Last week's net 2023/24 U.S. #wheat sales were the largest single-marketing year sales total since Sept. 2007. That included 1.12 mmt of SRW to #China. Two cargoes of U.S. #corn were switched from unknown to China. #Soymeal sales were a 7wk high, #cotton a 9wk low.

USDA confirms the sale of 400,000 tonnes of U.S. #soybeans for delivery to unknown destinations in 2023/24.

Karen Braun

@kannbwx

USDA confirms the sale of 125,000 tonnes of U.S. #soybeans for delivery to unknown destinations in 2024/25.

This is the first flash sale for 2024/25 U.S. #soybeans. Ironically (or perhaps not), the first flash sale for 2023/24 soybeans came on December 13, 2022: 140,000 tonnes to unknown.

#Argentina's new government is reportedly seeking to raise the export tax on some grains to 15%, though it would not impact taxes on soy. Current duties are 12% for #corn & #wheat exports and 33% for #soybeans.

U.S. #ethanol production has picked up in the last two weeks, consistent with seasonal trends. Recent output is almost identical with year-ago but not as strong as other prior years. Production margins remain strong. Stocks are modest for the date.

Look how USA's production dominance in #soybeans has slipped throughout the decades, increasingly losing ground to South America. USA is currently slated to account for 28% of global soybean output in 2023/24.

·

Evolution of the four major #corn exporters over the last couple decades. #Brazil & USA are still sorting out the top spot (though Brazil has recently had the upper hand). #Argentina is set to rebound from last year's drought but #Ukraine has lost ground in the last few years.

metmike: We've been tracking this on our South America weather thread.

This is what the monthly precipitation chart would look like for Mato Grosso, #Brazil's crop-heavy north region using Tuesday's GFS rainfall forecast to project December. That only goes thru Dec. 27, so 4 extra days of possible precip aren't included, but you get the point.

THIS WAS FROM MONDAY!

·

Last week's #corn inspections did not live up to the previous week's magic, but the volume was still relatively average for the week & incl. 2 PNW corn cargoes to #China. Export inspections for #soybeans are fizzling, though, hitting a 10-week low last week.

Karen Braun

@kannbwx

Dec 11

The fall-off in inspection volumes for U.S. #soybeans is somewhat unsettling, but not sure there's any conclusions to draw just yet. Overall exports are expected to be relatively light in 23/24, and seasonally there is a chance for a later spike in shipments (early year?).

Export inspections for U.S. #corn & #soybeans were near the top end of expectations last week. Only 40% of the beans were destined for #China. #Wheat shipments continue to heavily lag last year's pace (for now).

#Soybeans rebounded closer to normal last week with a 3-week high in inspections. #Corn inspections were above average for the week and #wheat inspections were appropriate given this year's low export expectations.

Monday's midday GFS implies precip in Mato Grosso's crop-heavy north region falling 41% below normal for the month of December - basically tied with 2015, which was a rough season for #Brazil. Only 36% of the projected monthly total has fallen so far despite the month 55% over.

++++++++++++++++++++++++++++++

#Argentina on Monday announced plans to increase the export tax on soybean products to 33% from 31% in an effort to raise funds and dig the country out of economic crisis.

#China imported 3.59 million tonnes (141 mbu) of #corn in November, a record volume for any month. That comes despite China's record corn crop. Jan-Nov imports were up 12% from last year, largely due to increased arrivals from #Brazil.

M River will be dropping the next 2 weeks )-:

But upcoming rains might help that a bit, south of St. Louis.

https://water.weather.gov/ahps2/hydrograph.php?gage=memt1&wfo=meg

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

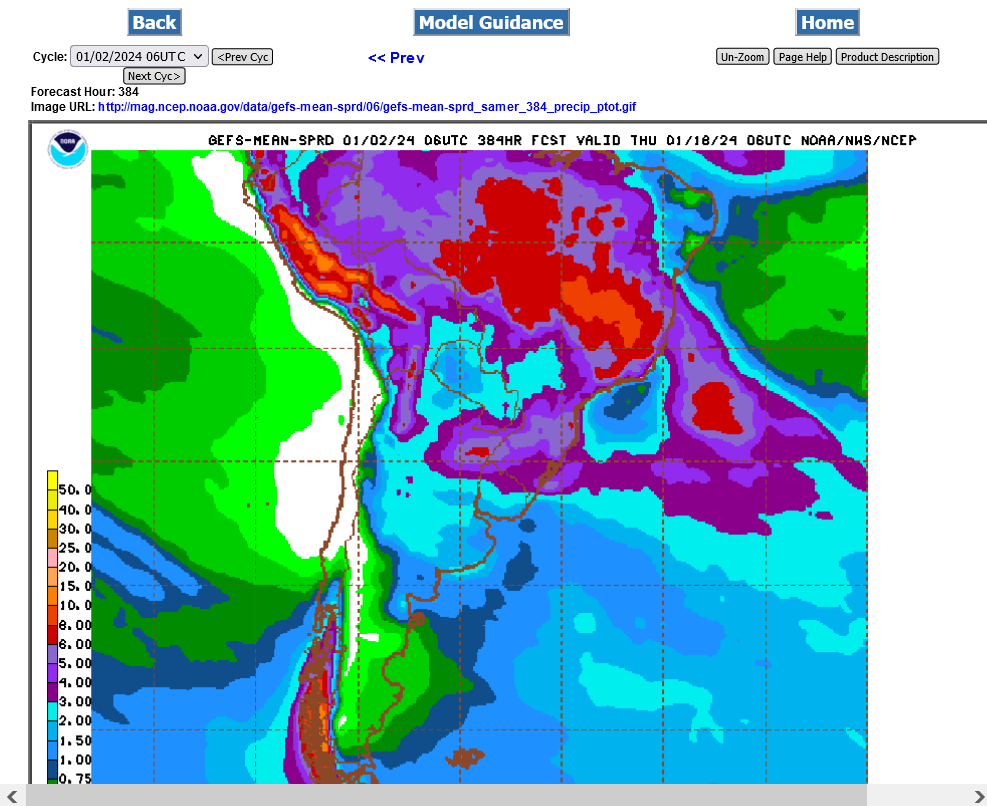

2 week totals from the 18z GEFS on 12-18-23

·

USDA confirms the sale of 132,000 tonnes of U.S. #soybeans for delivery to unknown destinations in 2023/24.

I just learned another thing new from her tonight, cutworm!

Just a fun reminder of how Brazilian states are abbreviated: Mato Grosso - MT Mato Grosso do Sul - MS Minas Gerais - MG

++++++++

I've been abbreviating Mato Grosso as MG, which is the abbreviation for Minas Gerais.

I should be using MT. Anybody that doesn't know that might be confused with MT. so I'll just type out the entire name or call it C.Brazil.

Speaking of that. The southwest quarter of MT is drier and the big deal now is that much of key Argentina growing areas are pretty dry. Only the farthest north have good rains. Almost 80% has less than 2 inches the next 2 weeks!

Karen Braun @kannbwx |

|

cutworm, that post/link just shot a blank.

Dec. 22: CBOT March #soybeans hit the lowest levels since Oct. 12 earlier in Friday's session. That is after a 3% decline between Tue and Thur on above-average volumes for the dates. Futures are up an hour into Friday's trading, hovering just above $13/bu.

·

As of Dec. 19, money managers' combined net short across U.S. grain and oilseed futures & options was the largest since June 30, 2020. Funds sold CBOT #corn, #soybeans, #soymeal & #soyoil during the latest week but were slight net buyers of CBOT & K.C. #wheat.

·

Money managers were net sellers of nearly 61,000 CBOT #soymeal futures & options contracts in the three weeks ended Dec. 19, the most for any 3wk period since records began in 2006. Emphasis was on exiting longs rather than short covering. Meal futures fell 9% over those 3 weeks.

For some odd reason that I don't understand, my laptop and Ipad won't give me the most recent posts from Karen Braun, so I can't post anything from this week )-:

the last post that I can find are the last ones you posted. Might be on vacation?

I can’t get anything after May of this year on my devices!

we’ll be home in 2 days and I’ll catch up on anything that got missed after that.

Thanks and Happy New Year, cutworm,

As Joe K would say, we trade FUTURES not PASTures. The market dialed this in weeks BEFORE it happened. Now we're trading the much wetter pattern.

Rainfall over the last two months in Mato Grosso's crop-heavy north region was the lightest in at least a quarter century (54% below the 10yr average at just under 200 mm/7.8 in). Temps WELL above recent averages/maxes. Mato Grosso is #Brazil's top grower of #corn & #soybeans.

Last 6z GEFS below.........extremely wet in the driest areas.