Monday, December 19, 2022

10:00 AM ET. December NAHB Housing Market Index

Housing Mkt Idx (previous 33)

Tuesday, December 20, 2022

8:30 AM ET. November New Residential Construction - Housing Starts and Building Permits

Total Starts (previous 1.425M)

Housing Starts, M/M% (previous -4.2%)

Building Permits (previous 1.526M)

Building Permits, M/M% (previous -2.4%)

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, M/M%

Ret Sales Mo-to-Date, Y/Y% (previous +5.8%)

Latest Wk, Y/Y% (previous +5.9%)

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous +7.8M)

Gasoline Stocks, Net Chg (Bbls) (previous +0.9M)

Distillate Stocks, Net Chg (Bbls) (previous +3.9M)

Wednesday, December 21, 2022

7:00 PM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 210.7)

Composite Idx, W/W% (previous +3.2%)

Purchase Idx-SA (previous 182.6)

Purchase Idx-SA, W/W% (previous +4.0%)

Refinance Idx (previous 350.5)

Refinance Idx, W/W% (previous +2.8%)

8:30 AM ET. 3rd Quarter International Transactions

Current Account (USD) (previous -251.09B)

10:00 AM ET. November Existing Home Sales

Existing Sales (previous 4.43M)

Existing Sales, M/M% (previous -5.9%)

Unsold Homes Month's Supply (previous 3.3)

Median Price (USD) (previous 379100)

Median Home Price, Y/Y% (previous +6.6%)

10:00 AM ET. December Consumer Confidence Index

Cons Conf Idx (previous 100.2)

Expectation Idx

Present Situation Idx (previous 137.4)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 424.129M)

Crude Oil Stocks, Net Chg (Bbl) (previous +10.231M)

Gasoline Stocks (Bbl) (previous 223.583M)

Gasoline Stocks, Net Chg (Bbl) (previous +4.496M)

Distillate Stocks (Bbl) (previous 120.171M)

Distillate Stocks, Net Chg (Bbl) (previous +1.364M)

Refinery Usage (previous 92.2%)

Total Prod Supplied (Bbl/day) (previous 19.956M)

Total Prod Supplied, Net Chg (Bbl/day) (previous +0.33M)

Thursday, December 22, 2022

8:30 AM ET. U.S. Weekly Export Sales

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 211K)

Jobless Claims, Net Chg (previous -20K)

Continuing Claims (previous 1671000)

Continuing Claims, Net Chg (previous +1K)

8:30 AM ET. November CFNAI Chicago Fed National Activity Index

NAI (previous -0.05)

NAI, 3-mo Moving Avg (previous 0.09)

8:30 AM ET. 3rd Quarter Revised Corporate Profits

8:30 AM ET. 3rd Quarter 3rd estimate GDP

Annual Rate, Q/Q% (previous +2.9%)

Chain-Weighted Price Idx, Q/Q% (previous +4.3%)

Corporate Profits, Q/Q%

PCE Price Idx, Q/Q% (previous +4.3%)

Purchase Price Idx, Q/Q% (previous +4.7%)

Real Final Sales, Q/Q% (previous +4%)

Core PCE Price Idx, Ex-Food/Energy, Q/Q% (previous +4.6%)

Personal Consumption, Q/Q% (previous +1.7%)

10:00 AM ET. November Leading Indicators

Leading Index, M/M% (previous -0.8%)

Leading Index

Coincident Index, M/M% (previous +0.2%)

Lagging Index, M/M% (previous +0.1%)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 3412B)

Working Gas In Storage, Net Chg (Cbf) (previous -50B)

11:00 AM ET. Dec. Federal Reserve Bank of Kansas City Survey of Tenth District Manufacturing

Mfg Activity Idx (previous -10)

6-Mo Exp Prod Idx (previous 6)

Mfg Composite Idx (previous -6)

6-Mo Exp Composite Idx (previous 0)

4:30 PM ET. Foreign Central Bank Holdings

4:30 PM ET. Federal Discount Window Borrowings

Friday, December 23, 2022

8:30 AM ET. November Personal Income & Outlays

Personal Income, M/M% (previous +0.7%)

Consumer Spending, M/M% (previous +0.8%)

PCE Price Idx, M/M% (previous +0.3%)

PCE Price Idx, Y/Y% (previous +6%)

PCE Core Price Idx, M/M% (previous +0.2%)

PCE Core Price Idx, Y/Y% (previous +5%)

8:30 AM ET. November Advance Report on Durable Goods

Durable Goods-SA, M/M% (previous +1.0%)

Dur Goods, Ex-Defense, M/M% (previous +0.8%)

Dur Goods, Ex-Transport, M/M% (previous +0.5%)

Orders: Cap Gds, Non-Def, Ex-Air, M/M%(previous +0.7%)

Shipmnts: Cap Gds, Non-Def, Ex-Air, M/M% (previous +1.3%)

10:00 AM ET. November New Residential Sales

New Home Sales (previous 632K)

New Home Sales, M/M% (previous +7.5%)

New Home Sales Months Supply (previous 8.9)

10:00 AM ET. 3rd Quarter GDP by State

10:00 AM ET. 3rd Quarter State Quarterly Personal Income

10:00 AM ET. December University of Michigan Survey of Consumers - final

End-Mo Sentiment Idx (previous 56.8)

End-Mo Expectations Idx (previous 55.6)

12-Month Inflation Forecast (previous 4.9%)

5-Year Inflation Forecast (previous 3.0%)

End-Mo Current Idx (previous 58.8)

Thanks tallpine!

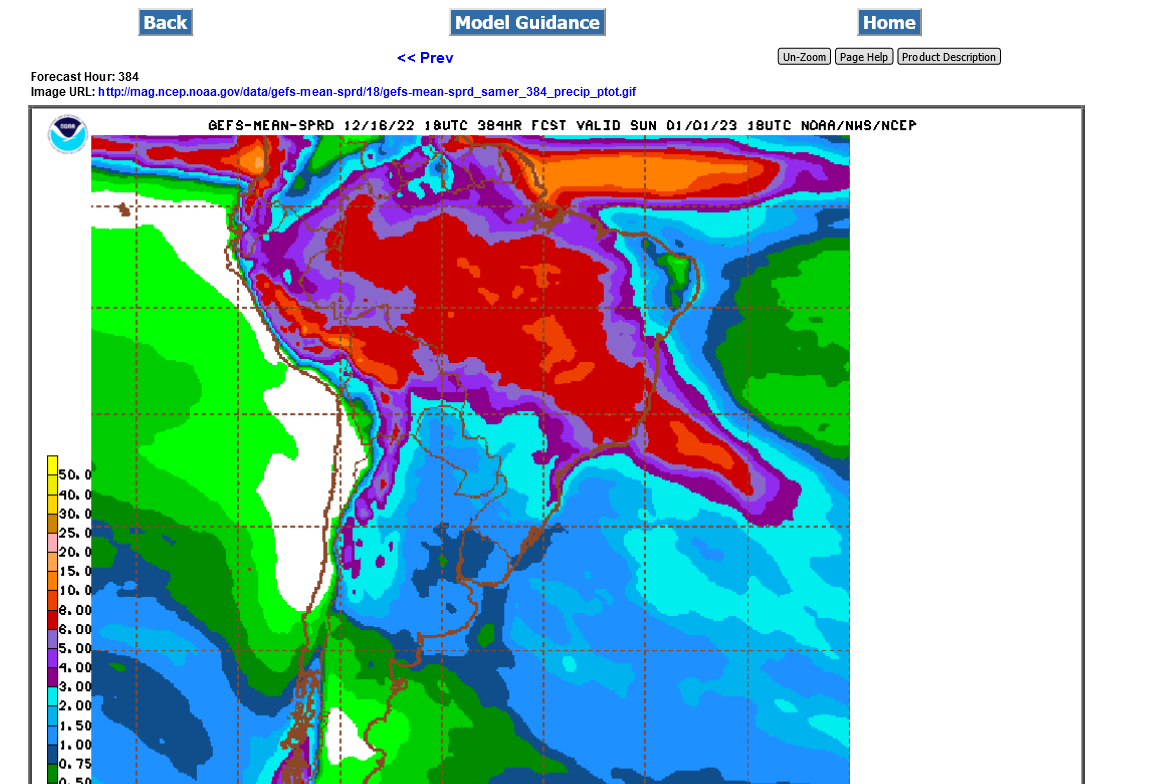

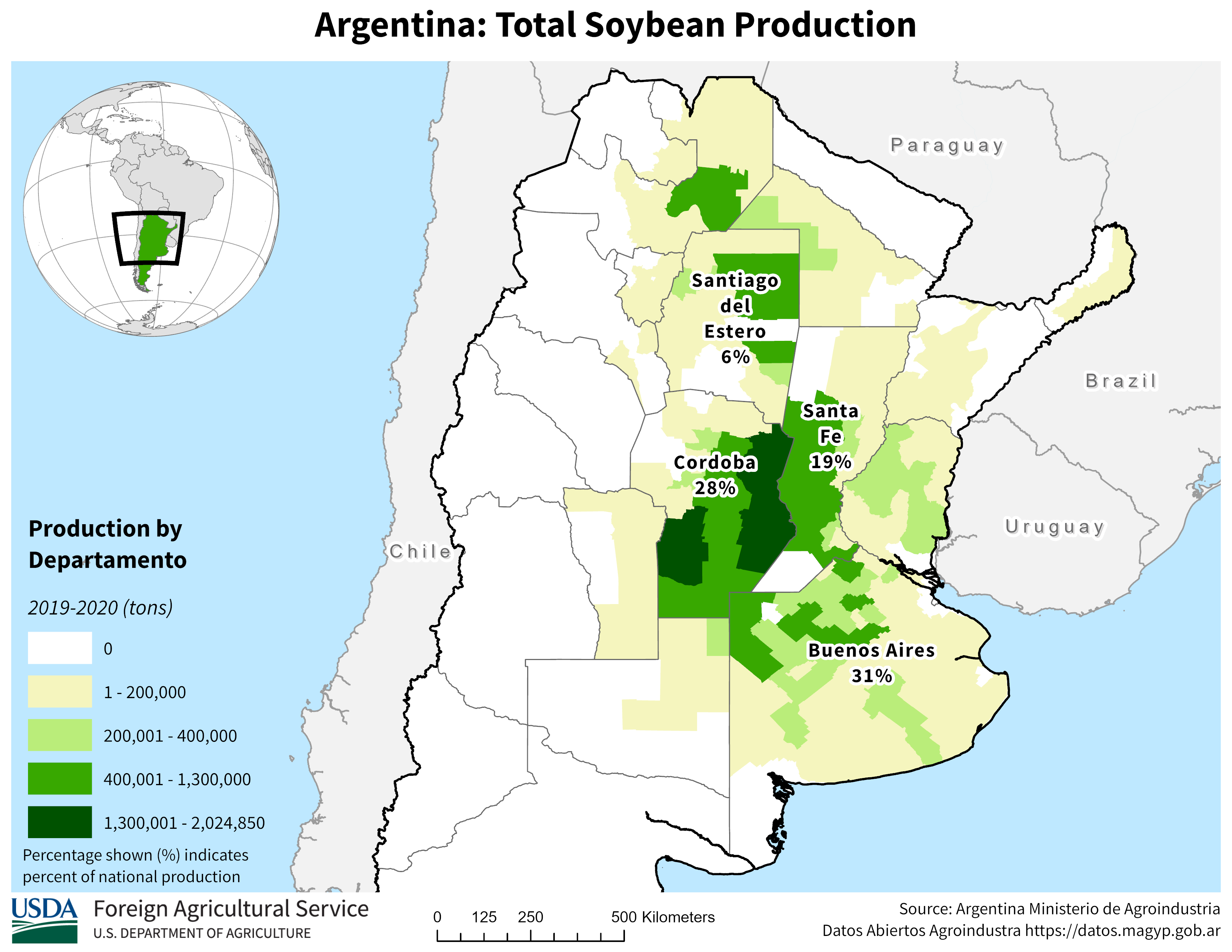

Big increase in rains for Argentina in the forecast compared to previous weeks!

Also for far S.Brazil. Not drought busting yet but close to 2 inches in 2 weeks vs only around 1 inch late last week.

Just out 18z GFS operational model forecast rains the next 2 weeks:

https://mag.ncep.noaa.gov/Image.php

Last Friday:

https://www.marketforum.com/forum/topic/91473/#91476

By metmike - Dec. 16, 2022, 8:37 p.m.

Thanks Tallpine!

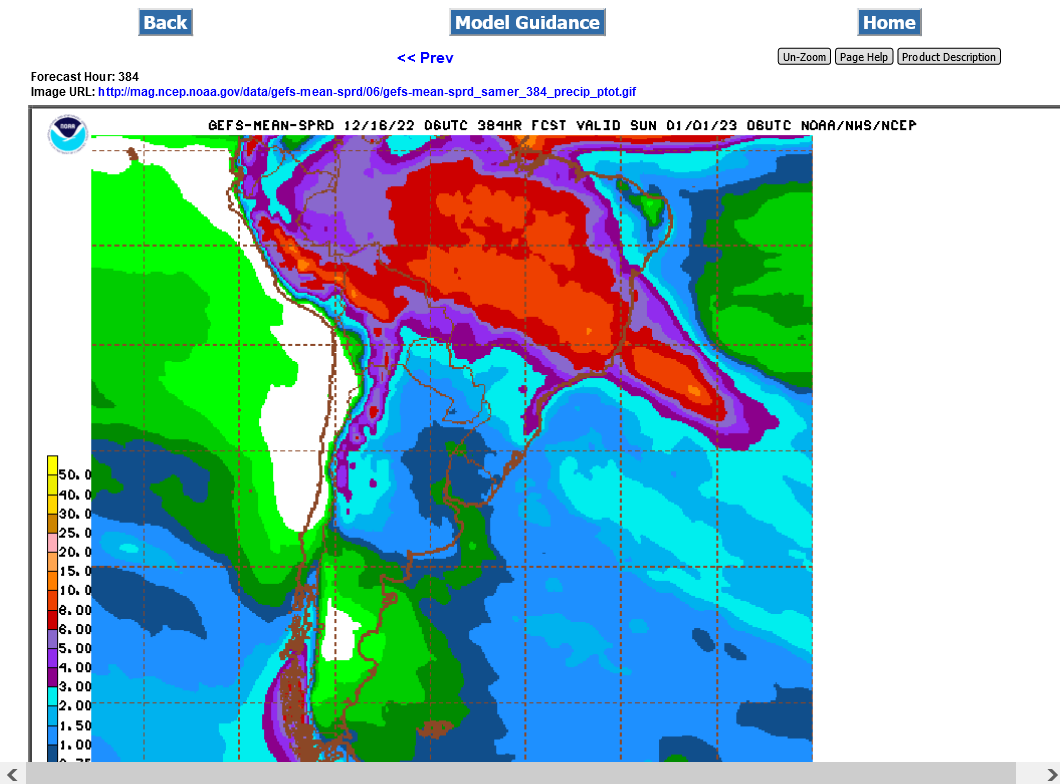

Still below normal rains for most of the Argentina beans and good rains for much of Brazil.........but NOT S.Brazil.

Just out 18z GEFS mean.

This was the 6z run from 12 hours earlier(on Friday):

https://mag.ncep.noaa.gov/Image.php

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.90day.figb.gif

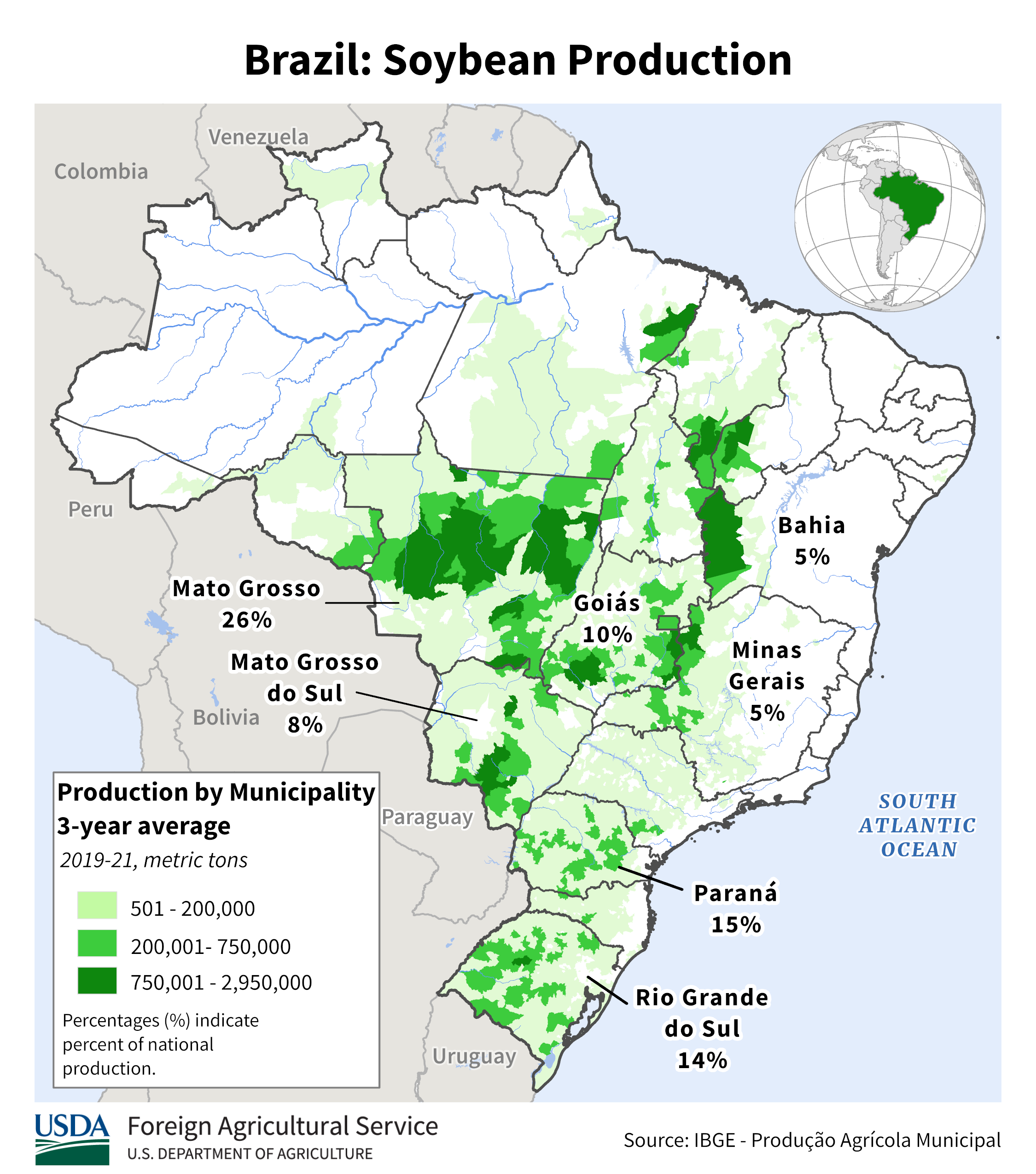

South America soybean production below

https://ipad.fas.usda.gov/rssiws/al/ssa_cropprod.aspx

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Soybean.png