If you're looking for my weekly U.S. export inspections charts, I will post them in a couple hours In the meantime, these were the trade estimates for the week ended March 16 and the previous week's figures:

U.S. #corn inspections are finally getting the pop they've needed - last week's volume incl. 3 cargoes to #China. Insp. for #soybeans were maybe a bit above average after lower volumes in the previous weeks (406kt to China last week). #Wheat was right in line with expectations.

Select U.S. winter #wheat crop conditions for March 19 (% rated good or excellent):

Kansas 19% (17% last week)

Colorado 36% (40% last week)

Oklahoma 29% (30% last week)

Texas 23% (17% last week)

These were the last ratings for Winter wheat at the end of last year:

https://www.marketforum.com/forum/topic/91204/

| Karen Braun@kannbwx A good portion of winter #wheat in the U.S. Plains - Kansas, Oklahoma, Texas, Colorado, Nebraska, South Dakota - is in poor or worse condition. Top grower Kansas is the worst at 43% poor/very poor. But look at drastic improvements vs last wk in other Plains states (Tex, OK, CO).  ++++++++++++++++++++++++++++++++ · From the good/excellent angle, #wheat in Montana, Colorado and Oklahoma improved last week, but Texas was marginal and Kansas worsened. Also don't overlook SRW producer Illinois, just 30% g/e. Crops around the country will need a good replenishment come spring.  | Dec. 1, 2022, 6:28 p.m. metmike |

Latest weather:

https://www.marketforum.com/forum/topic/83844/

https://www.marketforum.com/forum/topic/83844/#83853

Soilmoisture anomaly:

These maps sometimes take a day to catch up to incorporate the latest data(the bottom map is only updated once a week).

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

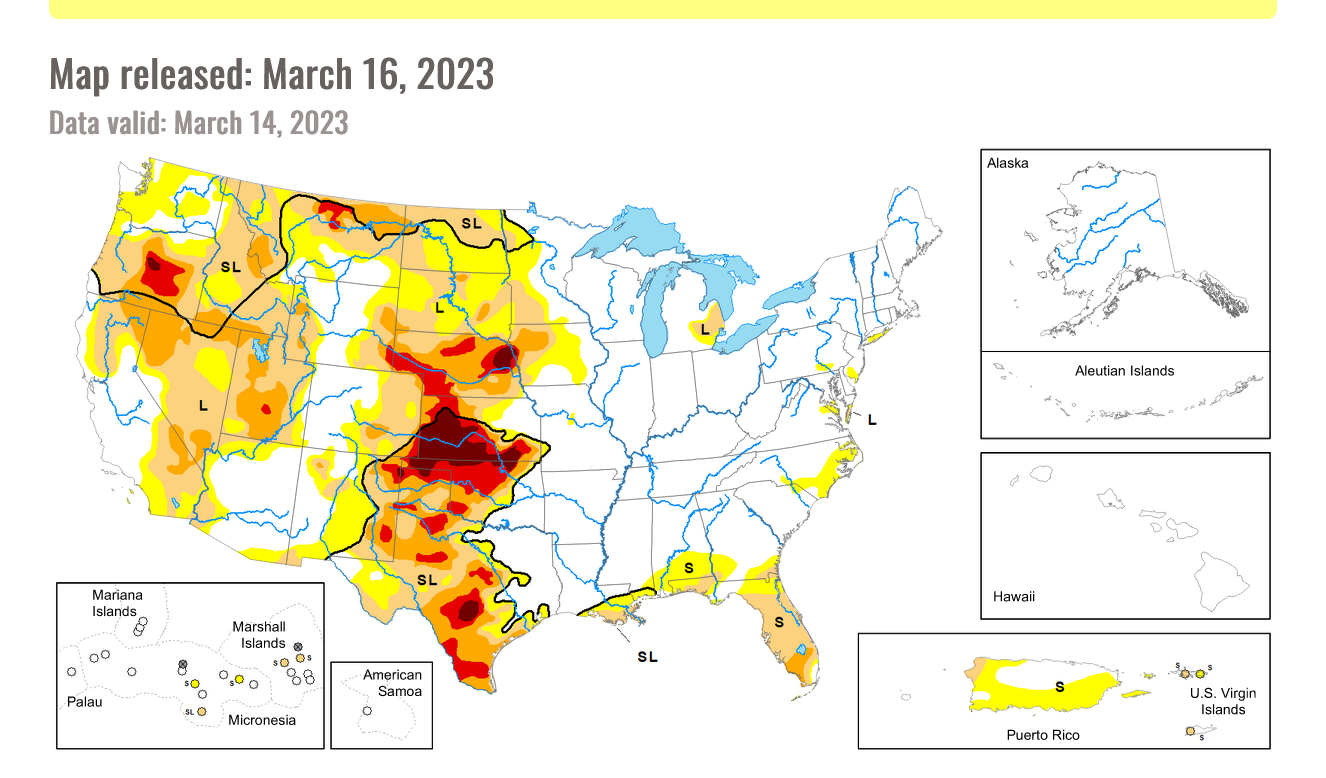

Drought Monitor:

March 14, 2023

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Total precip the next 384 hours from the 18z GEFS.

Net old-crop #corn sales reached a two-year high last week of 3.1 million tonnes. #China led with 2.25 mmt, #Japan had 683kt, #Mexico 225kt. Sales of #soybeans, #soymeal, and #wheat were disappointing. #Soyoil sales were a MY high, but #sorghum (net cancellation) was MY low.

The big #corn sales to #China were expected following last week's flash sales, but #Japan piled on, making their largest weekly purchase of old crop U.S. corn since Jan. 2021. YTD U.S. corn sales to Japan are still at 20+ year lows, but the trajectory is up for now.

New-crop sales last week were as follows: 13kt #wheat, 93kt #corn, 199kt #soybeans, 21kt #cotton.

Look how huge last week's old-crop U.S. #corn export sales were - 3rd biggest for any week in at least 20+ years. What do the three peak weeks identified in this chart have in common? #China.

46m

#China bought far less U.S. #corn in advance of the 22/23 marketing year than they had in the two prior years, hence the big old-crop sale last week. Current year sales are down 44% from the same date last year. Explains why you don't see a spike in 2022 on the chart.

·

....because #China had bought the corn for 2022 in 2021. Why didn't they buy more U.S. #corn in 2022 for shipment now? It's anyone's guess, but I imagine they knew (hoped) they'd be able to get some from #Brazil at the end of last year. And then #Ukraine's exports restarted...

·

With the huge volume of U.S. #corn sold last week, total export sales for 2022/23 covered 74% of USDA's full-year forecast as of mid-March, below the average of about 80% but up from 68% in the prior week.