Please continue here for NG discussion. Thank you.

NG has been down relative to yesterday’s settle with only moderate volatility. Dow is down but not by much with it still near record highs.

Supposed to be 40 here in NE Ohio tomorrow, Sat Jan 9th. Jobless claims rose for the first time since April. Not much for NG to hang its hat on.

Too much ng in storage with almost half of the heating season passed and recently bearish EIA reports.

Thanks for the new thread Larry!

Also, the extreme cold from the pattern change doesn't look like it will be as extreme as it did earlier in the week.

But it will look different on Sunday.

NG in Spain and china in short supply due to extreme cold

Madrid had snow

Is this a case of NG supply and demand not being in the places needed

Spain and china prices up

Nether can access supplies sufficient for needs

Not enough LNG boats

China forced to open coal fired plant as china had closed many coal fired plants and switched to electricity for industrial production and heat

China in deep freeze but wont accept coal from Aut due to tensions between countries. I thought china had their own coal supplies

Just what I am reading

Do not trade so FWIW

Thanks Wayne!

Models don't look as cold as they did early last week after we had the bullish gap higher.

Warming trends from forecasts over the weekend, albeit with hints of potential colder temperatures for key U.S. regions later this month, pressured natural gas futures lower in early trading Monday. The February Nymex contract was down 3.8 cents to $2.662/MMBtu at around 8:45 a.m. ET. After previously offering different outlooks on the upcoming pattern, the…

January 11, 2021

Buoyed by forecasts showing frigid temperatures finding their way into the Lower 48 later this month, natural gas futures rallied in early trading Tuesday. The February Nymex contract had surged 11.8 cents to $2.865/MMBtu as of 8:40 a.m. ET. Overall gas-weighted degree day expectations were largely unchanged day/day in the latest Bespoke Weather Services forecast…

January 12, 2021

With the market still eyeing a potential shift to notably chillier temperatures later this month, natural gas futures were up several cents in early trading Wednesday. The February Nymex contract was up 3.0 cents to $2.783/MMBtu at around 8:40 a.m. ET. Prices retreated in Tuesday’s trading as midday weather model runs backed off on the…

LNG Price Boom

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jan 14, 2021 | 10:30 | -130B | |||

| Jan 07, 2021 | 10:30 | -130B | -114B | ||

| Dec 31, 2020 | 10:30 | -114B | -125B | -152B | |

| Dec 23, 2020 | 12:00 | -152B | -160B | -122B | |

| Dec 17, 2020 | 10:30 | -122B | -120B | -91B | |

| Dec 10, 2020 | 10:30 | -91B | -83B | -1B |

for week ending January 1, 2021 | Released: January 7, 2021 at 10:30 a.m. | Next Release: January 14, 2021

-130 BCF Bearish again

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/01/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 01/01/21 | 12/25/20 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 765 | 810 | -45 | -45 | 771 | -0.8 | 737 | 3.8 | |||||||||||||||||

| Midwest | 923 | 973 | -50 | -50 | 905 | 2.0 | 871 | 6.0 | |||||||||||||||||

| Mountain | 196 | 204 | -8 | -8 | 173 | 13.3 | 171 | 14.6 | |||||||||||||||||

| Pacific | 282 | 289 | -7 | -7 | 251 | 12.4 | 274 | 2.9 | |||||||||||||||||

| South Central | 1,163 | 1,183 | -20 | -20 | 1,093 | 6.4 | 1,075 | 8.2 | |||||||||||||||||

| Salt | 333 | 334 | -1 | -1 | 313 | 6.4 | 323 | 3.1 | |||||||||||||||||

| Nonsalt | 830 | 849 | -19 | -19 | 780 | 6.4 | 752 | 10.4 | |||||||||||||||||

| Total | 3,330 | 3,460 | -130 | -130 | 3,192 | 4.3 | 3,129 | 6.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,330 Bcf as of Friday, January 1, 2021, according to EIA estimates. This represents a net decrease of 130 Bcf from the previous week. Stocks were 138 Bcf higher than last year at this time and 201 Bcf above the five-year average of 3,129 Bcf. At 3,330 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

7 day temps from last weeks report:

7 day temps for the EIA this week:

7 day temps-ending 1-8-21 for tomorrows EIA weekly storage report.

for week ending January 8, 2021 | Released: January 14, 2021 at 10:30 a.m. | Next Release: January 22, 2021

-134 BCF

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/08/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 01/08/21 | 01/01/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 726 | 765 | -39 | -39 | 727 | -0.1 | 697 | 4.2 | |||||||||||||||||

| Midwest | 879 | 923 | -44 | -44 | 861 | 2.1 | 829 | 6.0 | |||||||||||||||||

| Mountain | 188 | 196 | -8 | -8 | 162 | 16.0 | 165 | 13.9 | |||||||||||||||||

| Pacific | 278 | 282 | -4 | -4 | 238 | 16.8 | 248 | 12.1 | |||||||||||||||||

| South Central | 1,126 | 1,163 | -37 | -37 | 1,082 | 4.1 | 1,040 | 8.3 | |||||||||||||||||

| Salt | 327 | 333 | -6 | -6 | 321 | 1.9 | 308 | 6.2 | |||||||||||||||||

| Nonsalt | 799 | 830 | -31 | -31 | 761 | 5.0 | 732 | 9.2 | |||||||||||||||||

| Total | 3,196 | 3,330 | -134 | -134 | 3,070 | 4.1 | 2,978 | 7.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,196 Bcf as of Friday, January 8, 2021, according to EIA estimates. This represents a net decrease of 134 Bcf from the previous week. Stocks were 126 Bcf higher than last year at this time and 218 Bcf above the five-year average of 2,978 Bcf. At 3,196 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through2020. The dashed vertical lines indicate current and year-ago weekly periods.

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 134 Bcf from natural gas storage for the week ended Jan. 8. The result exceeded both the year-earlier pull and the midpoint of analysts’ estimates, but it fell short of fueling Nymex natural gas futures. It was “a stronger draw than we estimated…reflecting…

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jan 14, 2021 | 10:30 | -134B | -130B | ||

| Jan 07, 2021 | 10:30 | -130B | -114B | ||

| Dec 31, 2020 | 10:30 | -114B | -125B | -152B | |

| Dec 23, 2020 | 12:00 | -152B | -160B | -122B | |

| Dec 17, 2020 | 10:30 | -122B | -120B | -91B | |

| Dec 10, 2020 | 10:30 | -91B | -83B | -1B |

As models maintained expectations for a shift to colder U.S. temperatures to close out the month of January, natural gas futures reversed their recent losses in early trading Friday. After giving up 6.1 cents in the previous session, the February Nymex contract was up 9.1 cents to $2.757/MMBtu at around 8:40 a.m. ET. Recent weather…

metmike: Much colder Euro Ensemble is what REALLY ignited the rally just after midnight, after the GFS Ensemble had also been colder.

There is no conviction in the direction of NG in either direction. Hard to go lower in winter, but hard to go higher when there is so much of it.

By Kevin Dobbs

January 15, 2021

I’m just a bystander of NG for the time being, but I was a little surprised by the market direction tonight, given the forecast. Is their a warm up coming after this coming 2weeks?

Actually there is MUCH less cold coming the next 2 weeks.

Good to know! More from a personal perspective though. I hate the cold

I'm beginning to think that we can't trust the NOAA 8-14 day forecast anymore. Obviously, the market doesn't believe it.

They are often behind the market.

Watch today how they warm up.

January 19, 2021

11 Rigs running and I have 1.

No time to really comment but the numbers speak loudly. Believe production has peaked at current rig count/pricing and will decline.

| Directors Cut | 1/15/2021 | |||||||

| NDIC | ||||||||

| Oil | M over M | M over M | Gas | M over M | ||||

| Mth | Mthly cum | Bbls/ D | Mthly cum | Mcf/ D | ||||

| Nov | 36,736,201 | -3% | 1,224,240 | 0% | 86,323,059 | -3% | 2,887,402 | |

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | 2,873,654 | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | 2,815,112 | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | 2,635,250 | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | 2,302,356 | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | 1,973,289 | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | 1,928,122 | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | 2,712,168 | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | 3,125,895 | ||||

| All time highs | ||||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | |||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | |||||

| Rig count | 218 | 5/29/2012 | ||||||

Natural gas futures fell for a second consecutive day on Wednesday, as traders absorbed dwindling expectations for strong weather-driven demand, moderating U.S. liquefied natural gas (LNG) levels and a change in control in the nation’s capital. The February Nymex gas futures contract shed seven-tenths of a cent day/day and settled at $2.539/MMBtu. Prices recovered late…

January 20, 2021

metmike: The 12z European Ensemble model came out MUCH colder with an amazing +15 HDD vs the previous run and ng came from heavy losses to spike higher for the day, finally closing a tad lower but well off the lows.

The recent --AO, -NAO and +PNA are all shifting from those cold influencing values to much milder and closer to 0.......but tons of uncertainty.

metmike: Models were even milder yet overnight but it appears as if we are starting to struggle/find new sellers at this mornings lows but that could be temporary.

The EIA is delayed until Friday this week.

GFS products were warmer yet which put steady pressure on the market when the maps/data was coming out but we only dropped a little and did not come close to the lows from very early this morning.

Could be a sign that we are running out of bearish steam/pausing. Might be temporary with a pause if it gets warm enough.............or, the bullish outlook for ng prices in 2021 may be resulting in traders seeing prices down here as representing value.

Storage levels are very high right now though. In years past, high storage and warm temps in the forecast at this time of year is the recipe for lower prices.

Got bit about 10:30, when I entered a short before the Bollinger bands tightened up. Made up for it a half hour later.

Thanks Mark,

The early part of the European model came out colder and gave us the spike up a few minutes ago.

This is what happened yesterday...............then, the rest of the model and the Ensemble continued to get colder and we kept going higher.

That was yesterday. It may not happen like that today.

Well! That was fun. lol

Joe,

You are exactly right!

Your 2nd link is pay walled but I have one to replace it and others about Biden's actions yesterday, signalling his war on abundant, efficient, reliable, dense, cheap, job producing and economy stimulating fossil fuel energy based on a fake climate crisis has begun:

https://www.bostonherald.com/2021/01/21/president-biden-to-canada-drop-dead/

Climate activists are now running federal oil and gas permitting.

https://www.wsj.com/articles/bidens-fossil-fuel-freeze-11611359257

Of these decisions, how many of them will actually have a positive impact for Americans(or our trusted ally, Canada)?

None.

In fact, they are all entirely counterproductive and will have ZERO affect on the climate and very little environmental impact. I would say that yesterday, was an historical day for the US energy markets and Americans that use them.

Other than mostly short term oil price spikes because of issues in the Middle East during the past, when we depended on ME oil(which could happen again, thanks to Biden), yesterday marked the worst day in our countries history for US energy.

The biggest long term blow to US energy in history by a wide margin.

Most certainly this will cost tens of thousands of jobs in the near future, possibly hundreds of thousands of jobs.

Energy prices, as Joe mentioned will be going higher for all of us.

In the short term(next couple of years), this will put major upward pressure on prices in the entire energy sector. In recent years, natural gas gushing out at record levels has caused very low natural gas prices which enabled natural gas, that emits 50% less CO2 vs coal.......... to replace coal in many markets.

Bidens moves could completely change the pricing structure in the energy markets. If ng prices double, for instance or even triple, which is possible, coal may actually become cheaper to burn. Hard to say right now but we know that coal as a fuel is being targeted for elimination first.

Gasoline at the pump is going higher. That's money out of everybody's pocket and hits poor people the most, just like the price of escalating utility bills will be.

This presents some things to think about for us. Number 1 is that the price that we pay for all energy is headed higher to much higher. Also, it looks like we will once again become dependent on unstable, not so friendly countries for our oil.

Though the science tells us that CO2 is a beneficial gas that is greening up the planet, the market is trading CO2=pollution.........the politics. This is what will be increasingly driving the energy markets, decisions like this one, intentionally trying to obliterate the fossil fuels which are entirely responsible for the current high quality of life and average life spans increasing greatly the last century.

1-26-21: I think that in the future, I will try to remind readers more often, that I am an environmentalist.....not just words but practicing environmentalism the past 39 years.

Ask my wife why her crazy husband, who works from home, turns the heat off during the day when she is gone in the heating season/Winter and turns the AC off in the Summer until she gets home!

OK...............it also saves tons of money!

As updated forecasts pointed to a mild start to February, and as traders prepared to digest the latest government inventory data, natural gas futures were down a few cents early Friday. The February Nymex contract was off 3.6 cents to $2.455/MMBtu at around 8:40 a.m. ET. The U.S. Energy Information Administration (EIA) on Friday could…

metmike: Overnight we tested very strong support around the 2.4 area, with temps turning MUCH milder BUT that held. The chart pattern looks like an inverse head and shoulders, with the head being the late December spike low(2.262-that occurred on a gap and crap exhaustion.......gap lower that was quickly filled) and one of the shoulders being the early morning today low, 2.414, the other one was 2.393 on December 8.

There are some indications of a pattern chance to colder again at the end of week 2 and that could be part of the reason for the support to hold here.

Any legit signs of it turning colder and natural gas has a great chance to go higher.

However, if temps are warm enough next week and and beyond, it could be enough for this mornings low to get obliterated but at the moment, its MEGA support.

for week ending January 15, 2021 | Released: January 22, 2021 at 10:30 a.m. | Next Release: January 28, 2021

-187 BCF Bullish vs expectations...........spike higher that got sold because there is no cold in the forecast

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/15/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 01/15/21 | 01/08/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 679 | 726 | -47 | -47 | 702 | -3.3 | 653 | 4.0 | |||||||||||||||||

| Midwest | 828 | 879 | -51 | -51 | 825 | 0.4 | 773 | 7.1 | |||||||||||||||||

| Mountain | 176 | 188 | -12 | -12 | 154 | 14.3 | 156 | 12.8 | |||||||||||||||||

| Pacific | 275 | 278 | -3 | -3 | 224 | 22.8 | 236 | 16.5 | |||||||||||||||||

| South Central | 1,051 | 1,126 | -75 | -75 | 1,068 | -1.6 | 993 | 5.8 | |||||||||||||||||

| Salt | 296 | 327 | -31 | -31 | 326 | -9.2 | 293 | 1.0 | |||||||||||||||||

| Nonsalt | 755 | 799 | -44 | -44 | 742 | 1.8 | 699 | 8.0 | |||||||||||||||||

| Total | 3,009 | 3,196 | -187 | -187 | 2,973 | 1.2 | 2,811 | 7.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,009 Bcf as of Friday, January 15, 2021, according to EIA estimates. This represents a net decrease of 187 Bcf from the previous week. Stocks were 36 Bcf higher than last year at this time and 198 Bcf above the five-year average of 2,811 Bcf. At 3,009 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jan 22, 2021 Actual-187B Forecast-174B Previous-134B

U.S. Natural Gas Storage

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jan 28, 2021 | 10:30 | -134B | |||

| Jan 22, 2021 | 10:30 | -187B | -174B | -134B | |

| Jan 14, 2021 | 10:30 | -134B | -130B | ||

| Jan 07, 2021 | 10:30 | -130B | -114B | ||

| Dec 31, 2020 | 10:30 | -114B | -125B | -152B | |

| Dec 23, 2020 | 12:00 | -152B | -160B | -122B |

Sure is being a hard sell. Looking to get long, if they ever quit playing around.

Thanks Mark!

This was the temp map for this last EIA report. Very mild vs average in the NorthCentral region. Chilly in the deep South/TX made up for it.

The U.S. Energy Information Administration (EIA) on Friday reported a withdrawal of 187 Bcf from natural gas storage for the week ending Jan. 15. It marked the steepest withdrawal of the season and exceeded the midpoint of analysts’ estimates. But it failed to impress, and Nymex natural gas futures faltered. Ahead of the EIA report,…

When did -187 become a strong pull? In January. Against expectations doesn’t count. All this analyst talk of strong Exports, blah blah blah. We are still over last year in terms of storage, another warm winter and winter is creeping by us.

I said it kind of tongue in cheek a couple weeks ago that we could see $2 before we see 3$ and I still don’t see any reason to believe differently.

Agreed Jim. Halfway through winter, and forecasts are warm. I would have figured for a drop overnight to close the gap open. Maybe rollovers happening with the feb contract expiring on wednesday.

I agree Mark. That seems to be a trend with the front month going strong into expiration.

Expiration of the FEB on Wednesday is probably amplifying the affect but I think its the advertising by most models of much colder temps in early February that has the market so bullish today.

If you look at the warm 8-14 day forecast just out, you might think the market is out to lunch and not trading weather but think back just 1 week when we were MUCH lower early in the week with a very cold 8-14 day.

The market is usually a day or two, possible more ahead of the NWS and also looks at the trend at the end of 2 weeks and speculates on weeks 3/4 using that and guidance for that period.

After a bruising run a week earlier, natural gas futures rebounded Monday on substantial increases in expected heating demand over the weekend and a fresh bout of winter weather settling in across parts of the Midwest on Monday. The February Nymex gas futures contract jumped 15.6 cents day/day and settled at $2.602. The prompt month…

metmike: GFS ensemble colder, European Ensemble a bit milder.

12z models were all colder and gave ng an afternoon boost.

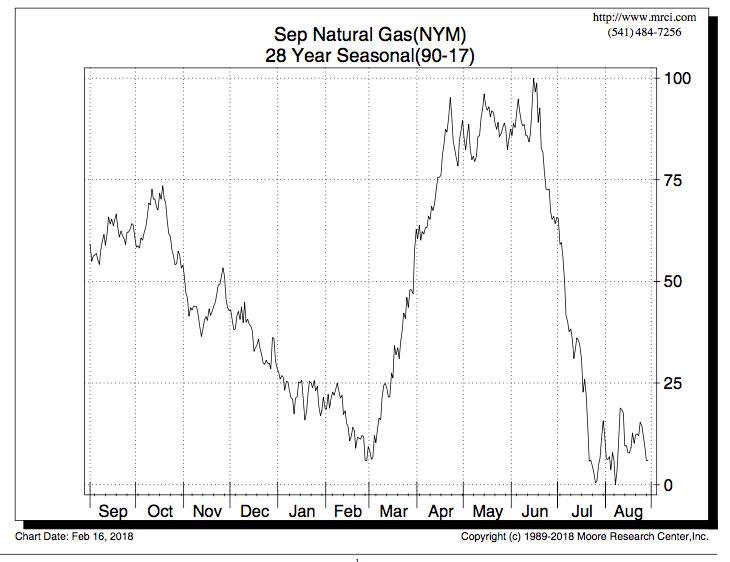

With the feb contract expiring today, one might think that we might see the march contract set up for the seasonal run up into april. If we have a seasonal this year.

Thanks Mark,

Yes, wonderful point! Prices do, VERY often see strength in the Spring, last Spring was a noted exception.

The seasonal, in many years actually turns up right around this period/here, so it could be a big factor.

In many years, it waits, and really takes off after we are well into February.

March and April are often very, very strong months, with it tapering off in May. Some years, it lasts into early June.

Robust heating demand for January? January is over! I guess you have to ask yourself, where could NG go when it's at $2.70 and winter is half over and we are 7% over last years storage? $2.80? That is not much to hang your hat on.

Jim,

It's true that there is a ton of ng in storage but the market continues to look ahead at some very bullish items.

1. Biden is very bullish on all energy prices with his war on fossil fuels, including trying to ban fracking on Federal land.

2. Exports have been increasing and will only go up.

3. COVID has peaked.

4. Seasonals turn up here..........Winter is more than half over but, interestingly, prices display most sustained strength at the end of Winter(all things equal, especially weather)

5. Potential inflationary pressure on all commodities.................excessive money supply/DX going lower.