Here's where they grow the orange crop in Florida:

https://en.wikipedia.org/wiki/Tropical_cyclone_windspeed_climatology

metmike:Keep in mind that the right side of the hurricane will always cause the most damage.........with wind speeds of the entity ADDING to the winds speeds of the circulation. On the left side, the wind speed of the entity subtracts from the winds revolving around the hurricane. See the graphic above.

The farther south the hurricane hits in Florida, the more of the orange crop will be on the most damaging right side(with it tracking westward)

Here are some links from the NHC to get the latest:

|

https://www.nhc.noaa.gov/graphics_at5.shtml?key_messages

![[Key Messages]](https://www.nhc.noaa.gov/storm_graphics/AT05/refresh/AL052019_key_messages+png/145247_key_messages_sm.png)

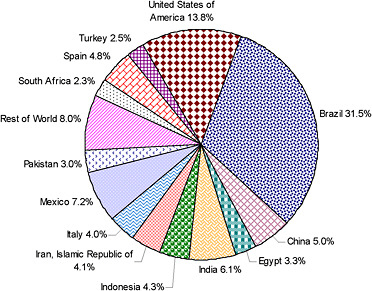

But the US has not been the #1 producing country for oranges for a long time. Brazil has that distinction:

They grow most of the oranges in Brazil in Sao Paolo(more than double US production), shaded red on the map below:

The oj market has had a pretty big bounce this week from the threat of damage from Dorian.

Price charts below are for the front month Sept which has the lowest volume. Prices that I will mention here though are for the Nov. contract that has the most volume(for OJ) and what you would want to trade.

On 8-19 It made the lows of 94.65, after and open of 101.00 and highs of 101.90 that day, closing 96.35.

Since then, its been pretty strong, closing on Thursday at 108.50, the highest close since June 14, over 2 months ago.

It gapped higher Thursday morning at 106.00. That was the low on Thursday too. With the highs on Wednesday(top of the gap) 104.95..............so just over 1c gap.

The highs Thur were 109.15.

My guess is that we will take those out on Friday. If the forecast is bullish enough overnight, maybe another gap higher(if the track is farther south and at least 130 mph.

Take out this hurricane or have zero damage and prices will dive below $1 in a flash.

Orange juice the last 3 months

Orange juice the last year:

Orange Juice the last 10 years:

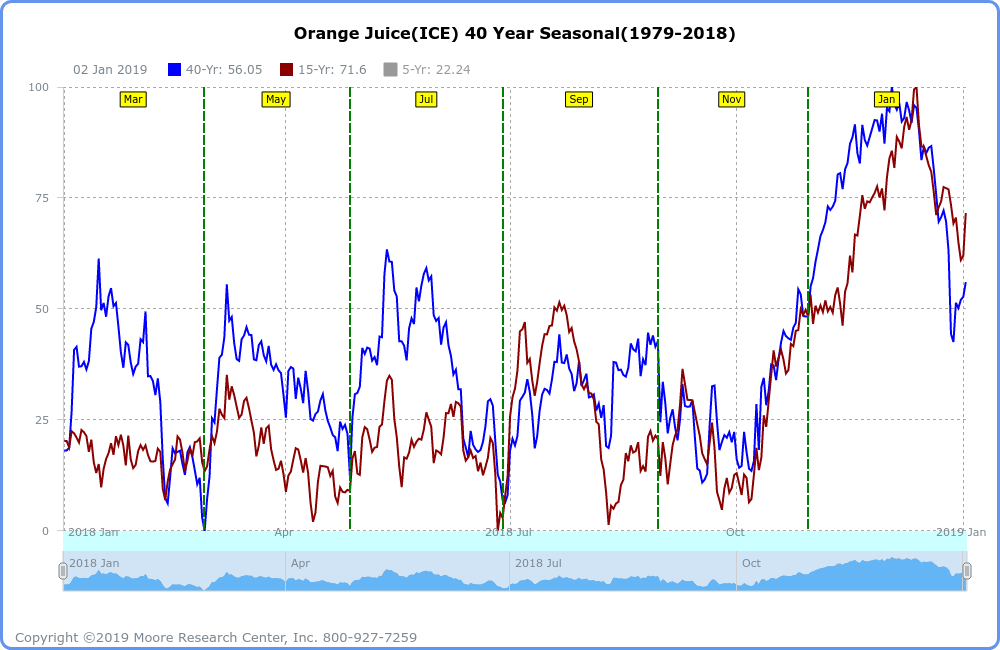

By hayman - Feb. 6, 2019, 10:31 p.m.

https://commodityseasonality.com/softs/

https://www.mrci.com/client/spmarket/jod.php

For the latest on the hurricane:

https://www.marketforum.com/forum/topic/37474/

And latest weather, including rain amounts in FL:

The OJ market did gap higher on the open at 109.55-Nov but filled the gap, made new highs at 110.00 and has since dropped down to 107.80, the lows and is now just above that and a bit above unch for the day.

Volume for today in this lightly trade commodity is still just under 1,000 contracts.

My take is that the OJ has completely dialed in the hurricane risk premium based on the latest 140 mph forecast aimed into OJ country and the fact that we can't go any higher on a more bullish forecast, suggests a buying exhaustion. We are 10c higher than the price was a week ago today.

This is not a huge hurricane as far as size, like Irma was for instance, so the path/area with damage might not be massive.

However, the track and winds still make for the potential for VERY significant damage.

There's an outside chance for enough damage for us to be limit up when OJ opens on Tuesday morning..............as well as damage reports to be less than expected and a lower price.

What often happens is that theres enough damage and video/news stories/reports over the weekend to cause OJ to open higher on Tuesday, then it crashes lower because the market has completely traded it...............and there is no more bullish news ahead to feed the bulls and it collapses lower.

Uncertainty over how bad it MIGHT or possibly could get right now has an no upper end potential and is supportibe.

Certainty after the event, unless its MUCH worse than even high end estimates, allows aggressive sellers to feel more comfortable ascertaining upside risk and buyers usually don't keep buying when all the bullish news is completely out on a weather event that's in the rear view window,

But its early. I would not want to be short OJ over the long weekend in case this hurricane got even stronger and obliterated a huge path of trees. There's actually a chance of that, which makes me a bit surprised that we just traded back to the lows, made new lows barely and are a tad lower for the day.

One should note too, that the US is not #1 in production anymore. Brazil has had those honors for over a decade(Sao Paolo)

A key area of support for the Nov is 106, bottom of the gap higher yesterday.

I would be surprised if we drop below that today in the absence of a sudden change to the forecast in the next 3 hours...........very unlikely.

If there is less/minor damage over the weekend, we will gap BELOW that and it will be an island gap reversal, that stays...........a very powerful negative chart formation.

OJ is getting hit pretty hard and down near the bottom of the Thursday morning gap.

OK, we spiked below the top of the Thursday morning gap but didn't quite fill it with the volume picking up on this selling surge.

Clearly, the 2nd gap higher on the open getting filled this Friday morning was a gap and crap negative price formation and we aren't waiting around until Tuesday morning to fill this gap farther down from Thursday mornings open.

Surprised at how weak the price has been though, down over 2c.

Obviously 10c of hurricane premium was too much according to the market.

Latest NHC forecast seems unchanged but there could be some less bullish models that are causing this pressure on OJ.

OK, the US model definitely had the hurricane going farther north, which means less OJ country hit by the most damaging front/right side of the cane and more on the back/left side(which will be to the west/southwest of it track).

Also, the track, instead of going right across the state of Florida from east to west, now is more along and up the east coast of FL, with the weaker, left/backside over Orange country.

I would be VERY surprised if we can keep going too much lower because the intensity of this hurricane and threat is still there despite the much less damaging track.

Need to drop to 105.20 Nov to fill the gap. Been down to 105.40.

OJ market is telling us the threat has diminished greatly with the latest track.

GAP AND CRAP TECHNICAL FORMATION DEFINED

Breakaway upside gap from earlier this week in OJ on Thursday Morning because of the elevated risk from the stronger hurricane taking a more damaging path..............HAS JUST BEEN FILLED entirely from the latest forecasts showing a farther north track, leaving most of OJ country to the left/west of the strongest winds.

This is a very negative, buying exhaustion price formation. Initially, the market gaps above the previous days high on the next days open, leaving a gap in prices that were never traded between those previous days highs and the new days lows. This happens because of some powerful force affecting market/trader mentality while the market was closed that caused the bulls to get much more aggressive with buy orders and bears to pull back or be overwhelmed with BUY orders ABOVE the previous days high.

When that gap is open, it is often a breakaway gap, signaling even higher prices as the new force that caused it remains. If that gap is filled and prices return to the previous, lower range, it can be quite bearish...........usually only happens when the bullish force pushing the buying goes away. At that point, the exuberant buying has been exhausted and everybody buying on the most bullish news yet, has bought already and there's nobody left to keep buying and sellers actually have to push the market lower to attract buyers at lower prices.............BELOW the gap.

Ensembles also a bit farther north but still have the track across the peninsula from east to west.........on the mean(which a wide spread)

Been down to 104.50.

Wow, hurricane premium sure can come out fast, even faster than it went in when the threat drops.

Down over 5c from the highs during the first hour of trading(when the threat was highest)

OJ traded all the way down to `103.20, almost 7c below the highs that occurred in very early trading, (when Dorian posed the greatest threat on weather models that it showed in the last week )then bounced back to over 105 near the close and finished 104.60.

OJ is very thinly traded(sometimes less than 1,000 contracts in a day) but today the November OJ spiked to a record(for that contract) 4,000 contracts.

This makes it prone to price gyrations which other markets don't see as often.......like gaps higher or lower on a hurricane or freeze forecast(actually, natural gas has high volumes and this happens alot on Sunday Night)

As expected from the weather an hurricane page comments, OJ crashed lower after the open. Was shocked that we opened as high as we did, only down a bit before dropping 5c in a flash.

No damage coming to the orange crop obviously.

More later when I get a chance.