Any thoughts on market reactions to War?

On Friday, Stocks had a very positive day; bonds recovered from a 12 week low; crude had a small reversal up; gold had a key reversal up; silver rallied strongly; softs were firm; grains (other than rice) witnessed harvest pressure, and dollar showed signs of topping.

By ten/eleven est time tonight it will be 8am Sunday in Israel and I strongly suspect a very strong retaliation!

Thoughts?

Great question and great topic, tjc.

If the market perceives the threat of this expanding into a widespread war, numerous markets could have gaps.

Crude is one of them!

what do you think?

Crude and liquid energies gapped higher as expected.

CL +$2.64

HO +7.90c

RB +5.58c

NG not impacted, up just a tad.

All the markets impacted had some big spikes overnight but well off those highs.

C and S now lower. W still +6c but well off the highs. KC Wheat still strong at +10.5, Minn wheat the strongest _12c.

CT spiked sharply higher, now just +60c.

+++++++++++

Cl is the strongest still +$3.7, close to the highs

RB +6c

HO +8c.

Well off the highs.

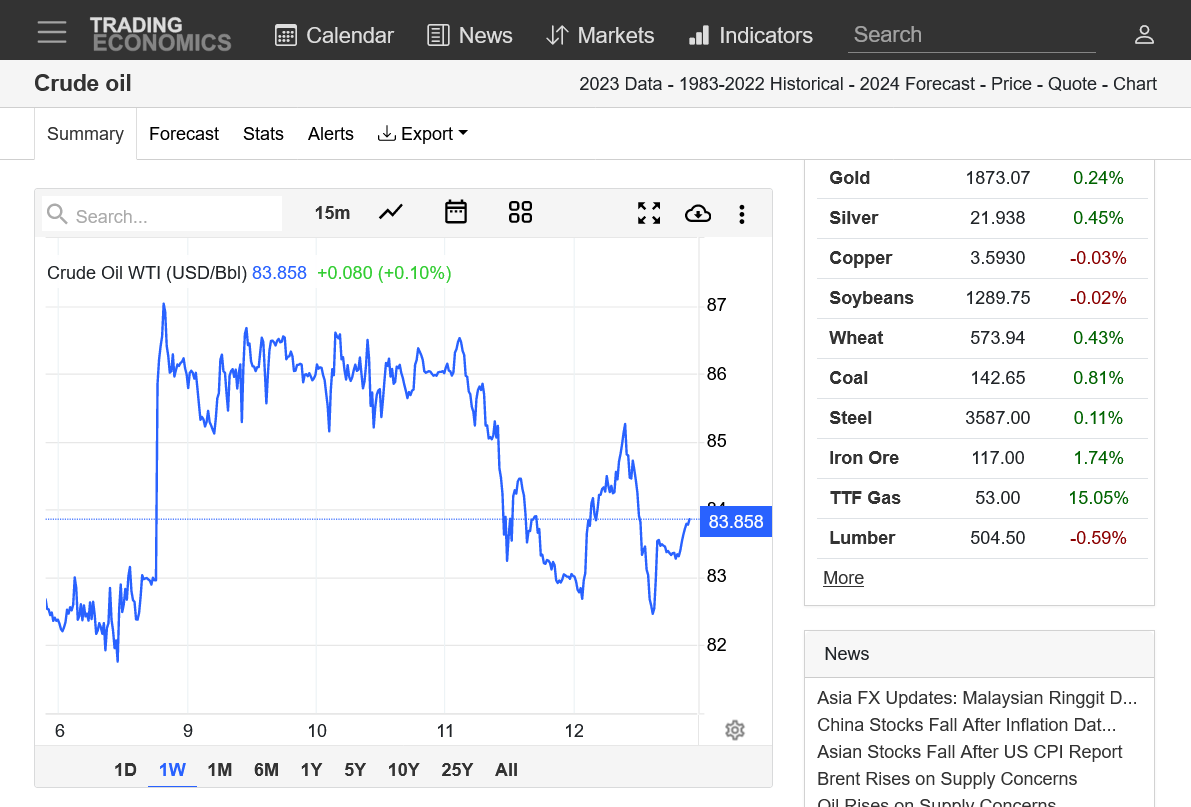

Cl had 0 follow thru and has filled the gap higher!

The market knows there's no threat to supply.......at the moment.

Back down, close to where we were a week ago for Crude!

1. 1 week

2. 1 month

3. 1 year

4. 40 years

https://tradingeconomics.com/commodity/crude-oil

Must be some reason for crude to be +$4 here.

We gapped higher Sunday Night, stalled out early in the week, then plunged down, filling the gap and testing the recent lows yesterday.

Today, we're surging back to new highs for the week.

Gotta be some news.

https://tradingeconomics.com/commodity/crude-oil

Yesterday's news:

Today's news:

Elon Musk Warns of World War III Risk

Started by metmike - Oct. 24, 2023, 11:34 a.m.

https://www.marketforum.com/forum/topic/99936/#99937

By metmike - Oct. 24, 2023, 11:48 a.m.

An interesting measure to gauge SHORT TERM risk to the situation in the Middle East that I've been using is the price of crude oil.

It's not perfect but on days when the news is much more volatile, crude usually moves up strongly based on speculation, of course.

Crude is -$2 at the moment, so I'll assume that's a good sign and indicates, at the very least no escalation today.

What will happen when news is impacting the price of a commodity, is a massive price spike up or down on the release of that news.

It's usually a 1 time event for most news releases. However, this one is ongoing.

You can see several price spikes higher on the monthly graph below. However, we're going DOWN now. This suggests that speculative crude traders that are staying on top of the news more than the rest of us are feeling safer from escalation............at the moment compared to yesterday's mentality.

There are several other factors, like if demand is plunging or supply news that I don't know about, so this indicator is far from perfect.

We're actually a bit below the gap higher on Sunday Night, Oct 8, after the horrific Hamas attack, which is a wonderful sign of some sort of potential positive progress that we are not aware of yet.

If we close decisively below $82 it's very bearish for crude and very bearish for a war in the Middle East.

We should note that crude had topped and was in a downtrend BEFORE the attack and could be resuming that downtrend because of shrinking demand and negative seasonals.

https://tradingeconomics.com/commodity/crude-oil

Crude is having a risk off week so far with prices at major support.

https://tradingeconomics.com/commodity/crude-oil

1. 6 months

2. 10 years-major top June 2022!!

We held that support yesterday and last night and crude is +$2 at the moment.

https://tradingeconomics.com/commodity/crude-oil

Crude dropped $3 on Tuesday.

breaking some major support And breaking out to the downside.

Is the market looking at the Ukraine war ending(increased global supplies)?

slowing global economies/demand collapsing?

less risk in the Middle East?

seasonal weakness?

Biden and his energy policies being defeated in 2024?

More follow thru after the downside break out below major support.

https://tradingeconomics.com/commodity/crude-oil