Here's a new NG thread.

Mike, did the CDDs increase substantially at noon today? Absent that, Today's WSJ take is another example of US weather not being as dominant a factor as it used to be.

08/03 01:54p CST DJ Natural Gas Ends Sharply Higher On Freeport Reports -- Market Talk 1454 ET - Natural gas prices in the US finish 7.3% higher at $8.266/mmBtu after a late-session rally that NatGasWeather.com attributed to unconfirmed reports regarding a possible upcoming restart of the closed Freeport LNG plant in Texas. NatGasWeather.com says the reports indicate the Freeport plant, which closed in June due to a fire, may be able to restart some operations by early October, perhaps exporting nearly 2B cubic feet per day. Representatives from Freeport weren't immediately available. For tomorrow, the gas market will turn its attention to a weekly EIA storage report. A WSJ survey is forecasting it will show a below-average 29B cubic feet injection. (dan.molinski@wsj.com) (END) Dow Jones Newswires

Thanks a ton Larry!

Here's the previous thread:

https://www.marketforum.com/forum/topic/86665/

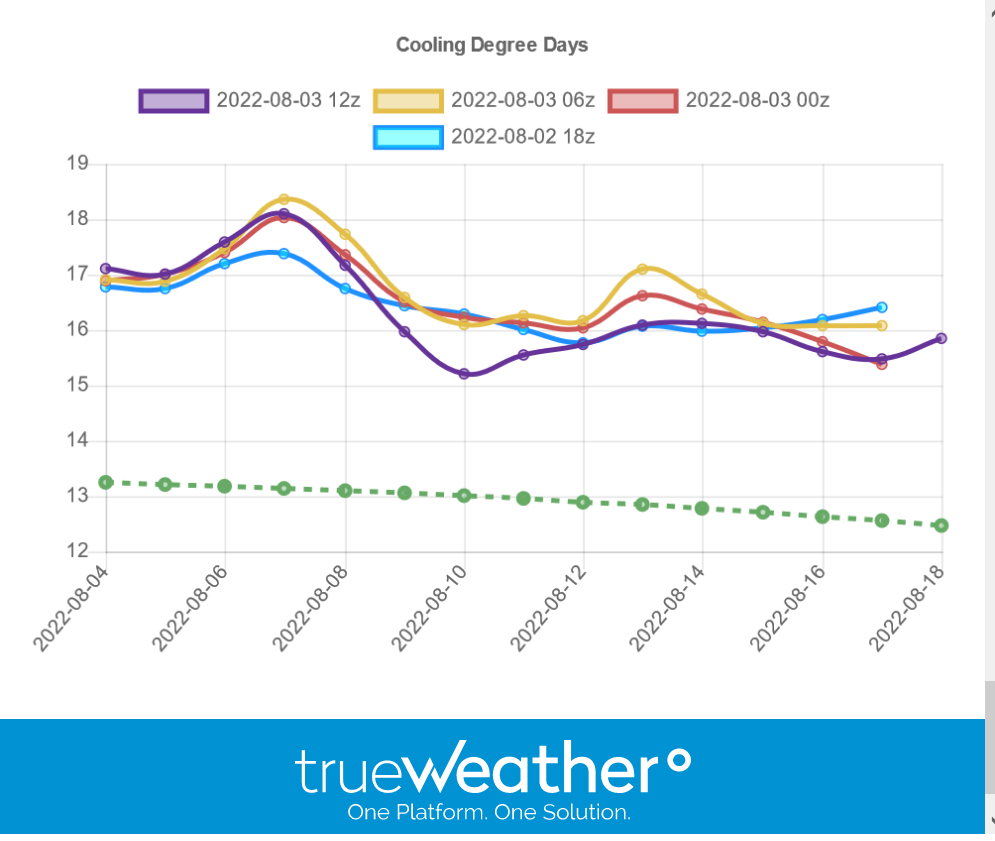

As I mentioned to Jim in another thread (Noon Maps) it was the complete opposite.

The GFS ensemble CDDs were -6 and BEARISH vs the 6z model. -4 vs the 0z model and -2 vs the 12z model yesterday at the same time.

Traders short based on less heat(but still hot) got their heads handed to them....unless they had a tight stop in.

The $6,000 spike around Noon happened in around 45 minutes and was clearly tied to news.

The European model that comes out later was around the same as before.

https://www.marketforum.com/forum/topic/87806/#87814

Here's the 7 day temps from last week for tomorrows EIA report:

Cool-ish North/Central, Hot elsewhere.

Seasonals.....often strong buying between now and the start of the heating season which is when we need to have a large amount of gas in storage to meet high Winter residential demand for heating.

BEARISH!

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Aug 04, 2022 Actual 41B Forecast 29B Previous 15B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 11, 2022 | 10:30 | 15B | |||

| Aug 04, 2022 | 10:30 | 41B | 29B | 15B | |

| Jul 28, 2022 | 10:30 | 15B | 22B | 32B | |

| Jul 21, 2022 | 10:30 | 32B | 47B | 58B | |

| Jul 14, 2022 | 10:30 | 58B | 58B | 60B | |

| Jul 07, 2022 | 10:30 | 60B | 74B | 82B |

https://ir.eia.gov/ngs/ngs.html

for week ending July 29, 2022 | Released: August 4, 2022 at 10:30 a.m. | Next Release: August 11, 2022

+41 BCF = BEARISH

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/29/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 07/29/22 | 07/22/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 549 | 532 | 17 | 17 | 601 | -8.7 | 626 | -12.3 | |||||||||||||||||

| Midwest | 643 | 625 | 18 | 18 | 717 | -10.3 | 709 | -9.3 | |||||||||||||||||

| Mountain | 147 | 144 | 3 | 3 | 184 | -20.1 | 178 | -17.4 | |||||||||||||||||

| Pacific | 253 | 253 | 0 | 0 | 244 | 3.7 | 273 | -7.3 | |||||||||||||||||

| South Central | 865 | 862 | 3 | 3 | 979 | -11.6 | 1,007 | -14.1 | |||||||||||||||||

| Salt | 195 | 195 | 0 | 0 | 253 | -22.9 | 263 | -25.9 | |||||||||||||||||

| Nonsalt | 671 | 667 | 4 | 4 | 726 | -7.6 | 744 | -9.8 | |||||||||||||||||

| Total | 2,457 | 2,416 | 41 | 41 | 2,725 | -9.8 | 2,794 | -12.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,457 Bcf as of Friday, July 29, 2022, according to EIA estimates. This represents a net increase of 41 Bcf from the previous week. Stocks were 268 Bcf less than last year at this time and 337 Bcf below the five-year average of 2,794 Bcf. At 2,457 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

metmike: Weather is turning hotter again.

Yesterday's NG EIA was the most bearish in relation to the WSJ survey mean since the report for the week ending 4/29/22. In reality, there's more than likely some "making up" of sorts for the last two weeks of solidly bullish reports.

Thanks Larry!

When they flip flop like that, it makes it impossible to discern a bearish/bullish production/supply dynamic.

Weather turned MUCH cooler since yesterday.

12z GFS ensemble -18 CDDs since the 18z model on Thursday.

After choppy trading, natural gas futures slipped firmly into the red after the latest weather model dropped a decent chunk of projected demand from the 15-day forecast. The September Nymex gas futures contract settled Friday at $8.064/MMBtu, down 5.8 cents day/day. October futures fell 6.3 cents to $8.051. At A Glance: Weather models converge in…

metmike: Yep! GFS ensemble was -18 CDD's over 3 runs. That's huge.

As weekend forecast trends lowered August cooling demand expectations, natural gas futures pulled back in early trading Monday. The September Nymex contract was off 31.9 cents to $7.745/MMBtu as of around 8:40 a.m. ET. Weather models trended cooler over the weekend, including a decline of nine cooling degree days (CDD) in the European model’s projections,…

metmike: MUCH cooler than last week and coolest of the Summer for the East.

As some teachers and students headed back to the classroom, traders appeared to call an end to the summer for natural gas markets as well. With the latest weather models slicing more projected demand off the 15-day forecast, the Nymex September gas futures contract tumbled 47.5 cents to $7.589/MMBtu on Monday. October futures fell 47.3…

metmike: Quite a bit cooler than any outlooks for quite awhile. Even some large Below average temps for parts of the east. Here's all the weather: https://www.marketforum.com/forum/topic/83844/

It is clear from what Mike and news reports have said that cooler wx forecasts/models were by far the main driver Friday-Monday 8/5-8. US wx changes are still a very important driver of price changes and on many days they are still dominant as even i've acknowledged. However, they're not as dominant as they used to be largely due to LNG exports to Europe and that hasn't changed. On some days, that has caused very sharp moves opposite to what US wx changes suggested. Example: as recently as Wed 8/3 as Mike confirmed.

It is sort of like this: US wx changes used to dominate on very roughly 85% of days. Now it is probably closer to only very roughly 2/3 of days.

You really nailed that one Larry. Exactly right!

I would add that when the weather FIRST changes to something that is a surprise to the market/traders is when its can sometimes be most powerful but even then, you will get knee jerk reactions/brief spikes in the wrong direction as the market dials in the new weather, while digesting it.

Those are the ones killing me. They take out all the protective stops..........then go back in the direction the market should go.

And then there's the news factor. Breaking news about export (facilities) or Europe, for instance have led to moves of $6,000/contract in an hour, no matter what the weather is.

Not having a stop in with an aggressive position and being wrong could wipe out your entire account in an hour!

Natural gas futures pared their losses in early trading Tuesday as production estimates pointed to a sizable day/day drop in supply, though analysts continued to see downside on moderating summer temperatures. Coming off a 47.5-cent decline in the previous session, the September Nymex contract was up 14.2 cents to $7.731/MMBtu at around 8:50 a.m. ET.…

metmike: This was NOT weather related, like Fri/Mon were, as was noted by WeatherFollower. Weather is still LESS bullish than last week and most of the Summer.

Also, August is not always the greatest weather market for natural gas.

Winter is the best for trading DD's by far.

Early/Mid Winter is the best of the best. Late Winter, unless ng in storage is extremely low........means less threat to supplies, which are ample for the rest of the heating season........but then strongly positive seasonals kick in at the end of Winter.

Same in Summer. Early/Mid Summer offers the best opportunities because sustained heat has a longer time to keep storage from building. Late Summer, unless ng is very low(we are low this year) is running out of time with the dwindling CDDs seasonally.

The best spikes higher in the past at this time of year thru September came from hurricane threats to the GOM, when much more production was in that location before fracking/horizontal drilling on land.

Natural gas spot prices at Henry Hub are on track to average $7.54/MMBtu for the second half of 2022 before falling to $5.10 in 2023 on rising production, the Energy Information Administration (EIA) said in its latest monthly forecast. Prices at the national benchmark averaged $7.28 in July, EIA said in the updated edition of…

https://www.eia.gov/outlooks/steo/

Electricity, coal, renewables, and emissions

Life without petroleum based products: 6,000 products made with petroleum. KillingCoal. Fossil fuels and fertilizer. Biden praises high gasoline prices.

https://www.marketforum.com/forum/topic/84689/

08/10 05:11a CST DJ European Natural-Gas Storage Building Is Making Good

Progress -- Market Talk

1011 GMT - European natural-gas storage building is on track to provide

sufficient supplies come winter, says Standard Chartered. Prices have risen in

recent weeks as Russia curtailed the flow of gas through the Nord Stream

pipeline. That has made it harder for EU states to fill their storage but

strong imports of liquefied natural gas have been a counterweight, the bank

says. Gas in storage could reach 103 billion cubic meters by the start of

winter "which should provide sufficient insulation even if no more Russian gas

flows," the bank says in a note. "It was once thought unthinkable that Europe

could get through a winter comfortably without Russian gas, but thanks to the

strength of the inventory build, we now think it can." (william.horner@wsj.com)

(END) Dow Jones Newswires

Thanks Larry!

Some of the NWS products are not available right now but the huge rally this week is NOT from weather(heat)

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Aug 11, 2022 Actual44B Forecast39B Previous41B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 11, 2022 | 10:30 | 44B | 39B | 41B | |

| Aug 04, 2022 | 10:30 | 41B | 29B | 15B | |

| Jul 28, 2022 | 10:30 | 15B | 22B | 32B | |

| Jul 21, 2022 | 10:30 | 32B | 47B | 58B | |

| Jul 14, 2022 | 10:30 | 58B | 58B | 60B | |

| Jul 07, 2022 | 10:30 | 60B | 74B | 82B |

https://ir.eia.gov/ngs/ngs.html

for week ending August 5, 2022 | Released: August 11, 2022 at 10:30 a.m. | Next Release: August 18, 2022

+44 BCF BEARISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (08/05/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 08/05/22 | 07/29/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 564 | 549 | 15 | 15 | 625 | -9.8 | 647 | -12.8 | |||||||||||||||||

| Midwest | 663 | 643 | 20 | 20 | 738 | -10.2 | 732 | -9.4 | |||||||||||||||||

| Mountain | 148 | 147 | 1 | 1 | 185 | -20.0 | 181 | -18.2 | |||||||||||||||||

| Pacific | 252 | 253 | -1 | -1 | 241 | 4.6 | 272 | -7.4 | |||||||||||||||||

| South Central | 874 | 865 | 9 | 9 | 979 | -10.7 | 1,007 | -13.2 | |||||||||||||||||

| Salt | 193 | 195 | -2 | -2 | 247 | -21.9 | 259 | -25.5 | |||||||||||||||||

| Nonsalt | 681 | 671 | 10 | 10 | 731 | -6.8 | 749 | -9.1 | |||||||||||||||||

| Total | 2,501 | 2,457 | 44 | 44 | 2,769 | -9.7 | 2,839 | -11.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,501 Bcf as of Friday, August 5, 2022, according to EIA estimates. This represents a net increase of 44 Bcf from the previous week. Stocks were 268 Bcf less than last year at this time and 338 Bcf below the five-year average of 2,839 Bcf. At 2,501 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

metmike: NG was on a mission to test $9 today. The highs were just shy of that, when it was up $8,000/contract. Insane trading considering that the NWS extended guidance is, by far the coolest of the Summer. The much cooler temps vs last week DID have a big impact early in the week.

Since the lows on Monday, NG has rallied 14,500/contract. Since early Tuesday morning, NG has rallied 13,500/contract. Those lows on Monday represented a drop from last weeks Thursday highs to Mondays lows of around -9,000/contract....basically in less than 2 trading days(Thu am to Monday am).

The drop made sense based on much cooler weather. The incredible spike higher the last 2 days is against the bearish weather/low demand....however, it does look like a change to MUCH warmer late in week 2. I'm sure that Larry is NOT missing a market like this.

Mike,

You're correct!

To add to what you posted, here's the DJN's take:

08/11 02:16p CST DJ US Natural Gas Nearly Tops $9, Ends 8.2% Higher -- Market

Talk

1516 ET - US natural gas prices climbed to within a few cents of $9

before closing the session up 8.2% at $8.874/mmBtu, the highest closing price

since July 26. Weather, which is often the main driver of natural gas prices,

has actually turned mildly bearish in recent days as August temperatures have

moderated slightly from July, reducing cooling demand. And today's weekly EIA

storage report was bearish compared to forecasts as storage rose by a

near-average 44B cubic feet. But as analysts at NatGasWeather.com note, bullish

investors bought when prices dipped after the storage report, and kept pushing

the market higher into the close. (dan.molinski@wsj.com)

(END) Dow Jones Newswires Also, from yesterday:

The EIA says gas-in-storage rose last week by 44B cubic feet versus forecasts in a WSJ survey for a 39-bcf injection and an average 45-bcf increase.

Weather models are not that different than Friday. Temps will start to warm up a bit.......when that is depends on the model.

GFS later this week and beyond.

European model, not until late week 2.

Very late in the Summer and prices are very high already and the market has not been consistently tracking weather.

Sometimes yes, other times the opposite.

Perhaps (but who the heck knows??), the market will avoid any significant drop til after this week's EIA report. Why? Because the week that it is based on had 91 HDDs, which is only one less than the hottest so far this summer and the market acts weird like that even though the EIAs should already be baked in.

Last 4 EIA weeks:

Week ending 7/22/22 8 AM: 92 HDD/+15 EIA bullish vs WSJ's +23

Week ending 7/29/22 8 AM: 90 HDD/+41 EIA bearish vs WSJ's +29

Week ending 8/05/22 8 AM: 86 HDD/+44 slightly bearish vs WSJ's +39

Week ending 8/12/22 8 AM: 91 HDD/?

Edit: I meant CDD, not HDD...ooops!

Great stuff Larry!

You mean CDDs of course.

NG came roaring back to higher now.

It does look like we warm up in week 2 but I wouldn't count on that being the reason.

From earlier:

What accounts for this morning's huge rally?

Hi TJC. Maybe Larry knows. I don't. It's not likely hotter weather forecasts.

Could be the approaching EIA number on Thursday that's expected to be bullish as Larry suggested earlier.

tjc and Mike,

Today was up per DJN mainly due to soaring European NG prices. However, NGI suggested it could have also partially been due to expectations for a small injection on this week's EIA in addition to production cuts. That is related to what I alluded to in my most recent post, the weird thing about this market in recent years treating the upcoming EIA report as if it weren't already baked in to the price:

A) DJN stories today: Europe

08/16 07:52a CST DJ US Natural Gas Tops $9 as Prices in Europe Soar -- Market

Talk

0851 ET - Natural gas prices in the US climb above $9 and are quickly

approaching new 14-year-highs, recently up 5.7% at $9.240/mmBtu. The surge is

being triggered mainly by natural gas prices in Europe that have continued to

skyrocket in recent days to their highest levels since Russia's invasion of

Ukraine, and just shy of all-time highs. While US natural gas prices were

historically well-isolated from moves in other global natural gas markets,

that's not so much the case anymore as US LNG exports now represent more than

10% of total US natural gas demand, compared to just a 3% or 4% a few years

ago. (dan.molinski@wsj.com)

(END) Dow Jones Newswires 08/16 01:23p CST *DJ U.S. Natural Gas Jumps 7.2% to Session-High $9.360 as Germany Denies Report It Will Keep Nuclear Plants Running (END) Dow Jones Newswires

08/16 01:54p CST DJ Natural Gas Prices Finish at a 14-Year High -- Market Talk

1453 ET - Natural gas prices end 6.9% higher at $9.329/mmBtu, the highest

closing price since Aug. 1, 2008 as soaring natural gas prices in Europe amid

the continent's ongoing energy crisis creates even more bullish sentiment in

the US domestic market. Slightly hotter weather patterns over the next couple

days also boosted prices, traders say, but it was the European market, where

Dutch TTF gas prices climbed to a new all-time high, that really drove the

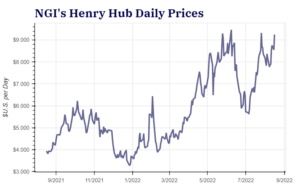

buying frenzy in the US. Gas prices have more than doubled since starting the

year at $3.73, and if they reach above $11 they will have tripled in price.

(dan.molinski@wsj.com)

(END) Dow Jones Newswires

B) NGI closing story: small EIA injection expected in Thursday's report

"After a solid recovery throughout Monday’s session, natural gas futures extended their streak Tuesday as maintenance activities took another toll on production."

"Mobius Risk Group said bulls also benefited from storage data that continues to portend soft injections in the near term."

"'“Considering a sample of daily facilities reported a marginally higher build than the July 21 week, it is logical to believe the market will be expecting the Thursday inventory report from the EIA to be at or below 20 Bcf,' Curry said. 'This would compare to the same week last year at 38 Bcf, and the year-over-year change in weather was a modest 6 degree days. This is the tailwind for the market countering the current week where temperatures are significantly cooler than both the prior week and the same week last year.'”

Thanks a ton Larry!

7 day temps last week for the upcoming EIA report on Thursday at 9:30 am CDT.

metmike: More from NGI. An expert that understands the realities and speaks the truth, loud and clear!!!

Liberty Energy Inc. CEO Chris Wright made no bones about prognosticators calling for the demise of oil and natural gas on Monday.

“The energy transition is not happening,” he said in Denver. “This drumbeat is crazy.”

Wright, speaking at the LDC Gas Forum Rockies & West, said demand for fossil fuels is robust and poised to remain elevated for the foreseeable future, given the world’s industrial, transportation and residential energy needs. He also noted that oil and natural gas are used to produce steel, cement, plastics and fertilizer – materials that are vital for the world’s infrastructure and global agriculture production.

Wright said minimizing oil and gas – not to mention ridding the world of the fuel sources – would send the global economy into a tailspin, create widespread energy shortages and plunge swaths of the world into an era of starvation. Without fertilizer created using the hydrocarbons found in fossil fuels, food production could get cut in half.

“Climate change is real. Humans are contributing to it,” Wright said. The effects are gradual and not as severe as activists claim, he noted. Reducing greenhouse gas (GHG) emissions is important and work to that end should continue.

However, calls for an end to oil and gas in the world’s energy mix over a few decades are “massively” unrealistic. The transition, he said, is something that could take centuries.

In the meantime, the Liberty Energy chief said politicians, environmentalists, scientists, industry leaders and others should focus on deploying rapidly evolving technology to continually improve the precision – and safety — at which oil and gas is extracted. They should also galvanize their efforts to find ways to deliver renewable sources of energy more efficiently.

Wright said North American completions expert Liberty, based in Denver, is so confident in demand that it is adding seven fracturing fleets this year.

Grandiose talk of squeezing oil and natural gas from the world’s energy pie is simply unrealistic, Wright said. The “damage caused by fighting climate change” unrealistically “is worse than climate change.”

metmike: MUCH worse because the planet is having a climate optimum for most life, NOT a climate crisis!

For example, Wright noted that since the rise of Lower 48 natural gas production in the United States, the country has, on a per capita basis, embarked on a 30-year trend of lower GHG emissions largely because gas steadily supplanted coal.

Still, he said, if the United States or the world as a whole tries to abandon natural gas, it could quickly find itself in the situation in which Europe currently struggles.

Europe, well before the tumult caused by Russia’s invasion of Ukraine, pulled back on natural gas production and found itself desperate for supply from other countries, including Russia.

Other sources of fuel to power industrial plants and heat homes were insufficient. Western Europe has grown dependent on Russia in the years since. Now, with Russia threatening to dramatically curb supplies to Europe amid the chaos of war, Europe is poised to increase coal use to make it through the coming winter, worsening its climate goals, Wright said.

Even with that shift, it may not be enough, said Wright. “Many people will die of the cold this winter in Europe.”

Bold talk about net zero emissions while depleting a market of needed energy “does a disservice to everyone,” he told the audience. It is “not only foolish but it’s immoral.”

More industry leaders and front-line workers, he said, need to speak out about the merits of oil and natural gas. In essence, the industry needs to stand up for its essential role in powering the world and supporting quality of life.

“The world runs on oil and gas,” Wright said. “Nothing is going to change that.” Affordable energy “enables everything we do…It’s the industry that enables every other industry.”

Colorado Oil and Gas Association CEO Dan Haley agreed. He said at the forum Monday that critics of oil and gas have seized upon the industry’s overall hesitancy to defend itself and also to champion its outsized role in the global economy.

Oil and gas, Haley said, are “literally the underpinnings of our modern life.” Renewable fuels “have an important role to play” alongside natural gas and crude. “That is a realistic future.”

A confluence of entrenched domestic demand, mounting calls for U.S. exports of LNG and modest production growth – all factors forecast to endure – propelled natural gas futures above $9.00/MMBtu in August and could keep upward pressure on prices for years. Such was the assessment of analysts who spoke Tuesday at the LDC Gas Forum…

metmike: Wow!

metmike: Pretty bullish. Buy the rumor, sell the fact price reaction.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 18, 2022 | 10:30 | 18B | 34B | 44B | |

| Aug 11, 2022 | 10:30 | 44B | 39B | 41B | |

| Aug 04, 2022 | 10:30 | 41B | 29B | 15B | |

| Jul 28, 2022 | 10:30 | 15B | 22B | 32B | |

| Jul 21, 2022 | 10:30 | 32B | 47B | 58B | |

| Jul 14, 2022 | 10:30 | 58B | 58B | 60B |

https://ir.eia.gov/ngs/ngs.html

for week ending August 12, 2022 | Released: August 18, 2022 at 10:30 a.m. | Next Release: August 25, 2022 +18 BCF VERY BULLISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (08/12/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 08/12/22 | 08/05/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 571 | 564 | 7 | 7 | 643 | -11.2 | 667 | -14.4 | |||||||||||||||||

| Midwest | 684 | 663 | 21 | 21 | 762 | -10.2 | 758 | -9.8 | |||||||||||||||||

| Mountain | 151 | 148 | 3 | 3 | 188 | -19.7 | 183 | -17.5 | |||||||||||||||||

| Pacific | 248 | 252 | -4 | -4 | 240 | 3.3 | 272 | -8.8 | |||||||||||||||||

| South Central | 866 | 874 | -8 | -8 | 983 | -11.9 | 1,006 | -13.9 | |||||||||||||||||

| Salt | 185 | 193 | -8 | -8 | 244 | -24.2 | 253 | -26.9 | |||||||||||||||||

| Nonsalt | 681 | 681 | 0 | 0 | 740 | -8.0 | 753 | -9.6 | |||||||||||||||||

| Total | 2,519 | 2,501 | 18 | 18 | 2,815 | -10.5 | 2,886 | -12.7 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,519 Bcf as of Friday, August 12, 2022, according to EIA estimates. This represents a net increase of 18 Bcf from the previous week. Stocks were 296 Bcf less than last year at this time and 367 Bcf below the five-year average of 2,886 Bcf. At 2,519 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

Today's EIA wasn't just pretty bullish, it was very bullish vs the WSJ survey mean, which was a whopping 17 bcf higher than the actual. This barely beat two weeks last month that were 16 bcf to the bullish and makes this one the most bullish nonholiday week since way back to the week ending 7/2/21, which was also 17 to the bullish.

Today's later selloff after kneejerk rise is similar to the 2nd of the two very bullish July weeks. This doesn't surprise me because the market didn't seem to want to sell off until after this week's expected low injection was reported due to the typical quirkiness of this market leading up to weekly EIA reports. Then, sell the bullish news as Mike said.

Per DJN:

08/18 07:53a CST DJ Natural Gas Prices Rise Toward 14-Year Highs -- Market Talk 0853 ET - Natural gas prices are climbing again after yesterday's profit-taking decline, with the front-month September delivery contract up 1.3% at $9.365/mmBtu. If current prices hold, the market would close at another 14-year-high amid a long-running rally that's been largely fueled largely by a price surge in Europe for natural gas. Europe's natural gas benchmark, known as Dutch TTF, is more than 16 times higher than it was two years ago, and hit another record-high earlier this week. The Dutch TTF price in dollar terms is around $67/mmBtu, a massive premium of more than seven times what gas is priced at in the US. (dan.molinski@wsj.com)

08/18 09:32a CST *DJ U.S. Natural Gas Jumps 4% to $9.610 After Below Forecast Rise in Storage

08/18 10:48a CST *DJ U.S. Natural Gas Erases Gains, Falls 3% to $8.968 Despite Small Storage Rise

08/18 01:53p CST DJ Natural Gas Ends Lower Despite Small Storage Rise --

Market Talk

1452 ET - US natural gas prices conclude another volatile trading day

with a slight, 0.6% decrease to $9.188/mmBtu. A weekly EIA report out this

morning was bullish as it showed inventories rose last week by just 18B cubic

feet, which was about half of the 35-bcf injection analysts surveyed by WSJ

were expecting. But weather patterns aren't as bullish as before, with places

such as Dallas-Fort Worth, the 4th largest metro area in the US, likely having

seen its final 100-degree day of the year yesterday. Investors are also closely

watching Europe's worsening energy crisis for signs of contagion in the

domestic market. (dan.molinski@wsj.com)

(END) Dow Jones Newswires

Last 4 EIA weeks:

Week ending 7/22/22 8 AM: 92 CDD/+15 EIA bullish vs WSJ's +23

Week ending 7/29/22 8 AM: 90 CDD/+41 EIA bearish vs WSJ's +29

Week ending 8/05/22 8 AM: 86 CDD/+44 EIA slightly bearish vs WSJ's +39

Week ending 8/12/22 8 AM: 91 CDD/+18 EIA very bullish vs WSJ's +35

Note that today's +18 on 91 CDD is very much on par with 3 weeks ago's +15 on 92 CDD. The reason the expectations were much higher today was very likely largely due to the prior two weeks of +40s EIA's on only a few less CDD than 3 weeks ago. Had those intervening bearish weeks not been in between, today's report's injection expectations would have been much lower than the WSJ's +35. They may have been something like +20, which would have meant the actual of +18 was neutral instead of very bullish.

Thanks much Larry!

The European model was +5 CDDs over night and we sold off anyways thru earlier this morning but are up 4,000 from the lows right now.

NG in storage is close to the low end of the 5 year range with less than 3 months to fill storage.

However, prices are at the highest in over a decade and Europe's extremely low storage/suppy situation is at a potential crisis level.

Sympathetic to spiking European prices amid constraints on imports from Russia, domestic natural gas futures were soaring in early trading Monday. As of around 8:55 a.m. ET, the September Nymex contract was up 53.5 cents to $9.871/MMBtu. Surging Dutch Title Transfer Facility (TTF) prices in Europe, driven by supply fears amid tensions over the Russian…

metmike: The weather is slightly bullish but close to late last week.

These were the temps last week for this Thurday's EIA storage report/injection. Hot Northwest/West, mild Midwest/East. Should be close to average and not nearly as bullish as last week.

September Natural Gas expires next Monday, August 29, 2022

metmike: Natural gas has gone haywire again this morning with extreme volatility. It managed to test $10 on 4 occasions between 2am and 10 am, then crashed $8,000/contract since just before 11 am........around 2 hours.

Any news Larry? It's not weather.

metmike: We saw an $8,000/contract drop in a couple of hours, apparently on that news.

for week ending August 19, 2022 | Released: August 25, 2022 at 10:30 a.m. | Next Release: September 1, 2022

+60 BCF close to neutral but note that the blue line below is tracking near the bottom of the 5 year average with the heating season starting in just over 2 months.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (08/19/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 08/19/22 | 08/12/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 598 | 571 | 27 | 27 | 659 | -9.3 | 689 | -13.2 | |||||||||||||||||

| Midwest | 714 | 684 | 30 | 30 | 786 | -9.2 | 785 | -9.0 | |||||||||||||||||

| Mountain | 153 | 151 | 2 | 2 | 188 | -18.6 | 186 | -17.7 | |||||||||||||||||

| Pacific | 243 | 248 | -5 | -5 | 241 | 0.8 | 272 | -10.7 | |||||||||||||||||

| South Central | 871 | 866 | 5 | 5 | 972 | -10.4 | 1,000 | -12.9 | |||||||||||||||||

| Salt | 184 | 185 | -1 | -1 | 231 | -20.3 | 246 | -25.2 | |||||||||||||||||

| Nonsalt | 687 | 681 | 6 | 6 | 742 | -7.4 | 755 | -9.0 | |||||||||||||||||

| Total | 2,579 | 2,519 | 60 | 60 | 2,847 | -9.4 | 2,932 | -12.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,579 Bcf as of Friday, August 19, 2022, according to EIA estimates. This represents a net increase of 60 Bcf from the previous week. Stocks were 268 Bcf less than last year at this time and 353 Bcf below the five-year average of 2,932 Bcf. At 2,579 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

+60 BCF is close to neutral but note that the blue line above is tracking near the bottom of the 5 year average with the heating season starting in just over 2 months.

That's part of the reason for the highest prices in 14 years. It's MUCH more bullish in Europe and we ramp up exports there in November after the repairs to our export facility. https://www.cnbc.com/quotes/@NG.1

%20in%20real%20time.png)

Natural gas futures were unusually quiet on Thursday, bobbing in and out of positive territory as the latest government inventory data offered no surprises and moved the needle only slightly on storage deficits. The September Nymex gas futures settled at $9.375/MMBtu, up 4.5 cents from Wednesday’s close. October futures ticked up 4.4 cents to $9.344.…

metmike: Weather is not a factor. Prices in Europe are more important right now.

Fertilizer/Natural Gas Prices

metmike: Sept NG, the front month expires on Monday. Often but not always we see fireworks headed towards expiration.

However, today was one of the quietest day before expiration trading sessions ever!

The weather is neutral here.

Larry, Mike, others

Are you buying or selling the sunday night jump (no gap)?

Hi tjc,

Larry stopped trading ng many months ago after it had too many violent/extreme moves that had nothing to do with weather.

As for me, I'm not doing anything here, the day before the front month, September expires.

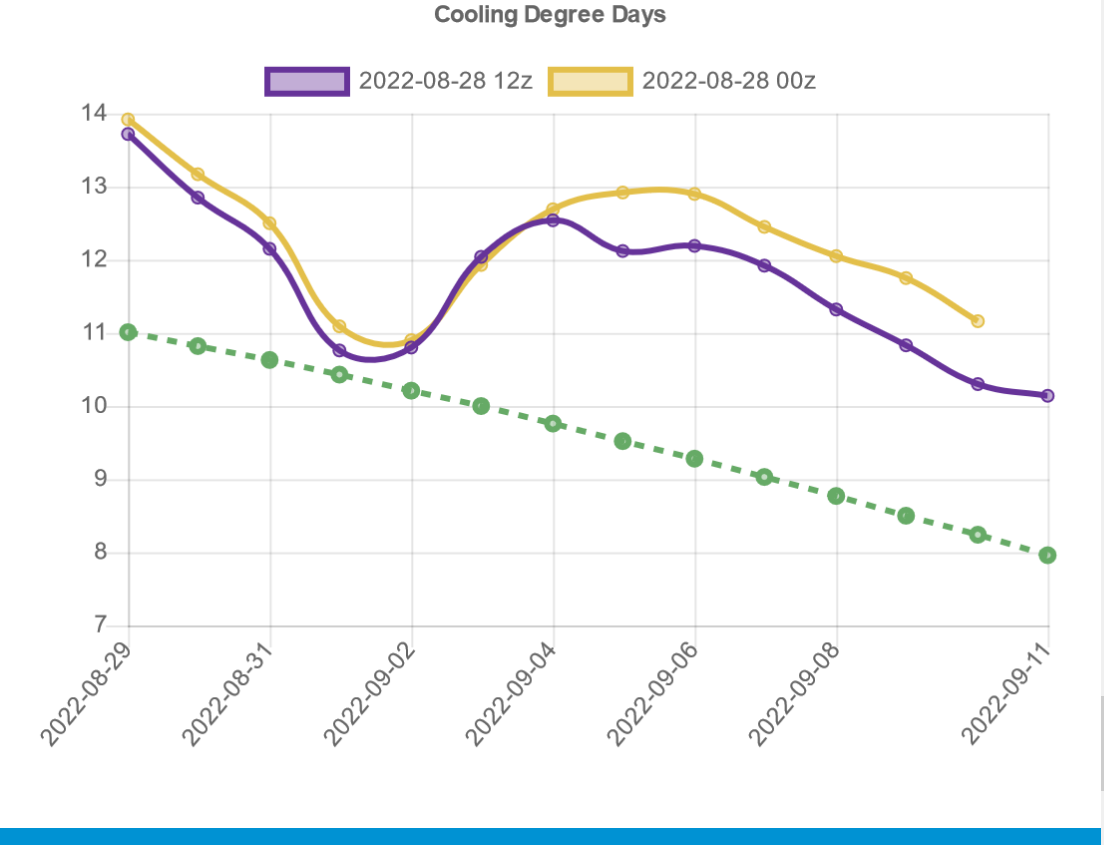

Overall, the weather is bullish(very warm) for the first half of September but the last 12z European model was -6 CDDs vs the previous 0z run.

The historical, legit. natural gas crisis in Europe is the most important trading item right now by far.

https://www.marketforum.com/forum/topic/88331/

Front month natural gas (September contract) going off the board near unchanged on the day of contract expiration. That's pretty unusual!

European model was cooler by -6 CDDs overnight which is pressuring ng.

Following an overnight drop in weather-driven demand expectations, and with global prices still seen influencing the domestic market, natural gas futures skidded lower in early trading Tuesday. The October Nymex contract was off 21.6 cents to $9.120/MMBtu at around 8:55 a.m. ET. Overnight changes in the weather data were mixed but included a decline of…

NG jumped $4,000 from lows to highs that I assume was related to this:

https://www.marketforum.com/forum/topic/88331/#88523

It wasn't US weather related!

Natural gas futures were lower early Wednesday, dragged down by softening global gas prices and production near recent highs. Bulls bought the dip and eventually garnered enough momentum to stage a recovery. After touching a $9.284/MMBtu intraday high, the October Nymex gas futures contract ultimately settled 8.5 cents higher day/day at $9.127. November futures climbed…

metmike: NGI is supposed to have access to many more sources than metmike, so I'm surprised at their explanation after this was headline news early today:

https://www.marketforum.com/forum/topic/87816/#88531

CDD's on the 12z GFS ensemble model this morning were incredibly LESS bullish, -10 CDDs compared to the 0Z run 12 hours earlier from big week 2 cooling below. If the market was following weather closely, it should have DROPPED not spiked higher!

One can speculate that this lessened the gains of the spike higher from European supply concerns.

This is exactly why WxFollower/Larry stopped trading natural gas.

These were the 7 day temps from last week for tomorrows EIA natural gas injection/storage report:

Hot in the West to N.Plains and also Northeast, offset a bit by mild/cool anomalies SouthCentral. The injection might be a bit less than the average for late August. However, factors other than weather can play a big role.

September heat has limited impact on CDDs compared to J-J-A heat.

However, hot enough with storage this low and it can be bullish. CDDs were actually lower overnight and mildly bearish but a news item in Europe, which is having a REAL energy crisis(in a world of fake crisis's) could send the price of NG up or down by thousands/contract in minutes.

CDDs were lower overnight and slightly bearish even though there is modest heat(for Sept) still in the extended forecast

+++++++++++++++++

7 day temps from last week for this Thursday's EIA storage report. Very warm/hot in much of the country. Could be a lower than average injection for the end of August.

Not sure what the projection was for this weeks injection, but this seems bullish.

Thanks Jim!

Bullish compared to historical averages but in line with expectations.

metmike: Weather is a bit bullish but at this time of year, ng is usually not a weather market and recently, weather has often not been the main price driving force.

New NG thread is here: