential rain on the way in dry areas the next week

Crude down sharply again today, so funds are covering more long positions in grains.

If the weather models are correct, the rain events will not be as plentiful after this week and the weather will go from bearish to bullish.

However it will be dry and COOL.

Cool is quite bearish for corn which offsets the bullishness of dry.

The lows should be in before the end of the week, unless the weather models for week 2 change or crude REALLY plunges.

After we get thru the next couple of big rains events, the remaining rains in the forecast will no longer be enough to pressure the grains.

New rains in week 2 that aren't there now would change that and it's very possible that will happen(or the forecast turn even cooler in week 2) but all things remaining the same, the lows should be in by the end of the week.

I like revisiting old graphics because sometimes it doesn't take all that long for the story to flip. Other times it takes years. I posted this in April 2020 when CBOT #corn was chasing its first sub-$3 since 2009. Front-month dropped to $3.00-1/4 per bushel on April 29.

+++++++++++++++++++++++++++

Exactly 2 years later, on Apr. 29, 2022, front-month #corn hit a high of $8.27 per bu, the sixth highest for any session on record and not far off the 2012 high of $8.43-3/4.

++++++++++++++++++++++++

Front-month July #corn is in delivery, so this chart in a few days will gap down as Sep becomes the front month. July settled at $7.44-1/4 per bushel Wed. Most-active Dec corn on Wed settled at $5.85 per bu, up 6.5c on the day. Contract has shed 20% in less than 3 weeks.

Corn earlier this evening had a small gap HIGHER on the open.

the low tonight has been 586.5.

this looks like a very bullish upside breakaway gap.

Sorry for the typo's earlier. When busy trading I was focusing on that.

It sure appears the July 4 weekend created a low!

This low is in the 25th week, but the lead contract low will be next week when July expires. Thus, a "normal" timeframe for a weekly cycle.

Cycle low would suggest 3-5 week rally (another weather scare upward retracement?)

Three day rule (Friday or Monday no trade) appears to have "worked".

The rain event in the Central Cornbelt may be putting pressure on the grains.

Yes, the rains appear to be the reason:

Corn 17c and beans 20c off the early session highs.

The gap lower on Tuesday morning, as speculated above has been filled and is now serving as a potential "gap and crap" selling exhaustion formation on the price charts for the corn.

However, we just barely filled the gap and came back down. For this to be a valid formation, we must be trading ABOVE THE TOP of the gap.

For beans, all we did was test the bottom of the gap (left between the lows last Friday and the open/highs on Tue) with today's highs.

Getting back up to the bottom of that gap required a +70 rally in just 1 day(from the lows yesterday), which is extremely impressive in light of the Tuesday collapse that wasn't too far from limit down.....FOR THE BEANS.

Many traders watch the price charts for direction.

In a weather market, the price charts react to the changing weather forecast.

When you see signatures like this on price charts, you think it's predicting the weather and would be right but it's actually the markets reaction AFTER the weather forecasts changed.

The weather forecast or rain on the radars almost always changes FIRST, then traders react with buying and selling based on those changes.

There are other factors that impact prices, especially in today's world but if it's a mainly weather market(like grains are in July-key production time frame for growing crop).........the weather will be the main driver of price.

Seasonals/historical prices are very negative in July as the crop gets 1 day closer to being made every day and 1 less day left to damage it.

Also, funds had mega longs going into the growing season and have been liquidating. They could still be in that mode?

Other markets and the economy that impose a strong bearish/bullish mentality on all the markets on some days are also a factor.

And the outlook for the rest of July, after this week to be mostly dry can change, almost overnight.

In the past, I lost the most money in July than other months by being extremely bullish Friday afternoon, loaded up and the weather models flipped to being very bearish and we gapped MUCH lower on the open the following week.

Another thing. If the maps turned extremely bullish over the weekend, the beans could gap much higher on Sunday night and ABOVE the top of the gap referred to above.

This would leave a very bullish, weekly island reversal bottom on price trading on the charts.

But that is not my prediction, just a potential outcome.

Here's an example of a bearish island/top:

https://www.investopedia.com/terms/i/islandreversal.asp

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Island_Reversal_Aug_2020-02-018c391240e54aa58a31a246122f20cd.jpg)

Here's a better illustration of the price chart pattern for where beans are(corn is the same but we touched the top of the gap today).

I would NOT use their trading advice.

I let traders decide for their own what to do.

I would consider buying the open on Sunday Night if there's no rain in the forecast but will not elaborate more than that because tons of things can change and I'm not able to update all of it all the time.

I'm just here to provide very informative, authentic, educational and useful information........for free!

That way, when I'm wrong, I don't have to feel bad about it (-:

You use it how you want to!

https://www.warriortrading.com/island-reversal-pattern/

The GFS increases rain again later in week 2 on the latest models overnight, so this could go back bearish as easily as it could get extremely bullish.

Never get married to a position or trading idea or you'll miss the early signs of being wrong.

In weather trading of commodities, the early bird usually catches the worm..........and also quickly recognizes when it's not really a worm............but instead, a bird eating snake!

", the early bird usually catches the worm..........and also quickly recognizes when it's not really a worm........

worm... what kind of worm ...lol

Good one cutworm!

With today's steep rally, many shorts exited or were stopped out of shorts. I anticipate a setback, but really look for market to then rebound as market may NOT want to be short over the weekend.

To me, low for nov/dec is in

Thanks tjc!

Grains are staying strong, even with decent rains falling in some dry spots........because this is the last of the rain for the current pattern.

https://www.marketforum.com/forum/topic/83844/

Next week starts the new pattern. Much drier but cool.

Week 2 looks to still be mostly dry and heating up for the WCB. Turning pretty bullish, especially in the WCB.

Lows are in unless we come in early next week with the weather models changed a great deal(which does happen) or crude down $10(which still won't cause new lows but will keep us from going much higher).

No change to the weather forecast.The La Nina driven heat ridge could be there for much of the rest of Summer!

Closing above the Tuesdays gap down confirms the gap and crap -selling exhaustion-technical signature on the charts for both c and s, (with c being stronger as it closed the gap on Thursday) as a result of the weather pattern change to much drier next week, then heating up and remaining dry in week 2.

Extremely bullish grains.........as long as the models don't change the next 2 days, it's setting us up for a gap higher on Sunday Night.............all things remaining the same.

https://www.cpc.ncep.noaa.gov/products/predictions/WK34/

This helps explain how filled gaps are buying/selling formations/signatures on a price chart.

Gap and Crap buying exhaustion formation

Started by metmike - Aug. 30, 2019, 6:12 p.m.

Huge gap higher coming for C and S on the open.