Karen BraunVerified account @kannbwx Jul 9

Trade estimates for USDA's WASDE on Thursday. The production estimates suggest that some analysts see adjustments to plant/harv #corn area from the NASS June survey. They also suggest a possible area tweak for #soybeans in addition to the expected yield cut.

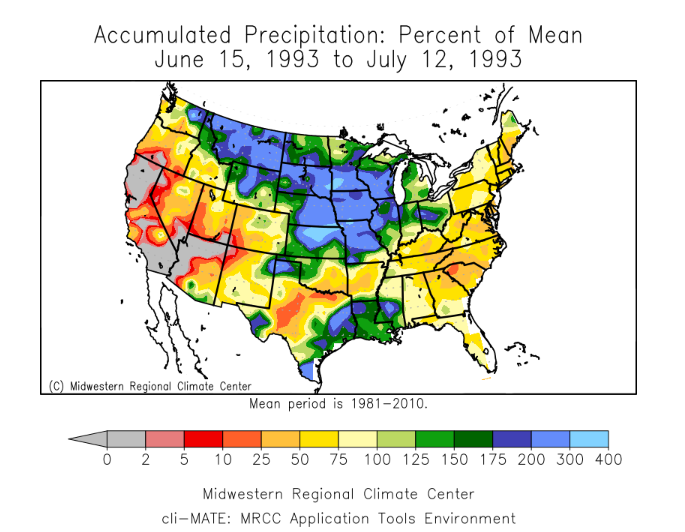

Interesting to look at the rainfall anomalies since mid-June 1993 and 2019. The heaviest rainfall this year was located mostly on the periphery of the main #corn and #soybean growing regions, unlike 1993 where it was centered on Iowa.

This would have had an effect on planting in some places during the 2nd half of June/early July...mainly beans.

Can any producers/farmers tell me if the PP crop insurance deals this year were more favorable compared to 1993 which would have resulted in less planted acres this year vs 1993?

I wonder if soybean prices being so low in 2019 resulted in a lot of PP acres (millions unplanted) that would have otherwise gone to beans if we were at $11, which historically is where beans should be compared to the current price of corn.

Karen BraunVerified account @kannbwx Jul 9

The only time I can find that USDA/WAOB did not take the EXACT #corn planted/harvested area directly out of the NASS June survey for the July WASDE was in 1993, where only harvested area was cut 0.8 mln acres. The snippet from the July 12, 1993 WASDE below explains why. #AGTRIVIA

After the June USDA report disaster, using acreage that seems impossible to justify for corn especially, will the USDA make an exception and cut the corn acreage tomorrow?

To me, this seems like the wise thing to do to establish an iota of credibility that they actually have a clue about what the market knew about a month ago.

Should they keep the same impossibly high corn acreage for this report, THEN cut it in later reports it maximizes the clueless USDA narrative evidence.

If they cut the corn acres by a couple of million tomorrow, the market will at least think "ok, they messed up bad in late June but are in redeeming mode by moving in the right direction just 2 weeks later".

Here's a summary of the late June USDA report, along with a discussion of why its almost impossible that we planted almost 92 million acres of corn this year and only lost 1 million acres since March.

Get ready for the wild spike in a few minutes, when the report is released!!!

Karen BraunVerified account @kannbwx 6m6 minutes ago

USDA leaves U.S. #corn yield unchanged at 166 bpa but reduces yield for #soybeans by 1 bpa to 48.5 bpa.

Karen BraunVerified account @kannbwx 4m4 minutes ago

USDA/NASS places U.S. spring #wheat production at 572 mln bushels, slightly above trade expectations.

Analysts generally underestimated the winter wheat crop, and all wheat production for 2019/20 comes in at 1.921 billion bu, up 2% on the year.

Karen BraunVerified account @kannbwx 9m9 minutes ago

USDA raised #Argentina's 2018/19 #corn harvest to a record 51 million tonnes, up from 49 mmt last month.

All other production estimates for Argentina and #Brazil corn and #soybeans stay the same for both marketing years.

The biggest changes for #soybeans in the July WASDE were in the USA with the new acreage numbers and a 1 bushel cut to yield.

#China's import numbers were unch. #Argentina's exports rose (both old and new crop). Despite a smaller harvest in the USA, global soy supply stays ample.

When all is said and done, I am going with 85 Million acres and 164 BPA for corn.

The USDA should hire you Jim (-:

I’m a fantastic arm chair quarterback. I just figured we all can debate where the crop is and acres. Let’s put some WAG numbers on it and let’s see how close we are.

Guessing the actual acres in a year like this is quite a challenge but would be fun if you want to go for it.

All I know is that it's at least 4 million acres less than the USDA states. The chance that we planted 91.9 million acres of corn is less than 1%.

The fact that corn finished sharply higher today tells us a couple of things.

1. The market is likely paying attention to the hot/dry weather pattern coming up.

2. The market no longer considers the USDA to be a credible source of information........at least with regards to corn this year.

Agreed. And if we don’t get at least some kind of rain with all that heat, we will be going on another rally.

Karen BraunVerified account @kannbwx Jul 11

After last month's huge cut to 19/20 U.S. #corn stocks (largest-ever monthly cut), USDA adds 335 mln bushels back this month (largest monthly increase in a long time, maybe ever?). Bigger crop and reduced old-crop use (new-crop use was actually up). Old-crop stocks keep climbing.

Karen BraunVerified account @kannbwx Jul 11

U.S. ending stocks for #soybeans in 19/20 was slashed by 250 mbu on a smaller crop. My records say that is the largest monthly drop in at least 23 years, maybe ever. The new forecast of 795 mln bu is the smallest number we've seen since the 18/19 forecast of 785 mbu in Aug 2018.

Karen BraunVerified account @kannbwx 13h13 hours ago

The 1,044 voters overwhelmingly believe that CBOT Dec #corn futures will top $4.73 per bushel, making a new high. The contract expires in 154 days. If the Aug. 12 USDA reports do not fully confirm the bullish U.S. crop ideas, the chances for new highs will fall off dramatically.

Both bean and corn estimates are based on 91 mil acres of corn and 80 mil acres of beans. As thoroughly discussed both acreage numbers are highly questionable.

I took a motorcycle trip through what is considered Amish country here in Ohio. Wilmot, Berlin, Millersburg. A couple fields with corn head high. What shocked me was quite a large number of fields of corn that looked like it got planted last week. Seriously. Corn plants that were only a couple inches high. Are the Amish not eligible for PP?

“ Are the Amish not eligible for PP?”

Probably morally opposed to it.

Thanks Jim,

metmike: It's possible that this was sweet corn for human consumption vs field corn for animal consumption.

Field corn has a longer maturity time and is planted ASAP in the Spring to get in the number of growing degres days and optimal sun/environmental conditions. It's dried and stored and often stored for years before fed to animals.

Sweet corn must be consumed immediately after it ripens, so there is only around a 2 week time frame or something like that after it gets harvested before it's no longer any good for consumption.

Based on this, those that raise sweet corn, don't want all of it to be ready all at once. If their entire crop is at peak consumption for just 1 week, this causes issues trying to get all of it harvested and sold to the market as a delay of just a few days can be costly..........in addition to it resulting in multiplying the work before selling vs staggering the corn planting so that X amount is planted every Y number of weeks from the start to the end of the planting ............which extends much later than the planting season of field corn even in ideal planting season years.

https://naldc.nal.usda.gov/download/21711/PDF

Sweet Corn Growth and YieldResponses to Planting Dates of the North Central United States

Abstract. Sweet corn is planted over a 3-month period in the north central United Statesto extend availability for fresh market and processing; however, the extent to whichdevelopment and growth of sweet corn changes during this period is unreported. Fieldexperiments were conducted in 2006 and 2007 to determine the effect of live plantingdates, ranging from mid-April to early Jul, on sweet corn establishment, growth, andy ield components. Da

Lots of good points and they all make sense.