KEY EVENTS TO WATCH FOR:

Tuesday, August 1, 2023

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, Y/Y% (previous -0.3%)

Latest Wk, Y/Y% (previous -0.4%)

9:45 AM ET. July US Manufacturing PMI

PMI, Mfg (expected 49.0; previous 46.3)

10:00 AM ET. July ISM Report On Business Manufacturing PMI

Manufacturing PMI (expected 46.9: previous 46.0)

Prices Idx (previous 41.8)

Employment Idx (previous 48.1)

Inventories (previous 44.0)

New Orders Idx (previous 45.6)

Production Idx (previous 46.7)

10:00 AM ET. June Construction Spending - Construction Put in Place

New Construction (expected +0.9%; previous +0.9%)

Residential Construction

10:00 AM ET. June Job Openings & Labor Turnover Survey

11:00 AM ET. July Global Manufacturing PMI

PMI, Mfg (previous 48.8)

4:00 PM ET. July Domestic Auto Industry Sales

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls) (previous +1.3M)

Gasoline Stocks, Net Chg (Bbls) (previous -1.0M)

Distillate Stocks, Net Chg (Bbls) (previous +1.6M)

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The September NASDAQ 100 was steady to slightly lower overnight. Overnight trading sets the stage a slightly lower opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. If September renews this year's rally, the December-2021 high on the weekly continuation chart crossing at 16,659.50 is the next upside target. Closes below the 20-day moving average crossing at 15,595.95 would confirm that a short-term top has been posted. First resistance is the July 19th high crossing at 16,062.75. Second resistance is the December-2021 high on the weekly continuation chart crossing at 16,659.50. First support is the 20-day moving average crossing at 15,595.95. Second support is the 50-day moving average crossing at 15,112.27.

The September S&P 500 was was slightly lower overnight. Overnight trading sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are overbought, diverging but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If June extends the rally off March's low, the 87% retracement level of the 2022 decline crossing at 4639.07 is the next upside target. Closes below the 20-day moving average crossing at 4545.15 would confirm that a short-term top has been posted. First resistance is last-Thursday's high crossing at 4634.50. Second resistance is the 87% retracement level of the 2022 decline crossing at 4639.07. First support is the 20-day moving average crossing at 4545.15. Second support is the 50-day moving average crossing at 4427.97.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: September T-bonds was slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off July's high, July's low crossing at 122-30 is the next downside target. Closes above the 50-day moving average crossing at 126-18 would signal that a low has been posted. First resistance is the 20-day moving average crossing at 125-14. Second resistance is the 50-day moving average crossing at 126-18. First support is last-Friday's low crossing at 123-09. Second support is July's low crossing at 122-30.

September T-notes were slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off July's high, July's low crossing at 110.050 is the next downside target. Closes above the 20-day moving average crossing at 111.267 would signal that a short-term low has been posted. First resistance is the 50-day moving average crossing at 112.250. Second resistance is the 50% retracement level of the April-July decline crossing at 113.313. First support is Friday's low crossing at 110.255. Second support is July's low crossing at 110.050.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:Septembercrude oil was lower overnight as it consolidates some of the rally off May's low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off the June 28th low, the November-2022 high crossing at $83.59 is the next upside target. Closes below the 20-day moving average crossing at $76.57 would signal that a short-term top has been posted. First resistance is Monday's high crossing at $82.00. Second resistance is the November-2022 high crossing at $83.59. First support is the 10-day moving average crossing at 78.91. Second support is the 20-day moving average crossing at $76.57.

September heating oil was higher overnight as it extends the rally off May's low. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off May's low, the 87% retracement level of the 2022-2023 decline crossing at 3.1313 is the next upside target. Closes below the 20-day moving average crossing at 2.6911 would signal that a short-term top has been posted. First resistance is the overnight high crossing at 3.0315. Second resistance is the 87% retracement level of the 2022-2023 decline crossing at 3.1313. First support is the 10-day moving average crossing at 2.8283. Second support is the 20-day moving average crossing at 2.6915.

September unleaded gas was slightly higher overnight and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off the June 23rd low, the October-2022 high on the weekly continuation chart crossing at 3.0221 is the next upside target. Closes below the 20-day moving average crossing at 2.6812 would signal that a short-term top has been posted. First resistance is last-Friday's high crossing at $2.9257. Second resistance is the October-2022 high on the weekly continuation chart crossing at $3.0221. First support is the 10-day moving average crossing at $2.8174. Second support is the 20-day moving average crossing at $2.6812.

September natural gas was slightly higher overnight and sets the stage for a slightly higher opening when the day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. If September renews the rally off the July 17th low, the June 26th high crossing at 2.911 is the next upside target. If September extends last-week's decline, the July 17th low crossing at 2.477 is the next downside target. First resistance is the June 26th high crossing at 2.911. Second resistance is the 25% retracement level of the 2022-2023 decline crossing at 3.193. First support is the July 17th low crossing at 2.477. Second support is the June 1st low crossing at 2.249.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The September Dollar was higher overnight as it extends the rally off July's low. Overnight trading sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off July's low, the 50-day moving average crossing at $102.122 is the next upside target. Closes below last-Thursday's low crossing at $100.320 would temper the near-term friendly outlook in the market. First resistance is the 50-day moving average crossing at $102.139. Second resistance is July's high crossing at $103.275. First support is last-Thursday's low crossing at $100.320. Second support is July's low crossing at $99.220.

The September Euro was lower overnight. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off last-Tuesday's high, the 50-day moving average crossing at 1.09683 is the next downside target. Closes above the 20-day moving average crossing at $1.11039 would temper the near-term bearish outlook in the market. First resistance is the 20-day moving average crossing at $1.11039. Second resistance is the July 18th high crossing at $1.13105. First support is last-Friday's low crossing at 1.09700. Second support is the 50-day moving average crossing at 1.09683.

The September British Pound was lower overnight and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices near-term. If September extends this month's decline, the 50-day moving average crossing at 1.2712 is the next downside target. Closes above last-Thursday's high crossing at 1.2999 would signal that a short-term low has been posted. First resistance is the July 14th high crossing at 1.3146. Second resistance is the 75% retracement level of the 2022-2023 decline crossing at 1.3253. First support is the 50-day moving average crossing at 1.2712. Second support is the June 29th low crossing at 1.2594.

The September Swiss Franc was lower overnight as it extends the decline off July's high. Overnight weakness sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off July's high, the 50-day moving average crossing at 1.13513 is the next downside target. If September resumes the rally off May's low, the January 2019 high crossing at 1.18680 is the next upside target. First resistance is the July 18th high crossing at 1.17650. Second resistance is the January 2019 high crossing at 1.18680. First support is the overnight low crossing at 1.14705. Second support is the 50-day moving average crossing at 1.13513.

The September Canadian Dollar was sharply lower overnight as it extended the decline off July's high. Overnight trading sets the stage for a sharply lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off July's high, the 50-day moving average crossing at $75.30 is the next downside target. If September renews the rally off July's low, the September-12th -2022 high crossing at $77.11 is the next upside target. First resistance is the 38% retracement level of the 2022-2023 decline crossing at $76.28. Second resistance is the September-12th -2022 high crossing at $77.11. First support is the 50-day moving average crossing at $75.30. Second support is July's low crossing at $74.78.

The September Japanese Yen was lower overnight as it extends the decline off last-Friday's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off the July 14th high, June's low crossing at 0.069755 is the next downside target. Closes above the 50-day moving average crossing at 0.071933 would temper the near-term bearish outlook. First resistance is last-Friday's high crossing at 0.07315. Second resistance is the July14th high crossing at 0.073585. First support is the overnight low crossing at 0.070475. Second support is June's low crossing at 0.069755.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

Precious Metals: Augustgold was sharply lower overnight. Overnight trading sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below last-Thursday's low crossing at $1941.70 would confirm that a short-term top has been posted while opening the door for additional weakness near-term. If August renews the rally off June's low, the 50% retracement level of the May-June decline crossing at $2001.40 is the next upside target. First resistance is the July 20th high crossing at $1989.80. Second resistance is the 50% retracement level of the May-June decline crossing at $2001.40. First support is last-Thursday's low crossing at $1941.70. Second support is June's low crossing at $1900.60.

September silver was lower overnight and sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 50-day moving average crossing at $23.968 would signal that a short-term top has been posted. If July resumes the rally off June's low, the 75% retracement level of the May-June decline crossing at $25.561 is the next upside target. First resistance is July's high crossing at $25.475. Second resistance is the 75% retracement level of the May-June decline crossing at 25.561. First support is the 20-day moving average crossing at $24.448. Second support is the 50-day moving average crossing at $23.968.

September copper was lower in late-overnight trading and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the rally off the June 29th low, April's high crossing at 4.1825 is the next upside target. Closes below the 50-day moving average crossing at 3.8054 would signal that a short-term top has been posted. First resistance the overnight high crossing at 4.0240. Second resistance is April's high crossing at 4.1825. First support is the 10-day moving average crossing at 3.8920. Second support is the 20-day moving average crossing at 3.8578.

GRAINS http://quotes.ino.com/ex changes/?c=grains

Grains: December corn was lower overnight as it extends the decline off last-Monday's high. Overnight trading sets the stage for a lower opening when the day sessions begins trading. Stochastics and the RSI are bearish signaling that sideways to lower prices are possible near-term. If December extends the decline off last-week's high, the July 16th low crossing at $5.02 is the next downside target. Closes above the 10-day moving average crossing at $5.41 1/4 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $5.22 1/4. Second resistance is the 50-day moving average crossing at $5.35 3/4. First support is the July 16th low crossing at $5.02. Second support is July's low crossing at $4.81.

September wheat was lower overnight as it extends the decline off last-Tuesday's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the aforementioned decline, the July 18th low crossing at $6.42 1/4 is the next downside target. Closes above the 10-day moving average crossing at $7.12 3/4 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at $6.83 1/2. Second resistance is the 10-day moving average crossing at $7.12 3/4. First support is the July 18th low crossing at $6.42 1/4. Second support is July's low crossing at $6.22.

September Kansas City wheat was lower overnight as it extends the decline off July's high. Overnight trading sets the stage for a lower opening when the day session begins trading later this morning. Stochastics and the RSI are bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off July's high, the July 12th low crossing at $7.92 is the next downside target. Closes above the 10-day moving average crossing at $8.63 3/4 would signal that a low has been posted. First resistance is the 20-day moving average crossing at $8.42 1/2. Second resistance is the 10-day moving average crossing at $8.63 3/4. First support is the July 12th low crossing at $7.92. Second support is July's low crossing at $7.87 1/4.

September Minneapolis wheat was slightly lower overnight and sets the stage for a slightly lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off July's high, the 50-day moving average crossing at $8.46 is the next downside target. Closes above the 10-day moving average crossing at $8.96 would signal that a low has been posted. First resistance is the 20-day moving average crossing at $8.79 1/2. Second resistance is the 10-day moving average crossing at $8.96. First support is the 50-day moving average crossing at $8.46. Second support is July's low crossing at $8.07 1/4.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

November soybeans was higher overnight as it consolidates some of Monday's sharp sell off. Overnight trading sets the stage for a higher opening when the day session begins trading later this morning. Stochastics and the RSI are bearish signaling that sideways to lower prices are possible near-term. If November extends the decline off July's high, the 50-day moving average crossing at $12.94 1/4 is the next downside target. Closes above the 10-day moving average crossing at $13.92 3/4 would signal that a low has been posted. First resistance is Monday's gap crossing at $13.79. Second resistance is last-Monday's high crossing at $14.35. First support is Monday's low crossing at $13.22 3/4. Second support is the 50-day moving average crossing at $12.94 1/4.

December soybean meal was steady to slightly lower overnight setting the stage for a lower opening when the day session begins trading. Stochastics and the RSI are bearish signaling that sideways to lower prices are possible near-term. If December extends the decline off July's high, the 50-day moving average crossing at $390.70 is the next downside target. Closes above Monday's gap crossing at $392.40 would temper the bearish outlook. First resistance is Monday's gap crossing at $392.40. Second resistance is the 10-day moving average crossing at $409.30. First support is the 50-day moving average crossing at $390.70. Second support is the July 7th low crossing at $384.70.

December soybean oil was higher in overnight trading as it consolidated some of the decline off July's high. Overnight trading sets the stage for a higher opening when the day session begins trading. Stochastics and the RSI are bearish signaling that sideways to lower prices are possible near-term. If December extends the decline off July's high, the 50-day moving average crossing at 55.72 is the next downside target. Closes above the 10-day moving average crossing at 62.37 would temper the bearish outlook. First resistance is the 75% retracement level of the 2022-2023 decline crossing at 65.45. Second resistance is the 87% retracement level of the 2022-2023 decline crossing at 68.81. First support is the July 7th low crossing at 58.20. Second support is the 50-day moving average crossing at 55.72.

Thanks much tallpine!

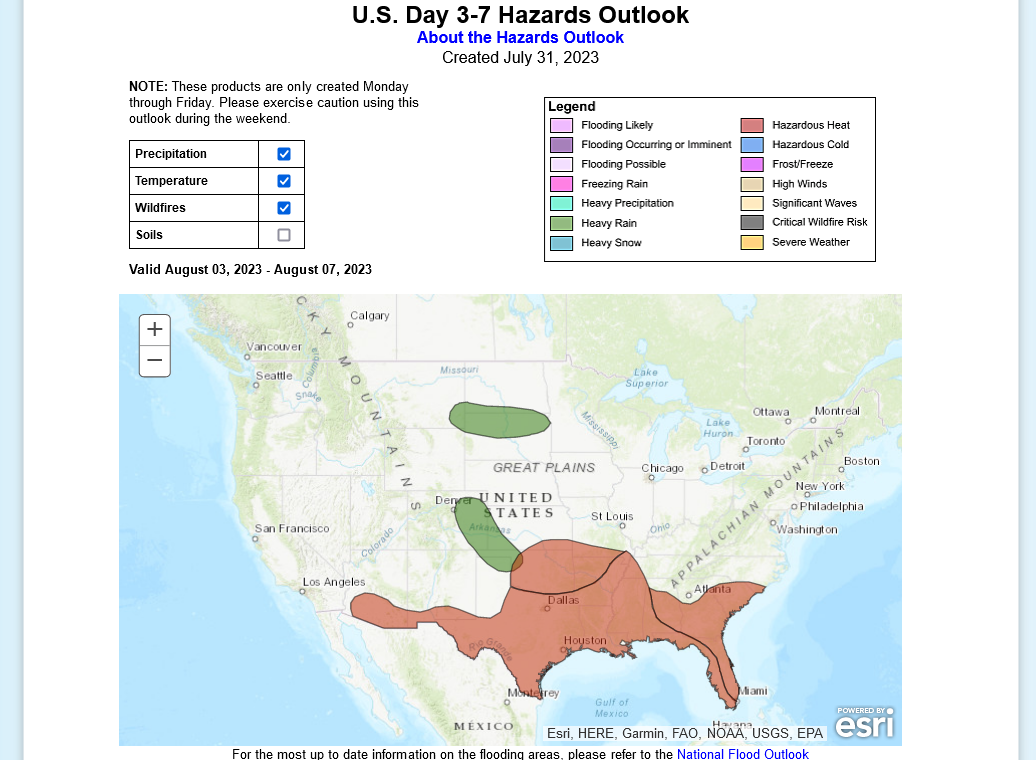

Grains are getting a bit of support from the deterioration in conditions reported yesterday. Lots of rain on the way in August without widespread heat is bearish weather.

There's the potential for the Southern belt to get excessive rains. Beans don't like wet feet.

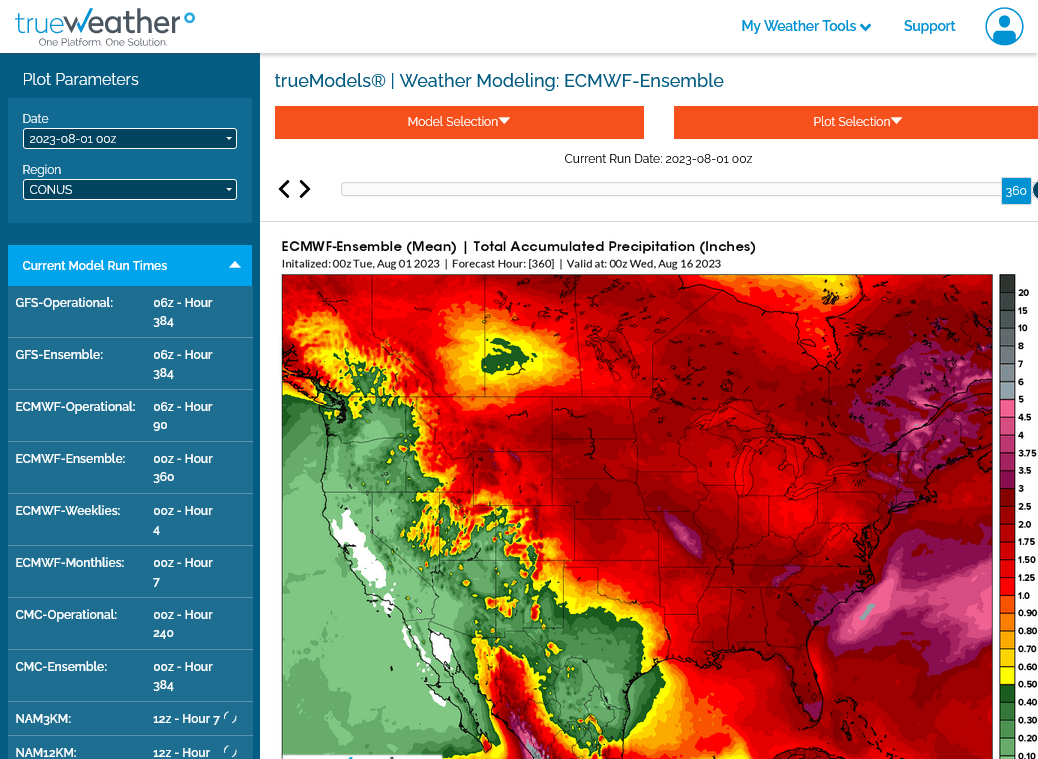

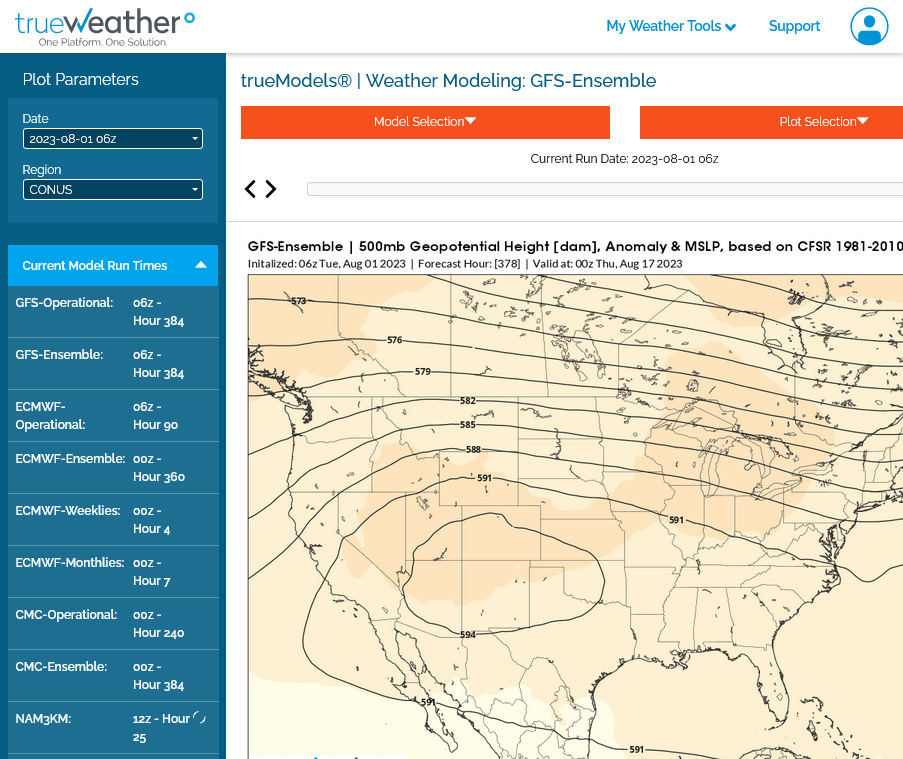

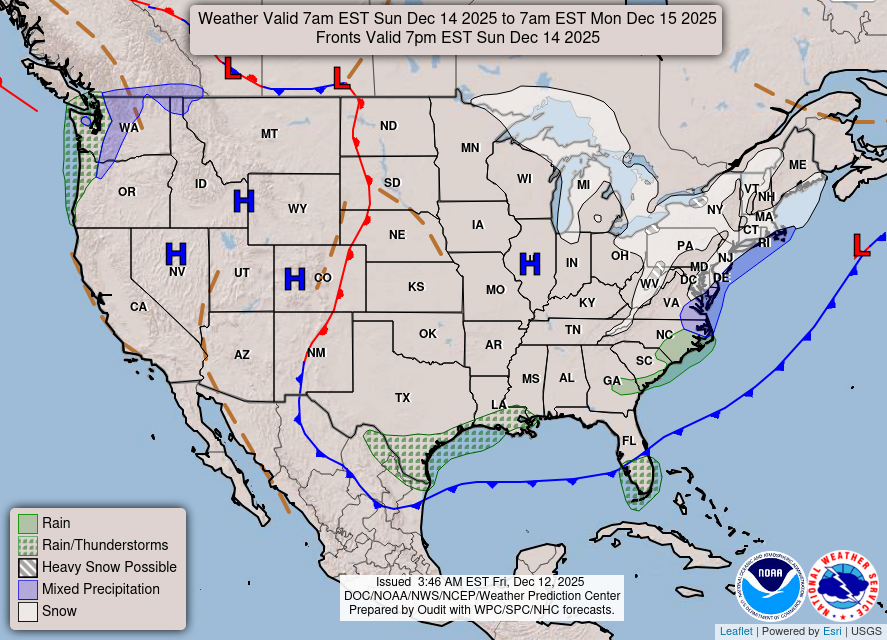

1. 6z GEFS 15 day total rains.

2. 0z Canadian model

3. 0z European model

4. 500 mb European model in 2 weeks. Active northwest flow with perurbations coming around the periphery of the dome to the southwest. Not much heat in the majority of the belt. This is a COOLER solution for the Midwest and East than yesterday at the same time frame, so NG is down today.

5. The GEFS is warmer than this.

All the weather:

https://www.marketforum.com/forum/topic/83844/

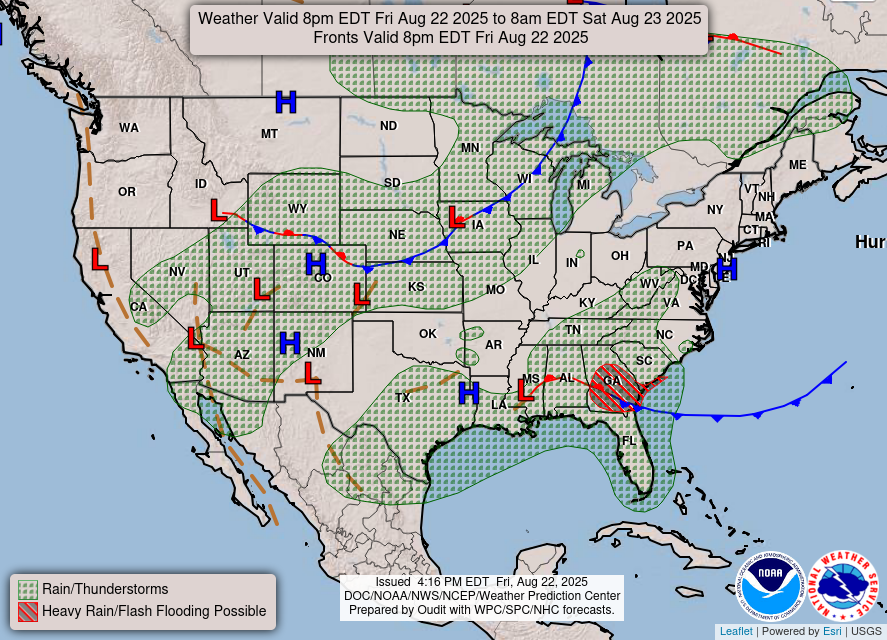

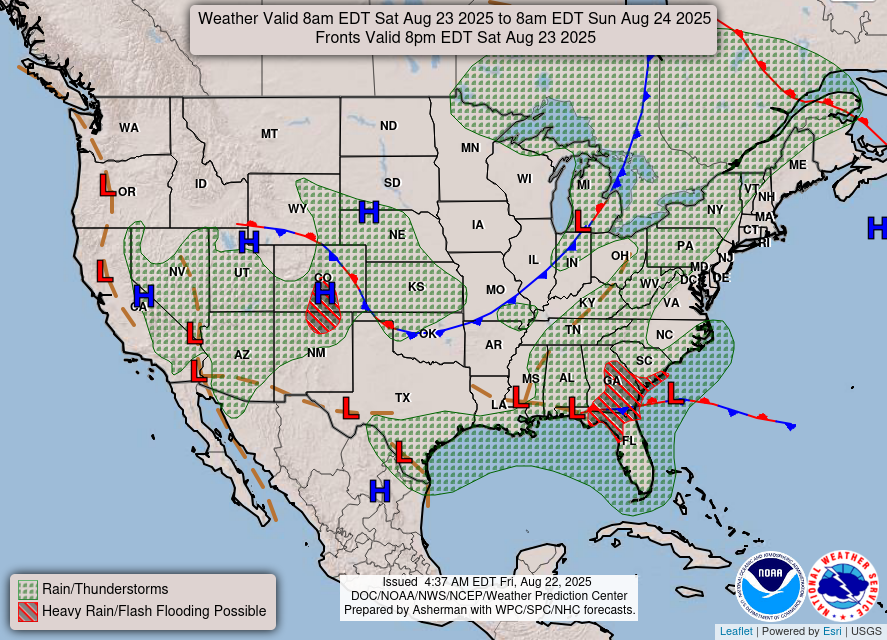

Weather maps now.

In 24 hours and

In 48 hours.

https://www.wpc.ncep.noaa.gov/#

+++++++++++++++++++++++++++++++++++++++++++++++++

Surface Weather maps for days 3-7 below:

https://www.wpc.ncep.noaa.gov/medr/medr.shtml

+++++++++++++++++++++++++++++++++++++++++++

The latest 7 day precip forecasts are below.

Day 1 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_94qwbg.gif?1526306199054

Day 2 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_98qwbg.gif?1528293750112

Day 3 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_99qwbg.gif?1528293842764

Days 4-5 below:

http://www.wpc.ncep.noaa.gov/qpf/95ep48iwbg_fill.gif?1526306162

Days 6-7 below:

http://www.wpc.ncep.noaa.gov/qpf/97ep48iwbg_fill.gif?1526306162

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Cooler forecast trends put pressure on natural gas futures in early trading Tuesday as the market looks to summer heat to help soak up a still-hefty storage surplus. The September Nymex contract was down 6.5 cents to $2.569/MMBtu at around 8:50 a.m. ET. Updated forecasts from Maxar’s Weather Desk showed cooler trends in the six-…

++++++++++++++++

0z European model on the right(purple line) was -4 CDDS overnight. All of it from week 2 cooling changes.

The threat for an area of excessive rains increased with the 2, 12z models out so far:

1. Canadian model

2. GEFS model

The NWS will probably increase this threat (in light green) in their update this afternoon for the 8-14 day period.

https://www.cpc.ncep.noaa.gov/products/predictions/threats/threats.php

This one from yesterday will be updated shortly too.

https://www.cpc.ncep.noaa.gov/products/predictions/threats/threats.php

This was there Aug 1 update for 8-14 days. I zoomed in on it with this image.

It's a week 2 event and over extremely dry soils in much of that region(not AR), so it's just a slight risk right now.

This is probably going to eradicate the drought in that region.

https://www.cpc.ncep.noaa.gov/products/predictions/threats/threats.php

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

++++++++++++++++++++++++++++

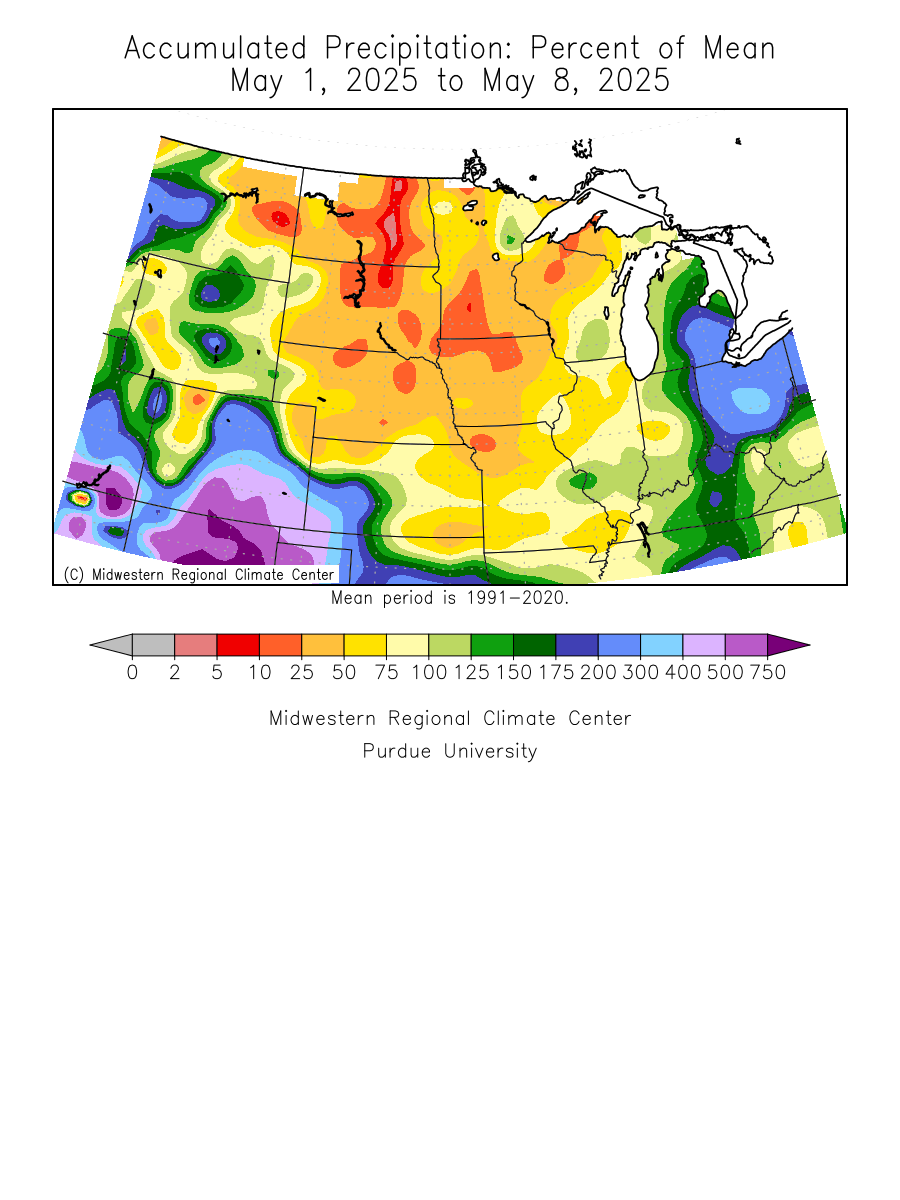

Updated daily below:

https://mrcc.purdue.edu/cliwatch/watch.htm#curMonths

Most of the severe drought in the West has been wiped out!

https://droughtmonitor.unl.edu/

Last week, July 25, 2023

The just updated EE also increased rain amounts in the zone discussed above. It has shifted the heaviest rain zone farther northeast, including us in far sw Indiana.

I won't need to do any irrigating in August with this pattern.