Please continue with coffee discussions here that were going on at this old thread;

https://marketforum.com/forum/topic/60535/

------------------------------------------------------------------------------------------------------

North Central Vietnam has already been hit by 4 named tropical cyclones just since October: Linfa, Ofal, Molave, and Goni, which have lead to massive flooding.

Source: https://en.wikipedia.org/wiki/2020_Pacific_typhoon_season

But this evening, TS Etau is doing something different as it is landfalling further south in south Central Vietnam. What's the significance of this for coffee? That's where the heart of it is:

So, the other 4 storms had the bulk of their impact north of most of the main Robusta. But TS Etau was aiming right for the heart of it per this radar loop from ~6 hours ago:

Here's the forecast track from when it was still offshore, which takes it all the way through the heart of Robusta territory tonight and tomorrow:

The expected main effect from Etau is very heavy rain, not wind. Though they have yet to be hit headon by any tropical system this season with the heaviest rain north of there, even the main Robusta areas have still had above to well above normal rainfall the last 30 days from the outskirts of the other storms as well as the monsoon pattern:

So, heavy rain is the last thing they need now, especially with this being early in the harvest season.

12Z 11/9/20 Euro 48 hour rainfall: worst of it for main Robusta coffee areas PM of Mon 11/9 through AM of Tue 11/10, which is the same as most of the day Tue 11/10 Vietnam time:

As a reminder, NY coffee prices are based on Arabica as opposed to the Robusta basis of the London market. However, there is some correlation between Robusta prices and Arabica prices. So, Arabica is not in a vacuum as regards Robusta.

Thanks Larry!

I will comment more tomorrow hopefully and appreciate you keeping us so informed.

These were closing comments from Monday.

KC is dead today. Hardly any price movement.

+++++++++++++++++++++++++++++++++++++

https://www.barchart.com/futures/quotes/KC*0/futures-prices

Coffee Prices Settle Slightly Lower on Forecasts for Rain in Brazil by Barchart - Mon Nov 9, 2:01PM CST

Dec arabica coffee (KCZ20) on Monday closed down -0.10 (-0.09%). Jan ICE Robusta coffee (RMF21) closed down -3 (-0.22%).

Coffee prices on Monday settled slightly lower. Arabica coffee fell back from a 3-week high after Rural Clima forecasted as much as 50 mm of rain for Brazil’s coffee-growing areas this week.

Arabica initially rose to a 3-week high Monday on recent dryness in Brazil's coffee-growing regions. Data from Somar Meteorologia on Monday showed rain in Minas Gerais, Brazil's largest arabica coffee-growing region, measured 8.2 mm last week, or only 19% of the historical average. Coffee growing areas of Minas Gerais have faced above-average temperatures and a lack of significant rain in the past five months, which has depleted soil moisture levels and water resources for irrigation. The U.S. Climate Prediction Center on Sep 24 said a La Nina weather pattern has emerged in the Pacific Ocean, which could lead to below-average precipitation in Brazil in Q4.

I see your point on the importance of Vietnam!(and am learning a few things........thanks much)

https://en.wikipedia.org/wiki/List_of_countries_by_coffee_production

This map shows areas of coffee cultivation by type of coffee:

r: Coffea canephora (also known as robusta)

m: Both Coffea canephora (robusta) and Coffea arabica (arabica)

a: Coffea arabica

| Rank | Country | 60 kilogram bags | Metric Tons | Pounds |

|---|---|---|---|---|

| 1 | 44,200,000 | 2,652,000 | 5,714,381,000 | |

| 2 | 27,500,000 | 1,650,000 | 3,637,627,000 | |

| 3 | 13,500,000 | 810,000 | 1,785,744,000 | |

| 4 | 11,000,000 | 660,000 | 1,455,050,000 | |

| 5 | 6,400,000 | 384,000 | 846,575,000 | |

| 6 | 5,800,000 | 348,000 | 767,208,000 | |

| 7 | 5,800,000 | 348,000 | 767,208,000 | |

| 8 | 4,800,000 | 288,000 | 634,931,000 | |

| 9 | 3,900,000 | 234,000 | 515,881,000 | |

| 10 | 3,400,000 | 204,000 | 449,743,000 | |

| 11 | 3,200,000 | 192,000 | 423,287,000 | |

| 12 | 2,200,000 | 132,000 | 291,010,000 | |

| 13 | 1,947,000 | 116,820 | 257,544,000 | |

| 14 | 1,800,000 | 108,000 | 238,099,000 | |

| 15 | 1,492,000 | 89,520 | 197,357,000 |

You're welcome, Mike. I've learned a whole lot about coffee outside of Brazil, myself, the last couple of weeks.

It is like deja vu all over again! Invest 98L, now in the E Car., was designated today. Unfortunately, with it headed toward some of the warmest waters in the world, the W Car., this is liable to end up another hurricane, possibly very strong. Even more unfortunately, models are strongly hinting that this could early next week be another hit on C Amer, much of which is still only in an early recovery phase from the devastating Eta.

Regarding the potential threat of Invest 98L to C Amer, very heavy rains rather than wind would likely be the biggest overall danger by far (including to coffee) just as was the case with Eta's hit on C Amer last week and Etau's hit on south central Vietnam earlier today.

I'm educatedly guessing that Invest 98's recent designation was the main cause for NY to finish so strongly today after earlier weakness. This is despite decent S MG/E SP rains the last two days, which I estimate averaged ~2/3" with most getting 1/2"-1" with possibly some more in some spots this evening. Also, more good rains remain on the models for the next ~8 days though all of this rain is likely already dialed in as it has been modeled for many days. (After 8 days, the models do suggest there could be another dry period though I'm getting on a tangent about a more speculative period since it is further out.)

For those who don't know this, the C Amer/Mexican coffee is almost all Arabica and adds to ~16% of the worldwide Arabica (what NY trades). In contrast, the Vietnam crop is almost all Robusta, which is what London trades. Regardless, they are loosely correlated as one would expect since they are both coffee.

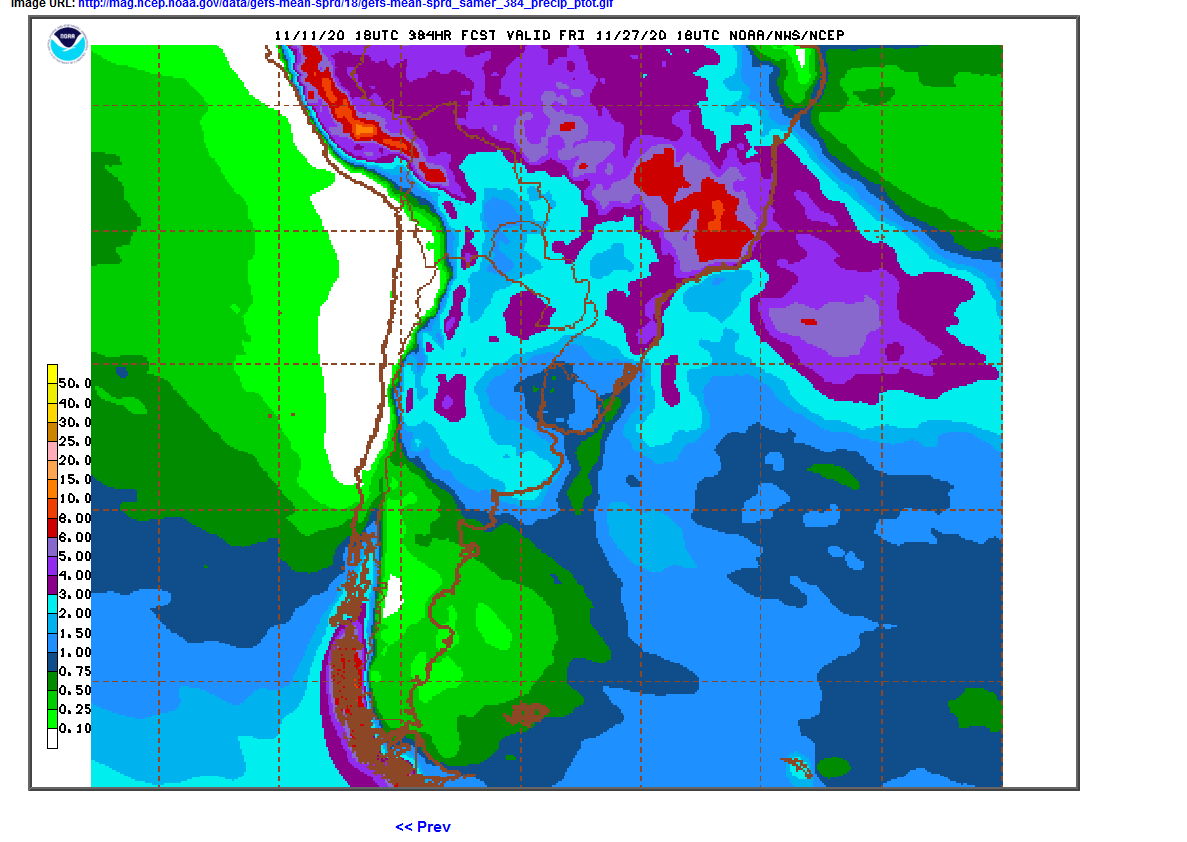

The 12Z Euro moves 98L W to the SW Caribbean early next week and then takes 98L SW all the way through Nicaragua and into the E Pac, where it keeps moving SW! I'm guessing this SW movement all the way well out into the E Pac is overdone similarly to how much it overdid it with Eta at this forecast stage. But who knows? Regardless, look at how much rainfall it puts out over Central America, especially over Nicaragua (12-24" over a substantial part of the country), far W Honduras/far E Guatemala (8-12" over an area that just had historic flooding from Eta that was in some cases even worse than Mitch thanks largely to already very wet soils), and a large portion of N Honduras (8-12"). Hopefully this is overdone, but regardless, it presents a new risk to the market especially since this would be coming on the heels of Eta:

12Z Euro ens at 180 looks scary:

South central Vietnam main coffee areas per this map got mainly 3-5" of totally un-needed and harvest hampering rains from TS Etau the prior 2 days. I suspect there were some higher amounts in the higher elevations of coffee that don't show on here:

Thanks Larry!

Would love to see the rain amounts dry up from the south but it still looks too wet.

Dec arabica coffee (KCZ20) on Wednesday closed up +1.80 (+1.68%). Jan ICE Robusta coffee (RMF21) closed up +27 (+1.98%).

Coffee prices on Wednesday rallied sharply, with arabica at a 3-1/2 week high and robusta at a 1-1/2 month high. Adverse weather in Brazil and Vietnam has sparked coffee crop concerns and has boosted coffee prices.

Arabica on Wednesday rallied to a 3-1/2 week high on recent dryness in Brazil's coffee-growing regions. Data from Somar Meteorologia on Monday showed rain in Minas Gerais, Brazil's largest arabica coffee-growing region, measured 8.2 mm last week, or only 19% of the historical average. Coffee growing areas of Minas Gerais have faced above-average temperatures and a lack of significant rain in the past five months, which has depleted soil moisture levels and water resources for irrigation. The U.S. Climate Prediction Center on Sep 24 said a La Nina weather pattern has emerged in the Pacific Ocean, which could lead to below-average precipitation in Brazil in Q4.

Robusta coffee on Wednesday climbed to a 1-1/2 month high on crop concerns in Vietnam. The National Weather Agency in Vietnam said that Vietnam's Central Highlands, the country's major coffee-growing region, might receive as much as 100-250 mm of rain Tuesday and Wednesday from the remnants of Tropical Storm Etau, which could flood the region's coffee farms and reduce coffee yields. Typhoon Molave late last month slammed into Vietnam, the world's largest producer of robusta coffee, and damaged crops and infrastructure in the Central Highlands of Vietnam, which will delay Vietnam's coffee harvest.

A La Nina weather system is prolonging the rainy season in Vietnam's Central Highlands. The rainy season in the Central Highlands usually ends in the first week of November, but according to the Buon Ma Thuot Coffee Association, the La Nina weather pattern's influence may prolong the rainy season until the end of November. The USDA's Foreign Agricultural Service (FAS) on June 10 forecasted that Vietnam's 2020/21 coffee production would fall -3.5% y/y to 30.2 mln bags.

Wednesday's data from CeCafe was negative for coffee prices as it showed Brazil Oct green coffee exports jumped +14.4% y/y to 3.8 mln bags.

Surging Covid infections throughout the world have prompted governments to impose new restrictions that have curbed coffee consumption. The Covid virus has now infected 51.974 million persons globally, with deaths exceeding 1.282 million.

Coffee inventories have rebounded recently, which is bearish for prices. ICE-monitored arabica coffee inventories rose to a 2-1/4 month high of 1.186 mln bags on Tuesday, recovering from the 20-1/2 year low of 1.096 mln bags on Oct 5. Also, ICE-monitored robusta coffee inventories climbed to a 5-3/4 month high Tuesday after they fell to a 1-3/4 year low of 10,808 lots on Oct 14.

For the first time this spring, I can finally report on pretty widespread generous rainfall in the prime S MG/Mogiana region of Brazil. The last time I reported was for the period Oct 1-Nov 7, during which time average rainfall in that region was well below normal. And the first week of November, alone, had had an average of only 0.63" as per the table I had posted.

However, for the period 11/8-11, an average of a whopping 1.80" fell for the 7 stations I'm following. 1.44" of this was just from 11/10-11, likely the wettest 2 day period so far this season. That brings 11/1-11 to 2.43" (62 mm) average, which is actually near normal for those 11 days, alone, and is slightly more than the 2.06" (52 mm) for the entire month of Oct:

Rain (mm)

| Municipalities | 11/11/20 | 10/11/20 | 09/11/20 | 08/11/20 | Monthly Cumulative | Monthly History |

| Alfenas | 7,6 | 13,2 | 0,4 | 0,0 | 50,6 | 182,6 |

| Alpinopolis | 24,2 | 1,6 | 0,0 | 9,2 | 50,4 | |

| Cape Verde | 27,8 | 39,6 | 2,6 | 0,0 | 90,8 | 209,4 |

| Caconde | 15,4 | 16,2 | 8,8 | 0,0 | 50,8 | 244,8 |

| General Fields | 7,0 | 12,4 | 0,0 | 0,0 | 25,2 | 247,5 |

| Carmo of the Claro River | 15,0 | 4,2 | 0,0 | 2,2 | 54,0 | 222,0 |

| Coromandel | 0,0 | 0,0 | 0,0 | 0,0 | 1,8 | 264,7 |

| Guaxupé | 44.8 | 14,0 | 21,0 | 0,0 | 61,0 | 197,9 |

| Mount Carmel | 0,0 | 0,0 | 0,0 | 0,0 | 12,8 | 250,8 |

| Monte Santo de Minas | 21,6 | 19,8 | 14,8 | 0,0 | 63,8 | 191,6 |

Source: Sismet Cooxupé

What do I think this means for the new crop? As I had said, any generous rain this month would be beneficial. However, what I also said is that it is my belief that the ceiling on potential had already likely been reduced substantially due to the mainly dry April-Nov 7th as well as the relentless intense heat of Sep 25-Oct 7. But I'm guessing that consistent generous rains from this point forward would stop that ceiling from falling much further though it may not matter too much at this point if that ceiling is already low.

Any other opinions about how much future rainfall can still help?

Thanks for that report Larry!

I've wanted to mention this for a couple of weeks now but just keep forgetting.

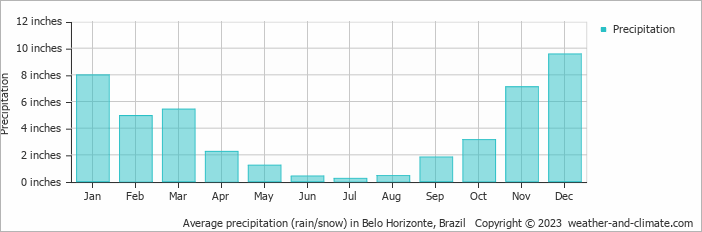

Regarding the very positive seasonals for coffee at this time of year. This also coincides with the big increase in rains that happens almost every year, starting in October and really increasing in November/December as the rainy season picks up.

A ton of rain is bearish for coffee but yet the typical Spring with increasing rains also features increasing prices.

I recall numerous years, when the first couple of rains in Sept/Oct are bearish and cause coffee prices to drop ahead of them but then, even near perfect weather can't keep coffee from going higher. Long dry spells are unusual and especially bullish from now on but not needed for KC to go higher.

After a long dry spell and sharp spike higher, the increase in rains will cause a drop in prices.

This is the mean monthly precipitation over the year, including rain, snow, hail etc.

Show average precipitation in Belo Horizonte in Millimeter »

* Data from weather station: Belo Horizonte, Brazil.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Seasonal below. Big up from Oct thru December......even in many bearish/rainy years.

Still looks like mostly bearish weather for coffeeland in Brazil...........but that might not be able to stop prices from fulfilling their seasonal move up.

Ideally, we could turn drier again in some of the key growing areas so the weather and seasonal would be in phase/sync but thats not the forecast right now.

Barchart Thu Nov 12, 2:05PM CST

Dec arabica coffee (KCZ20) on Thursday closed up +1.00 (+0.92%). Jan ICE Robusta coffee (RMF21) closed up +20 (+1.44%).

Coffee prices on Thursday settled moderately higher with arabica at a 3-1/2 week high and robusta at a 1-3/4 month high. Dryness in Brazil and storms in Vietnam have sparked coffee crop concerns and boosted coffee prices.

Tropics 10/29+

Started by WxFollower - Oct. 29, 2020, 8:25 p.m.

https://www.marketforum.com/forum/topic/60533/

Almost Iota to become a cat. 2 hurricane in the Caribbean then hit C.America.

https://www.nhc.noaa.gov/refresh/graphics_at1+shtml/155412.shtml?3-daynl

the system has the potential to produce 20 to 30 inches of rain with a focus across northern Nicaragua and Honduras.

Look at what most of Honduras, NE Nicaragua, N Guatemala, S Belize, and SE MX are facing less than 2 weeks after Eta left the scene. As bad as Eta was (worst since Mitch with even higher rivers than Mitch in at least NW Honduras due to already very wet soils), getting another that soon is hard to fathom and could very well place 2020 in unchartered territory for flooding in some of those areas, especially N Honduras, NE Nicaragua, and C Guatemala. I fear the worst coming out of this..so prayers that the vulnerable can get to safety in time are recommended:

Look at what most of Honduras, NE Nicaragua, N Guatemala, S Belize, and SE MX are facing less than 2 weeks after Eta left the scene. As bad as Eta was (worst since Mitch with even higher rivers than Mitch in at least NW Honduras due to already very wet soils), getting another that soon is hard to fathom and could very well place 2020 in unchartered territory for flooding in some of those areas, especially N Honduras, NE Nicaragua, and C Guatemala. I fear the worst coming out of this..so prayers that the vulnerable can get to safety in time are recommended:

Coffee taking off today because of Iota.

Great call over the weekend Larry!

https://www.marketforum.com/forum/topic/60533/

"Iota has roared up to a 160 mph major hurricane and is going to clobber some of the same areas that were hit by Eta just over 2 weeks ago.

Nicaragua and Honduras WILL BE hit especially hard."

https://www.nhc.noaa.gov/refresh/graphics_at1+shtml/155412.shtml?3-daynl

Arabica Coffee Rallies Sharply on Dryness in Brazil and Threats to Central American Crops from Hurricane Iota by Barchart - Mon Nov 16, 2:09PM CST

Dec arabica coffee (KCZ20) on Monday closed up +6.40 (+5.86%). Jan ICE Robusta coffee (RMF21) closed up +30 (+2.13%).

Coffee prices on Monday surged on fund buying, with arabica at a 2-month high and robusta at a new 1-3/4 month high. Dry conditions in Brazil are bullish for coffee prices, along with concern that Hurricane Iota will slam into Central America and damage that region's coffee crops.

Arabica coffee has support from recent dryness in Brazil's coffee-growing regions. Somar Meteorologia reported on Monday that rain in Minas Gerais, Brazil's largest arabica coffee-growing region, measured 44.3 mm last week, or just 87% of the historical average. Coffee growing areas of Minas Gerais have faced above-average temperatures and a lack of significant rain in the past six months, which has depleted soil moisture levels and water resources for irrigation.

Mike said:

"Coffee taking off today because of Iota.

Great call over the weekend Larry!"

---------------------------------------------------------

Thanks, Mike. March KC rose 5.8% yesterday, which was the largest daily gain since July 22nd.

Now the question is how much damage ends up occurring due to the combo of these two storms. I still haven't seen any estimates from Eta. My guess based on them having the worst flooding is that the Honduras and Guatemala crops were hit the hardest from Eta. I'm guessing the Nicaragua main KC area was hit harder by Iota than by Eta based on supposedly heavier rains and also some wind damage as winds stayed higher much further inland /closer to the main KC area (it is still 60 mph TS as of the brand new update and Eta was only 35 mph in the same area due to slower speed.) So, potentially all 3 had significant damage from Iota. These 3 produce ~11 mb Arabica in total or 10% of the world's Arabica. So, what % of this 11 mb will end up damaged? And it isn't just about direct coffee damage. It is also about the damage to roads preventing transporting the coffee to market in a timely manner as well as some deterioration of the crop waiting to be harvested.

Thank Larry!

https://www.barchart.com/futures/quotes/KC*0/futures-prices

Dec arabica coffee prices extended Monday's sharp rally of +5.9% to post a new 2-month high and closed the day moderately higher. Coffee prices this week have rallied sharply on concerns about coffee crop damage as Hurricane Iota on Monday slammed into Central America as a Category 5 hurricane, the strongest this season. Very heavy rain from the storm is expected to damage coffee crops. The same region is just recovering from Hurricane Eta two weeks ago that devastated Central America with floods and landslides.

Coffee prices received some support from Monday's news that U.S. green coffee inventories in October fell -15% y/y to 6.14 million bags, according to the Green Coffee Association.

Arabica coffee has support from recent dryness in Brazil's coffee-growing regions.

metmike: Looks like coffee is trying to break out above the 115.00 strong resistance that held it down in late September, when it tried to bounce after a 25c plunge from the early September spike higher on drought concerns (from 135 to 110).

We closed on the highs around 116.50 which is always a good sign. Maybe we will gap higher on Wednesday?

Mike, you're welcome. The 9.5% rise over the last 3 days combined is the largest rise for any 3 day period for the most active month since March.

Major profit taking today after the fastest rise in many months Mon-Wed. I doubt that anything changed in the fundamental picture today vs yesterday. I already noted the beneficial S MG/E SP November rains that got started in a big way Nov 8-11 and they have continued since to bring Nov to at least near normal overall for Nov MTD for that area. Nov 17-19 were quite wet. But the damage from the intense heat/drought before that is already done and can't be undone thus meaning the ceiling on the new crop size had already been lowered substantially. Also, the unknown amount of damage in Central America didn't disappear overnight.

Even at the low of today, KC was still 12 cents above the October lows!

Thanks Larry,

I was just getting ready to comment on KC's massive plunge today.

It happened so fast, that it looked like some sort of news.

Indeed, Mar KC fell from 121.70 at 10:35 AM EST to 117.50 at 10:37 AM EST!! That sounds like it could have been largely from one big seller that also triggered stops as well as other traders who got spooked and decided to cover. As you know, whenever there's a very sharp move in one direction, just the mere act of profit taking can cause a sharp move the other way (i.e., not necessarily the start of a new trend the other way).

Mar KC rose a whopping 19.5% in 10 sessions from the low of 11/4 (104.85) to the high of 11/18 (124.30)!

Weakness in the Brazilian Real vs the Dollar was noted as a reason for the drop, but it is not that much weaker and it is still much stronger than it was on Nov 4th. From Nov 4th through the low of today, the Dollar to Real ratio fell a whopping 8% (bullish). Yes, it has risen a decent amount since today's low of 2% but even that is still 6% below that of Nov 4th. I could see this as a factor in profit taking and even some new shorting, but unless this is the start of a new longer term weakening, I doubt this alone would cause a new longer term bearish trend.

I agree but have no idea where we go now.....

Unless it turns drier in Brazil. Then we go up more.

I’ve noted the strong up seasonal for coffee in November and that by itself keeps me from shorting unless weather goes from bullish (with a spike higher)to bearish suddenly.

That would not apply here.

It would be interesting/useful to have accurate information on current flowering and potential for more, if any with additional rains.

Mar arabica coffee (KCH21) on Friday closed down -5.15 (-4.18%), and Jan ICE Robusta coffee (RMF21) closed down -5 (-0.36%).

Coffee prices on Friday retreated, with robusta falling to a 1-week low. A rebound in coffee inventories was negative for coffee prices. ICE-monitored arabica coffee inventories rose to a 2-1/2 month high of 1.236 mln bags on Friday, recovering from the 20-year low of 1.096 mln bags posted on Oct 5. Also, ICE-monitored robusta coffee inventories climbed to a 6-1/2 month high Thursday, rebounding from the 1-3/4 year low of 10,808 lots posted on Oct 14.

Also weighing on coffee prices was Friday's report from the USDA's Foreign Agricultural Service (FAS) forecasting that Brazil's 2020/21 coffee production would climb +14.5% y/y to a record 67.9 mln bags.

Weakness in the Brazilian real is another bearish factor for arabica coffee, as the real fell -1.29% against the dollar on Friday to a 3-session low. The weaker real encourages export selling from Brazil's coffee producers.

Larry,

It's wonderful to have you posting here with your valuable insights and analysis.

You really nailed the move higher by coffee, with the spike higher on Monday ahead of hurricane Iota, a textbook/ideal weather trade.

Thanks, Mike!

"Also weighing on coffee prices was Friday's report from the USDA's Foreign Agricultural Service (FAS) forecasting that Brazil's 2020/21 coffee production would climb +14.5% y/y to a record 67.9 mln bags."

I mentioned earlier that the huge spike lower that started at 9:37 CST had the signature of a news related reaction.,

Not sure what the market was trading before the report but it must have been quite a bit less than that considering recent weather conditions and this last estimate is a record.

Maybe those conditions are not dialed into that estimate but it sure looks like the report must have hit at 9:37 CST and what killed coffee prices today.

I realize that I need to start trading the March contract now too, with December Coffee volume today less than 10,000 contracts and March just over 20,000 lots traded and the disparity will only grow in the days ahead.

Mike said:

"’Also weighing on coffee prices was Friday's report from the USDA's Foreign Agricultural Service (FAS) forecasting that Brazil's 2020/21 coffee production would climb +14.5% y/y to a record 67.9 mln bags.’

I mentioned earlier that the huge spike lower that started at 9:37 CST had the signature of a news related reaction.,

Not sure what the market was trading before the report but it must have been quite a bit less than that considering recent weather conditions and this last estimate is a record.

Maybe those conditions are not dialed into that estimate but it sure looks like the report must have hit at 9:37 CST and what killed coffee prices today.”

——————————————-

Mike,

Thanks but you’re getting crop years mixed up. It can be confusing as one would think 20-21 were the current developing crop that has had major drought to deal with. But actually, the 20-21 crop is the one whose harvest has essentially just been completed. It is a record and almost 68 mb, but that is very old news and was not affected negatively by the Apr-Oct ‘20 drought/heat. For example, this was released way back in June:

https://www.comunicaffe.com/usda-sees-brazil-2020-21-coffee-crop-at-a-record-67-9-million-bags/

It is the “21-22” crop which is now developing, whose ceiling has very likely been sharply reduced, is what is being traded on current wxwise, and is referred to in this:

Yeah, I haven’t traded Dec since Monday. It has been very thinly traded since. The bids/asks were very thin the last 3 or so days.

Fortunately my long exposure to risk was reduced by 90% by Wed as I sold my long exposure (contracts Mon-Tue/calls Wed) into the big rises of Mon-Wed. I had a few calls still leftover as of Friday that got hit on Fri, but they’re still way above what I paid for them. Actually, instead of selling those last few, I bought back a few more on Fri when I realized that the bulk of the drop was in only a 2 minute period and thus I figured it was an overdone correction with many stops hit, especially considering that the unknown damage in C America did not go away and the sharply lower 2021/22 S MG/E SP crop ceiling is already set. Despite adding back these few calls, my exposure is still light compared to before meaning my overall results this month (which also includes earlier Eta related gains) will end up by far my best ever for KC, even if KC continues down next week and these calls end up expiring worthless (although I doubt I’d let them get close to worthless).

And what’s interesting is that going long this month was the way to go despite good rains finally returning to S MG/E SP 11/8-19 partially because KC was already so cheap with hardly anyone left to do new shorts. Whereas those rains have been beneficial and will keep the ceiling from falling more than it would have already fallen, they won’t reverse the already done damage to 21-22 crop potential plus Cent America damage is new to Nov. In addition, the damage to Vietnam Robusta from way too much rain during early harvest in Oct/Nov has to be somewhat supportive even though KC is Arabica because it pushed up London, which has some correlation to KC. None of these 3 bullish things were priced into KC as of the start of Nov.

Larry,

Yes, Thanks for that needed correction.

I wasn't thinking about that earlier but of course you are correct.

Regardless, do you agree that the bearish USDA report (for the crop this past year)may have been responsible for the sudden spike down?

Congrats on some well deserved (from outstanding analysis) profits.

I would have loaded up on the Monday open except I was helping a new local tv show in ND practice for their debut in December and I'm their first main guest.

The topic? Climate change.

I wanted to be sharp for the interview and couldn't stay up all night babysitting a big position or take a nap later in the day, so I missed the best, extremely high confidence part of the trade.

The zoom signal was messed up much of the Monday practice, so it was wasted but we came back Tuesday with the issues resolved and it went perfect.

Being short natural gas on Monday was the other home run, high confidence trade that I passed on.

But there will be 100 more good trades, a few just as good.

An interesting but dangerous one is in soybeans right now. Volatility is about to go into the stratosphere.

Central Brazil, which still has a drought has a hot, dry period coming up for at least the next 10 days. After that???Over 40% of production could be subjected to this adverse weather.

Mike said:

"Regardless, do you agree that the bearish USDA report (for the crop this past year)may have been responsible for the sudden spike down?"

--------------------------------------------------------------------------------------

You're welcome.

It may have been but it wouldn't make much sense because it is old news as per the article I linked you to from way back on June 1 having the same number. So, it should have been dialed in long ago. Regardless, do you have evidence that this USDA report was released just before 10:35 AM EST? When was it released? Better yet, do you have a link?

I'm still wondering why most of the drop was just within 2 minutes. Was it due to this or some other report or was it due to, say, some big fund suddenly taking still good profits on longs opened, say, a couple of weeks ago? Could it have been due to a fat finger?

-------------------------------------------------

Thanks, Mike! 2020's been very wild due largely to COVID, but lately has been really good thanks mainly to KC and CT, both of which I've posted about. I have rarely ever posted about my trades (or rarely even say if I'm trading at all) and if I do it is almost never in advance. I post about the fundamentals and others can use that info if they wish. Even so, I don't make recommendations. Actually, I'm usually flat, my favorite position, especially when I post about NG.

Thanks for the S tip. I haven't traded S in many years and have no access to it right now. How reliable is SA wx for S or C trading? Is it ever a very dominating factor? If so, what time of year? Aren't we still just in planting season, when dry doesn't yet hurt much?

I hear you talk more about Mato Grasso than any other area. Does Mato wx trump all other regions for S and C now?

Edit: my bad. Please answer the S and C questions in the S & C thread. Don't want to clutter KC thread.

Actually, if you just go to this thread, all the answers are there.

Look it over and ask me additional/follow up questions please.

South America Oct/Nov 2020

45 responses |

Started by metmike - Oct. 1, 2020, 8:35 p.

https://www.marketforum.com/forum/topic/59680/

On the report yesterday, I am not familiar with the release time. Maybe it was something different that you speculated on. It was just a report like reaction to the price, then I read that a bearish report had come out after the close. Just me guessing is all.

Mike,

OK, I found out that that report showing 67.9 mb was released way back on Monday, 11/16/20:

Thanks Larry!

You're welcome. Time for a Nov MTD update of rainfall in the main S MG/E SP region. Unlike October through early Nov, this time the models did much better and verified about right instead of being too wet. As I've been doing, I follow 7 stations that are within this table: Alfenas, Alpinopolis, Cape Verde, Caconde, Carmo, Guaxupe, and Monte Santo:

Average of the 7 stations for 11/1-22: 151 mm or 5.92", which is 74% of the full month's longterm average. However, the forecasts to the end of the month are for only light rain of ~12.5 mm/0.5" on average. This would bring it to only ~80% of normal for the entire November. So, whereas this is much better than Oct, which had an average of only ~40% of normal, only 3 of the 7 are projected to be near normal while 4 are heading to drier than normal with an average of only 60-75% of normal for those 4 for Nov.

So, whereas Nov is going to end up a much closer to normal month vs Oct (and without the very intense heat of early Oct), it still looks to turn out not all that good with 4 of 7 stations still significantly drier than normal. By the way, these 4 drier than normal stations happen to have also been the driest 4 stations vs normal in Oct.: Alpinopolis, Cape Verde, Caconde, and Guaxupe.

Since I already disclosed this, I'm long a few calls. I actually bought more near the lows of Friday after having sold most of them last Wed.

Great stuff!

Looks like to me, that the GFS Ensemble has been taking a bit of rain out of the week 2 Central Brazil forecast on each run.

The Soy area, west of coffee land is especially drier but even farther east, in E.Brazil, it doesn't look quite as wet on some recent runs and rains may be barely making average the next 2 weeks. Is that what you see Larry?

Mike,

I have S MG/E SP drier than normal for days 1-10 and near normal days 11-15 overall on both the 0Z GEFS and 0Z EPS.

There was today a good cent or so cent sell off at about the same time as Friday’s 10:35-7 AM EST plunge, interestingly enough.

Edit: Make that ~1.5 cents on a high volume sell at the identical time that it occurred on Friday, 10:35-7 AM EST! It appears to be from the same large fund.

KC is down today due largely due to a weakening of the Real in relation to the Dollar. It was not a wx related selloff at all.

I don't know why Barchart.com keeps repeating this:

"Also weighing on coffee prices was last Friday's report from the USDA's Foreign Agricultural Service (FAS) forecasting that Brazil's 2020/21 coffee production would climb +14.5% y/y to a record 67.9 mln bags."

As I proved, this was released on a week ago (11/23, not on Friday) and, besides, the crop estimate was unchanged and is very old news! That would be like NG dropping now on bearish injections from way back in spring. This is very poor journalism and yet they keep copying and pasting it into their stories.

-------------------------------------------

I'm still long calls. If this falls much more, I may consider relonging a couple of contracts. But a lot is riding on how the Real does vs the Dollar as that is a leading reason for the drop back combined with profit taking. It clearly isn't wx (which by the way has remained wet in C Amer, is dry in Brazil for 9-10 more days along with lots of heat), worldwide crop condition, etc.

Rich Asplund - Barchart - 3 minutes ago Fri 11/27/20

Mar arabica coffee (KCH21) this morning is up +6.60 (+5.63%), and Jan ICE Robusta coffee (RMF21) is up +3 (+0.21%).

Coffee prices this morning are moving higher, with robusta at a 1-week high. The outlook for reduced coffee production in Brazil has sparked fund buying of coffee futures after Volcafe Ltd projected that Brazil 2021/22 coffee production will fall -33% y/y to 34.2 million bags as Brazil's arabica trees enter the lower-yielding half of a biennial cycle and that losses in coffee output will be exacerbated from excessive dryness in Brazil's coffee-growing regions. Volcafe also projects that the slump in Brazil coffee output will drive the global arabica market into a record -11 mln bag deficit in 2021/22.

----------------------------------------------------------------------------------------------------------------------------------------

Today's rise of 6% was the largest % rise for the most active month since 7/22/20.

With this big rise, I sold the remainder of my KC calls, which included some I had rebought on 11/20 and 11/23 at much cheaper prices than they had been the days before due to the big price drop of 11/20-23. (I assume this was largely due to a combo of profit-taking after such a steep rise the prior 2 weeks and the weaker Brazilian Real vs the Dollar.) This made me flat KC for the first time since I first bought these calls on 11/13. It's not that I don't think it will go higher on Monday. I actually suspect it will based on the close/settle near session highs. But because there's always some uncertainty and because I was able to take a very nice % gain vs what I paid, I decided to play it safe and sell all the calls. My long plays over the last couple of months have been based on a combo of drought/heat in Brazil, the 2 Cent Amer hurricanes, the central Viet Nam typhoons/flooding (a more minor factor since this impacts Robusta prices more directly), and what I thought were cheap prices after the big drop in mid Sept.

My long plays started 9/22 and were mainly quite lousy from then through 10/21. My consistent gains didn't start til late Oct, but they have since way more than made up for the 9/22-10/21 losses.

Thanks VERY much for sharing all that with us Larry. You stuck with it, despite that draw-down for awhile and accurately saw how the weather was going to affect prices on several occasions.............and got rewarded handsomely for it.

This has been one of the best threads ever here for that reason and thanks to you.

https://www.marketforum.com/forum/topic/61563/

We should especially note that you were trading PAST weather which is unusual. Numerous times, you insisted the hot/dry weather we had earlier this year, had already done permanent damage to next years crop that no amount of rain could offset.

This big drop in the production estimate, that caused today's spike higher, confirmed that.

We know that todays move was not because of a dry forecast. As I mentioned previously, at this time of year, KC usually goes up even when there is a ton of rain in the forecast-bearish(which is normal for Nov/Dec).

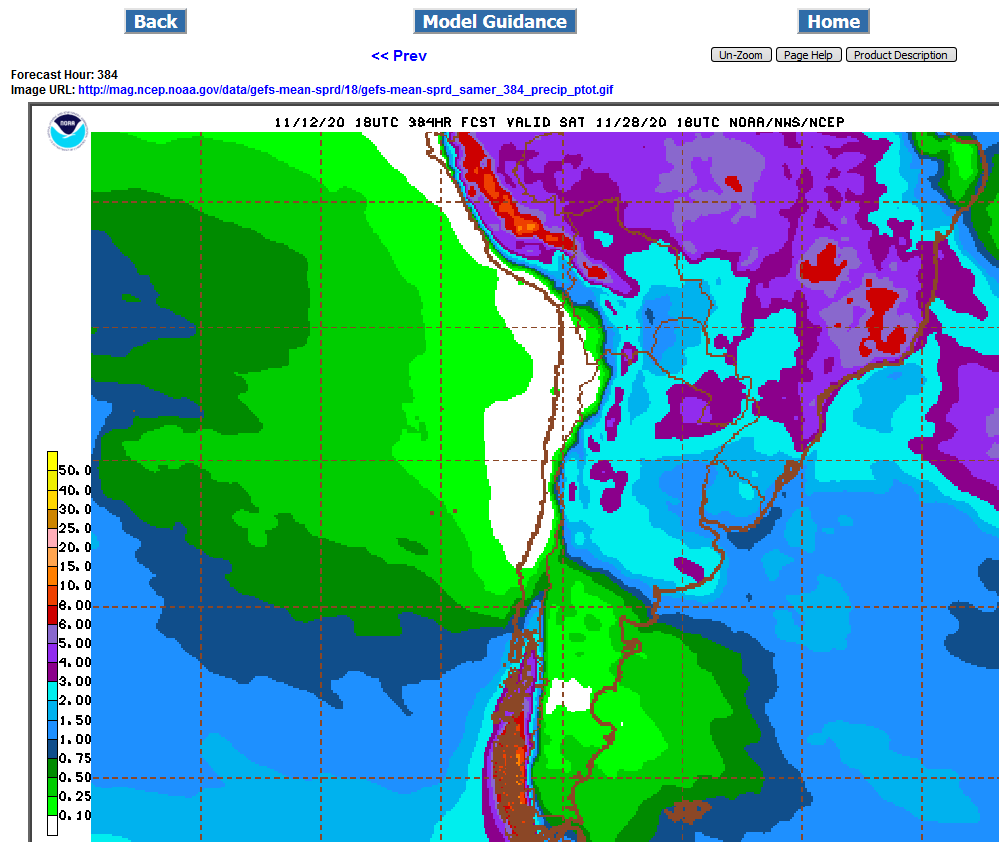

2 week rains below. Only the far west/central areas of Brazil that grow soybeans will have rains below average and most of that is a dry week 1.