Please continue NG posts here. Thanks.

Thanks Larry!

See the previous natural gas discussions here:

NG 11/27/20-12/8/20

54 responses |

Started by WxFollower - Nov. 27, 2020, 1:53 p.m.

Markets Tuesday after the close:

Even with a brief cold blast sneaking back into the December forecast, natural gas futures moved lower again on Tuesday. With a key spread flipping to negative, traders appeared to have closed the book on winter with weeks to go before the first verse of Auld Lang Syne is sung. The January Nymex contract settled…

December 8, 2020

metmike: In a replay from Monday, the European Ensemble came out colder early in the afternoon and gave us a nice bounce early in the afternoon that had held all evening Tuesday.

Milder 0z GFS ensemble at around Midnight is putting some pressure on ng.

This was followed by an even colder European model and the Canadian model earlier-that nobody cares about-was the coldest of them all.

Last weeks EIA: VeryBearish

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Dec 03, 2020 Actual-1B Forecast-12B Previous-18B

U.S. Natural Gas Storage

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 10, 2020 | 10:30 | -1B | |||

| Dec 03, 2020 | 10:30 | -1B | -12B | -18B | |

| Nov 25, 2020 | 12:00 | -18B | -18B | 31B | |

| Nov 19, 2020 | 10:30 | 31B | 15B | 8B | |

| Nov 13, 2020 | 10:30 | 8B | -3B | -36B | |

| Nov 05, 2020 | 10:30 | -36B | -26B | 29B |

for week ending November 27, 2020 | Released: December 3, 2020 at 10:30 a.m. | Next Release: December 10, 2020

-1 BCF BEARISH!

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (11/27/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 11/27/20 | 11/20/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 934 | 934 | 0 | 0 | 892 | 4.7 | 871 | 7.2 | |||||||||||||||||

| Midwest | 1,122 | 1,133 | -11 | -11 | 1,043 | 7.6 | 1,053 | 6.6 | |||||||||||||||||

| Mountain | 240 | 242 | -2 | -2 | 201 | 19.4 | 212 | 13.2 | |||||||||||||||||

| Pacific | 318 | 320 | -2 | -2 | 288 | 10.4 | 311 | 2.3 | |||||||||||||||||

| South Central | 1,326 | 1,312 | 14 | 14 | 1,172 | 13.1 | 1,202 | 10.3 | |||||||||||||||||

| Salt | 368 | 356 | 12 | 12 | 312 | 17.9 | 342 | 7.6 | |||||||||||||||||

| Nonsalt | 958 | 956 | 2 | 2 | 859 | 11.5 | 861 | 11.3 | |||||||||||||||||

| Total | 3,939 | 3,940 | -1 | -1 | 3,596 | 9.5 | 3,649 | 7.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,939 Bcf as of Friday, November 27, 2020, according to EIA estimates. This represents a net decrease of 1 Bcf from the previous week. Stocks were 343 Bcf higher than last year at this time and 290 Bcf above the five-year average of 3,649 Bcf. At 3,939 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

These were the temperatures for the period on this last EIA report. Very mild for the eastern 2/3rds of the country, especially in the South.

There were the 7 day temperatures for this next report, released on 12-10-20.

Very mild vs average northern tier, especially N.Plains. Very chilly southern tier, especially Texas.

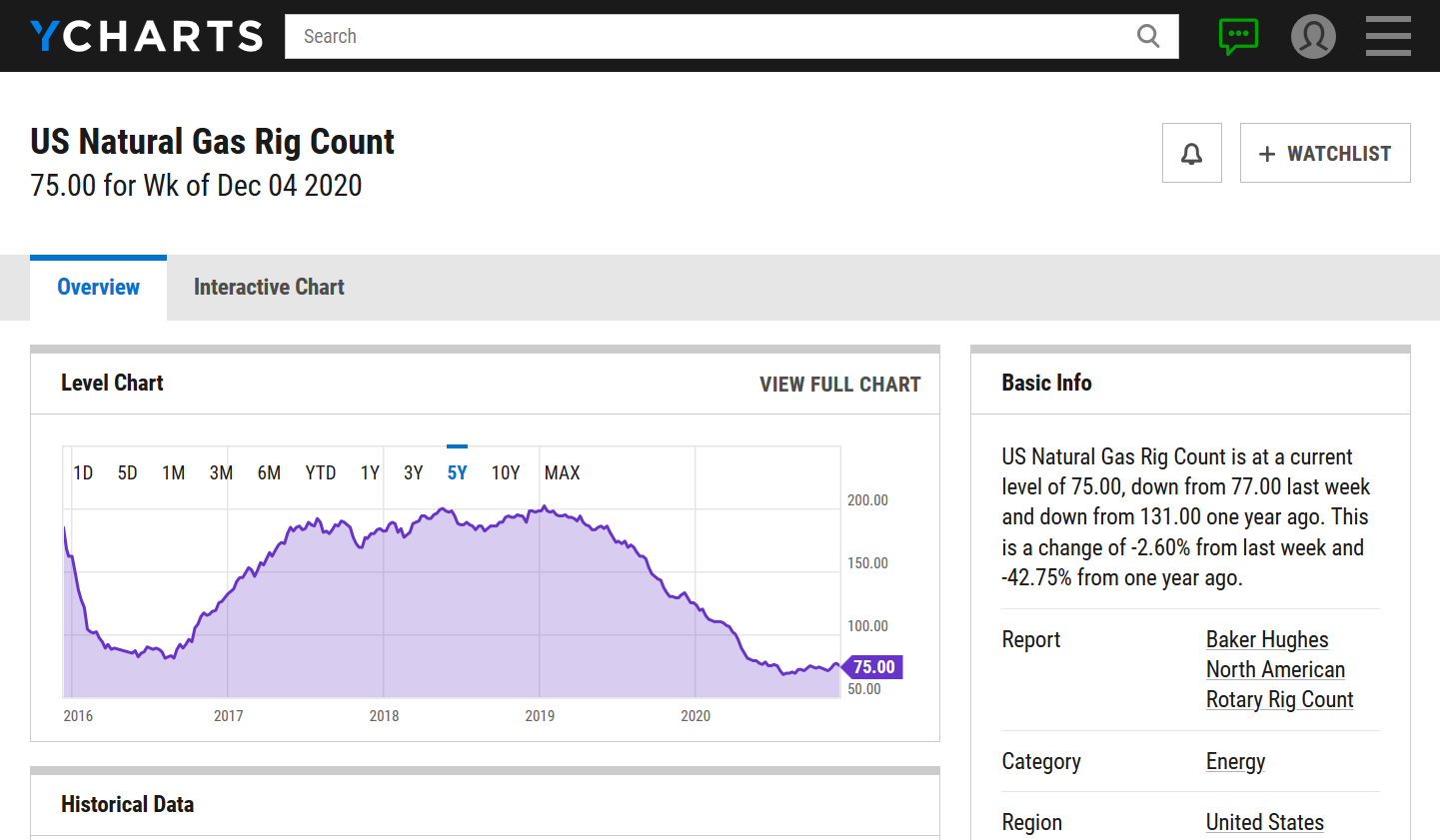

Rig count remains very low and actually dropped 2 to 75. This is still below the previous all time lows set in August 2016 of 83 rigs.

https://ycharts.com/indicators/us_gas_rotary_rigs

Natural gas futures rebounded in early trading Wednesday as the latest weather data showed less warmth in the weeks ahead. The January Nymex contract was up 10.4 cents to $2.503/MMBtu at around 8:50 a.m. ET. Weather models overnight extended colder trends from Tuesday’s midday runs, resulting in an increase in gas-weighted degree day expectations in…

metmike:

December 9: The AO/NAO really drop today. This is significant enough to have more confidence that the models are not cold enough yet. Typically, what we see in a solidly -AO/-NAO pattern is that models continue to get colder and colder(more HDD's) with each update as they get a better handle of the pattern which is predicted by the -AO-NAO. This is exactly whats happened the last couple of days.

Markets

for week ending December 4, 2020 | Released: December 10, 2020 at 10:30 a.m. | Next Release: December 17, 2020

-91 BCF BULLISH!!!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (12/04/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 12/04/20 | 11/27/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 915 | 934 | -19 | -19 | 874 | 4.7 | 855 | 7.0 | |||||||||||||||||

| Midwest | 1,095 | 1,122 | -27 | -27 | 1,021 | 7.2 | 1,030 | 6.3 | |||||||||||||||||

| Mountain | 232 | 240 | -8 | -8 | 195 | 19.0 | 206 | 12.6 | |||||||||||||||||

| Pacific | 312 | 318 | -6 | -6 | 279 | 11.8 | 303 | 3.0 | |||||||||||||||||

| South Central | 1,294 | 1,326 | -32 | -32 | 1,170 | 10.6 | 1,194 | 8.4 | |||||||||||||||||

| Salt | 361 | 368 | -7 | -7 | 320 | 12.8 | 345 | 4.6 | |||||||||||||||||

| Nonsalt | 933 | 958 | -25 | -25 | 850 | 9.8 | 849 | 9.9 | |||||||||||||||||

| Total | 3,848 | 3,939 | -91 | -91 | 3,539 | 8.7 | 3,588 | 7.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. Note: As of December 28, 2020, the U.S. Energy Information Administration (EIA) will no longer support HTTP requests for our products. The Weekly Natural Gas Storage Report (WNGSR) will move from HTTP to HTTPS web addresses to ensure the security and timeliness of the data releases. More information about this change is available at: http://ir.eia.gov/ngs/notice.html. | |||||||||||||||||||||||||

Working gas in storage was 3,848 Bcf as of Friday, December 4, 2020, according to EIA estimates. This represents a net decrease of 91 Bcf from the previous week. Stocks were 309 Bcf higher than last year at this time and 260 Bcf above the five-year average of 3,588 Bcf. At 3,848 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

U.S. Natural Gas Storage

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Dec 10, 2020 Actual-91B Forecast-83B Previous-1B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 10, 2020 | 10:30 | -91B | -83B | -1B | |

| Dec 03, 2020 | 10:30 | -1B | -12B | -18B | |

| Nov 25, 2020 | 12:00 | -18B | -18B | 31B | |

| Nov 19, 2020 | 10:30 | 31B | 15B | 8B | |

| Nov 13, 2020 | 10:30 | 8B | -3B | -36B | |

| Nov 05, 2020 | 10:30 | -36B | -26B | 29B |

December 10, 2020

NG skyrocketing just after the EIA was our tells me there was a “whisper number” that was likely a good bit lower than the high -80s.

Yes, Investing.com had 83.

Natural gas bulls were on parade Thursday as the stars aligned to offer support for struggling futures prices. Thanks to lower production, a “quite strong” storage withdrawal, cooler-trending weather outlooks and solid export demand, the January Nymex futures contract settled 11.1 cents higher at $2.553. February jumped 11.4 cents to $2.570. Spot gas prices continued…

December 10, 2020

NG has been bearish for months. Its still bearish and unless we have a polar vortex descend on the US, it will more than likely remain bearish.

I strongly disagree with that Jim.

NG was bearish earlier this year when we amassed the huge storage surplus because of COVID and spiked to the lowest prices in 30 years, putting in a bottom that might last.........forever.

When prices plunged down there, the rig count fell to the lowest ever.

Industrial demand has not fully recovered but likely will after the Spring of 2021 when the vaccine and COVID season has passed.

LNG exports have apparently recovered.

Residential demand is seasonally wimpy but this is a seasonal thing that varies and is unknown and can't be dialed into a long term projection that assumes it will be close to the historical average.

So the demand side in 2021 is bullish with LNG back up and industrial demand recovering.

The supply side has been bullish with the rig count still below the previous lows...........that occurred in August 2016.

This is why the big funds loaded up with record longs several months ago. They saw the massive bullish potential going into Winter. If we had/have extreme cold, the drawdowns will be extraordinarily huge. COVID did not and will not hurt residential demand which rules in Winter.

However, Winter didn't show up and we had very mild temps, so the massive supply overhang didn't get chewed up as quickly as the spec longs were hoping for..............and they liquidated much of the position. During the periods that they covered tens of thousands of contacts quickly , I think early the week before this one was one, ng collapsed lower and made it appear as if Winter was over before it really started.

Regardless, the overall fundamentals are bullish in the long run until the rig count recovers substantially. One may look at storage near historic highs and the price seemingly high compared to where its been recently but thats looking in the rear view mirror. We already knew and know all those things. The market is looking ahead.

The other factor that is going to affect the price of all commodities is upcoming inflation. The printing/creation of trillions of dollars over such a short period this year is going to cause inflation. We've managed to avoid that in recent years, despite injection of money into the system but this was just way too much. Unless the laws of economics no longer apply, inflation is coming.

Despite mixed signals from the weather data, evidence of tight balances in the latest government inventory data helped further bolster natural gas futures in early trading Friday. After advancing 11.1 cents in Thursday’s session, the January Nymex contract was up another 6.7 cents to $2.620/MMBtu at around 8:40 a.m. ET. Overnight, the American weather modeling…

December 11, 2020

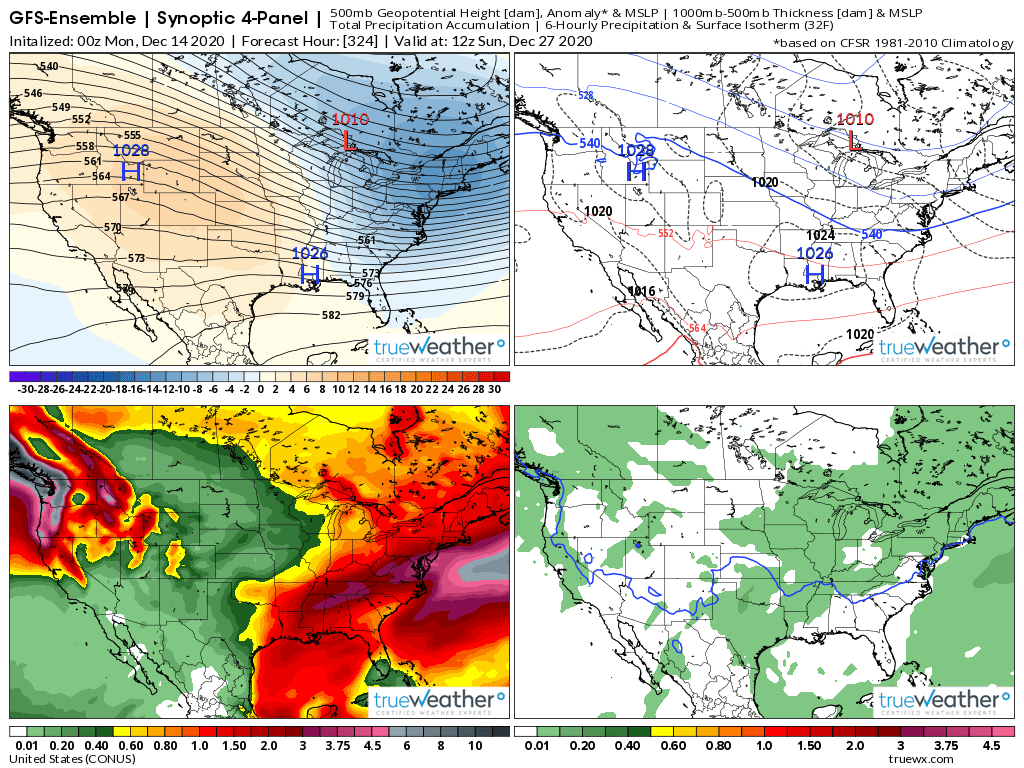

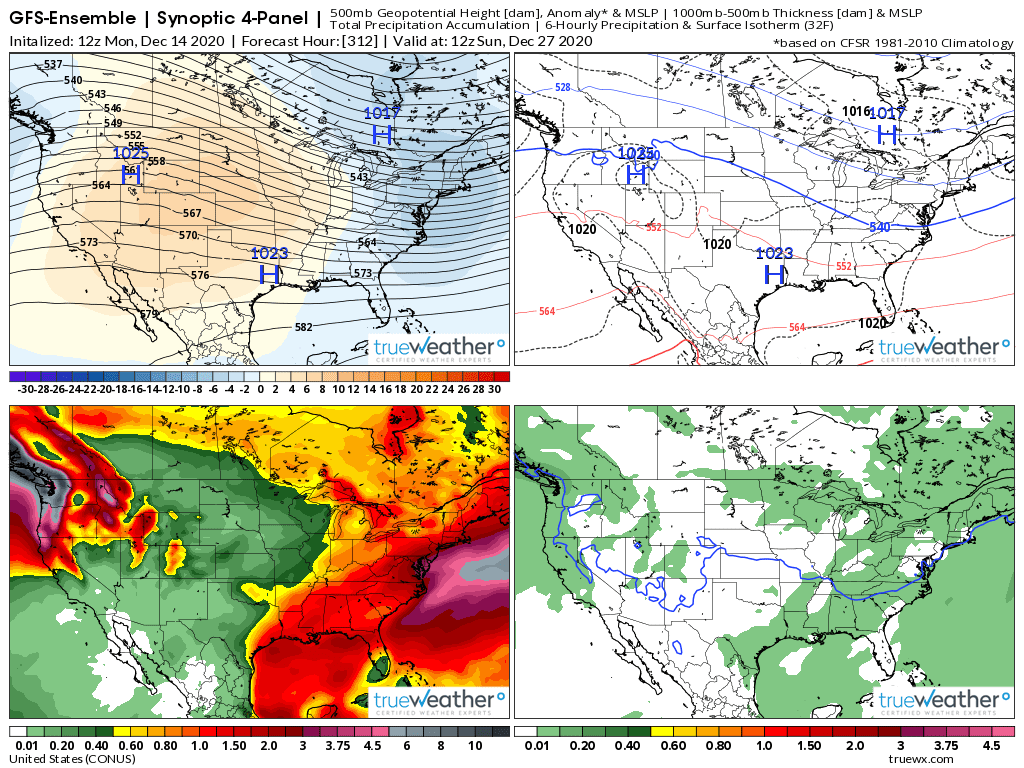

metmike: The GFS products had been the mildest all week but that changed overnight. The 6z GFS ensemble for instance, added 22 HDD's vs 2 runs prior, the 18z run. The European model was actually milder overnight vs the previous 12z run on Thursday but that is what caused our lows a bit after 1am this morning when that came out.

The 12Z models across the board came in significantly colder vs 0Z for the two week period overall thus allowing for an up day today.

I agree that they all came in MUCH colder but we actually sold off and hit our day session low of 2.566, 15 minutes before the close, despite all that having come out, except the last part of the EE.

The colder forecasts that have happened at times on models this week, I think is from the models under appreciating the -AO situation coming up and adjusting the solution as we get closer.

Despite the colder changes, the models don't show a pattern change to colder...........just temporary intrusions of stronger cold that go much deeper into the US than what they had previously....this happens frequently with a -AO.

If you look at the NWS extended guidance and even their 3-4 week outlook, you would think that the weather is mild as far as we go out.

It's just that the cold in Canada is major cold and a slight change in how much can surge south for a brief period can be huge for HDD's.

What do you think about the pattern Larry?

I think the market was trading mainly on something other than weather changes when it fell to its low point of the daytime session because all changes to that point were toward colder. Some of that may have been profit-taking on the recent days' gains.

Looking ahead, I think the best chance for colder than normal is in the SE US and Mid Atlantic based on the -AO. But with MJO in the typically mild Maritime Continent phases expected for the next 10+ days, that will make it hard for widespread extreme cold to plunge down.

Boosted in part by the prospect of a colder temperature shift around the start of the new year, natural gas futures surged higher in early trading Monday. The January Nymex contract was up 10.1 cents to $2.692/MMBtu at around 8:45 a.m. ET. Compared to previous expectations, the weather outlook was largely unchanged early Monday, according…

metmike: Models do not look impressive at all with the cold over the next 2 weeks. The main bullish item is the impressive --AO predicted which helps flush cold from high to mid latitudes. This often leads the models in colder updates, when the HDD's increase with time.

Slightly -NAO is slightly bullish. Interesting that the week 3 part of the forecast is getting the headline here.

Testing the bullish gap higher from Sunday nights low of 2.647............Fridays high was 2.630.

Trading below the gap leaves a potential gap and crap..............buying exhaustion (bearish)formation on the technical picture/charts.

It is trading on other factor(s) in addition to weather changes. Wx model/forecast changes are obviously often not the most dominant factor. They clearly aren’t now. Otherwise it wouldn’t be near session lows.

"Otherwise it wouldn’t be near session lows."

The trough along the East Coast is not as deep/impressive later in week 2 than the previous runs on the GFS Ensemble and more warming spreading northeast behind it, so I was thinking we should be making new lows.

Oz run first, followed by this last 12z run.

12z Canadian model was also slightly milder.

But if the European model comes in colder, we can go back up.

If it also comes in milder, then we have a gap and crap buying exhaustion formation that holds the rest of the trading session and suggests the highs might be in...........until the maps turns colder again.

If they don't, then the highs might be in for this week.

You may have noticed HO gaining on RB and CL overnight and much earlier today. Possibly from that deep trough along the East Coast(Northeast) threat with a --AO and slightly -NAO.

For others, the Northeast/New England is where most heating oil gets used in the US for heating.

Mike,

I disagree. NG was already at then session lows in the 2.640s way earlier than when late week 2 on the 12Z GEFS was released. At the time I was referring to, the 12Z GEFS was at about the coldest of any GEFS (similar to 6Z). It was selling off on something other than weather model changes because GEFS changes were not at all warmer then.

Here's what that potential threat looked like on the GFS 0z run.......... with anomalies at the end of the period. It's could end up as a Greenland block with positive anomalies growing over Greenland (weak neg anomoly in the Northeast........but there is also a building ridge/pos anomalies along the West Coast which could also assist in delivering cold farther south.

So one run, like the 12z ones out so far, that are a tad warmer than this below is............just 1 run with expected changes and doesn't change this potential much.

Hey Mike,

Thanks for your maps but they won’t sway me. We have different opinions and we’re both sticking to them.

In general, I do feel like you try to attribute too many moves of NG to wx model changes as opposed to other factors. I think this is one of those cases.

Larry,

The 06z GFS ensemble mean run was the first one to come out milder 6 hours ago.

Note that we set the highs at 6:18am at 2.708 just before the warmer late week 2 period came out from that 6Z run, 6 hours ago.

It's not my opinion, I'm just reporting what the models showed and what the price did.

This last spike down to new daily lows in the last hour, that filled that gap came after the 12z GFS Ensemble came out, confirming the milder 6z run.

Not my opinion, it's what happened.

"Thanks for your maps but they won’t sway me"

The last maps were actually to do the opposite of swaying you........they were to indicate that the threat of the colder pattern still exists and a couple of model runs have not changed that.

Also, my objective isn't to be prove I'm right and somebody else is wrong. I could care less. In fact, I bend over backwards to find common ground as much as possible.

I am just presenting objective, accurate weather and trading facts for readers. Let them use it or, at the very least recognize the significance and apply it to their understanding of how the markets work/trade.

That being said..............I am wrong sometimes and about the weather, alot of times.

Also, you bring so much value here to our discussions that words can't describe how much I sincerely appreciate your opinions.

For others that don't realize it, Larry/WxFollower is gifted at following weather patterns and applying their affects to markets. We are extremely fortunate to have him generously contributing his insights here.

The name that he picked couldn't more appropriate.

It would be like Babe Ruth, calling himself "BaseballPlayer"

OK, maybe he's not that good (-:

So the European model has in fact come out MUCH colder and we did reverse higher again and negated the potential gap and crap formation.....from the milder GFS Ensemble the last 2 runs.

With the MUCH colder 12z European model, prices should safely stay well above the gap area for the rest of the day.

Thanks, Mike, for the kind words!

I do believe like you that the much colder 12Z EE brought NG back up as it was colder throughout the entire run. However, it then sold off much of that (4 cents) and that selloff couldn't possibly be due to wx model changes since no new ones have come out since.

I believe that there's been some sort of bearish factor in the background leading to selling much of this afternoon which has negated much of the colder wx model related gains.

Thanks Larry!

This being the last piece of major weather, below after the EE was out sure didn't help and we closed well above the lows , gap/open last night and closer to the highs for the session. In fact, if you look at the maps below, you would never guess that ng could have been so strong today!

I agree that its more than weather with there being several bullish items that I listed last week, in a response to Jim

https://www.marketforum.com/forum/topic/62430/#62580

We have a huge difference in the models right now and model to model runs. This is not shocking considering there is a battle between the northern stream and its --AO and the southern stream with milder air and the models are not sure how to handle it.

The GFS Ensemble had +3 HDD and when the cold part of the forecast came out, we a little spike higher but the end of it looks anything but cold.

Yea....about that response Mike. :) NG "front month" hasn't closed above $3 all year. Jan is lower now that it was back earlier in the year. Sure, there was a rally for a month or so. Seasonal. There was no fundamental reason. Yes, well count is down, but thank goodness or we would be 20% over last year in terms of storage.

I stand by my opinion. NG has been bearish for months.

Thanks Jim!

"NG has been bearish for months."

I agree with that. You will note that my comments were directed at an outlook for 2021.

It's just a matter of time, with the near record low rig count and the pandemic induced industrial demand coming back after the Spring. Increased exports and inflationary pressure on all commodities because of the historic increase in money supply(dollars become worth less, so you need more of them to get the same stuff).

Like every Winter, the price the next 3 months will be determined mostly by the weather/residential demand.

If it stays mild, it will be almost impossible for us to hit $3 with the massive surplus.

If we have several weeks of unusually cold weather, prices will spike thru $3 like a hot knife thru butter.

Like Joe K. used to say: They call it futures and not pastures for a reason (-:

Joe K. Now that's a name I haven' heard in quite some time. Don't know what has become of him. But like Susan, he had a lot of insight to offer on the markets. And philosophical insights on the markets as well. Learned a lot from those two.

I play the NG market every day. I might make 1 trade. I might make 4. Just depends on how the market is reacting that day. And this is something that I learned from them. A profit is never a loss, no matter how large or small.

Thanks mark,

Sounds like words of wisdom from an experienced day trader.

Everything is "eventually" bullish.

"Everything is "eventually" bullish."

Actually Jim,

You have probably heard the expression "The cure for low prices..........is low prices!"

The ng market is going to experience that.

When COVID crushed industrial demand and exports earlier this year, stocks soared higher and prices dropped to 30 year lows.

BECAUSE of the extremely low prices, entities in the supply chain were losing money(costs greatly exceeded profits) and the rig count plunged to the lowest in history. https://www.marketforum.com/forum/topic/62430/#62451

The rig count has not recovered much, still below the record lows from August 2016. We can see that affect in some recently bullish EIA reports. However, while exports have picked up, demand has not recovered, partly because COVID is still really bad and partly because the weather has been mild.

So the amount of ng in storage remains robust. But that will change with certainty.

Demand will pick back up, likely from COVID going away and the weather will not stay mild forever.

When that happens, the amount of ng in storage and surplus will erode rapidly. It has to. We know that supplies are less than they were before COVID. It will take a higher rig count to change that.

To inspire those that increase the rig count to act, profit margins must increase....................with higher prices.

So it was lower prices which started the chain reaction, desribed above that led/leads eventually to higher prices.

What could cause that to not happen in 2021?

1. Mild weather and unusually low residential heating/cooling demand. This is possible.

2. The economy falters more and can't recover in 2021

3. The global economy weakens and exports drop

We have to assume seasonal weather and near the average HDD/CDD numbers.

We have to assume that COVID will get MUCH better, starting at the end of Winter.

What the Biden/Harris/Kerry Team and Climate Accord do with fossil fuels is a wild card on NG prices. Before anything, I think they will tax the heck out of them first and tell us its to cut planet killing emissions. When/If they make decisions on cutting fracking, it could really push prices much, much higher and launch us into an entirely different price trading range that is well above the one of the last few years. A wild card. Even with ample supplies the market would see legislation that is against fracking as extremely bullish.

The latest related to that (from Canada-which is 1 step ahead of us for the moment) below:

15 Rigs running and I have 2. The Directors cut below: Looking like production is stablelizing at this rig count and commodity prices. Have noticed minor revisions in prior months. Probably due to operators filing prod reports late.

Directors Cut | |||||||||

| NDIC | |||||||||

| Oil | M over M | M over M | Gas | M over M | M over M | ||||

| Mth | Mthly cum | Bbls/ D | Mthly cum | Mcf/ D | |||||

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | 2,873,654 | 2% | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | 2,815,112 | 7% | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | 2,635,250 | 14% | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | 2,302,356 | 17% | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | 1,973,289 | 2% | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | 1,928,122 | -29% | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | 2,712,168 | -13% | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | 3,125,895 | |||||

| All time highs | |||||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | ||||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | ||||||

Thanks very much Joe!

Always great to hear from an expert in the natural gas business!

December 15, 2020

I know it's been a mild winter so far, and that has helped NG to come down and stay down. But I also wonder if there are times that speculation over what the incoming "no fossil fuels" president is actually going to do. He flip flopped a lot about it on what little of his campaigning he had.

Thanks Mark,

Yes, mild Winter so far.

On fossil fuels. Not only will there be enormous and increasing pressure from the extreme left, he has already clearly signaled his intentions with the Climate Accord, signing us back up on day 1 and has put heavy weight John Kerry in charge.

The Accord's objective is to shut down fossil fuels but has ZERO to do with climate.

The train has already left the station here and the US is just part of the global socialism movement but after healthcare, this was Obama's other signature issue.

It's been sort of sputtering because they need the US to be a key part and with Biden on board, it can now accelerate with John Kerry leading the way.

For sure we can expect carbon and energy taxes under Biden and we should look for many other changes in this arena that appease his far left and global alliances.

It's not a matter of if but when for some of this stuff now.

The world is going to be a completely different place by the end of this decade. We are in the early stages of the massive cultural revolution.

Natural gas may get some temporary reprieves, only because they need to completely obliterate the coal industry and natural gas is the only way to do that the fastest.

NG as it has been for a number of days is imo clearly trading on something(s) bearish in the background in addition to wx model/forecast changes. It isn’t nearly just about the upcoming wx prospects.

Thanks Larry!

I agree but why do you think that its something bearish in the background?

With the fairly mild forecast, especially GFS(at of below total seasonal HDD's) and very mild 6-10/8-14 day outlooks, under many Winter situations this would be the recipe for us to drop hard.

I was thinking that there could be something bullish in the background thats preventing that from happening.

On this just out GFS Ensemble, when the cold part of it came out(12-24/25), ng spiked to new highs, taking out some buy stops then as the rest of it is coming out, MUCH milder, we've dropped back down.

NG has been range bound all week though. Even with these very mild, later week 2 forecasts, mainly on GFS Ens solutions, they only give us spikes lower.........that hold and then we wait for the European model solutions.

I know you don't pay attention to the cold biased Canadian model but its pretty cold late in week 2. Half the solutions are extremely cold and half are mild.

I think this is an underlying bullish item but more so the --AO, causing a threat for cold intrusions to increase later this month.

However, the AO can be negative and the cold intrusions limited to brief and shallow penetration if other factors are uncooperative in the US.

HG

Mike,

Sometimes it is hard to explain what a trader sees as we all look at things differently, even amongst us wx traders.

The fairly mild forecasts have been known for quite a while and aren't getting any milder overall. In other words as you put it, they're already "dialed in". But since late last week, the models have been adding quite a few HDDs, which also have to be dialed in. Well, you get these short lived spikes up in response to dialing them in but then folks take their profits on their short term longs and it comes back down and in some cases even lower. Also, new shorts are put in on these spikes. Why do they keep doing this on these spikes? There must be something bearish in the background which obviously has nothing to do with wx changes because they've been bullish. That's all I have to say for now.

Same thing seems to be happening when we test support levels too and the price continues to trade above last week, so it just seems like a pause here to me, while the market waits for more definitive wx. We have quite a cold snap for a few daysstarting before X mas surrounded by mild temps.

Thanks much for your insights. I use them always to see things from another angle, which helps me....even though I appear to think I’m right too often.

All 12Z models were pretty significantly colder than 0Z and yet NG is still only barely up now. Something is keeping it down so to speak.

I guess it must be the way that you are defining "keeping it down" Larry.

NG made new highs for the day in the Wed afternoon session and closed near the highs and is now trading near the highs of the week, threatening a potential upside breakout.

It's not like the HDD's are way above average and this doesn't make any sense.

The EE increased HDD's by 6 but they were still 3 below average.

The key is colder than before. Before was mild and that was dialed in. The newer runs were less mild. Less mild is normally bullish. Just like less cold is bearish.

I'm saying that despite solidly colder 12Z ensembles, NG still settled fractionally lower vs yesterday. that's not impressive to me. But as you said, it still closed not far from session highs.

Yeah it is up a good bit now. I think this is partially a delayed reaction to the colder 12Z ensembles and partially because the 18Z GFS suite so far is agreeing with 12Z on it being colder.

This 12z model run was colder but the one before was milder(0z and 6z for GFS and 0z forEuro) and we were lower then, so the colder 12z brought us back up to the highs.

Now the 18z GFS was MUCH colder and we'll see what the last couple of day say on the Ensemble.

http://ir.eia.gov/ngs/ngs.html

http://ir.eia.gov/ngs/ngs.html

Weekly Natural Gas Storage Report

for week ending December 11, 2020 | Released: December 17, 2020 at 10:30 a.m. | Next Release: December 23, 2020

-122 BCF Supposedly neutral but the market gave us a pretty BEARISH response

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (12/11/19) | 5-year average (2015-19) | |||||||||||||||||||||||

| Region | 12/11/20 | 12/04/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 881 | 915 | -34 | -34 | 846 | 4.1 | 827 | 6.5 | |||||||||||||||||

| Midwest | 1,059 | 1,095 | -36 | -36 | 984 | 7.6 | 995 | 6.4 | |||||||||||||||||

| Mountain | 223 | 232 | -9 | -9 | 188 | 18.6 | 199 | 12.1 | |||||||||||||||||

| Pacific | 306 | 312 | -6 | -6 | 274 | 11.7 | 295 | 3.7 | |||||||||||||||||

| South Central | 1,256 | 1,294 | -38 | -38 | 1,149 | 9.3 | 1,167 | 7.6 | |||||||||||||||||

| Salt | 348 | 361 | -13 | -13 | 320 | 8.8 | 338 | 3.0 | |||||||||||||||||

| Nonsalt | 908 | 933 | -25 | -25 | 830 | 9.4 | 829 | 9.5 | |||||||||||||||||

| Total | 3,726 | 3,848 | -122 | -122 | 3,442 | 8.3 | 3,483 | 7.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. Note: Because the federal government will be closed on December 24, the Weekly Natural Gas Storage Report will be released December 23 at noon ET. Note: As of December 28, 2020, the U.S. Energy Information Administration (EIA) will no longer support HTTP requests for our products. The Weekly Natural Gas Storage Report (WNGSR) will move from HTTP to HTTPS web addresses to ensure the security and timeliness of the data releases. More information about this change is available at: http://ir.eia.gov/ngs/notice.html. | |||||||||||||||||||||||||

Working gas in storage was 3,726 Bcf as of Friday, December 11, 2020, according to EIA estimates. This represents a net decrease of 122 Bcf from the previous week. Stocks were 284 Bcf higher than last year at this time and 243 Bcf above the five-year average of 3,483 Bcf. At 3,726 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2015 through 2019. The dashed vertical lines indicate current and year-ago weekly periods.

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 24, 2020 | 10:30 | -91B | |||

| Dec 17, 2020 | 10:30 | -122B | -120B | -91B | |

| Dec 10, 2020 | 10:30 | -91B | -83B | -1B | |

| Dec 03, 2020 | 10:30 | -1B | -12B | -18B | |

| Nov 25, 2020 | 12:00 | -18B | -18B | 31B | |

| Nov 19, 2020 | 10:30 | 31B | 15B | 8B |

I'm going to help make NG bullish by posting my bearish opinion. We are still over last years stocks of NG and we have to be in a time period where we had the same amount of wells that we had a year ago.

With more gas, the same amount of wells (if not slightly increasing) and covid still slowing our economy, any bullishness in NG (without a significant weather event) seems highly unlikely. Even compared to last years mild winter (at least in my area) there is a lot of gas to go through with an economy that is limping along.

With the market asking itself on a daily basis, do we have enough, currently we have MORE than enough. Look at a chart and no matter how you look at it, the market is speaking to you.

Thanks Jim!

The European Ensemble was just over 4 HDD warmer overnight.

6Z GEFS was colder. The 12Z GFS is quite cold for next week. NG is not down now this far due to wx changes. The EIA was slightly bullish. There is some underlying bearish factor(s) in play as I've been thinking. Likely the relatively high storage though one would think that would be dialed in.

Someone keeps hyping up China demand and the market is looking for some sign of it and yet.....either it isn't there, if it's there it's insignificant or US demand is down so much even China demand isn't helping.

I would have to argue against that bullish sentiment. The initial estimate for todays draw was almost 140 bcf, they dropped it to 120 and ended up at 122. When measured against "expectations" ....not very bullish.

- I never saw -140 bcf as the estimate.

- A -122 on just 164 HDD is historically solidly bullish when comparing it to past seasons.

Thanks, Jim. Well, I will say that a -138 on just 164 HDD would have been near historically bullish. So, I think a -138 was a unreasonably high guess to begin with.

Meanwhile, the 12Z GEFS is coming in colder so far.

The 310 HDD from the Thur 0z EE was the most bearish of the week.

These are the EE numbers I recorded after they came out, going back to the weekend. The last time the model was this warm was the overnight Saturday run.

I added the GFS ensemble as the 2nd number

0z Thu-310...........last run 313 (6Z was also 313)

12z Wed-314 316

0z-Wed-312 316

12z Tue-320 313

0z Tue-either 320 or 316 318

12z Mon-324....cold peaked on EE 322-cold peaked on the 18z run with 325

0z Mon-313 321

12z Sun-315 317

0z Sun-305..............last time below 310 Last time it was 313 or less.other than 12z Tue

12 Sat-304

updated with GFS ensemble info

I know that the 0Z EE was slightly warmer but the later 6Z GEFS was colder and the 12Z GEFS is coming in colder so far. I don't think it is down due to wx changes and I'm sticking with that idea. Sometimes wx isn't the dominant factor.

It isn't down due to a bearish EIA because it was anything but bearish.

Large fund algos are in sell mode. Sometimes it is hard to overcome those.

I updated the info above to include the GFS Ensemble numbers.

https://www.marketforum.com/forum/topic/62430/#62874

addition: The HDD's peaked on Monday and have been getting lower. Yet the price is higher than last weeks highs right now.

I am bullish like you Larry and think the models are not nearly cold enough but thats not what has been happening the last 3 days.............just the opposite.

However, if the models start getting colder again, especially late in week 2(instead of milder like they have since Monday) we should make new highs pretty easily.

Us three having different perspectives are good for robust discussions. This thread is lively.

Agreed. Thanks Larry, you always bring a tremendous amount to the discussion!

Glad to see that response. I sometimes worry that I'm going to tick you(or others) off with my views

but I will always be very honest and respectful........and extremely grateful!

And yet in other parts of the world, NG is getting very expensive. Can the US get enough off shore to change it's storage situation.

'There is hardly any gas': LNG price rally exacerbates gas crunch in Asia | Nasdaq

12Z GEFS colder than prior run but NG is as of now down not to far from lows of session. Wx changes not always the dominant factor though overall they're usually important.

12z Euro starting off like it may be a colder run than 0Z fwiw.

This is a great point Jim!

Exports of NG are only going higher in the future, despite any short term set backs.