interesting concept that is not really hard to understand....tax cuts should probably go to the people that pay taxes....thankyou

then why try to sell it as a tax cut for the working class.

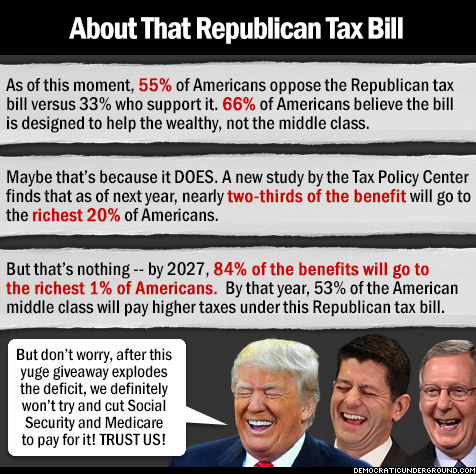

It is what it is a big wet kiss to the 1% donors

What I do not understand is the republican party of my youth was considered fiscal conservatives and now they are the party of borrow and spend which is totally against the long held virtues of the GOP. but it all changed with Reagan.

The easiest way to be elected in this country anymore is to run on the slogan that I will cut your taxes today, ( and make your kids pay for it tomorrow ) budget deficits are somebody elses to worry about.

http://www.cnn.com/2017/12/13/politics/calculate-americans-taxes-senate-reform-bill/index.html

Everything I put in shows that below 125,000 going to get tax break for at least 7 years.

No responce for 125-450

"Another takeaway: Those claiming a child tax credit for dependents are much more likely to be winners in the bill. Much of the benefit to middle income earners comes from the doubling of the child tax credit and the standard deduction. The bill Congress is voting on will also make the child tax credit available to many more high-income earners. The credit also has a larger refundable portion, which will benefit some lower earners."

cnn

The misrepresentation of this tax bill is entertaining. And many seem to rely entirely on "HuffPost" like Facebook memes for their education/information.

But, even if the people who pay 70% of the taxes are getting a 20% break, how is that a punishment for the rest, particularly if most of them are also getting a break? Even those who currently pay no taxes at all.

And, if this tax bill ends up creating jobs/opportunities that were not there before and leads to increased wages, which is more than a good possibility, doesn't that make this a win for everyone?

Or have we become a country where more and more prefer not to work? One where it's OK for the poor to be poorer as long as the rich are poorer too?

So your saying adding trillions to the debt does not matter.

I didn't saying adding trilions to the debt didn't matter and even the most ridiculous estimate doesn't say we're adding trillions to the deficit. The worst was from the JCT that estimates 1.4 trillion in 10 years based on a .8% increase in GDP which is an unreal (to the conservative side) estimate. More realistic run from 1-3% per year.

So Lets say it a trillion to the debt -- You see that is how it matters to the rest of us and our children and grandchildren.

BTW History tells us that these tax cuts will add virtually nothing to GDP -- this is the third run at Trickle down and the first two were utter disaster.

You need to review your history.

JFK was the first proponent of Supply Side and had some success. Reagan tried it in response to the Carter recession and we saw GDP's as high as 7% with the revenue to the treasury doubling in under 10 years for the 1st time in history. The deficit under Reagan came from all the pork attached to the defense spending bills that he would sign every time. This lead to the ill fated line item veto debate. But the ensuing prosperity lasted until a mild recession in the latter part of the Bush I admin.

Bush II also had some success tempered by the 9/11 attack and of course the "Home Ownership is a right" financial collapse.

Economists familiar with history understand that the economy does much better when the government settles for a smaller slice of a larger pie.

Also, if this adds 1.5% or more to the annual GDP and Congress keeps spending under some semblance of control (A much bigger if), this willlikelydecrease the deficit.

growth under Reagan was a mere 3.64% less than clinton's, johnson's and kennedy's and barley above Carter's who had to endure the oil price shock.

btw bushII was a dismal 1.8% inspite off the fact that the first 3 years move a nearly a 3.5% clip on the coat tails of clinton and then his trickle down started to kick in.

http://politicsthatwork.com/economic-record-president/bush43

the truth and your vision of what went on seem to diverge here

Among other things, it appears you give Clinton credit for the dot com boom. Anyway, here is a chart of annual GDP's.