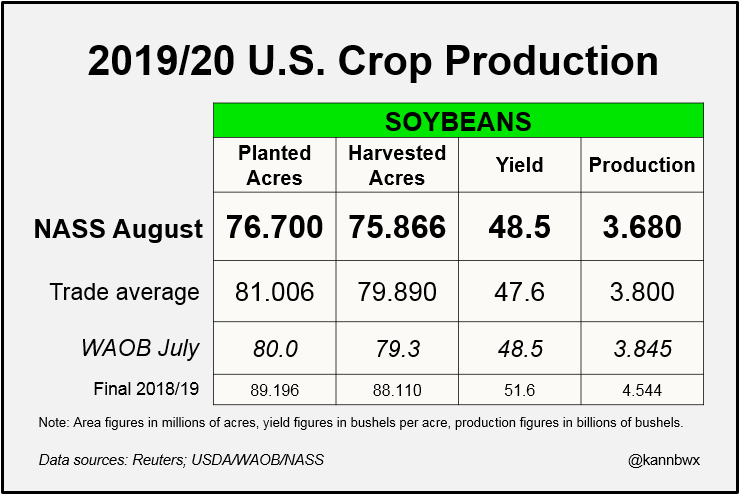

USDA's resurvey on acres results in smaller-than-expected area for #soybeans, which places production below expectations at 3.68 billion bushels, despite higher-than-predicted yield at 48.5 bu/acre.

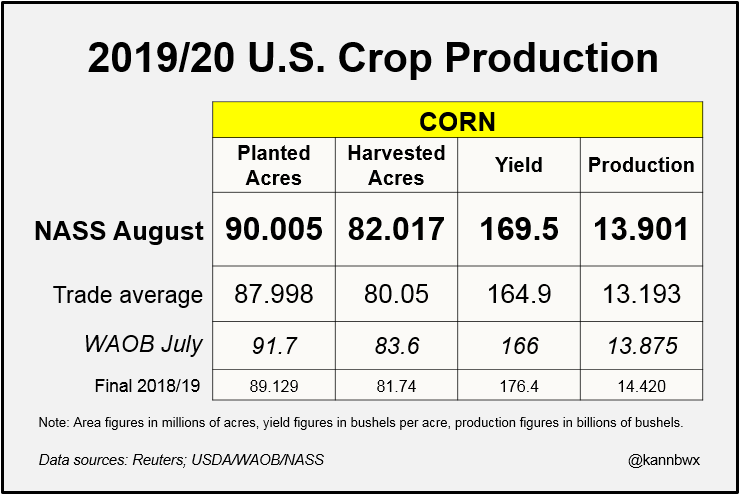

USDA places U.S. #corn yield at 169.5 bu/acre, well over the trade range of expectations. Area also larger than expectations after NASS resurveyed 14 states in July.

Corn has been trading locked limit down for the past 30 minutes.

Beans had a pop to new highs for the day session 15 minutes after the bullish surprise but dropped to test the earlier lows..........and barely held so far.

The weather has turned more bearish today with added rains in the extended forecast.

Karen BraunVerified account @kannbwx

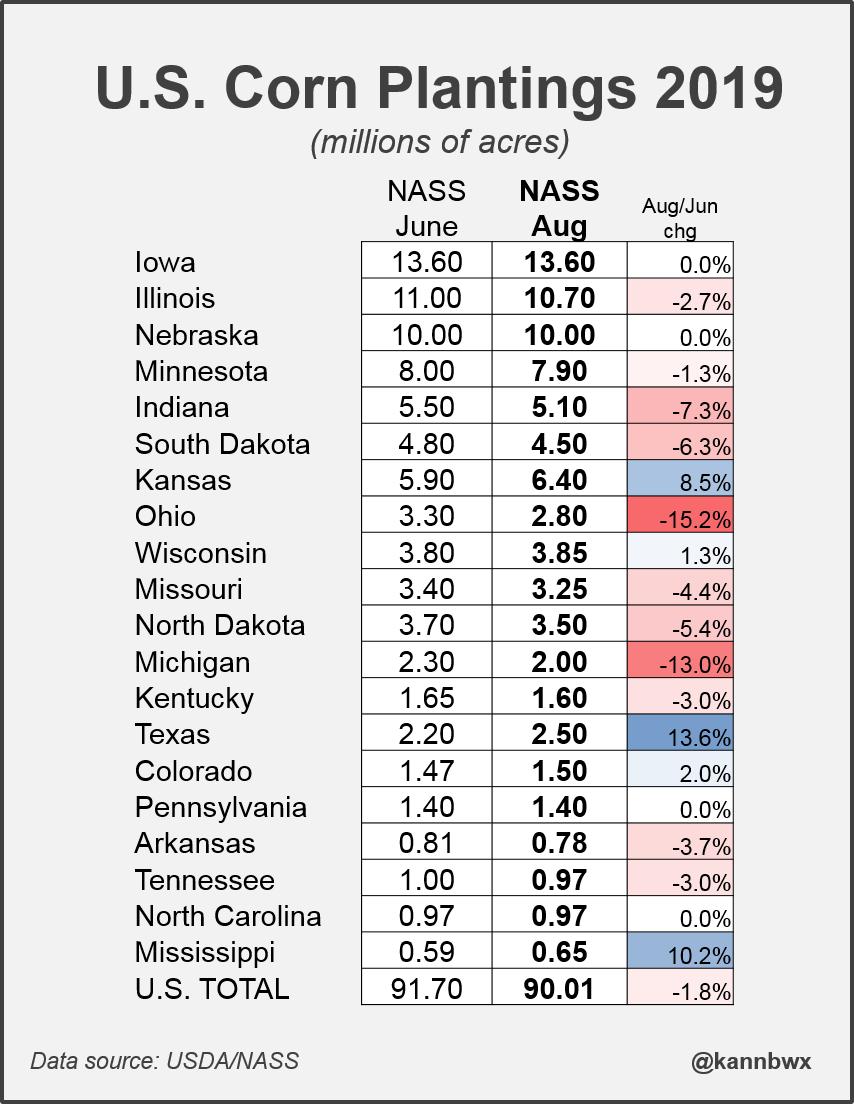

U.S. #corn plantings come in at 90 million acres, down from 91.7 mln in June but well above trade expectations. Here are the state-by-state changes from June. Most significant reductions were in Ohio and Michigan. Indiana and the Dakotas were also down a good amount.

NASS places U.S. #corn yield at 169.5 bpa, much larger than analysts thought. Here's a comparison with 2018 finals. The largest declines from a year ago are expected in Illinois (181 bpa), Indiana (166), and Ohio (160).

https://twitter.com/ScottIrwinUI some comments about this fake report with so many fake numbers printed {that deeply effect producers} it should of been printed in the daily beast and then burned. This report is an embarrassing mess. I had the feeling the numbers guy was interviewed and was using words like ordinary, usual etc to cover for this absolute injustice. 169? 101m intended corn acres? At every turn this report should put people at the USDA out of work.

bean yld down 1 bu from 18? are you kidding me. There is hardly a bean that developed a pod in Indiana alone. Do they really think this resurvey was does last month and not Aug the 12th?

Karen BraunVerified account @kannbwx

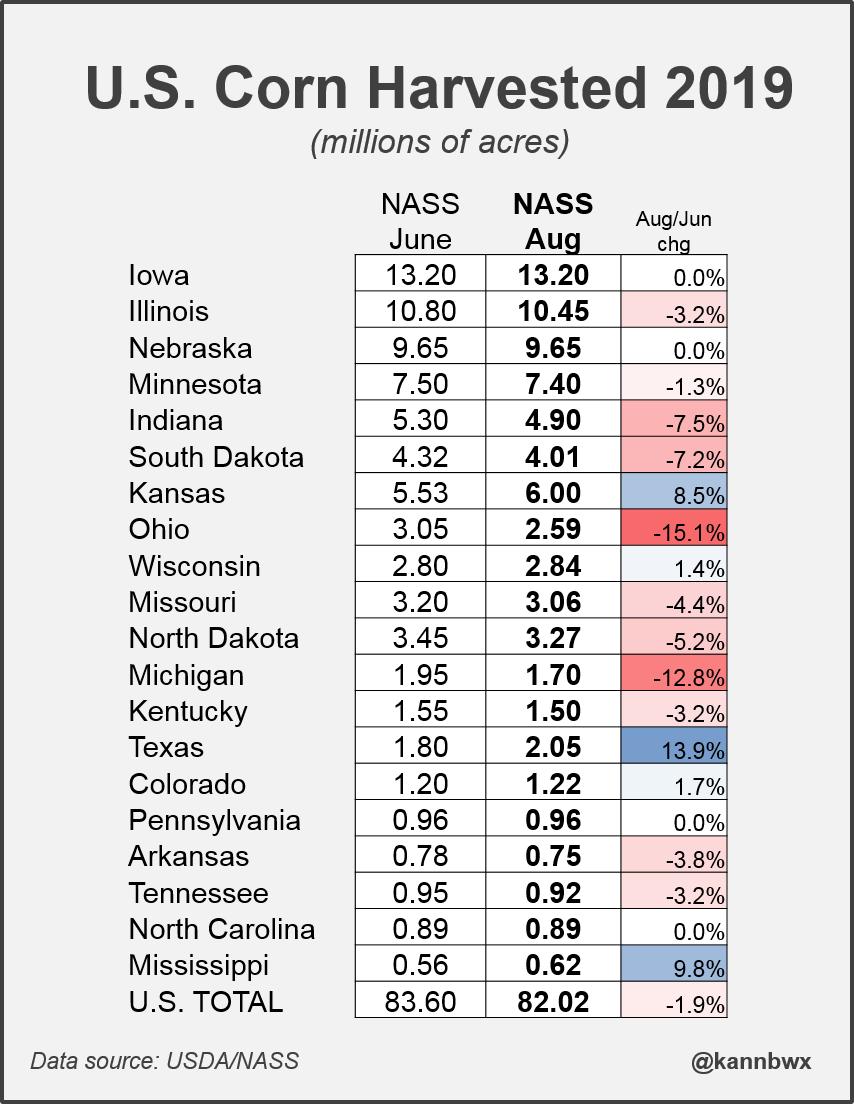

Harvested acres for grain are what actually makes the #corn crop, but harvested fraction is actually largely the same as in June (~91.1%). Here are those numbers by state:

Karen BraunVerified account @kannbwx 10m10 minutes ago

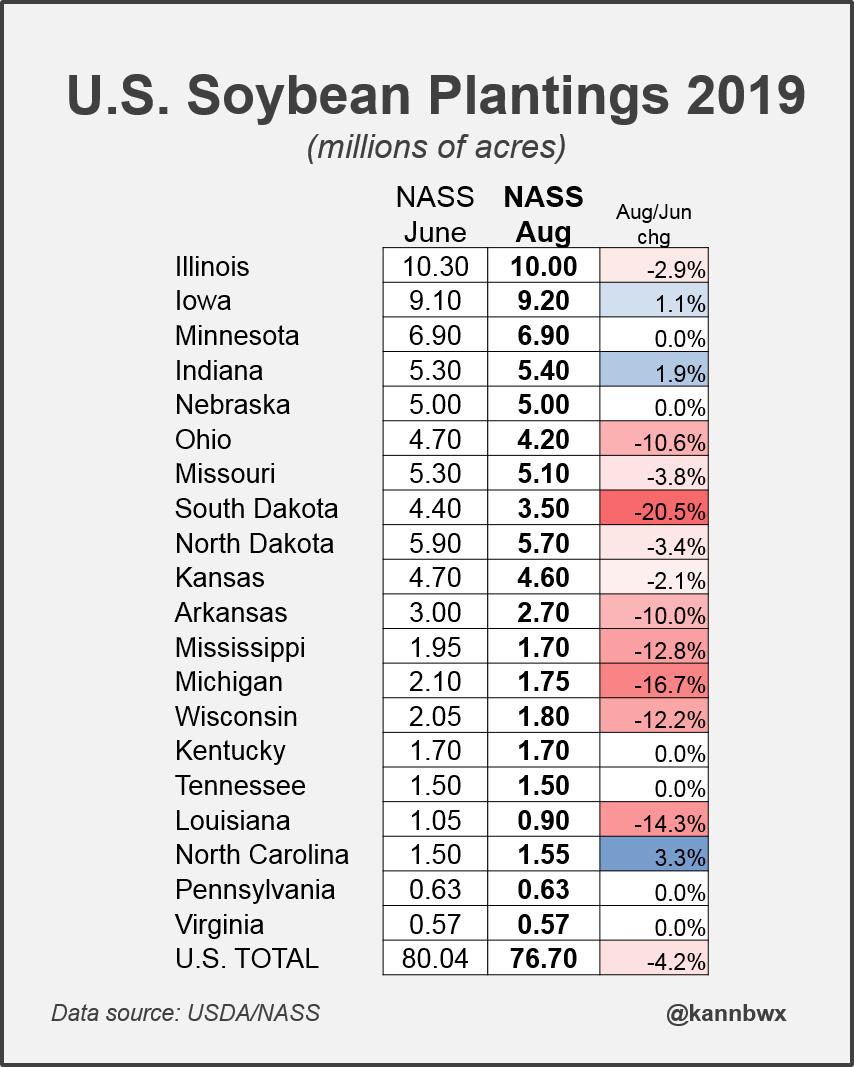

U.S. #soybean planted acres fall to 76.7 million, some 12.5 million (14%) lower than last year. This is the smallest acreage of #soybeans planted since 2011. Ohio, Michigan, and the Delta decreased acreage since June, but South Dakota had the biggest loss at 900k acres.

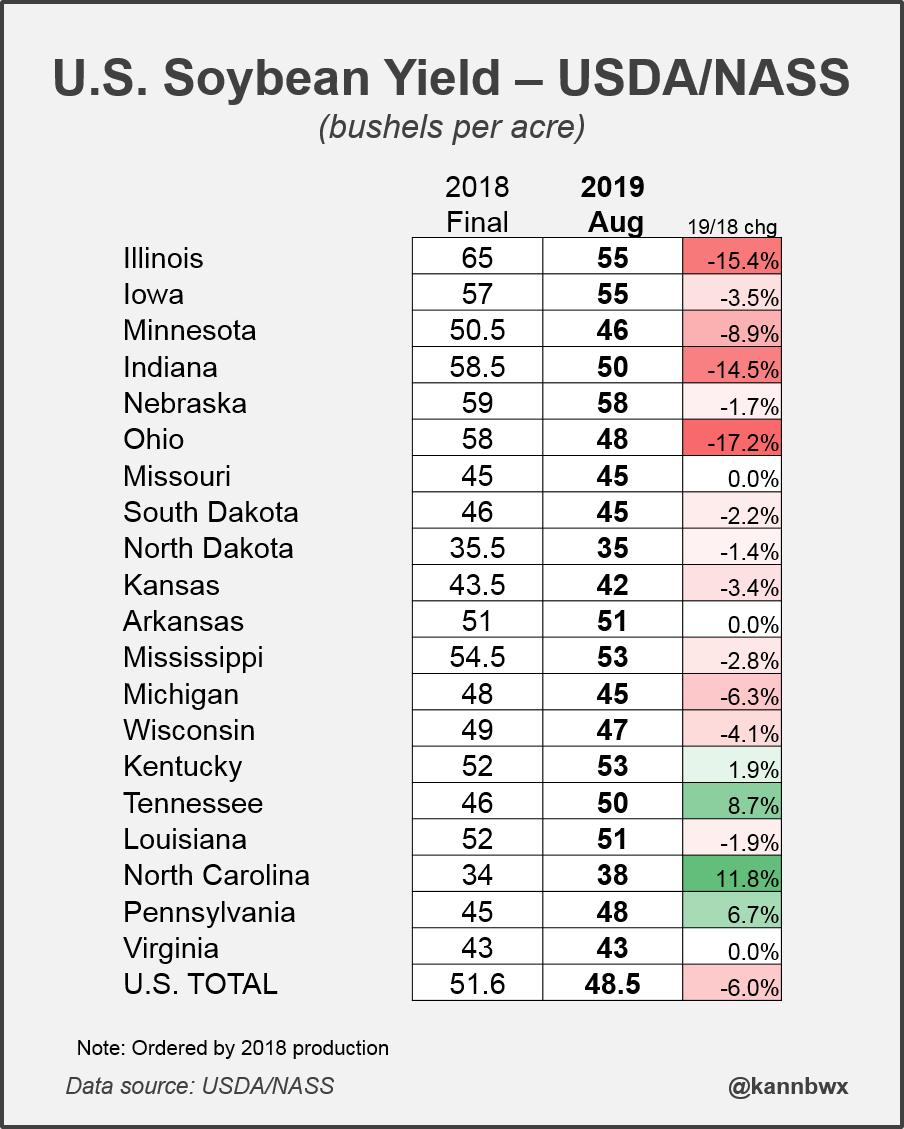

NASS places yield for U.S. #soybeans at 48.5 bpa, the same as what WAOB had in July. That would be 6% lower than last year's yield. Here is the comparison with 2018 by state. The top producers are the ones with the most drastic YOY reduction.

Beans down 15c after one of the more bullish August USDA crop reports ever?

The weather has turned bearish!

More rains, especially week 2 and no long lasting intense heat. Corn being lock limit down is surely hurting too.

This is for anybody who thinks the recent USDA report is hog wash

Yes price went down

Now think about this for a minute

If the report is wrong, then prices going down is okay

The only way you will be hurt is if you have unsold old crop, that needs to be moved

Yes, some want higher prices for old crop still in storage

That is not good, and I agree with that part

However, opportunity waits for new crop sellers

For those who think the crop is short, lower prices now are what we need

This will clear out a lot of old and some new crop.

If shortage or rationing does happen, then don't join the rush to sell and you will have your crop to sell at higher prices

Everybody should try to have a working agreement with your banker, that allows you to chose when to sell. You have the crop in the bin, so work with the banker if cash flow is a problem. Don't wait until the bills are due. Talk early and often if need be.

CBOT may be irrelevant

Around here basis is doing the work

Our price hasn't varied 10 cents all summer and even today, after the report our cash price stayed constant

Obviously, that is where the price buyers and sellers agree, to keep enough supply

So, if you are correct on a short new crop then hold and wait for the buyer come to you

If the crop is not short then USDA was correct and you were wrong

I will not be selling any new crop corn, other than corn already sold some time ago

I will wait for the price to come to me

As of now, new crop is not being bid very heavily, locally Somebody will sell, at the price offered, but not me. I think the crop will need to bid more for my new crop corn, as next summer comes closer and we see how much is stored, in the bin, for summer sales.

A big 2020 new crop ,coming to market in the fall, does not put corn in the bin for summer needs of 2019

Basis should be doing the work or else there is no shortage.

I may be correct or wrong, by waiting for price to come to me.

Such is the nature of farming

This was not the way to market in the past, but I think this yr requires a different approach to marketing

Almost every yr gives the farmer a chance at least once and some times twice to sell at a profit.

https://www.indigoagriculture.com/hubfs/August%202019_YieldResults%20Pre-USDA%20final-1.pdf?__hssc=212554059.2.1565656733597&__hstc=212554059.f5eb208aae3ffed9d311d6b89e2d2878.1565656733596.1565656733596.1565656733596.1&__hsfp=56542976&hsCtaTracking=6ec5caa8-9390-4130-a5bc-b818a879666b%7Ca3088894-7f22-40a8-b99a-df47d96ea3f1 another tke on the fake numbers from today's report

I need to make a correction to my post

I mentioned old crop in the bin during summer of 2019. That should be changed to next yr [2020] old crop in the bin, stored, before harvest starts

Thanks for the comments and the link.

The USDA shockaroos continue.

Numbers like IL having corn planting down just 2.7% vs intended acres doesn't seem to make sense.

IN was down 7.3% which seems closer and OH down 15.2% might be closer. Just looks like too many planted acres of corn based on what was going on in June:

Below is the USDA report for corn planting progress as of June 16th, about the time when it doesn't make sense to plant corn anymore.

92% of the intended corn acres were planted as of that date and in fact, some acreage intended for corn had already switched to beans at that late point in time.

That left roughly 8% not planted to corn yet. Any corn planted after that date, has yield prospects of 50%. Producers knowing this, are very unlikely to plant corn as their main crop("main" as in not for silage or cover crop) after this date. They can plant beans for another few weeks or take the PP insurance.

The USDA, cut corn planted acres a bit more to 90 million. If we assume that this represents an 8% drop of the originally intended crop not getting planted, we are saying that farmers would have planted 98 million bushels of corn had weather not caused the big problems.

That one seems pretty far fetched. Considering that prices favored more corn than beans, one can make a case for something like 95 million maybe but going much higher is stretching it.

https://downloads.usda.library.cornell.edu/usda-esmis/files/8336h188j/qb98mr27h/8910k4428/prog2519.txt