07/01 01:48p CST DJ Natural Gas Rises as Freeport LNG Stays in Focus -- Market Talk 1448 ET - Natural gas prices end the session 5.6% higher at $5.730/mmBtu, but finish with a large, 8.7% weekly decline as investors become more pessimistic regarding a restart on a Freeport LNG plant in Texas that's been shut for more than three weeks after an explosion and fire. Federal regulators yesterday said the plant cannot reopen until it gets official approval from them, and that has investors worried bureaucratic red tape could keep the plant shut even if repairs are made. But the company said in response to the regulators' report that it is fully cooperating and it still thinks it can be back to full production by year-end. (dan.molinski@wsj.com) (END) Dow Jones Newswires

Thanks much Larry!

Any thoughts of your own here?

Previous thread:

NG 6/5/22+

62 responses |

Started by WxFollower - June 5, 2022, 8:16 p.m

7 day temps ending last Friday for this next EIA report. Mild in the middle to the Midatlantic. Hot in the West.

You're welcome, Mike.

Here are my thoughts fwiw, which are based on reflections on my many years of trading NG:

1. I traded NG for gains in 72% of years with the cumulative gains in those years 3 times as high as the cumulaive losses in the 28% loss years. So, overall success for sure and making me feel very good about my decision to trade it in retrospect. My longterm broker had even told me that I was by far the best at trading NG of all of his clients.

2. My last solid year in NG was in 2019, which happened to be my best by a good margin.

3. On my last trading day early this year, my longs were stopped out for no good reason from a wx perspective at THE low of the day early in the day. From that moment on, it rose very sharply: closed nearly 40 cents higher that day, 34 cents higher the next day, and 75 cents higher two days later!!

4. Since then, I've been reading market recaps like these in 2022:

02/14 01:48p CST DJ Natural Gas Ends 6.4% Higher on Russia Jitters -- Market

Talk

1448 ET - Natural gas prices jump 6.4% to finish at $4.195/mmBtu, the

highest closing price in nearly a month, as the market gets swept up in

frenzied buying of energy commodities due to the growing belief that Russia

will soon invade Ukraine.02/16 07:43a CST DJ Natural Gas Adds to Big Gains, Up 6% -- Market Talk

0843 ET - Natural gas prices climb 6% to $4.566/mmBtu and are 16% higher

so far this week after dropping by 14% last week. The huge price swings are

becoming commonplace in natural gas markets in recent months, partly due to

Europe's energy crisis over the winter, and more recently due to concerns that

Russia may stop gas shipments to Europe if a military conflict starts with

Ukraine.06/14 08:43a CST *DJ Natural Gas Falls 13% to $7.460 After Freeport LNG Says Full Restart Not Likely Until Late 2022

06/17/22 01:55p CST DJ Natural Gas Prices Fall Sharply On LNG, Broader-Market --

Market Talk

1455 ET - Natural gas prices fall 7% to $6.944/mmBtu, finishing below $7

for the first time since late April. The move also leaves the market with a

large, 22% weekly decline, a drop fueled by an announced, extended outage at

Freeport LNG, an important LNG production and export facility in Texas that was

forced to shut due to an explosion and fire.06/23 12:23p CST DJ Natural Gas Prices Drop 10% as Inventories Rise -- Market Talk 13:23 ET - Natural-gas prices are falling sharply after a weekly EIA report showed a larger-than-forecast increase in gas inventories, which could suggest the shutdown of an important LNG plant in Texas is hurting demand more than analysts were expecting. The front-month July contract was recently down as much as 10% at a session-low $6.175/mmBtu, and if those prices hold it would be the lowest closing price since April 6. Prices have fallen some 33% since Freeport LNG announced a fire and shutdown of its liquefaction plant two weeks ago. The EIA says gas inventories rose by 74B cubic feet last week, which tops forecasts in a WSJ survey for a 66-bcf increase.

06/30 01:55p CST DJ Natural Gas Posts Biggest Decline Since 2003 -- Market Talk 1454 ET - Natural gas prices plunge 16.53% to finish at $5.424/mmBtu, marking the biggest one-day percentage decline since Feb. 27, 2003 as it just barely out-declines a Nov. 15, 2018 drop of 16.52%. The reason for the decline is the Federal government's Pipeline and Hazardous Materials Safety Administration issued preliminary findings on its investigation into the Freeport LNG plant in Texas that had a fire June 8 and has been shut since.

07/01 07:19a CST DJ Volatile Natural Gas Prices Jump 8% After 16% Drop -- Market Talk

5. These stories further show me that my decision to lock in my still overall solid net gains and not risk giving back any more than I had in 2021 and early 2022 was a sound one. Due to NG prices no longer being as dominated by US wx as it had been for decades prior thanks largely to a sharp increase in LNG exports and also somewhat due to unexplained mainly short term moves (what I consider manipulation), I feel better than ever about my decision. I fully realize that US wx is still a major factor in prices and that that will likely be the case especially in winter. On any single day, it can dominate. However, it is no longer dominating with the reliability it used to have. That in combo with my poor performance in 2021 through early 2022 along with only a small NG gain in 2020 thanks to COVID, which really screwed up what would otherwise have been a strong NG year (though it was my best year by far with softs), has told me to avoid the stress by staying away while still being able to reflect back on an overall solid performance.

6. Mike, I know your intentions are very good. But in case you're thinking about it, I'd prefer you not make this a post of the week.

Thanks very much Larry, I had not thought about it but it would have made a great post of the week but TOTALLY understand it being a very personal story that you don't want permanently carved into a library archive for everybody to see every time they go to that link.

I greatly appreciate you sharing that too because it seriously helps me with my own discernment in natural gas trading and confirms many of my own thoughts and frustrations recently.

I'm still trading it but it feels like I'm just gambling and have no rational profit/loss strategy that connects to any successful trading strategies in the past.

My thoughts are to just try to jump in early on a position overnight based on a big change in CDD's, then put in a stop to not lose money on the position, in case crazy news like you displayed hits. Then move the stop up if the position goes in the right direction.

Positional trading based on weather is almost impossible........even without crazy news.

Trading algorithms often trigger strong knee jerk spikes against the direction that market should go from weather and are clearly designed to take out stop loss orders from people trading things like weather............as you noted in one of your great examples.

I've had almost every single great weather call on natural gas end that way this year.

Stopped out with a spike, only to have the market then moves strongly in my directions.

From 1992, when I started with 2K to 2011, when I had all my money vanish (6 figures) on Oct 31st, at MF Global I NEVER used stops. If I was right about the weather, they were not needed. If the weather started to change.............I just got out before the market had a chance to take me out.

In 2002/3 I emailed almost daily with Greenman and local from the forum and spoke to Greenman on the phone numerous times(he always called me)

I shared all my trades. Greenman said that I was the best weather trader in the world!

In July 2002, I made $200,000 trading over 5,000 contracts(after paying 100,000 just in commissions). Lind Waldock was scared s as hell of my trading because I traded in 100 and 200 lots and sometimes 300 lots with corn and never used a stop.

They made a special rule just for me.

Anything over 100 contracts, in beans and 200 lots in corn, they assessed DOUBLE the margin just for me.

They also assigned a phone number, mainly for me and called it the "high rollers hotline". That was nice. I got fills back fast. Electronics is much better but back in those days, fills, especially on the open could take 10 minutes+ to come back.

I appealed the higher margins but to no avail and I had enough equity that it didn't matter anyways, even though I got pretty close to my limits sometimes.

I had some decent years shortly after 2011(by other peoples standards), doubling the account but it was so tiny that when I took money out to pay bills, it drained it back down.

I would call my natural gas trading just a fun hobby in recent years.

I also trade grains and those have also been challenging.

Are you done with trading coffee and cotton, or just ng?

Hey Mike,

You're welcome. I'm not trading any commodities right now.

metmike: Yep, less heat in the forecast compared to late last week. Been getting cooler every day since then.

From last Thursday:

https://ir.eia.gov/ngs/ngs.html

for week ending June 24, 2022 | Released: June 30, 2022 at 10:30 a.m. | Next Release: July 7, 2022

+82 BCF Bearish!

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (06/24/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 06/24/22 | 06/17/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 461 | 430 | 31 | 31 | 509 | -9.4 | 526 | -12.4 | |||||||||||||||||

| Midwest | 535 | 506 | 29 | 29 | 619 | -13.6 | 603 | -11.3 | |||||||||||||||||

| Mountain | 134 | 128 | 6 | 6 | 172 | -22.1 | 158 | -15.2 | |||||||||||||||||

| Pacific | 235 | 231 | 4 | 4 | 243 | -3.3 | 266 | -11.7 | |||||||||||||||||

| South Central | 886 | 875 | 11 | 11 | 1,003 | -11.7 | 1,020 | -13.1 | |||||||||||||||||

| Salt | 242 | 248 | -6 | -6 | 296 | -18.2 | 303 | -20.1 | |||||||||||||||||

| Nonsalt | 644 | 628 | 16 | 16 | 707 | -8.9 | 716 | -10.1 | |||||||||||||||||

| Total | 2,251 | 2,169 | 82 | 82 | 2,547 | -11.6 | 2,573 | -12.5 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,251 Bcf as of Friday, June 24, 2022, according to EIA estimates. This represents a net increase of 82 Bcf from the previous week. Stocks were 296 Bcf less than last year at this time and 322 Bcf below the five-year average of 2,573 Bcf. At 2,251 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jun 30, 2022 | 10:30 | 82B | 74B | 74B | |

| Jun 23, 2022 | 10:30 | 74B | 65B | 92B | |

| Jun 16, 2022 | 10:30 | 92B | 97B | ||

| Jun 09, 2022 | 10:30 | 97B | 96B | 90B | |

| Jun 02, 2022 | 10:30 | 90B | 86B | 80B | |

| May 26, 2022 | 10:30 | 80B | 89B | 89B |

Most of the Freeport LNG shipments this year were going to Europe:

The sudden ~2 Bcf/d glut in domestic supply caused US natural gas prices to retreat and European LNG prices to skyrocket again.

The Freeport facility accounts for roughly 20% of U.S. LNG processing capacity, drawing 2 billion cubic feet per day (bcfd) of natural gas from U.S. shale producers.

A full restart of the facility will not happen until late this year, the company said this week. The outage sent U.S. gas futures down 18% from the price a day before the fire, while European gas prices have surged more than 60%, with an additional boost from less gas on Russian pipelines. r

metmike: Models were HOTTER overnight. The direction of crude appears to be having a strong impact on the direction of NG.

metmike: July is usually a bad month for ng bulls and the forecast was LESS hot too.

Latest Release Jul 07, 2022 Actual60B Forecast74B Previous82B

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jul 07, 2022 | 10:30 | 60B | 74B | 82B | |

| Jun 30, 2022 | 10:30 | 82B | 74B | 74B | |

| Jun 23, 2022 | 10:30 | 74B | 65B | 92B | |

| Jun 16, 2022 | 10:30 | 92B | 97B | ||

| Jun 09, 2022 | 10:30 | 97B | 96B | 90B | |

| Jun 02, 2022 | 10:30 | 90B | 86B |

https://ir.eia.gov/ngs/ngs.html

https://ir.eia.gov/ngs/ngs.html

+60 BCF VERY BULLISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/01/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 07/01/22 | 06/24/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 482 | 461 | 21 | 21 | 520 | -7.3 | 548 | -12.0 | |||||||||||||||||

| Midwest | 562 | 535 | 27 | 27 | 636 | -11.6 | 627 | -10.4 | |||||||||||||||||

| Mountain | 138 | 134 | 4 | 4 | 176 | -21.6 | 164 | -15.9 | |||||||||||||||||

| Pacific | 240 | 235 | 5 | 5 | 246 | -2.4 | 272 | -11.8 | |||||||||||||||||

| South Central | 890 | 886 | 4 | 4 | 993 | -10.4 | 1,023 | -13.0 | |||||||||||||||||

| Salt | 233 | 242 | -9 | -9 | 287 | -18.8 | 297 | -21.5 | |||||||||||||||||

| Nonsalt | 657 | 644 | 13 | 13 | 706 | -6.9 | 726 | -9.5 | |||||||||||||||||

| Total | 2,311 | 2,251 | 60 | 60 | 2,572 | -10.1 | 2,633 | -12.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,311 Bcf as of Friday, July 1, 2022, according to EIA estimates. This represents a net increase of 60 Bcf from the previous week. Stocks were 261 Bcf less than last year at this time and 322 Bcf below the five-year average of 2,633 Bcf. At 2,311 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

In the third weekly surprise in a row, the Energy Information Administration (EIA) reported a 60 Bcf injection into natural gas storage for the week ending July 1. Unlike the previous two weeks, though, the latest EIA data was a hugely bearish whammy. The 60 Bcf injection was about 15 Bcf lighter than estimates ahead…

metmike: All models were HOTTER overnight and we were sharply higher BEFORE the extremely bullish EIA report spiked us up another +$4,000/contract in a flash.

10:29am: I take the back. Only the European Ensemble was hotter by + 2 CDD. The GFS was actually cooler overnight.

Today's EIA was clearly bullish vs recent weeks imho. It was based on the same # of CDDs as two weeks ago, which then yielded a +74 EIA. Also, todays report was based on only 8 more CDD vs last week's EIA and yet today's EIA was a whopping 22 bcf lower. So, bullish vs last 2 weeks. Also, because the report for the week ending 5/20/22 was revised from +80 to +87, that week lost most of its bullishness meaning today's report was the first solidly bullish report of this injection season.

Today's report was a whopping 16 bcf to the bullish vs the WSJ mean poll. That is the most bullish vs that survey since the late December holidays and is the most bullish no holiday week since the 16 bcf bullish miss for the week ending 10/8/21.

Thanks Larry. That was a shocker.

metmike: I'm very unsure of where we go. Uncertainty about the economy. Crude prices, supply dynamics and amount of heat in the forecast, as well as very negative seasons. NG in recent years can have massive spikes up or down unrelated to the weather and you never know when one of them is coming.

Mike said:

"NG in recent years can have massive spikes up or down unrelated to the weather and you never know when one of them is coming."

--------------------------

Though there are also other factors, this by itself is enough to be a deal breaker for me. I'll probably just stick to posting occasional analyses at most when I have some free time, which has been more limited recently, mainly related to the EIA reports. At least doing that can't lose me money.

Thanks Larry!

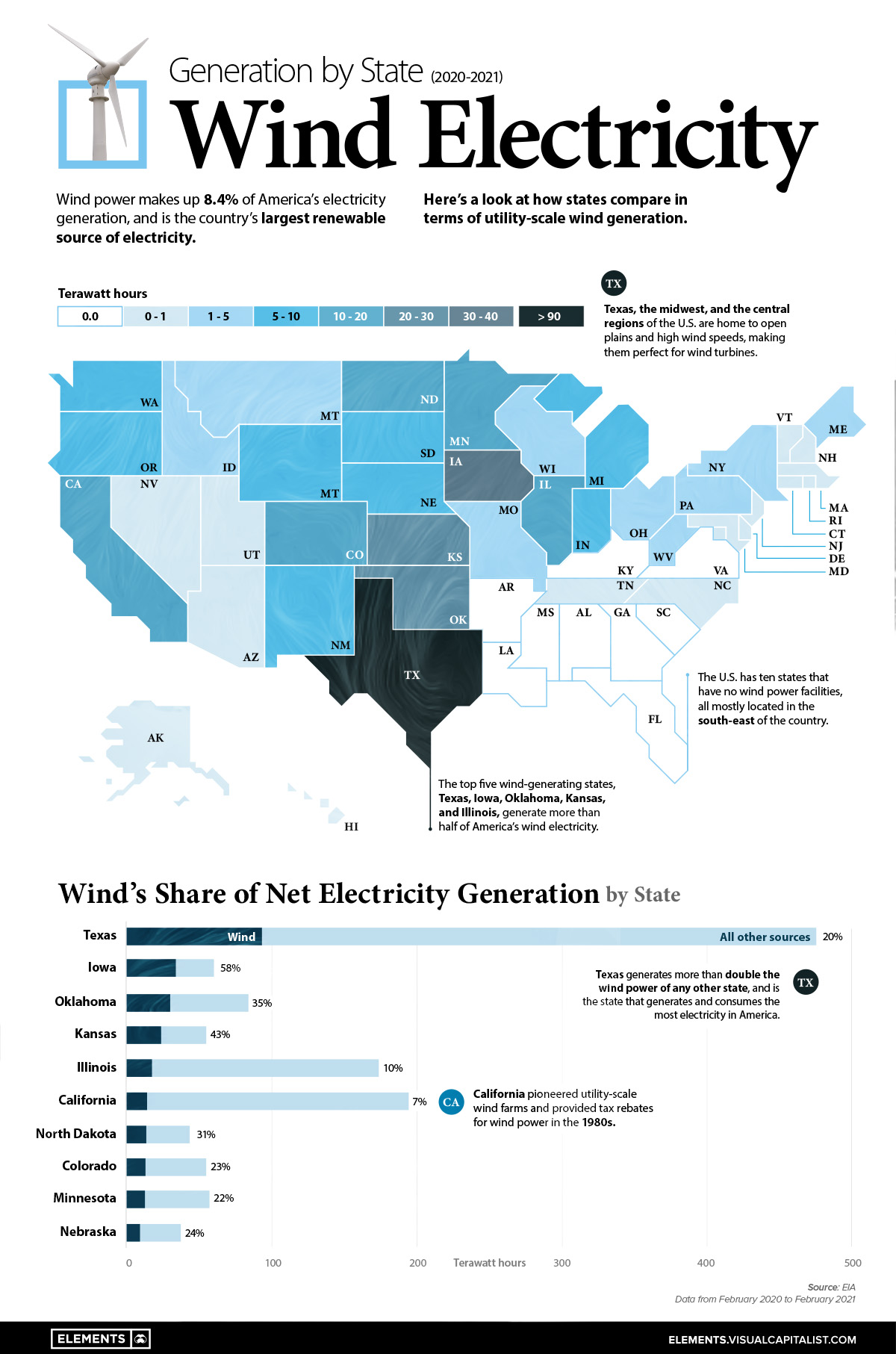

Another key element is that when we have this heat ridge moving into the Plains/WCB later this month, there won't be much wind on the big wind turbine farms to generate electricity.

This could have been why the injection yesterday was so low/bullish...........not much wind!

https://elements.visualcapitalist.com/mapping-u-s-wind-electricity-generation-by-state/

| State | Wind Electricity Generation (Terawatt hours) | Wind's Share of Net Electricity Generation |

|---|---|---|

| Texas | 92.9 TWh | 20% |

| Iowa | 34.1 TWh | 58% |

| Oklahoma | 29.6 TWh | 35% |

| Kansas | 23.5 TWh | 43% |

| Illinois | 17.1 TWh | 10% |

| California | 13.6 TWh | 7% |

| North Dakota | 13.2 TWh | 31% |

| Colorado | 12.7 TWh | 23% |

| Minnesota | 12.2 TWh | 22% |

| Nebraska | 8.7 TWh | 24% |

Data from Feb 2020-Feb 2021

Source: EIA

metmike: That's actually a massive flaw with wind power. During heat waves, when you need to generate massive amounts of electricity for air conditioning, the weather feature that causes the heat waves is a heat dome that kills the wind. So the wind turbines will produce the LEAST amount of electricity during the highest weather demand periods of Summer.

NG just filled the fairly large sized gap from earlier after both the GFS and Euro were quite a bit Less hot at 0z.

ALSO, possibly huge, there will not be much wind in the areas that don't have many people but have many of the wind turbine farms. Less unreliable wind= less energy for electricity = more demand for ng.

It likely was part of the reason for the bullish EIA shocker last Thursday.

Natural gas prices spiked Monday alongside soaring temperatures and potential supply risks. The August Nymex gas futures contract jumped 39.2 cents day/day and settled at $6.426/MMBtu. September climbed 35.2 cents to $6.319. NGI’s Spot Gas National Avg. gained 73.0 cents to $6.785 amid widespread highs in the 90s and 100s to start the

week. More…

metmike: Here's all the weather: https://www.marketforum.com/forum/topic/83844/

A day earlier, the prompt month mounted a 39.2-cent rally.

NGI’s Spot Gas National Avg. on Tuesday ticked up further, coming off a 73.0-cent surge Monday. The average advanced 3.5 cents to $6.820.

Cash prices and futures early in the day were fueled by what AccuWeather described as a dangerous heat dome that spanned much of the Lower 48, delivering highs in the 90s and 100s.

Additionally, U.S. production estimates Tuesday showed a 2.8 Bcf/d decline day/day, down to around 93 Bcf/d on lower supply flowing out of the Northeast and the New Mexico portion of the Permian Basin, Wood Mackenzie Laura Munder said.

That was notably below the recent highs around 96 Bcf, keeping production far from the 97 Bcf/d level that many analysts had anticipated the market to reach this summer.

In the Northeast, declines totaling roughly 1.3 Bcf/d were spread across Ohio and Pennsylvania, Munder said. Permian New Mexico output, meanwhile, was off around 1 Bcf/d.

Munder attributed the declines to various pipeline maintenance or operational events in these regions.

The output decline followed other recent news of supply threats. Energy Transfer LP shut in 0.2 Bcf/d of capacity on the Old Ocean Pipeline system after a fire last Thursday, while officials on Saturday reported a fire at a Oneok Inc. natural gas liquids processing plant in Oklahoma.

Futures flew higher Monday and early Tuesday on sentiment that hits to supplies could offset the outage of the Freeport LNG terminal in Texas. That early June development forced the Freeport facility offline through at least the early fall. This freed up about 2.0 Bcf/d of gas once designed for export to be used domestically, easing supply concerns that had fueled a massive spring rally.

However, exceptionally intense heat so far this summer, coupled with relatively light production, put “upside pressure” on prices early this week, EBW Analytics Group noted. In Texas on Tuesday, the Electric Reliability Council of Texas (ERCOT) forecast a new peak load record, EBW added.

Continued strong global demand for U.S. liquefied natural gas so far in July added further bullish sentiment to start the week. NGI data show export volumes hovering above 11 Bcf/d this month – effectively keeping LNG facilities operating at maximum capacity. This excluded Freeport, which when fully operational accounts for 17% of U.S. LNG export capacity, according to the U.S. Energy Information Administration (EIA).

In its latest Short-Term Energy Outlook, the agency said U.S. dry natural gas production in its forecast averages 96.2 Bcf/d in 2022, up 2.7 Bcf/d from 2021, boosted by gains in the back half of the year. EIA forecast average production would approach 100 Bcf/d in 2023.

What’s more, Wood Mackenzie projected that production could rebound as soon as this week as several short-term maintenance projects culminate.

With strong production potential still viable, some traders determined the early-week rally was overcooked and took profits, curbing momentum and sending futures into the red Tuesday.

A broader sell-off in commodities, including oil, also likely influenced natural gas futures on Tuesday, Bespoke Weather Services said. Rising coronavirus cases in China and other countries – and the specter of new lockdowns – fueled the commodities slump.

The drop in Henry Hub futures “appears to be tied to macro selling across all commodities,” Bespoke said. “While we would still hesitate to have much confidence in this market…our lean would be to the bullish side, given hot weather, and a supply/demand balance that appears supportive.”

metmike: Still hot but the heat ridge backs up west in week 2, to where less people live.

Could be some bullish injection data for the South this Thursday!

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jul 14, 2022 Actual58B Forecast58B Previous60B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jul 14, 2022 | 10:30 | 58B | 58B | 60B | |

| Jul 07, 2022 | 10:30 | 60B | 74B | 82B | |

| Jun 30, 2022 | 10:30 | 82B | 74B | 74B | |

| Jun 23, 2022 | 10:30 | 74B | 65B | 92B | |

| Jun 16, 2022 | 10:30 | 92B | 97B | ||

| Jun 09, 2022 | 10:30 | 97B | 96B | 90B |

https://ir.eia.gov/ngs/ngs.html

for week ending July 8, 2022 | Released: July 14, 2022 at 10:30 a.m. | Next Release: July 21, 2022

+58 BCF exactly the guess number

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/08/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 07/08/22 | 07/01/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 501 | 482 | 19 | 19 | 540 | -7.2 | 568 | -11.8 | |||||||||||||||||

| Midwest | 586 | 562 | 24 | 24 | 659 | -11.1 | 650 | -9.8 | |||||||||||||||||

| Mountain | 143 | 138 | 5 | 5 | 180 | -20.6 | 169 | -15.4 | |||||||||||||||||

| Pacific | 249 | 240 | 9 | 9 | 249 | 0.0 | 276 | -9.8 | |||||||||||||||||

| South Central | 890 | 890 | 0 | 0 | 994 | -10.5 | 1,027 | -13.3 | |||||||||||||||||

| Salt | 221 | 233 | -12 | -12 | 283 | -21.9 | 292 | -24.3 | |||||||||||||||||

| Nonsalt | 669 | 657 | 12 | 12 | 711 | -5.9 | 735 | -9.0 | |||||||||||||||||

| Total | 2,369 | 2,311 | 58 | 58 | 2,621 | -9.6 | 2,688 | -11.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,369 Bcf as of Friday, July 8, 2022, according to EIA estimates. This represents a net increase of 58 Bcf from the previous week. Stocks were 252 Bcf less than last year at this time and 319 Bcf below the five-year average of 2,688 Bcf. At 2,369 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

With supply challenges enduring and cooling demand mounting, traders initially shrugged off a modestly bearish government inventory report and drove up natural gas futures much of Thursday. The August Nymex gas futures contract ultimately fizzled in afternoon trading, though, dipping 8.9 cents day/day to settle at $6.600/MMBtu. September fell 7.8 cents to $6.511. NGI’s Spot…

metmike: The heat ridge will be back up/retrograding westward, with the most intense heat being where population density is LOW. So AC demand will be highest in low population areas....with a notable exception being TX.

Also, it's still very warm across MOST of the country, even the cooler locations.

https://www.cpc.ncep.noaa.gov/products/predictions/814day/index.php

Overnight guidance was -4 CDD's, both GFS and Euro and that caused selling pressure for several hours but this was more from model variation and not weather pattern change, so we came all the way back (here at mid morning) to the solid gains noted before the less hot models were released overnight.

Below is a case of the reporter at NGI not following NG close enough to know why we were lower:

Continued expectations for widespread sweltering temperatures based on the latest forecasts had natural gas futures surging higher in early trading Monday, extending gains from late last week. After posting a 41.6-cent gain in Friday’s session, the August Nymex contract was up 23.4 cents to $7.250/MMBtu as of around 8:50 a.m. ET. Major weather models over…

metmike: Interesting that the most intense heat is in the western half of the country and not in the East/Southeast where it has the highest impact on NG demand to burn for generating AC use.

Still very warm/hot there though and very hot in TX.

I wonder how much extra NG is now being used to generate electricity for AC in Western Europe due to the record breaking heatwave in Spain, France, the UK, and other locations. I assume though that many in especially up in the UK likely have no AC. But do many in Spain have it?

Great question Larry because the last I heard they were still battling a low ng storage crisis.

As you remember, last Fall, that was actually the main driver for US prices of NG.

though the damage to a US export facility has taken 2 bcf of exports away.

maybe the heat and prices there are affecting US prices again?

More on the amazing heat in Europe, thanks to WxFollower/Larry........here:

https://www.marketforum.com/forum/topic/87177/

US weather:

Shrugging off weaker numbers in updated production estimates, natural gas futures pared their gains in early trading Tuesday as sweltering forecasts cooled somewhat. The August Nymex futures contract was off 24.7 cents to $7.232/MMBtu at around 8:40 a.m. ET, cutting into the previous session’s 46.3-cent rally. Updated domestic production estimates from Wood Mackenzie were showing…

metmike: 0z Euro and 6z GFS were -4 CDDs cooler/less hot.

Some sort of bullish news was just released 3 minutes before Noon CDT as ng shot up $3,000 in 2 minutes.

Maybe related to the damaged export facility? You got anything Larry?

7/20 07:51a CST DJ US Natural Gas Rises Despite Putin's Nord Stream

Commitment -- Market Talk

0849 ET - Natural gas prices in the US climb 3.2% to $7.497/mmBtu despite

Vladimir Putin's assurances that Russia would fulfill commitments to supply

natural gas to Europe by way of the Nord Stream pipeline. But Putin also says

flows could soon be disrupted if sanctions prevent needed maintenance on the

line. Worries that gas flows to Europe might be cut off have provided extra

bullish sentiment in the US gas market in recent days, as it would tighten

global supplies of the commodity in commercial markets. The latest US weather

forecasts have also moderated somewhat, with the Weather Channel saying the

10-day forecast for the Southern Plains is looking slightly less-hot than it

projected earlier. (dan.molinski@wsj.com)The above is from earlier in the day. That's all I have.

Thanks Larry!

We managed a high almost $2,500 higher than that....+$5,500 from just before the market was fed that news before backing off a bit from the high around 1:48 pm.

The high for the day was 8.03 then.

Mike said: "We managed a high almost $2,500 higher than that....+$5,500 from just before the market was fed that news before backing off a bit from the high around 1:48 pm."

-------------------------------

Thanks, Mike. So, it sounds like you're implying that today's big rise at midday had little to do with wx forecast/model changes. Just another example of a day that reminds me to "be afraid, be very afraid" of taking a position in this market and instead just watch from the sidelines if I want.

There's a chance the release of some weather info product beyond 2 weeks that I don't get updated for a hotter August.

The week 2 models are suggesting the heat ridge rebuild farther in early August but nothing came out in that realm that could have triggered +3,000 in 2 minutes.

In the first half of Winter, with low storage a profound weather pattern change and in HDDs might have that sort of impact. Not a chance today.

Could have been news in Europe too.

Only 32 Bcf of natural gas was injected into storage for the week ended July 15, the U.S. Energy Information Administration (EIA) reported on Thursday. The print fell far short of expectations amid inventory decreases in a South Central region barraged by unrelenting heat. Median estimates of major surveys ahead of the print hung in…

metmike: models were LESS hot overnight. Euro was -5 CDDs bearish. But the EIA was pretty BULLISH! Maybe the news yesterday at this time was the release of an experts EIA guess being this low? Or something in Europe? Onward we go.

Latest Release Jul 21, 2022 Actual 32B Forecast 47B -WOW! Previous58B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jul 21, 2022 | 10:30 | 32B | 47B | 58B | |

| Jul 14, 2022 | 10:30 | 58B | 58B | 60B | |

| Jul 07, 2022 | 10:30 | 60B | 74B | 82B | |

| Jun 30, 2022 | 10:30 | 82B | 74B | 74B | |

| Jun 23, 2022 | 10:30 | 74B | 65B | 92B | |

| Jun 16, 2022 | 10:30 | 92B | 97B |

https://ir.eia.gov/ngs/ngs.html

for week ending July 15, 2022 | Released: July 21, 2022 at 10:30 a.m. | Next Release: July 28, 2022

+32 BCF- VERY BULLISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/15/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 07/15/22 | 07/08/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 521 | 501 | 20 | 20 | 559 | -6.8 | 587 | -11.2 | |||||||||||||||||

| Midwest | 608 | 586 | 22 | 22 | 680 | -10.6 | 671 | -9.4 | |||||||||||||||||

| Mountain | 144 | 143 | 1 | 1 | 183 | -21.3 | 172 | -16.3 | |||||||||||||||||

| Pacific | 253 | 249 | 4 | 4 | 247 | 2.4 | 276 | -8.3 | |||||||||||||||||

| South Central | 874 | 890 | -16 | -16 | 1,001 | -12.7 | 1,023 | -14.6 | |||||||||||||||||

| Salt | 206 | 221 | -15 | -15 | 280 | -26.4 | 283 | -27.2 | |||||||||||||||||

| Nonsalt | 669 | 669 | 0 | 0 | 721 | -7.2 | 740 | -9.6 | |||||||||||||||||

| Total | 2,401 | 2,369 | 32 | 32 | 2,671 | -10.1 | 2,729 | -12.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,401 Bcf as of Friday, July 15, 2022, according to EIA estimates. This represents a net increase of 32 Bcf from the previous week. Stocks were 270 Bcf less than last year at this time and 328 Bcf below the five-year average of 2,729 Bcf. At 2,401 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

These were the temps last week for the EIA period:

Hot western 2/3rds of the country, especially TX. These are some pretty solid positive anomolies for the hottest time of year.

Mild/pleasant Great Lakes to Mid Atlantic to Northeast.

metmike: The huge question is what will August weather be like? There WILL be a heat dome but the location matters tremendously. The farther east it is, the more people might be affected and the more ng is used for cooling.

Today's EIA release tied with the one released two weeks ago as the most bullish vs the WSJ survey since the late December holidays and the most bullish no holiday week since the 16 bcf bullish miss for the week ending 10/8/21.

The following DJ news releases from the last two days are still more examples of why I wouldn't feel confident trading NG if I were still doing it: note the three in which I highlighted "Russia" or "Russian". I also included the one sent out just after the very bullish EIA because of the followup 7/21 1:58 PM release saying NG still came back down later due to a resumption of Russian gas flows. In other words, that trumped the very bullish EIA.

07/21 01:58p CST DJ Natural Gas Falls Despite Bullish EIA Report -- Market Talk 1458 ET - Natural gas prices in the US fall 0.9% to finish at $7.932/mmBtu as a resumption of Russian gas flows to Europe through the Nord Stream pipeline temporarily alleviate worries of global shortages. Prices turned higher mid-morning and were trading at a five-week-high above $8 after the EIA reported a bullish 32B cubic feet weekly injection to storage that was well below forecasts and averages. It highlighted a surge in domestic demand due to a heatwave stretching across much of the nation. But temperature forecasts over the next couple weeks are beginning to moderate some, and that's once again bringing out some bearish investors, especially since peak summer heat is just about over. (dan.molinski@wsj.com) 07/21 09:43a CST DJ Natural Gas Turns Higher After Below-Forecast Storage Rise -- Market Talk 1043 ET - Natural gas prices in the US erase earlier declines and climb 0.6% to $8.056/mmBtu after a weekly EIA report lands bullish compared to forecasts and averages. The government agency says gas-in-storage rose last week by just 32B cubic feet, compared to a WSJ survey forecast of 48-bcf and a five-year average rise of 41. Total storage now stands at 2.401T cubic feet, 10% below last year and 12% below the five-year average. The small weekly increase reinforces the view that a very hot summer in some large population regions of the US such as Texas is boosting cooling demand considerably. (dan.molinski@wsj.com) 07/21 09:32a CST *DJ Natural Gas Erases Declines, Gains 1.4% to $8.116 After Below-Forecast Storage Rise 07/21 07:05a CST DJ US Natural Gas Drops 5% as Russian Gas Flows Resume -- Market Talk 0805 ET - Natural gas prices in the US quickly shed about half of yesterday's large, 10% increase, falling as much as 5.1% early in NY to $7.606/mmBtu as the resumption of Russian gas flows through the Nord Stream pipeline takes some bullish fears of global shortages out of the market. Technically, US natural gas prices shouldn't be impacted much by what Russia does, as US LNG export capacity is already maxed out, meaning it can't increase exports to Europe anyhow. But that hasn't stopped speculators from injecting the Russian situation into the market, partly on the argument that it will hasten LNG construction projects and may also lead to looser regulations that could boost US LNG exports. (dan.molinski@wsj.com) 07/20 01:59p CST DJ US Natural Gas Ends at 5-Week-High Above $8 -- Market Talk 1459 ET - Natural gas prices in the US finish the session with a massive 10.2% increase to a five-week-high $8.007/mmBtu as investors become increasingly bullish on the commodity due to fears Russia may stop providing gas to Europe. Russian President Vladimir Putin said that gas shipments through the Nord Stream pipeline into Europe would restart this week but may be as low as 20% of capacity. Putin also warns that further reductions are possible if maintenance can't be done to the pipeline due to sanctions. If gas to Europe is disrupted, it would likely cause global demand for commercially available natural gas to surge much higher. (dan.molinski@wsj.com) (END) Dow Jones Newswires July 20, 2022 14:59 ET (18:59 GMT)

Russia, Russia, Russia:

07/22 03:46a CST DJ Natural Gas Prices Rebound on Nord Stream Turbine Report

-- Market Talk

0846 GMT - Natural gas prices rise after a report that a Nord Stream

turbine, that had been cited as the cause of reduced flows through the gas

pipeline, was stuck in Germany. Benchmark European gas futures gain 6.4% to

EUR169.98 a megawatt hour, erasing declines that came Thursday after the

pipeline restarted following a period of maintenance. Reuters reported that the

missing turbine, which had been undergoing maintenance in Canada, was now stuck

in Germany as Russia hadn't permitted it to be transported back to the Nord

Stream pumping station near St. Petersburg. It had earlier been held up in

Canada by sanctions, which Gazprom said was the cause of reduced gas flows to

Europe through the pipeline. (william.horner@wsj.com)

(END) Dow Jones Newswires Thanks. That confirms my concerns earlier this week that news from Europe, like last Fall, is most important at times.

and the news doesn’t trickle in. You get hit with it all at once with an event or report and the market goes up or down thousands of dollars in minutes, sometime even seconds.

metmike: August ng expires on Wednesday. There is often volatility and spikes(more than usual) as that day gets near.

metmike: At around 6:45 am, ng spiked up over $6,000 in just over 30 minutes.

After that, around 6 different well defined waves of selling took the price down $7,000 from that price spike higher by the close.

August NG expires tomorrow.

metmike: Volatility is ng's middle name!

August Nymex natural gas futures faltered Wednesday, snapping a furious rally that dated to last week amid robust cooling demand and global supply worries. The prompt month gas futures contract settled at $8.687/MMBtu, down 30.6 cents day/day. September fell 27.1 cents to $8.554. At A Glance: Nymex gas trading proves volatile Weather-driven demand holds strong…

metmike: How how will August be? The market knows it will be hot but if its LESS hot, that can be a bit bearish as it gets dialed into forecasts.

Weather: https://www.marketforum.com/forum/topic/83844/

"Europe", "LNG", "Russian"...no thanks as I like my NG domestic ;)

07/26 01:49p CST DJ Natural Gas Ends at 7-Week-High Just Below $9 -- Market

Talk

1449 ET - Natural gas prices finish up 3% at $8.993/mmBtu, the highest

closing price since June 7 as hot weather and an ongoing, natural gas-led

energy crisis in Europe triggers some of the market's biggest gains in months.

Gas prices have climbed by 66% since the month began, including a 24% jump over

the past week alone. Investors sold off the commodity in June after a fire at

an LNG plant in Texas sparked fears demand would decline and inventories would

surge higher. But inventories have instead remained in a large deficit compared

to averages, helped by hot temperatures in Texas and elsewhere that boosted

cooling demand. (dan.molinski@wsj.com)

07/26 07:40a CST DJ US Natural Gas Prices Surge Toward 14-Year High -- Market

Talk

0840 ET - Natural gas prices in the US jump 10.5% to $9.643/mmBtu, and if

those prices hold then the market would close at its highest level since 2008.

"Clearly, hot weather patterns, tight US supplies, and production failing to

hold above 96 Bcf/day are primary contributors," says NatGasWeather.com in a

research note. It adds that last week's bullish storage report was also

important as it showed supplies remain tight even six weeks after the shutdown

of an LNG plant in Texas that was expected to cause inventories to bulk up as

feedgas demand declined. The front-month August contract expires tomorrow. The

September contract is up 8% at $9.249. ( dan.molinski@wsj.com )

07/25 10:20a CST DJ Natural Gas Extends Gains Amid Nord Stream Reduction Fears

-- Market Talk

1120 ET - Natural gas prices are up nearly 4% today. WSJ reports that

Russia's Gazprom says natural-gas exports through Nord Stream to Germany will

drop to about a fifth of the pipe's capacity, blaming problems with a turbine.

That raises questions about Europe's ability to store enough gas for the

winter. The reduction in the pipeline's capacity-from 40% currently to 20%-is

expected to take effect Wednesday, Gazprom says. (paulo.trevisani@wsj.com;

@ptrevisani)

Tomorrow's EIA release will be based on 92 HDD, which is the hottest week since the week ending 7/24/20. A very small injection is expected. WSJ average guess is +23.

Thanks much Larry!

7 day temps for last week and the EIA report tomorrow. Last week, we seasonally/climatologically the hottest week of the year.

Pretty impressive, widespread positive anomalies considering that, so no wonder the injection is expected to be dinky!

https://ir.eia.gov/ngs/ngs.html

for week ending July 22, 2022 | Released: July 28, 2022 at 10:30 a.m. | Next Release: August 4, 2022

+15 BCF-BULLISH

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/22/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 07/22/22 | 07/15/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 532 | 521 | 11 | 11 | 580 | -8.3 | 606 | -12.2 | |||||||||||||||||

| Midwest | 625 | 608 | 17 | 17 | 699 | -10.6 | 690 | -9.4 | |||||||||||||||||

| Mountain | 144 | 144 | 0 | 0 | 184 | -21.7 | 175 | -17.7 | |||||||||||||||||

| Pacific | 253 | 253 | 0 | 0 | 246 | 2.8 | 275 | -8.0 | |||||||||||||||||

| South Central | 862 | 874 | -12 | -12 | 999 | -13.7 | 1,015 | -15.1 | |||||||||||||||||

| Salt | 195 | 206 | -11 | -11 | 270 | -27.8 | 272 | -28.3 | |||||||||||||||||

| Nonsalt | 667 | 669 | -2 | -2 | 728 | -8.4 | 743 | -10.2 | |||||||||||||||||

| Total | 2,416 | 2,401 | 15 | 15 | 2,709 | -10.8 | 2,761 | -12.5 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,416 Bcf as of Friday, July 22, 2022, according to EIA estimates. This represents a net increase of 15 Bcf from the previous week. Stocks were 293 Bcf less than last year at this time and 345 Bcf below the five-year average of 2,761 Bcf. At 2,416 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

Spike higher seconds after the release, then lower for the day and now coming back a bit.

Overnight guidance, mainly Euro was NOT AS hot. European model was -5 CDDs vs the previous run.

metmike: Actually, NG has been under alot of pressure the last 2 hours, since the release........LESS hot forecasts/lower CDD's and the bullish # out of the way.

Presenting a new buying opportunity.

Or marking a short term top and buying exhaustion if the models get even less hot.

The Euro added back much of the heat that it took out 12 hours ago and gave us a little bounce that's already fading.

metmike: Less heat is bearish in a relative sense even when its still pretty hot and traders expect extreme heat.

It's another commodity that has come a long way in a short amount of time.

I had something that never happened to me before on my computer happen earlier.

I looked on my computer, in the right hand corner of the screen with my Sept Natural gas depth of market quotes and positions and saw that I was long 1 contract of ng at 8.304 and behind $220......out of nowhere.

What the heck!

I've accidentally hit the place order button a ton of times before but then, when the next screen came up, immediately canceled it and never actually sent it.

Somehow, this time I hit the place order button accidentally AND hit the send order button accidentally after that.

And only noticed it some time later, which wasn't too long before the close. If I'd left the computer after unknowingly placing the order and come back after the market was closed, I would be long 1 contract.

As soon as this was realized I closed the position for a tiny loss but a good lesson to be more careful.

Making that mistake at the wrong time on the wrong day in natural gas could have cost many thousands of bucks.

I just did this again on purpose and it's almost impossible for this to happen unless there was a glitch in my key board that triggered this response. I've been having huge glitch issues with this keyboard for weeks..........time to replace it.

In 30 years of trading, I think I only did this one time before, 10 years ago...........though I was convinced that time was not me. It was a decent sized position that lost something like $8,000 in KC wheat on my Ipad in the middle of the night, at my dad's house when I woke up 3 hours later and looked at my trading screen.

I called the broker and insisted that I didn't place the order and they thought I was nuts and an idiot. "Who else would have done it!" was his response. Must have left the screen open and accidentally hit the wrong buttons while sleeping.

So I try to remember to close that screen in the middle of the night.

Anybody else do this?

Models are cooler...........can you tell by the open (-:

Huge gap lower. Could be a downside breakaway gap.

I was trying to sell the open but missed it by a mile and its not appealing to get short at $4,500/contract lower than the Fri close. Such are Sunday Night opens. It happens all the time.

The open was a big OVER reaction to changes from Friday. I can only guess that an large amount of longs(in this case) bailed at the market to get out.

WOW! We just closed the gap by shooting up $3,000 in around 20 minutes.

It's a gap and crap selling exhaustion signal on the charts now but not especially powerful because of where it is and in this volatile market.

metmike: Not much change in the forecast. The $3,000 spike higher came BEFORE the midday models came out.

Rally before gov data, but from PRIVATE (expensive) data??

tjc,

That would be impossible for 2 reasons, if it was tied to the main models that go out 2 weeks.

1. The data wasn't even out yet to use to run the models early

2. When the data WAS available and run on the main GFS ensemble(American model) it was -3 CDD's COOLER. The spike higher, should have been a spike lower if that was the reason.

However, there could have been a longer range model for the month of August that I don't get that came out. Those have low skill.

Thank you for informative reply.

Someone always has better data, but you are still one of the best interpreters----just wish you were not so bogged down "administrating" as you can/did make some GREAT price projections! (Remember the hurricane week and NG!!)

tjc,

Appreciate the high compliment!

Temps continue cooler, especially east with the heat ridge backing up on most models.

However, a few ensembles want to hang on to the idea of a strong heat ridge farther east.