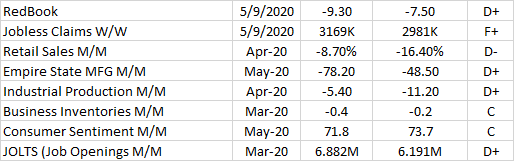

Another week with no real surprises.

Retail is showing the worst numbers I've ever seen.

Jobless claims came in at below 3,000,000. I honestly never thought I'd say something like that. It's about 10 times a "normal" rate.

MFG/Production are in the basement. Boeing is retiring the 777 line to save money.

Wholesalers continue to trim inventories.

For the 1st time in my life, job openings are totally eclipsed by unemployment.

In spite of all this, Consumer Sentiment is up nearly 2%, but still at historical lows.

Call me an eternal optimist, but I expect some improvement in the near term. Can't give the week better than a D+ though.

Thanks very much Tim!

How long have you been doing this Week in Review?

I was wondering, since these are such unprecedented, mind bobbling numbers, what goes thru your head when you analyze them?

There is unprecedented uncertainty about many things right now, especially the economy. I think your Week in Review helps us to understand where we are right now.

I've been watching these numbers for decades but started Week in Review somewhere after the last recession, (2009/2010?) largely because everyone was all doom and gloom while I was seeing signs of life in the data. Seemed the easiest way to communicate what I was seeing was to put the numbers into some kind of format, and the Week in Review was born <G>

It became a habit that I got out of a few years ago... I will keep doing it, at least until things approach normal, then we'll see. But I am hoping, once again, it will show positive indications long before they become apparent.

And no, never have I Seen anything approaching the economic devastation I am seeing now, I suppose, had I been doing this around the time of the great depression, I'd have something to compare. I really hope I don't get 1st hand knowledge of a depression, and in my mind at least, I won't this time.

M2 is increasing at a faster rate then I have ever seen in my life. This points to a very strong economy in the immediate future (2 to 3 more months from now).

Thanks very much Tim

I watch the numbers to se if there might be some life in manufacturing.

Looks sort of grim at the moment for us

Hi Richard

Hard to believe their is money and easily converted assets to money, sitting around not being used with unemployment so high

With int rates so low, are people waiting to buy equities, if the Fed goes into equities

The treasury has a huge amount of bills they have to sell, this month, or next [not sure which month] to support all this stimulas spending. The Fed will have to back stop the treasury, so investors are wondering what will happen

I don't pretend to understand so I offer no ideas

It did cross my mind if this M2 money went into consumer goods then could there be inflation with surplus money chasing a shortage of some goods

Food looks like a shortage developing but it will take more than food prices to cause inflation, especially with oil so cheap. One expense off sets the other in a house hold budget, so hard to see inflation happening, unless Trump decides to severe all trade with china.

Of coarse M2 could be higher because people are not paying rent, but need to keep that money on hand for the day when they have to catch up on rent, mortgages etc. Plus people got a big shot of money injected, into their bank acct with the stimulas money. I dunno, just wondering where this M2 money came from

Any ideas Richard???

This last bill being considered but by no means passed into law gives tenants up to 12 months free rent, so land lords get no revenue and tenants get a 12 month holiday from paying rent

Not sure what is in the bill for mortgage payments for the land lord, but real estate may take a big hit, if land lords have to make payments with no revenue

Over 1/2 of all real estate [1-4 units/complex] is owned by mom and pop owners. Instead of investing in a retirement acct. these people invest in houses etc., do most of the repairs and upkeep themselves and hope the appreciation in value equals a retirement fund plus a revenue stream to supplement old age security cheques

Now that rent might not be paid that would add up to a lot of M2 money, just sitting in a bank acct.

I dunno, just guessing. These are different times so nobody has any thing to compare, even the depression as Tim said. During the depression my family told me money just seemed to disappear, not increase as Richard tells us, is happening today. Very strange to say the least, if one wants to compare anything like the depression.

Keep up the good work Tim and we will add our 2 cents from time to time. Really appreciate your commentary on what you see.

Give me a couple more weeks and I am sure I'll have some better ideas as too what the fed is doing. very crazy world and I think it will get crazier before it gets better.

One thing I'd like to mention... For years, when I was doing the Week in Review, I was accused of being an "easy grader". I'd give an employment situation with a net 100k job loss a C-, or maybe a D+.. Things like that. I was told they deserved worse, maybe an F.

Had I done that, how would I grade numbers like these?

TN, appreciate all the (non-compensated) time and effort you put in on this. Keep up the good work.

Good point Tim.

I mentioned that a couple of weeks ago about grading in the real world.

If an F, is anything below 60%, then when somebody only sees the grade, they don't know if the student got an 59% or a 0% F.

So the range for F is actually 59% but for the other grades, it's basically a 10% range.

I suppose, if you had used F back then, you could have introduced an F- and F--.

Actually, considering some of the economic numbers, one could make a case now but I am thrilled with everything exactly how you do it and very grateful for the big positive contribution that it makes to our forum.