Precipitation for June 1994

In June the average monthly rainfall in Chicago, IL is 2.46 inches with rain usually falling on 9 days. In June 1994 there was a total of 0.00 inches of rain, that fell on 7 days.

https://release.nass.usda.gov/reports/prog2423.txt

Corn crop rating fell 6% in the G/E category

Soybeans fell 5% in the G/E category.

SPRING WHEAT WAS DOWN A WHOPPING 9%

G/E #Corn & #Soybeans Conditions v Last Wk. Significant declines seen across key growing regions. IL corn down 12%, IA down 11%. Notable declines seen in WI down 16%, SD 12%, ND 14%. Not much better for IL on soybeans down 14 & IA down 10%, ND -11%.

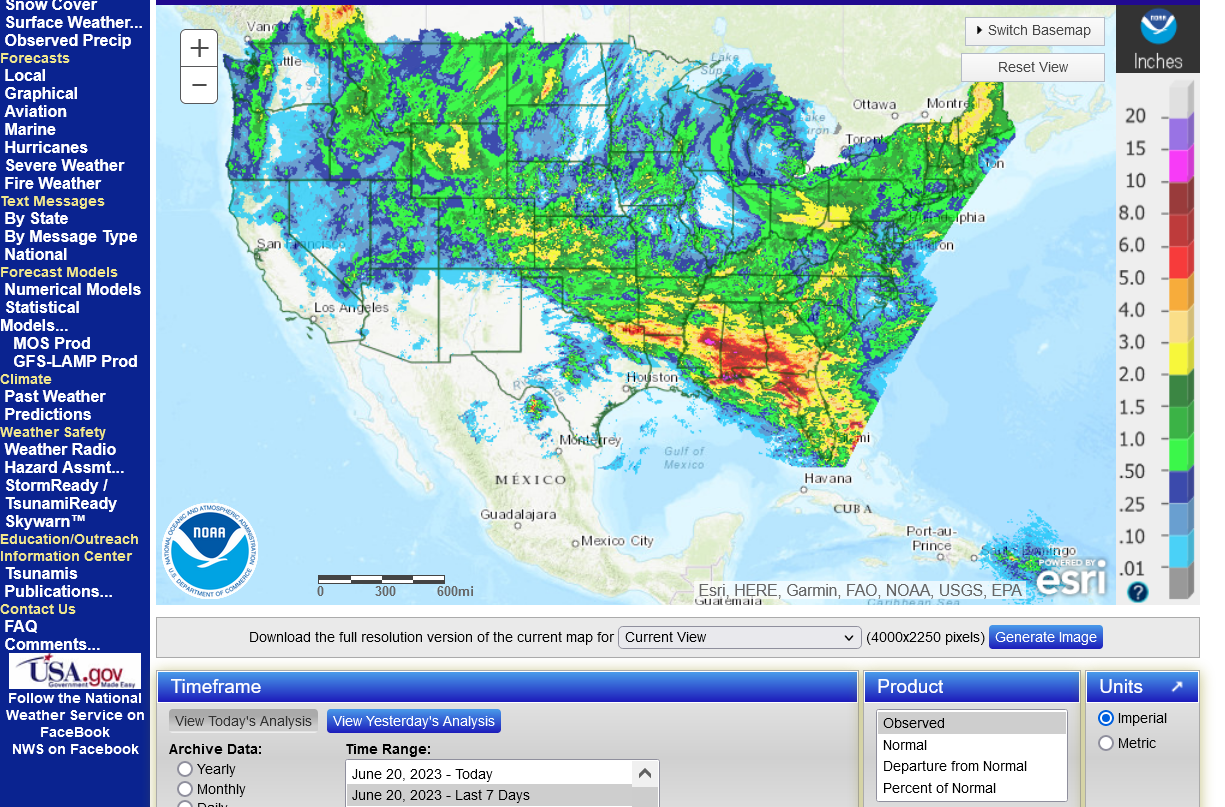

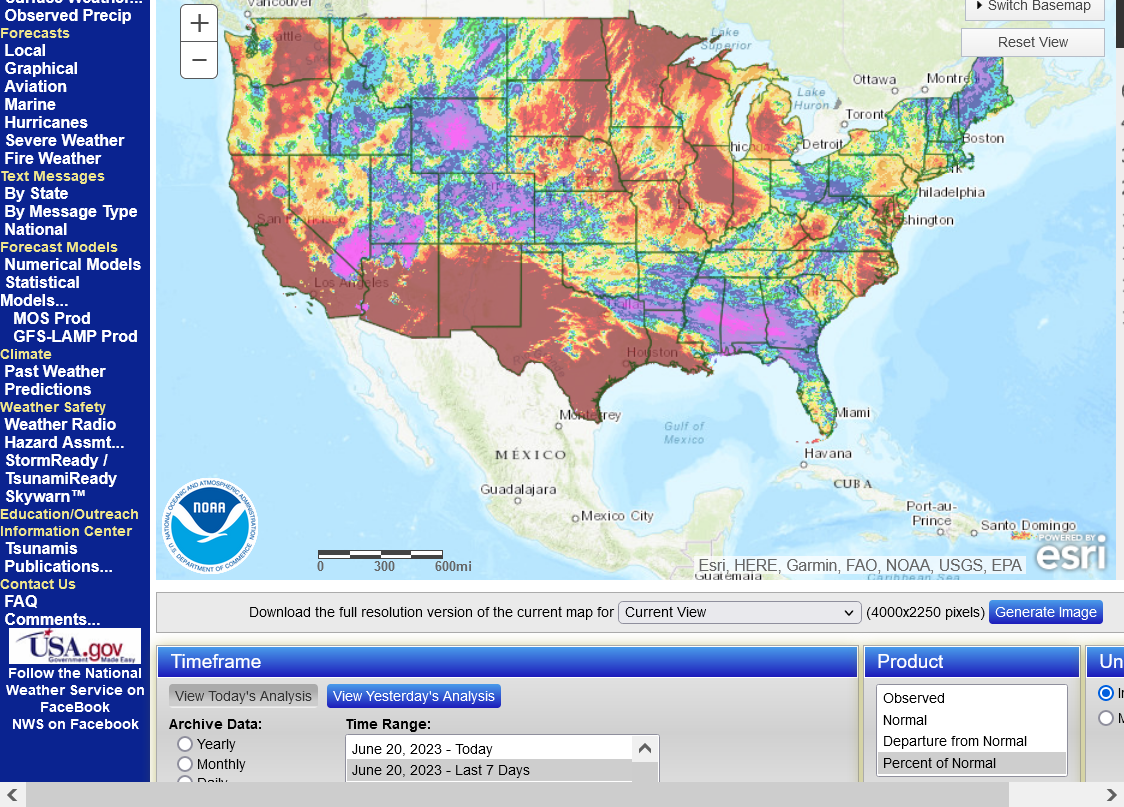

The last 7 days

1. Total rain

2. % of average rain

3. Temps-cool(except northwest) but extremely low humidity = high evaporation rates

https://water.weather.gov/precip/

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

++++++++++++++++++

Soilmoisture anomaly:

These maps sometimes take a day to catch up to incorporate the latest data(the bottom map is only updated once a week).

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

++++++++++++++++++++++++++++

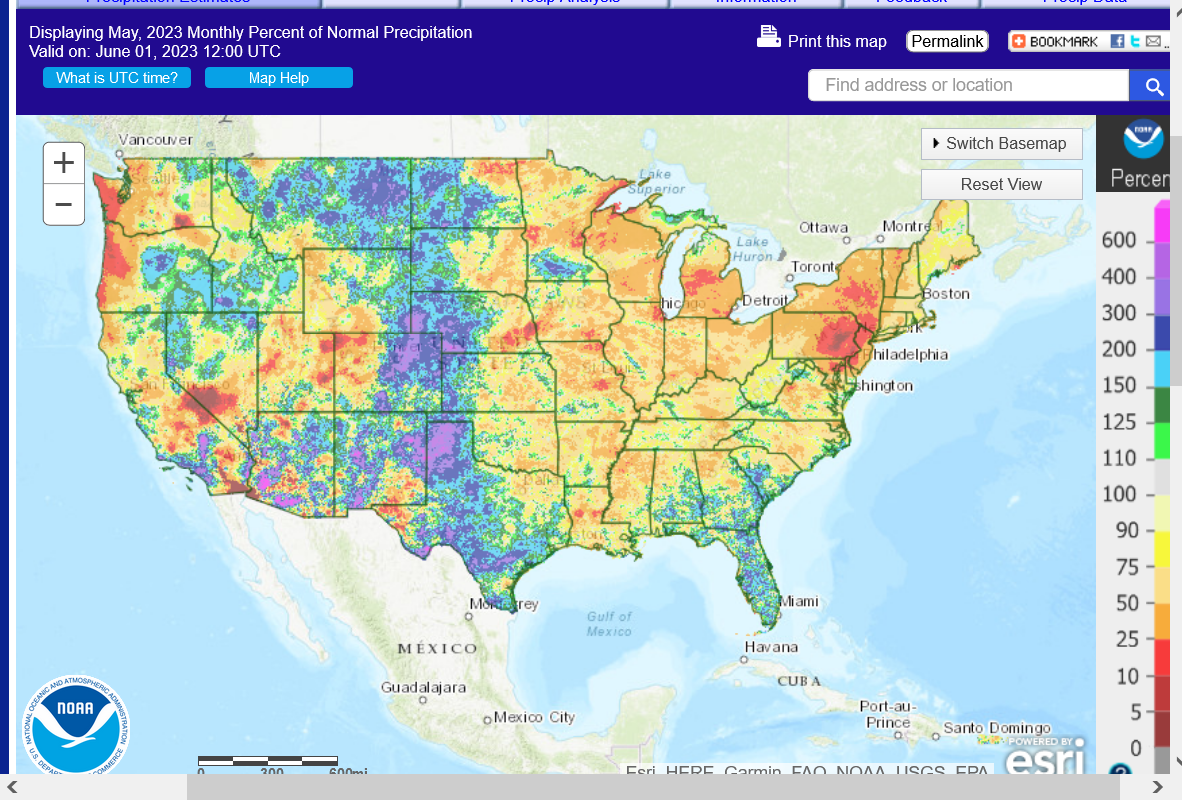

Final May precip map below

https://water.weather.gov/precip/

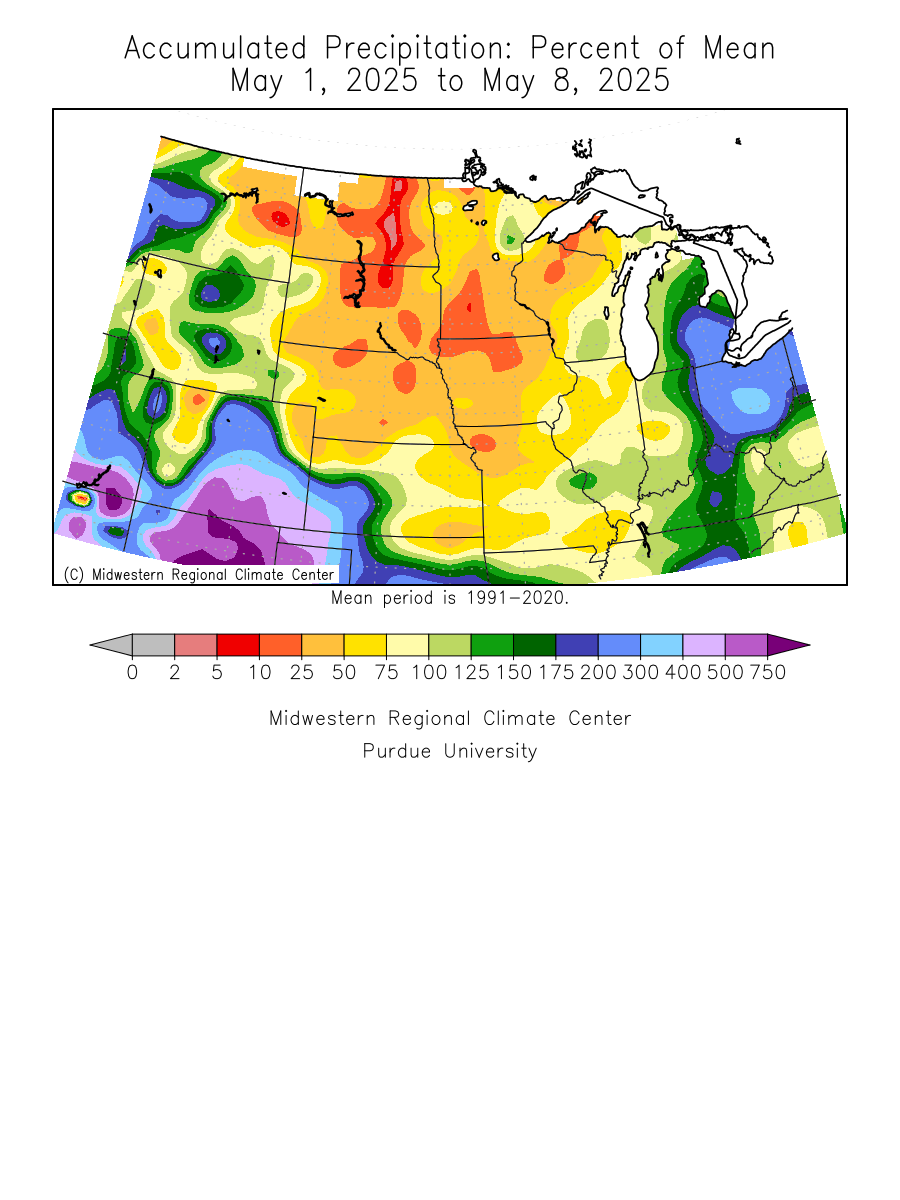

Updated daily below:

https://mrcc.purdue.edu/cliwatch/watch.htm#curMonths

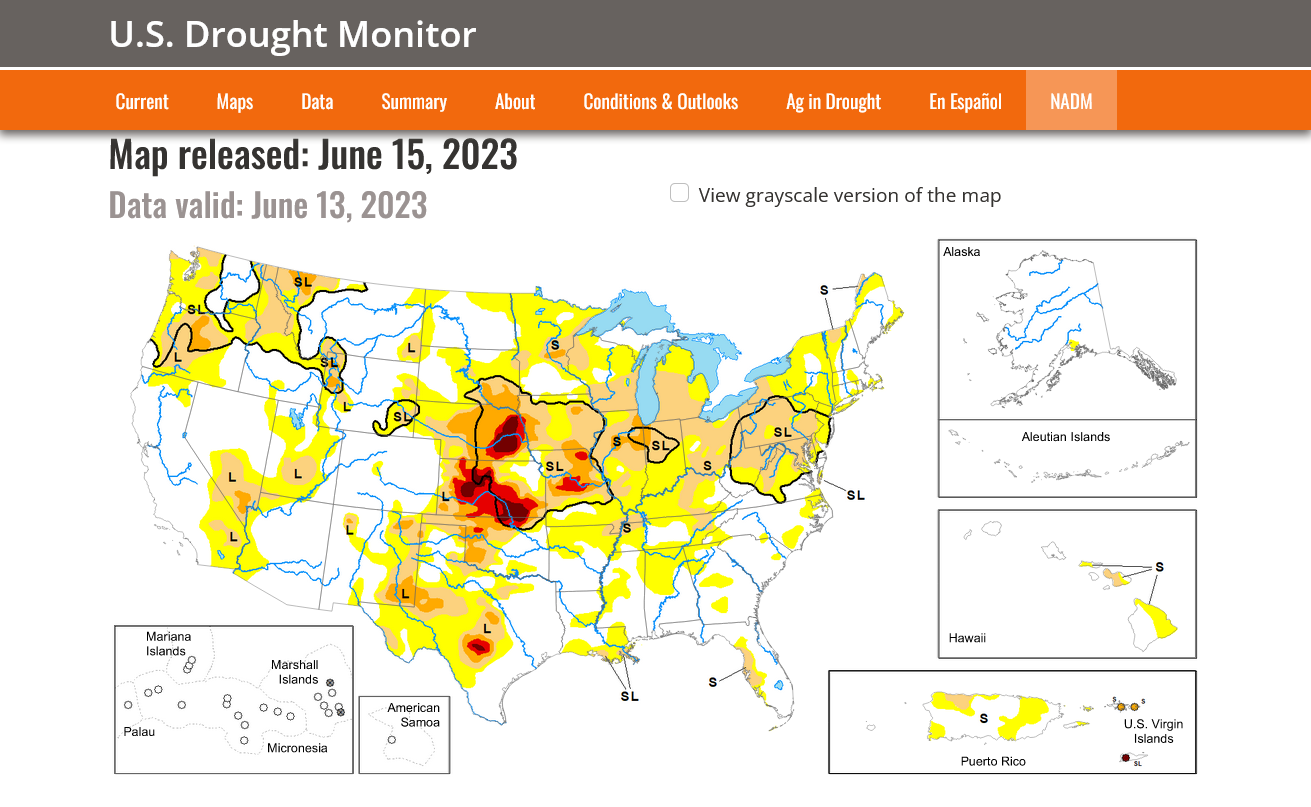

Most of the severe drought in the West has been wiped out!

https://droughtmonitor.unl.edu/

Last week, June 15, 2023

Huge expansion of drought in the Midwest!!

Drought monitor previous years: You can see the natural La Niña, (cold water-in the tropical Pacific)causing the drought! Starting in 2020, then worsening for 2+ years!

All the weather:

Much of last weeks huge move up was from short covering by funds:

Money managers thru June 13 massively covered shorts in CBOT #corn & #soyoil - flipping to net longs in both. June 13 positions in fut&opt (vs week earlier): Corn: net long 2.1k (was net short 44.5k) Soyoil: net long 8.7k (was net short 18.3k)#Soybeans: net long 47.9k (was 14k)

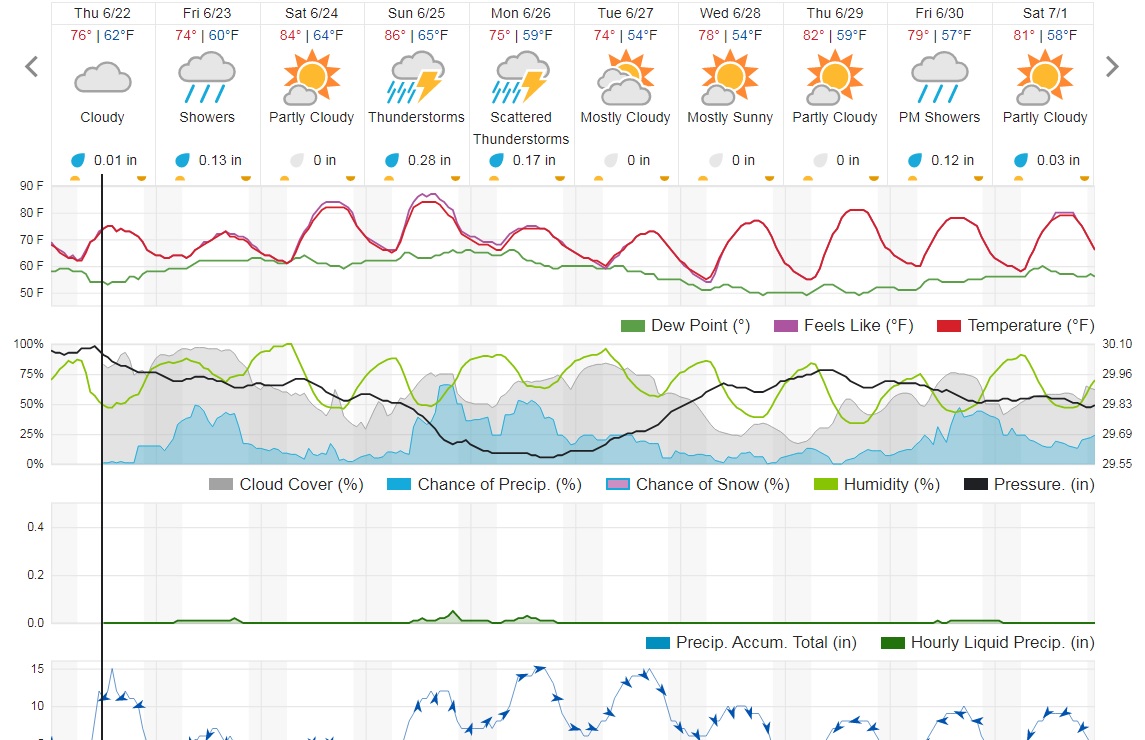

Last update of key weather forecasts driving grain prices;

With the EE still being pretty dry and the bullish crop conditions, the C and S should open modestly to SHARPLY higher tonight. Especially the new crop months.

We can make new highs for the move and then some as long as the central Cornbelt keeps losing production from lack of rain.

If we get an EE solution that adds a ton of rain, that will trigger a spike down. If that continues and the rains get closer and show up on all the models...... prices will plunge as quickly as they went up BEFORE the rains hit.

The weather every Summer is different and this Summer is turning out to be one of the strangest so far. believe the anomalous warmth in the Atlantic might be causing a teleconnection that's sabotaging the warm water in the Pacific (El Nino) from bringing in the rains it normally would.

That's the thing with weather this far away from a strong forcing mechanism that you expect to play a major impact. Another, even stronger forcing mechanism from a different direction can unexpectedly show up and completely deflect the impact of the first one over a certain region.

We had record rains in the S.Plains recently from the El Nino jet stream.

But it's been unable to push farther northeast, like it usually does because the NORTHERN STREAM, creating a pattern in Canada and points eastward won't let the El Nino jet stream progress any farther.

We got the much higher open from the deterioration in crop ratings exceeding market expectations.

What happens next depends on weather models overnight. Bull markets need to keep getting bullish news. This item was pretty bullish and without much rain for the next several days can be the focus to make new highs for the move as long as more rain doesn't show up in the forecasts.

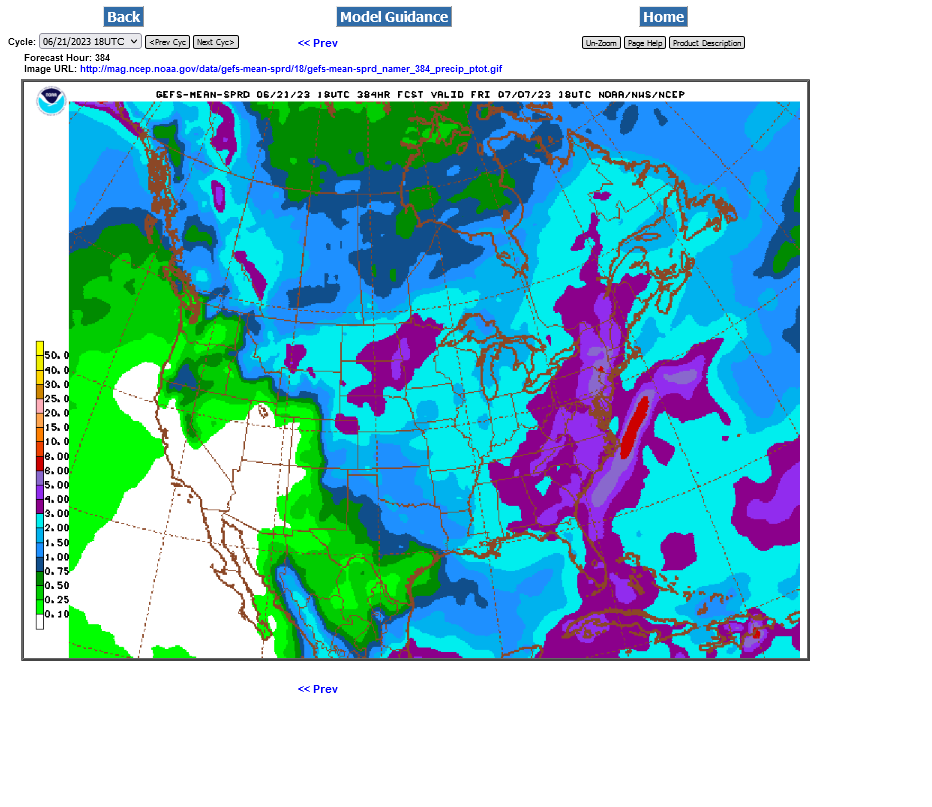

But this news will also be considered old news pretty quickly too if more rain shows up. The current 18z GEFS is coming out drier than the previous 12z run but that one was pretty wet compared to previous runs........so we're sort of back where we were before that.

Thank you, Mike, for your thoughts. No one has a better insight into a weather market than you.

You're very welcome, cutworm.

The last EE was pretty dry again with around an inch of rain, while the last 6z GEFS had double that amount in most places. Quite a difference.

+++++++++++

U.S. #corn conditions fall to 55% good/excellent as of Sunday, below the trade guess of 58% and down from 61% a week earlier. That is the week's lowest since 1992 and the lowest for any week in June or July since 2012. Illinois corn to 36% GE from 48% a week earlier.

U.S. crop conditions, #corn & #soybeans, June 18 vs June 11. Corn down 6 and soy down 5 points on the week. Top soy producer Illinois falls 14 points in beans and 12 in corn. Double digit falls in both crops for top corn grower Iowa, both Dakotas and Wisconsin.

+++++++++++++

U.S. #corn & #soybeans, crop conditions, June 18, 2023 versus date's 5yr average. Notably low ratings right now in many top states. Illinois is down 29 pts in both. Double digit departures in both Iowa and Nebraska. Michigan continues struggling with drought.

The only other year besides 1992 where U.S. #corn was worse off in this same week was 1988 (major drought continued that year). Record yields resulted in 1992, but this was the first week of July (and it continued). Relief came as soon as June ended.

If this were a dome of death, huge, rain suppressing upper level high like previous droughts...........2012 and 1988, we would be limit up.

But its an odd pattern that SHOULD BE transient and the market does not anticipate it continuing into July, like was the case in most previous droughts.

I actually remember some Junes in 1992 and 1994 with domes of death and the market spiking higher.

There was no rain in June 1994 in Chicago. As in ZERO. We went into 1 weekend with the market almost limit up and the weather models having 0 rain and MA temps. I was long over that weekend. Then, over the weekend the maps changed to MB temps and A precip and stayed that way for all of July.

Here's a story about that:

https://www.marketforum.com/forum/topic/90490/#90583

In June the average monthly rainfall in Chicago, IL is 2.46 inches with rain usually falling on 9 days. In June 1994 there was a total of 0.00 inches of rain, that fell on 7 days.

Latest comments:

https://www.marketforum.com/forum/topic/96537/#96554

Thanks tallpine!

As mentioned several times recently, this is NOT a dome of death type blocking pattern like most other long lasting droughts in the Summer.

It's an extremely odd pattern that has lasted much longer than expected and probably related to the very warm temps in the Atlantic Ocean.

Regardless, odds are pretty high that it will be breaking down in early July.

If that's the case, we may be at or close to the highs right now.

It's weather and I've been really wrong hundreds of times the last 40 years and will adjust that based on the latest information.

I'm not suggesting selling but that's the set up right now.

The models are turning wetter right now. If they verify, its over for the grains but earlier this month, the same thing looked likely.

If they turn drier again (possible) you DON'T want to be short.........we can go much MUCH higher.

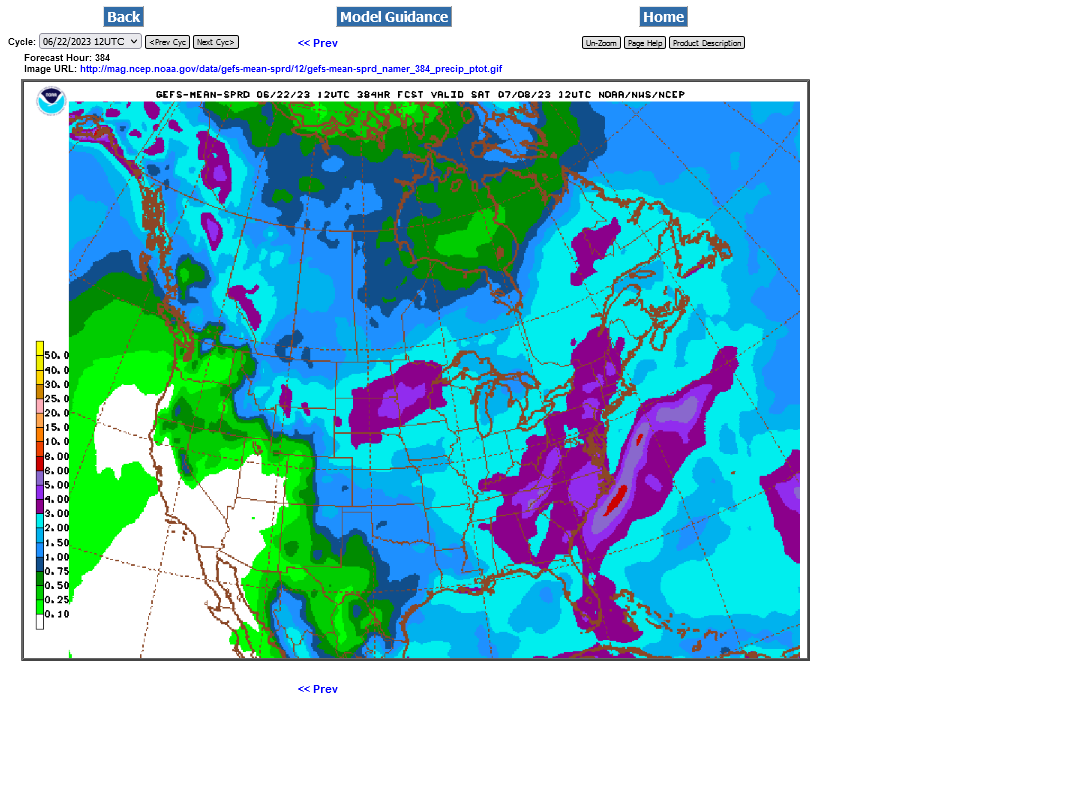

This was the 2 week rain map from the last 18z GEFS.

C and S had a spike lower at the open, probably from this.

We need the EE to get wetter than it is and match the GEFS(which has been too wet and not as good) but it also added rain this afternoon.

No change from yesterday, the highs MIGHT BE in unless the weather turns back to drier.

Last update:

Re: INO Morning Market Commentary

By metmike - June 22, 2023, 10:49 a.m.

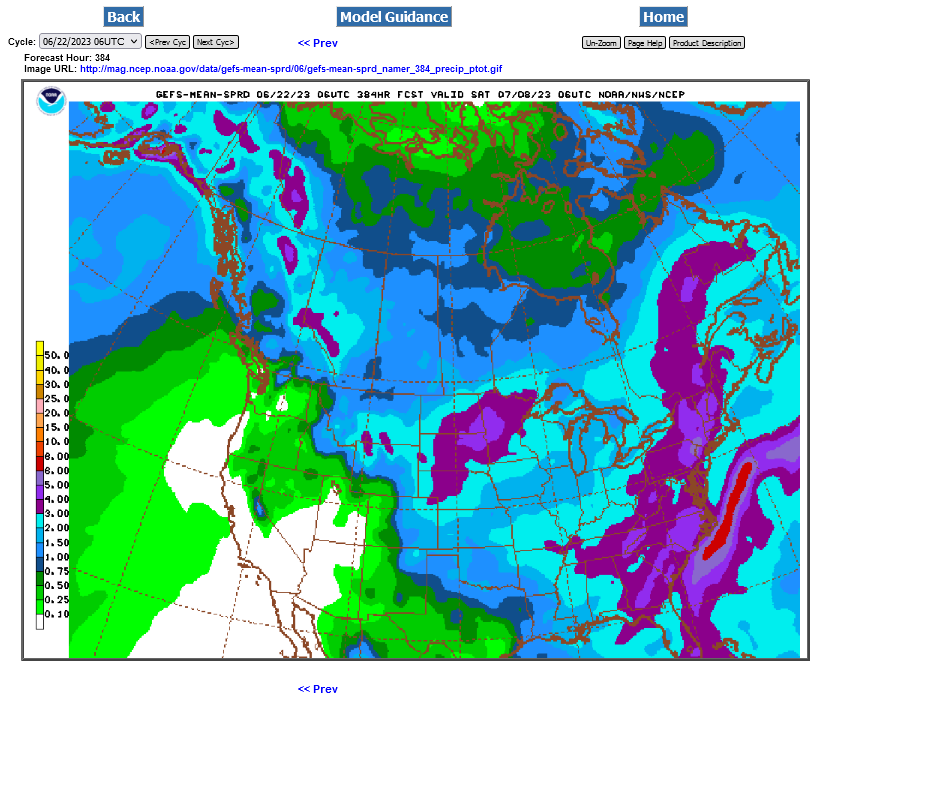

Rains increasing, as suspected with the NON dome of death pattern:

The last 6z GEFS below. This model has been too wet during the current flash drought. The EE is still trailing but also increased rains a bit the last 2 runs.

THEY PUT SOMEMORE RAIN BACK IN

Wild trading. SN went from more than 45c lower to almost back to unchanged, now back down 18c.

Rains continue to increase as expected with this NON dome flash drought. This was the last 12z GEFS. It's extremely difficult to stay short in this environment with the markets being so volatile and spiking in both directions. And you need to pick he right month and grain, which during this last trading session was new crop beans.

Old crop beans went up 40c between 10:30 am-Noon. No way that a day trader can be short during that period or even know those 90 minutes would be when that would happen. It ended -14c.

SX only went up 20c then and ended -37c for the day.

CN and CZ moved much closer to each other. They had about a +12c pop/correction to the upside during that same 90 minute period.

However, the CN at -12c was WEAKER than the CZ, -8c.

So a person selling on wetter weather would have done best by far in the SX new crop and 2nd best with the CN old crop.

All the weather is here:

https://www.marketforum.com/forum/topic/83844/

Week 2 guidance WET!

July Beans have bounced back 25c from the lows, almost unch. NOT from weather but there must be a shortage of old crop beans right now!

Corn is still more than half the limit down.

Not much change for the moment. Latest comments:

I predict that weekend rains will be disappointing in much of the key flash drought areas.

The ground is too dry and dewpoints too low to generate the type of 1 inch+ widespread rains we need with a fast moving cold front like this.

The main hope is for a skinny unbroken line of heavy storms can be very extensive from north to south and hit alot of areas with .5+ inch rains.

The upper level support with this system is incredible for June, so thats a huge plus.