Weekly Petroleum Status Report/Energy Information Administration

https://www.eia.gov/petroleum/supply/weekly/

https://www.eia.gov/petroleum/supply/weekly/pdf/wpsrall.pdf

BULLISH CRUDE! Crude was +$3 today, partly from the report.

Warm weather is bearish Heating oil. -19c today. The highs are in.

RB was +9c today. Following crude. HO/RB spreads unwinded.(long HO/short RB spreads reversed)

October 19, 2022 09:30 CDT

https://www.cmegroup.com/education/events/econoday/2022/10/feed541177.html

| Actual | Previous | |

| Crude Oil Inventories - W/W | -1.7M barrels | 9.9M barrels |

| Gasoline Inventories - W/W | -0.1M barrels | 2.0M barrels |

| Distillate Inventories - W/W | 0.1M barrels | -4.9M barrels |

Highlights

Crude oil inventories eased by 1.7 million to 437.4 million barrels in the Oct. 14 week after jumping by 9.9 million to 439.1 million barrels in the Oct. 7 week. The latest total is down about 2 percent from the 5-year average for this time of year, and up 2.5 percent from a year ago.

Product inventories showed motor gasoline down by 0.1 million barrels from a week ago, about 7 percent below the 5-year average for this time of year, and down 3.8 percent from a year ago. Distillates inventories rose 0.1 million, about 20 percent below the average level for this time of year, and down 15.3 percent from a year ago.

Overall product demand over the last four weeks averaged 20.4 million barrels a day, down 2.4 percent from the same period last year. Gasoline demand over the past four weeks averaged 8.8 million barrels a day, down 6.4 percent from the same period last year. Distillate fuel demand averaged 4.2 million barrels a day over the past four weeks, up 1.1 percent. Jet fuel demand was up 7.5 percent compared with the four-week period last year.

Here's a look at historical stocks of the main petroleum/liquid fuels with my analysis of where they are compared to stocks since 1982.

Crude stocks are actually in good shape.

Gasoline is low but not critical.

Heating oil is record lowest and potentially a problem in the Northeast this Winter.

SPR oil continues to plunge, now the lowest since June 1984 and destined to be the lowest since these records started in short order.

Enjoy the analysis.

Weekly US ending stocks of crude oil.

Stocks are NOT low! Stocks still MUCH higher than at any time prior to 2015!

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCESTUS1&f=W

.png)

+++++++++++++++++++++++++++++++++++++

Weekly ending stocks for unleaded gasoline.

Stocks are the lowest in 8 years now, here at the end of the driving season but NOT historically low like they are for heating oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W

.png)

++++++++++++++++++++++++++++

Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast).

This is the fuel with the lowest stocks right now by a wide margin and the Northeast could face severe shortages and price volatility this Winter from bad decisions by refiners.

For this time of year, mid-October, heating oil stocks are now easily the lowest going back to these records starting in 1982!

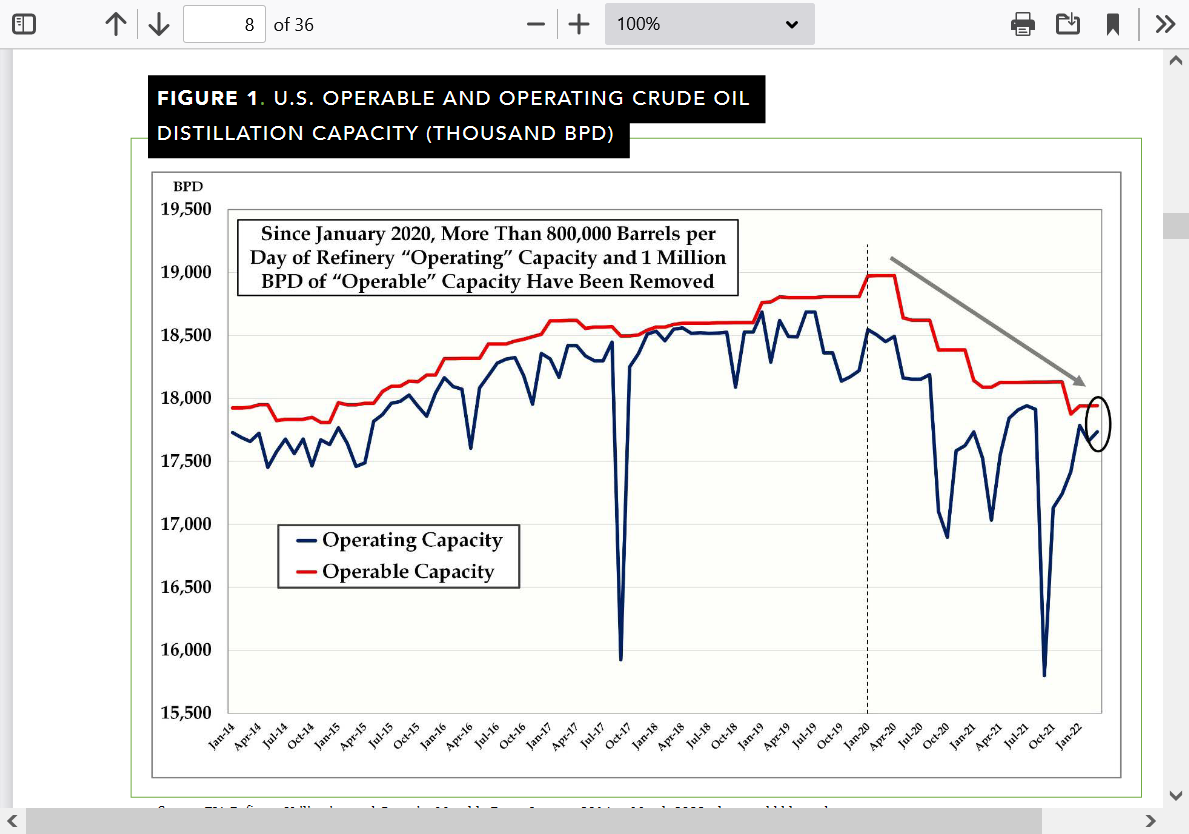

What must have happened is the refineries that use crude to make RB and HO are just not capable of churning out much more RB and are NOT restocking the HO like they always do every year...... leaving the heating oil market vulnerable this upcoming heating season. We have a serious problem with refining capacity in this country!!! Waste as much SPR oil as you want pretending to fix it for political posturing and not understanding the energy markets but if refining capacity can't keep up........it doesn't fix the problem of the shortage of refined products. In the long run, it makes it much worse by breaking our energy security piggy bank.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W

.png)

++++++++++++++++++++++++++++++++++++++

Weekly ending stocks for the SPR(Strategic Petroleum Reserve). US energy security being drained away for self serving political interests.

Lowest stocks since June 1984 now and continue to fall fast. Unbelievable!

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCSSTUS1&f=W .png)

++++++++++++++++++

Operable refinery capacity has been dropping. Even with more crude, if we can't refine it fast enough, it doesn't make it to consumers!

https://assets.realclear.com/files/2022/10/2058_energyinflationwasbydesign.pdf

+++++++++++++++++++++++++++++++++++++++++

.png)

++++++++++++++++++++++++++++++

| Product | Gallons |

|---|---|

| Finished motor gasoline | 20.08 |

| Distillate fuel oil | 12.47 |

| Kerosene-type jet fuel | 3.53 |

| Petroleum coke | 2.06 |

| Still gas | 1.72 |

| Hydrocarbon gas liquids | 1.68 |

| Asphalt and road oil | 0.92 |

| Residual fuel oil | 0.59 |

| Naptha for feedstocks | 0.46 |

| Lubricants | 0.46 |

| Other oils for feedstocks | 0.25 |

| Miscellaneous products | 0.21 |

| Special napthas | 0.08 |

| Finished aviation gasoline | 0.04 |

| Kerosene | 0.04 |

| Waxes | < 0.01 |

| Total | 44.60 |

| Processing gain | 2.60 |

| Source: U.S. Energy Information Administration, Petroleum Supply Annual, August 2022 | |

+++++++++++++++

++++++++++++++++++++

Life without petroleum based products:6,000 products made with petroleum. Killing Coal. Fossil fuels and fertilizer. Biden praises high gasoline prices.

https://www.marketforum.com/forum/topic/84689/

++++++++++++++++++++++++

https://www.eia.gov/energyexplained/heating-oil/use-of-heating-oil.php

.png)

.png)

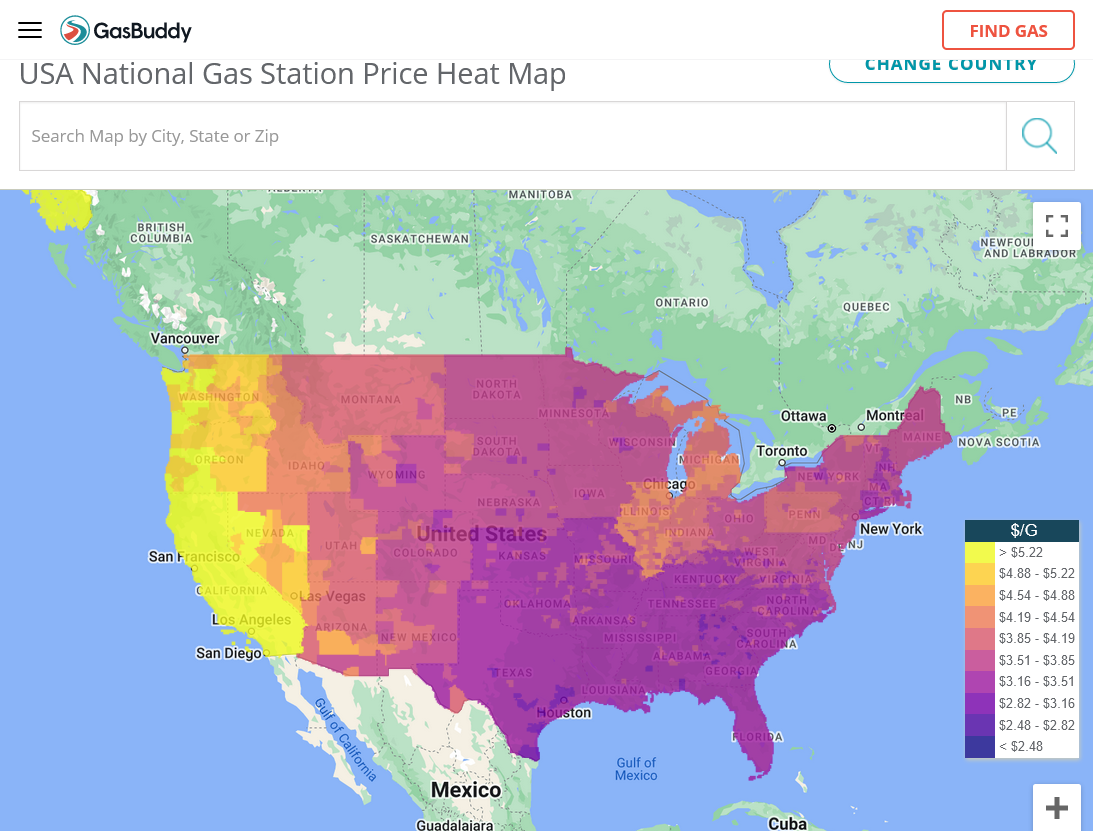

Latest gas prices across the country:

https://www.gasbuddy.com/gaspricemap?z=4&lng=-96.591588&lat=38.822395

US Crude inventories

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

Latest Release Oct 19, 2022 Actual-1.725M Forecast1.380M Previous9.880M

BULLISH Crude!!!!! Crude up $2+

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Oct 19, 2022 | 10:30 | -1.725M | 1.380M | 9.880M | |

| Oct 13, 2022 | 11:00 | 9.880M | 1.750M | -1.356M | |

| Oct 05, 2022 | 10:30 | -1.356M | 2.052M | -0.215M | |

| Sep 28, 2022 | 10:30 | -0.215M | 0.443M | 1.142M | |

| Sep 21, 2022 | 10:30 | 1.142M | 2.161M | 2.442M | |

| Sep 14, 2022 | 10:30 | 2.442M | 0.833M | 8.844M | |

| Sep 08, 2022 | 11:00 | 8.844M | -0.250M | -3.326M | |

| Aug 31, 2022 | 10:30 | -3.326M | -1.483M | -3.282M | |

| Aug 24, 2022 | 10:30 | -3.282M | -0.933M | -7.056M | |

| Aug 17, 2022 | 10:30 | -7.056M | -0.275M | 5.458M | |

| Aug 10, 2022 | 10:30 | 5.458M | 0.073M | 4.467M | |

| Aug 03, 2022 | 10:30 | 4.467M | -0.629M | -4.523M | |

| Jul 27, 2022 | 10:30 | -4.523M | -1.037M | -0.446M | |

| Jul 20, 2022 | 10:30 | -0.446M | 1.357M | 3.254M | |

| Jul 13, 2022 | 10:30 | 3.254M | -0.154M | 8.235M | |

| Jul 07, 2022 | 11:00 | 8.235M | -1.043M | -2.762M | |

| Jun 29, 2022 | 10:30 | -2.762M | -0.569M | -0.386M | |

| Jun 29, 2022 | 10:25 | -0.386M | 1.956M |

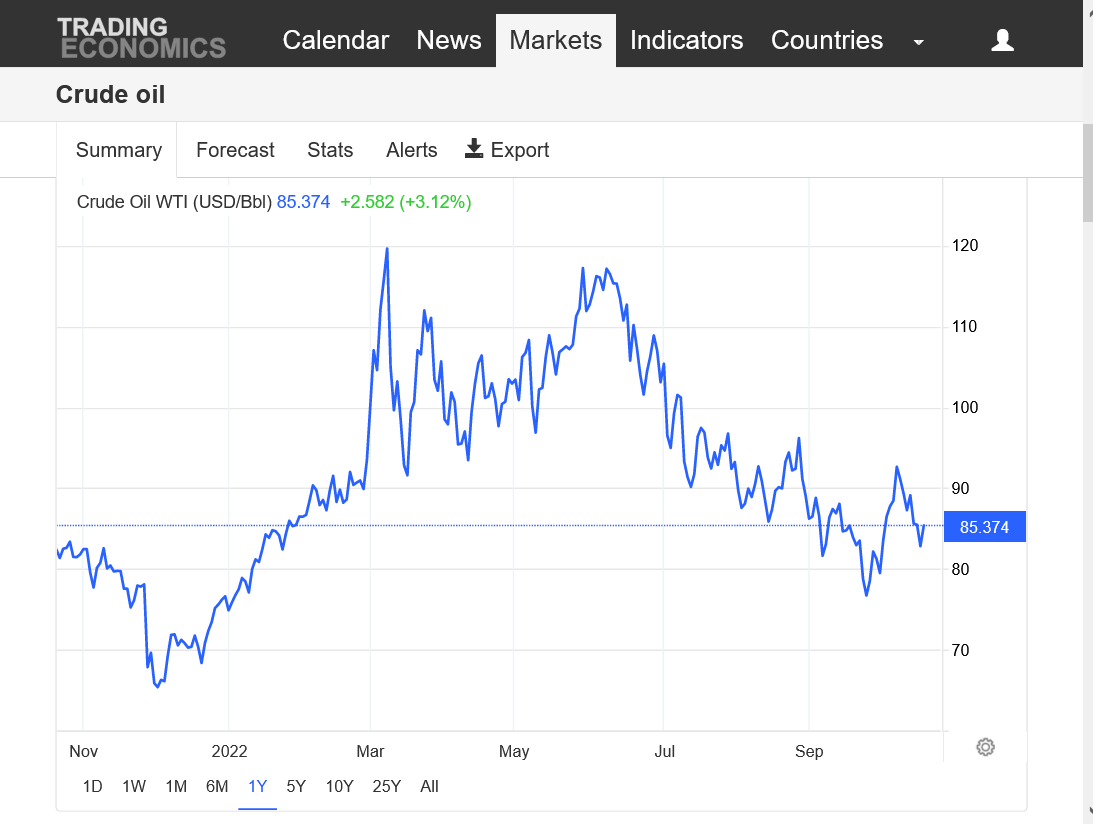

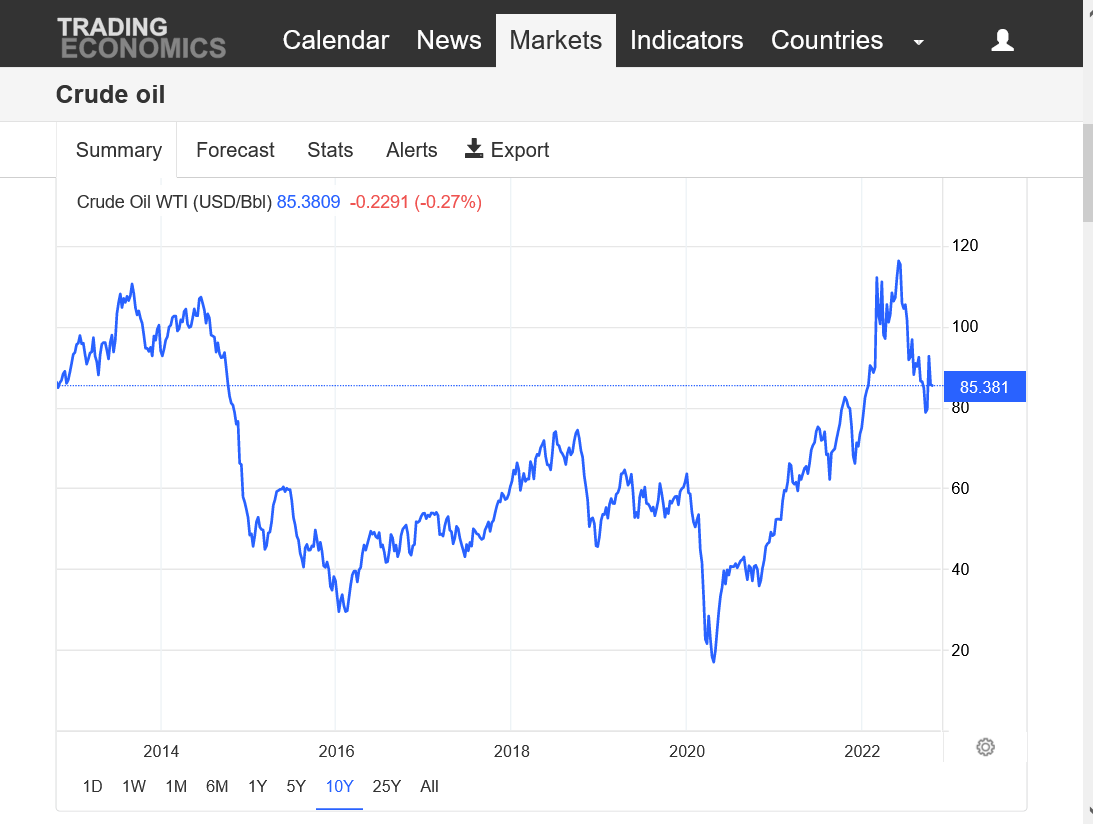

Crude price charts with WAG analysis that means nothing because the news and governmental decisions that control the news trumps EVERYTHING else.

https://tradingeconomics.com/commodity/crude-oil

1 month below: Bottom in September, higher bottom in October? Headed higher? Close above early Oct high or below Sept low to confirm trend.

1 year below: Double top Mar-June 2022. However, the September bottom was HIGHER than the previous low. Need close below last December to confirm lower or take out the June highs for higher.

10 year below. June 2022 high looks like potential double top. Solid closes below $74, the 2018 highs would potentially confirm for this technical picture.

35+ years.

Potential upside breakout of previous downtrend channel, defined by the 2018 highs, then 2011-14 highs, that accelerated downwards with 2018 highs. Lower lows from 2009, then 2016, then 2020 COVID lows defined the downside of the down channel.

Could also be: Triple top with, 2008 then 2011-2014 highs?

As you can see, crude oil is has NOT been following the seasonal since we topped in June and crashed lower when the seasonal was higher!

Politics and news are dominating this market. Seasonals are usually extremely negative in October and November.

Historic, Crude oil thread here with us posting live as crude crashed below $0!

US crude tumbles to 18-year low

50 responses |

Started by metmike - April 17, 2020, 12:43 p.m.

Release Date: Oct. 12, 2022

https://www.eia.gov/outlooks/steo/marketreview/petproducts.php

U.S. heating oil expenditures: In the 2022–2023 winter season (October 2022 through March 2023), we currently estimate U.S. average household heating oil consumption—most of which occurs in the Northeast—will be 519 gallons, which would be the most since the 2014–2015 winter season (Figure 8). High heating oil prices going into this winter, combined with higher forecast consumption result in our expectation that heating oil expenditures will be about $2,350 this winter, for homes in which heating oil is the primary space heating fuel. Expenditures at that level would be the highest since 2013–2014 winter season when adjusted for inflation.

The high estimated consumption this winter is a result of our estimates for higher heating degree days,

+++++++++++++

metmike: The EIA states "High heating oil prices going into this winter, combined with higher forecast consumption result in our expectation that heating oil expenditures will be about $2,350 this winter, for homes in which heating oil is the primary space heating fuel. Expenditures at that level would be the highest since 2013–2014 winter season when adjusted for inflation."

They are referring to the brown line on the graph above. What deception! How about a more honest assessment "highest in history" outside of the spike higher in June 2008 when crude hit $150!

https://tradingeconomics.com/commodity/heating-oil

Crude is up $3+ at the moment but heating oil is down 10c, what gives?

This is it: Warmth in the Northeast heating oil region! Same thing that's cause Natural Gas prices to drop over $10,000+/contract in the last week.

https://www.cpc.ncep.noaa.gov/products/predictions/610day/

THANKS, MIKE!

I CAN SPEND LOTSA TIME DISSECTING THIS KINDA STUFF LOL

YW Jean!

Just enjoy it and use it to enhance your knowledge/understanding of these markets.

+++++++++++++

On the after hours close:

BULLISH CRUDE! Crude was +$3 today, partly from the EIA report.

Warm weather is bearish Heating oil. -19c today. The highs are in.

RB was +9c today. Following crude. HO/RB spreads unwinded.(long HO/short RB spreads reversed).

U.S. gasoline demand has improved a little over the past several weeks but is still below normal, hanging out near the 2014 levels. The latest 4-week average is 6.4% below the same period a year ago.

Crude up another $2 this morning.

HO +2c, RB +5c but its early.

RB declines seasonally for the next 2 months and politics are trying to jawbone it lower ahead of the election too

Even as the longer term fundamentals and the technical picture as well as fake green energy schemes are screaming higher.

Futures prices below will always be $1 lower than the price at the pump(depending on your location).

https://tradingeconomics.com/commodity/gasoline