https://quotes.ino.com/charting/?s=NYMEX_CL.V22

head and shoulders can take us down to 60 in the new year. this should coincide with a continued recession.

the inverted yield curve tells us we should contract within the next year.

anybody short here?

I'M ON THE SIDELINES, ACROSS THE ENTIRE MARKET. LOL I DON'T LIKE SHOOTIN' DICE ;)

MY EYES ARE ON THE CHINA, TAIWAN "ISSUE". CHINA IS, IMO... "PLAYIN' THEIR GAME'S", IN ANTICIPATION OF THE NOV. ELECTION RESULTS. JUST LIKE RUSSIA DID IN 2020, WITH UKRAINE.

HAVE A GREAT LABOR DAY

Have no idea what your looking at but oil is going vertical. every single time I have been looking at quote since it opened sunday night oil is higher. Think the bottom is in and we will see 100plus soon enough.

Biden came out and said that he would fill the SPR if oil went below $80 and then an hour later Saudi came out and said if Brent went below $90 they would cut production. I guess Goldman Is long oil and wants a back stop against there long position so $60 Oil is a NO!

Thanks!

Great topic, especially with Bidens horrible policy of draining down the SPR for entirely political reasons.

I'll try to have some fundamentals with a more comprehensive look at the liquid energy markets later today.

https://www.rpc.senate.gov/policy-papers/biden-drains-the-strategic-petroleum-reserve

https://finance.yahoo.com/news/oil-edges-higher-china-demand-010314752.html

West Texas Intermediate futures dropped 3.8% to settle at $85.10 a barrel. The DOE said its plan to replenish the nation’s emergency oil supply doesn’t include a trigger price and isn’t likely to occur until after fiscal 2023. Earlier this week prices rallied after Bloomberg News reported that administration officials have discussed refilling the Strategic Petroleum Reserve should crude dip below $80, suggesting a potential floor for prices.

“The White House sending mixed messages on the strategic reserve has pushed this market up and down,” said Phil Flynn, senior market analyst at Price Futures Group. “They’re putting out some trial balloons to see how their buying is going to impact prices.”

Meanwhile, China is considering exporting more fuel, a move designed to boost the economy but which also raises questions about how much domestic consumption is falling amid Covid-19 lockdowns. The news comes after the International Energy Agency said Wednesday the country will see its biggest drop in demand for oil in more than three decades.

Oil is on course for the first quarterly loss in more than two years as central banks including the Federal Reserve tighten monetary policy to tame inflation, hurting the outlook for energy consumption. The retreat has erased all the gains seen in the wake of Russia’s invasion of Ukraine, with prices earlier this month hitting the lowest since January.

Weekly US ending stocks of crude oil.

Stocks are NOT low! Stocks still higher than at any time prior to 2015!

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCESTUS1&f=W

.png)

+++++++++++++++++++++++++++++++++++++

Weekly ending stocks for unleaded gasoline.

Stocks are NOT historically low, although they're less than the 5 year average.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

.png)

++++++++++++++++++++++++++++

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

This is the fuel with the lowest stocks right now by a wide margin and the Northeast could face severe shortages and price volatility this Winter from bad decisions by refiners.

For this time of year, early September, heating oil stocks were slightly lower than this just 3 times using EIA records. In 2000, 1996 and 1985. In 2022, we are just barely above the record lows for this week in September.

What must have happened is the refineries that use crude to make RB and HO( RB does NOT have low stocks) are churning out much more RB and are NOT restocking the HO like they always do every year...... leaving the heating oil market vulnerable this upcoming heating season. This smells like politics.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

.png)

++++++++++++++++++++++++++++++++++++++

Weekly ending stocks for the SPR(Strategic Petroleum Reserve)

Lowest stocks since 1985!

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCSSTUS1&f=W _20ntH8E.png)

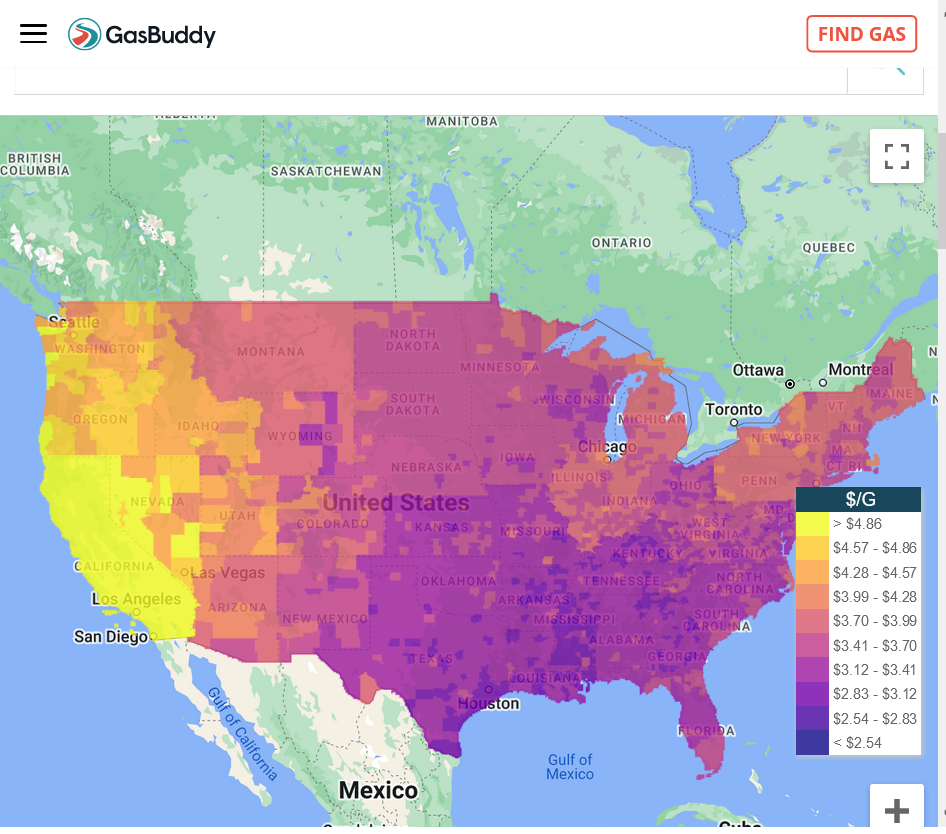

Latest gasoline prices on 9-16-22. Huge drop in recent months! -$1.30 ($5.00 to $3.70) since the peak in June.

https://www.gasbuddy.com/gaspricemap?z=4&lng=-96.591588&lat=38.822395

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

Latest Release Sep 14, 2022

Actual 2.442M Forecast 0.833M Previous 8.844M

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 21, 2022 | 10:30 | 0.833M | 2.442M | ||

| Sep 14, 2022 | 10:30 | 2.442M | 0.833M | 8.844M | |

| Sep 08, 2022 | 11:00 | 8.844M | -0.250M | -3.326M | |

| Aug 31, 2022 | 10:30 | -3.326M | -1.483M | -3.282M | |

| Aug 24, 2022 | 10:30 | -3.282M | -0.933M | -7.056M | |

| Aug 17, 2022 | 10:30 | -7.056M | -0.275M | 5.458M | |

| Aug 10, 2022 | 10:30 | 5.458M | 0.073M | 4.467M | |

| Aug 03, 2022 | 10:30 | 4.467M | -0.629M | -4.523M | |

| Jul 27, 2022 | 10:30 | -4.523M | -1.037M | -0.446M | |

| Jul 20, 2022 | 10:30 | -0.446M | 1.357M | 3.254M | |

| Jul 13, 2022 | 10:30 | 3.254M | -0.154M | 8.235M | |

| Jul 07, 2022 | 11:00 | 8.235M | -1.043M | -2.762M | |

| Jun 29, 2022 | 10:30 | -2.762M | -0.569M | -0.386M | |

| Jun 29, 2022 | 10:25 | -0.386M | 1.956M | ||

| Jun 15, 2022 | 10:30 | 1.956M | -1.314M | 2.025M | |

| Jun 08, 2022 | 10:30 | 2.025M | -1.917M | -5.068M | |

| Jun 02, 2022 | 11:00 | -5.068M | -1.350M | -1.019M | |

| May 25, 2022 | 10:30 | -1.019M | -0.737M | -3.394M | |

| May 18, 2022 | 10:30 | -3.394M | 1.383M | 8.487M | |

| May 11, 2022 | 10:30 | 8.487M | -0.457M | 1.302M | |

| May 04, 2022 | 10:30 | 1.302M | -0.829M | 0.692M | |

| Apr 27, 2022 | 10:30 | 0.692M | 2.000M | -8.020M | |

| Apr 20, 2022 | 10:30 | -8.020M | 2.471M | 9.382M | |

| Apr 13, 2022 | 10:30 | 9.382M | 0.863M | 2.421M | |

| Apr 06, 2022 | 10:30 | 2.421M | -2.056M | -3.449M | |

| Mar 30, 2022 | 10:30 | -3.449M | -1.022M | -2.508M | |

| Mar 23, 2022 | 10:30 | -2.508M | 0.114M | 4.345M | |

| Mar 16, 2022 | 10:30 | 4.345M | -1.375M | -1.863M | |

| Mar 09, 2022 | 11:30 | -1.863M | -0.657M | -2.597M | |

| Mar 02, 2022 | 11:30 | -2.597M | 2.748M | 4.515M | |

| Feb 24, 2022 | 12:00 | 4.515M | 0.442M | 1.121M | |

| Feb 16, 2022 | 11:30 | 1.121M | -1.572M | -4.756M | |

| Feb 09, 2022 | 11:30 | -4.756M | 0.369M | -1.046M | |

| Feb 02, 2022 | 11:30 | -1.046M | 1.525M | 2.377M | |

| Jan 26, 2022 | 11:30 | 2.377M | -0.728M | 0.515M | |

| Jan 20, 2022 | 12:00 | 0.515M | -0.938M | -4.553M |

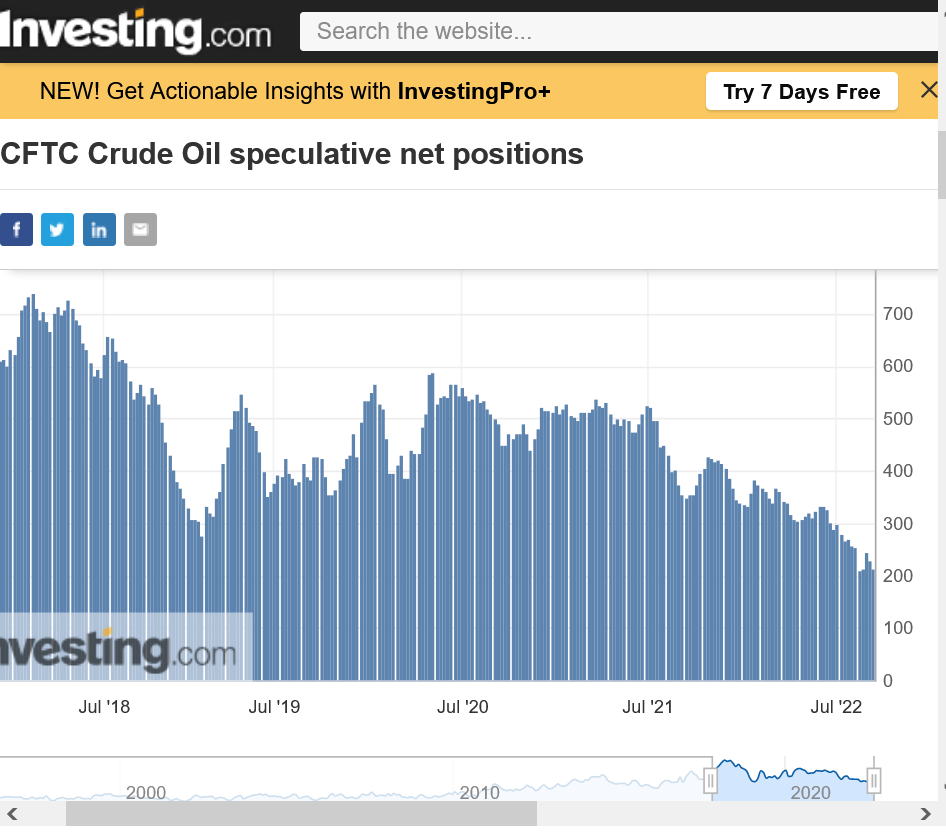

Fund position in crude.....liquidating/covering their massive long position by selling.

Their peak long was +700,000 contracts in early 2018.

Latest is down to +214,000 contracts last week.

Steady selling the last year from +500K down to the latest +214K

Latest Release Sep 09, 2022

Actual 214.5K Previous 229.2K

https://www.investing.com/economic-calendar/cftc-crude-oil-speculative-positions-1653

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Sep 16, 2022 | 15:30 | 214.5K | |||

| Sep 09, 2022 | 15:30 | 214.5K | 229.2K | ||

| Sep 02, 2022 | 15:30 | 229.2K | 246.2K | ||

| Aug 26, 2022 | 15:30 | 246.2K | 214.9K | ||

| Aug 19, 2022 | 15:30 | 214.9K | 210.7K | ||

| Aug 12, 2022 | 15:30 | 210.7K | 253.8K | ||

| Aug 05, 2022 | 15:30 | 253.8K | 259.3K | ||

| Jul 29, 2022 | 15:30 | 259.3K | 271.1K | ||

| Jul 22, 2022 | 15:30 | 271.1K | 268.3K | ||

| Jul 15, 2022 | 15:30 | 268.3K | 280.5K | ||

| Jul 08, 2022 | 15:30 | 280.5K | 299.7K | ||

| Jul 01, 2022 | 15:30 | 299.7K | 289.5K | ||

| Jun 24, 2022 | 15:30 | 289.5K | 302.9K | ||

| Jun 17, 2022 | 15:30 | 302.9K | 328.3K | ||

| Jun 10, 2022 | 15:30 | 328.3K | 333.0K | ||

| Jun 03, 2022 | 15:30 | 333.0K | 334.8K | ||

| May 27, 2022 | 15:30 | 334.8K | 325.6K | ||

| May 20, 2022 | 15:30 | 325.6K | 310.8K | ||

| May 13, 2022 | 15:30 | 310.8K | 321.7K | ||

| May 06, 2022 | 15:30 | 321.7K | 316.1K | ||

| Apr 29, 2022 | 15:30 | 316.1K | 307.7K | ||

| Apr 22, 2022 | 15:30 | 307.7K | 304.8K | ||

| Apr 15, 2022 | 15:30 | 304.8K | 308.6K | ||

| Apr 08, 2022 | 15:30 | 308.6K | 318.7K | ||

| Apr 01, 2022 | 15:30 | 318.7K | 340.0K | ||

| Mar 25, 2022 | 15:30 | 340.0K | 341.8K | ||

| Mar 18, 2022 | 15:30 | 341.8K | 361.7K | ||

| Mar 11, 2022 | 16:30 | 361.7K | 368.7K | ||

| Mar 04, 2022 | 16:30 | 368.7K | 339.0K | ||

| Feb 25, 2022 | 16:30 | 339.0K | 348.1K | ||

| Feb 18, 2022 | 16:30 | 348.1K | 363.4K | ||

| Feb 11, 2022 | 16:30 | 363.4K | 368.9K | ||

| Feb 04, 2022 | 16:30 | 368.9K | 373.4K | ||

| Jan 28, 2022 | 16:30 | 373.4K | 385.8K | ||

| Jan 21, 2022 | 16:30 | 385.8K | 360.5K | ||

| Jan 14, 2022 | 16:30 | 360.5K | 332.8K | ||

| Jan 07, 2022 | 16:30 | 332.8K | 338.4K | ||

| Jan 03, 2022 | 16:30 | 338.4K | 340.3K | ||

| Dec 27, 2021 | 16:30 | 340.3K | 347.1K | ||

| Dec 17, 2021 | 16:30 | 347.1K | 367.2K | ||

| Dec 10, 2021 | 16:30 | 367.2K | 387.2K | ||

| Dec 03, 2021 | 16:30 | 387.2K | 407.7K | ||

| Nov 29, 2021 | 16:30 | 407.7K | 415.8K | ||

| Nov 19, 2021 | 16:30 | 415.8K | 421.3K | ||

| Nov 15, 2021 | 15:30 | 421.3K | 419.3K | ||

| Nov 05, 2021 | 15:30 | 419.3K | 423.7K | ||

| Oct 29, 2021 | 15:30 | 423.7K | 429.6K | ||

| Oct 22, 2021 | 15:30 | 429.6K | 404.8K | ||

| Oct 15, 2021 | 15:30 | 404.8K | 398.3K | ||

| Oct 08, 2021 | 15:30 | 398.3K | 373.8K | ||

| Oct 01, 2021 | 15:30 | 373.8K | 356.0K | ||

| Sep 24, 2021 | 15:30 | 356.0K | 355.1K | ||

| Sep 17, 2021 | 15:30 | 355.1K | 349.2K | ||

| Sep 10, 2021 | 15:30 | 349.2K | 356.5K | ||

| Sep 03, 2021 | 15:30 | 356.5K | 374.3K | ||

| Aug 27, 2021 | 15:30 | 374.3K | 404.3K | ||

| Aug 20, 2021 | 15:30 | 404.3K | 400.4K | ||

| Aug 13, 2021 | 15:30 | 400.4K | 430.5K | ||

| Aug 06, 2021 | 15:30 | 430.5K | 449.8K | ||

| Jul 30, 2021 | 15:30 | 449.8K | 448.7K | ||

| Jul 23, 2021 | 15:30 | 448.7K | 499.1K | ||

| Jul 16, 2021 | 15:30 | 499.1K | 497.4K | ||

| Jul 09, 2021 | 15:30 | 497.4K | 522.5K | ||

| Jul 02, 2021 | 15:30 | 522.5K | 526.2K | ||

| Jun 25, 2021 | 15:30 | 526.2K | 510.5K | ||

| Jun 11, 2021 | 15:30 | 510.5K | 491.3K |

https://tradingeconomics.com/commodity/crude-oil

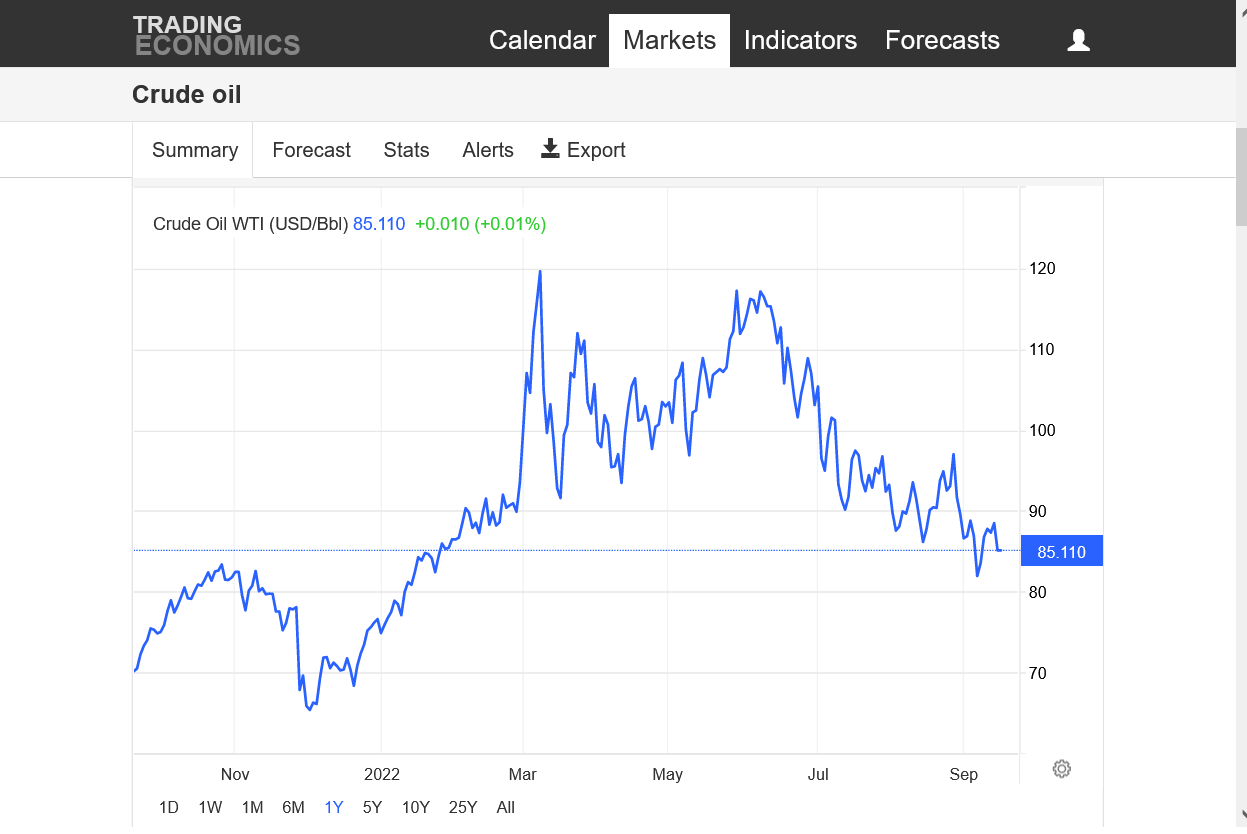

Crude 1 year chart below

Double top around $120 area(Mar-June). Testing support from last November just above $80 area.

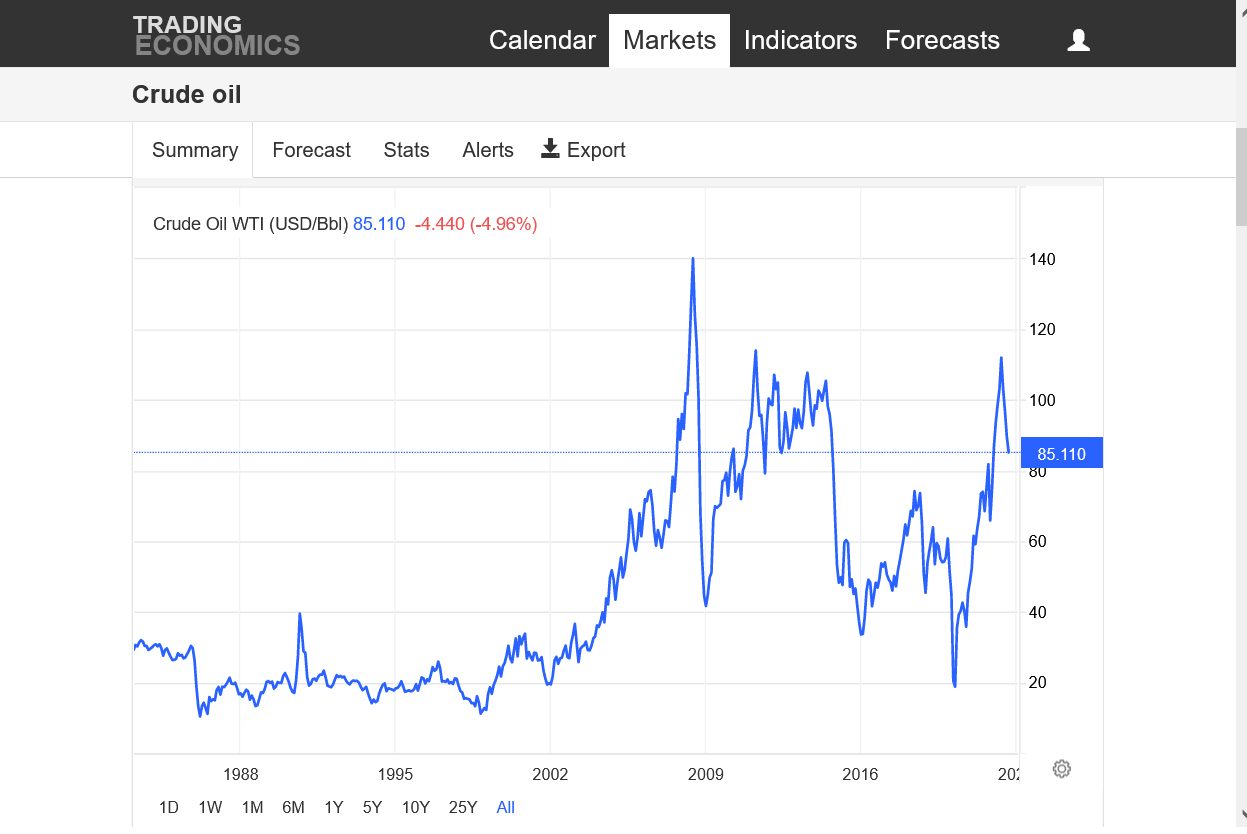

Crude, almost 10 years below.

Prices broke out from the down trending line defined by the highs in 2008, lower highs in 2011 and wimpy lower highs/bounce in 2018. This upside break out is the current long term trend!

We can see the COVID spike lower in the Spring of 2020.

Crude, 35+ years below.

Tight range for crude until the upside break out above $40 in 2004!

$40 was tested in Jan. 2009 with a spike lower because of the great recession, then a spike lower in Feb. 2016. Then the fluke, COVID spike lower in 2020.

As you can see, crude oil is has NOT been following the seasonal since we topped in June!

Historic, Crude oil thread here with us posting live as crude crashed below $0!

US crude tumbles to 18-year low

50 responses |

Started by metmike - April 17, 2020, 12:43 p.m.

HO +6c, while RB and CL are lower.

exactly for the reason mentioned above on the stocks/inventory page, regarding refining crude to make gas at the expense of heating oil……which now has extremely low stocks for this time of year as we approach Winter.

.png)

++++++++++++++++++++++++++++++

| Product | Gallons |

|---|---|

| Finished motor gasoline | 20.08 |

| Distillate fuel oil | 12.47 |

| Kerosene-type jet fuel | 3.53 |

| Petroleum coke | 2.06 |

| Still gas | 1.72 |

| Hydrocarbon gas liquids | 1.68 |

| Asphalt and road oil | 0.92 |

| Residual fuel oil | 0.59 |

| Naptha for feedstocks | 0.46 |

| Lubricants | 0.46 |

| Other oils for feedstocks | 0.25 |

| Miscellaneous products | 0.21 |

| Special napthas | 0.08 |

| Finished aviation gasoline | 0.04 |

| Kerosene | 0.04 |

| Waxes | < 0.01 |

| Total | 44.60 |

| Processing gain | 2.60 |

| Source: U.S. Energy Information Administration, Petroleum Supply Annual, August 2022 | |

Life without petroleum based products:6,000 products made with petroleum. Killing Coal. Fossil fuels and fertilizer. Biden praises high gasoline prices.

https://www.marketforum.com/forum/topic/84689/

https://wattsupwiththat.com/2022/09/20/gulf-of-mexico-oil-gas-lease-sale-update/

Guest “Give ’em Hell” by David Middleton

As I have written many times before, the US government is legally obligated to hold annual auctions for oil & gas leases in Gulf of Mexico and under other Federal lands and waters. Thus far, the Biden maladministration has utterly flouted the law, holding only one Gulf of Mexico lease sale in November 2021 (Sale 257), to avoid contempt of court charges against the Secretary of the Interior. This lease sale was unlawfully voided by a corrupt Obama judge. Some of this damage was undone by Joe Manchin’s Inflation Increasing Act. The legislation ordered the Department of the Interior to immediately honor the results of Lease Sale 257, hold additional lease sales and to implement a new Five Year Leasing Program for 2023-2028, which they were legally required to complete by June 30, 2022.

Last week, the Interior Department awarded leases to most of the high bidders in Lease Sale 257. Hopefully, they will continue to obey this part of the law by approving exploration and drilling plans in a timely manner. They have not announced plans to hold any further lease sales under they existing Five Year Leasing Program. However, they have issued a draft for a new program, which includes an option to hold no lease sales. They have opened the plan to public comment. I have no doubt that the Biden maladministration is banking on getting thousands of comments demanding that no more offshore lease sales be held… because… climate change… And then kowtowing to the Climatariat.

The National Offshore Industries Association (NOIA) is encouraging sane Americans to submit comments, supportive of continued offshore oil & gas leasing.

| Having your workers lend their voice in support of the Gulf of Mexico and offshore oil and gas leasing will go a long way in supporting reasonable and regular lease sales in the Gulf of Mexico. Comment Link: https://actnow.io/JIMWf8Q Note: Energy employees can also text keyword OFFSHORE to 52886 to submit comments## The National Ocean Industries Association (NOIA) represents and advances a dynamic and growing offshore energy industry, providing solutions that support communities and protect our workers, the public and our environment. |

| Copyright © 2022 National Ocean Industries Association, All rights reserved. |

The HO/RB spread really popped earlier today +20c because of the colder weather in the forecast in the Northeast and MidAtlantic where they us heating oil in the cold season to heat homes.

The decision comes after gas prices spiked in the U.S. in the summer and have trended downward in recent weeks.

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

Latest Release Oct 05, 2022 Actual-1.356M Forecast2.052M Previous-0.215M

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 05, 2022 | 10:30 | -1.356M | 2.052M | -0.215M | |

| Sep 28, 2022 | 10:30 | -0.215M | 0.443M | 1.142M | |

| Sep 21, 2022 | 10:30 | 1.142M | 2.161M | 2.442M | |

| Sep 14, 2022 | 10:30 | 2.442M | 0.833M | 8.844M | |

| Sep 08, 2022 | 11:00 | 8.844M | -0.250M | -3.326M | |

| Aug 31, 2022 | 10:30 | -3.326M | -1.483M | -3.282M |

https://www.reuters.com/markets/commodities/us-crude-fuel-stockpiles-down-last-week-eia-2022-10-05/

Crude dropped a bit vs expectations to build +2 MB

RB dropped almost a whopping -5 MB the huge deal was

HO dropped by over 3 MB to the lowest in history for the end of September, just a tad less than 1996, which previously had the lower HO supplies at this time of year.

HO stocks are below 111 MB. They better get going in refining crude to make more heating oil or the East Coast which is already going to get hit with extremely high prices and could run pretty low in the event of a cold Winter.

I think the verdict is out and $60 is not going to happen. It did go down more after I posted it would not, but it also came back and more. All is good. I've been wrong a zillion times, but oil is bullish. -:))

Thanks Richard!

Heating oil is up another 17c today, with the lowest stocks in history(failing to refine crude into heating oil this year caused this), cold weather coming up for the Northeast and the looming OPEC cut.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

.png)

https://www.eia.gov/energyexplained/heating-oil/use-of-heating-oil.php

.png)

.png)

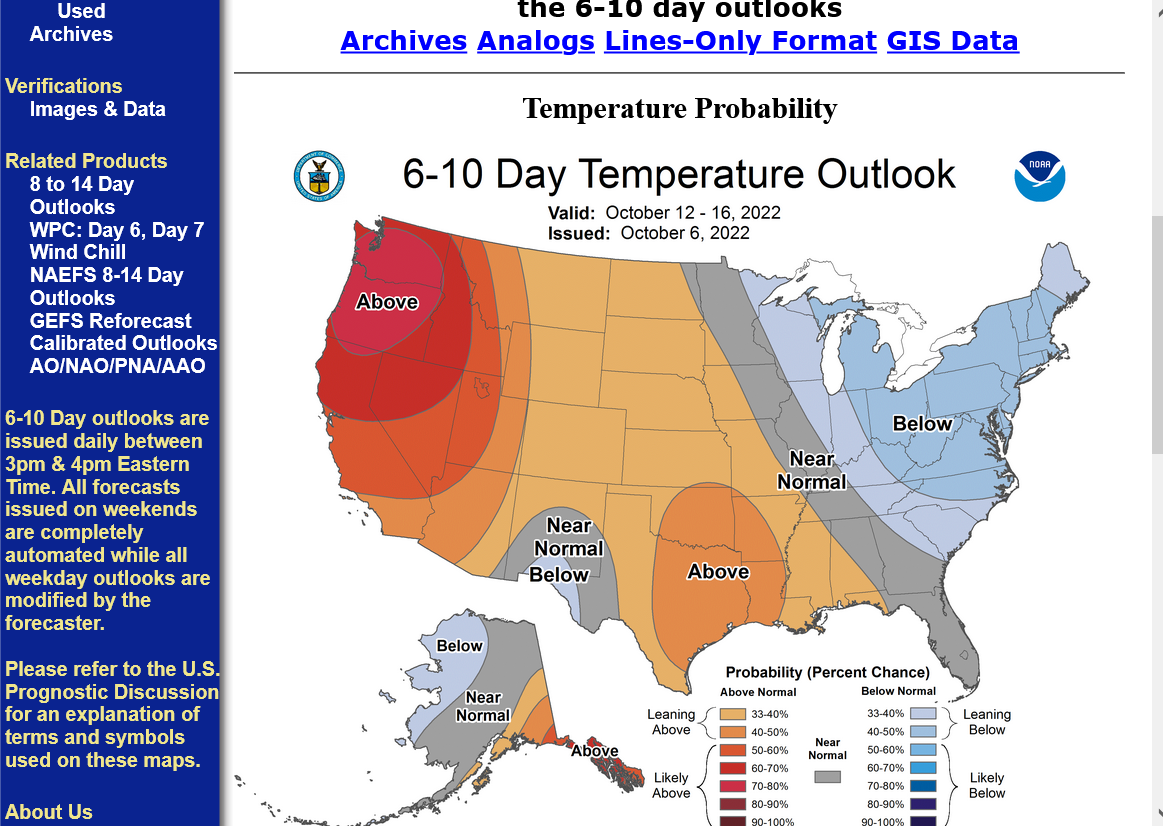

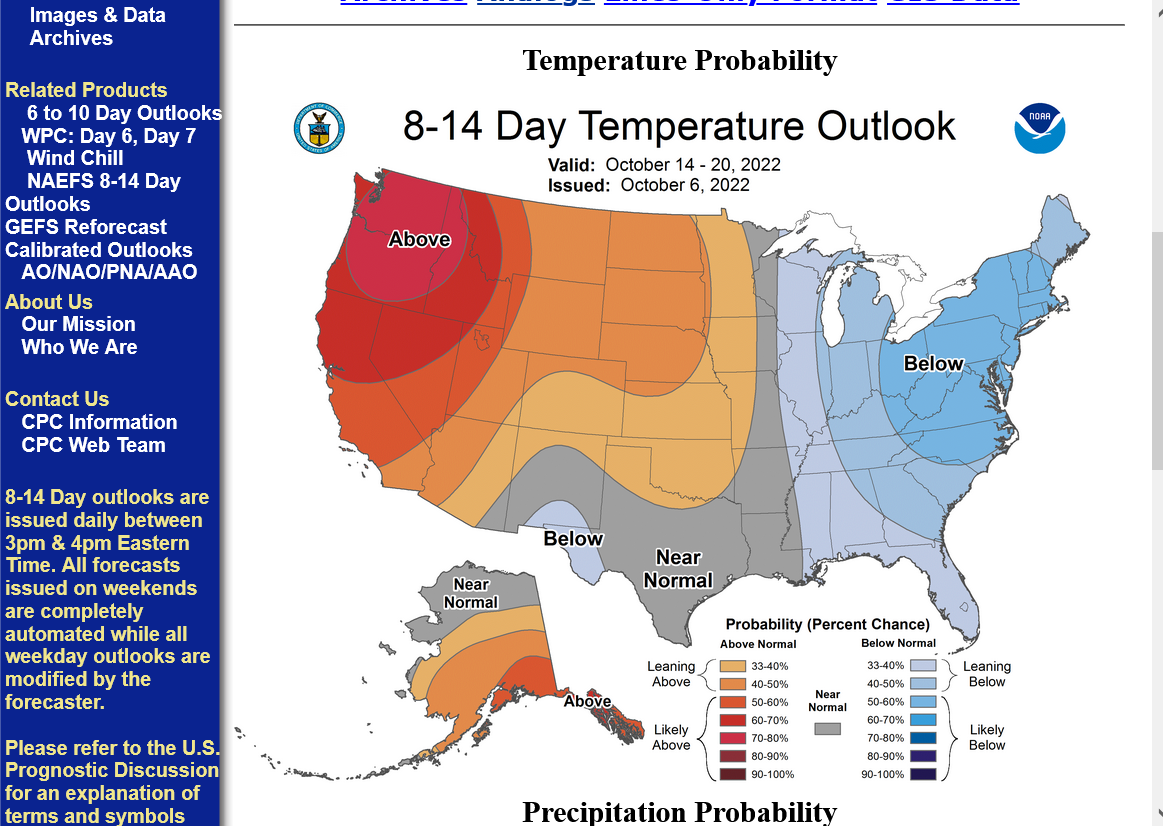

https://www.cpc.ncep.noaa.gov/products/predictions/610day/index.php

Just to remind you, the amount of heating oil in storage right now is the lowest in history for the end of September, just a tad lower than 1996 at this time. This is going into the Winter. The Northeast uses most of the heating oil in the United States.

This is extremely poor planning which WILL cause people in the Northeast to pay very high residential heating prices this Winter and potentially lead to shortages if we have a cold Winter.

This is just another example of the clueless counterproductive energy policies we've had in this country over the past 2 years. I'll spare you from my typical rant related to the fake climate crisis and focus on energy market trading.

The HO/RB spread right now (heating oil/unleaded) is $1.27, with front month HO over $4 again.

This spread was already very high and has gained at least 30c just since Wednesday.

I don't have the records but this has got to be the most extreme this spread was ever at.

Here more on the market dynamics.

Release Date: Sept. 7, 2022 | Forecast Completed: Sept. 1, 2022 | Next Release Date: Oct. 12, 2022 |

https://www.eia.gov/outlooks/steo/marketreview/petproducts.php

.png)

Operable refinery capacity has been dropping. Even with more crude, if we can't refine it fast enough, it doesn't make it to consumers!

https://assets.realclear.com/files/2022/10/2058_energyinflationwasbydesign.pdf