tjc is on top of the cotton market for us.

CT has been performing VERY NICELY.

Here are some price charts and analysis for you:

https://tradingeconomics.com/commodity/cotton

1. 100 years Wow! 2nd highest price spike ever in early 2022

2. 10 years-Double top in late 2018, then dropped for almost 2 years

3. 5 years-Plunged lower in 2020-below 60-then went on a tear to 3 times higher by early 2022-above 150! Then plunged lower in 2022. Then sideways until this month.

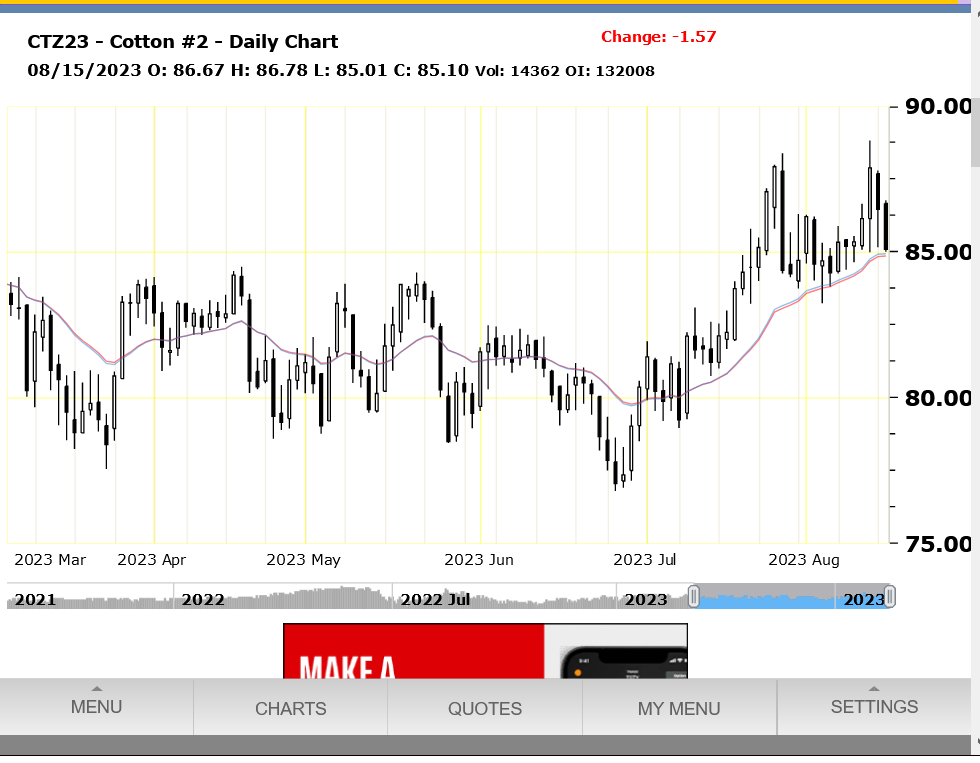

4. 1 year-bear flag Sep 2022. clear bottom-Nov 2022- upside break out this month after sideways trading since late 2022

5. 1 month-looks bullish-straight up

I have been on this trade for couple weeks with a ctz average 78, so I can 'weather' a dip. Also long sept 82 and 84 calls.

Exercise judgment--rsi now above 60.

In some respects, the calls, even though you are paying a premium, buy you time to Aug 18.

Trade only the dec--no volume Oct

Thanks, tjc!

Great advice. I haven't traded cotton for over a decade.

Agree on December having MUCH more volume by an extremely wide margin.

Even in May, I would often trade that one over the July with its greater volume because December is the new crop growing in the ground impacted the most by weather.

Now, its just thinly traded October and December for 2023. No brainer for most traders unless they have some unique insights that we aren't privy to that impact only Oct(it happens).

From tallpine:

https://www.marketforum.com/forum/topic/97620/

December cotton closed higher for the eighth-day in a row on Wednesday as it extends the rally off June's low. The high-range close sets the stage for a steady to higher opening on Thursday. Stochastics and the RSI are overbought but remain neutral to bullish signaling sideways to higher prices are possible near-term. If December extends the rally off June's low, the 75% retracement level of the May-July decline crossing at 91.29 is the next upside target. Closes below the 20-day moving average crossing at 82.12 would signal that a short-term top has been posted.

FULL DISCLOSURE

Stopped out of ctz, then liquidated calls.

Will look to re-enter.

Perhaps I 'protected' profits too much, but the uncertainty of weather and the vicious selloff Friday had me defensive.

tjc,

Thanks much for sharing some of your extensive/experienced wisdom with us and specific trades!

Not sure why cotton spiked so much higher overnight and came back down.

And congrats on a great call!

Despite some early strength from conditions dropping 5%, cotton couldn't hold the gains.

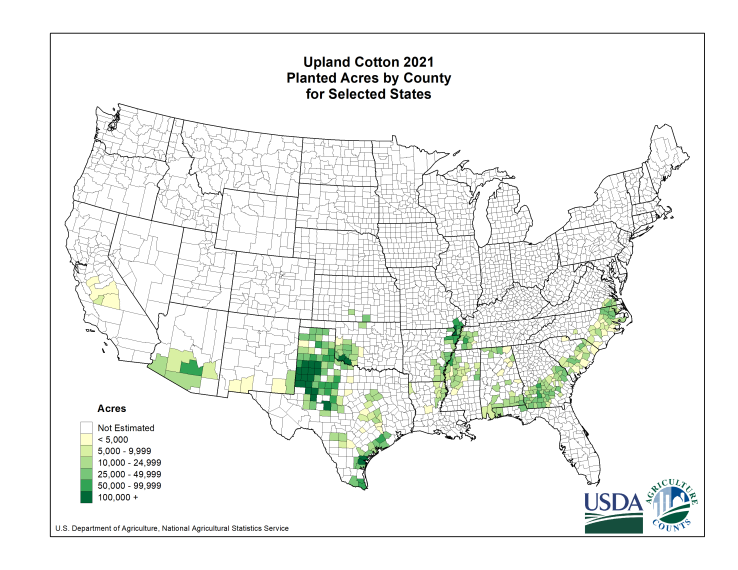

Weather will continue brutal for the TX cotton crop.

https://www.marketforum.com/forum/topic/83844/

https://www.nass.usda.gov/Charts_and_Maps/Crops_County/ctu-pl.php

https://tradingeconomics.com/commodity/cotton

1. 1 week

2. 1 month

3. 1 year

4. 100 years

https://tradingeconomics.com/commodity/cotton

https://tradingeconomics.com/commodity/cotton

IF so inclined, today may be a buy day

Thanks, tjc,

Cotton looks like it might close higher today.

Great call yesterday, tjc!

Report is out of the way.

Now back to trading weather and real diminishing yield prospects.

Hope a few bought calls

The report was extremely bullish cotton. I almost bought a few contracts ahead of the report because the re was no way for the report to be bearish With the brutal weather in TX.

great call tjc! Congrats

looks like we are breakingmout above the July highs above 88 today if we close up here.

weather is still bullish.

Cotton dropped a bit from those highs at the last post and we couldn't quite close above extremely strong resistance and July highs. Closing just under 88c but a huge day.

By metmike - Aug. 13, 2023, 9:59 p.m.

Cotton is getting hammered here. I will guess on that.

1. We couldn't close above the July high 88c on Friday. We spiked above it after the report but faded in the last hour+. Which was a price that we hit with absolutely MEGA bullish weather in TX and a very bullish USDA report. Friday had big gains but dropped below 88c towards the end of the trading session.

2. The dome of death in the south is weakening in the weather forecast. There still no rain and it will still be hot but not AS hot in TX later this month.

3. It's getting late in the year for hot/dry weather trading with cotton. Places that have had hot/dry all Summer and are poor/very poor will not be losing much more yield with more of the same. There's no category below VP. If the crop is 0 yield and dead it's still VP.

4. Cotton is a global market and I don't know what the fundamentals are globally. Maybe a horrible US crop isn't able to get us above 88c. If our competitors are selling cotton for 80c for instance(hypothetical) what will happen is that all the buyers will go there because there's no global demand for 88c cotton.

If we can't sell/export 88c cotton, no matter how small the crop is the price has to come down to export it.

Domestic demand/supply and prices is another thing. This is just an example of how the global market plays a role.

Despite the cotton condition dropping -5% on todays report, cotton only opened up slightly and now is down slightly.

Cotton put in an ugly day after the -5% condition report on Monday. Crude down sharply today put on additional pressure. But its still barely holding on to a potential bullish story but can drop much more than this before its more decidely negative. Last Friday's spike above 80c and close just below that looks like a double top with the late July high.

What do you think, tjc?

https://futures.tradingcharts.com/chart/CT/

Greetings, Everyone

Sorry for no replies, was in Wisconsin with friends--limited access.

MetMike has very accurately summarised the last seven days. I did not expect the 'severity' of the correction.

I WOULD enter today using a stop. All commodities have a 'feel' of reversals today.

Trade well!

(Buy ct, kc, silver, foreign currencies (sell $), AND BUY NQU, even bonds, maybe grains (with idea to resell).

BTW---somebody SHOULD have alerted us to a BUY OJ!!!

Thanks, much tjc!

Adding to ctz and kcz today

Thanks for sharing your trading ideas with us, tjc!