The jig is up for the electric car industry.

The most impressive thing being manufactured about it, has been the fairytale, "science fiction" promises that defy the laws of physics, energy and economics:

NEW: Electric cars are not the solution: Our mechanical engineer chimes in with great points. November 2022 https://www.marketforum.com/forum/topic/90429/

California tells electric car owners NOT to charge vehicles. Energy crisis in California because of unreliable, fake green/anti environmental energy!September 2022 https://www.marketforum.com/forum/topic/88534/

https://www.marketforum.com/forum/topic/27498/#88241

https://electrek.co/2022/05/16/tesla-top-3-electric-cars-us/

It's obviously making it much worse with the "Man going to Mars with a million people" being exposed as the charismatic man using people with agenda/ideas(some delusional) for self serving enrichment! Rich and powerful but still a delusional fraud and its pretty obvious now to millions of others.

Elon Musk is a Fraud

Started by joj - Dec. 15, 2022, 9:23 p.m.

https://www.marketforum.com/forum/topic/91460/

https://www.cbsnews.com/news/elon-musk-tesla-down-700-billion-in-value-angry-investors/

Abandoned?

Elon Musk played his electric car scheme as far as it could go. California, with just a small % of their vehicles being electric couldn't support them when the energy grid was taxed this past Summer........and that's while we still have fossil fuels providing energy to the power plants.

It's retarded to think we can go all electric(increasing demand to the electric grid by 40%) AND get rid of the source powering most of the electric grid using fake physics and bs.

If this is the math of the current electric grid with supply meeting demand:

Supply = Demand

2+4+4=10

This is their new math with 0 fossil fuels and 40% more demand....under a best case scenario.

2+2+2 = 10+4

The cost to completely electrify our entire grid and cars would be 433 trillion.......20 times the GDP.

https://www.marketforum.com/forum/topic/85535/#85776

So even if it was possible(its not) the cost exceeds anything affordable. It's an economy killer!

This was never about environmentalism. It's always been about crony capitalism, politics and self serving enrichment for people/groups hoodwinking many millions of sincere people that believe the convincing sounding "save the the planet messaging.

Therealenvironmental crisis's/insects dying-dead zones-aquifers drying up-plastics in the ocean-landfills/trash-over consumption of natural resources-REAL pollution in the air/soil/water-WIND TURBINES (metmike is a PRACTICING environmentalist):

https://www.marketforum.com/forum/topic/27498/

Crony capitalismin leading wind producer Texas.

https://www.marketforum.com/forum/topic/88534/#88536

https://www.thegwpf.org/content/uploads/2022/11/Menton-Energy-Storage-Conundrum.pdf

https://wattsupwiththat.com/2022/12/03/the-manhattan-contrarian-energy-storage-paper-has-arrived/

They want to replace the REAL green energy that's been massively greening up the planet with fake green, anti environmental energy like wind, the energy source from environmental hell that WRECKS the planet.

Death by Greening:

https://www.marketforum.com/forum/topic/69258/

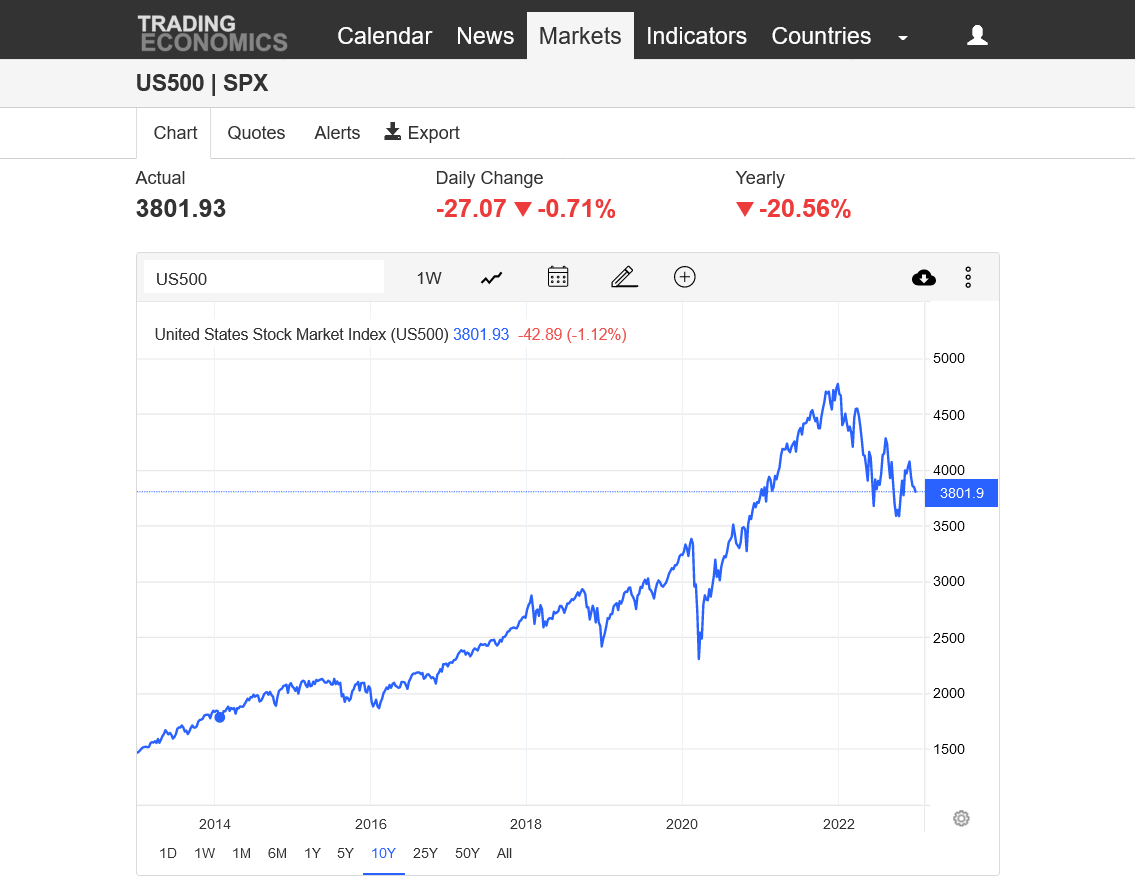

Keep an eye on the price gap at $50 on the chart. Will it bounce?

Increasing earnings from TSLA. Is it overpriced? It certainly is in a down trend. But I doubt that it is dead.

Rather "irrational exuberance" is over. JMHO

Tesla EPS - Earnings per Share 2010-2022 | TSLA | MacroTrends

Tesla EPS for the twelve months ending September 30, 2022 was $3.24, a 213.26% increase year-over-year. Tesla 2021 annual EPS was $1.63, a 666.67% increase from 2020. Tesla 2020 annual EPS was $0.21, a 165.14% decline from 2019. Tesla 2019 annual EPS was $-0.33, a 13.95% decline from 2018.

just in terms of the stock price,... of course stocks were far too high, and things will go down. often, the bigger the runup, the bigger the drop.

but they do sell quite a few cars.

as for the cars, yes, musk is making money off the climate paranoia nonsense.

from my perspective, i can buy a 10yr old used car with Low mileage, and drive it forever, and it still will not cost me as much as buying a new electric car.

Thanks cutworm!

I'm sure that it's not dead but the irrational exuberance that you spoke of was based on a manufactured reality that promised some impossible things.

Those are nice stats you show but that's just proof of a market flourishing in its early stages based on promises that can never be kept.

People just believed all that stuff, so of course they were willing to throw money at something with those impressive sounding promises on the drawing board which was going to save the planet...........until enough real world application and understanding sinks in..........and exposes the fraudulence.

There are several factors that by themselves make those false promises impossible.

This is just one of them below:

https://www.marketforum.com/forum/reply_post/91613/

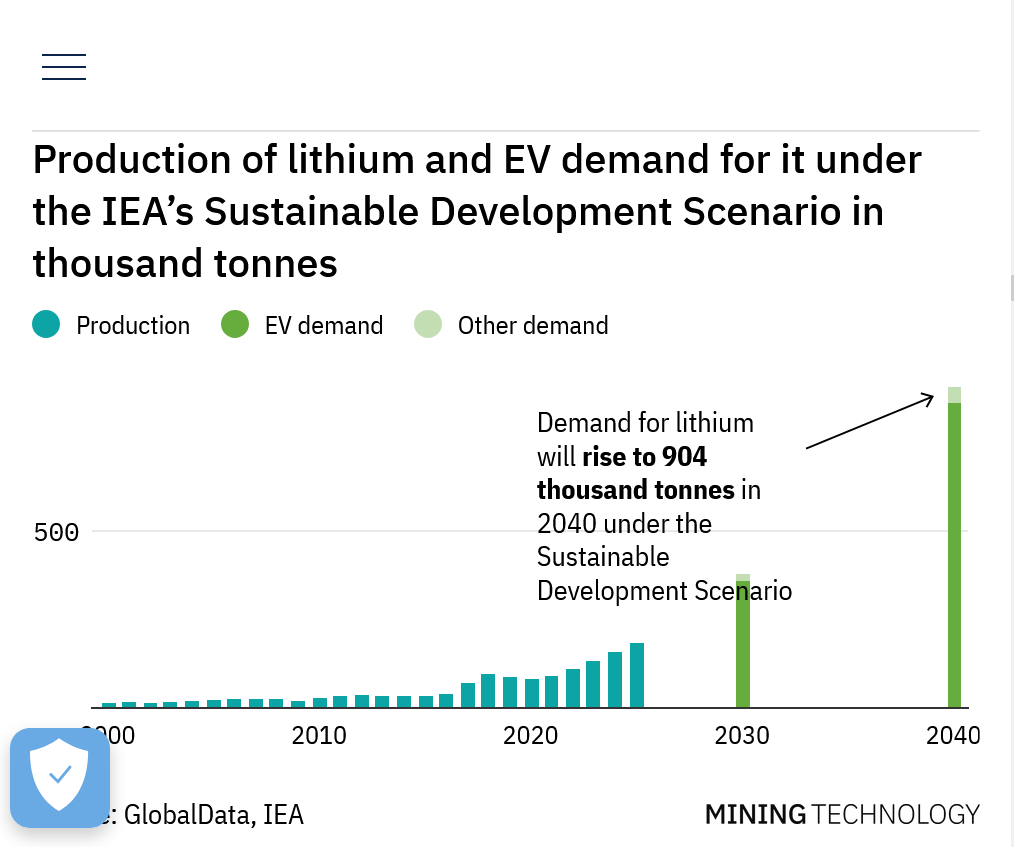

Lithium mines that started operations between 2010 and 2019 took an average of 16.5 years to develop, according to the IEA report The Role of Critical Minerals in Clean Energy Transitions. McKinsey estimates that over 80% of mining projects are completed late.

“There simply isn’t going to be enough lithium on the face of the planet, regardless of who expands and who delivers, it just won’t be there,” Lake Resources Chairman Stuart Crow told the Financial Times. “Car makers are starting to sense that maybe the battery makers aren’t going to be able to deliver.”

Volkswagen, the world’s second-largest car manufacturer, has already sold out of EVs in the US and Europe for 2022. Ford’s E-Transit van sold out before production had even begun.

Another potential obstacle to getting lithium out the ground and into electric vehicles around the world is the concentration of these resources in a few places.

“China owns basically 70-80% of the entire supply chain for electric vehicles and lithium-ion batteries,” Lake Resources’ Stuart Crow told the Financial Times. The IEA puts China’s share of global lithium chemical production at 60%, and says it accounts for 80% of lithium hydroxide output. “Five major companies are responsible for three-quarters of global production capacity,” it says.

Australia had the highest production in 2021, according to the US Geological Survey, but Chile has the world’s biggest lithium reserves. The South American country is part of the so-called “Lithium Triangle”, along with Argentina and Bolivia. Just under 60% of Earth’s lithium resources are found in these three countries, according to the 2021 US Geological Survey’s Mineral Commodity Summary.

However, lithium extraction requires very high volumes of water, and this is leading to problems around water stress – a situation where a region’s water resources are not enough to meet its needs.

This is particularly concerning given that a lot of lithium is found in drought-prone regions – such as South America and Australia. Bolivia’s San Cristóbal mine reportedly uses 50,000 litres of water a day, and lithium mining companies in Chile have been accused of depleting vital water supplies.

More than half of today’s lithium production is in areas with high water stress, the IEA says. “Several major producing regions such as Australia, China, and Africa are also subject to extreme heat or flooding, which pose greater challenges in ensuring reliable and sustainable supplies,” it adds.

Serbia this year withdrew licences for a lithium mine because of widespread protests. The demonstrators said the site would contaminate water supplies and damage the landscape irreversibly.

++++++++++++++++++

If we'd been using electric cars entirely to this point and fossil fuels were just discovered, the world would be going gang busters to convert entirely to fossil fuels.

Fossil fuels ARE THEIR OWN BATTERIES!

The energy is stored in the fuel.

No need to generate the energy with a source like wind that destroys ecosystems and landscapes, bird/bat killing, massive mining required source from environmental hell.

Huge blades that go into landfills and need to be replaced every 20-25 years.

Then, after that diffuse, intermittent energy is sent by transmission lines to power plants, they still haven't developed a battery technology to effectively store enough of it to be reliable when the wind isn't blowing and sun not shining....without using fossil fuels as back up much of the time.

Then, it has to go back out on transmission lines (each time, losing some of the power) to recharging stations or homes that can use it to charge up car batteries, that lose even more of the energy.

There is a process for refining liquid energies that uses some electricity but its small compared to the losses for wind and fake green energy.

https://www.cfr.org/blog/do-gasoline-based-cars-really-use-more-electricity-electric-vehicles-do

Business Insider published an interview today with Tesla founder Elon Musk in which Musk makes a striking claim: “You have enough electricity to power all the cars in the country if you stop refining gasoline,” he asserts. “You take an average of 5 kilowatt hours to refine [one gallon of] gasoline, something like the [Tesla] Model S can go 20 miles on 5 kilowatt hours.”

Here's the reality:

As any first-year physics student will tell you, transmitting electricity over distances results in a mathematically predictable loss of the power transmitted, over any given distance. The greater the distance, the greater the absolute loss.

Is it better to build a natural gas power plant close to where it’s needed or build a wind farm a thousand miles from where the electricity can be used, and in each case build a new transmission line to carry the electricity from either the new wind farm or a new NGCC power plant?

In each instance, the plant would generate 6 billion kWh per year of electricity.

The cost of building an 800 MW natural gas combined cycle (NGCC) power plant would be $800 million (800,000 KW * $1,000 per KW) and have a capacity factor of 85%.

The cost of building a comparable wind farm would be $3,800 Million (1,900,000 KW * $2,000 per KW). The larger capacity is needed because the capacity factor of the wind farm would only be 36%. However, the costs are calculated so that the total generation of 6 billion kWh is the same for both the wind farm and NGCC power plant.

The distance between Billings, Montana, near where excellent wind conditions are found, to Chicago is 1,245 mils. Or alternatively from Casper, Wyoming, is 1,092 miles.

The cost of constructing a new 230 KV transmission line is approximately $1 million per mile.

The table compares the cost of the two alternatives: A new wind farm where renewable wind is plentiful, with an NGCC power plant near where the electricity can be used.

| Wind Farm | NGCC | |

| Cost of plant | $3,800,000,000 | $800,000,000 |

| Cost of Transmission Line | $1,100,000,000 | $100,000,000 |

| Total | $4,900,000,000 | $900,000,000 |

These costs ignore some other factors. Line losses, for example, will be about 11 times worse for the wind farm than for the NGCC alternative.

In addition, wind is unreliable and may not be available when it’s needed. And the winters where the wind farm is built are severe. See, Wind Power Warning

Obviously, the AWEA proposal is very expensive and amounts to spending $4 trillion unnecessarily.

No matter how rosy a picture the American Wind Energy Association paints, wind is always less reliable and more expensive.

+++++++++++

When adding energy to an EV's battery pack, more is expended than what makes it into the pack. How much varies considerably depending on the electrical output and ambient conditions.

https://www.caranddriver.com/features/a36062942/evs-explained-charging-losses/

It's easy to think recharging an EV is like filling your car with gas. If it takes 13.0 gallons of fuel to fill an empty 13.0-gallon tank, then why wouldn't an empty battery with a capacity of 60.0 kilowatt-hours require 60.0 kWh to reach full charge?

Because the battery is more complicated than a simple container. A rough expectation is that your EV may use as much as 12 to 15 percent more energy than what you add back to the battery. Some energy is written off to what's known as "transmission loss," some is converted to heat, and some is used to keep the battery at the right temperature during charging.

Excellent thread! I've been watching Tesla with great interest. I'm not here to argue about the climate aspects of the Tesla business model.

As for lithium, I did a quick google search and got this:

What metal will replace lithium in batteries?

"Magnesium. Magnesium can theoretically carry a significant charge of +2, more than either lithium or sodium. Because of this, batteries made out of the material would have a higher energy density, more stability, and lower cost than lithium-ion counterparts used today, according to researchers.May 16, 2022."

I don't know the science and I won't pretend to. But if you asked a scientist in the 1970s if you could produce the computer power / storage into a laptop they probably would have said that it is impossible.

But I will gingerly make the case for preparing for an opportunity to make money buying Tesla stock when capitulation happens (if it happens).

As Cutworm pointed out, Tesla is currently still in the growth stage. Granted the stock price got massively overvalued. I have a friend who owns a Tesla. Believe me, he's no tree-hugger. He always votes Libertarian. He loves the car and upgrades periodically when a new model comes out. He likes the "smart car" technology. He likes the performance of the drive. He likes instantaneous acceleration that only an EV can provide.

Charging stations (for Tesla, not other EVs) litter the east coast. The recharge (I'm told) is down to 20-30 minutes (down from hours) and takes the car 200 miles along the way (and increasing with each new model). So, stop for a bite to eat and be on your way.

I think the slaughter of share value we are witnessing comes about not because of all the valid points MM is making but for 2 reasons. The bubble bursting and Elon Musk's purchase of Twitter.

Tesla is his personal ATM for buying Twitter as well as keeping it running. He has tried to drum up business (or is it attention?) by making controversial tweets like: "My pronouns are Prosecute / Fauci." A little clickbait for the MAGA crowd with a backhand slap at transgender people. The result is that he is losing advertisers, which is 90% of Twitter's revenue source. Ooops. Gotta sell more Tesla shares. The last report I saw had his ownership down to 13% of Tesla's remaining shares. At some point the board of directors will assert itself. It happened with Meta (Facebook) when shareholders took CEO Zuckerberg to task for blowing billions on the Metaverse. He dialed it back a few billion and the share price went from mid 80's to 120 in less than a month.

ALL of the previous musings are secondary to what I'm looking for. Capitulation. A big down day at the end of this slide with 3-5 times the average daily volume would be the price for Tesla shares that I would see significantly reduced downside risk and reasonable upside potential. And I would make that trade even if I thought Tesla's long term prospects were questionable.

Will that price be 100? 75? 50? I don't know. Markets don't make bottoms because brave buyers step in, but because there is no one left to sell their shares who is considering selling their shares. Of course, if Tesla is heading toward bankrupcy, then I am wrong. That is why one doesn't bet the farm on any play.

To be continued....

Great points, joj and everybody else.

magnesium has great potential if a couple of obstacles can be overcome and theres plenty of it.

calcium might even be worth looking at.

regardless, these are batteries that store energy that must come from somewhere, not green fairy dust or unicorn farts.

wind and solar will never satisfy current needs +40% more demand from EVs. Never!

hydrogen has potential but has some serious problems with embrittlement in containment vessels. The hydrogen atoms diffuse into the metal containers and weaken them to the point of failure with time. More on this later

the absurd thing is that if fossil fuels were just discovered and were seen as opportunities for capitalists, government, politicians and scientists to Benefit, they would be promoted as being tremendous agricultural fertilizers from the beneficial CO2 and contributors to a booming biosphere and beneficial warming on a planet that still features double digit more times people dying from cold than heat and 200 times more life dying from cold than heat.

Increasing co2 causes plants to be more water efficient and drought tolerant because they don’t need to open their stomata as wide to get CO2 which reduces transpiration.

sorry to get carried away on this aspect on a Tesla thread.

The "irrational exuberance" that I talk about is common in all the FAANG stocks.

We are in recession ( 2 quarters of falling GDP). The question is do we go into another depression? Will the October 13 low in NASDAQ hold? We have been in a sideways channel since the low.

JMHO

I believe you, cutworm!

I was getting carried away because of my position based on authentic climate science and laws of energy physics.

https://www.marketforum.com/forum/topic/91478/

Latest prices here......having a bounce the last couple of days.

https://tradingeconomics.com/spx:ind

Is the recent recovery over and we have the next leg down or will the low hold?

Tesla below:

1. 50 years

2. 10 years

3. 1 year

4. 1 month

5. 1 week

https://tradingeconomics.com/spx:ind

| NAME / PRICE | + / - | % | DATE |

|---|---|---|---|

| TSLA 113.28 | 4.18 | 3.84 | 12/28/22 1:02 PM metmike: Tesla stock is having a strong day, so the streak is over. |

They're a really good buy.

Published Mar 12, 2018

But there comes a time when the theoretical promises based on fairy tale science that defy the laws of physics and energy and economics get reconciled with the REAL world.

That will always happen when the fake/manufactured world meets the REAL world.

Enough people have electric cars. Enough diffuse and intermittent solar and wind (energy from environmental hell) energy plays, with no viable method to store the energy on a grid scale have been installed..........for the bamboozled markets and people with money to realize.......it never had a chance to work because they blatantly deceived us us about what it could do.

This is eye rolling, laughable bs and the opposite of the truth in many cases, tricking people to be gung ho for electric vehicles.

The people that write articles like the one below are either very dishonest or very ignorant about the realities of physical laws that determine economics, energy and applications in the real world which don't come close to matching promises on the drawing board that represent a fake world.

+++++++++++++++++++

Jun. 25, 2020

This is what happens when the fake world meets the real world.

Tesla price below:

https://tradingeconomics.com/tsla:us

1. 10 year

2. 5 year

3. 1 year

4. 1 month

5. 1 week

The truth is that our planet is experiencing a climate optimum for life.........best weather/climate in the last 1,000 years (the last time that it was this warm-during the Medieval Warm Period).

The biggest selling point for electric cars has been that they will save the planet from the (fake) climate crisis.

Ironically, fossil fuels are GREENING UP the planet:

Death by Greening:

https://www.marketforum.com/forum/topic/69258/

++++++++++++++++++++

Ironically, it's electric cars that are WRECKING the planet!

And the market in 2022, suddenly became aware of that!

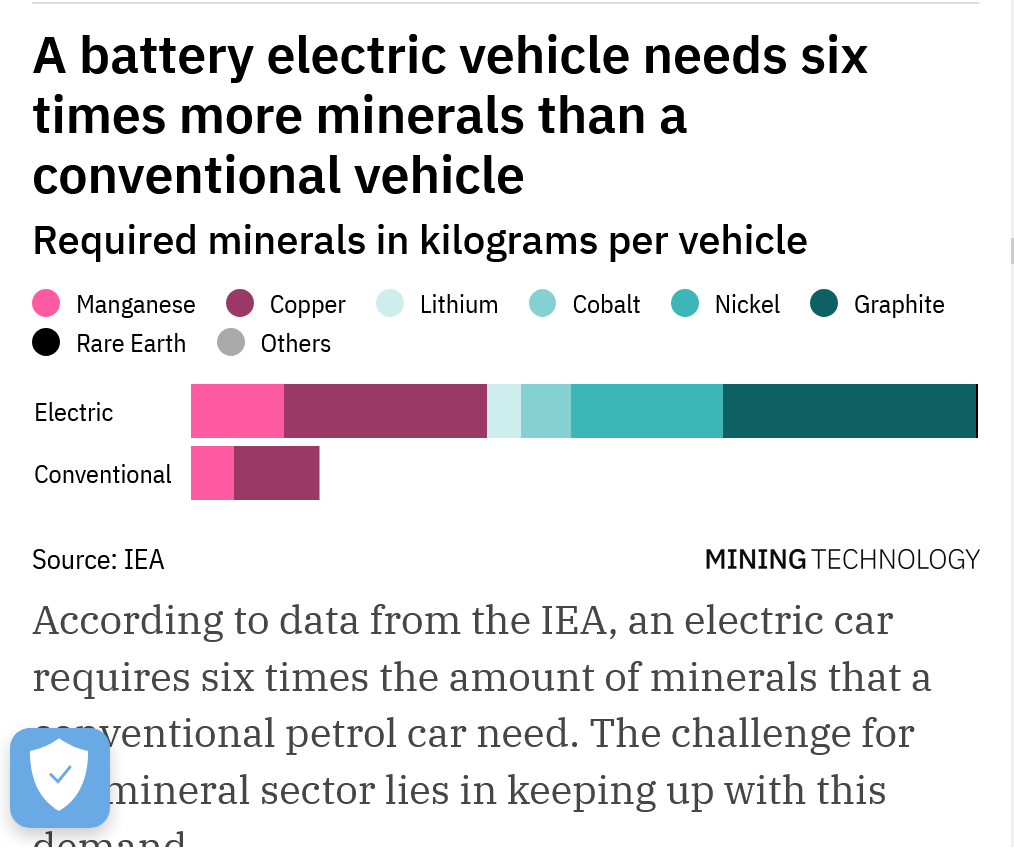

An electric vehicle requires six times the mineral inputs of a comparable internal combustion engine vehicle, according to the International Energy Agency.

https://fee.org/articles/the-environmental-downside-of-electric-vehicles/amp?gclid=Cj0KCQiAnsqdBhCGARIsAAyjYjRYCWuuJt6N67XIDA8aLJI6QmdiQjKsVy0pe50MrF23180i35SxWjMaAhW3EALw_wcB

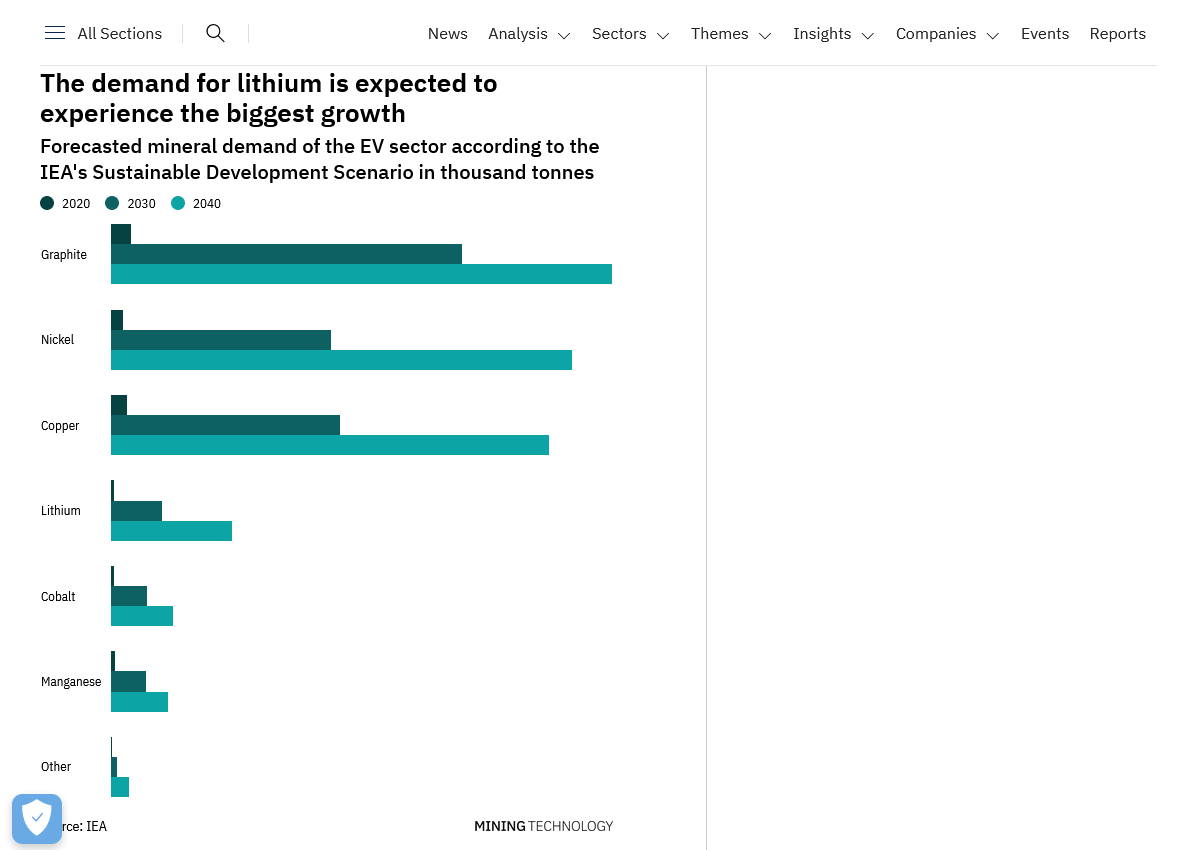

The sales of electric cars are booming, but the rising demand for transition minerals will pose a challenge for the mining industry.

https://www.mining-technology.com/analysis/concerns-for-mineral-supply-chain-amid-booming-ev-sales/

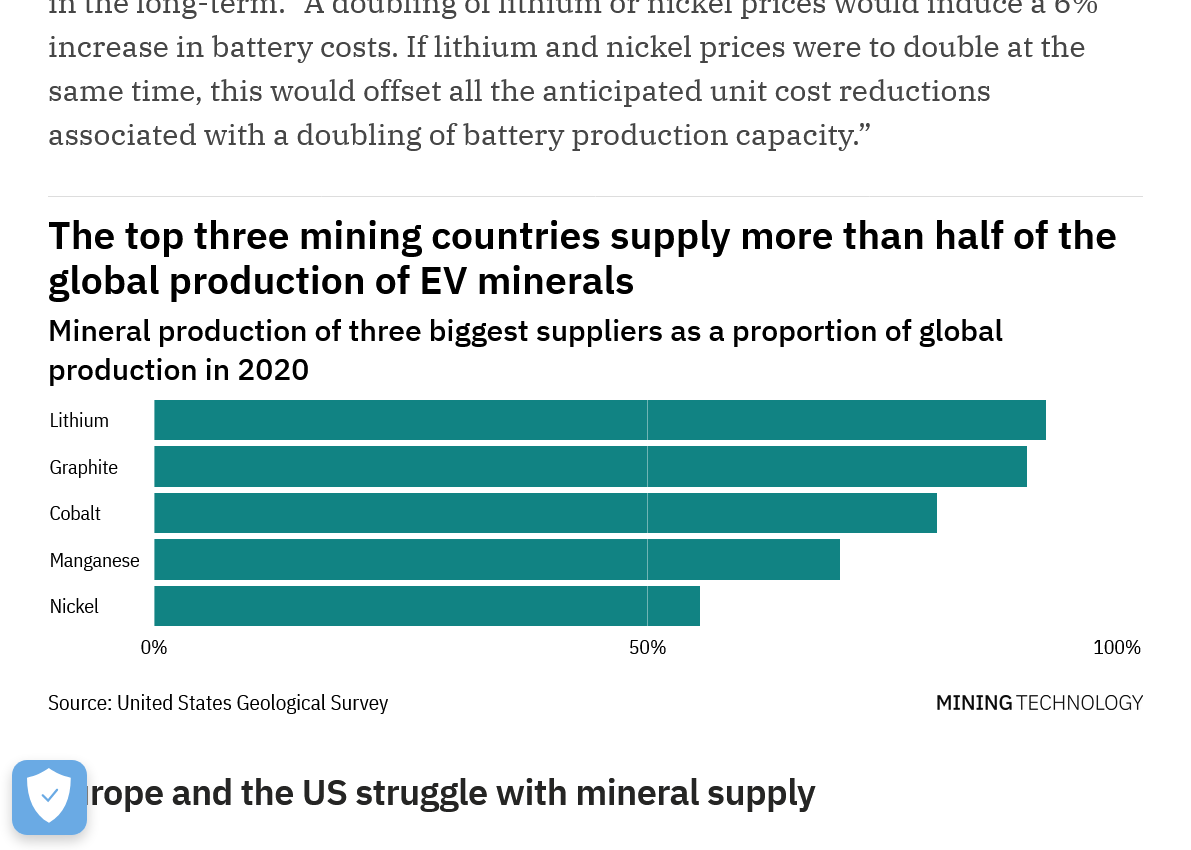

Another challenge for the future supply chain is that unlike some fossil fuels, many of the minerals essential for EVs are produced in just a handful of countries. Over half of the supply of minerals needed for EV batteries comes from the top three producing countries.

In 2020, Australia was responsible for 48% of global lithium production. For graphite, China is the world’s main supplier, with nearly 79% of global production originating from the country. In the same year, the Democratic Republic of the Congo (DRC) supplied 69% of global cobalt.

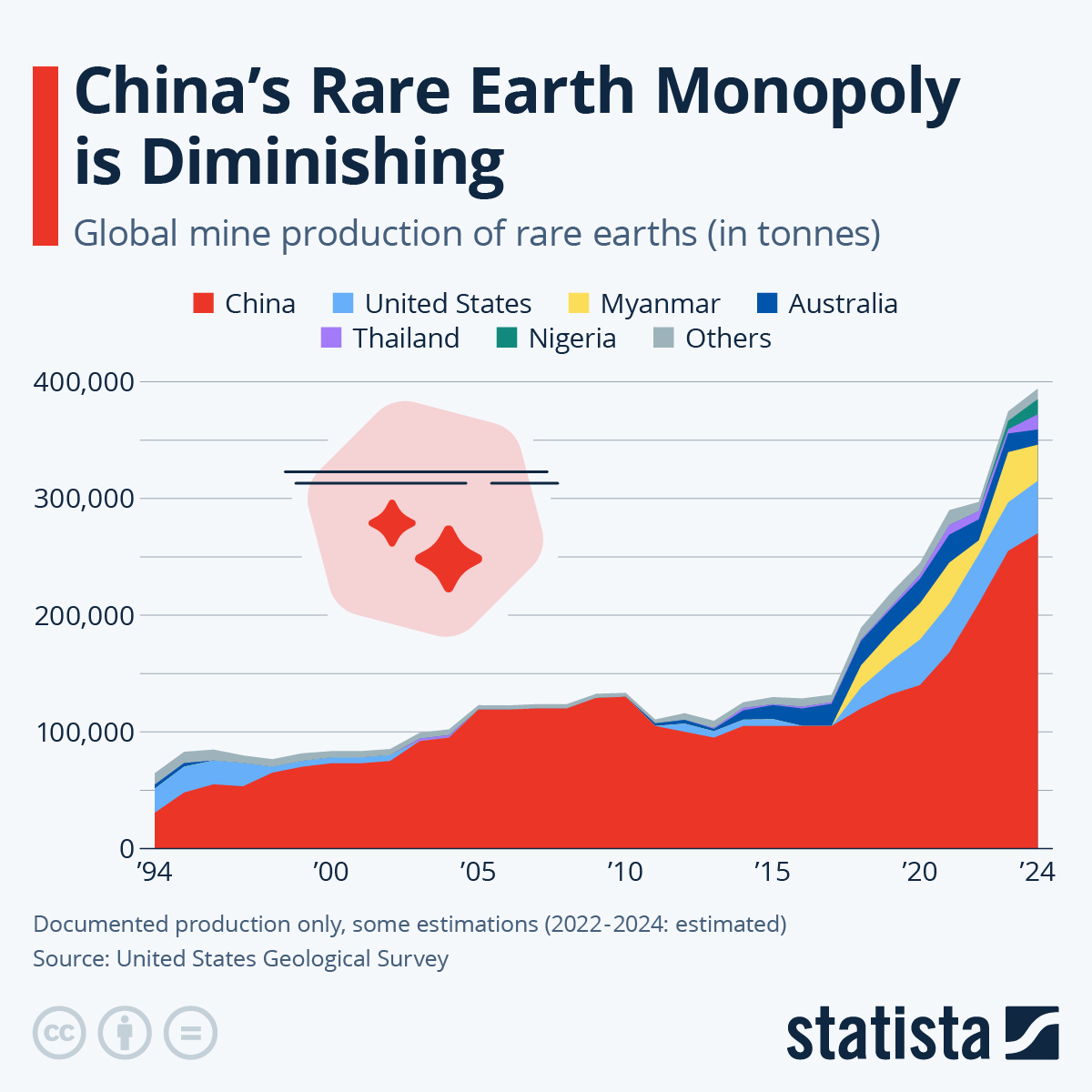

With regards to rare earth metals, China has most of them!

https://www.statista.com/chart/18278/global-rare-earth-production/

https://geology.com/articles/rare-earth-elements/

Note the amount of reserves below:

World Mine Production and Reserves | ||

| Country | Production (Metric Tons) | Reserves (Metric Tons) |

| United States | 38,000 | 1,500,000 |

| Australia | 17,000 | 4,100,000 |

| Brazil | 1,000 | 21,000,000 |

| Burma | 30,000 | not available |

| Burundi | 500 | not available |

| Canada | -- | 830,000 |

| China | 140,000 | 44,000,000 |

| Greenland | -- | 1,500,000 |

| India | 3,000 | 6,900,000 |

| Madagascar | 8,000 | not available |

| Russia | 2,700 | 12,000,000 |

| South Africa | -- | 790,000 |

| Tanzania | -- | 890,000 |

| Thailand | 2,000 | not available |

| Vietnam | 1,000 | 22,000,000 |

| Other Countries | 100 | 310,000 |

| World total (rounded) | 240,000 | |

+++++++++++++

China Dominates the Rare Earths Supply Chain

Great reality discussion on (grid level) batteries https://www.marketforum.com/forum/topic/91274/

Heat and cold affect the range, charging ability, and durability of electric car batteries. Recurrent explains how.

Range is one thing. Charging is something else entirely. Cold weather makes ions flow through battery cells more slowly, causing lithium to build up outside the node and turn into an inert metal. This lithium plating disrupts the future flow of energy and uses up some of the lithium that is supposed to power the battery, which can lead to a decrease in power and range.

Did you know more batteries fail in summer than in winter? AAA does. It replaces many more batteries in hot weather than in cold weather.

++++++++++++++++++++

We are no longer relying on the impossible promises on the drawing boards/on paper that defy the laws of physics and energy.

The electric vehicles are in widespread production and the experiment is well underway around the globe. Across the board, the massive flaws are being realized and there is widespread disappointment across the board from the real world. Try as they might, you can't use the previous promises, excuses and DISinformation to cover up the real world forever........when so many people, in so many countries are part of the failing experiment.

And its all in the name of saving the GREENING planet........which is experiencing the best weather/climate and CO2 levels for life since humans have existed.

The whole EV thing is a carnival show. It's a way for the 1% to sell wind turbines and consumables such as windmill blades.

The number of video's that came out on YouTube over the winter over non-working charging stations and cars that wouldn't charge because it was too cold, was significant.

The world has been furiously working on a better battery for at what....two decades now? Remember when graphene was going to take us to the next level of battery technology? It doesn't look like li-ion is going anywhere soon and without a MUCH better battery, I don't see EV adoption in the US taking off without Government interference, which clearly, they are willing to do.

If people like eating crickets and sitting around for a couple days waiting for your car to charge on your 110 garage outlet, people just need to keep voting like they have been.

GM has already abandoned the Ultium battery. What do you think the replacement for that battery is going to cost in 10 years.

And what if the next best battery comes out tomorrow with twice the capacity? You know what the current EV's are worth? Nothing.

Thanks, Jim.

Like with everything else, they can sell crap to us based on convincing marketing schemes to get our money.

After parting with our money and owning the crap..........ONLY THEN do we realize it's crap.

That is, for most people who have lost their ability to do critical thinking and vetting of information and just put trust in the massive propaganda and DISinformation that features junk science that enriches the gatekeepers that have self serving objectives that DO NOT line up with OUR best interests.

https://www.marketforum.com/forum/topic/77011/#85110

https://www.marketforum.com/forum/topic/77011/#86468

https://www.marketforum.com/forum/topic/77011/#88222

https://www.marketforum.com/forum/topic/77011/#89163

https://www.marketforum.com/forum/topic/77011/#89534

https://www.marketforum.com/forum/topic/77011/#91174

https://www.marketforum.com/forum/topic/77011/#91542

I know nothing about the science of all this, although I have an open mind to both sides of the argument.

I only wish I would have bought Tesla shares when this thread was initially posted:

"Tesla getting obliterated". 12/20/22

December 20th TSLA was at 136

This morning TSLA is 214 and rising.

Thanks joj!

You will note the title wasn't Tesla IS GOING to get obliterated.

I provided the charts this time to confirm what you just stated..... that the previous posts/start of the thread here were made very close to the low. The bad news is usually peaking close to the low for whatever is trading......stock or commodity.

https://www.marketforum.com/forum/topic/91607/#93103

I don't trade stocks. Just an explanation of the scientific realities that have been experienced to temper the "irrational exuberance" with an acknowledgement that Tesla wasn't dead to cutworm.

With a response by you of:

By joj - Dec. 21, 2022, 8:25 a.m.

Excellent thread!

I've been bashing electric vehicles for years, ESPECIALLY when the stock price was experiencing the irrational exuberance.

That's actually when you should have been SHORTING or selling Tesla to make a killing!

https://www.marketforum.com/forum/topic/90429/

https://www.marketforum.com/forum/topic/88534/

https://www.yahoo.com/lifestyle/ruining-electric-cars-top-youtuber-140000470.html

The chart below shows a potential major bottom for Tesla 2 months ago but still selling at only 50% of the peak price in November 2021.

tsla now at $253.

JOJ had 3 great marketing post including the following:

By joj - Feb. 16, 2023, 10:51 a.m.

I know nothing about the science of all this, although I have an open mind to both sides of the argument.

I only wish I would have bought Tesla shares when this thread was initially posted:

"Tesla getting obliterated". 12/20/22

December 20th TSLA was at 136

This morning TSLA is 214 and rising.

Thanks much cutworm!

Please note that the only predictions so far, were these, from above:

Started by metmike - Dec. 20, 2022, 6:44 p.m: The jig is up for the electric car industry.

By cutworm - Dec. 20, 2022, 9:26 p.m. Is it overpriced? It certainly is in a down trend. But I doubt that it is dead. Rather "irrational exuberance" is over. JMHO

Dec. 21, 2022, 1:02 a.m.metmike: "I'm sure it's not dead but the irrational exuberance that you spoke of was based on a manufactured reality that promised some impossible things. " ++++++++++++

By metmike - Feb. 14, 2023, 2:15 p.m: Tesla stock has recovered recently. Potential bottom formation.

++++++++++++++++

By metmike - Feb. 23, 2023, 12:31 p.m: "The chart below shows a potential major bottom for Tesla 2 months ago but still selling at only 50% of the peak price in November 2021."

+++++

Not to take anything away from joj but his wasn't a prediction, just a comment about wishing he bought when I was pointing out how far Tesla had collapsed from the highs.

By joj - Feb. 16, 2023, 10:51 a.m:

I only wish I would have bought Tesla shares when this thread was initially posted:

cutworm,

So far, your prediction that you doubt Tesla is dead has been right.

What's your prediction on Tesla now. Do you own Tesla stock? Do you think we'll get back above the 400+ level highs of 19 months ago?

Maybe joj can chime in again to tell us what he wished he did a couple of months ago (-:

Totally kidding. joj doesn't comment that often but when he does, he makes some of the most profound posts here and they're all much appreciated!

Here's the last graph of Tesla and my objective technical comments. Thanks for being kind enough to post on this topic again.

It's clearly confirmed the spike bottom formation mentioned 2 times in February. Along with that, it's broken the steep downtrending line from the spike highs above 400 in Nov. 2021. Now close to 255. We need to get above 300 to turn especially bullish.

I don't trade stocks, let alone predict where they are going but love doing technical analysis(which is a wonderful predictor of almost everything). As noted previously a zillion times, I AM VERY BIASED against electric cars based purely on the laws of energy/physics and science. If markets want to believe in the fake climate crisis and fake green fairy energy schemes that are actually wrecking the planet for crony capitalism and political agenda.......that's the only thing that really matters for awhile.

https://tradingeconomics.com/tsla:us

I have no strong opinions about Tesla. It is richly valued (P/E ratio of 76 to 1). Perhaps overvalued? But that is typical of growth stocks. And no doubt about it. Tesla sales are growing smartly.

No question Elon is a bit of a nut (and I don't care for his politics). But he is an innovator. I saw his interview recently on CNBC and he envisions a network of driverless Teslas on the road. He suggested that future Tesla owners will send their cars out to "work" for them while they are not using their cars. Imagine if such a thing came to pass. Sales would explode. He also suggested that it is close at hand. If that ever came to pass it would certainly be huge. Of course, he has been talking about driverless Teslas for years now.

From a technical perspective, the chart is on fire. The share price of Tesla closed higher for the 13th trading day in a row. One might think that it is "due for a correction". My experience is that after a streak like that, it is better to be long than short.

2 cents...

sell 270ish

Thanks for the thoughts. Another one is that we’re barely back above the necKline of the head and shoulders topping formation, which makes sense based on the confirmed low and breaking the downtrend line mentioned earlier.

so who thinks that Tesla will make new highs?

Not me!

at Least not for awhile and only if the their company shifts to the selling a product that offers much more true value for the money.

If we get an R president that reduces the massive rebates and tax benefits and mandates forcing this industry on the market……Tesla will NOT Be close to 400 before 2028….. unless they sell something different…..which is possible because the smart companies and owners adjust to go where the money is.

The parabolic move/spike high in Nov 2021 was likely tied to Biden’s massive freebies, hundred of billions for industries like this.

buy the news sell the crap out of the fact, especially with a greatly over valued entity.

https://www.investopedia.com/articles/technical/121201.asp

https://www.shutterstock.com/image-vector/abstract-background-head-shoulder-pattern-stock-2141835475

%202141835475%20Shutterstock.png)

Tesla

https://tradingeconomics.com/tsla:us

The neckline goes from the May 2021 low around 200 below the LEFT shoulder to around 220 below the right shoulder in June 2022.

That neckline, if drawn forward to June 2023 would be BELOW the current price of 257. So this negates the previous negativity from that head and shoulders top formation and is considered bullish at 257.

However, we are still below the left and right shoulders(need 300+) and the top(400+)

Re: Re: Tesla is NOT getting obliterated

By tjc - June 13, 2023, 8:43 p.m.

"sell 270ish"

+++++++++++

tjc,

You nailed it!

https://tradingeconomics.com/tsla:us