We're getting a bit of a bounce, part of that from a frost scare in coffee country!

The charts below are in July. However, the September contract is the main front month. The KCU price gapped higher this morning. A daily and weekly gap higher in fact.

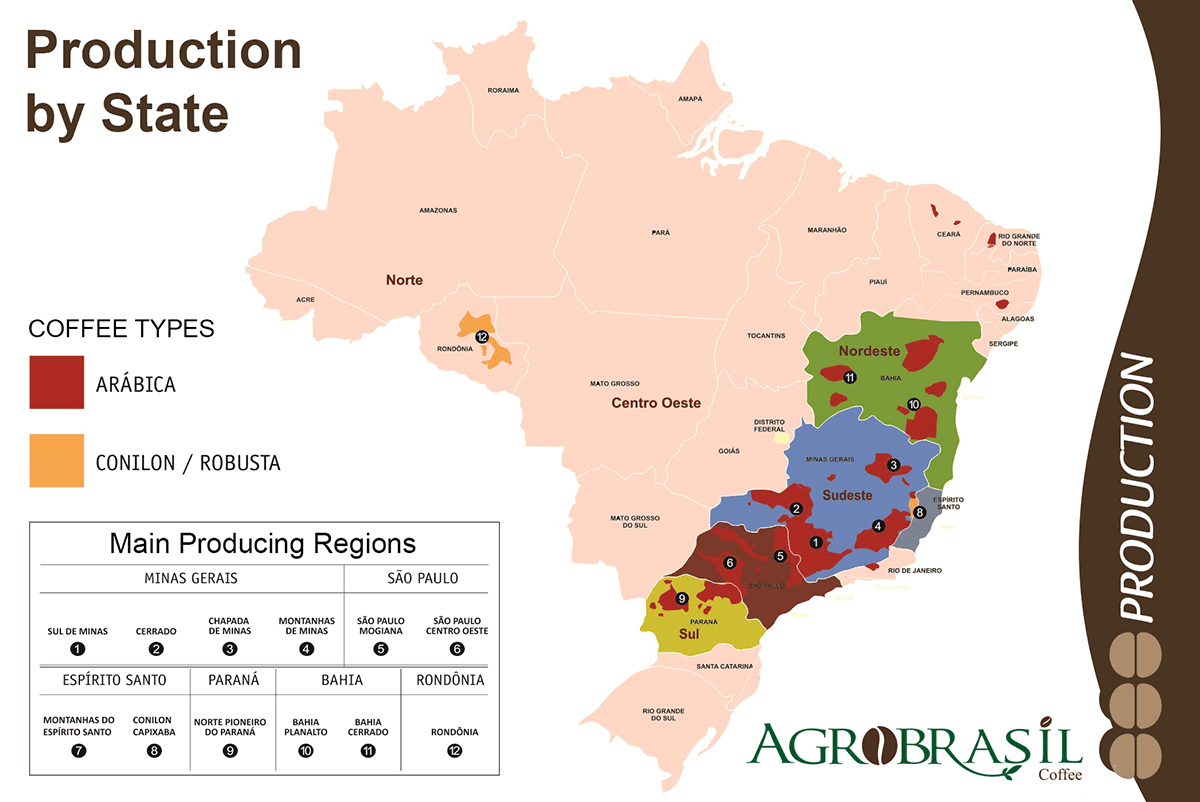

Last weeks high was 110.50. We gapped higher at 111.75 this morning, spiked to a high of 114.10 several hours later, then sold off to the lows of 110.55 when the mid-day model was not quite cold enough for a freeze, still leaving a tick of the gap unfilled, closing weak, near the lows at just over 111.00 as this air mass looks like it will not quite be cold enough to do more than just minor damage in very minor producing Parana.........the coffee areas farthest from the equator.

1 Year Below

| |

| |

Drought in Brazil in 2014 caused a spike

Drought in Brazil and bad weather globally in 2010 caused the 2011 spike

| |

Note at this link below, that coffee prices dipped below 50c in late 2001 and the first half of 2002!

Seasonals at this time of year are usually very weak with harvest going on. Legit freeze scares can take us higher temporarily. This one has enough cold but needs to go farther north to affect the crop with powerful market moving damage threat.

| Date Posted & Author | |

|---|---|

Coffee |

History of frosts/freezes and droughts in Brazil thru 2000.

http://www.coffeeresearch.org/market/frost.htm

http://www.coffeeresearch.org/market/frosthistory.htm

| Date | Severity (Damage) | Coffee Frost or Drought |

| 1902 (Late July/early August) | Devastating | F* |

| 1918 (June 24-26) | Severe | F* |

| 1942 (Late June/early July) | Severe | F* |

| 1943 | Moderate | F* |

| 1953 (July 4-5) | Severe | F* |

| 1955 (July 30-August 1) | Severe | slight F |

| 1957 | Severe | F* |

| 1962 (July 25-26) | Minor | F* |

| 1963 (August 5-6) | Moderate | F and D |

| 1965 | Minor | F* |

| 1966 (August 6) | Severe | slight F |

| 1967 (June 8) | Minor | F* |

| 1969 (July 9-10) | Moderate | F* |

| 1972 (July 8-9) | Moderate | F* |

| 1975 (July 17-19) | Very Severe | F* |

| 1978 (August 13-16) | Moderate | F* |

| 1979 (June 1) | Moderate | F* |

| 1981 (July 20-22) | Severe | F* |

| 1984 (August 25) | Minor | F* |

| 1985 (August-November) | Minor | D |

| 1988 | Minor | F* |

| 1994 (June 25-26 and July 9-10) | Severe/Very Severe | F and D |

| 1999 (August to November) | Severe (40% crop lost) | D |

| 2000 (July 17) | Moderate (est) | F* |

* In most cases frost or drought was not indicated by the source. Although only F is written in these cases it is likely a combination of the two forces that caused devastation to the coffee crop.

The higher the number, the greater the production.

This link has more good stuff including a map that I can't copy here:

2 week temperatures in Brazil show the very cold blue anomalies in far southern Brazil, just south of coffee country. The 2 days with a chance for frost are Saturday and Sunday early mornings.

Mike

Any weather update? Seems to be buyers!

Price is seeing typical gyrations ahead of the first frost threat in several years, with overall support from lack of aggressive sellers staying out until the threat is over. Also, probably a lot of traders not wanting to be short with the market closed tomorrow, if the forecast changes to colder.

The threat hasn't changed the last 3 days. Still looks like just the southern most locations and both Saturday and Sunday early morning hours will have some damage........mainly Parana which doesn't produce much.

However, the air mass is cold enough to do significant damage if it would move a couple hundred miles farther north. Just that possibility is bullish, even if that is not the most likely scenario.

The position of the cold high pressure system coming in is not far enough to the west for the ideal set up for the cold to penetrate deeply into Minas Gerais right now but there is still enough time for that to change............which is why we are higher here.

Interesting that we were down at the lows earlier this morning, just above 110, then shot up. There was no new weather guidance or forecasts that came out then, just market josling and players with different ideas of what they want to do with the above dynamics ahead of the holiday.

Edit 11am: After looking at the American model that came out around 5am CDT this morning, I do see that it was a couple of degrees colder and this last one that just came out confirms it, though the rest of the guidance has not changed..........this this actually could explain the additional risk premium going into the price this morning.

Thank you, Mike

Coffee forum poster suggests this front similar to 1994?

I'll have to see what that person is saying but this is not at all like 1994. There were actually 2 freeze events then, the high pressure was MUCH stronger and came in much farther from the west. Temperatures were much colder and the cold penetrated deeply into coffee country and was on weather models advertising it for days ahead of time.

If this pattern was similar to 1994, coffee would be 50c higher here and sky rocketing higher.

tjc,

Actually, they show that this system is NOT like 1994. In 1994 the high came from W.Argentina and circulated/flushed cold in Argentina deeply north.

This one is coming in from E.Argentina, which will not provide as much favorable southerly wind flow ahead of it.

Winds move counterclockwise around highs in the Southern Hemisphere, the opposite of the NH.

http://mb.boardhost.com/coffeetraders/msg/1562106685.html

Contrast that to the position of the High in far Northeast Brazil on Saturday morning with this event:

You sure know your WEATHER!

Since I did not buy a call, 125 here we come!

Thanks tjc,

Would call the models a smideon colder this morning.

The Canadian model has been the coldest every run all week. If it should happen to be correct, then there will be some significant damage.

I will guess that coffee will continue supported on Friday, just because nobody wants to be short ahead of the potential freeze events over the weekend, when the market is closed. Sunday looks like the main threat.

Also, historically, the market does not sell off BEFORE freeze/frost threats unless they would weaken substantially along the way.

This one has NOT weakened, it's actually increased a bit the last couple of days.

Here on Friday, the models are about the same with the cold this weekend for coffee country in Brazil. Just a wee bit colder overall.

We opened sharply higher and spiked to our highs early, then tested the highs and failed badly, now lower and looking to put in a reversal lower today.

Probably some damage in the far southern areas.......Parana. The market doesn't think major damage. Sunday morning will feature the coldest temperatures.

Reports of FROST. I do not know how extensive.

What have you learn about Sunday morning frost, MetMike?

tjc,

I can't get a hold of all the min temps but it sure doesn't look like it was cold enough to do much damage to me. Close to the model forecasts.

No doubt the southern most, minor areas had some frost and some minor damage but this was not a major freeze event.

I wouldn't be shocked to see a report coming out that says otherwise and possibly give us a very brief spike higher but I would be surprised if the amount of losses make much difference to the amount of coffee supplies that matter to the price.

One interesting element to the price of coffee is that it looked like it had bottomed in May, well before this frost threat first appeared, so I wouldn't want to be short here.

However, we have bounced over 20c since the lows 2 months ago around 90c and this is harvest season and historically/seasonally the weakest time of year for coffee prices.

I will guess that we made our seasonal lows early(Aug/Oct) is usually the ideal time frame but have no interest in trading coffee in the absence of it trading weather and it won't be trading this week because there is no additional threat of cold.

Freezes are still possible in coffee land thru early August but this was the best time frame to have one., especially with coffee being closer to the equator than it was 50 years ago, when it was much more vulnerable..........and this one didn't do much damage.

Not surprisingly, with videos circulating around the internet of frost in Brazil, coffee opened sharply higher, spiking to a high of 114.65 on the open, which was what I speculated could cause a brief spike higher.

It didn't last long as we have crashed lower and are at 106.80 at the moment. Almost 8c off the highs.

For those keeping track, one coffee contract is worth $375/c(1 contract is 37,500 pounds), so the move from the highs to the current price is over $2,900/contract.