KEY EVENTS TO WATCH FOR:

Friday, December 9, 2022

8:30 AM ET. November PPI

PPI, M/M% (previous +0.2%)

Ex-Food & Energy PPI, M/M% (previous +0%)

Personal Consumption (previous +0.4%)

10:00 AM ET. October Monthly Wholesale Trade

Inventories, M/M% (previous +0.6%)

10:00 AM ET. December University of Michigan Survey of Consumers - preliminary

Mid-Mo Sentiment (previous 54.7)

Mid-Mo Expectations (previous 52.7)

Mid-Mo Current Idx (previous 57.8)

12:00 PM ET. World Agricultural Supply & Demand Estimates (WASDE)

Corn, End Stocks (Bushels)

Soybeans, End Stocks (Bushels)

Wheat, End Stocks (Bushels)

Cotton, End Stocks (Bales)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The Dow closed higher on Thursday as it consolidates some of the decline off last-Thursday's high. The low-range close sets the stage for a steady to slightly higher opening when Friday's night session begins trading. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. If the Dow extends the aforementioned decline, the November 10th gap crossing at 33,065.11 is the next downside target. If the Dow renews the rally off October's low, the 75% retracement level of the January-October decline crossing at 34,893.55. First resistance is last-Thursday's high crossing at 34,595.51. Second resistance is the 75% retracement level of the January-October decline crossing at 34,901.54. First support is the November 11th gap crossing at 33,065.11. Second support is the November 3rd low crossing at 31,727.05.

The March NASDAQ 100 closed higher on Thursday as it consolidated some of the decline off last-Thursday's high. Today's high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are neutral to bearish signaling sideways to lower prices are possible. Closes below the 50-day moving average crossing at 11,526.34 would confirm that a short-term top has been posted. If March renews the rally off November's low, the 62% retracement level of the August-October decline crossing at 12,618.67 is the next upside target. First resistance is the 50% retracement level of the August-October decline crossing at 12,229.32. Second resistance is the 62% retracement level of the August-October decline crossing at 12,618.67. First support is the 50-day moving average crossing at 11,526.34. Second support is the November 9th low crossing at 10,932.75.

The March S&P 500 closed higher on Thursday as it consolidated some of the decline off last-Thursday's high. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the aforementioned decline, the 50-day moving average crossing at 3874.59 is the next downside target. If March renews the rally off October's low, the September 13th high crossing at 4194.25 is the next upside target. First resistance is last-Thursday's high crossing at 4142.50. Second resistance is the September 13th high crossing at 4194.25. First support is the November 17th low crossing at 3945.50. Second support is the 50-day moving average crossing at 3874.59.

INTEREST RATES? http://quotes.ino.com/ex?changes/?c=interest ""

March T-bonds closed down 24-pts. at 131-06.

March T-bonds posted an inside day with a lower close on Thursday as they consolidated some of this week's rally. The low-range close sets the stage for a steady to lower opening when Friday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off November's low, the 62% retracement level of the August-November decline crossing at 133-30 is the next upside target. Closes below the 20-day moving average crossing at 127-02 would signal that a short-term top has been posted. First resistance is Thursday's high crossing at 131-31. Second resistance is the 62% retracement level of the August-October decline crossing at 133-30. First support is the 10-day moving average crossing at128-31. Second support is the 20-day moving average crossing at 127-02.

March T-notes closed down 225-pts. at 114.150.

March T-notes posted an inside day closed lower on Thursday as it consolidated the rally off October's low. The low-range close sets the stage for a steady to lower opening when Friday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off October's low, the 62% retracement level of the August-November decline crossing at 116.232 is the next upside target. Closes below the 20-day moving average crossing at 113,134 would signal that a short-term top has been posted. First resistance is the 50% retracement of the August-October decline crossing at 115.090. Second resistance is the 62% retracement of the August-October decline crossing at 116.232. First support is the 20-day moving average crossing at 113.134. Second support is the 50-day moving average crossing at 112.044.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

January crude oil closed lower for the fifth-day in a row on Thursday as it extends the decline off November's high. The low-range close sets the stage for a steady to lower opening when Friday's night session begins. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If January extends the decline off November's high, the 62% retracement level of the 2020-2022 rally crossing at $63.80 is the next downside target. Closes above the 20-day moving average crossing at $79.95 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $79.95. Second resistance is the 50-day moving average crossing at $83.24. First support is today's low crossing at $71.12. Second support is the 62% retracement level of the 2020-2022 rally crossing at $63.80.

January heating oil posted an inside day with a higher close on Thursday as it consolidated some of the decline off November's high. The high-range close sets the stage for a steady to higher opening when Friday's night trading session begins. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If January extends the decline off November's high, the 50% retracement level of the 2020-2022 rally crossing at $2.6219 is the next downside target. Closes above the 10-day moving average crossing at $3.0921 would signal that a short-term low has been posted. First resistance is the 10-day moving average crossing at $3.0921. Second resistance is the 20-day moving average crossing at $3.2521. First support is today's low crossing at $2.7750. Second support is the 50% retracement level of the 2020-2022 rally crossing at $2.6219.

January unleaded gas closed lower on Thursday as it extended the decline off November's high. The low-range close sets the stage for a steady to lower opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If January extends the decline off November's high, the 50% retracement level of the 2020-2022 rally crossing at 1.9894 is the next downside target. Closes above the 20-day moving average crossing at $2.3370 would signal that a short-term low has been posted. First resistance is the 10-day moving average crossing at $2.2319. Second resistance is the 20-day moving average crossing at $2.3370. First support is today's low crossing at $2.0463. Second support is the 50% retracement level of the 2020-2022 rally crossing at 1.9894.

January Henry natural gas closed higher on Thursday as it consolidates some of the decline off November's high. The mid-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If January extends the decline off November's high, the 75% retracement level of the 2020-2022 rally crossing at 4.501 is the next downside target. Closes above the 50-day moving average crossing at 6.663 would signal that a short-term low has been posted. First resistance is Monday's gap crossing at 6.221. Second resistance is the 50-day moving average crossing at 6.663. First support is the 62% retracement level of the 2020-2022 rally crossing at 5.500. Second support is the 75% retracement level of the 2020-2022 rally crossing at 4.501.

CURRENCIES? http://quotes.ino.com/ex?changes/?c=currencies ""

The March Dollar closed lower on Thursday. The low-range close sets the stage for a steady to lower opening when Friday's nights session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off September's high, the 75% retracement level of the January-September rally crossing at $101.331 is the next downside target. Closes above the November 30thhigh crossing at 106.775 would signal that a short-term low has been posted. First resistance is the November 30thhigh crossing at 106.775. Second resistance is the November 21st high crossing at $107.500. First support is the 62% retracement level of the January-September rally crossing at $103.643. Second support is 75% retracement level of the January-September rally crossing at $101.331.

The March Euro closed higher on Thursday. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If March extends the rally off September's low, the 25% retracement level of the 2018-2022 decline crossing at $1.07982 is the next upside target. Closes below the 20-day moving average crossing at 1.04797 would signal that a short-term top has been posted. First resistance is Monday's high crossing at $1.06745. Second resistance is the 25% retracement level of the 2018-2022 decline crossing at $1.07982 is the next upside target. First support is the 20-day moving average crossing at $1.04797. Second support is the November 21st low crossing at $1.03165.

The March British Pound closed higher on Thursday. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are turning neutral to bullish signaling sideways to higher prices are possible near-term. If March extends the rally off September's low, the 62% retracement level of the May-September decline crossing at 1.2770 is the next upside target. Closes below the 20-day moving average crossing at 1.2038 would confirm that a short-term top has been posted. First resistance is August's high crossing at 1.2324. Second resistance is the 50-week moving average crossing at 1.2438. First support is the 20-day moving average crossing at 1.2038. Second support is the 50-day moving average crossing at 1.1626.

The March Swiss Franc closed higher on Thursday. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to higher prices are possible near-term. If March extends the rally off November's low, the 38% retracement level of the 2018-2022 decline crossing at 1.09661 is the next upside target. Closes below Tuesday's low crossing at 1.07000 would signal that a short-term top has been posted. First resistance is last-Friday's high crossing at 1.08460. Second resistance is the 38% retracement level of the 2018-2022 decline crossing at 1.09661. First support is Tuesday's low crossing at 1.0700. Second support is the November 21st low crossing at 1.05670.

The March Canadian Dollar closed higher on Thursday as it consolidated some of the decline off November's high. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off November's high, the November 3rd low crossing at 72.58 is the next downside target. Closes above Monday's high crossing at 74.82 would signal that a short-term low has been posted. First resistance is Monday's high crossing at 74.82. Second resistance is the November 25thhigh crossing at 75.16. First support is Wednesday's low crossing at 73.12. Second support is the November 3rd low crossing at 72.58.

The March Japanese Yen posted an inside day with a lower close on Thursday. The mid-range close sets the stage for a steady to lower opening when Friday’s night session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at 0.073210 would confirm that a short-term top has been posted. If March renews the rally off October's low, the 87% retracement level of the August-October decline crossing at 0.076735 is the next upside target. First resistance is the 75% retracement level of the August-October decline crossing at 0.075398. Second resistance is the 87% retracement level of the August-October decline crossing at 0.076735. First support is the 20-day moving average crossing at 0.073210. Second support is the November 21st low crossing at 0.071410.

PRECIOUS METALS? http://quotes.ino.com/ex?changes/?c=metals ""

February gold closed slightly higher on Thursday as it consolidates some of the decline off Monday's high. The mid-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to lower prices are possible near-term. If February extends the rally off November's low, August's high crossing at $1836.70 is the next upside target. Closes below the 20-day moving average crossing at $1778.80 would signal that a short-term top has been posted. First resistance is Monday's high crossing at $1822.90. Second resistance is August's high $1836.70. First support is the 20-day moving average crossing at $1778.80. Second support is the November 23rd low crossing at $1733.50.

March silver closed higher on Thursday and the high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If March renews the rally off October's low, the 75% retracement level of the March-August decline crossing at 24.779 is the next upside target. Closes below the 20-day moving average crossing at 21.926 would confirm that a short-term top has been posted while opening the door for additional weakness near-term. First resistance is the 62% retracement level of the March-September decline crossing at 23.503. Second resistance is the 75% retracement level of the March-September decline crossing at 24.779. First support is the 20-day moving average crossing at 21.926. Second resistance is the November 28th low crossing at 21.045.

March copper closed higher on Thursday and the high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If March renews the rally off September's low, the 50% retracement level of the March-July decline crossing at 4.0343 is the next upside target. Closes below the 20-day moving average crossing at 3.7431 would signal that a short-term top has been posted. Closes below the 20-day moving average crossing at 3.7431 would signal that a short-term top has been posted. First resistance is November's high crossing at 3.9470. Second resistance is the 50% retracement level of the March-July decline crossing at 4.0343. First support is the 20-day moving average crossing at 3.7431. Second support is the 50-day moving average crossing at 3.5677.

GRAINS? http://quotes.ino.com/ex?changes/?c=grains "

March Corn closed up $0.01 1/2-cents at $6.44 1/4.

March corn posted an inside day with a higher close on Thursday as it extended the trading range of the past three-days. The mid-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off October's high, the 62% retracement level of the July-October rally crossing at $6.23 is the next downside target. Closes above the 20-day moving average crossing at $6.59 1/2 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $6.59 1/2. Second resistance is the 50-day moving average crossing at $6.77 1/2. First support is Wednesday's low crossing at $6.35. Second support is the 62% retracement level of the July-October rally crossing at $6.23.

March wheat closed down $0.03 1/4-cents at $7.46 1/4.

March wheat closed lower on Thursday. The mid-range close sets the stage for a steady to lower opening when Friday's night session begins trading. Stochastics and the RSI are oversold and remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off October's high, the September 9, 2021 low crossing at $6.94 is the next downside target. Closes above the 20-day moving average crossing at $7.96 3/4 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $7.96 3/4. Second resistance is the 50-day moving average crossing at $8.48 3/4. First support is the 75% retracement level of the 2018-2022 rally crossing at $7.24 1/4. Second support is the September 9, 2021 low crossing at $6.94.

March Kansas City Wheat closed up $0.04-cents at $8.44 3/4.

March Kansas City wheat closed lower on Thursday. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off October's high, August's low crossing at $8.18 3/4 is the next downside target. Closes above the 20-day moving average crossing at $9.02 would confirm that a short-term low has been posted. First resistance is the 20-day moving average crossing at $9.04. Second resistance is the 50-day moving average crossing at $9.35 3/4. First support is Tuesday's low crossing at $8.21 3/4. Second support is August's low crossing at $8.18 3/4.

March Minneapolis wheat closed up $0.07 1/2-cents at $9.09 1/2.

March Minneapolis wheat closed higher on Thursday as it consolidated some of the decline off October's high. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends the decline off November's high, August's low crossing at $8.75 3/4 is the next downside target. Closes above the 20-day moving average crossing at $9.42 1/4 would signal that a short-term low has been posted. First resistance is the 10-day moving average crossing at $9.23 1/2. Second resistance is the 20-day moving average crossing at $9.42 1/4. First support is Tuesday's low crossing at $8.90. Second support is the August's low crossing at $8.75 3/4.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

January soybeans closed up $0.14 1/4-cents at $14.86 1/4.

January soybeans closed higher on Thursday as it extends the rally off October's low. The high-range close sets the stage for a steady to higher opening when Friday's night trade begins. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If January extends the rally off October's low, September's high crossing at $15.12 1/4 is the next upside target. Closes below the 20-day moving average crossing at $14.44 1/4 would renew the decline off November's high. First resistance is the September 21st high crossing at $14.93 1/2. Second resistance is the 75% retracement level of the June-July decline crossing at $15.15 1/2. First support is the 20-day moving average crossing at $14.44 1/4. Second support is the 50-day moving average crossing at $14.21.

January soybean meal closed up $7.40 at $466.40.

January soybean meal closed sharply higher for the seventh-day in a row on Thursday as it extends the rally off November's low. The high-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If January extends the aforementioned rally, monthly support on the continuation chart crossing at $478.60 is the next upside target. Closes below the 10-day moving average crossing at $429.50 would signal that a short-term top has been posted. First resistance is today's high crossing at $468.60. Second resistance is monthly resistance crossing at $478.60. First support is the 10-day moving average crossing at $429.50. Second support is the 20-day moving average crossing at $417.10.

January soybean oil closed up 35-pts. At 61.31.

January soybean oil posted an inside day with a higher close on Thursday as it consolidates some of the decline off November's high. The mid-range close sets the stage for a steady to higher opening when Friday's night session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If January extends the decline off November's high, the 75% retracement level of the July-November rally crossing at 59.72 is the next downside target. Closes above the 50-day moving average crossing at 68.48 would signal that a short-term low has been posted. First resistance is last-Friday's gap crossing at 67.38. Second resistance is the 50-day moving average crossing at 68.48. First support is Wednesday's low crossing at 60.73. Second support is the 75% retracement level of the July-November rally crossing at 59.72.

LIVESTOCKhttp://quotes.ino.com/exchanges/?c=livestock

February hogs closed down $1.93 at $84.72.

February hogs gapped down and closed lower on Thursday. The mid-range close sets the stage for a steady to lower opening when Friday's session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. If February extends the decline off November's high, the 62% retracement level of the October rally crossing at $82.29 is the next downside target. Closes above the 20-day moving average crossing at $88.36 is the next upside target. First resistance is the 50-day moving average crossing at $86.54 Second resistance is the 20-day moving average crossing at $88.36. First support is today's low crossing at $83.10. Second support is the 62% retracement level of the October rally crossing at $82.29.

February cattle closed up $0.38 at $153.93.

February cattle closed higher on Thursday as it consolidates some of this week's decline but remains below the 50-day moving average crossing at $154.13. The mid-range close sets the stage for a steady to higher opening on Friday. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If February extends this week's decline, November's low crossing at $152.28 is the next downside target. Closes above the 10-day moving average crossing at $154.85 would signal that a short-term low has been posted. First resistance is Monday's high crossing at $156.38. Second resistance is November's high crossing at $156.95. First support is November's low crossing at $152.28. Second support is the October 14th low crossing at $146.72.

January Feeder cattle closed up $2.68 at $183.58.

January Feeder cattle closed higher on Thursday and the high-range close sets the stage for a steady to higher opening when Friday's session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If January renews the rally last-week's low, the 62% retracement level of the August-October decline crossing at $184.60 is the next upside target. Closes below the 50-day moving average crossing at $179.23 would signal that a short-term top has been posted. First resistance is Monday's high crossing at $184.20. Second resistance is the 62% retracement level of the August-October decline crossing at $184.56. First support is the 20-day moving average crossing at $180.29. Second support is the 50-day moving average crossing at $179.23.

FOOD & FIBERhttp://quotes.ino.com/ex changes/?c=food

March coffee closed lower on Thursday as it extended the decline off last-Thursday's high. The low-range close sets the stage for a steady to lower opening on Friday. Stochastics and the RSI are neutral to bearish signaling sideways to lower prices are possible near-term. If March extends the decline off August's high, November's low crossing at $15.41 is the next downside target. If March renews the rally off November's low, the 50-day moving average crossing at $17.86 is the next upside target. First resistance is last-Thursday's high crossing at $17.44. Second resistance is the 50-day moving average crossing at $17.86. First support is November's low crossing at $15.41. Second support is the 75% retracement level of the 2020-2022 rally crossing at $14.74.

March cocoa closed sharply higher on Thursday as it renewed the rally off the November 23rd low. The high-range close sets the stage for a steady to higher opening on Friday. Stochastics and the RSI have turned neutral to bullish signaling sideways to higher prices are possible near-term. If March extends the rally off the November 23rd low, November's high crossing at 25.77 is the next upside target. If March renews last-month's decline, the 50-day moving average crossing at 24.12 is the next downside target.

March sugar closed higher on Thursday. The mid-range close sets the stage for a steady to higher opening on Friday. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above Monday's high crossing at 19.94 would confirm that a short-term low has been posted. Closes below last-Monday's low crossing at 19.05 would renew the decline off November's high while opening the door for additional weakness near-term.

March cotton closed lower on Thursday. The low-range close sets the stage for a steady to lower opening on Friday. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If March extends today's decline, the November 28th low crossing at 77.50 is the next downside target. If March renews the rally off October's low, November's high crossing at 89.92 is the next upside target.

Thanks tallpine!

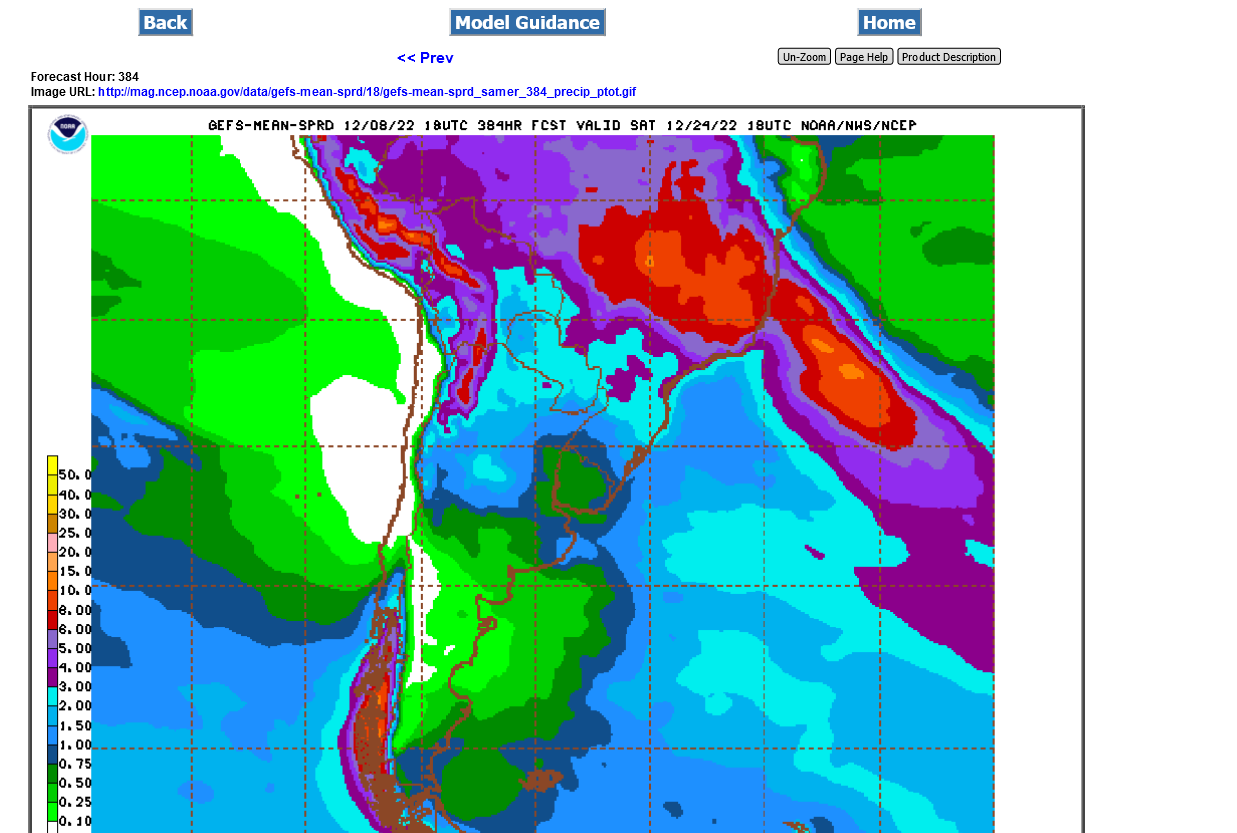

USDA report out tomorrow +bullish weather in Argentina

Bullish weather for NG too but we couldn't fill the downside gap from Sunday Night with the huge spike higher today.

Got close, filling much of the gap but missed filling it by $600/contract.

EIA was bearish again.

+++++++++++++++++++++++++++++