Previous thread:

Grains 4-10-24

Started by metmike - April 10, 2024, 11:07 p.m.

https://www.marketforum.com/forum/topic/103084/

++++++++++++

RELATED:

Wheat

Started by metmike - April 22, 2024, 9 p.m.

https://www.marketforum.com/forum/topic/103420/

The U.S. EPA will temporarily expand sales of higher-ethanol blends of gasoline (E15) this summer, seen as a win for U.S. ag as it raises ethanol (thus corn) demand. Higher ethanol blends can increase smog in hot weather, but the difference between E15 and E10 is minimal.

Money managers staged a RECORD weekly selloff in CBOT #soyoil futures & options in the week ended April 16 as oilshare continued tumbling off six-month highs. Bean oil futures were down more than 5% in the week, and funds' net selling totaled nearly 50k contracts.

This month's oilshare unwind has had specs cutting bearish bets in CBOT #soymeal fut&opt over the last two weeks. Managed money net short on April 16 of 10.5k contracts (vs 43k on April 2) is a three-month low but still relatively bearish for the date.

++++++++++++++++++++

Money managers were net sellers of CBOT #soybeans in the week ended April 16, and they remain the most bearish for the time of year (close to all-time). Pattern seems to be recently tracking 2019 (blue line).

U.S. #corn export inspections hit a marketing-year high last week of 1.62 million tonnes (64 mbu), landing above all trade estimates. Mexico was the top destination though there were a couple cargoes to China. These are the weekly volumes you need to see this time of year.

Full crop progress report:

tjc,

Oats planting and emergence is FASTER than average!

+++++++++++++++++

U.S. winter #wheat conditions plunge 5 percentage points to 50% good/excellent (analyst range was 52-55). #Cotton planting is moving at an average pace but #corn, #soybeans and spring #wheat are all a bit ahead of average.

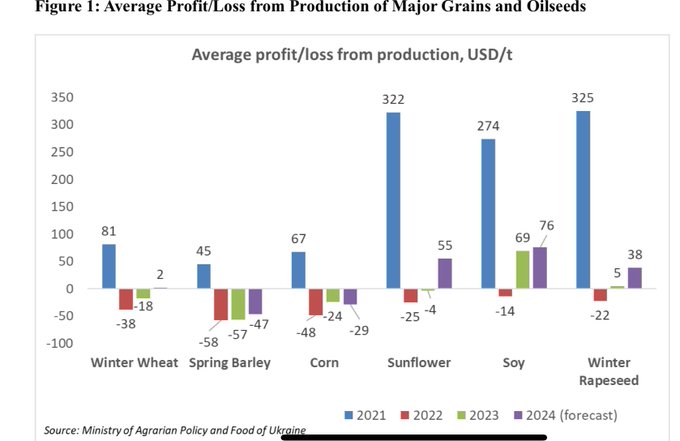

It’s quite incredible that even with subsidizing and supporting Ukraine with BILLIONS of US Taxpayers money, UKRAINIAN farmers still lose money This is why Europeans farmers are pissed off. Imagine having to compete with ultra subsidized grain farmers next door

metmike: Ukraine is a corrupt sinkhole stealing incredible amounts of US tax payer money to benefit the US military-industrial-political-media complex and NATO.

April 23: CBOT July #wheat futures extend gains on US crop health decline and general crop concerns in the N Hem. July wheat topped the 100-day avg for the first time since Jan and is up 8+% in the last 3 sessions, biggest rally since July. First $6+/bu since early Feb, too.

Busy chart on purpose - drives the point home. Funds need to cover some shorts for any bullish hopes. Will see on Fri how many were covered through 4/23. July CBOT #soymeal gained 2.8% in week ended 4/23 and #soyoil was +0.9%. Both had bigger 5-day rises earlier this month.

COT could be interesting on Friday. Net buying prominent in last 3 sessions (estimates tend to lowball bigger moves). In week ended April 23, CBOT July contracts:#Corn +2.2% (best 5-day stretch for most-active in 6 wks)#Soybeans +1.9% (5+ wk best)#Wheat +6.7% (best since Dec)

U.S. #ethanol production has declined in recent weeks after a stronger showing late last month. In the past 3 weeks, ethanol output has declined 11.1%, ethanol stocks fell 2.6% and implied U.S. gasoline demand is down 8.8%.

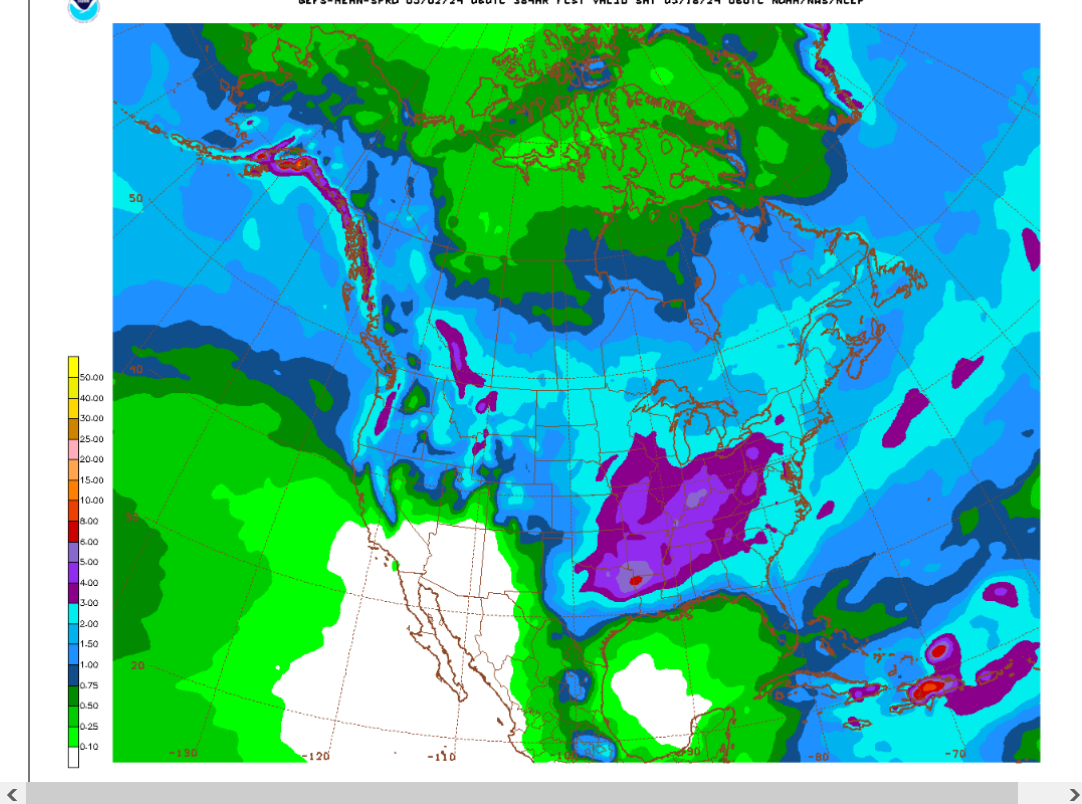

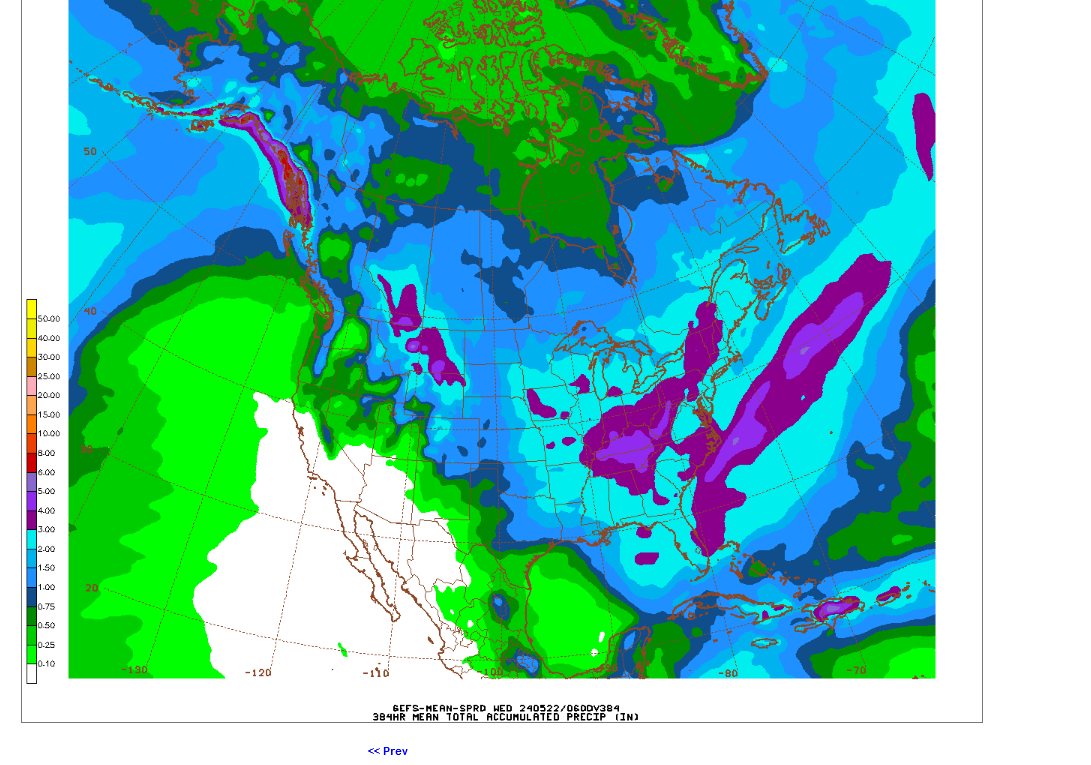

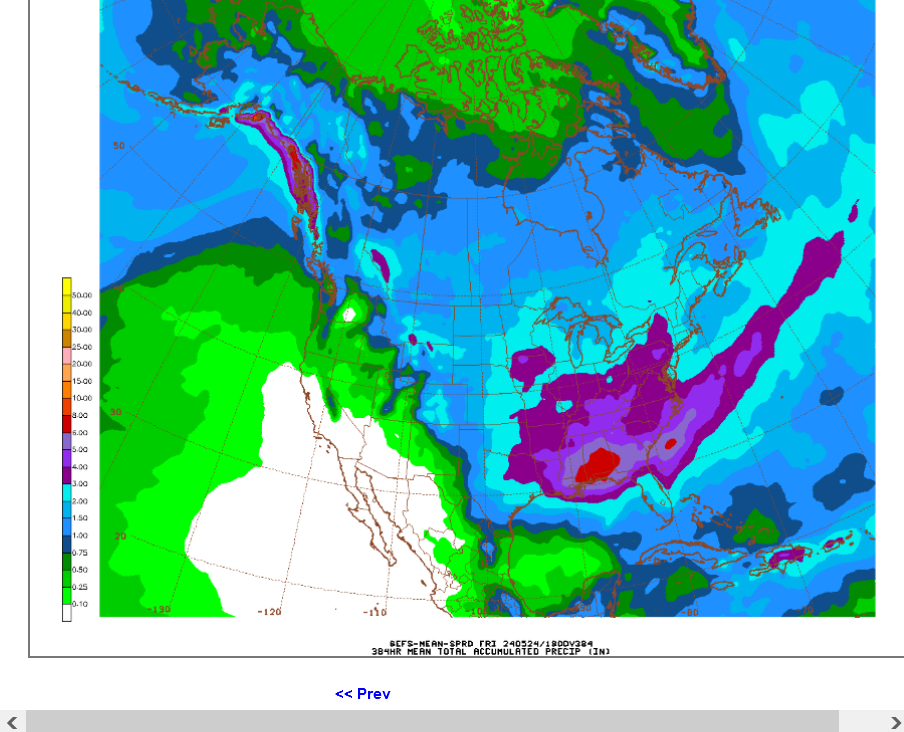

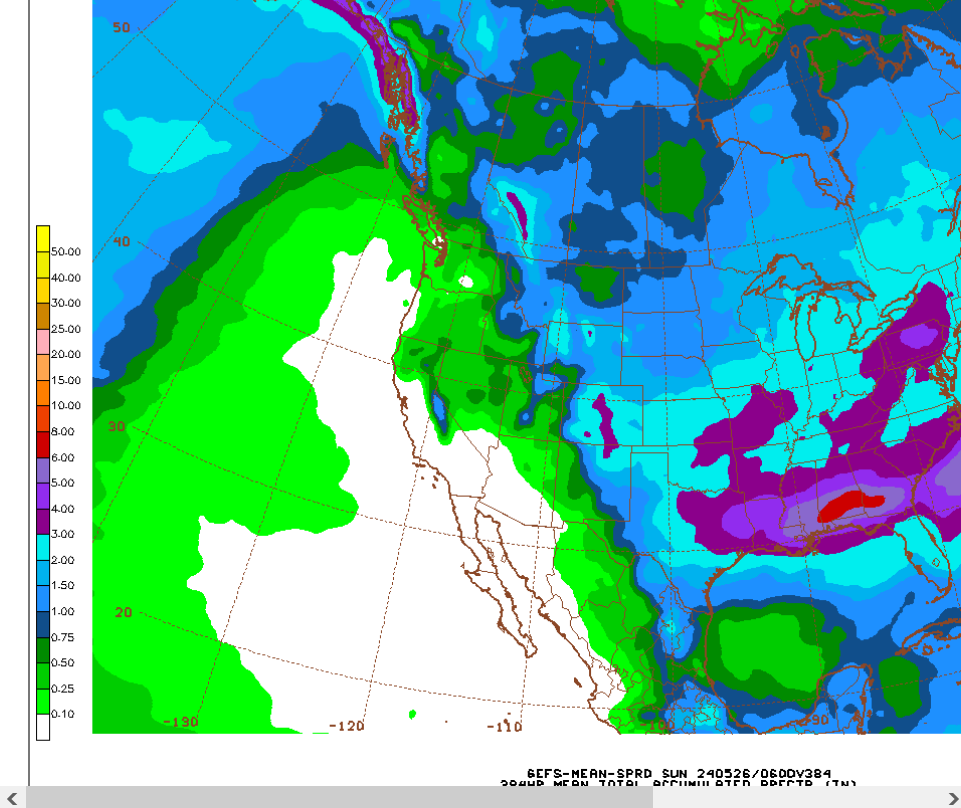

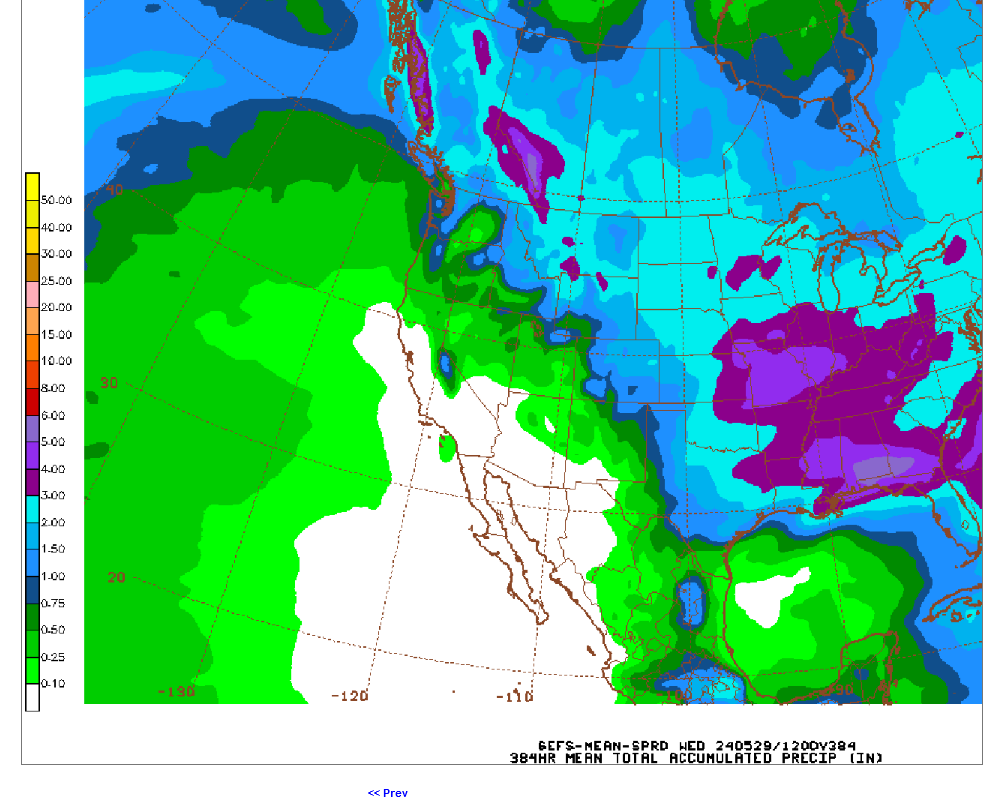

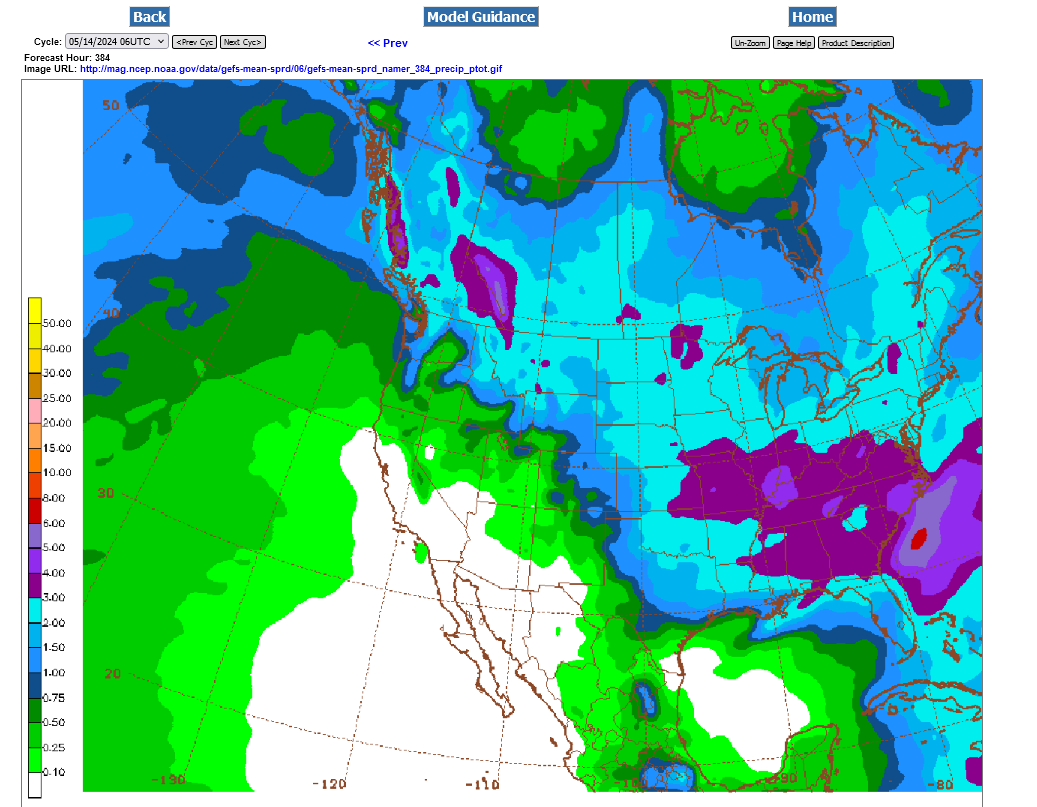

Rain the next 384 hours(16 days) on the last 6z GEFS.

One can guess that this might be bearish for beans with any planting delays and possibly bullish for corn but its still early and planting is off to a good start and its hard to be too bullish on very heavy rains in an area with drought..........even during the planting season!

Very heavy rains coming up in the SouthCentral US!

https://www.marketforum.com/forum/topic/83844/#83848

In places that have drought:

U.S. export inspections last week came in within expectations. 1 cargo each of #wheat and #sorghum were destined for #China, but no #corn or #soybeans. No big adjustments to the previous week's numbers, either.

This past week would be soybeans' first below-average volume since January - not too shabby. For corn this would be a 7-week low, let's see if there are any revisions next week. Wheat shipments have been respectable for 2+ months.

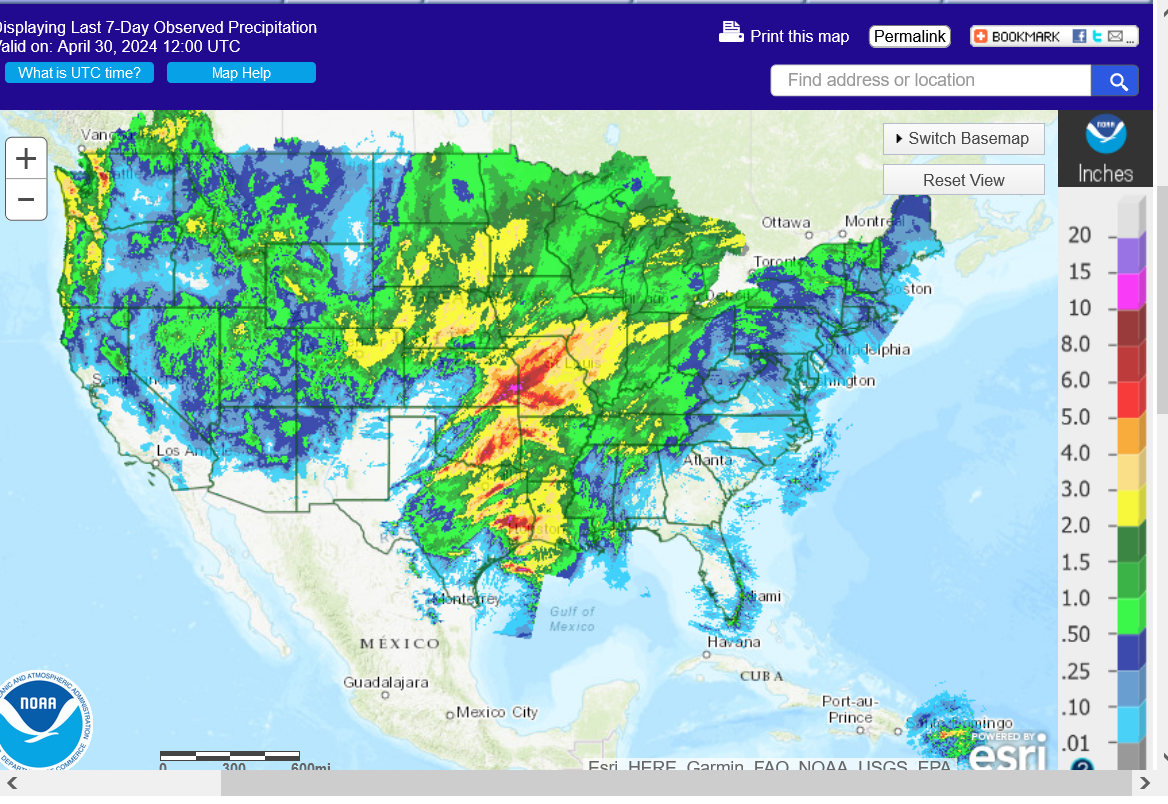

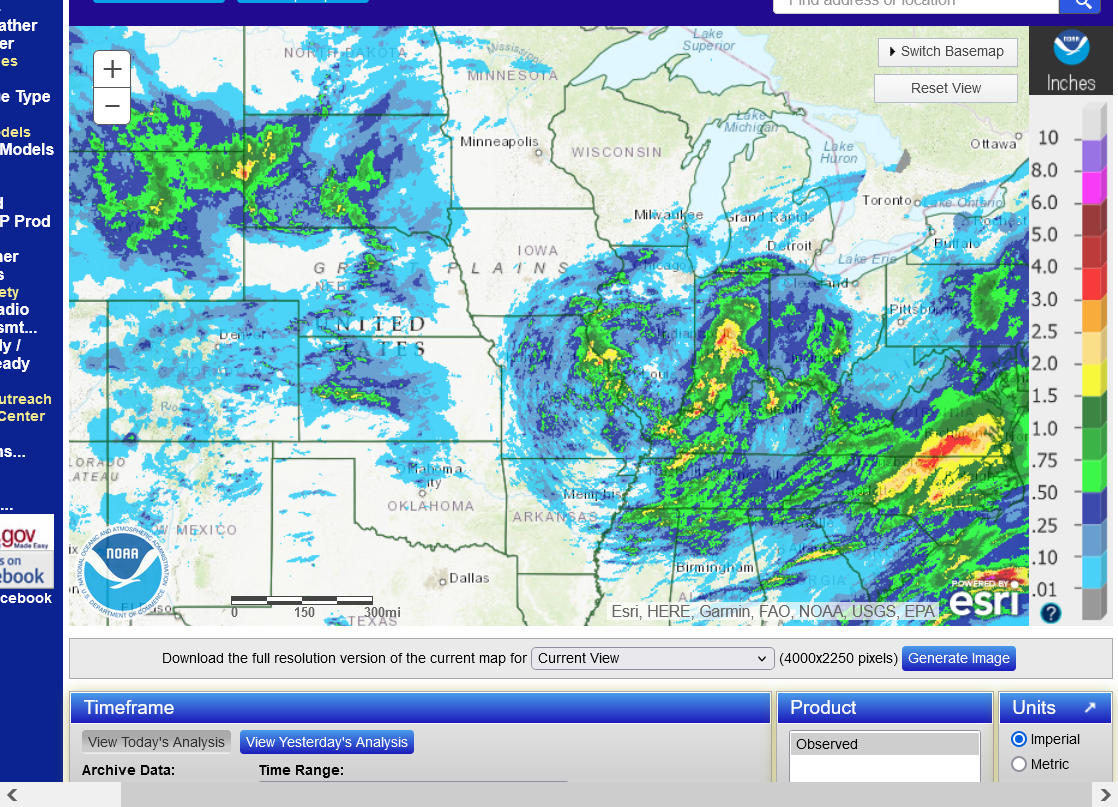

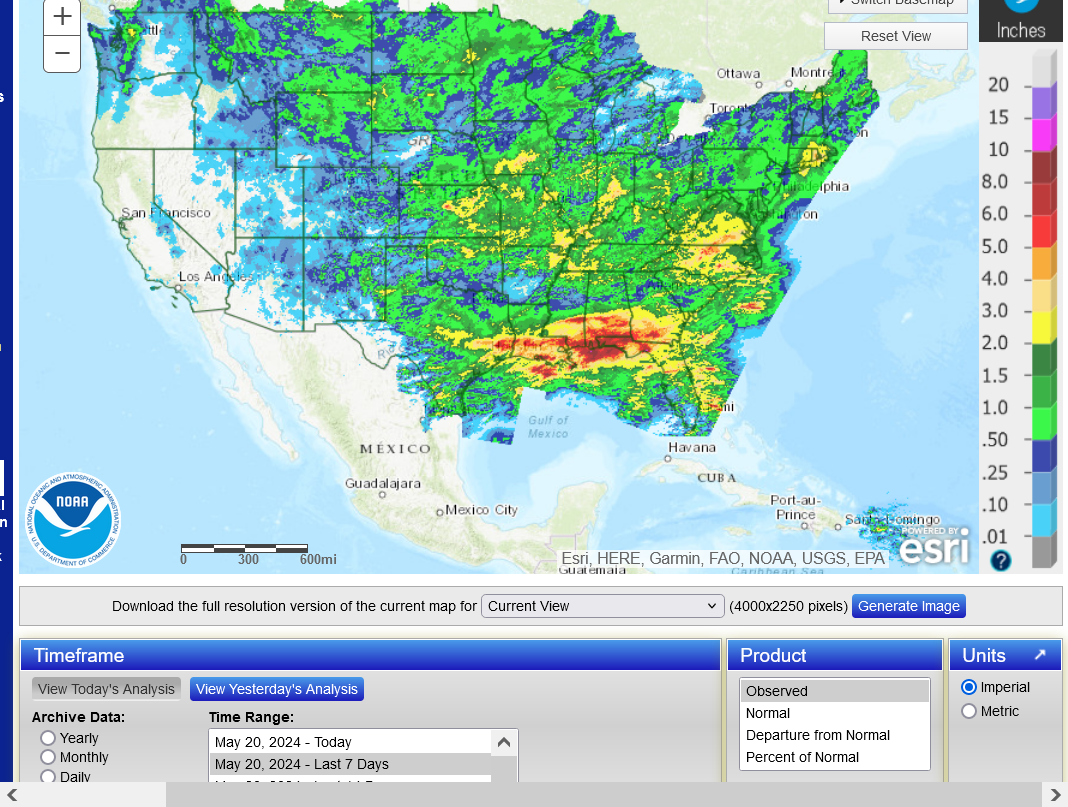

7 day rain totals:

April was great for #Ukraine's grain exports. As of Mon, YTD (since July 1) exports are down 1.7% on the year vs an 8.2% deficit four weeks ago. Exports in last 4 wks were approx 3.7 mmt of #corn & 1.8 mmt of #wheat. That's very strong for April relative to past yrs (pre war).

++++++++++++++++

Oilseed workers at one of #Argentina's largest ports plan to begin striking from Monday to protest against the government's proposed tax and labor reforms. Argentina is a key supplier of #soymeal and #soyoil, though this could put those exports in jeopardy.

#Russia's state weather forecaster on Saturday said it sees threat of drought persisting in May for eastern portions of the Southern District, Russia's top #wheat growing region. The March-April period has been among the driest ever for the district.

U.S. #corn was 27% planted as of Sunday, exactly as the trade expected and above the recent average. Spring #wheat planting pace is the fastest since 2021, and progress last week was much quicker than analysts thought. Winter wheat conditions down 1 pt as predicted.

See the entire report here:

https://usda.library.cornell.edu/concern/publications/8336h188j

tjc,

Oats have seen FASTER than average planting in every state, except for PA.

U.S. spring #wheat is sought after for its high protein content and great milling/baking qualities. Foreign buyers have already booked a larger-than-normal volume of U.S. hard red spring wheat for 2024/25 delivery:

U.S. #wheat export sales for 2024/25 (2.15 mmt as of April 18) are on an efficient pace for the date. Big difference from the lousy year-ago volumes. 35% of that is hard red spring (5yr avg share for the date is 24%) and 16% is hard red winter (5yr avg of 30%).

Show more

After two years of dreadfully slow U.S. spring #wheat planting, last week's progress was well above average, lifting planting to 34% complete by April 28 from 15% a week earlier. Top grower North Dakota was 20% done (vs 11% avg and 31% in 2021).

More on Tuesday's impending announcement:

Biden team sets out ethanol's path to aviation fuel subsidies - Reuters News

Here's the updated article (no link was available when I first posted). Includes details: The SAF subsidies amount to $1.25 per gallon for fuels that hit the 50% emissions reduction threshold, and up to $1.75 per gallon for those that exceed it.https://reuters.com/sustainability/biden-team-sets-out-ethanols-path-aviation-fuel-subsidies-2024-04-30/#:~:text=April%2030%20(Reuters)%20-%20The,use%20climate-friendly%20growing%20techniques

OUCH!

@kannbwx

April 30: CBOT #soyoil crashing for a second session, reaching the most-active contract's lowest price since January 2021. Crude oil and other global vegoils sank on Tuesday, and anticipation is building for the US biofuels announcement later today.

Less than 24 hours later and on its way to break the chart

Rains the last week that caused runoff into rivers that fed into the M River:

https://water.weather.gov/precip/

> Scraped 20 years worth of PDF’s and split them out into images in python > Stitched them into one massive GIF > Converted GIF into video using FFmpeg Thank you

US Drought History 2000 - 2022

https://twitter.com/i/status/1595631905415856128

Total rains the next 384 hours from the last 0z GEFS.

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

https://www.cpc.ncep.noaa.gov/products/predictions/threats/hazards_d8_14_contours.png

All the weather: https://www.marketforum.com/forum/topic/83844/

U.S. export sales last week were modest, and virtually no new-crop #corn or #soybeans were sold. Net old-crop corn+soy sales, while not that strong, were actually close to average for the week. Egypt was the top bean buyer, Japan & Mexico in corn.

U.S. #soymeal exports in March hit an all-time monthly record of 1.485 million tonnes, besting the prior high of 1.449M set in Jan. 2013. Halfway through 23/24, total exports sit at 8.1 mmt, up 22% from the 5yr avg. USDA has full-year 23/24 exports +14% on the 5yr avg.

Beans exploded higher today!

https://tradingeconomics.com/commodity/soybeans

1. 1 week

2. 1 year

3. 10 years

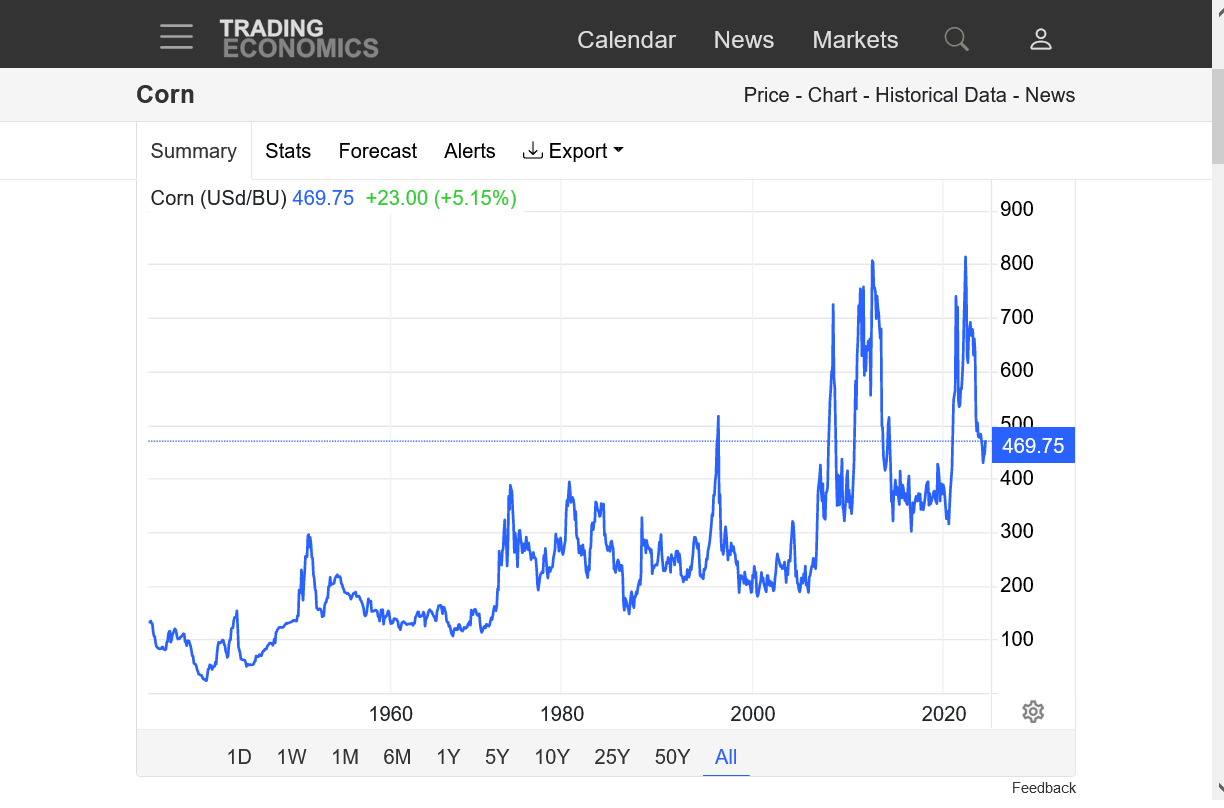

May 2: CBOT July #corn hit a 3-month high, jumping 2% to settle at $4.59-3/4 per bushel. That is down from $5.80 on this date a year ago but up 9% from the Feb low. In focus: smaller Argy corn crop, harvest-disrupting rains in southern Brazil, slower US field work this week

CF Industries says the brisk pace at which U.S. agricultural companies have imported Russian fertilizer has unwittingly helped fund #Russia's war efforts. The U.S. does not have direct sanctions on Russian fertilizer.

+++++++++++++

Cold weather this week could help contain some of the insects, which thrive in warmer weather:

#Argentina's Buenos Aires exchange cut its #corn crop estimate to 46.5 mmt from 49.5 mmt previously (initial forecast was 56.5 mmt).

Heavy round of short-covering by managed money in CBOT #wheat futures & options in the week ended April 30. The new net short (48k contracts) is smallest since July. Chart shows that whenever short wheat this time of year, funds are forced out of (some) shorts between April-June.

++++++++++++

Through April 30, funds covered shorts in CBOT #corn futures & options for a 2nd straight week in sympathy with wheat, but the move looks relatively unexciting on a chart. Futures were actually down on the week and the fund net short is still huge, though corn rallied 3% Wed-Fri.

Money managers' views in CBOT #soymeal have fluctuated wildly over the last 6+ months. In the week ended April 30, the MM net long surged to 44k fut&opt contracts, their most bullish since December. Futures hit 3-mo highs during the week and Friday's settle was a 4-mo high.

U.S. export inspections last week fell in line with expectations, though #corn & #soybeans were a bit closer to the higher end of guesses. One #wheat and one #sorghum cargo were inspected for China, but no corn or beans.

#Wheat inspections were a 13-week low but in line with seasonal tendencies (esp given such a low export target). #Soybeans a bit lower than normal (but also - low overall target). #Corn is now on 2 straight lower weeks, haven't yet calculated if overall expectations are at risk.

Total precip the next 384 hours from the last 6z GEFS.

The latest 7 day precip forecasts are below.

Day 1 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_94qwbg.gif?1526306199054

Day 2 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_98qwbg.gif?1528293750112

Day 3 below:

http://www.wpc.ncep.noaa.gov/qpf/fill_99qwbg.gif?1528293842764

Days 4-5 below:

http://www.wpc.ncep.noaa.gov/qpf/95ep48iwbg_fill.gif?1526306162

Days 6-7 below:

http://www.wpc.ncep.noaa.gov/qpf/97ep48iwbg_fill.gif?1526306162

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Full report: https://downloads.usda.library.cornell.edu/usda-esmis/files/8336h188j/8623kn58k/ks65k270h/prog1824.pdf

Planting of U.S. #corn & #soybeans last week was slower than analysts thought, and corn planting is now behind the 5-year average. Spring #wheat remains well ahead while soy & #cotton are a little ahead of average. Winter wheat conditions up 1 pt.

U.S. #corn planting progress summary, May 5 Example: corn in top grower Iowa was 47% planted, 6 percentage points below the date's 5-year average. That's +8 pct points on the week, but +25 pct points is the week's normal. Nebraska also planted very slowly but Ohio was quick.

May 7: New-crop CBOT #corn is chasing the annual high of $5.02-1/4 per bu set on the first trading day of the year (Jan. 2). Dec futures hit $4.91 by mid-session Tuesday, their highest since Jan. 11. Average Feb (insurance) price was $4.66 per bu.

Unfortunately, heavy rains are likely to persist this week for parts of Rio Grande do Sul. LSEG research writes on Tuesday that these rains may weaken mid-next week but potentially return late month. The rest of #Brazil's crop areas are forecast to remain very dry.

Deadly flooding in #Brazil's southernmost state of Rio Grande do Sul has impacted transit of grains & other goods to the port. The railway is reportedly not operational and trucks have had to travel an extra 400 km to reach the port, raising costs. Port itself is operational.

Three of #Russia's grain regions on Wednesday declared a state of emergency over crop-damaging frosts. LSEG ag research as of May 1 pegged the three identified regions (Lipetsk, Voronezh, Tambov) as accounting for 10% of this year's winter #wheat crop.

+++++++++++++

Rosario grains exchange cuts #Argentina's #corn harvest to 47.5 mmt from 50.5 mmt a month ago on leafhopper damage. Rosario had previously pegged the crop at 57 mmt.

#China's April imports of #soybeans were a record for the month at 8.57 million tonnes, up 18% from the same month last year. Marketing YTD (Oct-Apr) imports of around 50 mmt is pretty average in historical context.

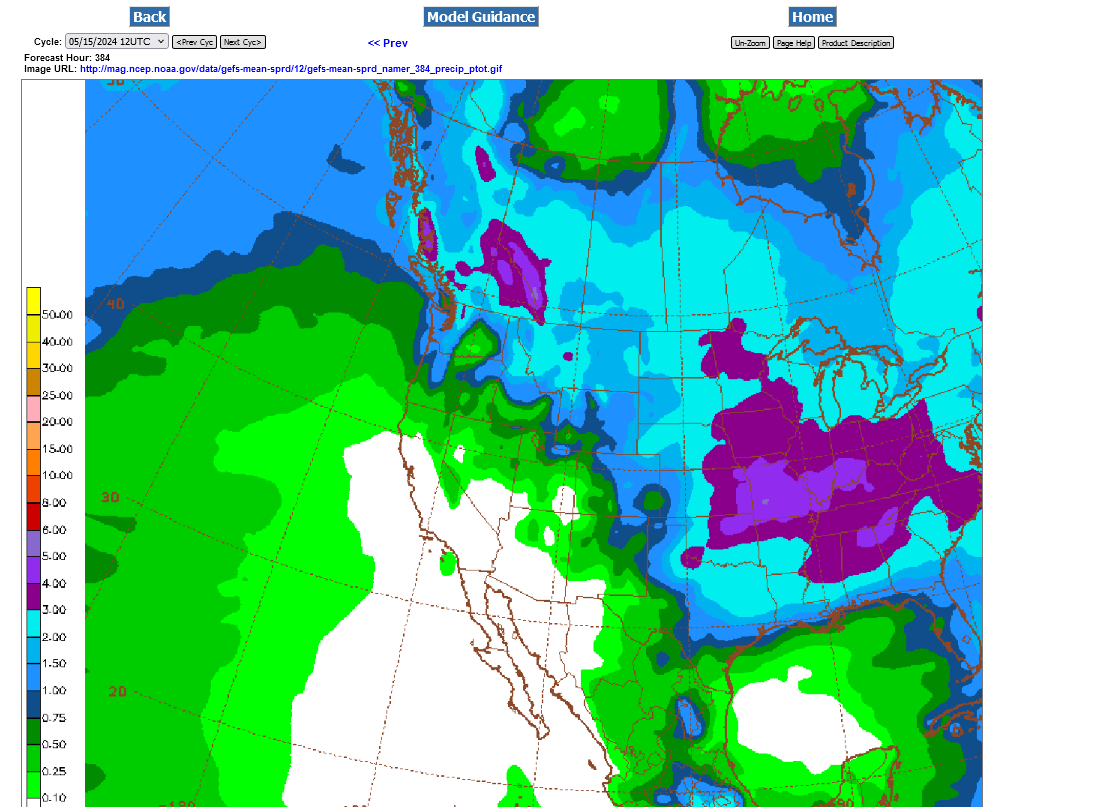

Still too much rain the next 2 weeks (18z-GEFS below) for ideal planting. May is usually the month with the most C and S planting.

Planting got off to a good start but is now falling behind average, especially corn which is usually planted earlier than beans.

·

2014 and 2024: twinning? In ways, yes. New-crop CBOT #corn prices have been very similar between the two years and there are some overlapping fundamental themes. But these two charts weaken the argument. Fund positioning and price trends since Jan. 1 have been opposite.

If you made it this far in the thread, you've been rewarded with a chart of speculators' positioning throughout 2014 and into 2015, plus most-active CBOT #corn futures during the period.

Port & soy processing workers around #Argentina's Rosario hub are striking Thursday to protest harsh austerity measures implemented by President Milei. Rumors of this strike circulated last week and may have helped boost #soymeal futures even after the prior 2-day strike ended.

U.S. exporters have sold an unusually small volume of #soybeans for the upcoming marketing year, the smallest for the date since 2005. Relative to (likely) expectations, it's probably among the smallest in decades. Sales explicitly to #China = 0.

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

+++++++

Total precip from the last 384 hour run of the 6z GEFS:

Too wet for much planting in the Southern Midwest/Southern US!

YA THINK OATS ARE GONNA CATCH CORN, EARLIER THAN USUAL? I DO.

You might be right, Jean!

tjc was on to it 2 months ago!

Early planting issues 3-20-24

32 responses |

Started by metmike - March 20, 2024, 12:22 p.m.

https://www.marketforum.com/forum/topic/102729/

Oats price charts

https://tradingeconomics.com/commodity/oat

1. 1 month

2. 1 year

3. 5 years

4. 45 years

CORN PRICE CHARTS:

https://tradingeconomics.com/commodity/corn

1. 1 year

2. 10 years

3. 75 years

Last week's U.S. #corn export inspections preliminarily reported at 13-week lows, #soybeans at 3-week highs (and slightly above expectations). 1 cargo of beans, 2 #sorghum and 2 #wheat were inspected for China last week.

Not the greatest look for corn last week, but one bad week doesn't make the whole season. USDA increased old crop exports 50 mbu on Friday.

StoneX sees Rio Grande do Sul in southern #Brazil losing 3 million tonnes of #soybeans following the deadly floods. USDA on Friday reduced its Brazilian soy crop estimate to 154 mmt from 155 mmt forecast in April.

+++++++++++

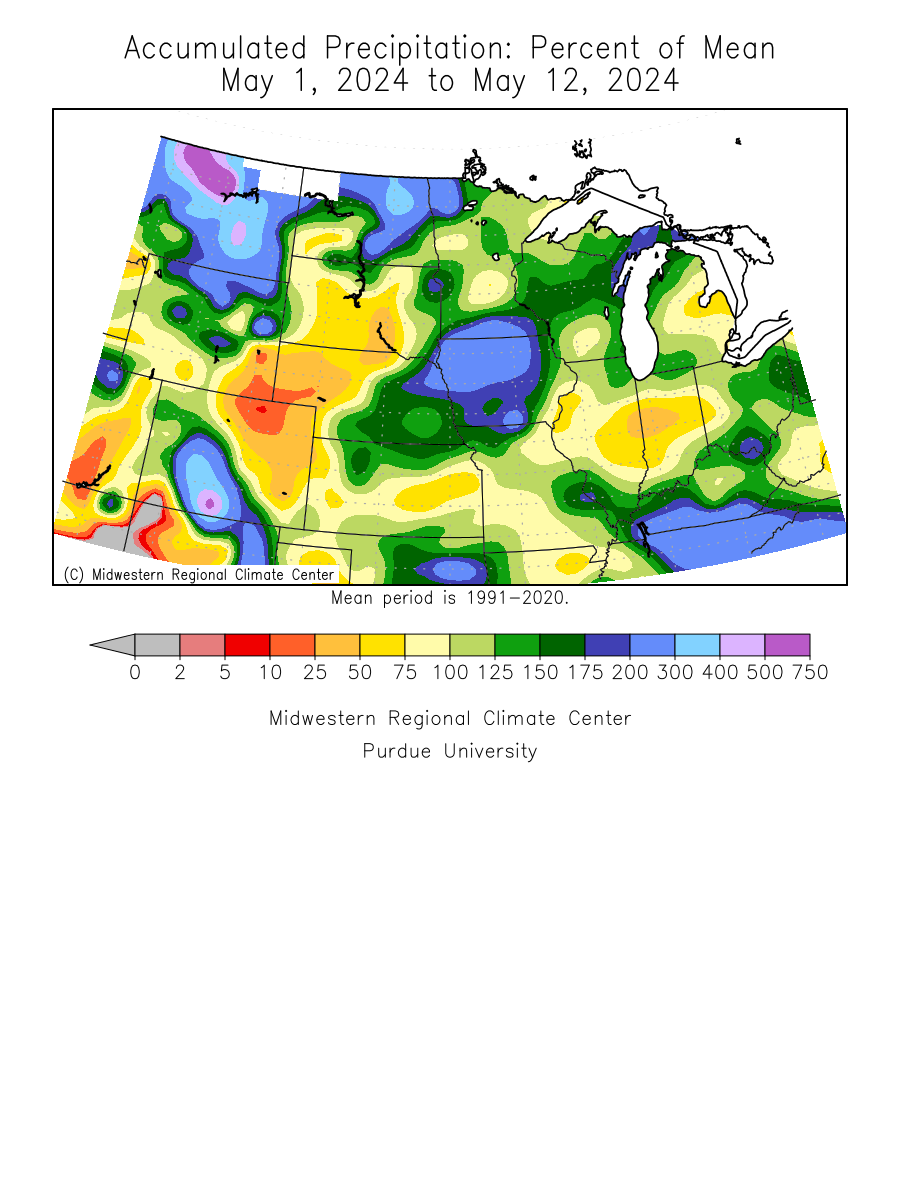

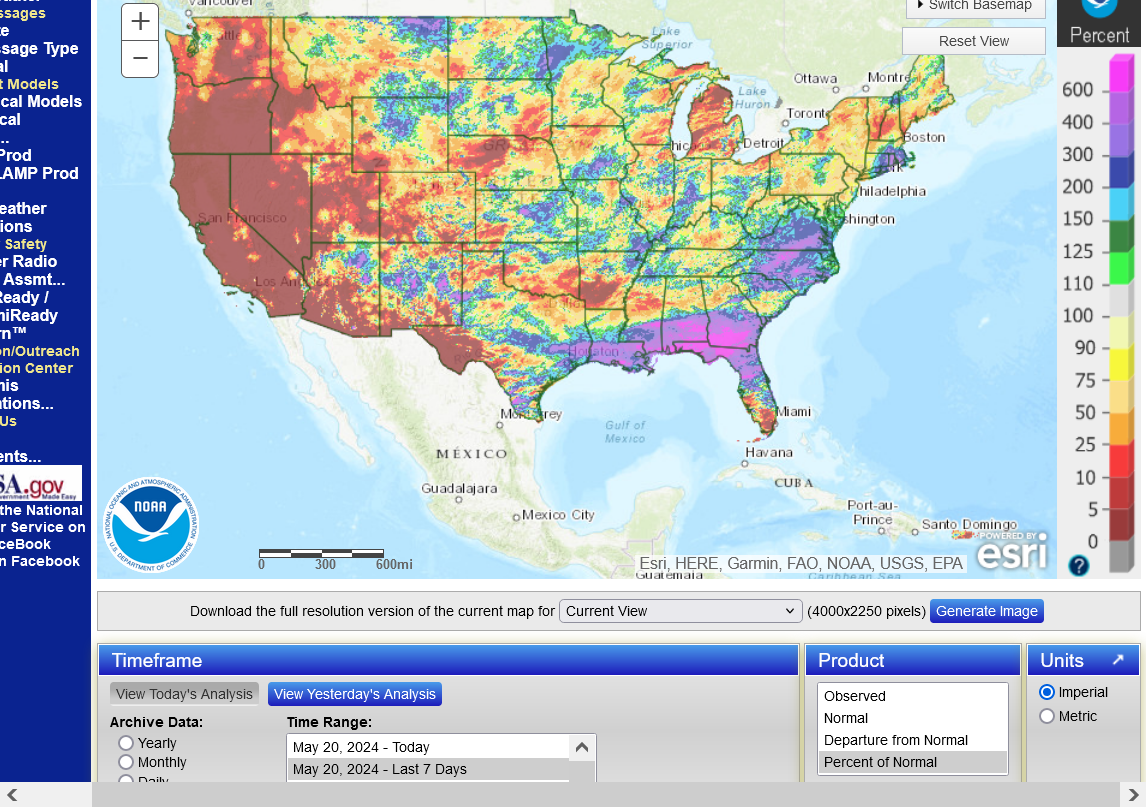

metmike: This is the % rain for the past month. Some areas of far Southern Brazil have seen over 300%!

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.30day.figb.gif

++++++++++++++++++

Looking at the last 5 weather headlines from the LSEG research team (as of Friday PM), the weather market could stay interesting in the coming weeks/months with continued S. Brazil flooding & dry center-west Brazil, and hot & dry threats to both USA & Black Sea growing regions.

Speculators cover short bets Speculators set short bets on FIRE in the week ended May 7 across U.S. grain & oilseed futures & options. This was money managers' biggest week of collective net buying since July 2017.

May 10: Most-active CBOT #corn futures notch their highest settle of 2024 ($4.69-3/4 per bushel) as USDA pegs corn supplies below expectations. Most-active corn had set a yearly high ($4.72) on Tuesday, though Dec corn has yet to return to its 2024 high ($5.02-1/4 set Jan. 2).

Entire, detailed report:

U.S. #corn planting at 49% complete is behind average pace (but in line with expectations). #Soybeans are just ahead of average at 35% but below the trade guess. Spring #wheat planting is well ahead of average & #cotton is a bit ahead. Winter wheat conditions unch at 50%.

U.S. #corn planting is 5 points behind the 5-year avg as of May 12 and last week's progress was 2 points slower than normal. Illinois & Iowa are the furthest behind and both planted slowly last week. Nebraska is still behind but made faster-than-normal progress last week.

See all the weather here:

https://www.marketforum.com/forum/topic/83844/

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

++++++++++++++++++++++++++++++++++++

++++++++++++++++++++++++++++++++++++

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Total 384 rains from the last 12z GEFS model. Not very good for corn planting!

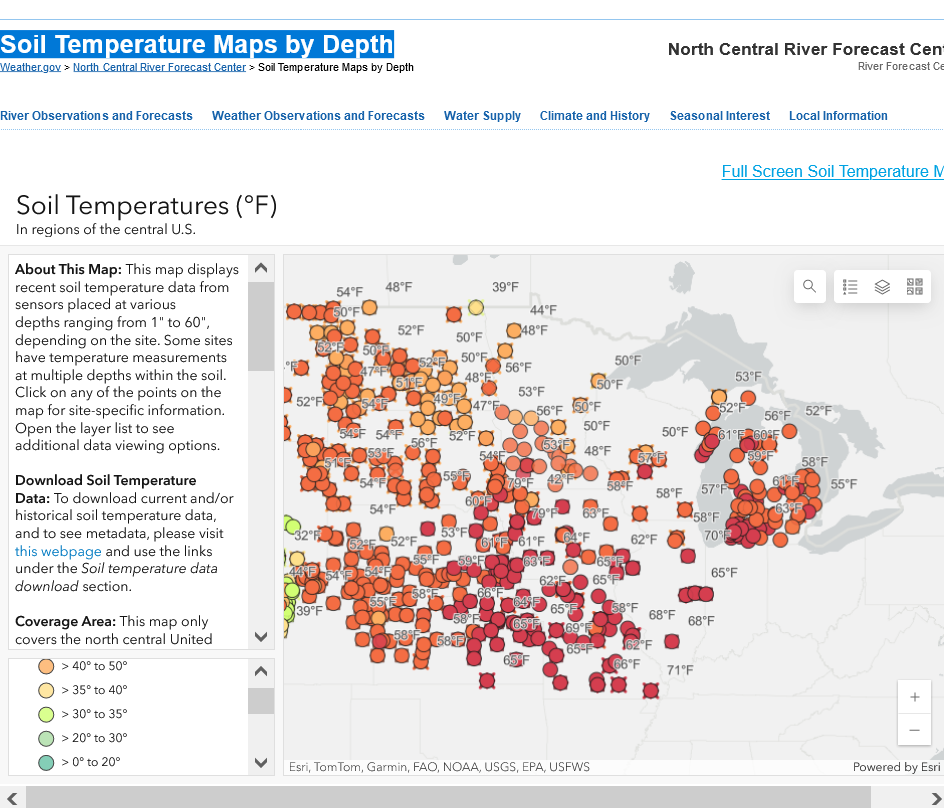

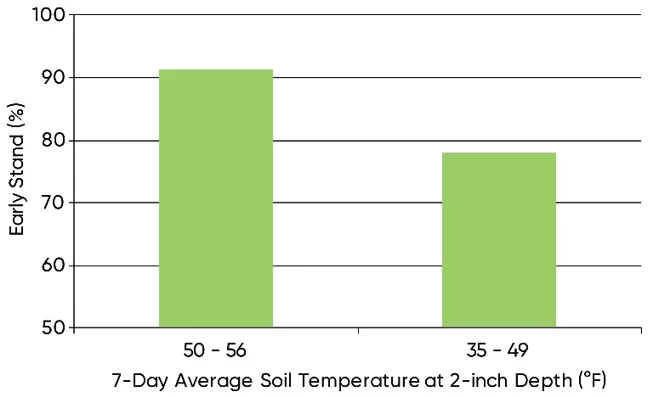

Temperatures are good for rapid germination! Corn needs 50+.

https://mesonet.agron.iastate.edu/agclimate/soilt.php

https://www.weather.gov/ncrfc/LMI_SoilTemperatureDepthMaps

+++++++++++++++

https://www.pioneer.com/us/agronomy/soil_temp_corn_emergence.html

Some chilly temps early in week 2 may not be the best but in the 2nd half of May, the sun angle is high and average temps are up from April and this shouldn't hurt much:

Total 384 hour rains from the last 6z GEFS model.

Rest of the weather here:

Too much rain in many places~

the last few trading sessions have been real disappointments. With weather factors. delayed planting, some fair exports, and lots more shorts to even up thought we would of seen better. read somewhere that the corn traders have been a long long time or maybe never seen a year where they did not get net long. seems some of that mess last nite over a large part of Ind and Ohio {2 inches plus on wet ground} would have been helpful. West central Ill where 200/a is not worthy of talk are having major trouble getting planted and highly unusual for that territory.

mcfarm,

We had 3.5 inches here yesterday. Good thing I installed a battery back up on 1 of the sump pumps or it would have been a disaster in the basement, as the power company, CenterPoint cut us off over an hour before sending the bill with the cut off warning.......before some of the heaviest rains were draining into the sump pit!!

https://water.weather.gov/precip/

3.5 is a train wreck for many small corn and bean fields unless they have sand and gravel or one terrific systematic tile system

I hear you mcfarm.

It actually fell in 2 waves which made is less bad but the 1.53 in an hour on saturated ground at this time of year had to do some bid damage.

In mid Summer not as bad.

After recent planting and newly emerged crops, pretty bad.

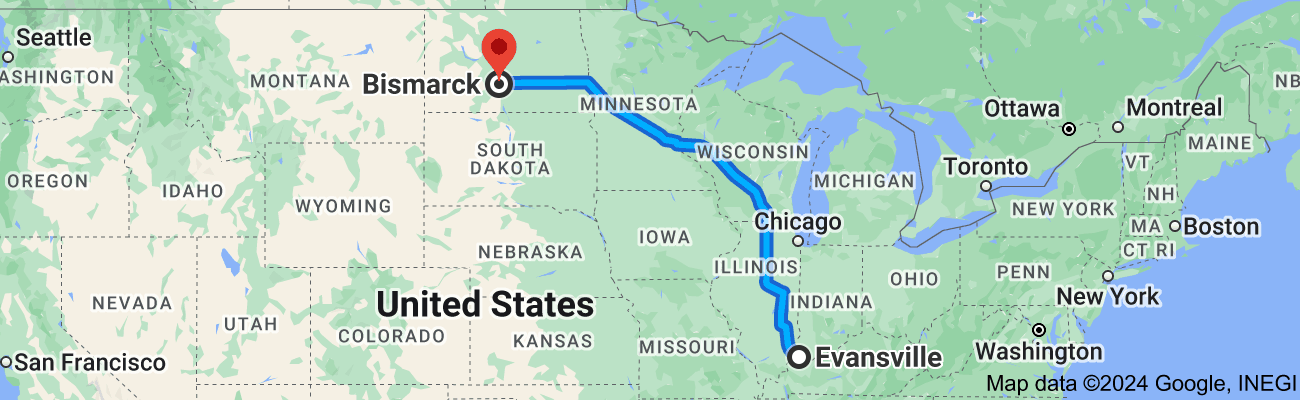

We've been pretty wet here the last several weeks, so I think not much is done but will get a good look tomorrow when I drive from near the Ohio River to ND.

Should be a 17-18 hour drive! My wife is not thrilled but she's not doing the driving and I'm very grateful to have a companion for the trip.

I'm tempted to take a different way back on Sunday just to see different terrain/places.s.

another 1 1/2 in the gauge last nite. Water everywhere and not a drop to drink. ditches, fields and road side over flowing and its getting really old. I should count my blessings have could of finished planting this week without the rain but now lost some of the new crop to water. In Kansas they say never wish to pass on a rain.

so new planting progress numbers out again and big government again wants us to all worship and praise these fake numbers derived out of thin air. Just think all the FSA directors looking out their air conditioned office windows at 1 day of sun after 5 inches of rain and he visualizing all the farmers out just planting away.....he gets his weekly call from high above in DC and dutifully reports the sun shining bright and planters all rolling because that is what he is supposed to do....you know just like the shot that stops the virus dead or the election messes all over the country....just bend over and take it. We are from the government and we are here to help.

Here's how they do it:

Crop Progress and Condition Layers

Understanding USDA

Crop Forecasts

I understand they have ways they are supposed to do it but that has very little to do with the ways big gov actually does things...... this year 66 billion to illegals.......2 b for veterans....makes perfect since to big gov as they thru another congressional hearing and wonder why anyone would question them

Thanks, mcfarm!

I get that for sure but the crop condition report is completely independent of the huge southern border crisis.

I have pointed out several times how the changes with data on USDA crop production reports has sometimes not made sense. Going from 1 extreme/market surprise to one size to the next report showing the opposite surprise.

A crop production report should never go from a bullish surprise to a bearish surprise

It would be like shooting a target with a gun, trying to hit the bullseye(which is the actual number). If your gun is completely missing the entire target too far to the right, you should adjust the gun so it shoots farther to the left to get closer and to at least hit the target with the next shot.

USDA sometimes misses the entire target(private estimate/market expectation) by being too far left.............followed by the exact next report being much too far left(compared with private estimates).

Legit things can happen to change the data but if a gun/USDA has a bias, it should either maintain a consistent bias, so the shooter/trade(market) can anticipate that or adjust it slighter to eliminate the bias NOT go from an extreme bias right/bullish to extreme bias left/bearish is successive reports.........that even do it again in the same growing season.

It's possible that this is just OVER compensation, which is bad enough from people that are not objective and manipulating data instead of just reporting it or even worse, that this is intentional because surprises on USDA crop reports MAXIMIZE profits for those positioned for the surprises.

I've read that USDA has strict rules that doesn't allow those who know what the report will show to exploit this knowledge for personal gain. Riiiiight. Who are these human beings that know about the information? Saint's??? That would never do anything wrong, unlike most people in their position? Idiots? That couldn't pass on the information to a person with no documentation tying it to them?

If the reports were almost always consistent with private crop firms that spend millions to provide accurate data, then this is not valid. But there are just too many surprises to not strongly suggest the surprises are not from randomness and incompetence.

Rains the last 7 days:

https://water.weather.gov/precip/

There was LESS planting than what we need to get all of our 2024 crop in the ground! Update by the USDA will come at 3pm this afternoon.

% average below:

U.S. export inspections last week were (preliminarily) a marketing-year-low for #soybeans and the lowest since Nov. for #wheat. However, #corn inspections were slightly above all trade estimates and incl. 4 cargoes to China. Two #sorghum shipments were also insp. for China.

Not the best week for soybeans but also no worse than the same week a year ago. Corn rebounded from the previous week's downturn.

Last week's planting pace for U.S. #corn, #soybeans and spring #wheat beat trade estimates. There were some weather disruptions, but analysts likely underestimated how hard farmers pushed whenever the planting window was open. Winter wheat conditions down 1 pt on the week.

++++++++++++

U.S. #corn was 70% planted as of May 19 versus a 5yr average of 71% and 10yr average of 76%. Average week-on-week gain is 17 pct points, but farmers added 21 points last week. Forecast is looking wet this week, and 5yr avg pace is +11 points. Can we get to 81% by Sunday?

This week versus a year ago. Huge improvement in the Southern Plains (HRW wheat country), which would be expected coming off El Nino versus last year's La Nina.

U.S. #corn export sales were decent last week, #soybeans were barely passable. Mexico was the top corn buyer and China had 274kt corn, mostly switched from unknown. Still no China on new-crop beans (tho 1 cargo sold to unknown). China bought its biggest beef volume since Oct.