Corn and Bean crop ratings should fall a bit again on Monday.

Several places maybe see moderate drops because of no rain and hot temps. The places that got rain should hold up well.

Those that got rain the week before may not drop much.

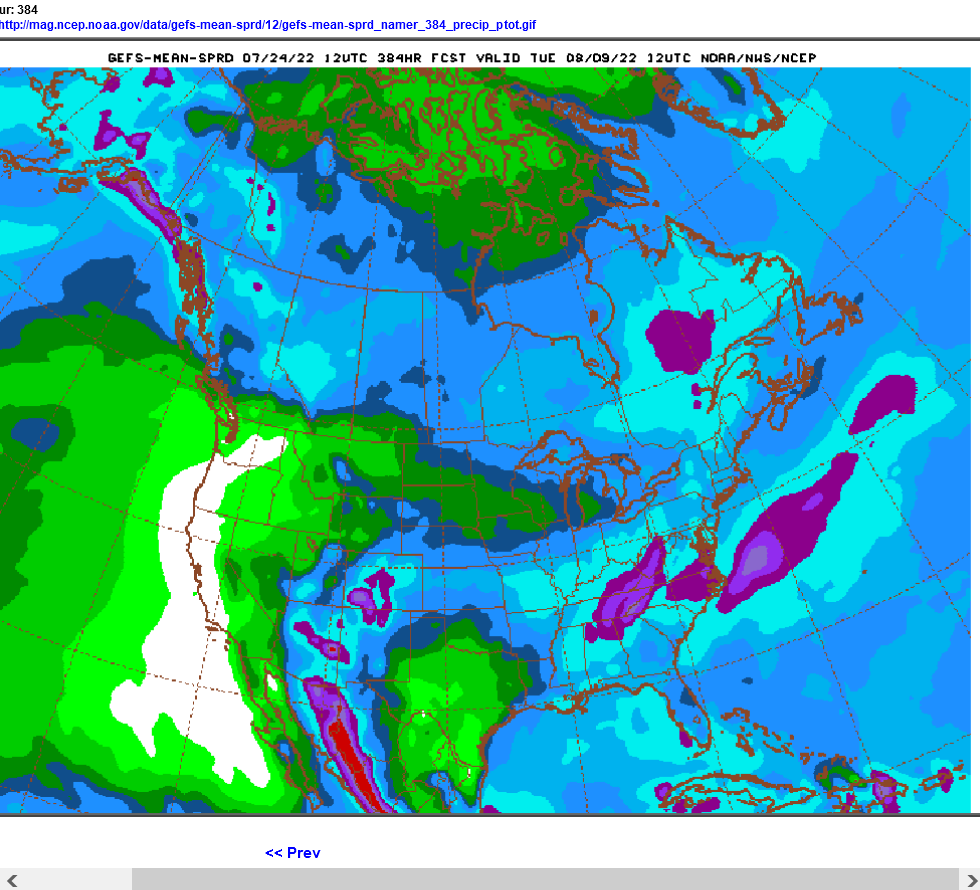

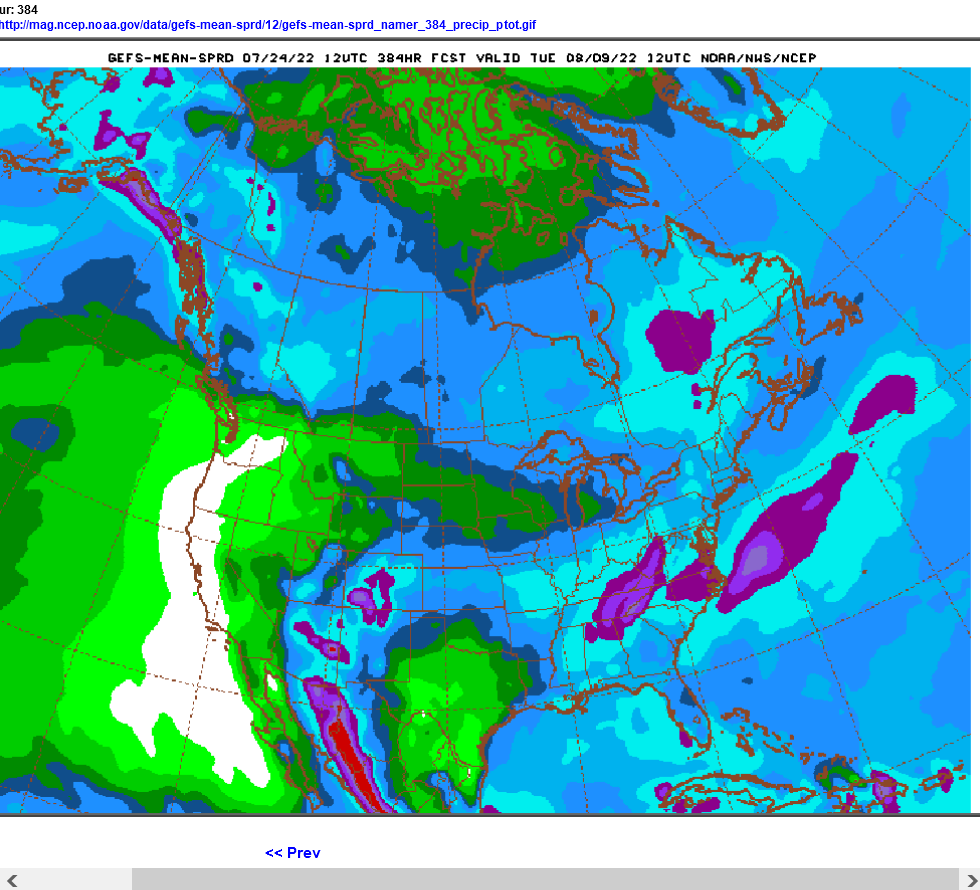

Look at the 14 day rain map below. Places not getting much rain during that period should all see ratings fall.

The almost no rain for 30 days map will tell us where the P/VP category increases.

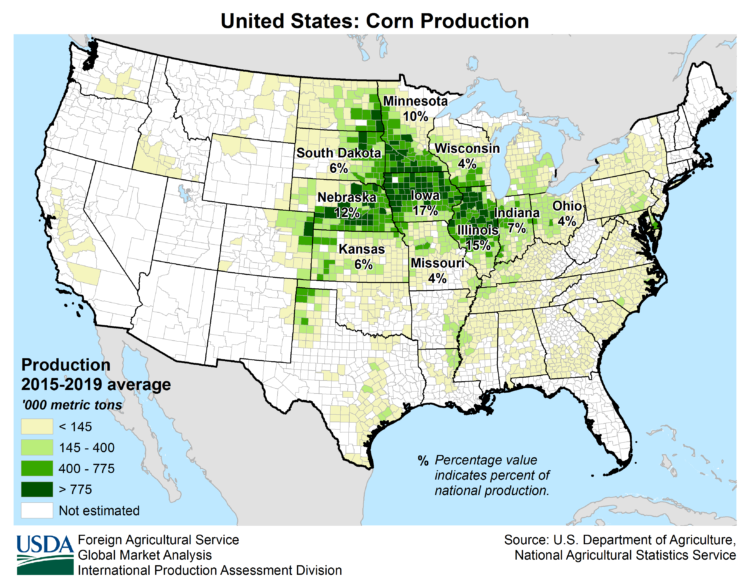

https://flowingdata.com/2021/11/29/map-made-of-candy-corn-to-show-corn-production/

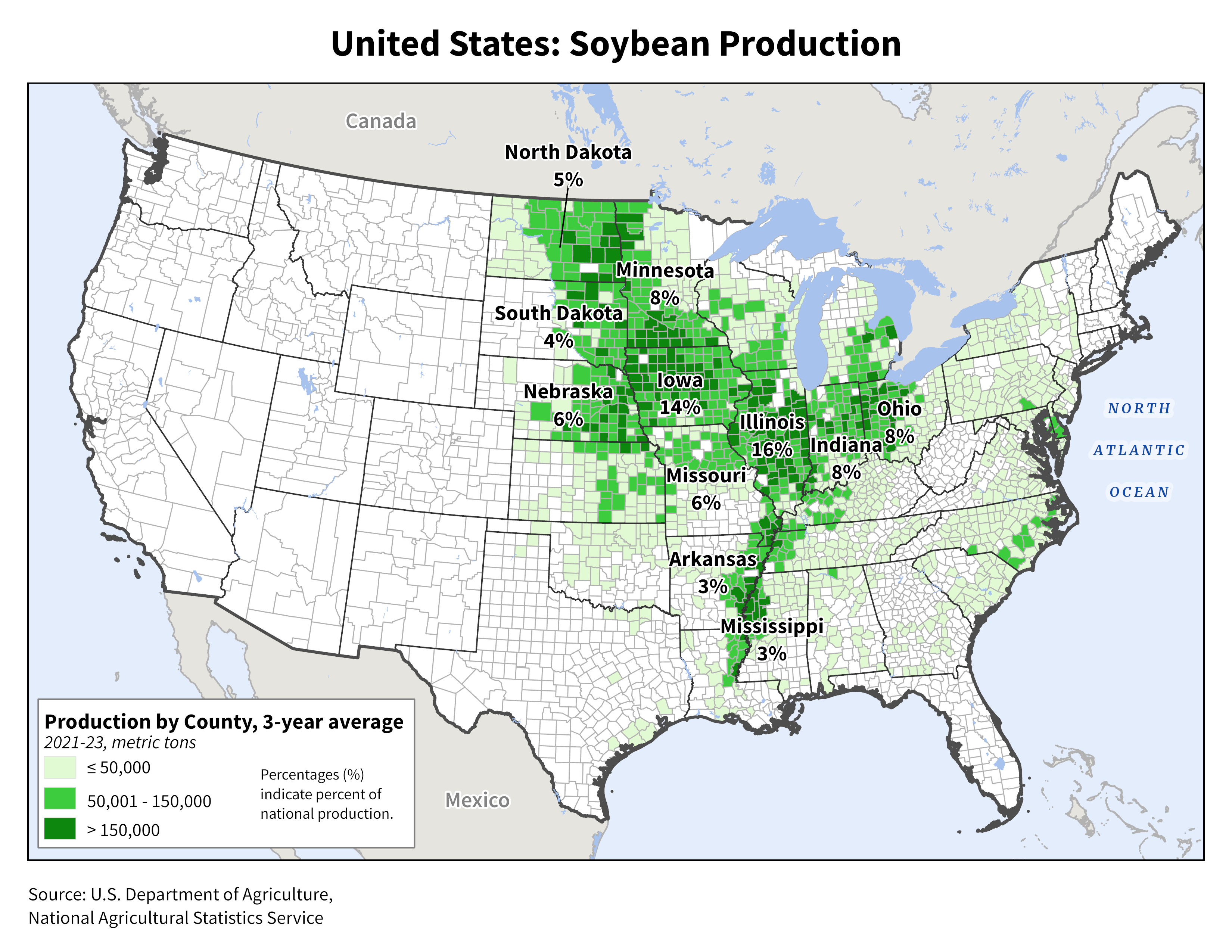

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/US/USA_Soybean.png

7 Day rainfall below

14 day rainfall below-no rain here and we should see a drop tomorrow.

30 day rainfall below-no rain here and we should see P/VP increase.

Rains the last 72 hours:

https://www.iweathernet.com/total-rainfall-map-24-hours-to-72-hours

Radar images:

https://www.marketforum.com/forum/topic/83844/

+++++++++++++++++++++++++++++++++++

Soil moisture anomalies:

https://www.marketforum.com/forum/topic/83844/#83853

+++++++++++++++++++++++++++++++++++

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

Temperatures thru last Friday....impressive anomalies for what is climatologically the hottest week of the year. So evaporation rates were very high.

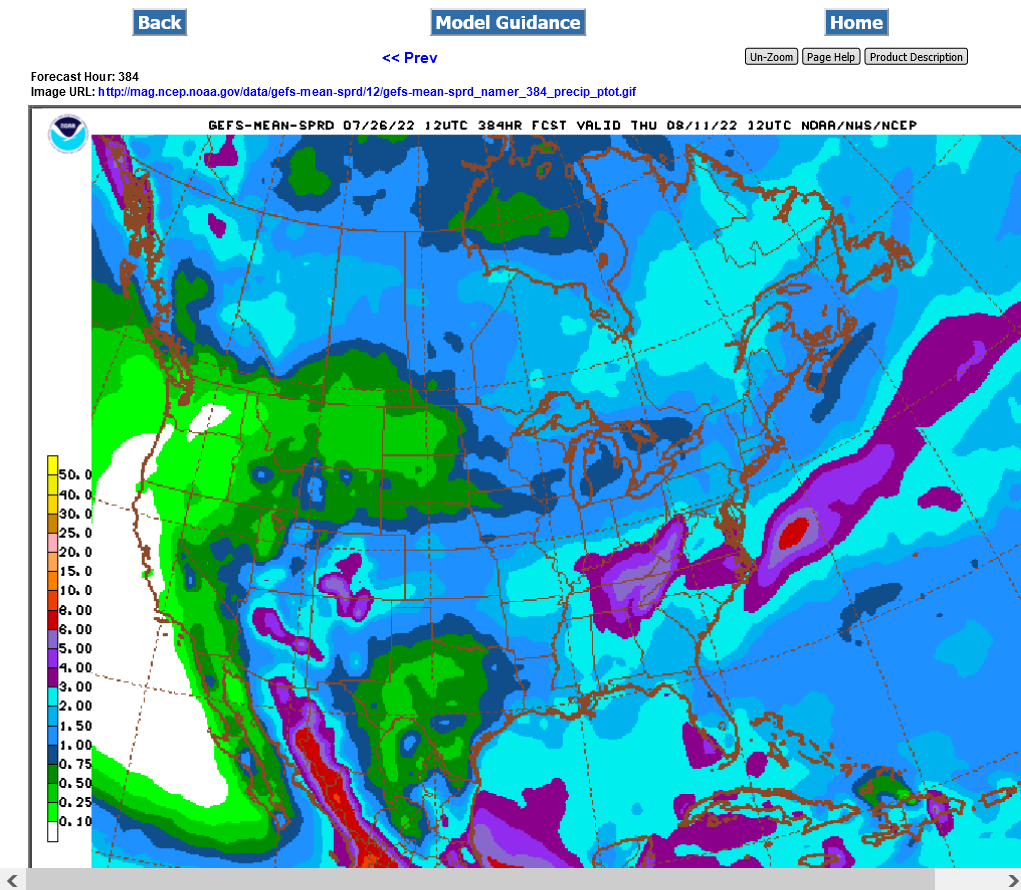

Rainfall forecast:

Latest GFS for 2 weeks from 12z model. We took out alot of rain in the Upper Midwest.

The latest 7 day precip forecasts are below.

Day 1 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_94qwbg.gif?1526306199054

Day 2 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_98qwbg.gif?1528293750112

Day 3 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_99qwbg.gif?1528293842764

Days 4-5 below:

http://www.wpc.ncep.noaa.gov/qpf/95ep48iwbg_fill.gif?1526306162

Days 6-7 below:

http://www.wpc.ncep.noaa.gov/qpf/97ep48iwbg_fill.gif?1526306162

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Extended forecasts:

https://www.marketforum.com/forum/topic/83844/#83852

Not surprised about the big open higher for C and S but we are struggling hard to hold the gains.

We are in an odd and uncertain place, so I wouldn't put a great deal of stock in it but regardless, not holding the opening price is showing weakness that I didn't expect.

The last 18z GFS ensemble did have a bit more rain, so that might be a factor but something else is pulling us lower.

The 6z GFS did at a bit more rain again but the WCB will struggle because of hot/dry in early August.

Corn and beans made new highs on the day open but have been under pressure since then......the last hour. Corn back to the lows and beans down 20c from the spike high on the open.

Hello, Mike and MarketForum

I believe 9 am cst was a great opportunity for shorts to profit take, and a few brave souls to get long. Weather "seems" to be less favorable and those who were nervous about a crop have pretty much given up hope.

Will the GOOD/EXCELLENT more than offset the so called fringe bad/poor acres? I am having my doubts.

MetMike, what are your expectations for crop conditions this week?

(I detect a suttle change in favorable weather---too many with .6 and neighbors with violent 2.25. Does not seem to be major fronts with "NICE" soakers---Is this accurate?)

Thanks tjc,

I gave my comprehensive thoughts on crop ratings above for this afternoon

and think that the next 2 weeks, they will fall in the Northern half of the cornbelt but improve a bit in the southern half next week.

The WCB, including IA northward is going to deteriorate in early August with this bullish weather forecast.....hot/dry in the WCB this afternoon on the extended guidance.

ADDED: I thought that after the sharply higher opens last night and this morning we would continue higher from more bullish weather compared to last week but instead we sold off hard.

I lost some money during that surprise. This market is getting impossible to predict with its gyrations before finally settling on a course.

Last night, beans were the weakest by far.

today, beans are the strongest by far.

maybe wheat was helping corn last night and hurting corn today.

A lot of this could have to do other the uncertainty in how the wax forecast will affect the crop.

this week is bearish for the southern half but bullish northern half.

mostly bullish beltwide in week 2.

As I expected, the corn rating dropped 3% and the beans dropped 2%.

U.S. #corn conditions are down across the board this week based on steeper declines in western states like Nebraska, Kansas and Colorado, where it has been very hot and dry. Nationally, 61% good/excellent compares with 64% a year ago and 73% in early June.

The darkest red category has made an appearance on the 6-10 day U.S. temp map - representing the highest confidence in the warm scenario. Forecasts currently show 100+ F possible for most of the western belt, including Iowa, for first week of August. Precip bias dry for now.

++++++++++++++++++++++++++++++++

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Gap higher tonight is extremely impressive for C and S.

Combination of crop ratings dropping and hot/dry extended forecast.

The only thing is that rain keeps trying to creep back in late in week 2 on the GFS Ensemble. The latest is the 18z below. I'm going with this being too wet for the northern half with these entirely week 2 rains of 1+ inch.

If crude crashes, that could all cause weakness. However, if the week 2 NWS outlooks end up correct, then prices should have more upside.

Compare that to the same map from Sunday evening below and note the increase in rains above from 24 hours earlier.

https://www.marketforum.com/forum/topic/87483/#87486

Weather is still bullish but big rains southern belt this week and the late week 2 GFS still keeps trying to bring back rain chances to the northern half which is going to really need it by then.

This is the last 2 week total for the 6z GFS. The next GFS update will be coming out late this morning.

That period has very low confidence:

Thanks Mike!

YW Jimbo!

CL went from sharply higher to lower, which isn't helping right now but unless the extended models add rain and/or continue to back up the dome farther southwest late in week 2, it would surprise me to close the very bullish breakaway gap higher from last night.

OK,nothing should surprise me anymore, the way markets trade in todays world.

I was positive the markets would focus on just this Sunday Night and Monday and got overextended being too long too early.

We went down and got close to testing the open last night/top of the gap but that held well.

For a position trader, this is impossible to trade.

Buying on the open last night, thinking of staying long the rest of the week with that position?

Well you were kicking butt with profits from the get go and looking very lucrative all night and earlier this morning.

Then we sell of down to where those profits are whittled down to almost nothing.

Dang, you sure wouldn't want to LOSE money after being ahead big bucks. And its the worst feeling in the world to watch all that profit vanish. So, inevitably you cover with a small profit because this position, absolutely cannot turn into a loss.

Then, we shoot back up and your out closer to the lows. Frustrating when markets trade like this.

Lots of uncertainty but a period of extreme heat and no rain is coming up and if it keeps lasting on models, no way will grains fill the gap(ok, never say never)

I see now that CZ actually dropped just below the lows of the open last evening but has come roaring back. 2nd opportunity to buy for those not long yet..........but if you just covered longs earlier, are you ready to get back in so soon at prices a bit lower?

The noon maps must have been something else.

I’m riding the wave now. On a one month chart, the 14 dma is around 1450. That’s my stop. I’m going to see how far that moving avg takes me.

Thanks Mike. It's been tough as a producer to figure out when to sell ! Started selling a little too early, although after the last several years, $5.50 looked awesome. Luckily priced a good chunk for $7+ right out off the combine. Hope to price more above $6. We are beginning to get dry here.

bowyer,

Great to hear from you!

Must be frustrating to see all that rain just south of you:

St. Louis had almost 10 inches in some spots!

https://www.iweathernet.com/total-rainfall-map-24-hours-to-72-hours

Wish I had wetter news for you.

Jim, this was the 12z GFS rain forecast for 2 weeks. Most of it is rain this week.

We'll see if anything develops in week 2 in the Upper Midwest below but it looks pretty dry. The heat ridge actually backs up southwest a bit late in week 2. We'll see if that trend continues.

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

See the rest of the weather by scrolling down here:

https://www.marketforum.com/forum/topic/83844/

Actually, I just checked and a few spots northwest of St. Louis had over 10 inches!

When you go to the map below, you can literally zoom far enough in to see your street on the map!

Rain amounts will be based on connecting known data points, so there will be some errors, especially with scattered heavy storms.

We had a bit over 2 inches and really don't want 3 more inches. …..HERE in southwest IN.

In August, yes but that's how it comes.........too much.......then not enough. That's the weather for you!

https://www.iweathernet.com/total-rainfall-map-24-hours-to-72-hours

I pulled up this Des Moines area computer generated weather forecast graphic for next Tue/Wed.

It peaks at 104 on Wed. Considering how dry the soils are and impressive the heat dome, it wouldn't be surprising to get several degrees hotter in places.

Please note the winds on Wednesday.

16 mph and gusting to 23 mph.

Humidity won't be all that high so evaporation rates with the powerful sun will be unbelievable.

Same thing coming on Thursday........then the pressure gradient relaxes and winds will be less breezy after that but still temps around 100.

By the end of next week, much of the crop in this area could drop 1 category in condition rating and I would think almost all of it could be down 1 category a week later with a flash drought in progress across most of the state in early August.

This is the entire reason for beans going up $1+ since Sunday Night/Monday.

| 48-Hour Period Starting: |

| ||

Most of the models do back the dome up a bit, westward, late in week 2 with the heat letting up but still hot, just less hot and mostly dry.

It's almost impossible to generate much rain in the cornbelt with this pattern.

There is a lot of upside for beans. With November not quite at $15, there is easily $3 there if this weather persists.

Thanks Jim!

You're probably right. If August features hot/dry much of the month, production estimates will plunge and mean that we have to ration the limited supplies.

The only way to accomplish that is via price.

The cure for high prices, as they say is............high prices.

However, I recall a few Fridays in June/July in my first 15 years of trading that the weather models could not have looked more bullish and I was loaded up long on the close Friday.

But the models changed over the weekend.

One time, in the early 90's the market opened Monday at 9:30 am(I thought it was going to be lock limit down and me stuck) but it opened corn -10c(limit was 12c) and beans -25c(limit was 30c) back then.

After spending the previous 24 hours convinced my account would be wiped out in a lock limit down move(and drinking beer) I got out and only lost 60% of the account.........and 10 minutes later it DID go lock limit down and opened another half a limit lower the next day.

I was actually celebrating the fact that I lived to trade another day and still consider that day to be the smartest trade of my career by an extremely wide margin.

By the end of that year, I had more than doubled the account size compared to where it was BEFORE that loss.

In the those days, I used to give market/weather presentations for a group of local farmer friends.

Every time, they wanted me to tell that story above again. There are some additional details that make it even more interesting/powerful.

The lesson to take from it is that you should be aggressive if you have a system that works and confident enough to stay focused on the signals but dial in enough humility to recognize when you are wrong and get the hell out vs hoping and always make sure, worst case scenario that you still have 50% left in the account.

To your point, I'm not as gung ho about holding onto my position over the weekends and sometimes not even in the evening. It's so easy to get out and get back in again when the market re-opens, it makes sense to get out or use some options as protection, especially in a weather market.

Thanks Jim,

I actually wasn't targeting you with that advise just remembering my past when I LOADED THE BOAT, sometimes even over the min margin requirements with positions over a weekend.

Risking over 50% of the account in a weather market, when the market was closed for 2.5 days.

That was dumb and you aren't doing that.