The Energy Information Administration reported today a massive crude oil inventory build of 15.189 million barrels for the week to December 4, after a modest draw of 700,000 barrels estimated for the previous week.

This week's rise in crude inventories came close to the largest crude build ever, which was recorded earlier this year for the week ending April 10, when the EIA reported a 19.25 million barrel inventory build.

A day earlier, the American Petroleum Institute had reported a crude oil stock build of 1.1 million barrels along with much larger builds in gasoline and distillate fuels.

In fuels, the EIA reported an inventory build in gasoline and another build in distillate stocks for the week to December 4.

In gasoline, the authority estimated an inventory increase of 4.2 million barrels, compared with a sizeable build of 3.5 million barrels for the previous week. Gasoline production averaged 8.3 million bpd, compared with 8.6 million bpd a week earlier.

In distillate fuels, the EIA estimated an inventory build of 5.2 million barrels for the reporting period. This compared with an increase of 3.2 million barrels for the previous week. Production of middle distillates averaged 4.7 million bpd last week, compared with 4.6 million bpd a week earlier.

Oil prices have reversed their recent rally this week as worries about the continuing rise in Covid-19 infections globally began to displace enthusiasm from positive vaccine news from earlier this month. Even the start of vaccinations in the UK did not arrest the slide.

Optimism driven by OPEC+ finally reaching an agreement how to continue cutting production from January next year also helped pushed prices higher, even though the agreement was for a moderate increase in collective production.

“We are confident that the weak demand will soon move back into the market’s focus,” Eugen Weinberg, head of commodities research at Commerzbank, told Bloomberg on Tuesday. “The latest price rise has been driven by speculation.”

At the time of writing, Brent crude was trading at $49.38 a barrel, with West Texas Intermediate changing hands for $46.05 a barrel, both up from opening.

So a massive build and today a nigh jobless claim report all which normally would have the market crashing, is fueling crude on a rally. Bizarro world.

I was going to ask.. What's bullish?

3 things stand out for me.

1. The COVID vaccine is here. It's actually being distributed in the UK and will be in the US in less than 2 weeks. My daughter, who is a geriatric occupational therapist, will be getting her first shot in less than 2 weeks, then the 2nd one 90 days later.

2. The unprecedented massive increase in the money supply. No way will we not have inflation. I think this one is worth a thread by itself.

3. The US dollar is making new lows for the move and year. This is related to #2. Inflation and higher interest rates and a lower dollar all mean higher prices for everything, especially crude.

The market is looking ahead. The huge increase in supply/storage this week is looking at the past.

WTI, Brent crude both end at highest levels since early March

Oil futures settled higher Thursday, with the global Brent crude benchmark above $50 for the first time in nine months, on progress toward a U.S. COVID-19 vaccine that may lead to a boost in the economy next year.

Brent oil had finished Wednesday a couple pennies higher and U.S. benchmark West Texas Intermediate crude saw a modest decline, mostly shaking off pressure from a sharp rise in U.S. crude inventories — the largest weekly increase since April.

“Oil prices stood tall even after a massive 15.2-million-barrel crude oil increase in U.S. oil supply” reported by the Energy Information Administration Wednesday, said Phil Flynn, senior market analyst at The Price Futures Group.

“The crude oil market is looking beyond the numbers,” he said in a note. “The market held key support and is now focusing on vaccine distribution that could lead to a spike in demand that should drive global supply back below normal levels next year.”

Meanwhile, the oil market also took note of reports that suggest Chinese demand is exceeding pre-COVID levels, and there are reports of an “uptick” in Chinese refinery runs, Flynn told MarketWatch.

WTI crude for January delivery CL.1, 3.08% CLF21, 3.10% rose $1.26, or 2.8%, to settle at $46.78 a barrel on the New York Mercantile Exchange.

The global benchmark, February Brent crude BRN00, 0.30% BRNG21, 0.30%, rose $1.39, or 2.8%, to $50.25 a barrel on ICE Futures Europe.

Prices for WTI and Brent, based on the front months, marked their highest settlements since March 4, according to Dow Jones Market Data.

“There is enough positive vaccine feeling to keep the market in check,” said Stephen Innes, chief global markets strategist at Axi, in a note. “The World Health Organization said jumps in weekly COVID-19 cases in the United States and Canada are particularly problematic as winter approaches. But the U.S. is drawing closer to vaccine approval.”

An all-day regulatory meeting Thursday is the next step toward the likely authorization of the first COVID-19 vaccine in the U.S. The vaccine, developed by Pfizer Inc. PFE, 0.29% and BioNTech SE BNTX, 5.48%, saw its rollout in the U.K. begin earlier this week after regulators in that country authorized it for emergency use.

Latest Release Dec 09, 2020 Actual15.189M Forecast-1.424M Previous-0.679M

https://www.investing.com/economic-calendar/eia-crude-oil-inventories-75

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 16, 2020 | 10:30 | 15.189M | |||

| Dec 09, 2020 | 10:30 | 15.189M | -1.424M | -0.679M | |

| Dec 02, 2020 | 10:30 | -0.679M | -2.358M | -0.754M | |

| Nov 25, 2020 | 10:30 | -0.754M | 0.127M | 0.768M | |

| Nov 18, 2020 | 10:30 | 0.768M | 1.650M | 4.278M | |

| Nov 12, 2020 | 11:00 | 4.278M | -0.913M | -7.998M |

| Weekly US ending stocks of crude oil. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRSTUS1&f=W Weekly ending stocks for unleaded gasoline. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WGTSTUS1&f=W Weekly US ending stocks for distillate fuel oil(heating oil-especially used in the Northeast). https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDISTUS1&f=W |

Crude 3 month chart

| |

Crude 1 year chart below

| |

Crude 5 year chart below

| |

Crude 10 year chart below

| |

Unleaded Gasoline Price Charts:

| |

| |

5 year........are we headed back to the highs?

| |

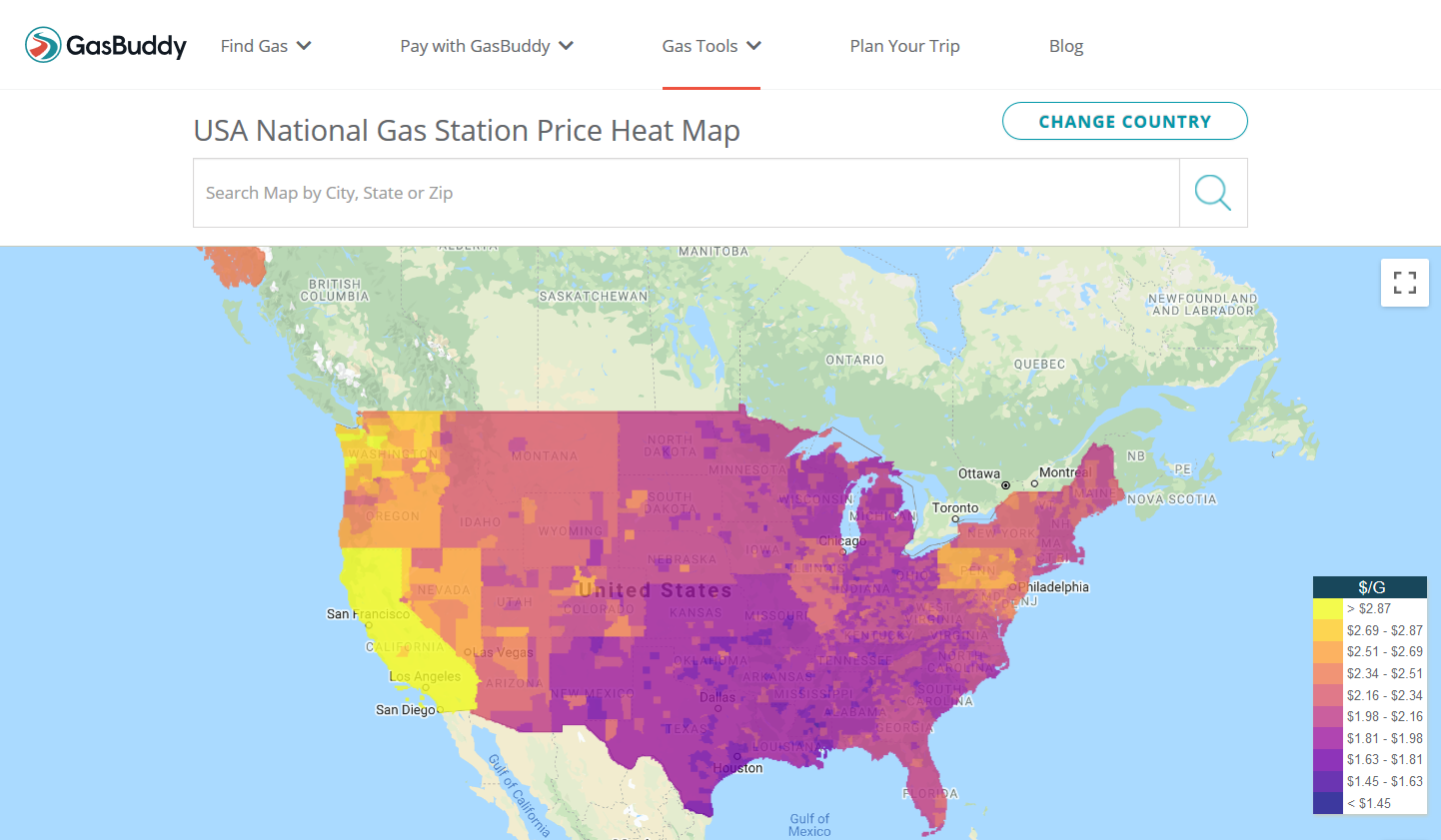

Current gas prices.

https://www.gasbuddy.com/GasPriceMap?z=4&lng=-96.591588&lat=38.822395

Why are west coast gasoline prices higher?

https://www.quora.com/Why-are-west-coast-gasoline-prices-higher