Previous thread:

Crop conditions May 15, 2023

14 responses |

Started by metmike - May 15, 2023, 11:53 a.m.

https://www.marketforum.com/forum/topic/95198/

+++++++++++++++++++++++

I'll start off with my last 2 weather posts to tallpine. We now have a weather market for C and S based on lack of rain the next 2 weeks in most of the Cornbelt.

Re: INO Morning Market Commentary

By metmike - May 22, 2023, 10:49 a.m.

https://www.marketforum.com/forum/topic/95370/#95371

I'm still convinced the weather is bullish/too dry. The market took awhile to react strongly last night/early this morning. The last EE run was even drier overnight for most of the Cornbelt.

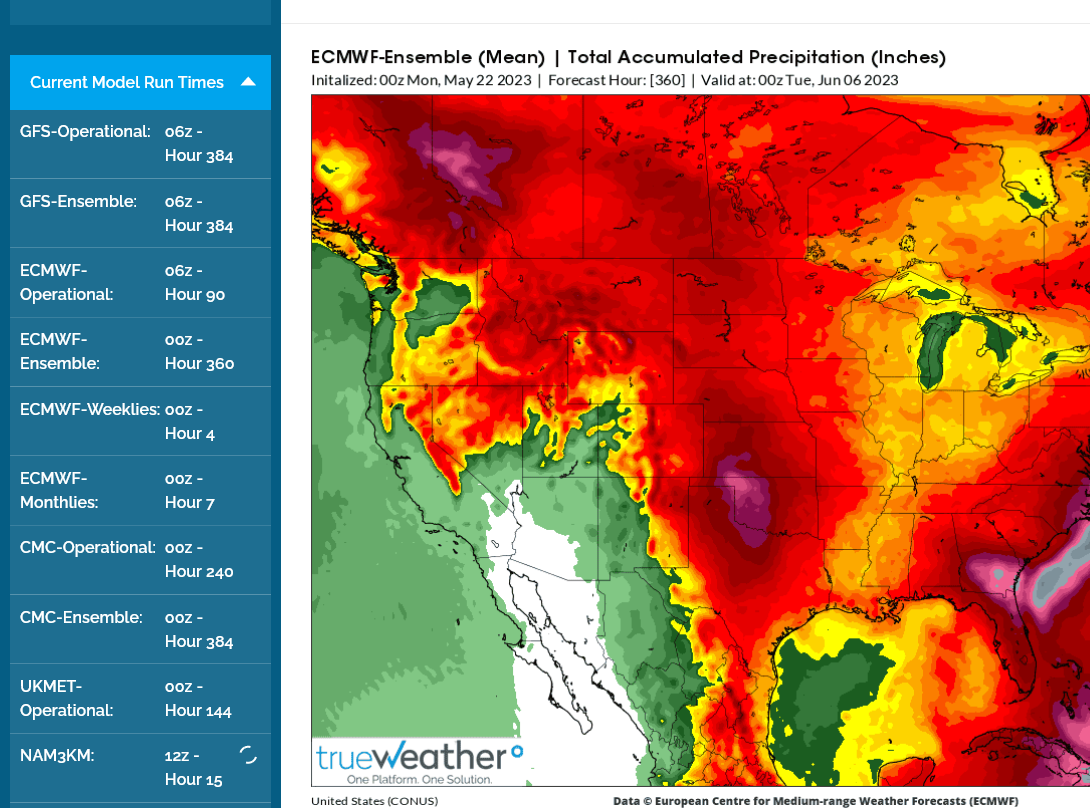

1. Latest European model 0z run 5-22-23

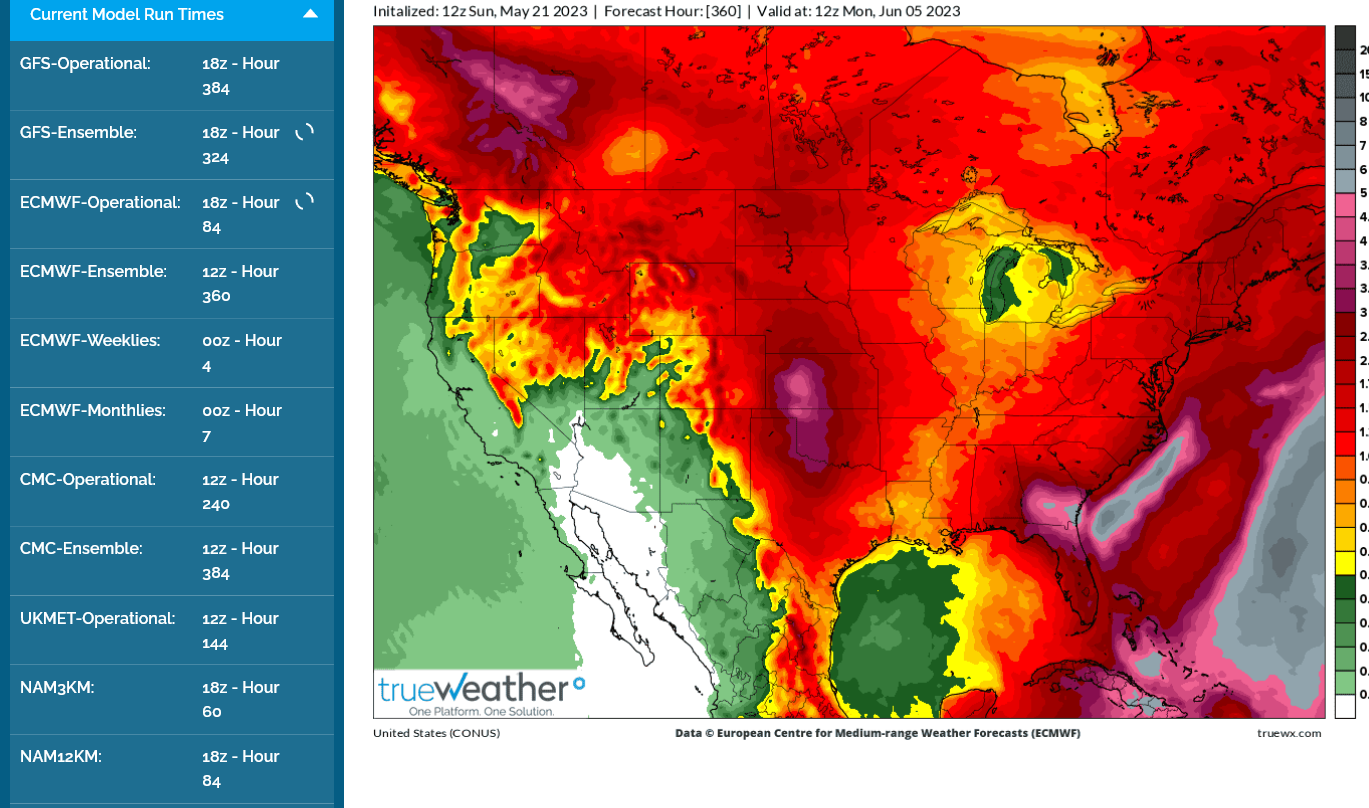

2. Previous one from yesterday afternoon 12z run 5-21-23

https://www.marketforum.com/forum/topic/95354/

By metmike - May 21, 2023, 8:12 p.m.

Thanks, tallpine!

To me, the weather looks too dry for C and S the next 2 weeks and is bullish. Especially the central and eastern Cornbelt.

W is still bearish because of big rain in the S.Plains.

EE last 12z run for total rains:

The European model above is MUCH drier than the GEFS model. I am solidly in the drier model camp.

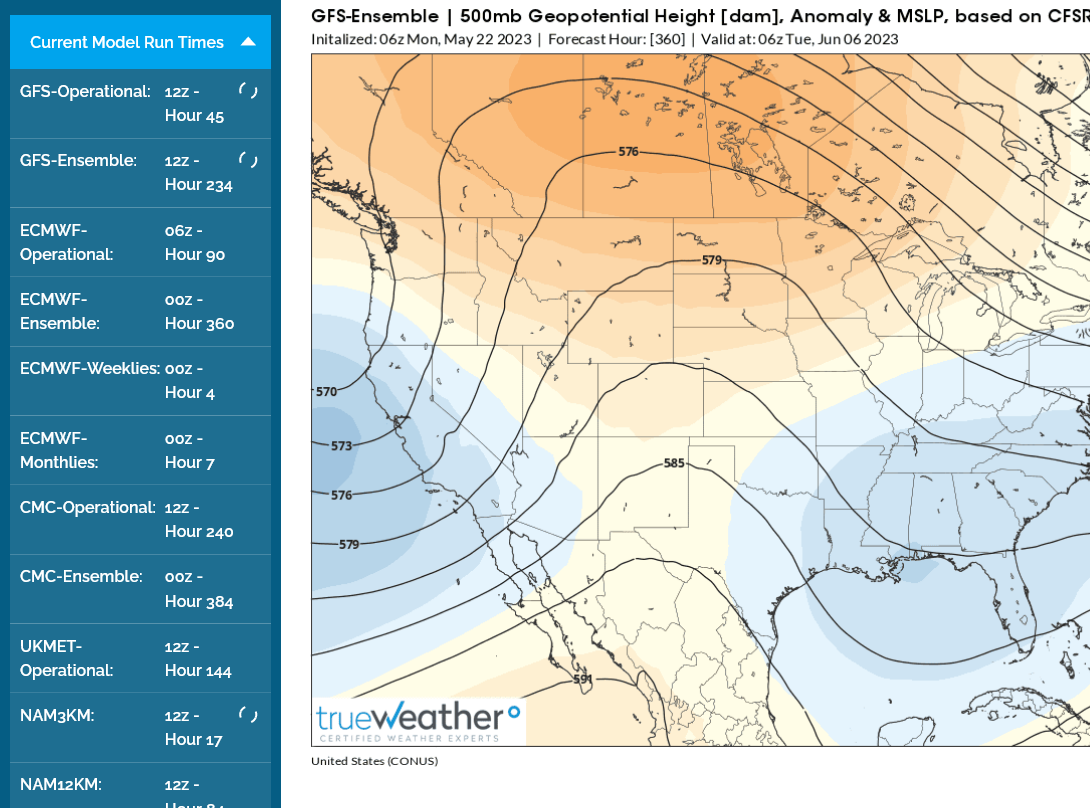

Maps 1 below is the 8-14 day guidance for this afternoon, using the GEFS guidance tool.

Crazy! Like night and day different than the very dry EE model guidance. The only way that makes sense to me is that the upper level ridge, will back up to the Rockies and result in northwest flow from the Plains to the Midwest with cold fronts dropping southeast. In the Summer, that can sometimes be a wet pattern.

However, this pattern is not shifted far enough west for that and the upper level trough in the Southeast will impede moisture flow into the Midwest. An upper level ridge there would assist with Gulf moisture moving north.

So I'm dry and the market is thinking dry right now but if NORTHWEST FLOW kicks in, with several active cold fronts, we might turn wetter.

The axis of the upper level ridge over the Plains MATTERS!

Updated weather.......still the same. Bullish for C and S!

North Dakota #corn was 32% planted as of Sunday, the second slowest ever for the date but well ahead of 18% in 2022. Thursday is the last day to plant corn per crop insurance rules in most of ND. Corn acres won't be as high as ND farmers planned, but how many will be lost?

I missed this one last week:

https://kswheat.com/news/abandoned-fields-and-low-yields-underscore-wheat-tour-2023

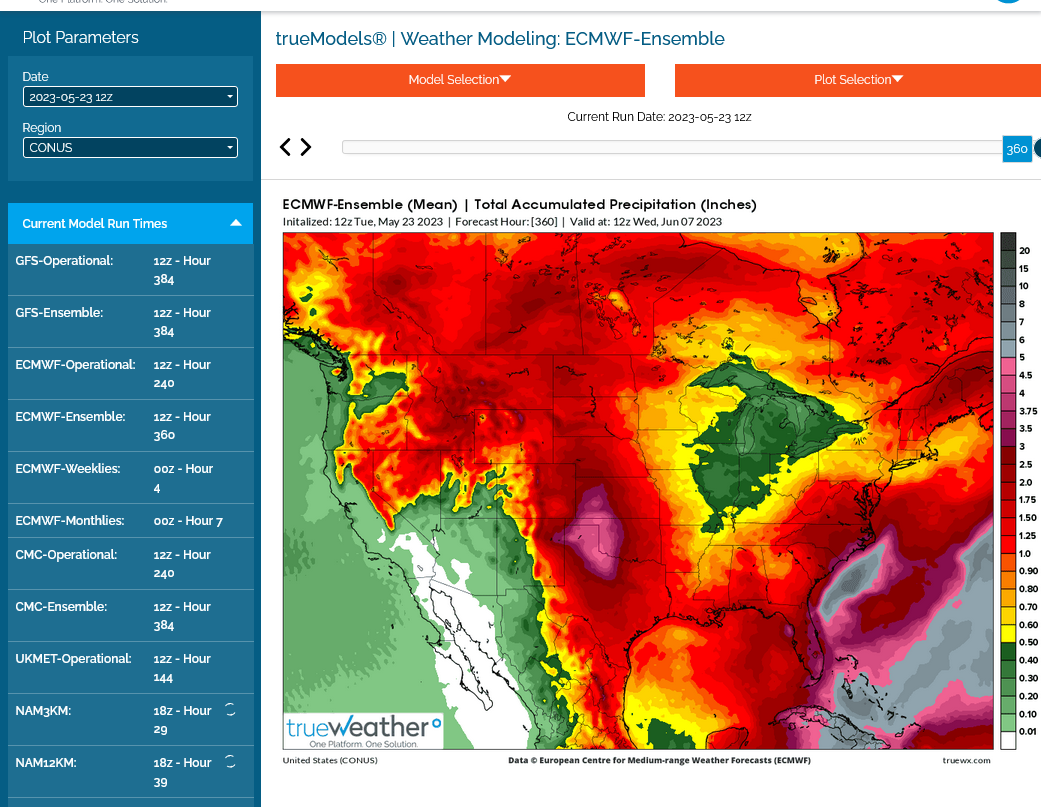

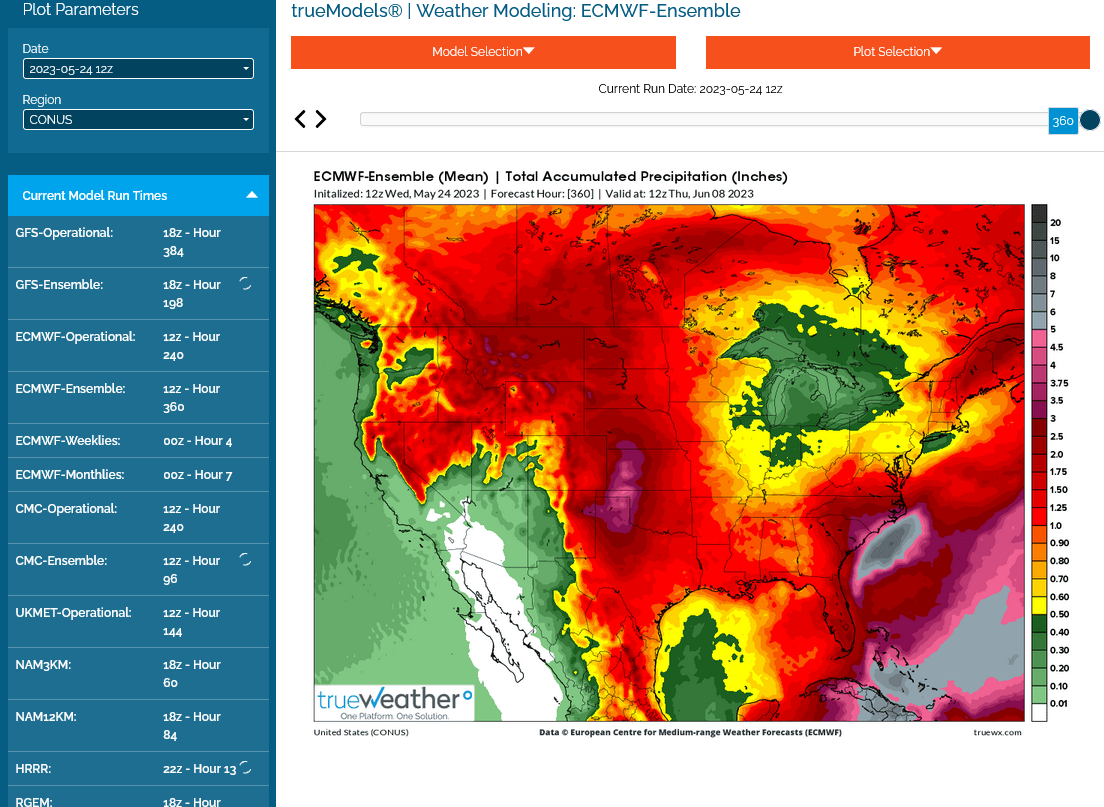

This is from the just out 12z European Ensemble. Not sure why beans were -19c today.

Very dry here in west central Illinois ! It's been 10 days since our last rain. Almost everything planted here.

Thanks bowyer!

at least 10: more days until your next rain )-:

Last 12z EE model below........still too dry )-:

But rains may be creeping in from the west, late in the week 2 period. I'm very surprised, almost shocked at the weakness in beans(lack of follow thru) after Mondays 30c spike higher and also the weakness in new crop for C and S. Old crop corn is taking off from something other than weather.

Wheat is getting clobbered from huge rains in the Plains during head filling this month.

Next Monday Night could be HUGE, after the holiday!

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Extended weather.

https://www.cpc.ncep.noaa.gov/products/predictions/610day/ | |||||||||

| 6 to 10 day outlooks | |||||||||

| Click below for information about how to read 6-10 day outlook maps Temperature Precipitation | |||||||||

| Click below for archives of past outlooks (data & graphics), historical analogs to todays forecast, and other formats of the 6-10 day outlooks ArchivesAnalogsLines-Only FormatGIS Data | |||||||||

Temperature Probability | |||||||||

Precipitation Probability | |||||||||

| |||||||||

The continued dry outlook, with some heat added has been unable to fire up the bulls after a Monday’s huge day up.

when a market is unable to respond strongly to very bullish or bearish news it’s usually a major warming sign.

in this case, the funds have huge shortw on and an extremely bearish mentality that won’t easily be shaken by a very dry weather pattern that would have us flying higher at this point in the growing season.

the current El Niño and resumption of global warming greatly increases odds for good growing weather and huge yields this Summer. The funds are banking on this too.

despite this black cloud (with potential Summer rains)hanging over the grain price right now, if we come back next week with a continued dry forecast, the funds will not be able to ignore this and the huge speculative shirts is fuel for some of the biggest short covering rallies.

there are great outside risks right now. News on default of our debt payments, war in Ukraine or banks defaulting could produce a spike, knee jerk reaction at any time.

Front month/old crop corn has by far been the most bullish this week!

May 24: CBOT July #corn rose for a third consecutive session. Futures settled Wednesday at $5.87-1/4 per bu, up nearly 6% from Friday's close. That's July corn's best three-day stretch so far in 2023

I post this in the wrong place on Monday.

U.S. spring #wheat planting last week advanced more than expected, but progress for #corn & #soybeans was largely as predicted. Winter wheat conditions improved slightly, though top grower Kansas is still just 10% good/excellent, (tied for) the worst for any week since 1989.

I WOULDN'T THINK THIS LONG, HOT & DRY WEEK COMIN' UP, WILL DO MUCH GOOD FOR ANY OF THE CROPS IN MY NECCO-DA-WOODS.

PM weather update: