Thanks very much, cutworm!

Low energy prices are the lifeblood of every developed countries economy and a key determinant in inflation.

So what will Yellen do? Raise interest rates even more and cause a complete collapse of the banking system?

This current administration is doing everything, 100% wrong for the US economy.

These countries are NOT our allies in Biden's/NATO's war with Russia in Ukraine.

We are their mortal enemies because of Biden's war on fossil fuels, which is their main source for generating income.

Remember, last Fall before the elections, when Biden went to visit Saudi Arabia to beg for more oil production to lower US energy prices?

Instead of more production, like he was asking(with some under the table promises) they responded with an "up yours" and instead, made cuts of 2 million barrels TO HURT US!

The surprise decision over the weekend by OPEC-plus countries to further cut crude production helped keep a rally in European natural gas prices alive as concerns over fuel supplies again bubbled up as the week got underway.

The slump in natural gas prices amid a mild winter has made the fuel more competitive with oil and coal this year, which have risen in recent sessions and helped support the Title Transfer Facility (TTF).

The decision by OPEC-plus to cut another 1.1 million b/d on top of reduced Russian output and the group’s previously announced cuts pushed Brent prices higher Monday, “feeding inflationary fears,” said Rystad Energy’s Jorge Leon, senior vice president.

“If fully delivered, the announced cut would further tighten an already fundamentally tight oil market,” he added.

While European natural gas storage inventories are at their highest level in more than a decade, the market remains sensitive to any perceived threat to energy supplies as the continent continues to wean itself off Russian imports.

TTF jumped 13% last week with below-normal temperatures forecast for much of the continent during the beginning of April. Problems disclosed in a U.S. regulatory filing last week by Venture Global LNG Inc. with commissioning the Calcasieu Pass terminal in the United States also jolted the market and pushed prices higher.

The OPEC-plus news helped TTF gain another 7% on Monday, with the prompt contract finishing above $18/MMBtu for the first time since February.

For now, supplies reaching the continent remain robust. Kpler data showed that 148 liquefied natural gas cargoes carrying 6.08 million tons (Mt) landed in Northwest Europe last month. That’s close to a record of 7.17 Mt that arrived on 141 vessels in December.

Tudor, Pickering, Holt & Co. also noted on Friday that European gas inventories built by 3 Bcf over the previous week, compared to the five-year average draw of 28 Bcf over the same time.

Overall, European storage is at 56% of capacity, well above the five-year average of 35% for this time of year.

Analysts at Goldman Sachs led by Samantha Dart said in a note last week that stockpiles offer “little-to-no near-term support” for European gas prices. But they cautioned that the longer TTF remains low, “the stronger the support to demand, especially as gas is now cheaper than coal for power generation.” If demand rises that could tighten the market heading into next winter, the firm said.

In Asia, meanwhile, JKM futures gained 8% last week as TTF rose. Europe still has the premium, though, as demand in Asia remains weak with the shoulder season in full swing.

JKM spot prices were assessed in the low $10s/MMBtu Monday. China gas demand remains subdued and regional storage inventories are said to be high, which is also weighing on prices.

China also settled an LNG trade in yuan for the first time last week, according to the Shanghai Petroleum and Natural Gas Exchange. China National Offshore Oil Corp. and TotalEnergies SE completed the trade in Chinese currency.

In other news in the region, the Philippines is set to receive its first ever LNG cargo in mid-April, said commodities trader Vitol Inc. Vitol said it would load the cargo at Das Island in the United Arab Emirates to commission the Philippine’s first LNG import terminal in Batangas Bay.

In the United States, Freeport LNG Development LP continued to ramp up operations at its export terminal on the upper Texas coast. Feed gas nominations were at 2.1 Bcf on Monday, the highest since the plant was knocked offline in June 2022 after an explosion.

Feed gas deliveries started climbingtoward 2 Bcf last week, indicating that all three trains at the facility were operating for the first time in more than nine months.

The export strength helped the May Henry Hub contract rebound Friday after three straight days of losses. Freeport overshadowed both domestic trends and Venture Global’s announcement that the power island and heat steam recovery generator at Calcasieu Pass would require “extensive repairs and replacements.”

The issues, the company said, are likely to delay commercial operations and obligations to fulfill contracts with long-term offtakers. Spot cargoes would continue to be loaded.

Henry Hub was again trading lower Monday after forecasts trended warmer over the weekend, sending futures tumbling.

Another U.S. natural gas export developer, G2 Net-Zero LNG LLC, has scrapped plans for a terminal in Cameron Parish, LA. The company was working to make the facilitythe first LNG terminal with net-zero emissions on the Gulf Coast, but it told regulators in a filing that it is now focusing on developing net-zero greenhouse gas emission energy products instead.

By DAVID McHUGHan hour ago

“It was a surprise to all, I think, watchers and the market followers,” he said. “The swiftness of the move, the timing of the move and the size of the move were all significant.”

Part of the October cut of 2 millions barrels per day was on paper only as some OPEC+ countries aren’t able to produce their share. The new cut of 1.15 million barrels per day is distributed among countries that are hitting their quotas — so it amounts to roughly the same size cut as in October.

It certainly could. Analysts say supply and demand are relatively well balanced, which means production cuts could push prices higher in coming months.

Those higher prices could fuel global inflation in a cycle that forces central banks to keep hiking interest rates, which crimp economic growth, he said.

The West shunned Russian barrels even before sanctions were imposed, with Moscow managing to reroute much of its oil to India, China and Turkey.

President Joe Biden addressed the OPEC+ cut on Monday before returning to the White House from a trip to Minnesota, predicting, “It’s not going to be as bad as you think.”

The White House response was milder than in October, when cuts came on the eve of U.S. midterm elections in which soaring gas prices were a major issue. Biden vowed at the time that there would be “consequences,” and Democratic lawmakers called for freezing cooperation with the Saudis.

Caroline Bain, chief commodities economist at Capital Economics, said the cutback shows “the group’s support for Russia and flies in the face of the Biden administration’s efforts to lower oil prices.”

+++++++++++++++++

This administration has, by their policies caused the following countries to view the United States as enemies: Russia, China and the Middle East. With many others not in NATO NOT supporting us.

It's crystal clear that they have united against NATO, which is basically an organization financially supported by and run by the US with our president calling most of the shots.

Look what we have done to Ukraine and its people for US political agenda by not agreeing that we won't take NATO into the US backed organization(NATO) which clearly views Russia as an enemy that must be eliminated. This is inexcusable.

Putin should be charged with war crimes. In a just, honest world, so would Biden.

And we are punishing ourselves tremendously while doing these retarded things to cause other countries to unite against us.

And the response? Push out more blatant propaganda and pretend that none of this is really happening. This time, from above it's:

Biden: “It’s not going to be as bad as you think.”

Bidens response to Xi's new strong alliance with Putin:

Biden says China-Russia partnership is 'vastly exaggerated'

https://www.marketforum.com/forum/topic/94074/

Now it's Syria 26 responses

https://www.marketforum.com/forum/topic/94068/

And the Biden response to ending the war by negotiating peace, which would stop all this pain for everybody?

THIS IS A WAR BETWEEN THE UNITED STATES AND RUSSIA BEING FOUGHT BY UKRAINIANS WHO ARE THE ONES GETTING KILLED BY THE HUNDREDS OF THOUSANDS IN THE COUNTRY OF UKRAINE THAT'S GETTING DECIMATED USING A CORRUPT NATO/BIDEN PUPPET, ZELENSKY THAT HAS BETRAYED HIS PEOPLE AND CAMPAIGN PROMISE TO NEGOTIATE WITH RUSSIA AND BRING PEACE TO UKRAINE!!!!!!!!!

It's being supported in the US by the industrial military complex that's getting rich and the US tax payers that only hear and read the false war propaganda from our government and media.

https://www.marketforum.com/forum/topic/93431/#93484

Do we also believe that the US didn't blow up the Russian natural gas pipeline?

NORD STREAM ~ RUSSIA ~ ETC,

35 responses |

Started by 12345 - Feb. 8, 2023, 8:26 p.m.

We know all those things above are lies from our side. So why would we believe Biden, when he tells us that Putin's threat to use nuclear weapons is just hot air?

+++++++++++++

Everything is going completely wrong and the damage so far is trillions of times worse than what our objective was/is..........to take all of Ukraine into NATO, to be protected by the US, with Russia our common enemy.

Now, the best that we can do is get PART of Ukraine because Russia will NEVER give up the part that it has control of!

And if Biden is wrong for the umpteenth time about Putin, this time with shrugging off the nuclear weapons threat?

Do you think the Chinese data gathering balloon allowed to track across our country didn't gather any intelligence about our communications systems that can be used against us in a cyber war between us and them/Russia? And instead, believe Biden that we somehow secured and protected all of our systems so they couldn't learn anything?

They insisted that we learned much more about China by observing their balloon tracing across the US than they learned about us!

https://www.politico.com/news/2023/03/21/congress-chinese-spy-balloon-00087980

As if he put out an invisible force field that protected all of our energy and power delivery systems. All of our communications delivery systems. All of our military facilities.

Biden is the best president every at being able to convince people of invisible things that don't exist. Like the manufactured climate crisis, while ignoring off the charts real world threats that do exist. Many that he is entirely causing ...........and selling his position with DISinformation/propaganda.

Do you ever think that China, OPEC, and Russia get tired of winning on energy policy. Global energy polices in Europe and President Biden in the United States continues to strengthen our adversaries while making the rest of us look pretty- stupid.

It’s nus cutworm,

Even if there was a climate crisis instead of the current climate optimum our actions will be insignicant.

Not only is CO2 from the other bigger emitters well mixed in the global atmosphere but the radiation bands absorbed by CO2 are getting saturated.

so eachadditional molecule of CO2 causes less additional warming than the previous ones.

If the position was to not use up all the cheap, reliable abundant fossil fuels, the lifeblood of every country’s economy that are freeing the planet and massively increasing global food production because we want to save them for our children then that makes sense.

Instead it’s save all fossil fuels for our adversary’s so they can kick our arse.

And it’s much worse than that

The US has 24% of the worlds coal. They want to completely eliminate coal.

And replace it with solar and wind and batteries.

China has the franchise on raw materials for building those products.

This is intentional energy and economic suicide.

Every credible energy market report tells us this but they refuse to use those

Instead, totally manufacturing a fairy tale fake green energy utopia that defies the laws of physics, energy and nature with impossible promises for crony capitalism and corrupt government agenda

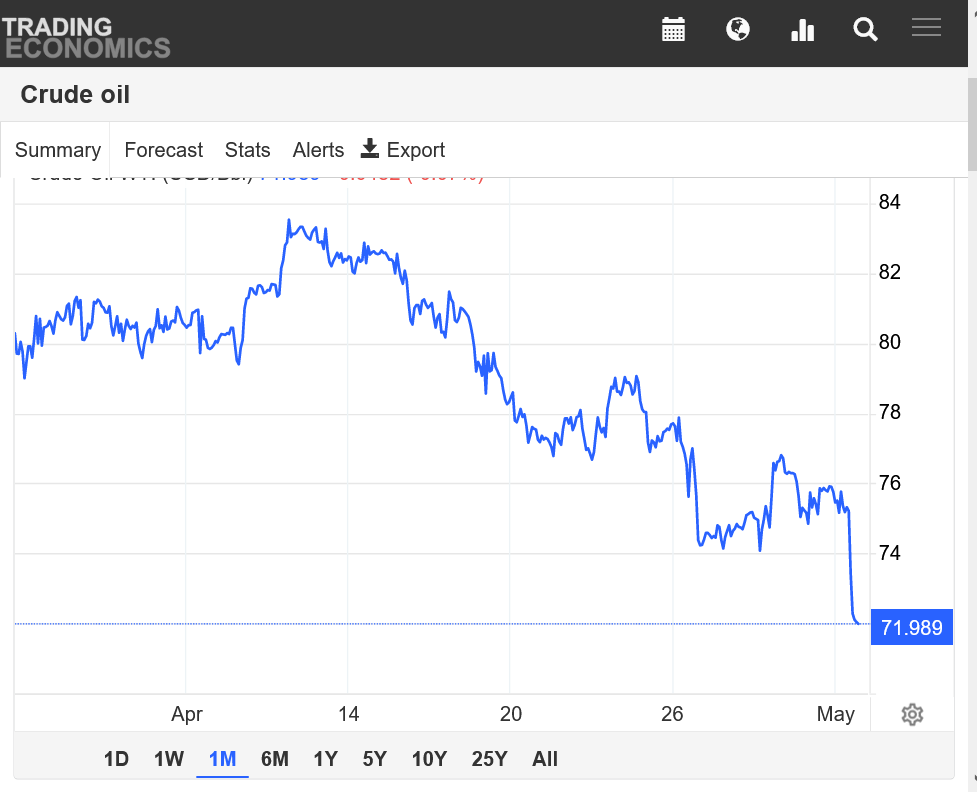

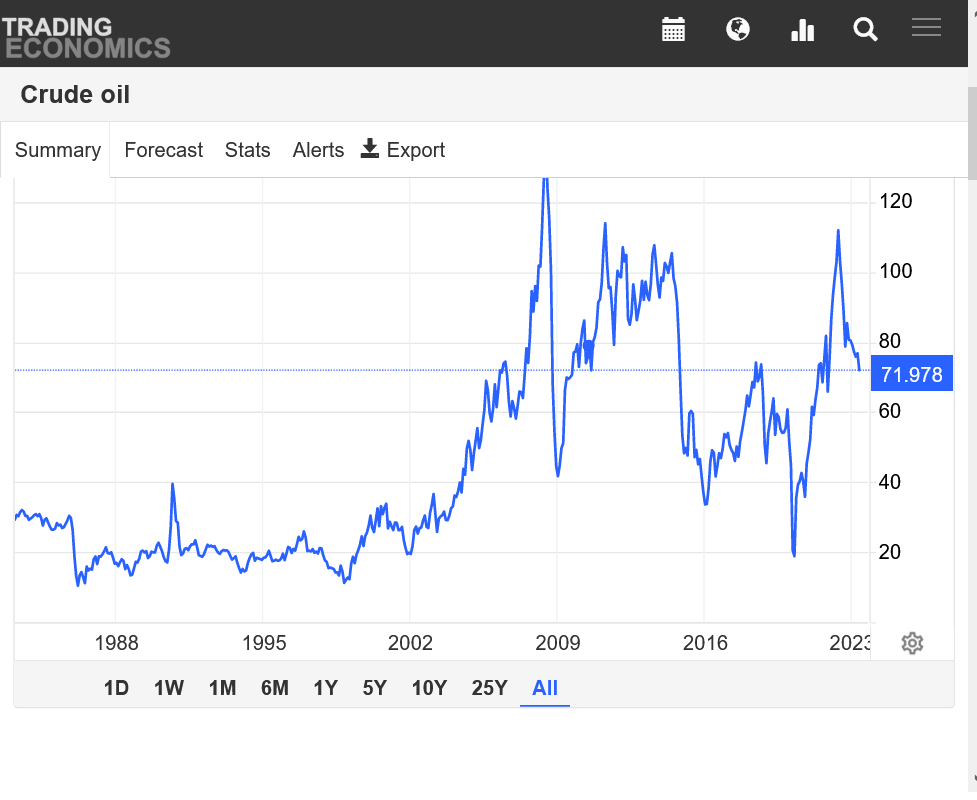

Gap almost filled by Wed-Fri trading. Small hook reversal up on Friday. 80 'looks' like resistance now,

Thanks tic,

June needs to get to 75.83 to fill the gap but like you said we had a little reversal.

May expired extremely weak on Thursday so maybe that was part of the drop.

Crude has been unable to follow thru with gains after the extremely bullish gap higher that cutworm alerted us too in this thread based on a bullish fundamental cut in OPEC supply.

seasonals are usually pretty strong in crude during Spring.

could be these extreme interest hikes are killing the economy as expected and with it, killing demand for energy products. Both industrial demand and the shipping fuel demand for diesel.

crude really should be trading higher if the economy was staying strong with the demand that goes with it.

If Biden would call for sincere negotiating for peace, I think we would fill that gap from expectations of more crude

Grains also likely dropping hard based on expectations for more global supply of wheat, oil seeds and corn.

since he’s been making the exact worst decisions possible every step of the way for everybody involved, it’s just as likely the escalation will continue with impossible to see consequences, including use of a nuclear weapon and black swan event.

crude has been amazingly stable this year considering the extreme circumstances but don’t let that fool you.

theres nothing stable and there are no responsible adults making the important decisions…..except for, maybe the OPEC countries which have us by the balls And are on Russias side.

The bank crisis is probably not over either.

Thanks Jean!

https://www.marketforum.com/forum/topic/94295/#94762

By 12345 - April 25, 2023, 11:16 a.m.

Texas is looking to natural gas to cover the failures of wind and solar that led to the famous Texas winter blackouts.

Getting close to KEY SUPPORT........oh, oh! At a time of year for seasonal strength in energies!

Very Bad sign if we drop below 75.83 and fill the $5 gap higher after the OPEC cut, extremely bullish news. Telling about what the market thinks regarding the economy!!

https://tradingeconomics.com/commodity/crude-oil

Mega support at the bottom of the gap higher held today. So the lower part of the gap higher has not been closed. Technically, this still gives the crude bulls hope.

We filled the huge, bullish gap that occurred when Opec announced the cuts in Crude production.

The technical formation is now a bearish, gap and crap buying exhaustion, however the markets are volatile and the gap filling was over a month later which makes it a weak technical signal.

This could serve as an area of support since we know about some very bullish supply fundamental news.

Regardless, CL is anything but bullish here based on price charts when we SHOULD BE going higher. So there are some pretty extreme negatives weighing us down that include, a rapidly weakening economy/demand which at the very least is a severe recession if crude traders are seeing the future correctly.

The US Dollar continues to get CRUSHED too. Normally, a weaker dollar means higher commodity prices. Potentially ominous for them to be going in opposite directions.

In this case, the weaker Dollar could be signalling a couple of things.

1. Global Loss of confidence in US leadership and policies

2. Loose cannon US Fed is going to have to reverse course again and start aggressively CUTTING interest rates to avoid an economic collapse from our catastrophically awful fake green energy, fiscal and war in Ukraine policies in tandem with the damage from higher interest rates to consumers and banks.

Crude held the major support after completely filling the gap and has reversed to slightly higher. A higher close would flip the signal to positive based on the reversal after testing mega support. Again, very uncertain market here with many mixed signals.

Crude has crashed down below the lows again. Threatening to close below the gap and below key support, obliterating the hopes of a reversal earlier.

I mentioned earlier this week that if Biden proposed peace, the markets would likely crash.

turns out that China has stepped up to the plate and is doing that.

Crude spiked just below $74 overnight and has reversed to sharply higher, above $76 and above the huge support that it broke on Wednesday.

A close up here would be very bullish.

1. 1 week

2. 1 year

3. 40 years

https://tradingeconomics.com/commodity/crude-oil

Crude getting crushed again. Couldn’t follow thru on the reversal higher. Not below last weeks lows yet. Lows today tested multiple times at $75. Usually that many tests means it won’t hold.

Crude is getting obliterated, here on Tuesday. Down almost $4! That's almost $3 below last weeks lows.

This could only happen if, either supplies are ready to increase OR demand is, or will be killed by an major global recession.

https://tradingeconomics.com/commodity/crude-oil

Crude down another $3 today. Down $14 in less than 3 weeks!

$67 is HUGE support.

Crude having a very strong day.

One of the Best free sources for crude news:

Crude continued the bounce today:

https://ycharts.com/indicators/us_oil_rotary_rigs

++++++++++

By Alex Kimani - May 08, 2023, 1:30 PM CDT

https://oilprice.com/Latest-Energy-News/World-News/14000-Inactive-Oil-Gas-Wells-In-US-Unplugged.html

QUITE A LENGTHY ENERGY ARTICLE FROM PHIL FLYNN

You put that oil in, you take the oil out, you put the oil in and you shake all about. You do the hokey pokey and you turn yourself around because that’s what it’s all about. The Biden administration's laughable and economically dangerous energy policy took another strange turn against a backdrop of an oil market that is worried about the stability of the banking sector while Fed officials give speeches surrounding the economic risk of climate change. The Federal Reserve, because of pressure from the Biden administration, had directed the nation’s six largest banks to show plans for how they would respond to climate-related events. US Energy Secretary Jennifer Granholm who provides the comic relief for this administration's dark energy policy gave traders a smile when she announced that the Biden administration will seek to purchase oil for the Strategic Petroleum Reserve as soon as they end the Congressionally mandated sales in June.

Yes, exactly Jean.

The indisputable biggest impact from the increase in CO2 from burning fossil fuels is from its key role in the LAW of photosynthesis.

the planet is massively greening up……not dying with world food production getting a huge boost.

life is experiencing a scientific climate OPTIMUM not a a climate crisis(completely made up for political agenda, crony capitalism and corrupt science)

the weather and climate recently has bee the best for most life in the last 1,000 years.

their replacement forms of energy like wind and batteries are really crappy and ironically….wrecking the planet to supposedly replace the energy form, fossil fuels which are greening up the planet from photosynthesis.

but we call the stuff wrecking the planet “green” energy and the stuff greening up the planet “pollution”

shows how powerful the propaganda and disinformation can be when the gatekeepers of messages collude to manufacture realities And repeat the exact same false narratives so many times that it defines what people believe and assume they know.

All they know is what they were taught to think.

anybody truly thinking independent of the fake climate crisis junk science rhetoric, just observing the planet massively greening up from more CO2 and a beneficial climate optimum, still not as warm as the Holocene climate optimum 9,000 to 5,000 years ago….would recognize immediately that there is no climate crisis killing the planet.