The jig is up for fake green, anti environmental, diffuse, unreliable, expensive, bird/bat/whale killing, landscape and earth wrecking(mining), crony capitalism rewarded and corrupt government forced wind energy. After 20-25 years, they need to be replaced and the old monstrosities are dumped in our landfills.

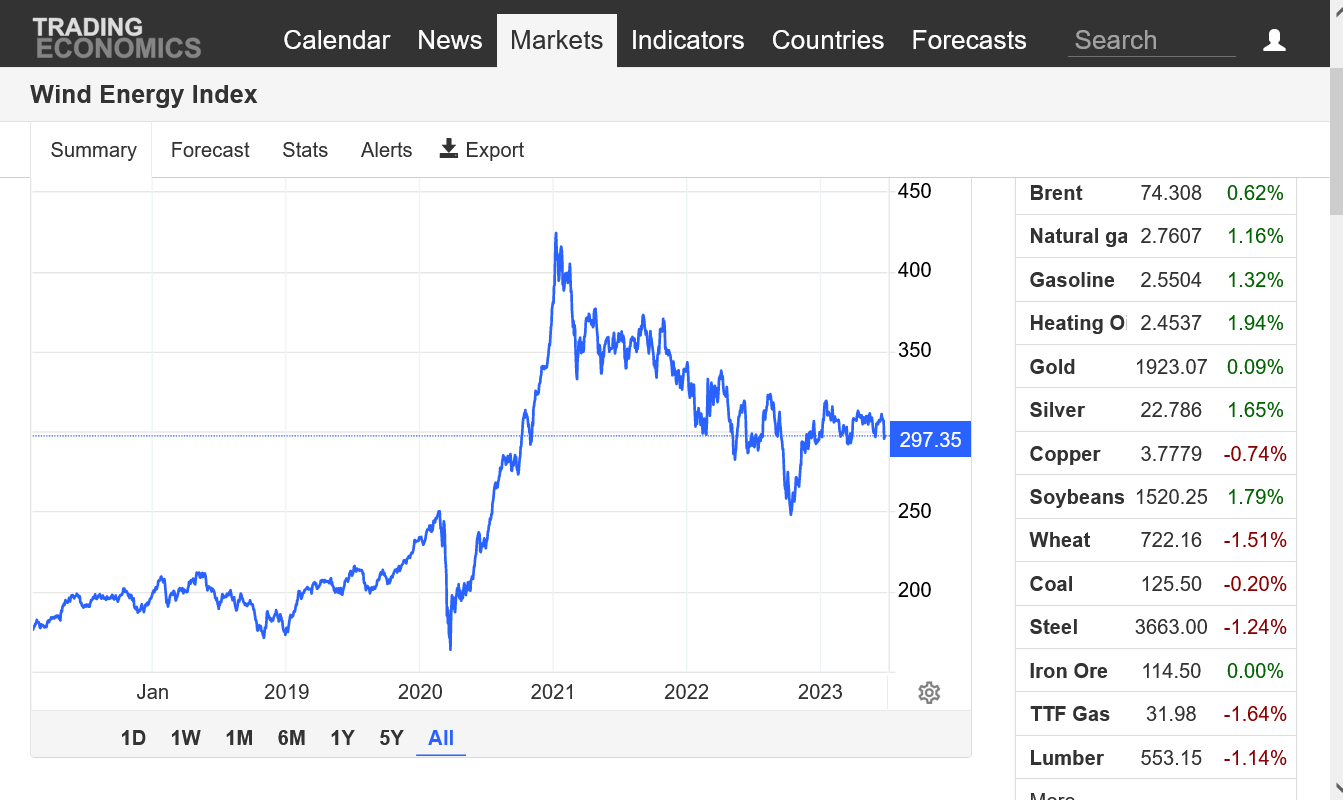

The wind market spiked higher ahead of the news of the scam money gushing in, then peaked on Biden's inauguration.......buy the news, sell the fact.

Even promises of trillions of dollars from the government this decade, with mandates and subsidies and nonsense physics that defy the laws of energy and nature can't won't ever get this market close to the old highs, when Biden was inaugurated in early January 2021.

Because in the REAL world, wind energy is massively under performing. Without massive, corrupt governmental support this industry would completely collapse.

Instead, it will be a continual, major drag on the US economy as it loses momentum and eventually dies out after the last billion dollars can be pilfered out.

Sustained as long as possible so the crony capitalists and politicians can maximize their personal enrichment/agenda's. With the citizens in our country the victims. Especially the poor people that are hurt the most from high energy prices and a weak economy.

Especially the wildlife that is harmed.

Especially the environments and earth that are harmed.

You can take this one to the bank:

IT'S THE RICH PEOPLE/POLITICIANS(ok, same thing) making all the money on this scam and the poor people getting hurt the most!

https://tradingeconomics.com/commodity/wind

By Felicity Bradstock - Apr 19, 2023, 2:00 PM CDT

https://oilprice.com/Alternative-Energy/Wind-Power/Wind-Power-Has-A-Profitability-Problem.html

For more comments, read here:

https://wattsupwiththat.com/2023/04/25/right-oilprice-com-wind-power-is-unprofitable/

The author of the OilPrice.com article, “Wind Power Has A Profitability Problem,” Felicity Bradstock, points out that despite massive investments and mandated construction by governments leading to growth in the wind power industry, “companies are realizing that it is difficult to translate wind power into profits.” Bradstock says the return on investment has not been what companies expected, writing:

In June last year, there were reports that some of the world’s biggest wind energy companies were battling heavy losses. Vestas Wind Systems, General Electric Co., and Siemens Gamesa Renewable Energy all faced extremely high raw material and logistics costs following the pandemic when supply chains were disrupted. This came after an arms race in which wind majors were competing to build the tallest, most powerful wind turbines at whatever cost would put them ahead of the rest.

Losses were seen across the board in 2022, to the tune of $2 billion for GE’s renewables division, $1.68 billion for the largest turbine manufacturer Vestas, and Siemens Energy lost $943.48 million.

Apparently, though companies are optimistic, in no small part because governments are requiring the use of their products through renewables mandates, “promising” high demand, and “new grants and subsidies are keeping the wind energy industry’s spirits high, and we can expect more incentives for new wind capacity worldwide as other countries and regions introduce their own climate policies.”

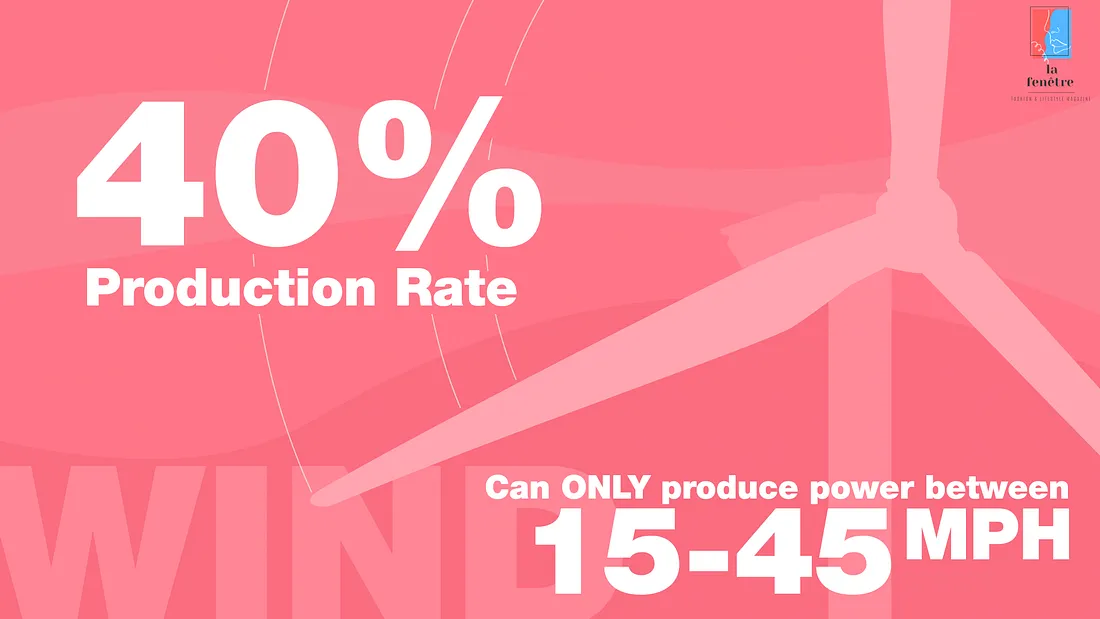

The wind industries’ losses are not all that surprising, given the unreliability of the product itself. In multiple posts, Climate Realism has discussed, here, here, and here, for example, wind power’s failure to provide the promised energy to customers.

Climate alarmists and renewables advocates frequently cite the claim that wind power, or renewables in general, are cheaper than fossil fuels, but the reality is different. The intermittent nature of wind power leads to higher grid operating costs. Additionally, the lifespan of these turbines is a lot less than manufacturers claim. In the case of one of Oregon’s largest wind power facilities, Bigelow Canyon, the turbines break down so often that they only survive for half of their purported lifespans. The facility averages at 27.6 percent of its rated production capacity. Also, when wind turbines aren’t operating, the power must be supplied from elsewhere, most often from fossil fuel powered plants, yet the costs of keeping such plants idled or operating as less than peak levels isn’t charged against the wind facilities, as it should be.

What is clear, is that wind facilities have tremendous upfront capital costs during the construction and installation of the turbines. The OilPrice.com article also confirms that these costs are rising quickly, due to higher materials costs, higher energy costs, supply-chain, and global trade issues.

Despite their tremendous losses, these companies continue to exist, entirely due to intervention by federal and state governments in the form of mandates, tax credits, property tax abatements, subsidies, guaranteed costs pass throughs to ratepayers, and other types of support. As Climate Realism discusses here, “without government subsidies and mandates, wind and solar power would largely be a boutique power supply for the wealthy.”

The public owes news outlets like OilPrice.com a debt of gratitude for reporting on the high costs and limited benefits of wind power. Sadly, most media outlets report on wind power through “rose-colored lenses,” which distort the true costs of wind power. If the technology was really so great, it would be able to compete in the marketplace without continuing government support.

Mike Maguire

June 26, 2023 2:31 pm

The Wind Energy Index shot up in 2020, as a Biden win was becoming increasingly likely.

All his policies favoring wind energy with subsides, tax breaks, rebates and mandates to force diffuse, intermittent, anti environmental, fake green wind energy on the market for crony capitalism and politics.

Then, in January 2021, it was buy the rumor, sell the crap since Biden was inaugurated.

https://tradingeconomics.com/commodity/wind

World Faces 'Terrifying' Future If Miners, Regulators Don't Step Up,

LOL SOUND THE ALARMS, OR STOP THE GOOFINESS, LOL

The mining industry needs to bring online the equivalent of 17 more Escondidas, the world's biggest copper mine, by 2050, to meet demand projections, she said as an example of the scale of the problem.

Other metals, such as nickel, cobalt and lithium, used in batteries and wind turbines, are also urgently needed for the energy transition.

"The next five to 10 years are critical," she said.

"The alternative is terrifying."

Newcrest is relying on a wind farm to supply 40% of its electricity needs for its Cadia gold mine in New South Wales state, but that power project development is struggling with regulatory time frames.

WIND POWER

10 responses |

Started by 12345 - June 20, 2023, 12:18 p.m.

https://www.marketforum.com/forum/topic/96469/

https://tradingeconomics.com/commodity/wind

John Raymond Hanger @johnrhanger

John Raymond Hanger @johnrhanger

·

Good morning with good news: A historic milestone for US offshore wind industry achieved. The first 13 MW turbine will be erected this week in 806 MW Vineyard 1. By October, 78 MW will deliver to Massachusetts, and up to 300 MW by end of 2023. All by 2024!

+++++++++++++++++++

Additionally, as Bloomberg notes, wind turbines can’t be recycled. Tens of thousands of aging blades are piling up in landfills. Many environmentalists and activists on all sides of the political spectrum are becoming aware of the “extensive damage done to nature’s bio-systems when vast regions are converted into wind and solar power plants,” as is detailed in Michael Moore’s documentary Planet of the Humans. The film “shows open-pit mines gouged deep into the Earth to extract iron, aluminum, copper, and other minerals needed for these plants. Hundreds of tons of cement are required to anchor the base of the 300–500-foot-high industrial wind turbines which slaughter millions of birds and bats every year. And then there are untold tons of earth and rocks blasted with thousands of pounds of dynamite to extract relatively small amounts of rare earth metals, often produced with few environmental controls in China.”

This article is part two of a three-part exposé detailing the staggering corruption and hidden costs embedded in “sustainable” wind energy including economic, human, social, and environmental impacts. This article discusses the human cost, and debt and subsidy cycles created by these industries.

Joe Biden has proposed to commit another $2 trillion to subsidies for renewable energy reported by Bloomberg Green. These subsidies come on top of tax credits, mandates, and other subsidies and investment in clean technologies.

Government subsidies and incentives already include Federal programs that provide direct cash outlays to producers or consumers of energy, Tax expenditures that reduce the tax liability of firms or individuals who take specified actions that affect energy production, distribution, transmission, consumption, or conservation, Loans and loan guarantees that provide financial support for energy technologies by guaranteeing the repayment of loans obtained in the private debt market or by lending money directly to energy market participants, and other forms of support.

Mr. Welch Jr. concludes the interview by stating, “The truth will set you free. The problem is that not everyone has the whole story. There is belief and support from teams of people around the world counting on us to win this battle.

“We can change this system of money laundering, slave labor, and environmental degradation into something different. What I want to see is America Strong, Africa Strong, South America Strong. All of our global citizens deserve a planet free from corruption and waste. We need to break through the cognitive dissonance to shed light on the truth, and then move forward with a just alternative.”