By Karen Braun

ACREAGE LIFT

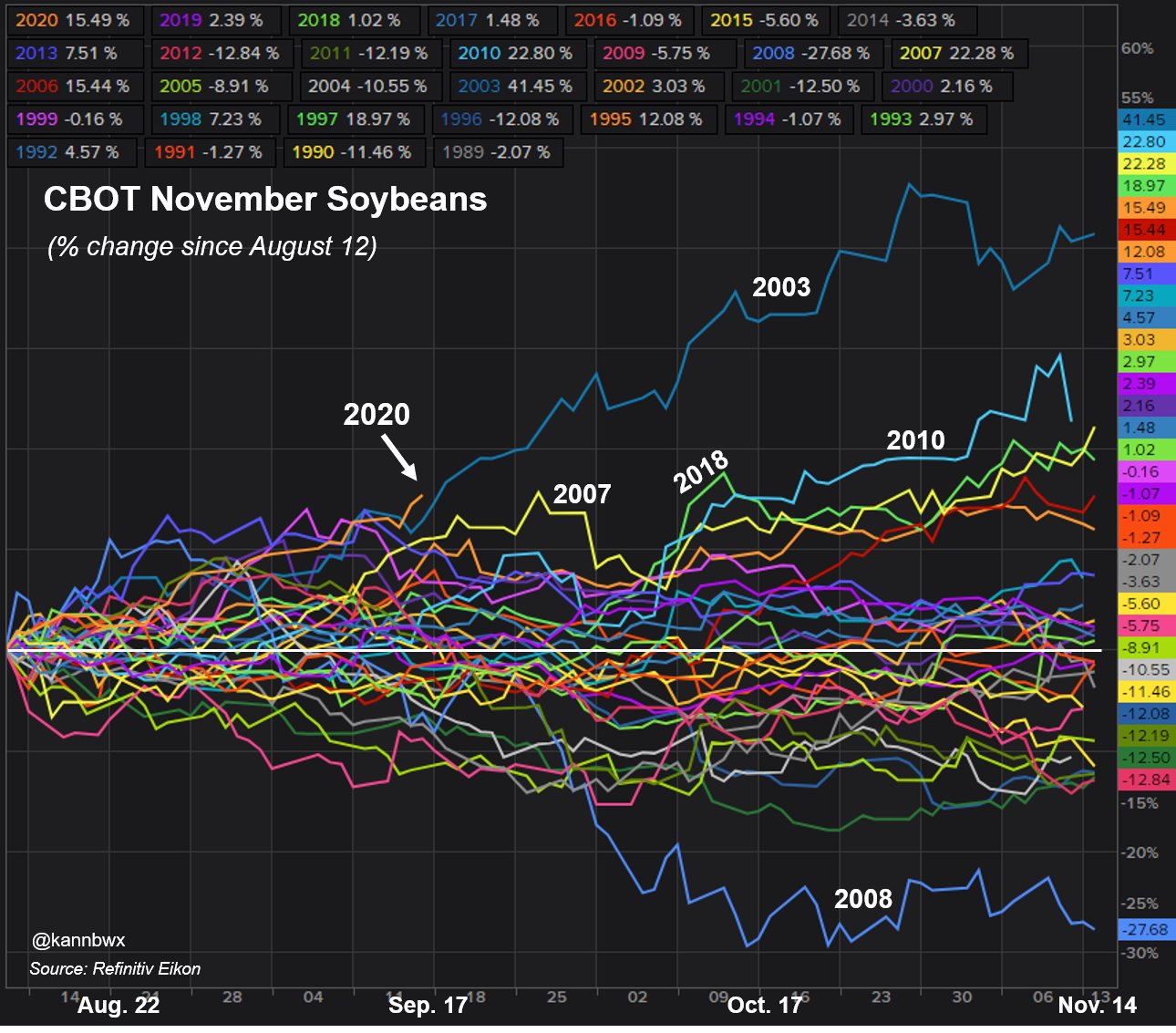

There is plenty of time for things to change, but as it stands, the ratio of new-crop 2021 CBOT soybeans to corn favors soybean plantings next spring by the largest degree in three years. That ratio indicates relative profitability among the two crops and is a decent predictor of acreage shifts long before planting begins.

The 2021 ratio finished at an all-time high of 2.49 on Wednesday, while the 2020 ratio ended at 2.72, close to the early August top of 2.75. Traditionally, values of 2.5 and above distinctly favor soybeans and those below 2.3 favor corn. (tmsnrt.rs/2Rxu5rR)

Next year’s ratio is the strongest for the date in three years, though below that of four years ago. High implied soybean profitability in late 2016 to early 2017 and late 2017 to early 2018 led to record U.S. acreage of the oilseed in 2017 and 2018.

A Farm Futures magazine survey this week indicated 2021 U.S. soybean plantings at 87.9 million acres and corn at 91.8 million. That survey was taken July 14-27, when the new-crop ratio was elevated though less so than now, so the recent price action would increasingly support the outlook.

That soy acreage would be the third-largest behind 2017 and 2018 and would be a 5% increase on the year. In 2017, soy acres rose 8% from what had been a record in 2016, reaching 90.2 million. Area dropped 1% in 2018 to 89.2 million acres, though that was still well above any pre-2017 level.

The idea of a strong 2021 soy acreage boost has additional support in the fact that 2020 soy acres surprised the market to the low side more than once, and supplies will likely be lower than originally thought due to a smaller harvest and strong demand.